Social Links: Twitter | Telegram | Newsletter

Learn More at www.rootstock.io and www.kuladao.io and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 325k weekly subscribers. This week the SEC removed the key hurdle for Ethereum ETFs, Ethereum led the crypto market with a 4% surge, and big new venture rounds came in from Conduit ($36M) and Freysa AI ($30M).

Price performance since we began writing Coinstack in January 2021

Thanks to Our Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ SEC removes key hurdle for Ethereum ETFs by exempting staking from securities rules: The US Securities and Exchange Commission (SEC) has issued new guidance clarifying that common forms of crypto staking do not fall under securities laws. On May 29, the SEC’s Division of Corporation Finance confirmed that those participating in staking activities, including self-staking, delegated staking, custodial, and non-custodial forms, are not required to register these actions with the financial regulator.

🚀 Ethereum leads crypto market with 4% surge to 3-month high above $2700: Ethereum outpaced the broader crypto market over the past 24 hours, posting the strongest performance among the top 10 digital assets.According to CryptoSlate data, ETH climbed nearly 4% during the reporting period, briefly touching $2,725, its highest level since February.In contrast, other major crypto tokens like Bitcoin, XRP, Solana, BNB, Dogecoin, Cardano, and Tron recorded flat or slightly negative movements, with gains or losses staying within the 1% range.

📉 US spot Bitcoin ETFs see $358 million in net outflows, ending 10-day inflow streak:U.S. spot Bitcoin exchange-traded funds saw $358.6 million in net outflows on Thursday, ending a 10-day streak of positive flows that had brought in a total of $4.26 billion.BlackRock's IBIT was the only spot Bitcoin ETF to report net inflows, with $125 million flowing into the product, according to SoSoValue data.

💸 BitGo and Kraken begin distributing $5 billion in former FTX user payouts:Former FTX users are reporting receiving payouts from the bankrupt exchange. On Friday, the exchange announced it has commenced the second round of distributions, valued at some $5 billion, to creditors as part of a previously announced bankruptcy plan.

⚖️ SEC moves to dismiss Binance litigation as agency looks to forge new regulatory path for crypto:The U.S. Securities and Exchange Commission is seeking to dismiss its lawsuit against crypto giant Binance, according to a court document filed on Thursday.The agency and lawyers representing the SEC, Binance, and former Binance CEO Changpeng Zhao filed a "joint stipulation" in the U.S. District Court for the District of Columbia.

💬 Tweet of the Week

Source: @BittelJulien

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

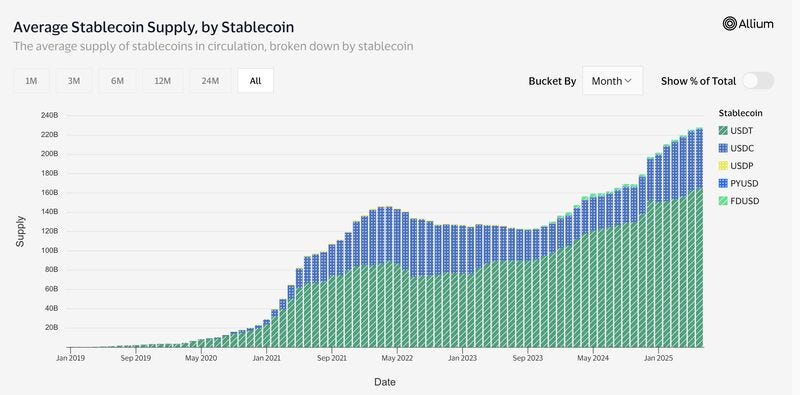

1. Fiat-backed stablecoins have now seen 20 straight months of growth, dating back to September 2023. In May, total supply reached yet another record high and surpassed $227B, up 16% ($31B) YTD.

Perhaps just as notable, over $757B was settled onchain in May, an 85% increase year-over-year.

