Learn More at www.crowdcreate.us and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week the SEC approved in‑kind redemptions, CryptoPunks NFTs saw its highest weekly trading volume since March 2024, PayPal rolled out, “Pay with Crypto”, and big new rounds were announced by Plasma ($373M) and OSL Group ($300M).

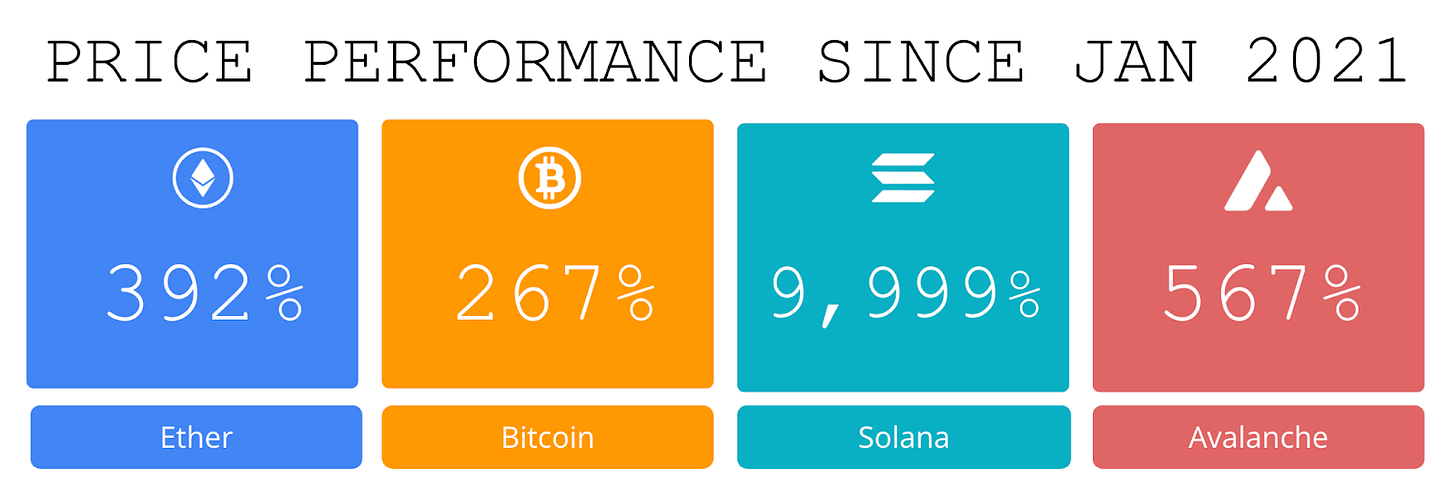

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

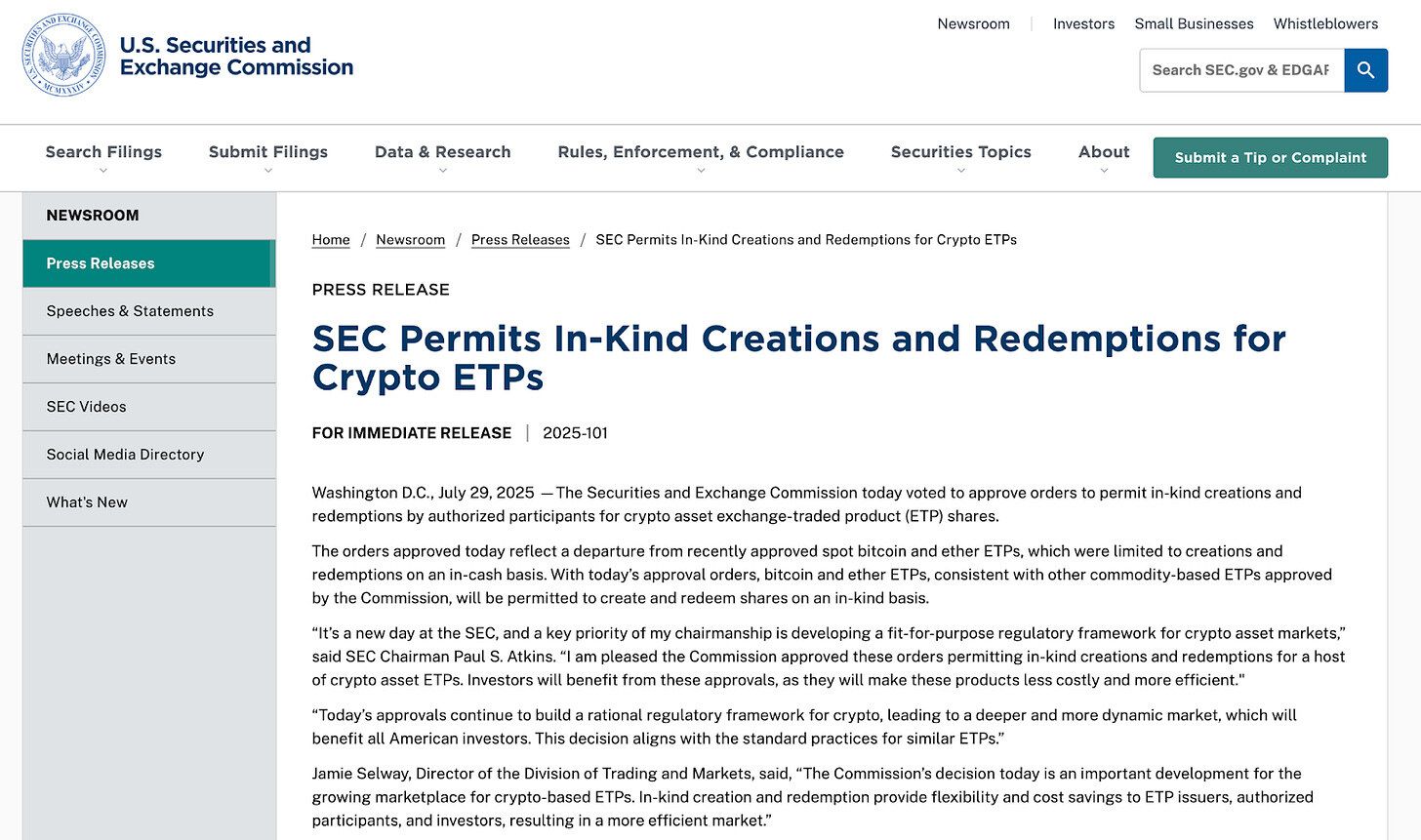

⚖️ SEC approves in‑kind redemptions for spot Bitcoin and Ethereum ETFs: The Securities and Exchange Commission today voted to approve orders to permit in-kind creations and redemptions by authorized participants for crypto asset exchange-traded product (ETP) shares.

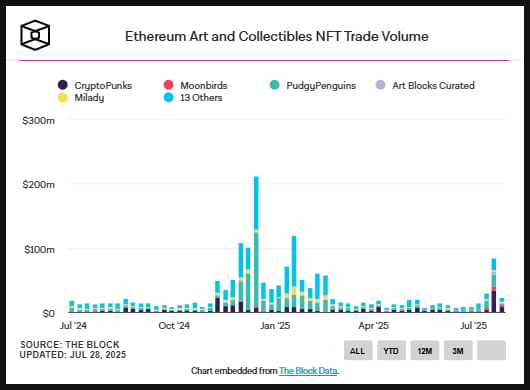

📈 CryptoPunks NFTs see highest weekly trading volume since March 2024: The CryptoPunks NFT series saw over $24.6 million worth of trading volume last week, its highest weekly total since March 2024. This also represents a 416% increase compared to the prior week.

🚀 PayPal uses PYUSD stablecoin to enable payments in over 100 cryptocurrencies: PayPal has unveiled a new payment option that will enable small businesses to accept dozens of cryptocurrencies. The tokens will be converted into the PayPal-branded, Paxos-managed stablecoin, which is increasingly being folded into the fintech giant’s business model.

