Learn More at www.rootstock.io and www.kuladao.io and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 320k weekly subscribers. This week, SharpLink made $425M Ethereum treasury plunge, SEC acknowledged Canary Capital's filing for staked Tron ETF, Bitcoin and Ethereum ETFs notched highest combined daily inflows since January, and big new venture rounds came in for Roxom ($17.9M) and Hyperdrive (6M).

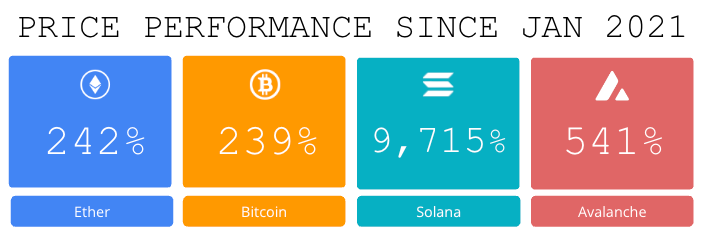

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 320,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

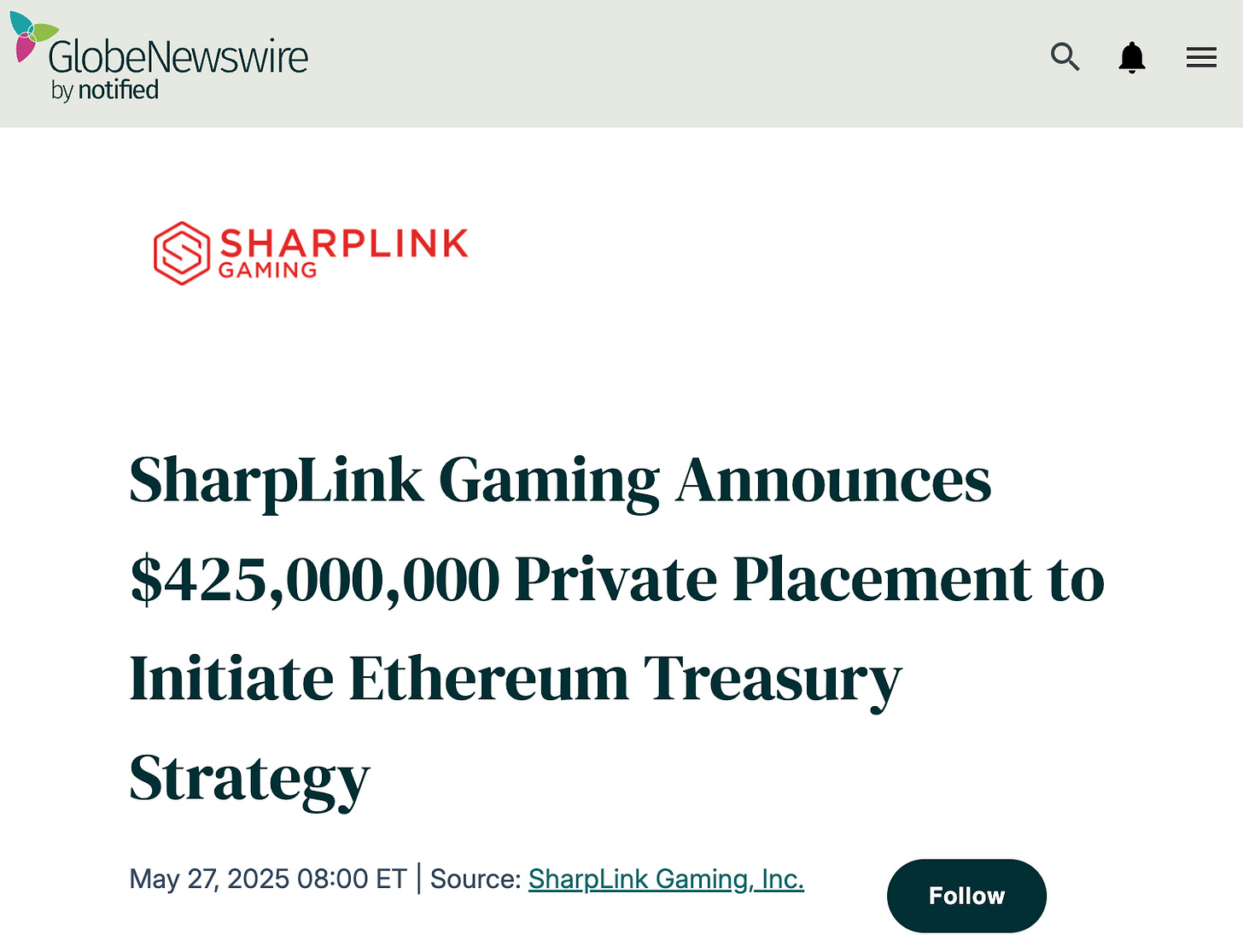

