Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors. This week, we look at recent volatility and do a deep dive into the top six Ethereum competitors including Terra, Avalanche, Fantom, Solana, BSC, and the soon-to-launch Polkadot. We also review the top news and reports in the digital asset ecosystem and share more new LuvMonster NFTs.

In This Week’s Issue:

Market Update: A Sea of Red by Ryan Allis

The Top 6 Ethereum Competitors By Ryan Allis

Upcoming HeartRithm Institutional Investor Webinars 1. Feb 3, 2022 - Market Thoughts: Crypto Investing Update 2. Feb 10, 2022 - Crypto Investing for RIAs

This Week in Crypto

🗞️ Top Weekly Crypto News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Crypto Podcasts

📈 Top 10 Tokens of the Week

Real Vision: Interview with Ryan Allis & Ash Bennington

NFTs: LuvMonsters Collection - NFTs for 0.01 & An Auction - 1/1 Mint 👀

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Headline Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto quant fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Market Update: A Sea of Red by Ryan Allis

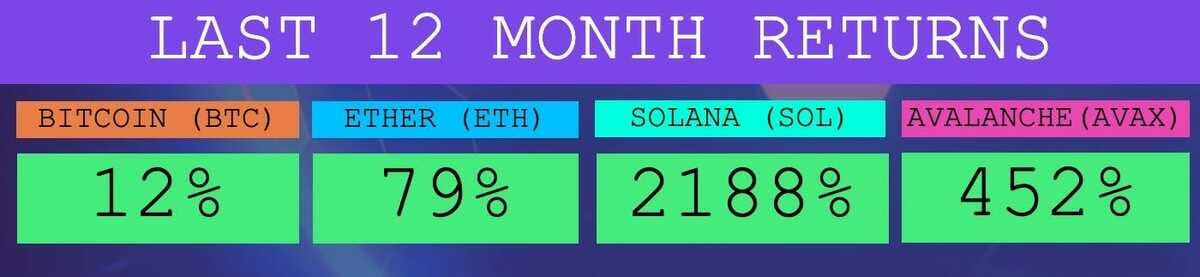

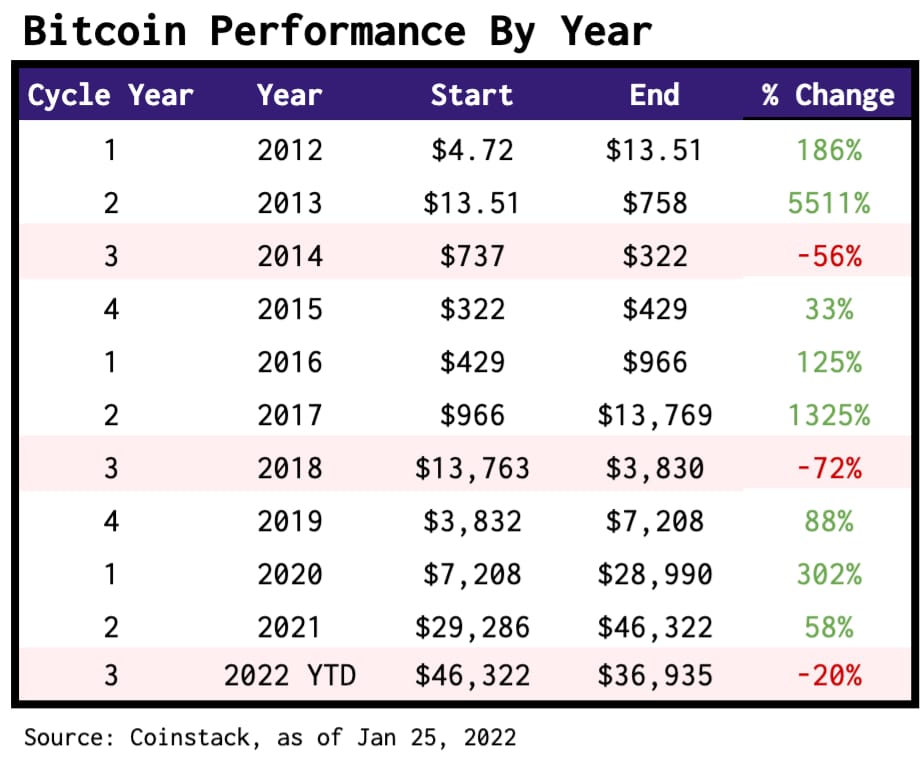

Bitcoin is now down 20% YTD in 2022 and so far has continued its trend of having a down year in the third year of its four year cycle.