💸 One of the Biggest Bitcoin Whales in History Just Cashed Out $9 Billion: Institutional crypto firm Galaxy said Friday that it had sold more than 80,000 Bitcoin—over $9.3 billion worth at the current price—for a Satoshi-era investor. In a Friday statement, Galaxy said "it was one of the largest notional Bitcoin transactions in the history of crypto on behalf of a client." The firm further described the sale as "one of the earliest and most significant exits from the digital asset market."

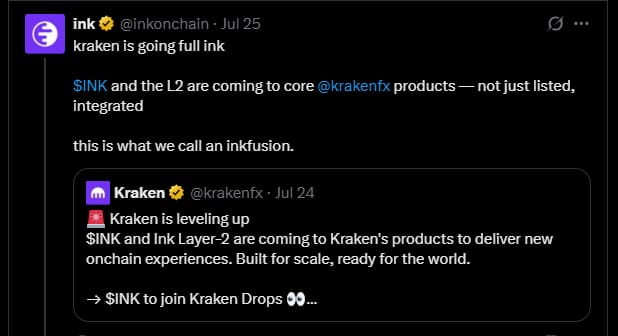

🚀 Kraken to integrate INK token and Ink network into 'core product suite' ahead of airdrop:Kraken is introducing the much-anticipated INK token and Ink Layer 2 into its existing product suite for its global client base. The move will "unlock a new wave of use cases powered by onchain protocols and infrastructure," the crypto exchange wrote in an announcement on Thursday.

💬 Tweet of the Week

Source: @maxkeiser

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

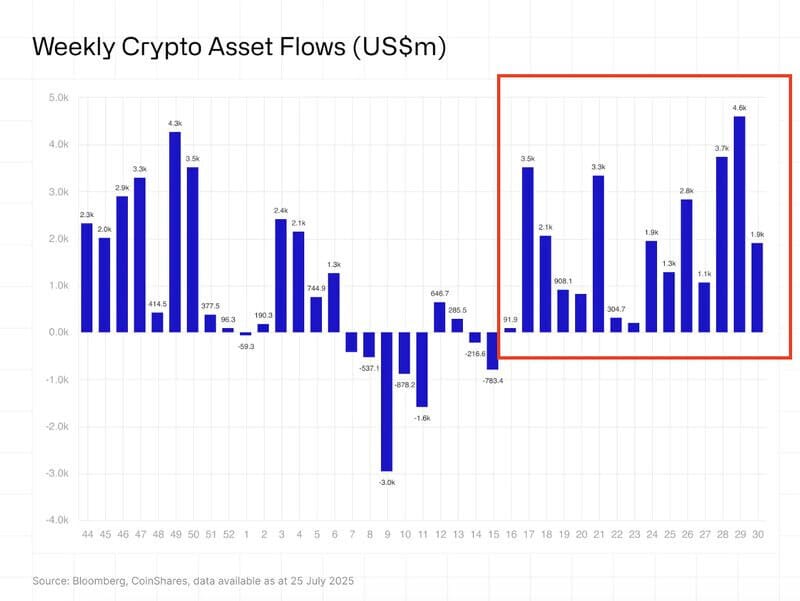

1. 15 straight weeks of positive inflows into digital assets, with another $1.9B pouring in - capped off by ETH ETFs ($1.85B) flipping BTC ($72M) for the first time.

Interestingly, SOL had its best week in 2025 with $311M of inflows, accounting for 37% of its entire YTD total. XRP also surged with $190M, while its RLUSD stablecoin grew by 12% week-over-week to a new high of $578M in circulation.

