Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, the SEC ended its probe into Paxos, the Dutch court denied bail for Tornado Cash dev Alexey Pertsev, Uniswap Labs publicly launched a wallet browser extension, and big new venture rounds came in for Partior ($60M) and ZAP ($15.1M).

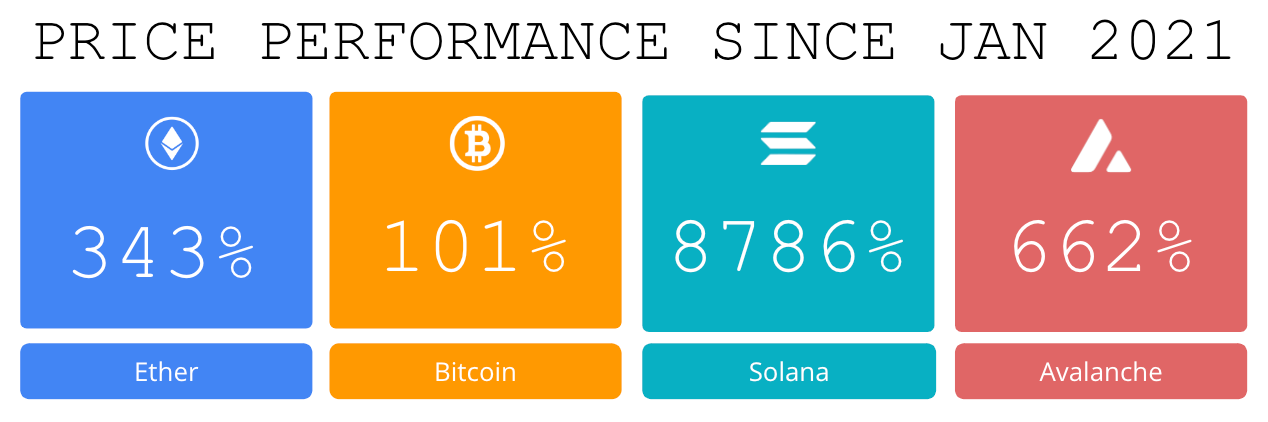

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ SEC ends probe into Paxos, no actions on BUSD stablecoin: On July 11, Paxos announced that it received an investigations termination notice from the SEC a few days earlier on July 9. The notice confirmed that the regulator would not pursue enforcement action against Paxos Trust Company regarding the Binance USD (BUSD) stablecoin.

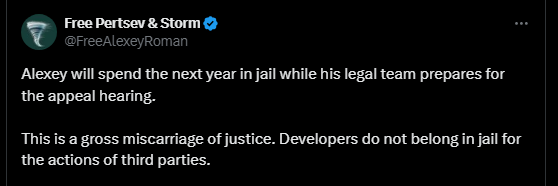

⚖️ Dutch court denies bail for Tornado Cash dev Alexey Pertsev while appeal process is ongoing: Alexey Pertsev, the Tornado Cash developer who was sentenced to five years and four months in prison by a three-judge panel in the Netherlands on charges of money laundering, will remain in jail while his appeal is processed after his bail request was denied.

🚀 Uniswap Labs publicly launches wallet browser extension supporting 11 blockchains: Uniswap Labs, the organization building out the decentralized exchange Uniswap, has publicly launched its wallet browser extension on Chrome.

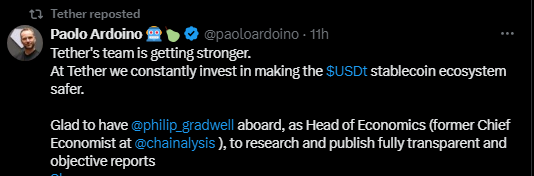

🤝 Tether taps Chainalysis' former Chief Economist to help communicate with regulators and stakeholders:Tether announced the appointment of Philip Gradwell — who previously spent six years at Chainalysis as the blockchain analytics firm’s Chief Economist — as the stablecoin issuer’s Head of Economics.

⚖️ Celsius to liquidate tokens, hundreds of NFTs following settlement with KeyFi founder Jason Stone: Following a lawsuit and countersuit regarding KeyFi and founder Jason Stone's relationship to bankrupt crypto lender Celsius, the two parties have agreed to settle according to an agreement filed in court last week.