🚀 SharpLink makes $425M Ethereum treasury plunge with Joseph Lubin’s guidance: SharpLink Gaming plans to establish a $425 million Ethereum (ETH) treasury under the guidance of Consensys CEO and Ethereum co-founder Joseph Lubin, the company announced on May 27.

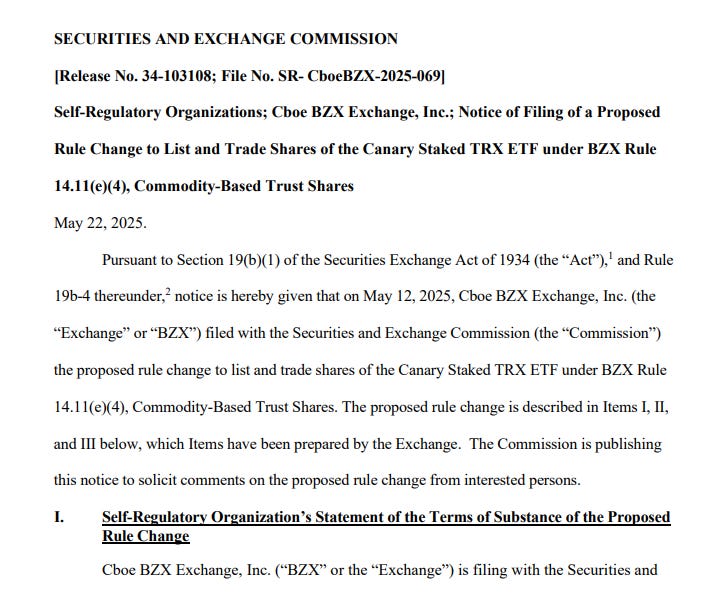

⚖️ SEC acknowledges Canary Capital's filing for staked Tron ETF:The U.S. Securities and Exchange Commission acknowledged Canary Capital's filing for a staked exchange-traded fund based on Tron (TRX), while delaying its decision on approving several other crypto ETFs.