Source: @DavidShuttleworth

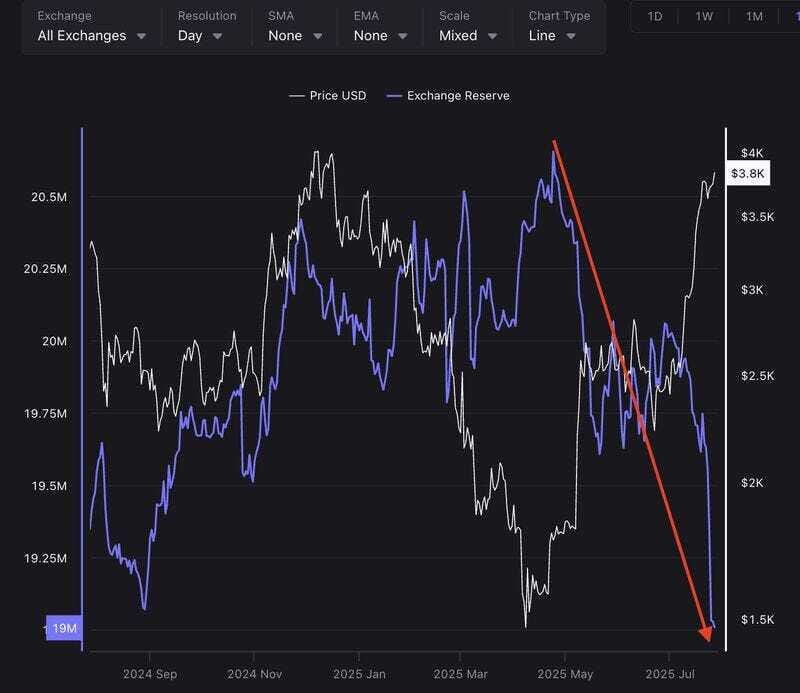

2. The supply shock is real. ETH liquidity on exchanges has dropped to its lowest level since June 2024 and since the Pectra upgrade in May, has declined by over 8% (~1,600,000 ETH valued at roughly $6.1B).

Meanwhile, ETH ETFs (5.8M ETH) and treasury strategies (2.3M ETH ) now collectively hold more than 6.5% of the entire supply.

Source: @DavidShuttleworth

3. For the first time ever, weekly ETH ETF inflows flipped BTC, with $1.85B compared to just $72M.

ETH ETFs have now seen 16 consecutive days of positive inflows. Meanwhile, BTC ETFs have experienced net outflows for 3 of the last 5 days.

Source: @DavidShuttleworth

4. Validator exit queues continue to grow, surpassing 705,000 ETH (~$2.8B) and are 32% higher than the previous peak in January 2024. Wait times are now approaching 13 days.

Interestingly, validator entry queues also remain elevated, with over 280,000 ETH (~$1B) waiting to enter and a current wait time of 5 days.

