Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com and www.fyde.fi

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week Robinhood’s crypto business becomes the next target in US crackdown, the Bitfinex CTO dismissed rumors of major database breach, Bitcoin network celebrated 1 billion transactions, and big new venture rounds come in for Securitize ($47M) and Baxus ($5M).

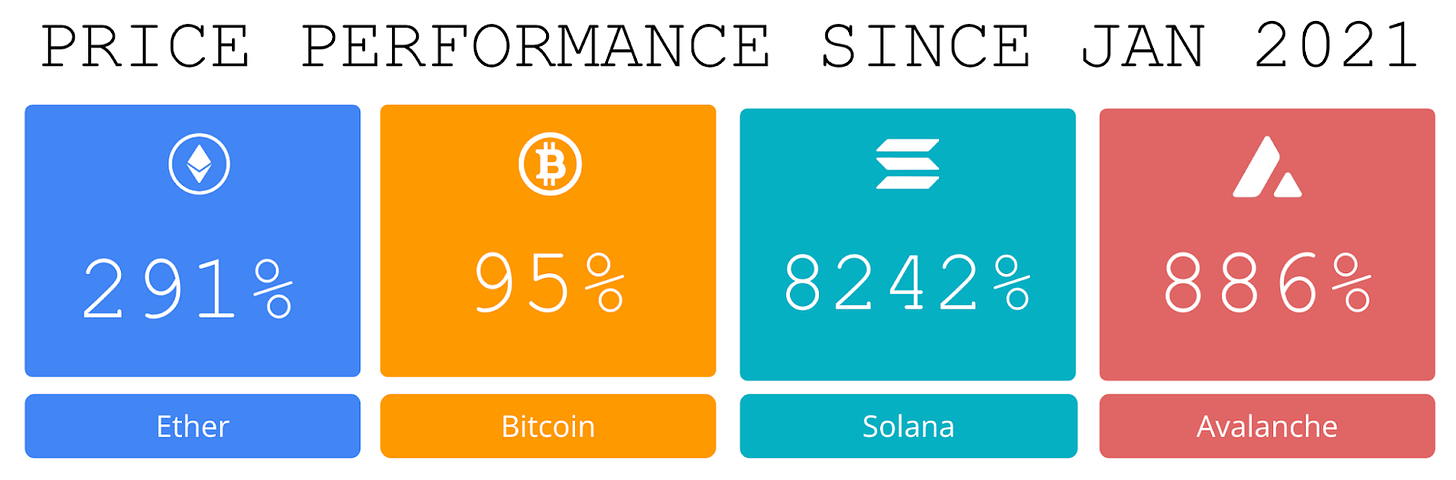

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 5.44% BTC on BTC in 2024 (77.89% YTD in USD terms) and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. Deck here: www.amphibiancapital.com

Fyde introduces AI-driven 'Liquid Vaults' to help crypto investors consistently lock in gains, earn yield, and stay liquid. Liquid Vaults are tokenized bundles of assets that can be traded and transferred, and use AI to mitigate risks. This innovation allows Fyde’s users to grow their crypto holdings faster with less volatility. To learn more, visit: Fyde Protocol or follow @FydeTreasury.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Fyde Brings Liquid Vaults to Ethereum

How often have you asked yourself: “Which category should I be buying (e.g. AI, RWA, meme, etc), and am I going to get rugged here?”

Given how fast-moving and volatile the crypto space is, users often struggle to keep track of different positions and to stay on top of time-sensitive events like airdrops or price dumps.

Fyde's Liquid Vaults have been designed to help in this situation.

Fyde is an on-chain portfolio and liquidity optimizer that helps users capture gains, earn yield, and stay liquid. At the core of Fyde is an innovation called the Liquid Vault, an on-chain, tradable vault that’s risk and liquidity managed by AI. The goal of the vault is to support the growth of crypto holdings with lower volatility. Users can then trade the vault wrapper token ($TRSY) as another means of liquidity.

How Fyde’s Liquid Vault Works:

Users can access the Liquid Vault via 40+ tokens. The vault redistributes deposited tokens into a diversified portfolio and gives the depositor a yield-generating wrapper token ($TRSY) tied to the underlying basket.

$TRSY is backed 1-to-1 with the initial deposit value at time of deposit (like liquid staking), but it represents the value of the vault so fluctuates based on performance of the vault’s assets. The vault can make returns more predictable and less volatile, allowing for quicker growth and compounding. As shown below, if two portfolios have the same average return (5% per year), the lower volatility portfolio can drastically outperform the higher volatility one.

Another feature of the vault is that users can retain voting rights on their native tokens, allowing them to still participate within their native communities' governance.

Vault rebalancing is driven by a combination of the algorithmic and community incentives via Fyde’s own native governance token ($FYDE).

