Learn More at www.ceek.com and kinto.xyz

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week SharpLink ETH treasury reached $3.6B, Grayscale filed to convert Avalanche Trust to ETF, MetaMask launched the mUSD stablecoin on Ethereum and Linea, and big new rounds came in from Hemi ($15M) and DigiFT ($11M).

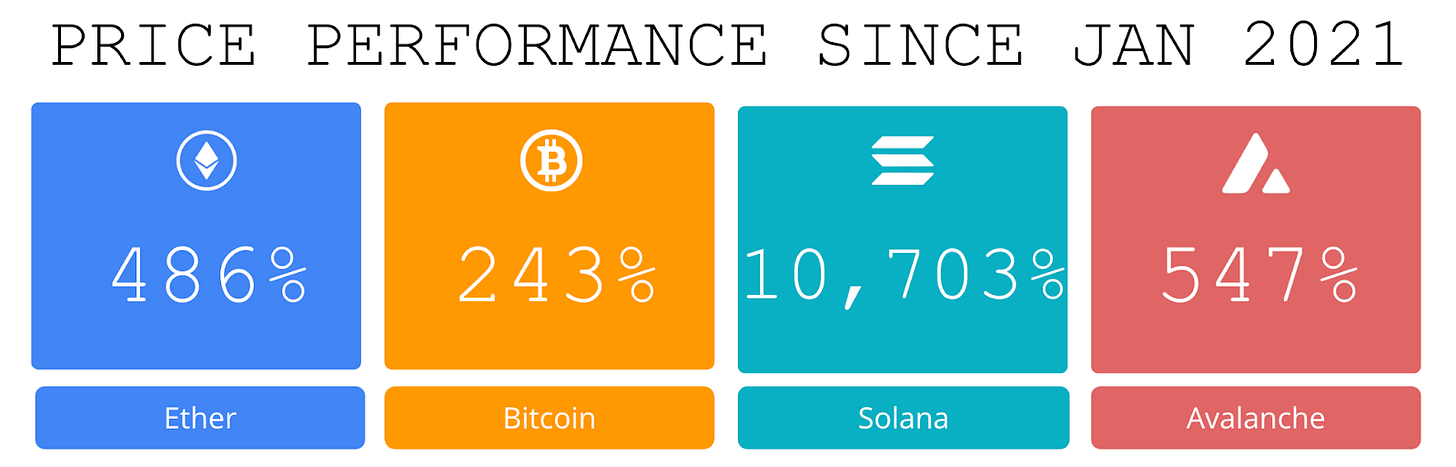

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉Learn more at www.ceek.com

Kinto operates an Ethereum layer-2 network with built-in compliance mechanisms, including Know-Your-Customer (KYC) and Anti-Money Laundering (AML) protocols, facilitating financial institutions that face strict regulatory requirements to participate in decentralized finance. Kinto offers these services without sacrificing decentralization, and features a non-custodial smart contract wallet with native insurance and high-grade security. Web: https://kinto.xyz

