Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week we cover the Ether price dropping 26% since ETF launch, US spot bitcoin ETFs, 3AC liquidators filing a lawsuit against Terraform Labs, and big new venture rounds for The Chaos Labs ($55M) and Fabric Cryptography ($33M).

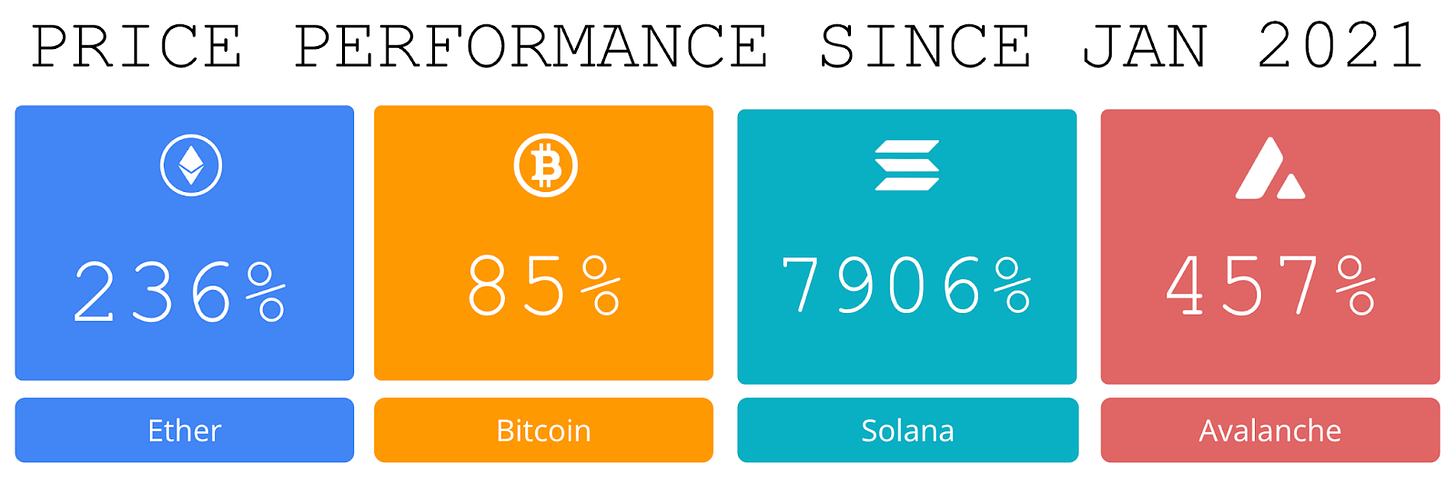

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ The SEC is poised to file fewer crypto cases in 2024: This year to date, there have only been nine. Quick math shows the SEC has, on average, brought 23 crypto-related actions per year since 2019 — almost two per month, annualized.

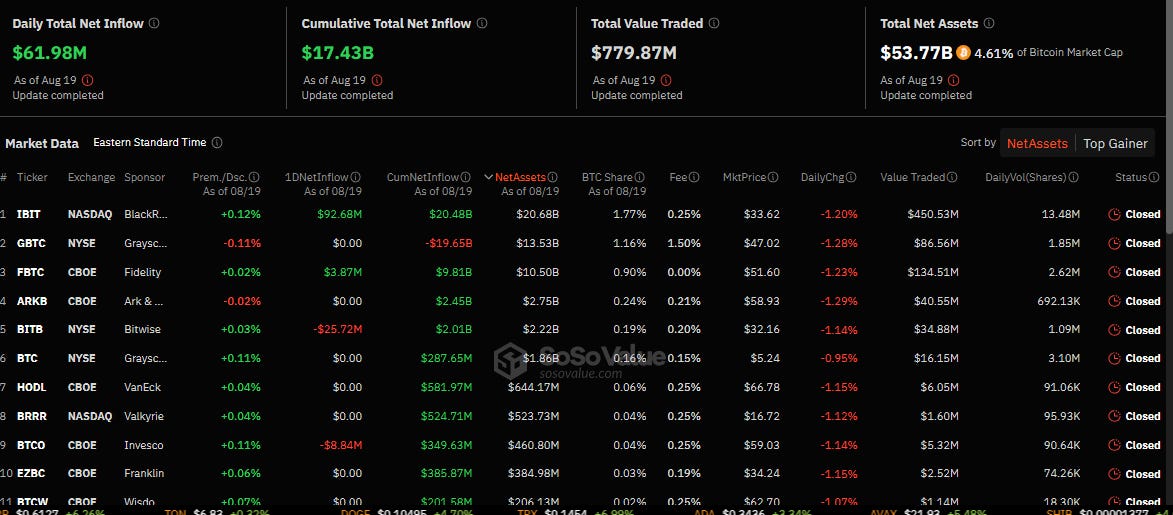

⚖️ US spot bitcoin ETFs see lowest daily trading volume since early February:U.S. spot bitcoin exchange-traded funds saw $61.98 million daily net inflows amidst a $779.87 million daily total trade volume on Monday, the lowest amount since Feb. 6 and the third lowest daily trade volume overall.