AI Risk and Liquidity Management:

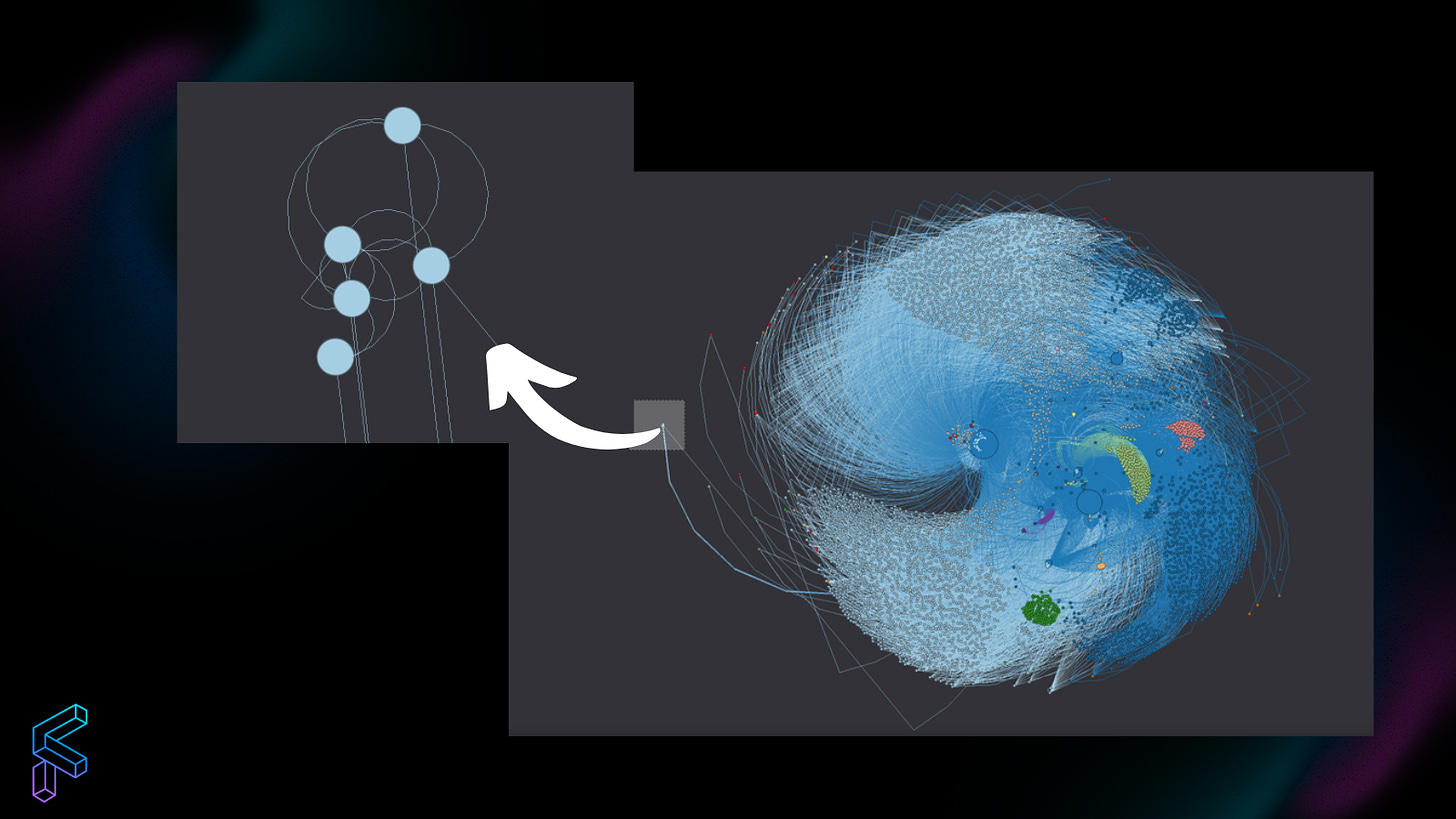

Fyde’s AI engine helps manage risk and liquidity for the protocol. Fyde runs network analysis (graph machine learning) to examine relationships between wallet flows and token prices, enabling Fyde to quantify risks in real-time. A visual example of this can be seen below:

To optimize liquidity for $TRSY, Fyde creates simulations that test liquidity strategies under different market conditions. The system dynamically adjusts these strategies based on real-time insights, increasing the liquidity generated for each dollar invested across DeFi.

Learn More:

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Robinhood’s crypto business is next target in US crackdown, filing reveals: Robinhood’s 8-K filing filed on May 4 revealed that it had received a Wells Notice, in which the SEC staff recommended the commission file an enforcement action against Robinhood’s crypto business, alleging securities violations.

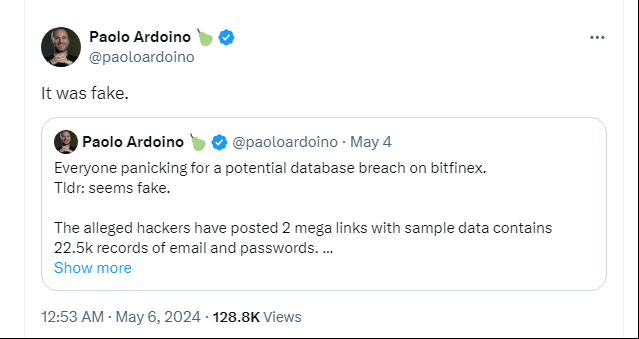

⚖️ Bitfinex CTO dismisses rumors of major database breach, suggests misinformation by hackers: Bitfinex Chief Technology Officer Paolo Ardoino has debunked rumors that the crypto exchange suffered a database exploit recently.Over the weekend, several reports suggested a potential database leak comprising 22,500 records of emails and passwords allegedly from Bitfinex users

⚖️ Bitcoin network celebrates 1 billion transactions as a Satoshi-era wallet awakens: Bitcoin network processed its one billionth transaction 15 years after it mined its genesis block in January 2009.Notably, the network achieved this milestone the same day a Satoshi-era Bitcoin address came to life.

⚖️ Terraform Labs' lawyers push back against SEC, argue token sales were mostly outside US:Lawyers for Terraform Labs pushed back against the Securities and Exchange Commission after the agency requested them to pay billions of dollars in fines.

