Learn More at www.amphibiancapital.com and www.rootstock.io

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week, the US Senate confirmed pro-crypto Treasury secretary, KuCoin plead guilty to unlicensed money transmission charges, CFTC acting chair rolled out roundtables focused on crypto and big venture news for SOON ($22M) and SignalPlus ($11M).

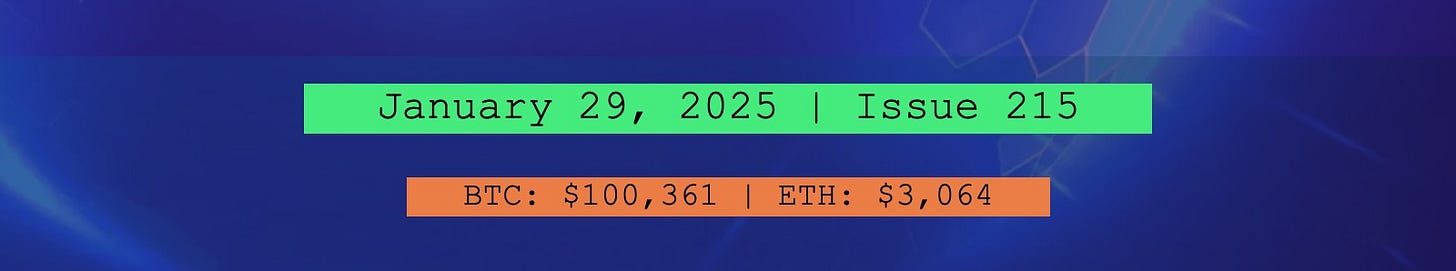

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Amphibian Capital, managing $130MM+ AUM, is a fund of the world's leading hedge funds. +20.37% net YTD approx with their USD fund, +14.93% net BTC on BTC YTD (*+154.05% in USD terms), and +18.10% net ETH on ETH YTD (+72.41% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com *Approximate estimates through 1/28/25

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ US Senate confirms pro-crypto Scott Bessent as new Treasury secretary:The U.S. Senate has confirmed pro-crypto Scott Bessent as the new Treasury secretary, who will succeed Janet Yellen. The confirmation was made in a Senate vote on Monday, where 68 voted for Bessent against 29.

⚖️ KuCoin Co-Founders Step Down Amid $300M Settlement Over US Charges: Seychelles-based crypto exchange KuCoin pleaded guilty on Monday to operating an unlicensed money-transmitting business and agreed to pay nearly $300 million in fines and forfeitures.

⚖️ CFTC acting chair rolls out roundtables focused on crypto, prediction markets:U.S. Commodity Futures Trading Commission Acting Chair Caroline Pham is kickstarting a sequence of public roundtable discussions about prediction markets and crypto, marking regulators' latest turn following Donald Trump's inauguration.