⚖️ 3AC liquidators file lawsuit against Terraform Labs seeking $1.3 billion in damages: Three Arrows Capital (3AC) liquidators have filed a lawsuit against Terraform Labs, seeking $1.3 billion in damages for TerraLUNA’s collapse.

🚀 Tether expands USDT to Aptos for low-fee transactions and DeFi boost:Tether said it is expanding its USDT stablecoin to the layer-1 blockchain network Aptos, according to an Aug. 19 statement.

🚀 Base introduces ENS subnames for users, plans fair launch via Dutch auction: Base, a Layer 2 network on Ethereum developed under Coinbase, is launching Basenames — subnames created through the Ethereum Name Service infrastructure, enabling users to convert their complex hexadecimal addresses into human-readable names.

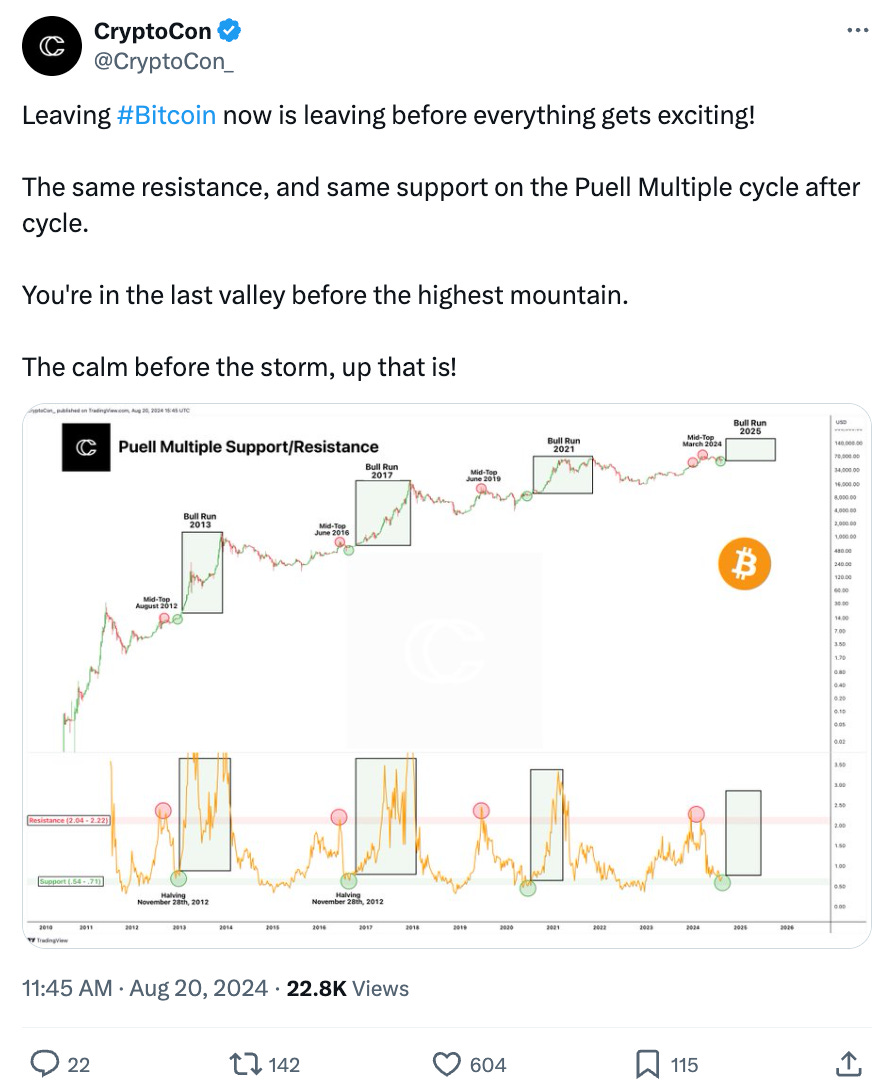

💬 Tweet of the Week

Source: @CryptoCon_

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

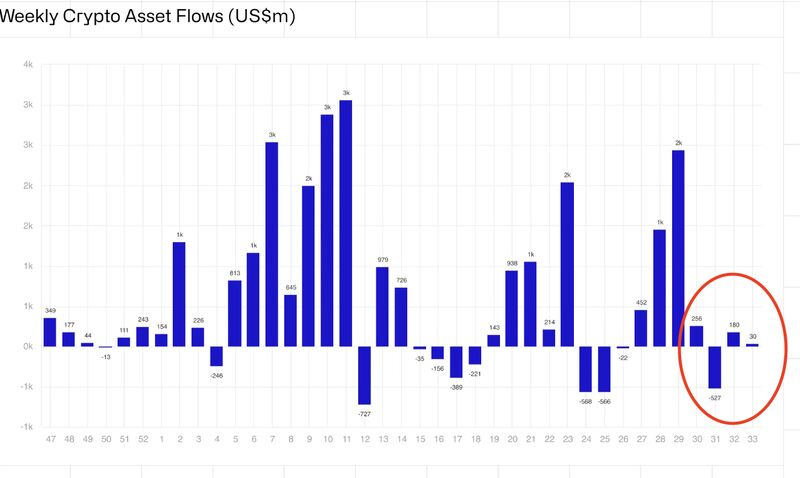