Source: @p_petertherock

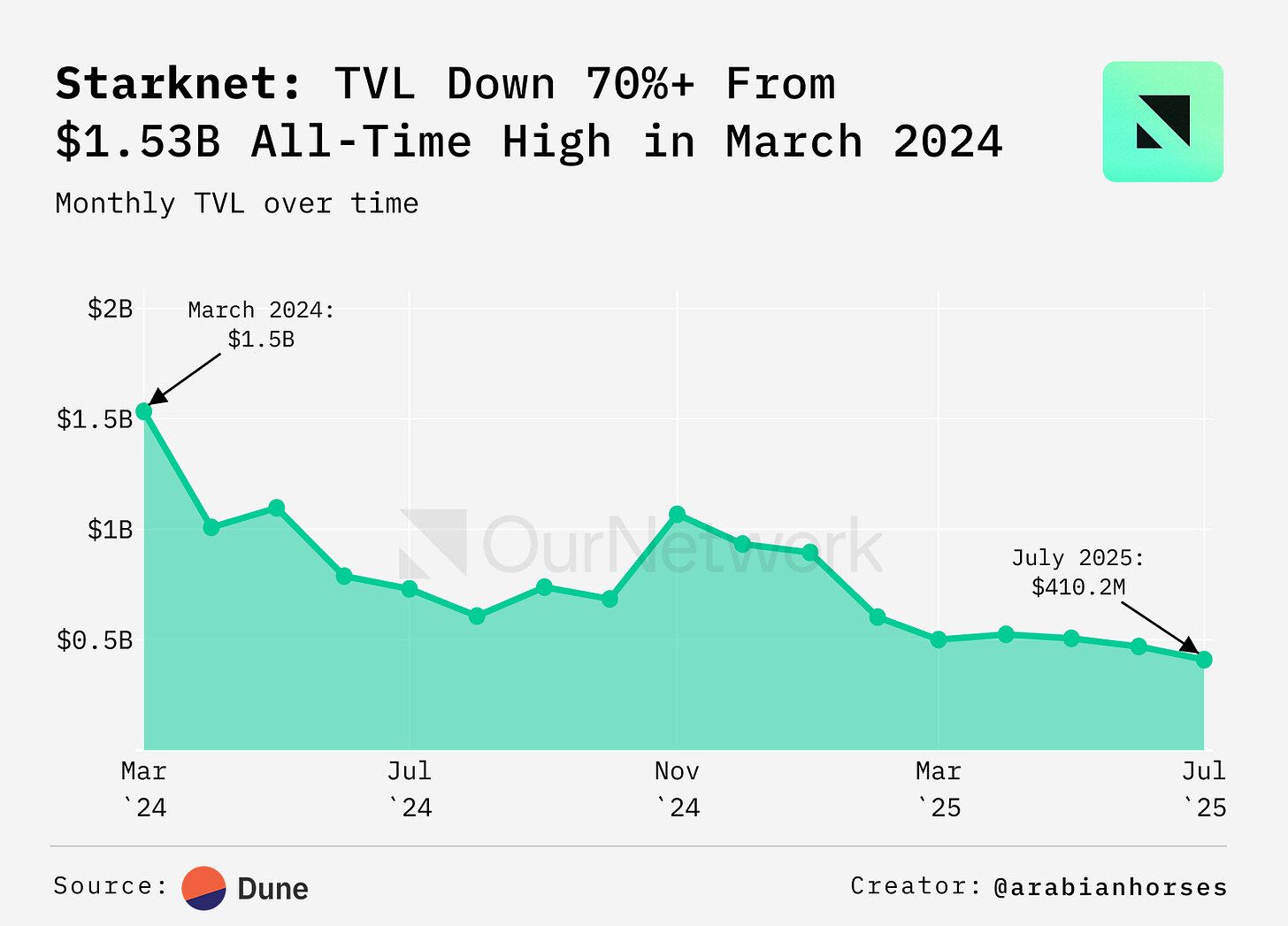

5. Starknet’s total value locked (TVL) peaked at $1.53B in March 2024 but since then has been bleeding, falling to levels of $410M, driven by net outflows in wstETH (-$5.4M in Dec 2024) and USDC (-$15.4M in June 2025). STRK token inflows were primarily token unlocks rather than new capital. TVL declined however, suggesting capital rotation rather than sustained growth. Stablecoin withdrawals and ETH outflows indicate real capital leaving the platform.

Source: @arabianhorses0

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork's latest. In this issue we're covering Layer 2s with insights from the growthepie team, Reuben, surfquery, and Sandesh. Be on the lookout for the second installment of this two-part series next week.