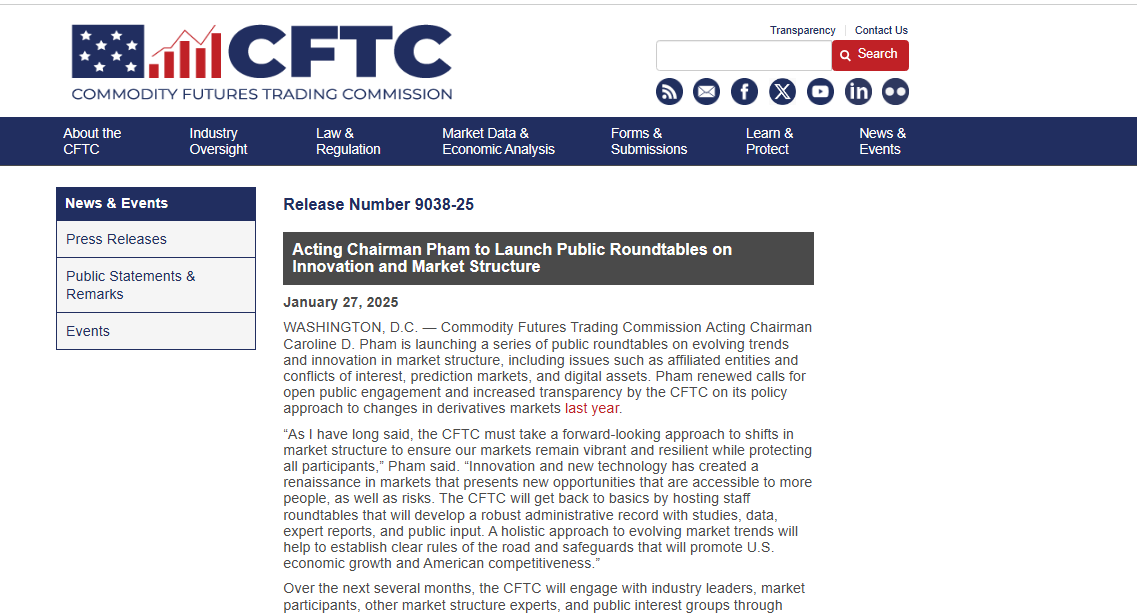

📊 Bitcoin retreats below $100,000, causing $850 million in crypto liquidations over past day:Bitcoin saw a notable pullback and retreated to trading below the $100,000 mark. The foremost cryptocurrency is trading at $99,100, with a 5.7% decline over the past day.

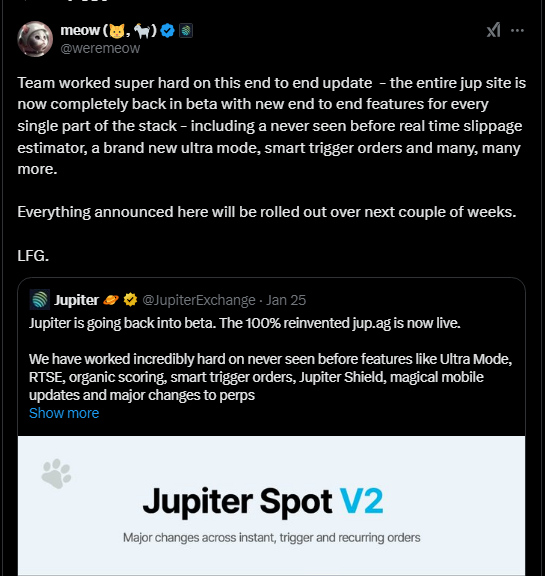

🚀 Jupiter acquires majority stake in Moonshot, announces 'Jupnet' and $10 million AI fund at Catstanbul event:Jupiter, which recently distributed over $600 million to its community in a 'Jupuary' airdrop, debuted a 'V2' redesign of its platform, declaring that the platform is once again in beta as new features are added throughout the platform. The new features include a "...real time slippage estimator, a brand new ultra mode, smart trigger orders and many, many more," according to Meow. "Everything announced here will be rolled out over [the] next couple of weeks."