1. It's been a pretty muted four weeks for institutional flows into digital assets. Last week, total net inflows reached just $30M compared to $176M the prior week. One takeaway, however, is that BlackRock continues its dominance in both the BTC and ETH ETF markets, reaching over $20.1B AUM of BTC and $977M of ETH. Moreover, BlackRock has achieved this without a single day of net outflows in either product through August.

Source: @DavidShuttleworth

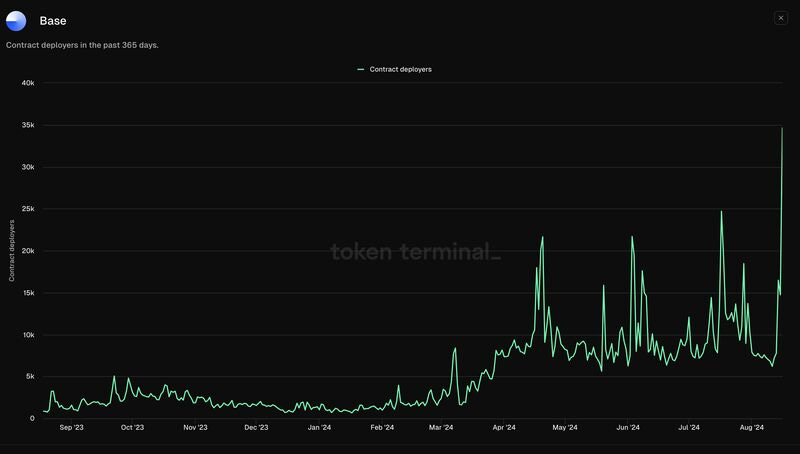

2. Developer activity on Coinbase Base has surged to all-time highs, with over 34.6K contract deployers operating on the network yesterday. Meanwhile, daily active users has increased by 22% week-over-week.

Source: @DavidShuttleworth

3. TON recently handled over $1.2B of daily stablecoin transfer volume, the most in the network's history. To put this into perspective, Optimism and Polygon currently handle $400M-$500M of daily volume, while Arbitrum handles about $1.9B.

Interestingly, about 41% of all monthly volume is attributable to activity on TON DEX DeDust.