⚖️LayerZero Labs finalizes initial snapshot for potential airdrop: LayerZero Labs, the developer of a cross-chain communication protocol, has completed the first snapshot apparently related to a potential airdrop distribution to community members.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @mrjasonchoi

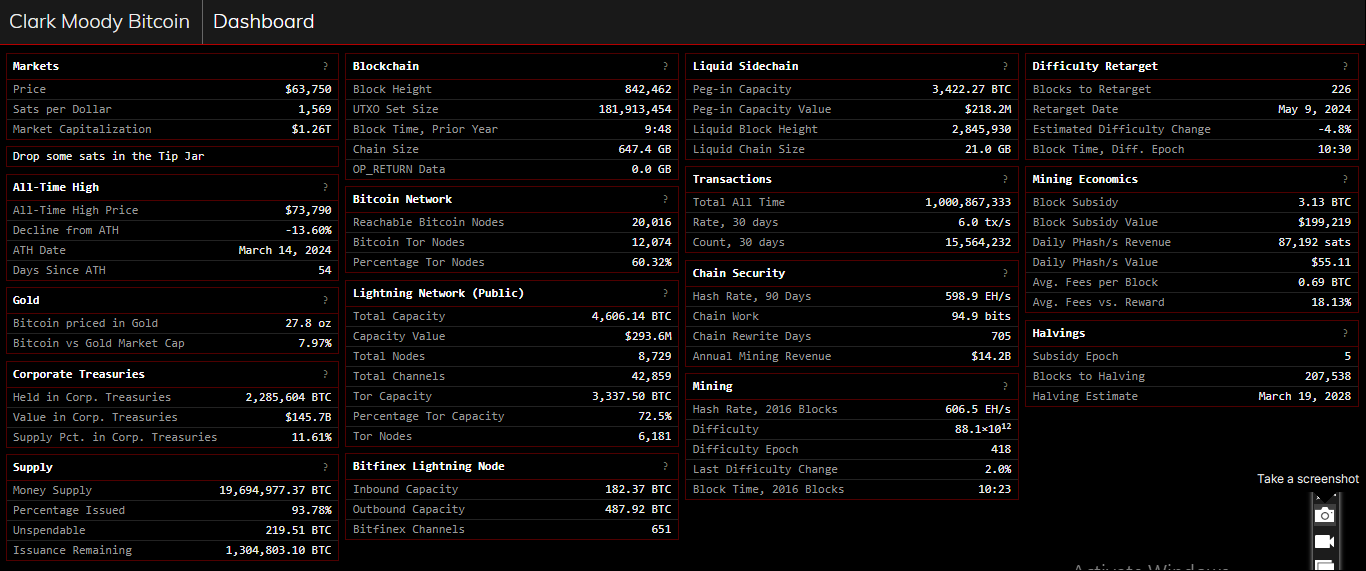