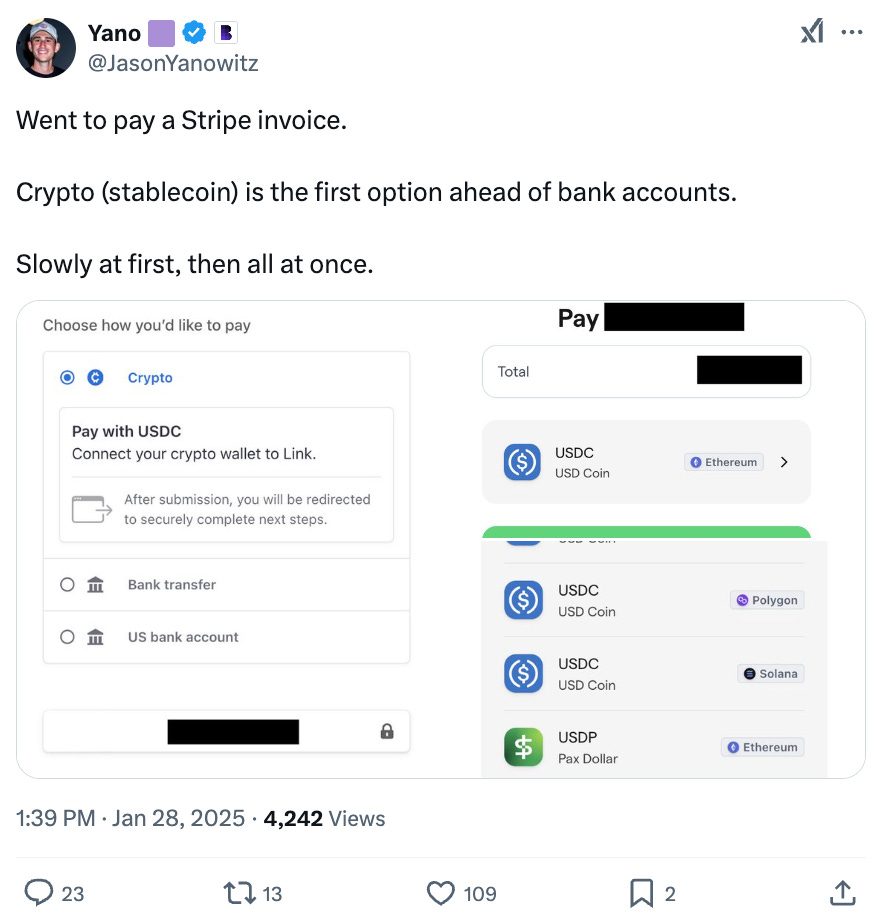

💬 Tweet of the Week

Source: @JasonYanowitz

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

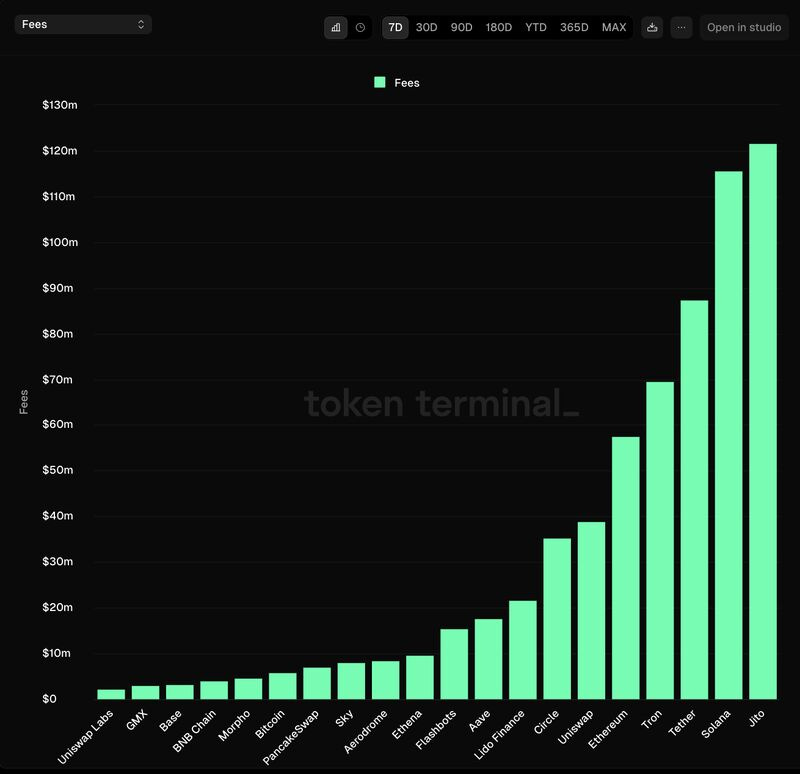

1. We close out the week with Solana continuing to experience some of the strongest demand in the space. Overall, Jito led the way with $122M in fees generated, followed by Solana ($116M). Both of which outpaced Tether and its $140B in reserves generating interest income.

Source: @DavidShuttleworth

2. The TRUMP token may have experienced the fastest ascension in futures open interest I've ever seen. In less than 48 hours, open interest grew to nearly $1B, just ahead of the inauguration.

This makes TRUMP the 9th largest asset in terms of total open interest, ahead of BNB, AVAX, ENA, and HYPE.

Obviously the markets are much different now, but just to put this into perspective, SOL futures didn't reach $1B until December 2023.

Source: @DavidShuttleworth

3. And just like that, total circulating supply of Circle USDC has grown by $3.5B (80%) on Solana this week, reaching yet another all-time high of $7.9B. Solana now represents 15% of all USDC in circulation.

Meanwhile, overall circulating supply of USDC has surpassed $50B for the first time since September 2022.