Since the market peaked on November 10, 2022, we’ve seen substantial declines in both Bitcoin and Ethereum prices.

Yes, it’s a sea of red. But we see it as the buying opportunity of the year.

Remember the key adage: successful investors buy low and sell high.

Now is not the time to sell, but rather to either hold or if you can, buy.

We see this moment as a very good buying opportunity -- where you can get in at the prices from 9-12 months ago as we prepare for the next leg up in the market.

We haven’t seen an RSI this low on Ether since the COVID crash of March 2020. Looking at the combination of both RSI and the amount of revenues going through the Ethereum network, which isn’t slowing down, this is a buying opportunity unlike we’ve seen in almost 24 months.

Ethereum revenues are more than 2x what they were the last time Ether was trading at $2500 per ETH last Summer. Ethereum revenues continue to climb quickly reaching an all-time record last month of $1.1 billion.

This isn’t an 18-month bear market winter -- but rather a macro-driven interest-rate driven reset that is presenting a great buying chance for people who know how to value Ethereum and similar assets.

Some digital assets, like the soon-to-launch Polkadot (DOT), a faster multichain-compatible version of Ethereum led by Gavin Wood, one of the original co-founders of Ethereum, are trading at the same price as they were a year ago.

My view, that I wrote about last week, is that we are no longer in the standard four-year cycles -- but now are moving in shorter 6-9 month volatility windows -- in which each cycle high is higher than the prior period. We saw these two peaks in 2021 exactly six months apart -- one in May 2021 at $64k BTC and another in November 2021 at $68k BTC.

The double peak theory that I wrote about last July when BTC was at $30k is now becoming triple peak theory.

And yes, that means I do expect to see new ATHs for quality digital assets and L1 smart contract platforms like Ethereum, Avalanche, Solana, Fantom, and Polkadot during 2022.

My sense is that we will see divergence in the market in 2022 -- with fast growing platforms like ETH, AVAX, SOL, FTM, and DOT rising and BTC perhaps having a flat to slightly down year.

So yes, if you’re investing directly in quality digital assets that pass along their cash flows to their holders via staking rewards -- I think you’ll still have quite a good year.

The wild card of course, is what happens to equities. Many, myself included, believe that equities are overpriced and have another 30-40% to come down before they will be in range of historical averages for PE ratios. The current Shiller PE10 ratio for equities 35.99. Even after a recent minor correction, equities remain more than twice the price of their 130 average going back to 1870 -- which is 16.9X trailing 10 year earnings.

So what to do? Well, personally I’m making a 10 year bet on the digital asset space and am planning holding my crypto bets from 2021 until 2030. Holding through multiple cycles is one of the keys to getting massive returns in crypto.

I’m also working at the market neutral crypto hedge fund HeartRithm which provides monthly yield to our investors via margin lending and DeFi Yield farming.

For everyone in the industry, it’s time to build. We’ve got the new global financial system to create this decade, running upon blockchains, smart contracts, and tokenized assets.

📈 The Top 6 Ethereum Competitors by Ryan Allis

About the Author: Ryan Allis is a Managing Partner of HeartRithm, a crypto yield fund, and the Publisher of Coinstack

As of January 2022, the top Ethereum competitors in the smart contract platform ecosystem are:

Terra (LUNA)

Binance Smart Chain (BNB)

Fantom (FTM)

Avalanche (AXAX)

Solana (SOL)

Polkadot (DOT)

Here is how each of the above compares based on TVL in DeFi. Note that Polkadot is launching in Q1 2022 and thus does not yet have any value locked in its DeFI application layer.

When you look at growth of usage since October 2021, Fantom (FTM), Avalanche (AVAX), and Terra (LUNA) stand out as intriguing investment opportunities.