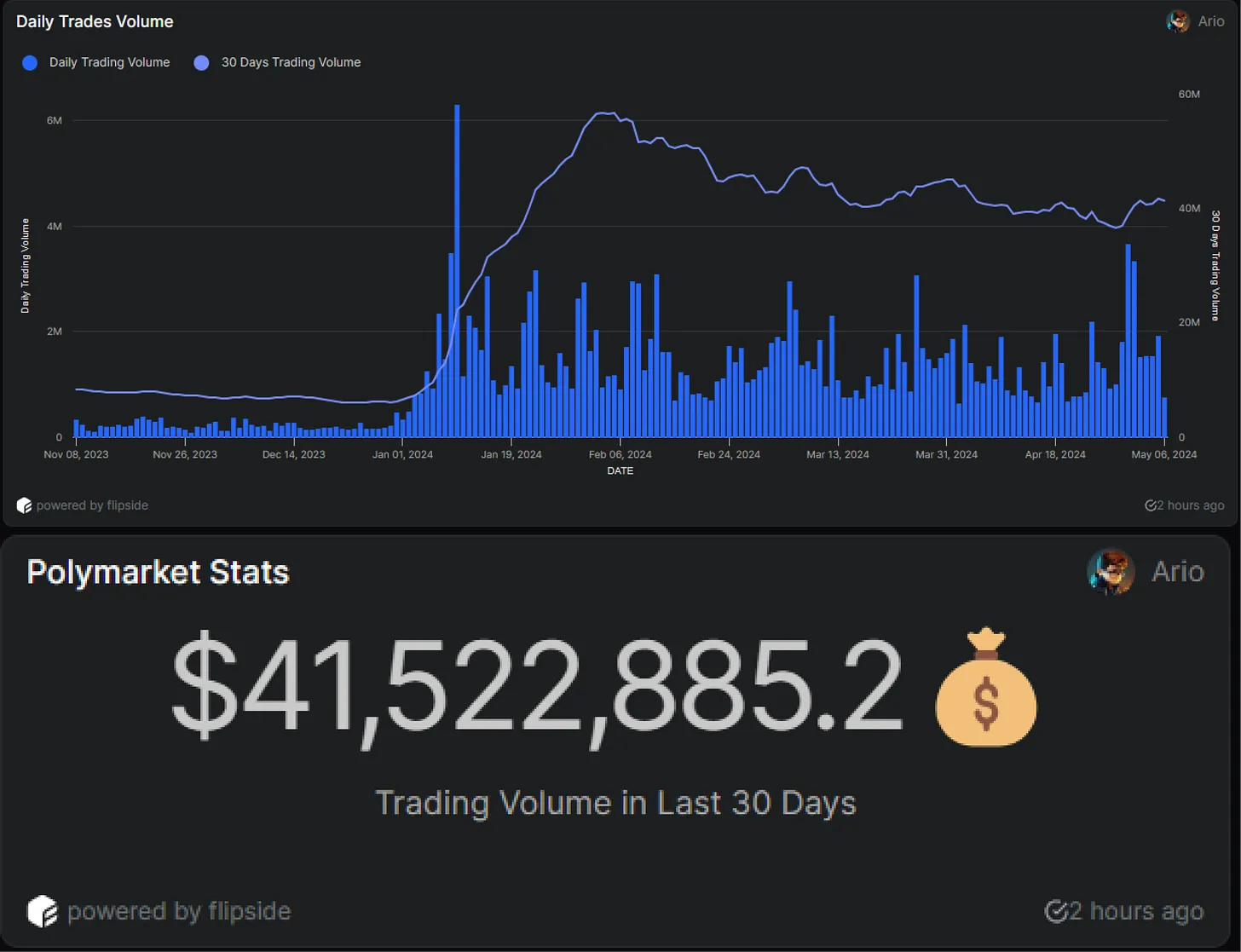

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

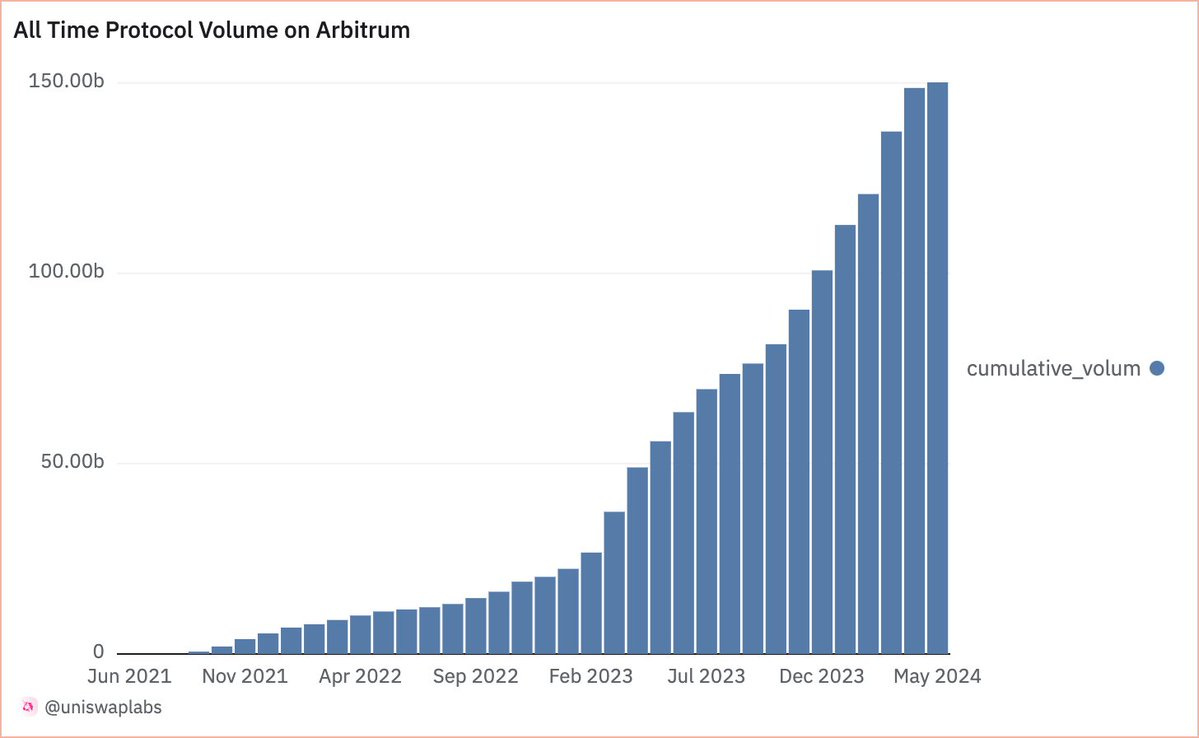

1. It’s official: Arbitrum is the first L2 to pass $150B in swap volume 🔷

Source: @Uniswap

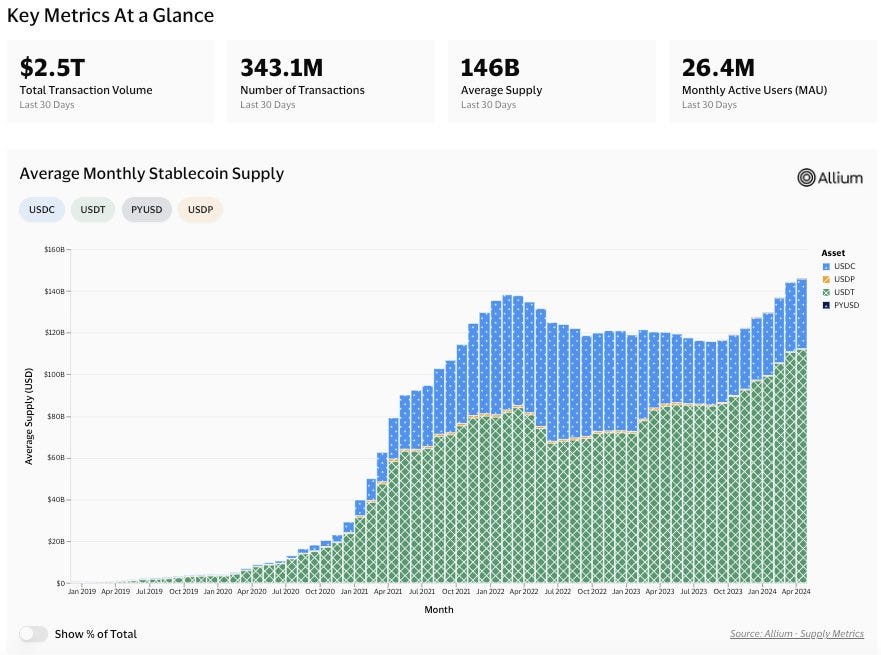

2. As Visa’s new stablecoin dashboard shows, monthly transaction volume is consistently over half a trillion dollars.