– ON Editorial Team

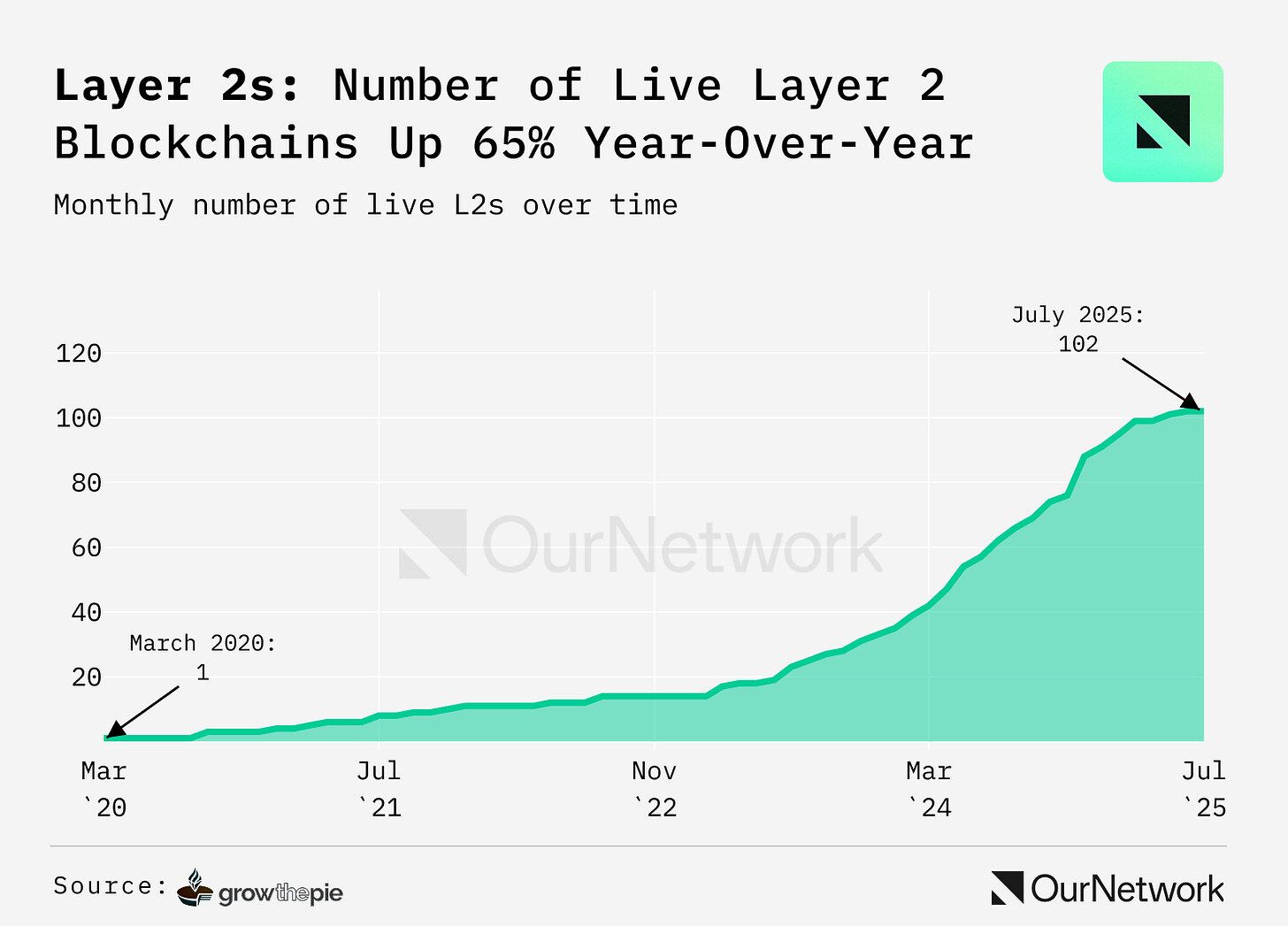

📈 Layer 2 Infrastructure is Starting to Mature Across Multiple Metrics, and Corporations are Not Just Taking Note, They're Starting to Build

There are currently 102 Layer 2s (L2s) live, up 65% from last year, though the growth rate has cooled off in recent months. The rise in both the number of L2s and activity per L2 has enabled the Ethereum ecosystem to scale from hundreds of transactions per second to thousands, recently hitting over 3,500 collectively. Sub-cent fees, as low as <$0.0001, are redefining the industry. growthepie attempts to track and visualize these data points and more to help educate and broaden the community.

