Learn More at www.ceek.com and kinto.xyz

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, Robinhood launched sports betting, DCG files lawsuit against Genesis, SEC pushes Solana ETF decision to October, and big new rounds from Bullish ($1.1B) and Neon Machine ($19.5M).

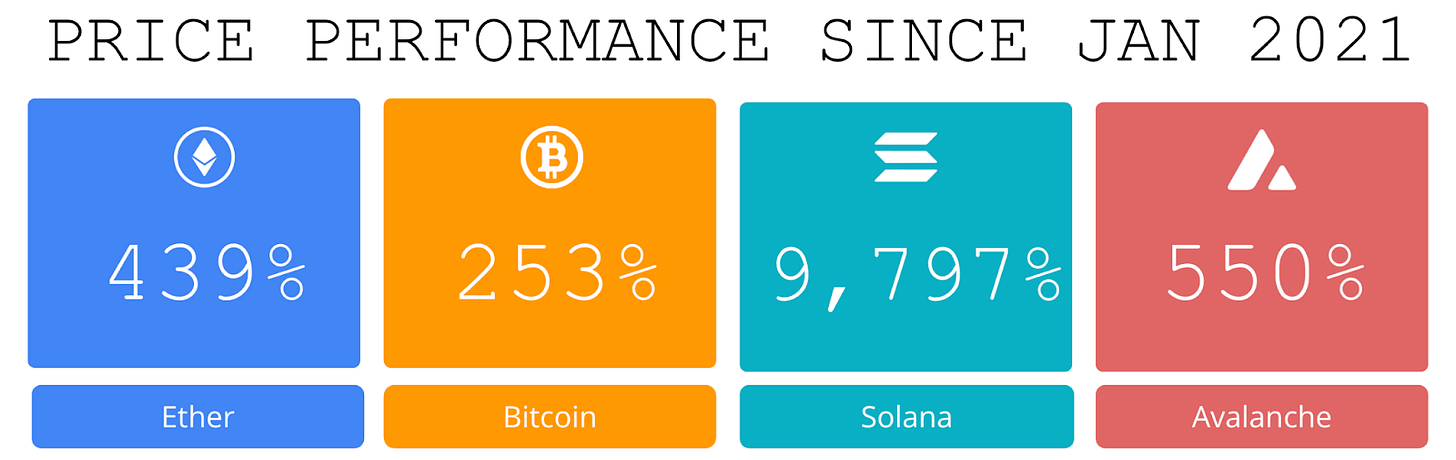

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉Learn more at www.ceek.com

Kinto operates an Ethereum layer-2 network with built-in compliance mechanisms, including Know-Your-Customer (KYC) and Anti-Money Laundering (AML) protocols, facilitating financial institutions that face strict regulatory requirements to participate in decentralized finance. Kinto offers these services without sacrificing decentralization, and features a non-custodial smart contract wallet with native insurance and high-grade security. Web:

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Book a Call

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🏈 Robinhood launching sports betting prediction markets on NFL and NCAA football via Kalshi partnership: Robinhood, the popular stock and crypto trading app, said on Tuesday that it's launching a pro and college football prediction market where users can wager on the outcome of games.

⚖️ Digital Currency Group files lawsuit against subsidiary Genesis over $1.1. billion promissory note amid post-crash fallout:Global investment firm Digital Currency Group is suing its subsidiary Genesis Global Capital LLC over a $1.1 billion safeguard it handed out during the last crypto crash to support the now bankrupt firm.

👨⚖️ SEC pushes Solana ETF decision to October amid growing investor interest in alternatives: The US Securities and Exchange Commission (SEC) has delayed its decision on multiple spot Solana exchange-traded fund (ETF) proposals from Bitwise, 21Shares, and Canary Capital. The regulator announced on Aug. 14 that it requires more time to evaluate the proposed rule changes, extending the review period by the maximum allowable 60 days.