Source: @chainlink

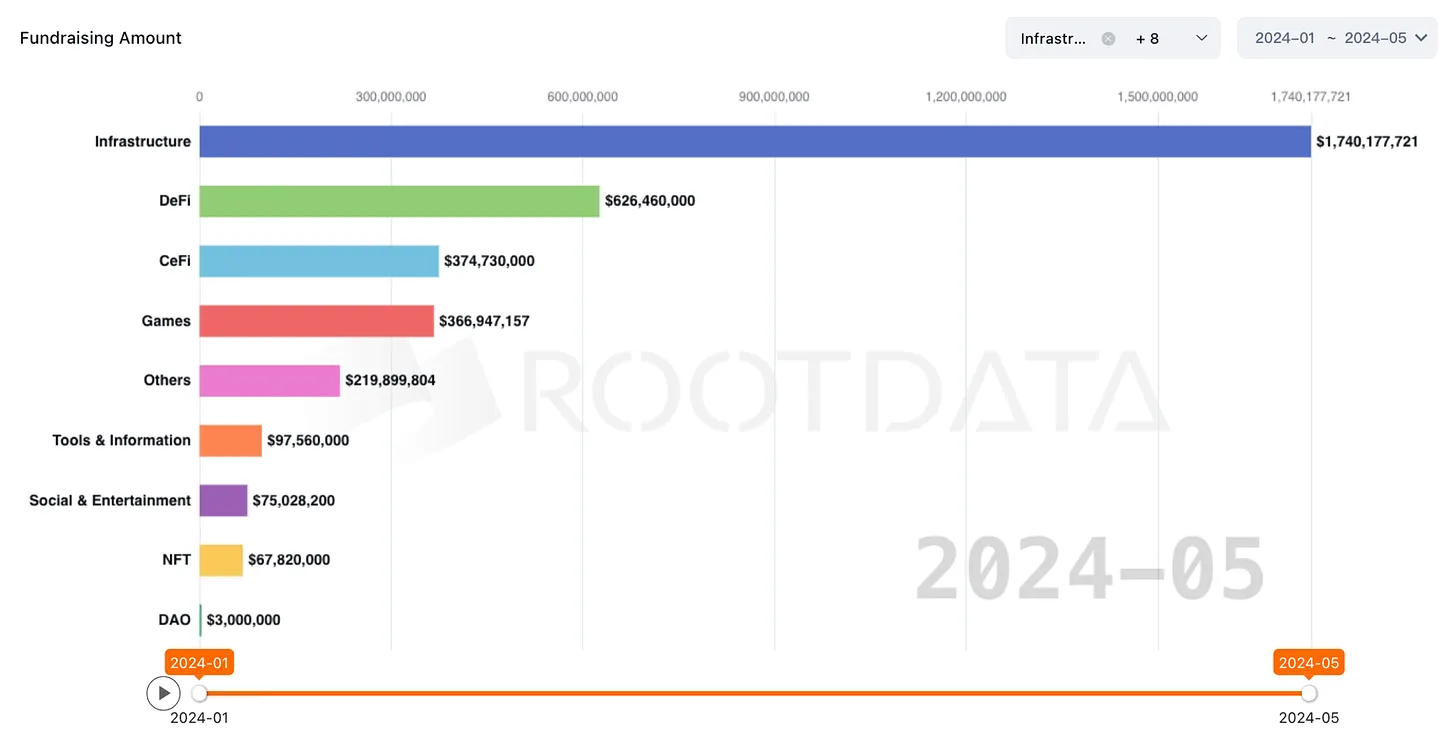

3. Consumer crypto projects have captured $563M in venture funding in 2024

Source: @OurNetwork

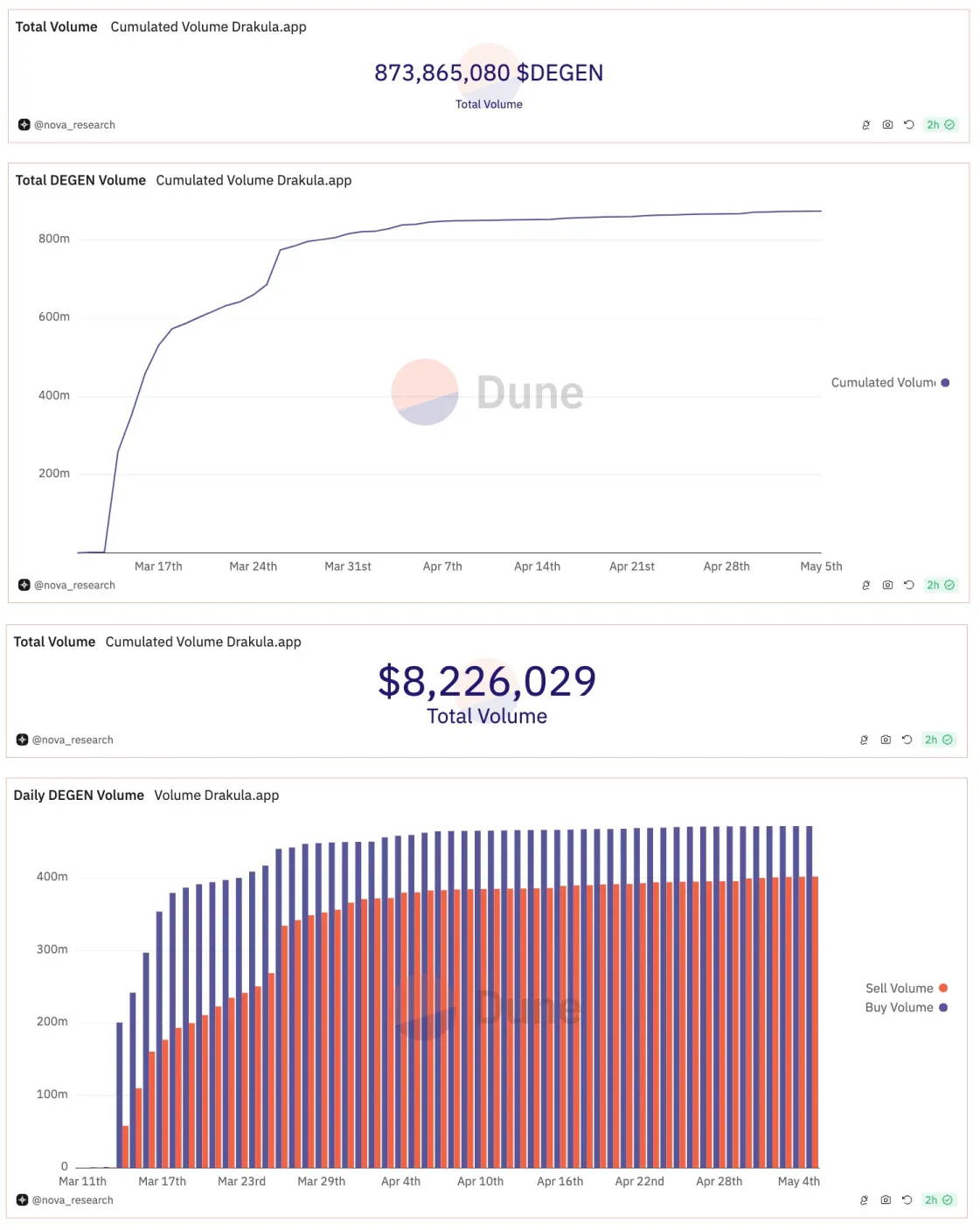

4. Drakula, a web3 short-form video app that allows users to trade social media creators, has surpassed 870M in $DEGEN volume, with over 21,000 creator tokens launched.