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

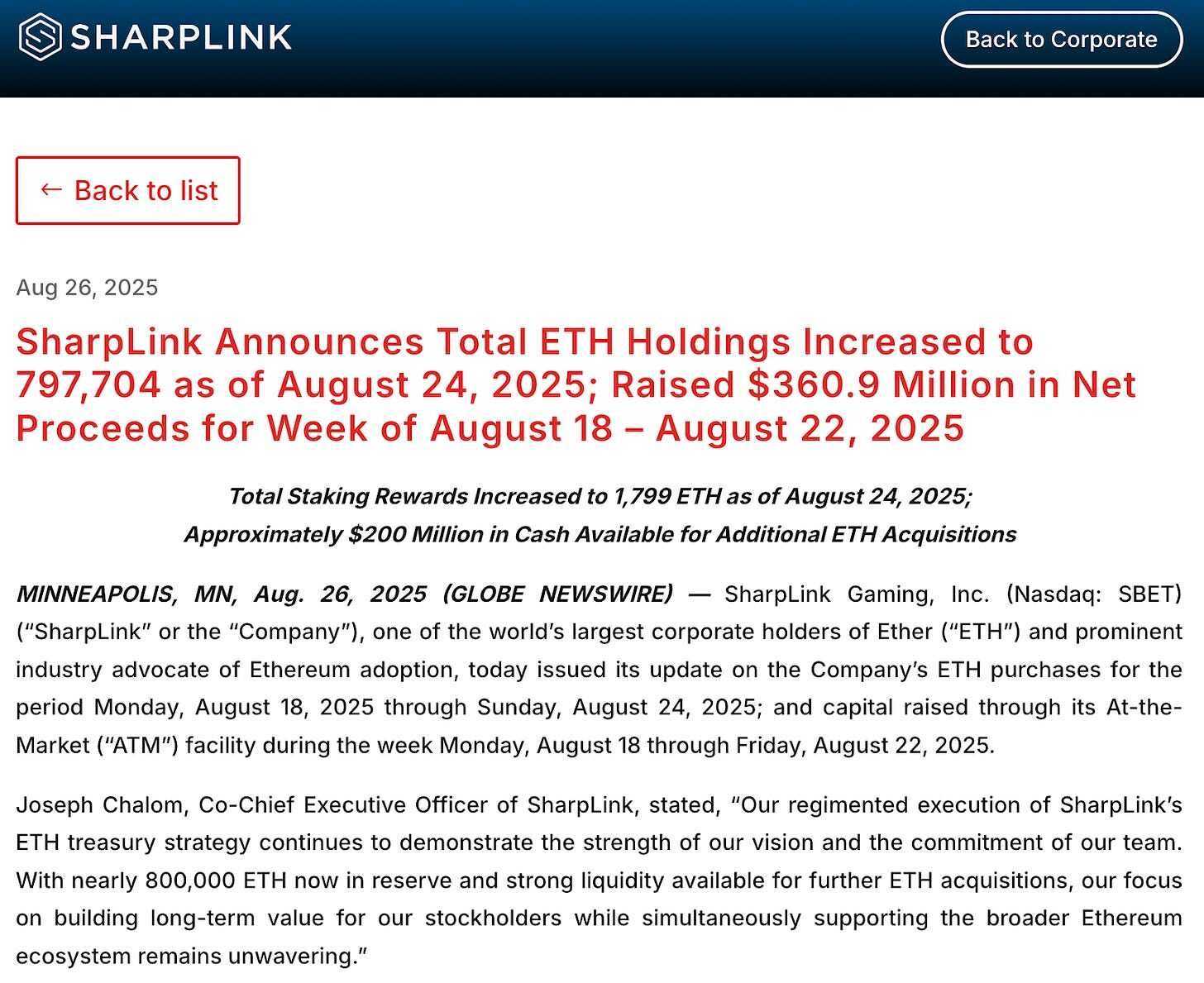

👑 SharpLink ETH treasury at $3.6 billion after adding over 56,000 ether: SharpLink now holds 797,704 ETH after last week adding 56,533 ether for around $252 million; putting its Ethereum treasury valued at $3.64 billion.