Interestingly, while 51% of the total supply is deployed on Ethereum, Tron continues to maintain a significant marketshare, now standing at 34%, followed by Solana (5%) and BSC (3%).

Source: @DavidShuttleworth

2. Monthly perp DEX volume surged to a new all-time high of $382B in May, growing 63% ($148B) year-over-year. Hyperliquid now accounts for more than 85% of all of this volume. Pure dominance and an absolute land grab.

Source: @DavidShuttleworth

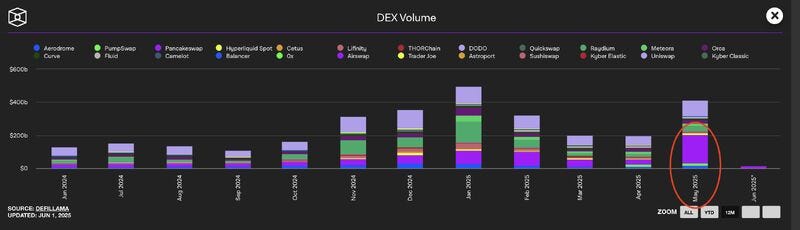

3. Interestingly PancakeSwap led all DEXes in May with over $171B in total monthly volume, accounting for 42% of all DEX volume across the space. This also marks the most activity PancakeSwap has ever seen, shattering its previous record of $137B set in May 2021.

Last week alone, the protocol handled a staggering $58B in onchain volume which is more than leading DEXes like Raydium ($28B), Meteora ($19B), and Aerodrome ($17B) processed over the entire month.

Overall, May saw over $410B in DEX volume, the second highest total in the past 12 months and more than April ($194B) and March ($200B) combined.

Source: @DavidShuttleworth

4. 📈 With Bitcoin Recently Surassing Its Previous All-Time High, Lombard Saw a New All-Time High in TVL, Eclipsing $2B