Source: @DavidShuttleworth

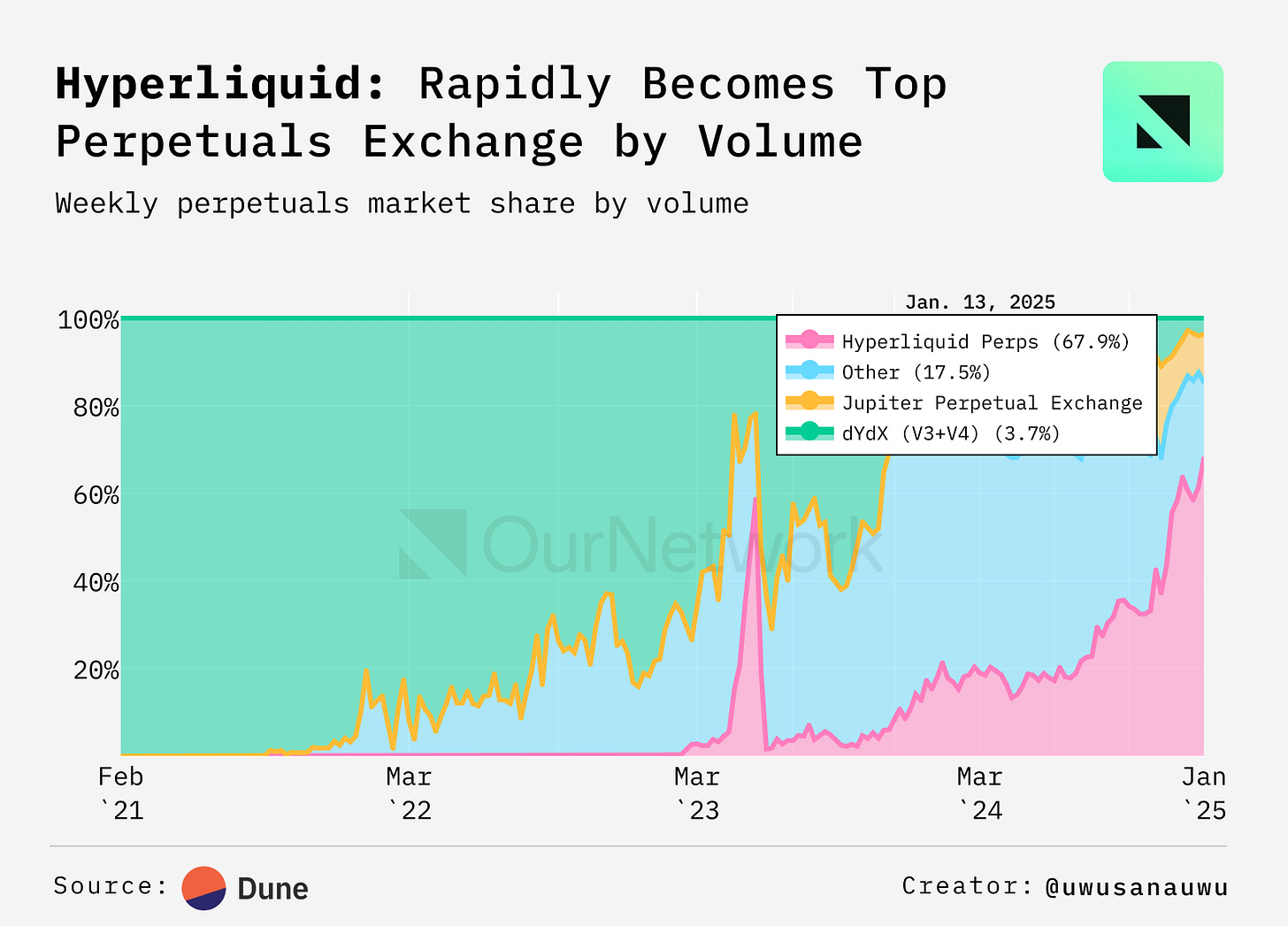

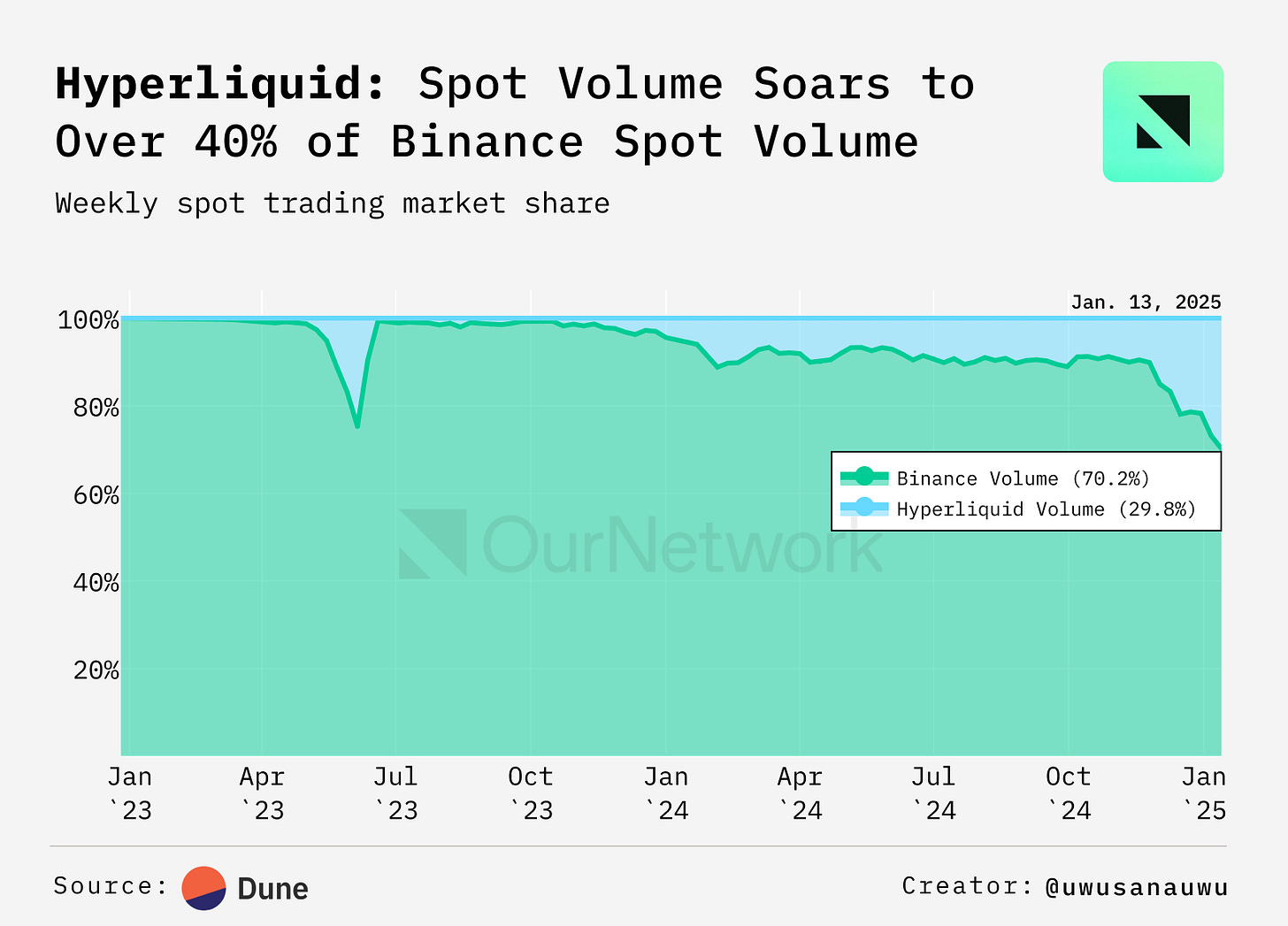

4. Hyperliquid Hits $21B Daily Trading Volume, Securing 64.8% Perps Market Share

Source: @OurNetwork

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is made possible by a community of contributors who actively participate at the forefront of this emerging data landscape. This is an excerpt from the full article, which you can find here.

Introduction

Many of the top crypto entrepreneurs are Americans, but many have had to leave because of regulatory uncertainty. This administration is taking the opportunity to reverse this trend and make the US a leader that invites crypto innovation.

The highly anticipated Crypto Executive Order was signed on Jan 23rd. In my last blog I touched on predictions on changes to crypto policy. Some have already come to fruition while even more promising decisions have been made. Let’s go through some of them.

Implemented Policy

On his very first day in office, Trump signed 26 executive orders. In his first term, he signed just 33 orders in his first 100 days. Since executive orders do not require Congress approval and stand until possibly being struck down by federal courts, they have become efficient ways to enact rules, no matter how far-reaching.

The two executive orders related to crypto are:

“Use for lawful purposes open public blockchain networks without persecution”

“Providing regulatory clarity and certainty … all of which are essential to support … innovation in digital assets, permissionless blockchains, and distributed ledger technologies”

“Promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide”

“taking measures to protect Americans from the risks of Central Bank Digital Currencies (CBDCs)”

Establishment of the President‘s Working Group on Digital Asset Markets, chaired by Special Advisor for AI and Crypto, and have members like the chair of the SEC and CFTC

“Within 180 days of the date of this order, the Working Group shall submit a report to the President … which shall recommend regulatory and legislative proposals”

“The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.”

“Establish the President’s Council of Advisors on Science and Technology (PCAST) … composed of not more than 24 members. The Assistant to the President for Science and Technology (APST) and the Special Advisor for AI & Crypto shall be members of the PCAST.”

SAB 121 was rescinded by SAB 122. SAB 121 directed banks to count customers’ crypto assets on their own balance sheets, treating crypto as a liability. Now, crypto is to be counted according to the Financial Accounting Standards Board rules.

Senate Banking Committee Chair Tim Scott named Senator Cynthia Lummis as the chair of the new Senate panel focused on digital assets. This panel’s focus is twofold:

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.rootstock.io