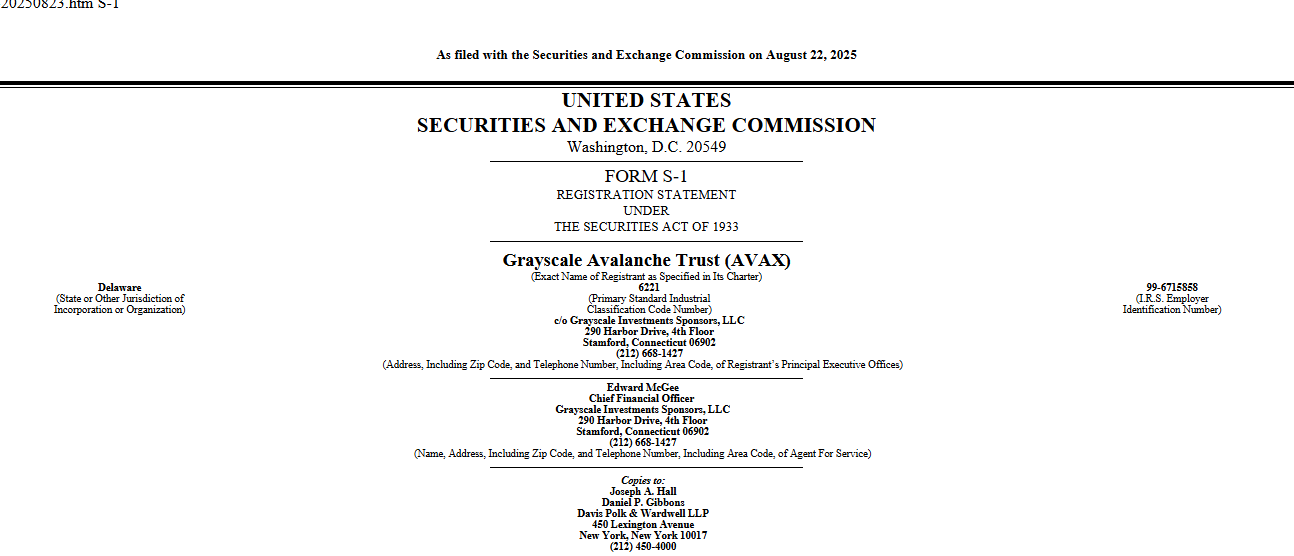

⚖️ Grayscale Files to Convert Avalanche Trust to ETF:Crypto asset manager Grayscale submitted a registration statement for its Avalanche Trust to the U.S. Securities and Exchange Commission on Friday, seeking approval to “uplist” the investment vehicle and convert it into a full-fledged exchange-traded fund.

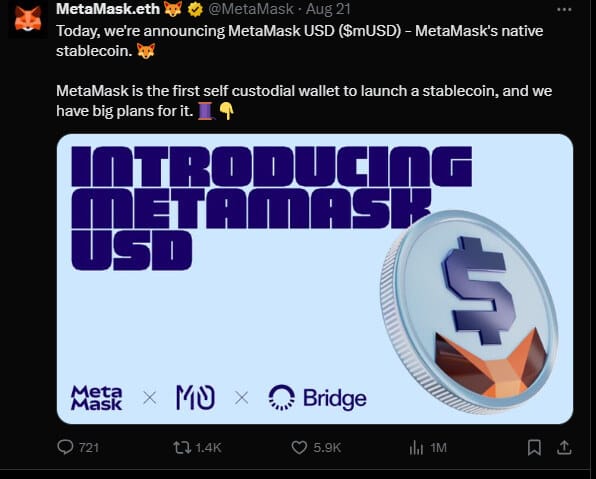

🚀 MetaMask set to launch mUSD stablecoin on Ethereum and Linea, issued by Stripe-owned Bridge: mUSD will be issued by Bridge, a Stripe-owned stablecoin issuance platform, and minted via M0’s decentralized infrastructure, MetaMask said Thursday. It added that mUSD will be fully backed 1:1 by “high-quality, highly-liquid dollar equivalent assets” with real-time transparency and cross-chain composability via M0’s liquidity network.

🚀Aave launches on Aptos in first non-EVM deployment as part of multichain strategy: Decentralized finance's largest lending provider, Aave, has launched on Aptos, marking its first deployment on a non-EVM blockchain and advancing the protocol’s multichain strategy.

⚖️ VanEck Files to Launch ETF With Jito's Liquid-Staked Solana Tokens: VanEck submitted an application to the U.S. Securities Exchange Commission for a JitoSOL exchange-traded fund, as investor interest in staked crypto ETFs continues to expand.