Source: @OurNetwork

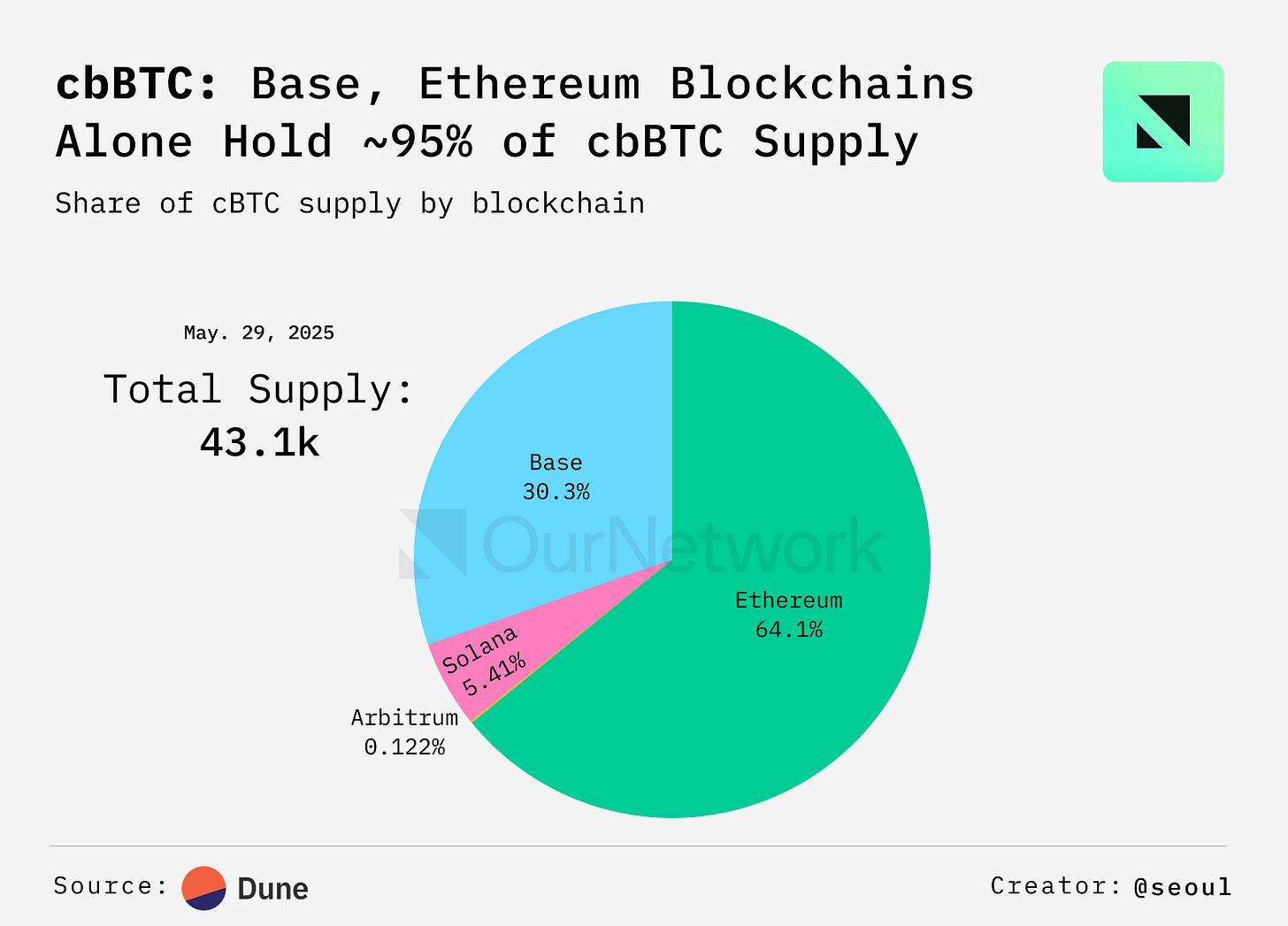

5. 📈 cbBTC Expands Footprint with 43K Circulating Supply in the Competitive Wrapped Bitcoin Market

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

While Bitcoin's core protocol remains relatively static and unchanged, systems to extend the asset's capabilities have grown and changed immensely.

Case in point — users have wrapped over 364,878 BTC, worth over $38B dollars, into bridgeable assets, according to the data provider Bitcoin Layers. This is a major change from BTC's early years, as it's clear there's demand from traders and investors to generate yield with the token on other networks, as opposed to just holding it.

We'll hear more on the growth of BTC's broader ecosystem below thanks to contributions from Kairos Research, Seoul Data Labs, Daedalus Angels, and Aptos.

Let's get into it.