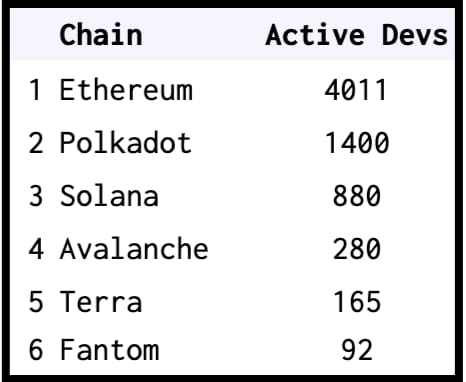

When you rank these chains by the number of active developers contributing to their GitHub repository monthly, Polkadot (DOT) becomes quite noticeable. Polkadot will be launching its first DeFi apps in Q1 2022, making it an interesting potential investment at these levels.

Combining TVL, devs, and current market caps, we suggest looking strongly at investment allocations in Fantom, Avalanche, Terra, and Polkadot. We leave out Binance Smart Chain and Solana for now from our recommendations as they have been shrinking the last four months based on TVL.

Here is a brief summary of each chain:

Terra (LUNA) - Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems. Terra offers fast and affordable settlements. Development on Terra began in January 2018, and its mainnet officially launched in April 2019. As of September 2021, it offers stablecoins pegged to the U.S. dollar, South Korean won, Mongolian tugrik and the IMF’s Special Drawing Rights basket of currencies. Its largest apps are Anchor, Astroport, and Terraport.

Avalanche (AVAX) - Avalanche is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality. Avalanche is fast, low cost, and eco-friendly. Any smart contract-enabled application can outperform its competition by deploying on Avalanche. Avalanche launched on mainnet, September 21, 2020. Its largest apps are Aave, Benqi, and Trader Joe.

Fantom (FTM) - Fantom is a directed acyclic graph (DAG) smart contract platform providing decentralized finance (DeFi) services to developers using its own bespoke consensus algorithm. Together with its in-house token FTM, Fantom aims to solve problems associated with smart-contract platforms, specifically transaction speed, which developers say they have reduced to under two seconds. Its largest apps are Multichain, Yearn, and SpookySwap.

Polkadot (DOT) - Polkadot is an open-source sharded multichain protocol that connects and secures a network of specialized blockchains, facilitating cross-chain transfer of any data or asset types, not just tokens, thereby allowing blockchains to be interoperable with each other. Polkadot was designed to provide a foundation for a decentralized internet of blockchains, also known as Web3. Polkadot is known as a layer-0 metaprotocol because it underlies and describes a format for a network of layer 1 blockchains known as parachains (parallel chains).

Solana (SOL) - The Solana protocol is designed to facilitate decentralized app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain. While the idea and initial work on the project began in 2017, Solana was officially launched in March 2020 by the Solana Foundation with headquarters in Geneva, Switzerland. Its top apps are Serum, Quarry, and Raydium.

Binance Smart Chain (BNB) - Binance Smart Chain launched in September 2020, about a year and a half after the launch of its older sibling Binance Chain. It is a smart contract platform mimicking the functionality of Ethereum. Its top apps are Pancake Swap, Tranchess, and Venus.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting two upcoming 55 minute webinars on crypto investing for family offices, RIAs, fund of funds, wealth managers, and financial advisors covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing and mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week...

⚡ Ethereum Foundation Kills ‘ETH 2.0’ in Favor of ‘Consensus Layer’ Rebrand - The Ethereum Foundation today, following the lead of the blockchain's core developers, announced that the term "Ethereum 2.0" is being retired in favor of "consensus layer." (Source)

😮 IMF Urges El Salvador To Discontinue Bitcoin’s Legal Tender Status - The global financial institution said BTC's use as legal tender poses risks to the country's financial stability, integrity and consumer protection. (Source)

🏧 JPMorgan Chase Closes Uniswap Founder’s Bank Accounts - JPMorgan Chase has closed the bank accounts of Hayden Adams, the founder of the largest decentralized exchange protocol Uniswap. (Source)

💰 U.S. Congressman Calls for ‘Broad, Bipartisan Consensus’ on Important Issues of Digital Asset Policy - Representative McHenry is convinced that Congress should take crypto regulation away from executive agencies and courts. (Source)