💬 Tweet of the Week

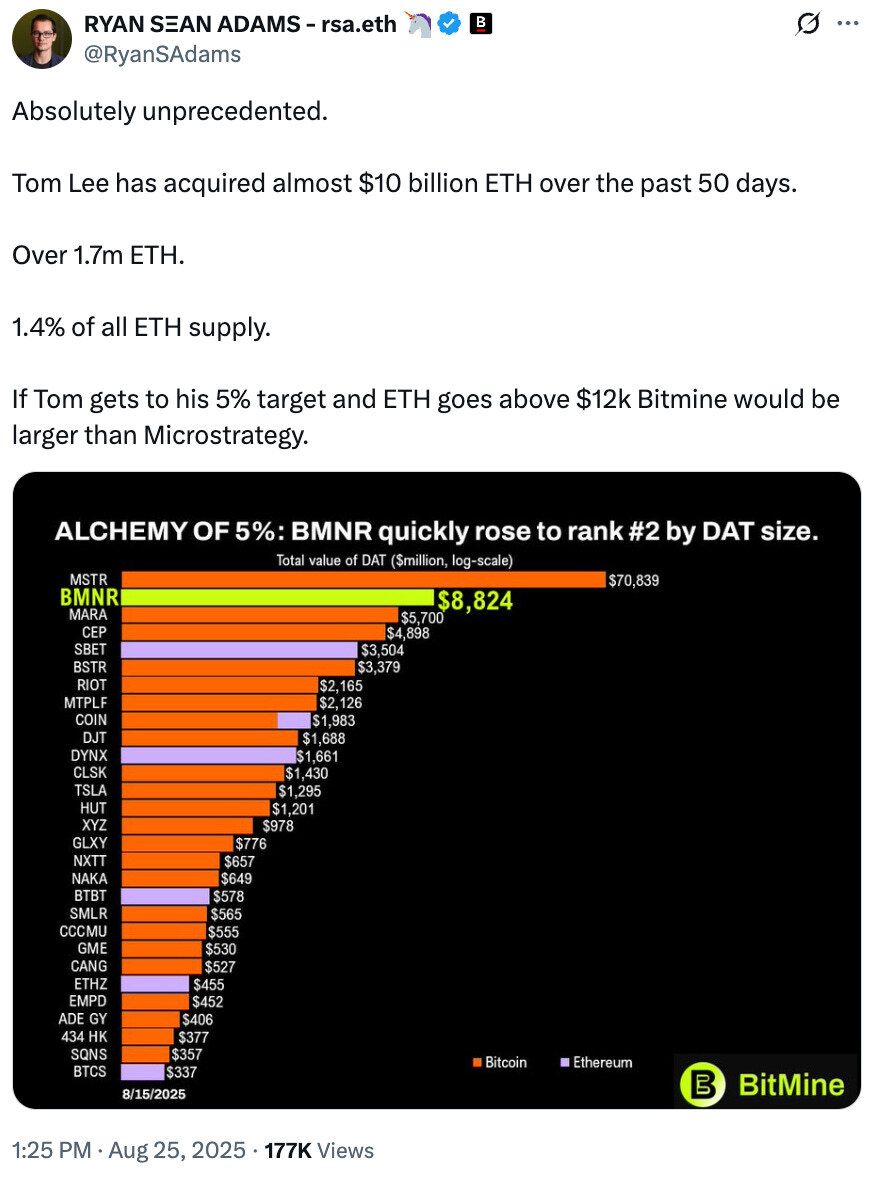

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

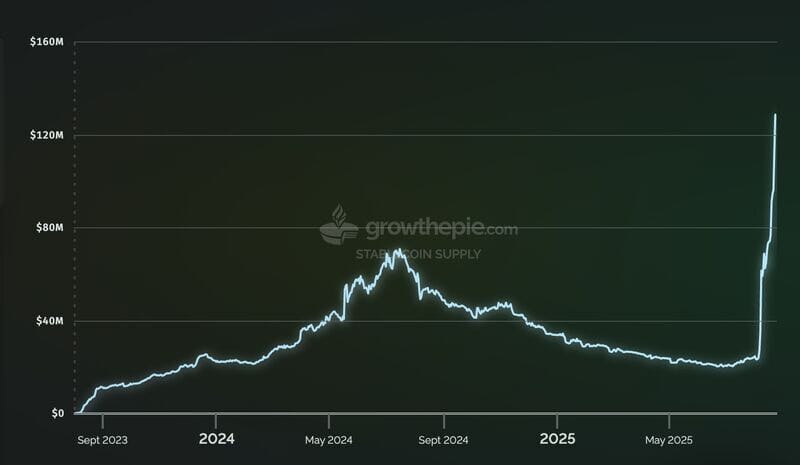

1. Stablecoin liquidity on Consensys Linea has surged by more than 437% in the last 3 weeks alone, reaching a record high of $129M.

Linea is now the 7th largest EVM L2, quickly closing the gap on Celo ($166M) and Optimism ($560M).

And the prospect of SharpLink and their 740,000 $ETH ($3.6B) treasury integration is still on the horizon.

Source: @DavidShuttleworth

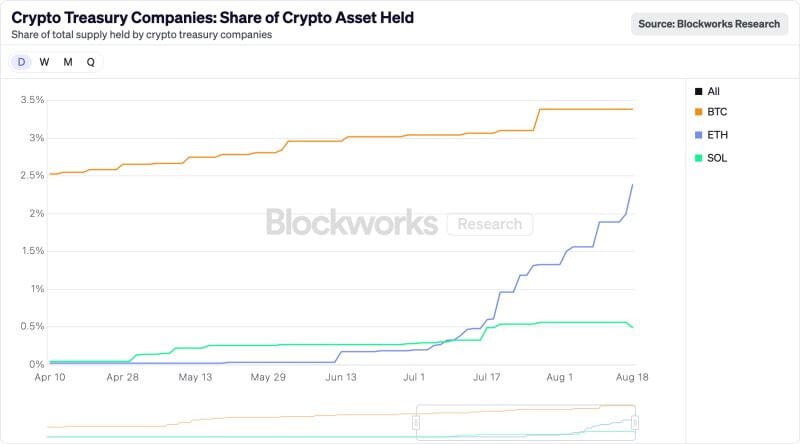

2. It's pretty wild that in less than 2 months, over 3% of the entire supply of ETH was scooped up by treasury companies.