Source: @OurNetwork

5. Polygon ranks number 3 by DeFi transactions, just slightly behind Base.

Source: @OurNetwork

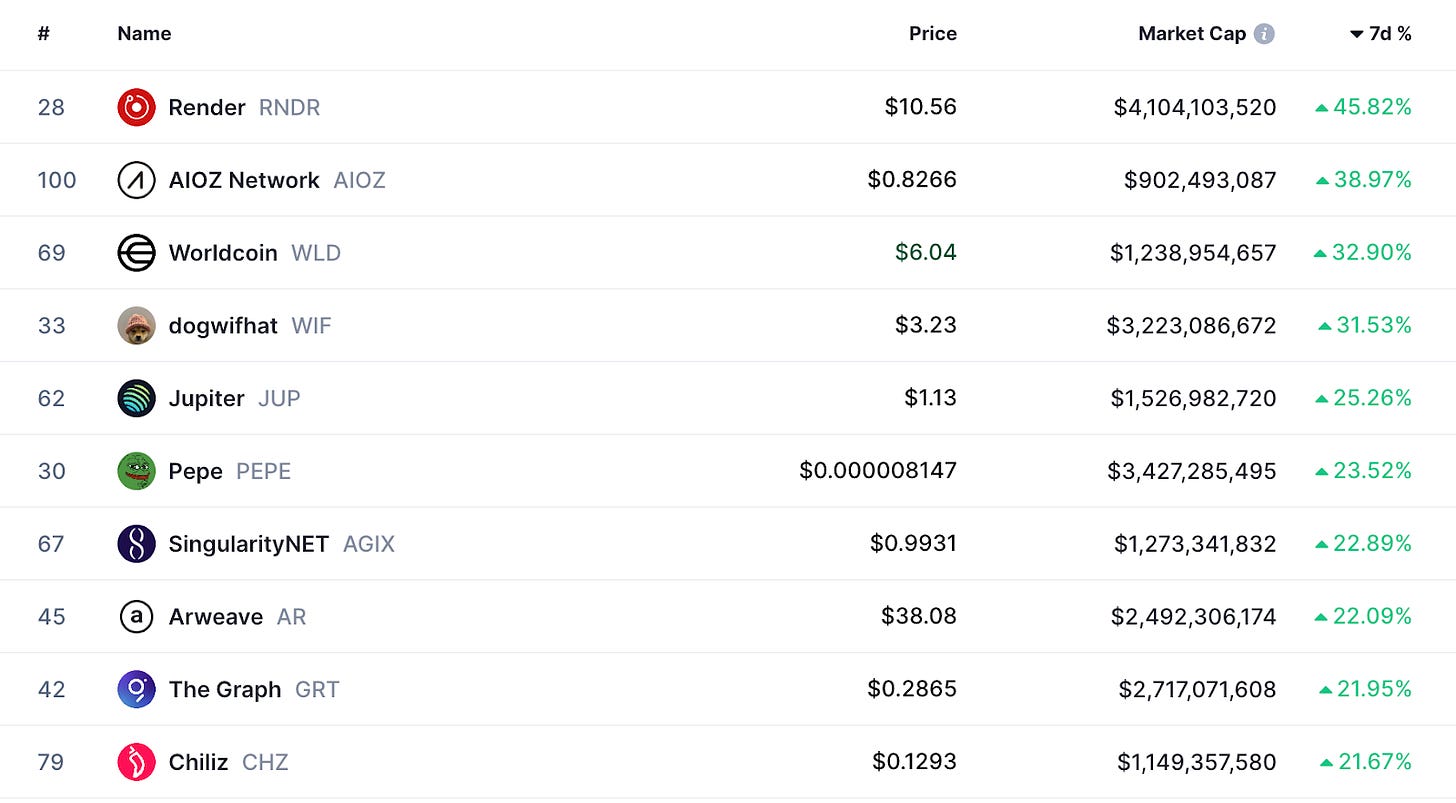

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

We at Pantera Capital are thrilled to announce our latest investment in TON, a Layer 1 network originally designed by Telegram and continued by the open source community. We believe TON has the capacity to introduce crypto to the masses because it is used extensively within the Telegram network. Telegram has over 900 million monthly active users on its future-facing, fast, and secure messaging platform that is used for personal and group communications, large-scale community building, content sharing, and more.