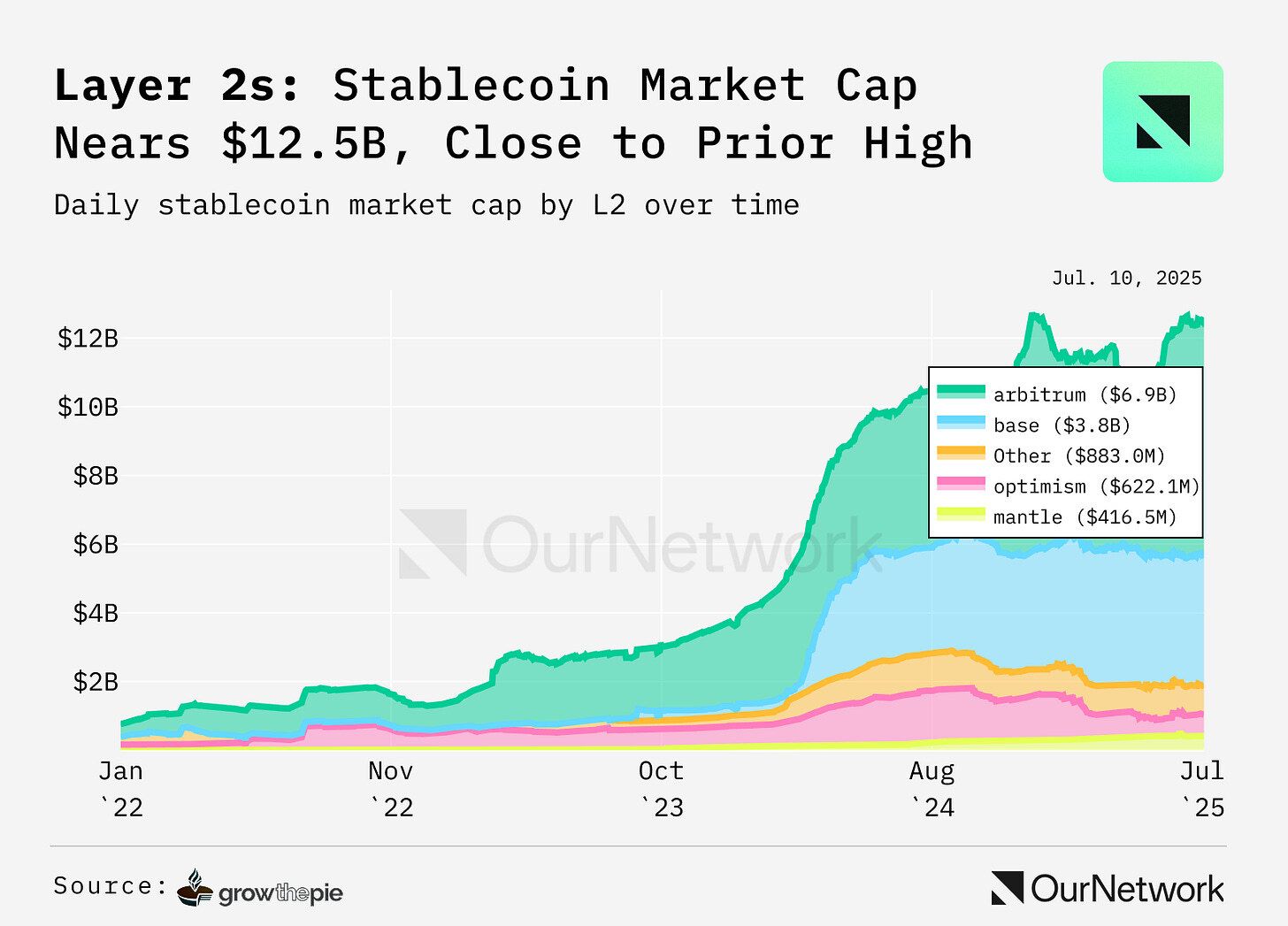

The Ethereum ecosystem secures over 50% of all stablecoins. L2s are playing an increasingly large role for these typically dollar-pegged assets. The scaling solutions secure over $12.5B in stablecoins, which equates to 8.8% of Ethereum's stablecoin supply. L2s are also experiencing record-breaking daily stablecoin transactions reaching over 1M daily.