Source: @DavidShuttleworth

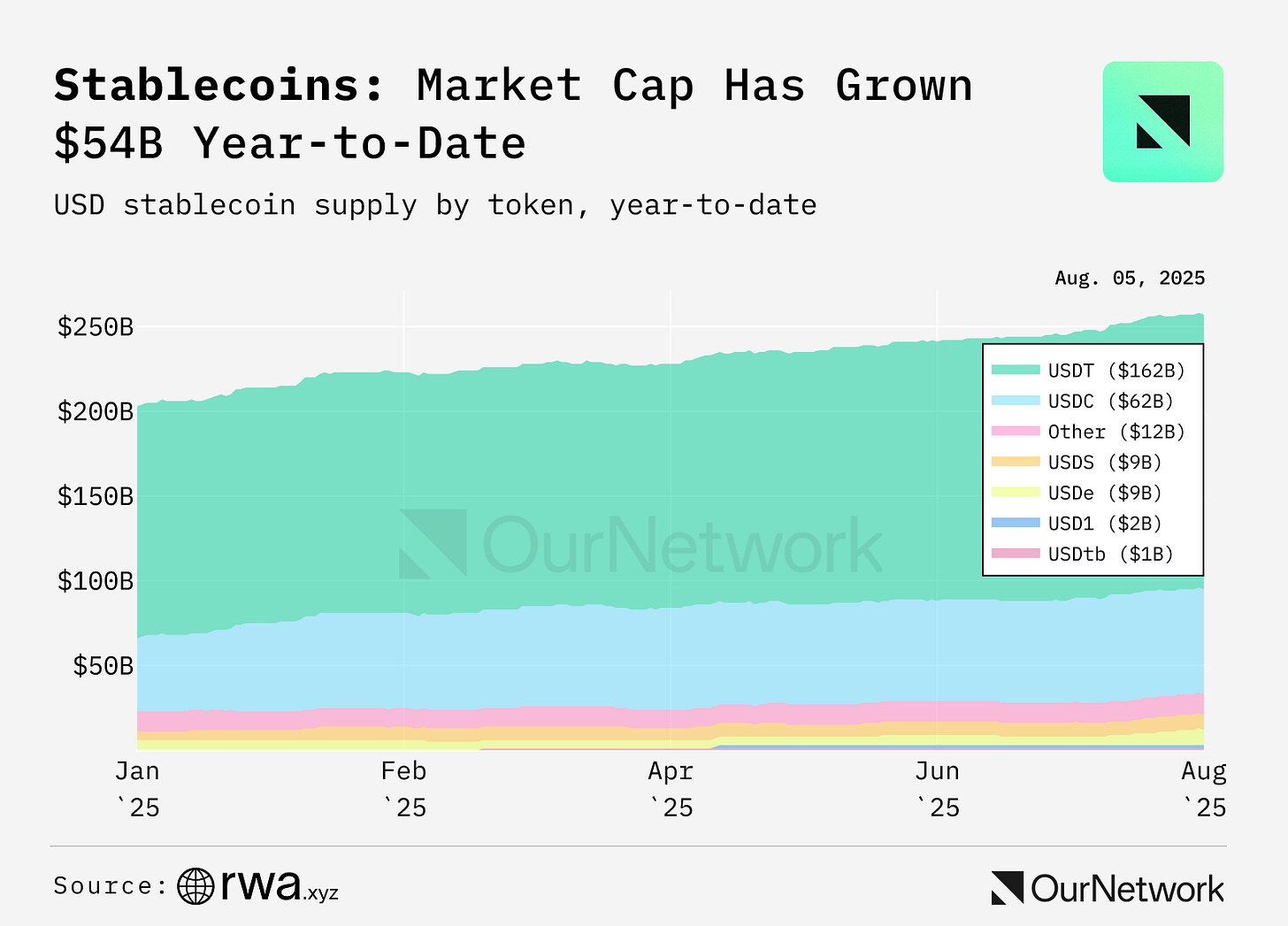

3. Stablecoins Surge Past $257B, Adding $54B in 2025 Showcasing the Fastest Year-to-Date Growth Since 2021

Source: @DavidShuttleworth

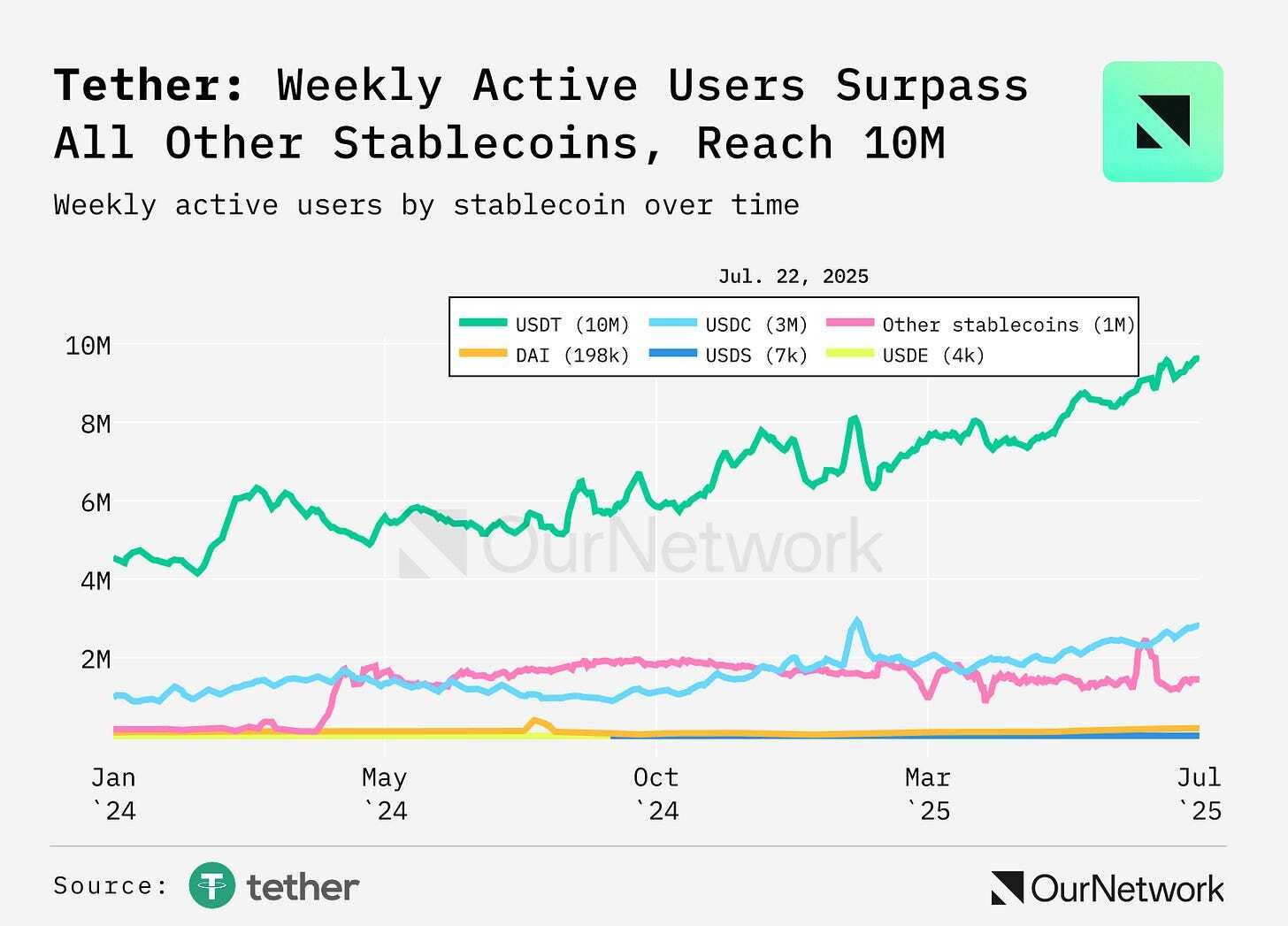

4. Tether Continues to Excel in Terms of TVL Growth, New Users and USD Flows

Source: @OurNetwork

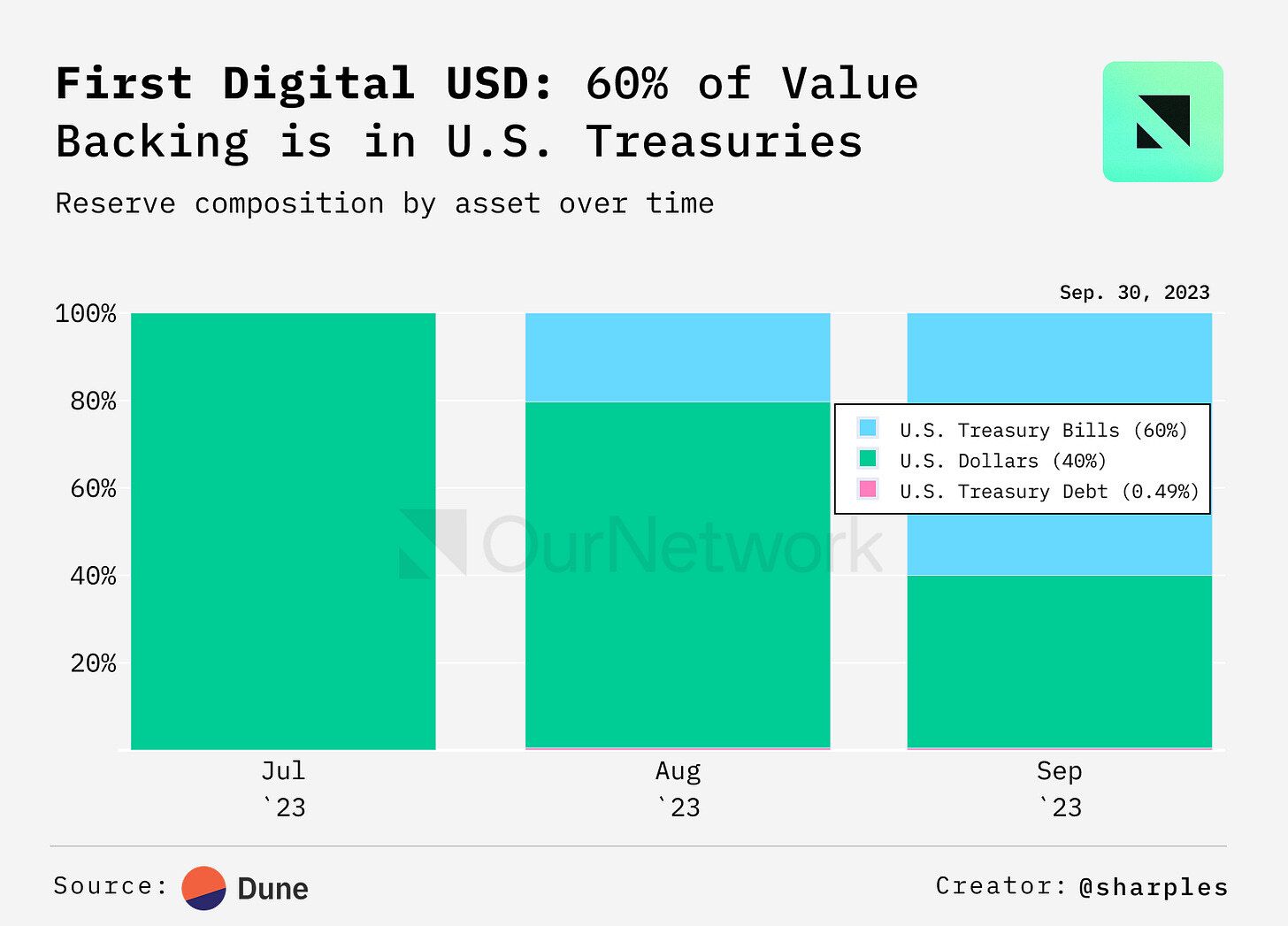

5. FDUSD is now live on Solana, TON, Arbitrum, and SUI blockchain with an Expectation of Flow from Ethereum and BNB Chain

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Crypto markets surged over 5% today to a $4.09T global market cap, according to our friends at CoinGecko. That’s only 4% off the crypto market’s all-time high of $4.26T which came earlier this month. The market's bullish interpretation of today's comments from US Fed Chairman Powell is largely responsible.

While markets rally, OurNetwork is diving into the steady backbone of crypto: stablecoins. Even as unpegged assets post gains today, stablecoins are red hot, consistently pushing to all-time highs.

In part two of OurNetwork's latest stablecoin series: Peter digs into USDC, Ian checks in with USDS, Seoul Data Labs looks into the onchain action for USD1, and Rafi explores stablecoins for emerging markets' currencies. Finally, Peter pulls double duty to cover EURe.

Let's get into it.

– ON Editorial Team

📈 USDC Supply Rises as Adoption Grows Across Multiple Use Cases

USDC, issued by Circle, is a fully-reserved stablecoin pegged 1:1 to the U.S. dollar and backed by cash and short-term Treasuries. As of August, supply reached a record $66.11B across 10 networks, including Ethereum, Solana, Base and Arbitrum. USDC supply is up 25% year-to-date. In July, cumulative transfer volumes reached $2.4T, with organic volumes hitting an all-time high of $345B, up 42% month-over-month.