🤑 MicroStrategy Stock Slides As the SEC Rejected Its Bitcoin Accounting Strategy - Shares of MicroStrategy tumbled in tandem with the crypto market downturn, following the unfavorable accounting ruling by the SEC. (Source)

💬 Tweet of the Week

😂 Meme of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Liquidations Spiked to 1,692 on Aave, DeFi’s Largest Protocol, on Jan. 23, Making It the Highest Liquidation Cascade Since the Crash in Late May 2021

2. Volumes for NFT Marketplaces Ticked Up, With OpenSea Setting a Record for Monthly Volumes This Week, Surpassing Its August Record After Reaching More Than $3.2 Billion

3. Minor Inflows of $14M in the Past Week Suggests Institutional Investors Are Taking Advantage of the Price Dip

4. MakerDAO Stands To Profit From All the Liquidation Events Happening Recently $17.5M Earned in Liquidation Revenue Thus Far

5. Fantom Is Now the Second-Largest DeFi Chain by Total Value Locked, Surpassing Terra, Avalanche, and Solana

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Block by Block: Assessing Risk in Decentralized Finance

Moody’s Analytics provides financial intelligence and analytical tools supporting clients’ growth, efficiency and risk management objectives. In their latest report, the Moody’s Analytics team goes in-depth on DeFi and assesses its risks.

"Blockchains are the core infrastructure of cryptocurrencies, acting as a digital, immutable transaction ledger stored on a distributed network. Each transaction is recorded in a "block" Once filled and validated, adds to a growing chain, with each storing a one-way hash of the previous block. A network of validating servers continually adds each new block to the chain via consensus, eliminating the need for institutional middlemen and associated prerequisites, such as business hours, settlement and clearing."

"We can view the current lending relationship in DeFi as between a collateralized borrower and the platform itself. Platforms tend to provide two types of associated cryptocurrencies: a promissory token, which represents the loan value, and a governance token, which allows the holder to influence platform decisions and often receive some fraction of platform fees. When a borrower creates a loan on a platform, the platform’s smart contracts retain custody of the collateral for the loan's lifetime. In exchange, the platform provides a promissory token that can be exchanged for the collateral supplied along with interest. These tokens, which are often pegged at a fixed rate to fiat or cryptocurrency, can be transferred between parties, but only the original party can redeem for the associated collateral."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: OpenOcean is a CeDeFi aggregator, PolySwarm is malware detection, and Elastos is an L1.

🖥️ Video Podcast Interview on Proof of Stake, Ethereum, & DeFi

Here is the transcript from the recent RealVision podcast appearance by Coinstack Publisher & HeartRithm Managing Partner Ryan Allis.

Topics: “Can Proof of Stake properly scale, let alone provide real services to the general public? A true believer in the core DeFi value proposition, Ryan Allis, managing partner at HeartRithm and publisher of Coinstack, addresses these issues in an interview with Ash Bennington. Allis also talks about the fierce competition among smart-contract platforms, Ethereum’s once and future dominance, and other macro factors at work in the cryptosphere right now. Filmed on January 12, 2022.”

🎨 NFTs of the Week: 0.01 ETH LuvMonster NFTs

This week Mrs. Luv Bubble has grown to 164 unique NFT owners and has sold a record 148 NFTs in a week. Our joyous plans are working.

All of our new mints last week sold out within 4 hours of Coinstack coming out, so get them quickly before they go into the resale market. We have new LuvMonster NFTs available on OpenSea on both the Ethereum network and Polygon network.

Our eventual goal with LuvMonsters is to build the new Pokémon + Beanie Babies equivalent -- but for the 2020s — complete with stuffed animals. collector cards, animated movies, and merchandising.

The CryptoPunks and Bored Ape Yacht Clubs of the 2020s are replacing the Hello Kitty and Pokemon media brands of the 1980-2010s.

We’re seeing the average LuvMonster climb in value about 10x from its initial launch price within its first week on OpenSea.

We believe in shared prosperity for the community, so collect them early and hodl as we build our community to 1000+ owners, creating an active secondary sale market for these beautiful paintings.