By leveraging Telegram’s vast user base and seamless UX with the vibrancy of TON’s emerging ecosystem, we believe TON has the potential to become one of the largest crypto networks.

Combining Web3’s Ethos With Massive Distribution

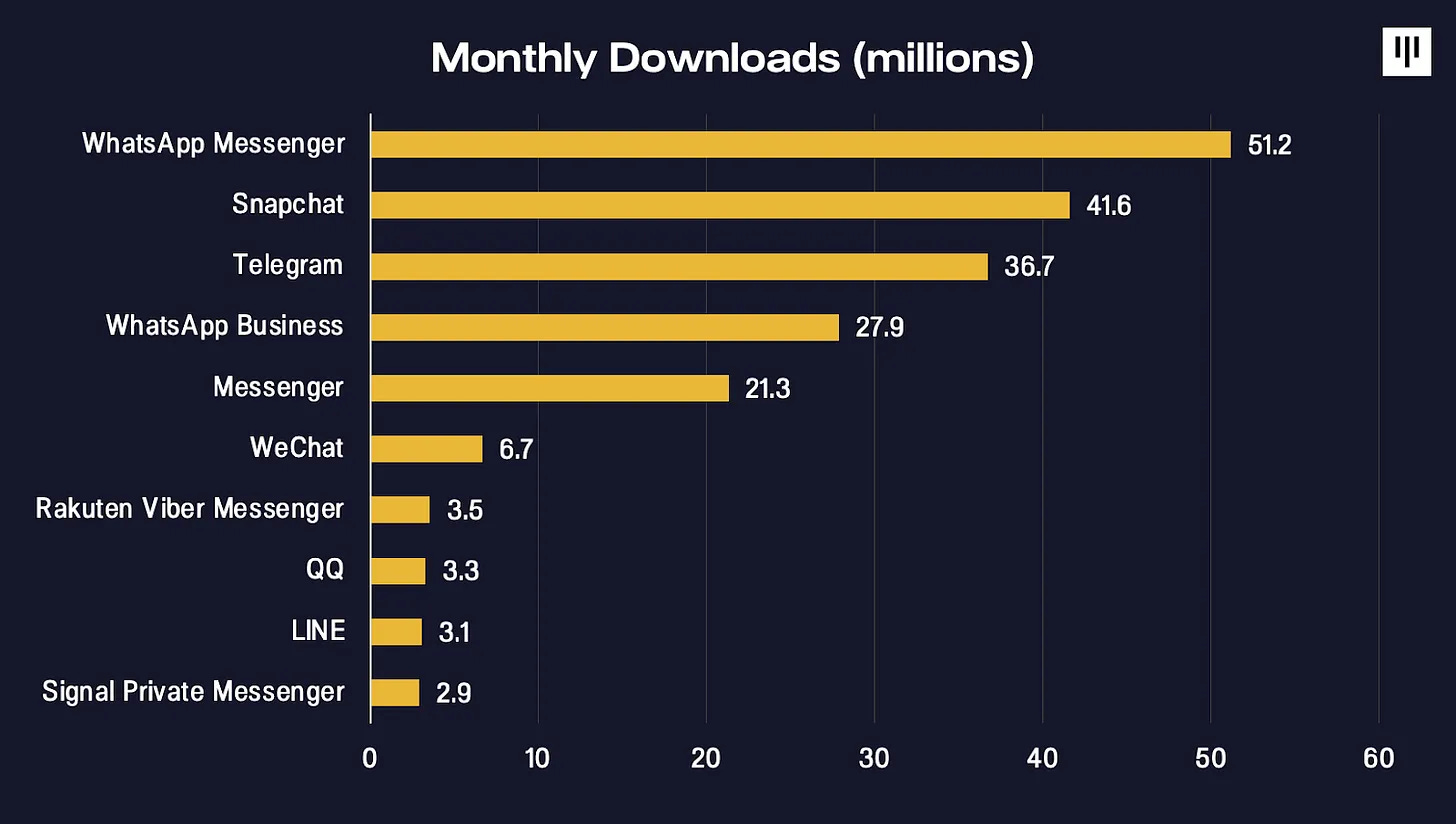

Among the world's leading messengers, Telegram stands out because its platform not only embodies much of crypto’s ethos, but has significant distribution. Telegram regularly outpaces its closest alternative, Signal, by 10x the amount of monthly downloads, garnering over 36.7 million in January of this year.