– ON Editorial Team

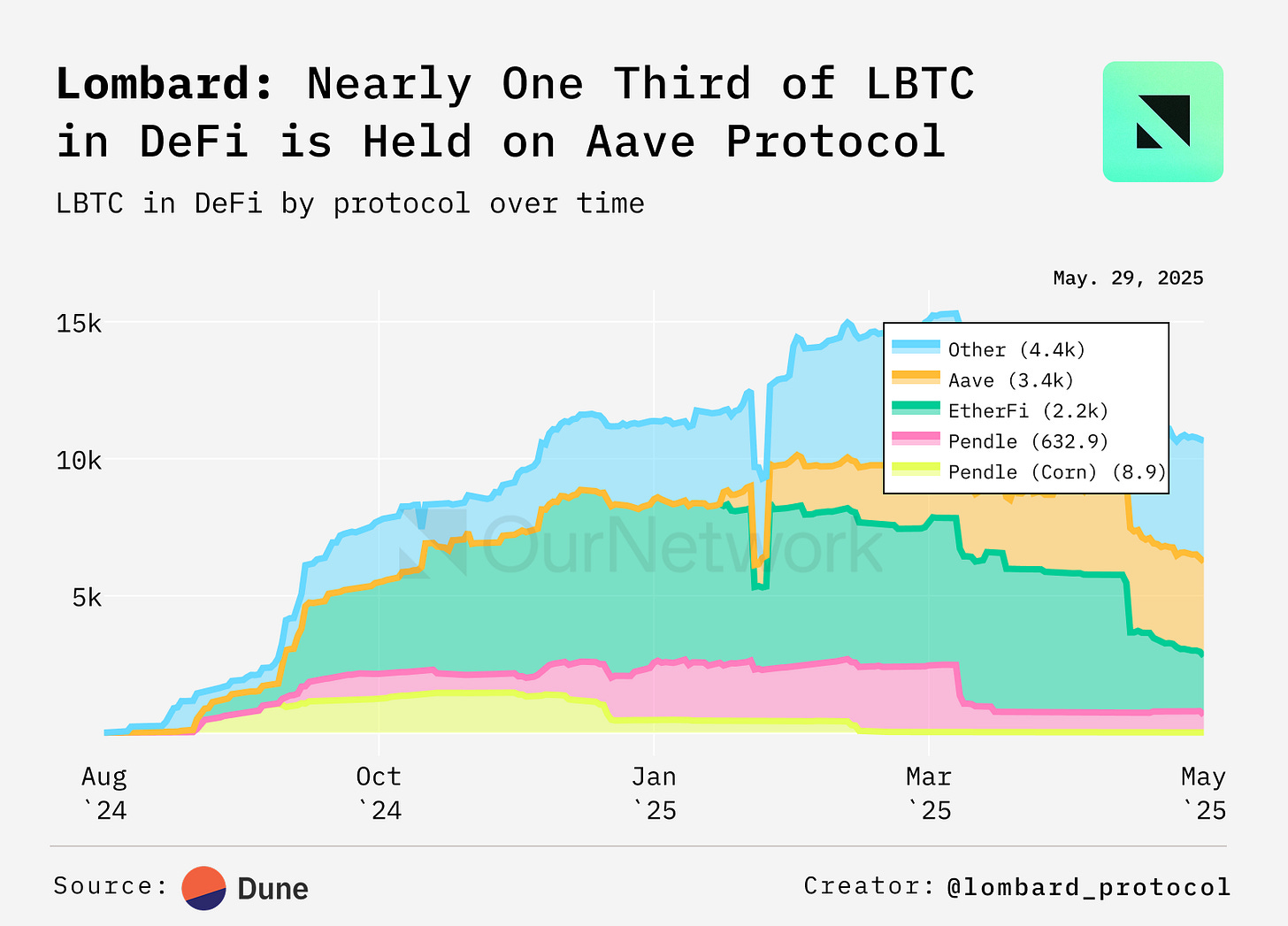

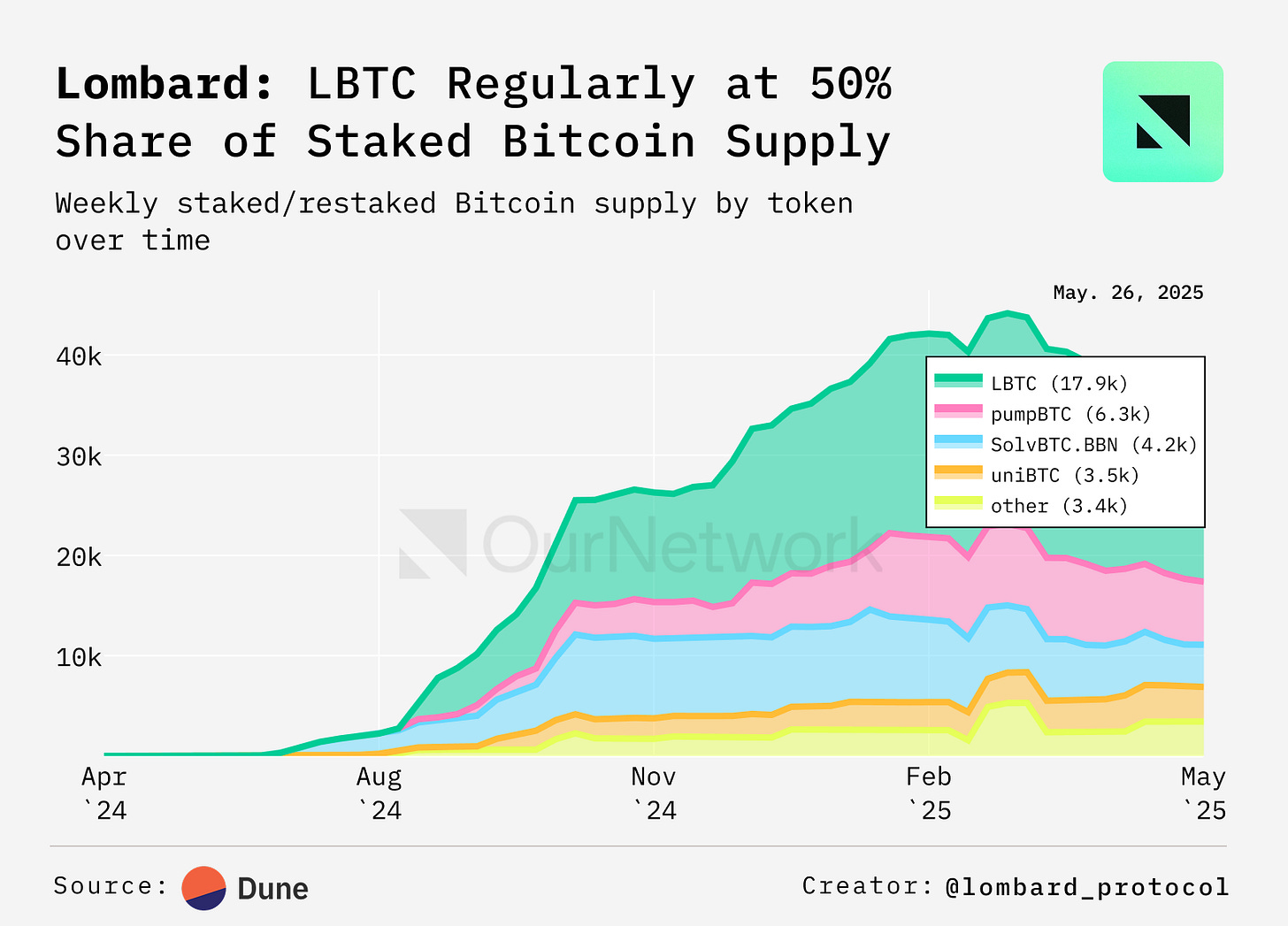

📈 With Bitcoin Recently Surassing Its Previous All-Time High, Lombard Saw a New All-Time High in TVL, Eclipsing $2B

Lombard provides users with a way to turn their otherwise idle BTC into LBTC, a yield-generating asset. There has been a notable drop off in LBTC-denominated TVL units, primarily driven by the end of the BOYCO incentive program, a large part of which was facilitated via ether.fi vaults. However, the amount of LBTC on Aave has continued to climb higher. This is a noticable trend we see amongst other analgous products like liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) for ETH, where the majority of the supply is on lending markets. Aave is now leading its peers with a 32% of the marketshare for LBTC utilized in DeFi.

While the overwhelming majority of LBTC is used on Ethereum, its important to look elsewhere too. While Berachain had a large dropoff, other chains like Sui have seen a steady and continued inflow. The amount of LBTC on Base has also shown steadiness over the last several months.

When looking at LBTC amongst its peers, the Bitcoin-backed asset continues to maintain the most marketshare for both staked, and restaked Bitcoin products, with approximately 50% marketshare against similar BTC LST products.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.kuladao.io and www.amphibiancapital.com