Listen to the sounds in their videos. Read their hilarious descriptions. And share with your friends in other Discord communities.

Once we get to 1000+ unique owners, then it’s time for the stuffed animal line and the animated video series. Thank you for helping us get there!

Mrs. Luv Bubble is a prolific artist of joy. She is now hand painting, digitizing, and launching a daily joyous LuvMonster NFT on OpenSea -- a hybrid joyous mythical creature. We’re up to 59 LuvMonsters and counting!!

Join our Telegram group for early access to our NFT drops just for our inner circle community at t.me/luvmonsters.

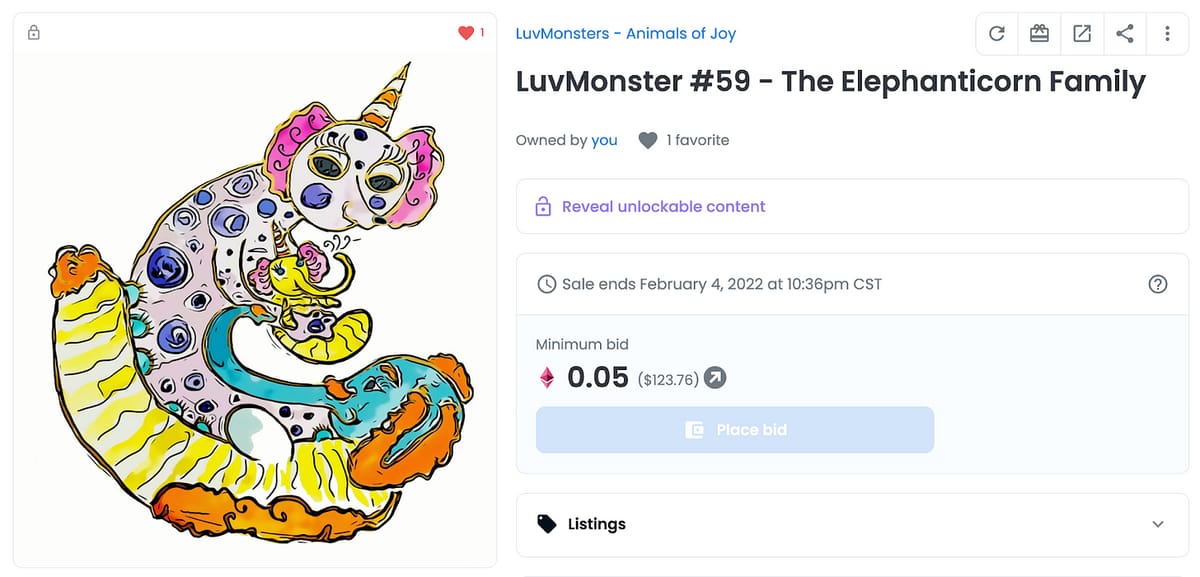

You can bid on her latest drop, an auction of LuvMonster #59, a 1/1 mint on the OpenSea Ethereum network.

New NFTs This Week - Limited Pre-Sale Available for 0.01 ETH

Here are her new NFTs launching this week that you can collect:

LuvMonster #53 - Kandy the Koalacow - 1 Final Copy Remaining, 0.01 ETH

LuvMonster #54 - Panda Moose - 3 Copies Remaining - 0.01 ETH

LuvMonster #55 - Porki the Poo - 16 Copies Remaining - 0.01 ETH

LuvMonster #56 - Chippy The Rat - 14 Copies Remaining - 0.01 ETH

LuvMonster #57 - Blukey the Lion Bear - 5 Copies Remaining - 0.01 ETH

LuvMonster #58 - Penguifly - 7 Remaining - 0.01 ETH

1/1 Mint - LuvMonster #59 - Auction Starts At 0.05 ETH

LuvMonster #59 - The Cute Elephanticorn Family is now being auctioned off. She is a special 1/1 mint on the Ethereum blockchain. All Bids Of 0.05 ETH or Higher Accepted. The auction will end in 9 days on February 10, 2022 and this gem will go to the highest bigger.

Here’s the beautiful hand-painted then digitized LuvMonster #59 that is being auctioned off:

Additional Coinstack Sponsors

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 16,632 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.