⚖️ Grayscale seeks nod from US SEC for Dogecoin ETF under the ticker 'GDOG': Grayscale is forging ahead with its proposal to list and trade an exchange-traded fund that trades Dogecoin, landing on the ticker symbol "GDOG," according to the latest filing.In a registration statement filed on Friday, Grayscale said it was renaming the Grayscale Dogecoin Trust to the Grayscale Dogecoin Trust ETF.

🚀 Circle’s Arc blockchain network to launch with day one access for institutions via Fireblocks: Circle’s upcoming Arc blockchain will debut with direct institutional access through Fireblocks, positioning the stablecoin issuer for a stronger foothold as competition in the sector accelerates. New York–based Fireblocks, which provides custody and tokenization infrastructure to more than 2,400 banks, asset managers, and fintech firms, confirmed it will support Arc from launch.

💬 Tweet of the Week

Source: @fundstrat

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. We closed the week with $2.85B of ETH ETF inflows, their highest weekly volume ever and the third largest of any digital asset ETF (behind BTC's $3.38B in November 2024 and $3.06 in April 2025).

That's nearly 2x the combined inflows from January through June ($1.55B).

ETH ETFs have now outpaced BTC for 4 straight weeks, and currently hold 5.5% of the entire supply.

Source: @DavidShuttleworth

2. With one trading day left, ETH ETF inflows have already smashed the previous weekly record of $2.18B, hitting $2.91B — and are on pace to break BTC s 2025 high of $3.06B set in April.

We've now seen 4 consecutive days of at least $500M inflows for ETH, including $1B on Monday.

Buckle up.

3. The Producer Price Index rose by 0.9% in July (the most in 3 years) and we have over $880M of liquidations so far today, including $728M worth of longs, led by ETH ($216M) and BTC ($145M).

Macro leads, crypto follows.

Source: @DavidShuttleworth

4. Onchain banking liquidity has surpassed $100B for the first time ever.

AAVE alone holds $63B worth of deposits, which would rank it among the top 40 largest US-chartered commercial banks, ahead of household names like Barclays ($45B) and Deutsche Bank ($40B).

There is now over $42B active loans onchain, and 9 different protocols with at least $2B in total deposits

Source: @DavidShuttleworth

5. Maple entered scale-up mode in Q2 with explosive AUM growth from $792M to $3.2B while ARR climbed to $15M – all while originating $1.12B of institutional loans. This growth positioned Maple as the largest onchain asset manager, surpassing BlackRock's BUIDL fund–with signs of continued market share capture.

Source: @SebyRubino

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to part 2 of OurNetwork’s series covering lending protocols, a sector which as a whole crossed over $75B in total value locked for the first time, according to DefiLlama.

In this issue we have Eloviano covering Kamino, Seby covering Maple, Biff covering SuiLend, rezarwz covering Yei Finance, Muggles covering Gearbox, and Mary covering Loopscale.

In total the six projects account for nearly $6B in TVL, according to DefiLlama.

Let's get into it.

– ON Editorial Team

📈 Kamino Lend’s 400k Users — How the Protocol’s User Base Evolved Across Seasons

Kamino has steadily become a DeFi powerhouse, with 390,000 users since its launch. But the real story isn’t just the numbers; it’s how user behavior has shifted across Kamino’s seasons. Season 1 was a rush, with the protocol seeing its highest daily and monthly activity, and a surge of new users. More than twice as many users participated in Season 1 than in later seasons, though its average supply and loan sizes per user were modest.

Season 3 looked quite different: new user numbers dropped, but the average supply per user soared to more than 20 times Season 1’s average. Kamino Lend’s user base became smaller but more concentrated, with larger, more committed players now dominating the protocol.

Interestingly, the earliest users, those who joined before Season 1, proved to be some of the most loyal. Even as overall numbers dipped, these users stuck around and continued to engage with the protocol at higher rates than later cohorts.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and kinto.xyz