Lending and P2P remain core drivers of USDC usage. In July, P2P volumes across the seven Ethereum Virtual Machine networks reached a record $364B. Ethereum led with 86% of the total, followed by Arbitrum at 6%. Over the past 12 months, $106.2B in USDC was loaned out, with Aave accounting for 79% of that activity.

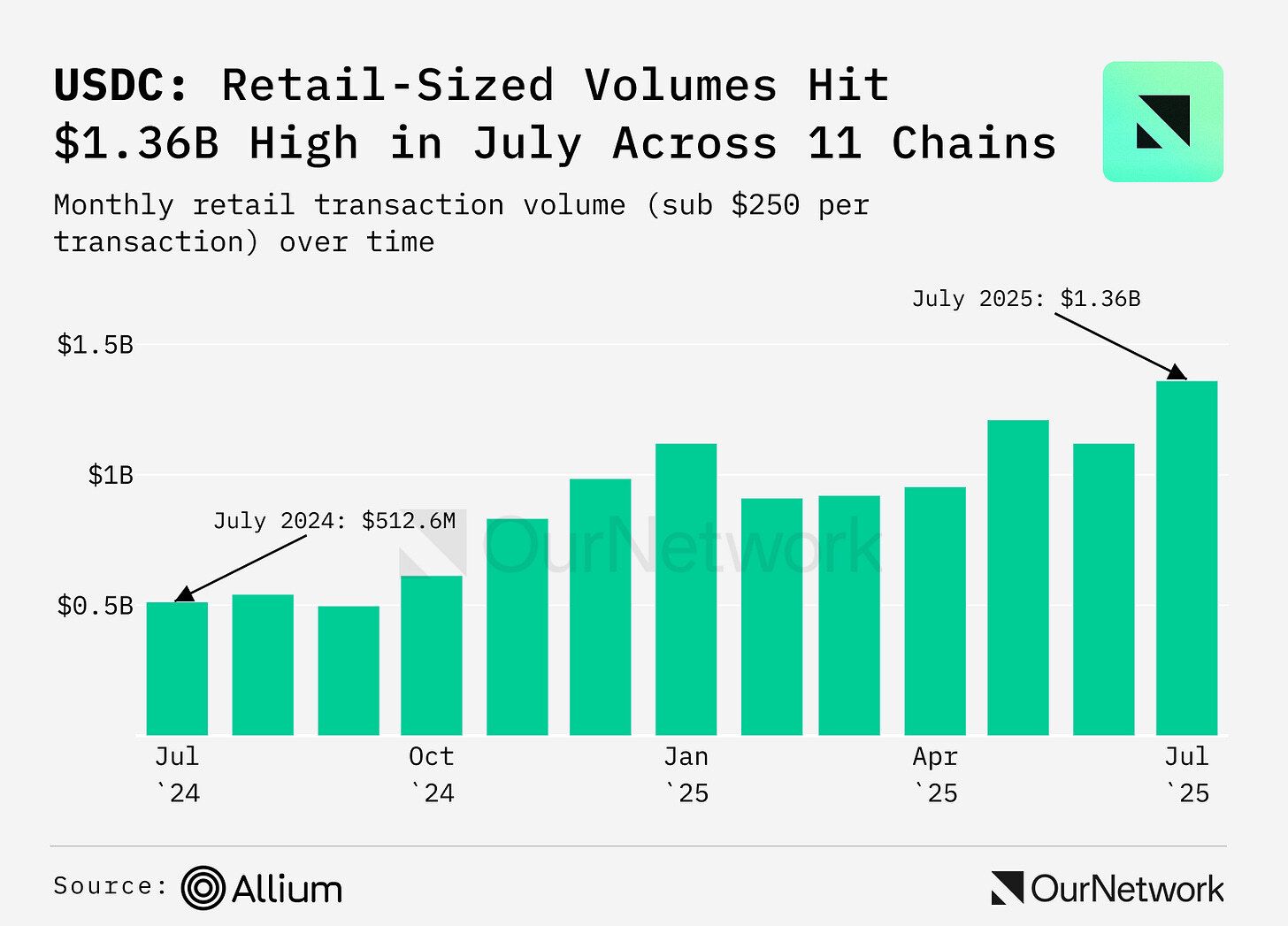

In July, retail-sized USDC volumes hit a record high of $1.37B across 11 networks. Solana led with 33% of these volumes, followed by Polygon at 17% and Arbitrum at 12%. Allium defines retail transactions as organic transfers under $250.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and kinto.xyz