💬 Tweet of the Week

Source: @DylanLeClair_

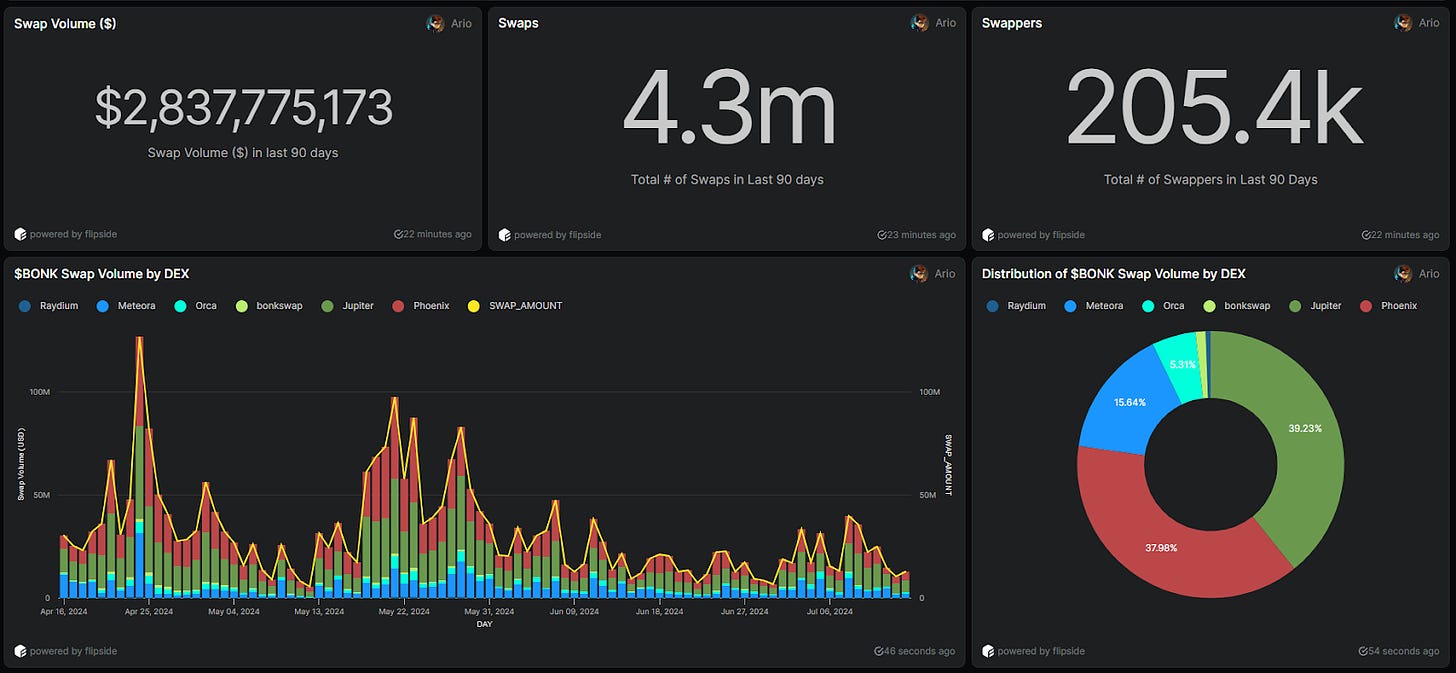

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Solana Actions and Blinks went live roughly two weeks ago, and Solana is now handling over 47.1M daily transactions, an increase of 35% month-over-month and the most since February 2022.

Source: @DavidShuttleworth

2. After integrating Tether.io native USDT on TON in April, the network has now handled over $9.29B of total transfer volume and has increased by 124% month-over-month from June.

Source: @DavidShuttleworth

3. Trump and Biden pairs hit highest launch count since late May

Source: @OurNetwork

4. Solana token drawdowns since their 2024 highs.

Source: @OurNetwork

5. Dogwifhat's WIF token among the top underperforming memecoins.

Source: @OurNetwork

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Do Crypto Users Need an Intervention?

A study by Pantera Research Lab found that crypto users exhibit a high present bias and low discount factor, indicating a strong preference for immediate gratification.

The quasi-hyperbolic discounting model, characterized by parameters such as present bias (ꞵ) and the discount factor (𝛿), is useful for understanding the tendency of individuals to prefer immediate rewards over future gains, a behavior particularly pronounced in the volatile and speculative crypto market.

This research can be applied to optimize token distributions, such as airdrops which serve to reward early users, decentralize governance, and market new products.

Introduction

A classic story in Silicon Valley startup lore is Paypal’s decision to pay people $10 to use their product. The reasoning was that if you could pay people to join eventually the network value would be sufficiently high that new people would join for free, and you could stop paying. It certainly seemed to work, as PayPal was able to stop paying and continue growing, thereby bootstrapping its network effects.

In crypto, we have adopted and extended this approach with airdrops, paying people not just to join but typically to use our products for some period.

Quasi-Hyperbolic Discounting Model

Airdrops have become a multifaceted tool used to reward early users, decentralize protocol governance, and, frankly, to market something new. Formalizing the distribution criteria has become an art, particularly when determining who should be rewarded and the value attributed to their efforts. In this context, both the quantity of tokens distributed and the timing of their release, often through mechanisms like vesting or gradual release, play significant roles. These decisions should be grounded in systematic analysis rather than relying on guesswork, sentiment, or precedents. Using a more quantitative framework ensures fairness and strategic alignment with long-term objectives.

The quasi-hyperbolic discounting model provides a mathematical framework to explore how individuals make choices involving trade-offs between rewards at different times. Its application is particularly relevant in areas where impulsivity and inconsistency over time significantly influence decision-making, such as financial decisions and health-related behaviors

The model is driven by two population-specific parameters: present bias, ꞵ, and the discount factor, 𝛿.

Present Bias (ꞵ):

This parameter measures the tendency of individuals to prioritize immediate rewards over those that are further away disproportionately. It varies between 0 and 1, where a value of 1 indicates no present bias, reflecting a balanced, time-consistent evaluation of future rewards. As values approach 0, they signify an increasingly strong present bias, indicating a heightened preference for immediate rewards.

For instance, given the choice between 50 today or 100 in a year, a person with a high present bias (closer to 0) will prefer the $50 immediately rather than waiting for the larger sum.

Discount Factor (𝛿):

This parameter describes the rate at which the value of future rewards diminishes as the time until their realization increases, accounting for the natural decline in their perceived value with delay. The discount factor is more accurately quantified over longer, multi-year intervals. When assessing two options in the short term (less than one year), this factor exhibits considerable variability as immediate circumstances can disproportionately influence perception.

For generalized populations, studies show the discount rate is usually around 0.9. However, this value is often substantially lower among groups with gambling tendencies. Research indicates that habitual gamblers typically exhibit a mean discount factor slightly below 0.8, whereas problem gamblers tend to have a discount factor closer to 0.5.

Using the above terms, we can express the utility U of receiving a reward x at time t through the following formula:

U(t) = tU(x)

This model captures how the value of rewards varies depending on their timing: immediate rewards are evaluated at full utility, while future rewards are adjusted downward in value, factoring in both the present bias and the exponential decay.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and paid advertising services. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website atCoinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel att.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com