Telegram vs. Signal: January 2024 Monthly Downloads

What about the other top messengers? Telegram is the only major platform that is free of regulatory hurdles to incorporate Web3 for an open blockchain network. While Messenger attempted to incorporate crypto payments with Libra, they ultimately faced regulatory hurdles from the U.S that led to a complete shutdown. WeChat has attempted to integrate CBDC payments of digital yuan, but the system is limited in scope and builders don’t have the ability to create permissionless applications.

We believe Telegram is well positioned to bring crypto to the world because of its shared Web3 ethos and large distribution.

A Scalable Platform Built For Hundreds of Millions

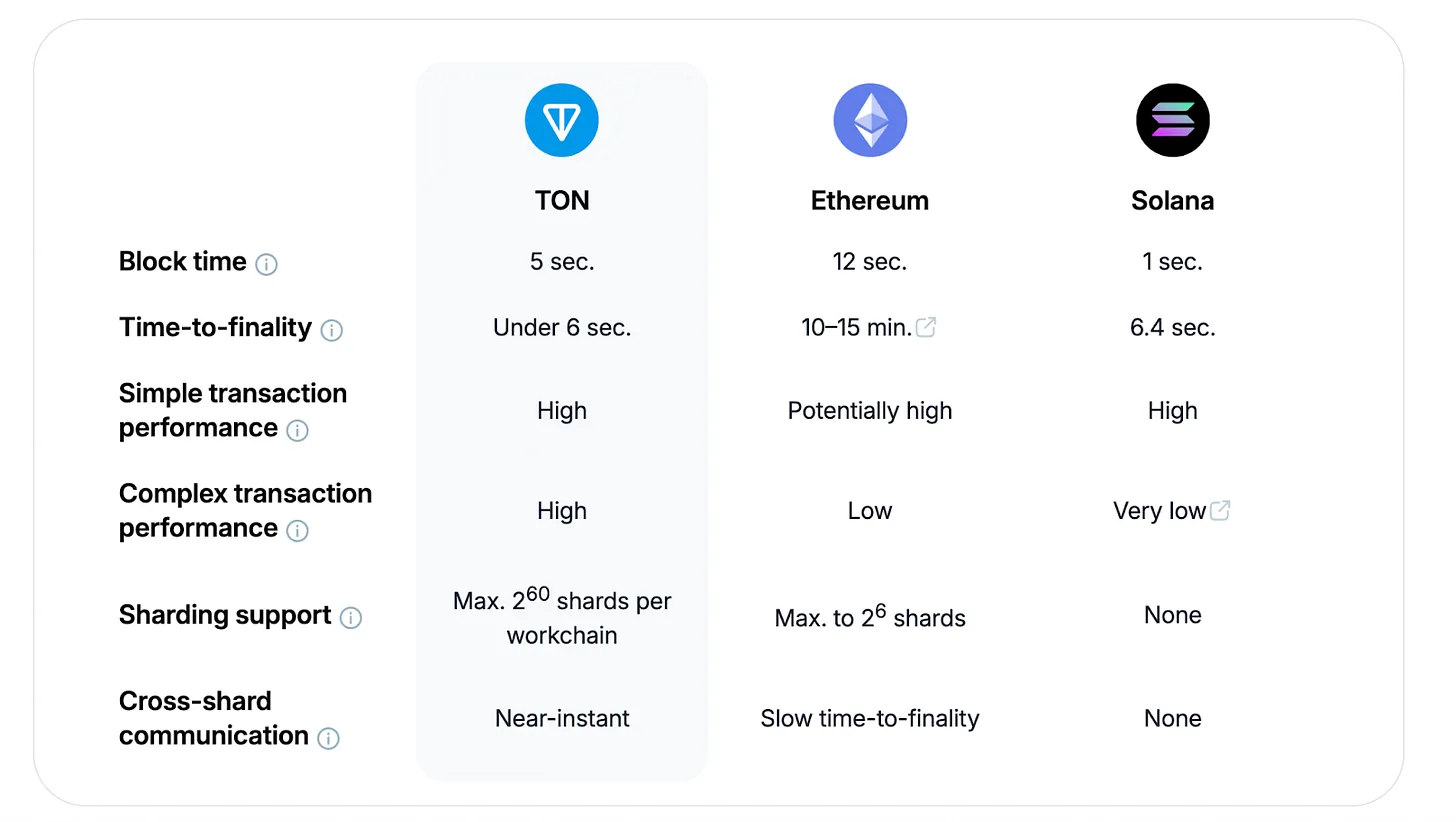

The Open Network (TON) is a blockchain initiative developed by Telegram, designed to leverage the messaging app's extensive user base to create a decentralized network capable of supporting a diverse range of applications. TON features a multi-component ecosystem, which includes TON Blockchain, TON Storage, TON DNS, and TON Services – all integrated to function seamlessly together.

The backbone of this system, the TON Blockchain, is built for high performance and scalability, processing transactions quickly thanks to its dynamic sharding mechanism. This architecture ensures the network can handle millions of transactions per second and scales efficiently as user numbers grow, making it ideal for developers aiming to launch applications for hundreds of millions of users without compromising speed or security.

TON’s dynamic sharding enables a scalable network for millions of users.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.fyde.fi