Source: @DavidShuttleworth

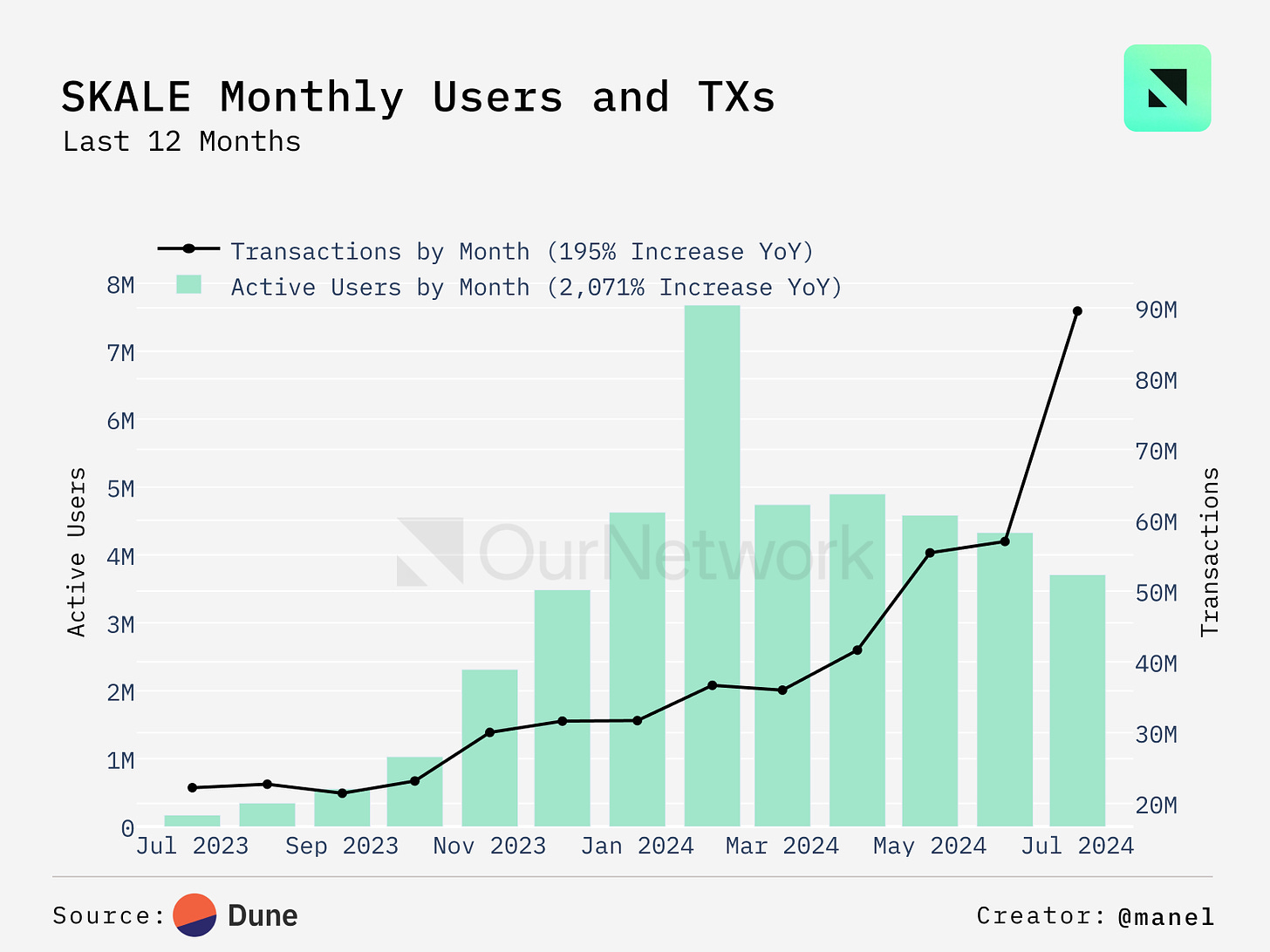

4. The SKALE Ecosystem has experienced 2,071% Unique Active Wallet growth year-over-year and has saved users nearly $8B Billion on gas fees