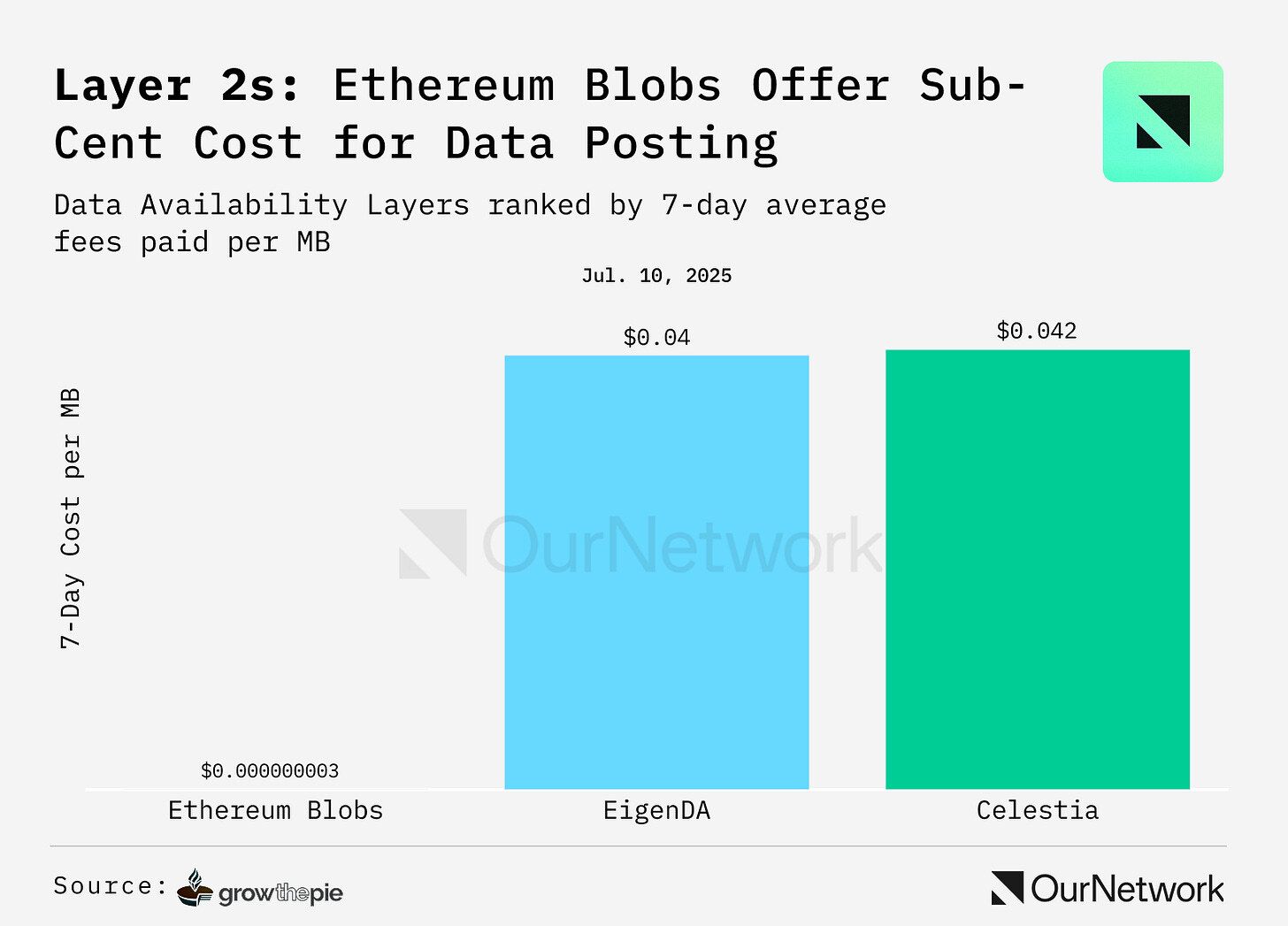

L2 data availability costs are historically low at $0.04 per MB for both EigenDA and Celestia. Meanwhile, Ethereum blobs are practically free, with the new target blobs per block increasing by 100%. current progress: 4.21 per block, a 40% increase, well below the fee mechanism threshold of 6.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.crowdcreate.us and www.amphibiancapital.com