Source: @OurNetwork

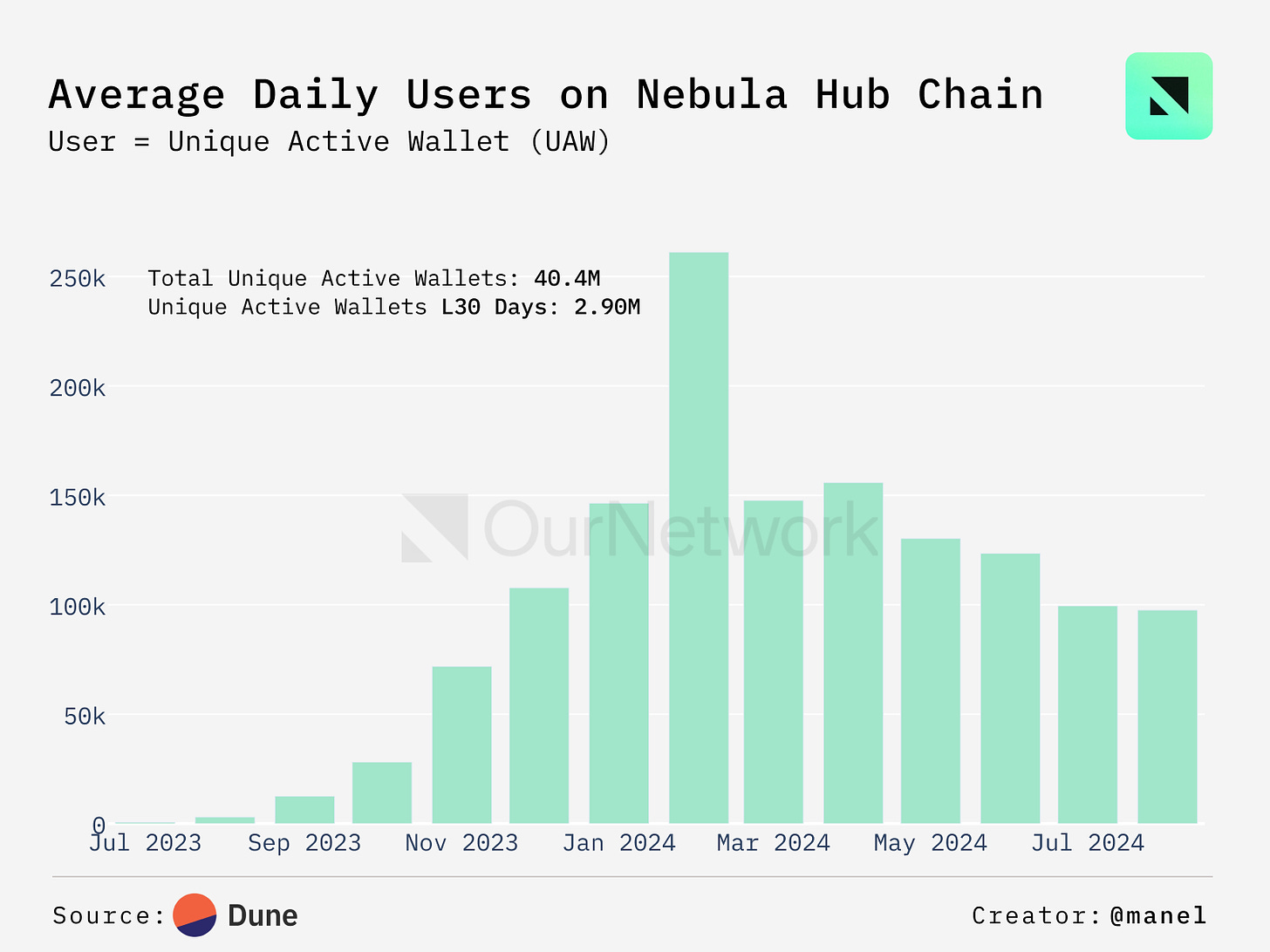

5. The Nebula Chain on SKALE is home to over 40M gamers, and 14 games with over 10K UAW in the last 30 days.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

Over the past decade, the emergence of smart contract blockchains has introduced a wave of innovations such as decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs). These advancements have not only reshaped the financial services landscape but have also augmented various industries—including the gaming sector.

The ubiquity of standards on public blockchain (IE: ERC-721 standards for Ethereum NFTs) have made it easier than ever for in-game items to be interoperable with not just a wider variety of games, but with the decentralized finance (DeFi) stack. As a result, in-game assets (avatars, skins, land, currencies, etc.) can now truly be owned and financialized like traditional assets (real estate, public and private equities, etc.). Consequently, game economies can benefit from greater liquidity and price discovery for cosmetic items and in-game currencies.

However, while the original crypto gaming thesis remains intact, many developers have become disillusioned with the critical problems between the needs vs. realities of onchain game developers. Game developers seek seamless user experiences (UX), unified liquidity, one-click deployment, and compatibility with crypto onramps. But today they are often confronted with a fragmented UX, fractionalized liquidity across multiple chains, high rollup-as-a-service (RaaS) overhead, and a lack of compatibility with onramps.

B3 changes this!

Overview

Developed by NPC Labs, B3 is a horizontal ecosystem of layer 3 (L3) blockchains, built on Base, that are focused on crypto games.

Base has quickly emerged as one of the preeminent layer 2 (L2) blockchains in the crypto ecosystem, largely due to its affiliation with Coinbase. Since launching in August 2023, Base has been profitable, growing, and sticky. Today, Base has the second largest number of wallets of any L2 (behind only Arbitrum) and is home to many applications such as Uniswap, Friend.Tech, USDC, ThirdWeb, OpenSea, Zora, and more.

By aligning with Base’s tooling and culture, B3 can build a robust L3 gaming ecosystem, strengthening Base's position as the dominant venue for consumer crypto applications.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Blockworks Macro: Deficit Spending Will Send S&P 500 To 6,000 And Beyond | George Robertson & Mel Mattison

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com