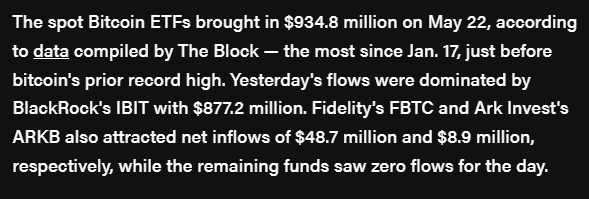

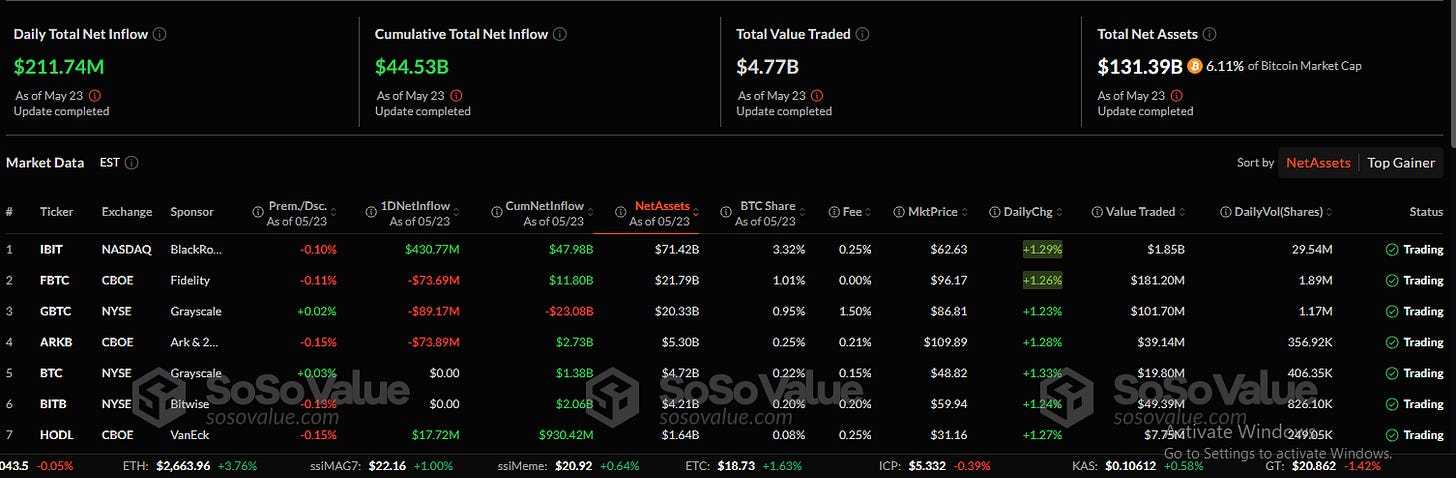

🚀 Bitcoin and Ethereum ETFs notch highest combined daily inflows since January, attracting over $1 billion amid price surge:The combined U.S. spot Bitcoin and Ethereum exchange-traded funds generated $1.05 billion in combined net inflows on Thursday — the highest daily figure since January amid BTC's latest all-time high and ETH's best run in months.

🚀 Spot bitcoin ETFs log highest volume week of 2025 as BlackRock's IBIT reaches 30-day streak:U.S.-based spot bitcoin ETFs saw their largest weekly trading volume yet in 2025 last week, as the rising price of BTC brought new inflows to the exchange-traded products.

🤝 Polygon co-founder Mihailo Bjelic steps down, marking third founder exit: Mihailo Bjelic, a co-founder of Polygon POL, is stepping back from the blockchain project he helped create, according to an announcement on Friday.

💬 Tweet of the Week

Source: @BittelJulien

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Everyone is max long.

Following Bitcoin's historical run this week, open interest on BTC futures smashed through $80B to reach record levels. That’s a staggering $45.5B (+125%) increase from last May, when BTC traded around $70K.

Funding rates on Binance, Deribit, and Hyperliquid quickly surged well beyond 50% annualized. Hyperliquid now handles upwards of $4.5B in BTC open interest (a new high), with BTC making up nearly 50% of all OI (up from 32% last month).

Meanwhile, institutions poured in: over $2.75B in weekly BTC ETF inflows, including $935M in a single day as BTC broke $110K, its strongest daily total since January.

Source: @DavidShuttleworth

2. A big milestone for Sui Foundation this week: total circulating supply of stablecoins on the network just surpassed $1B for the first time, growing by $657M (177%) since January.

Meanwhile, native Circle USDC on Sui has grown to $738M, a 7x jump from $100M in November.

Source: @DavidShuttleworth

3. Total stablecoin liquidity on Hyperliquid has just surpassed $3B for the first time and has now grown by 53% ($1.06B) since April. Virtually all it is $USDC.

For perspective, Hyperliquid now ranks as the 5th largest chain by total USDC in circulation, rapidly closing the gap on Base ($3.7B).

Over the same period, total open interest on the protocol has doubled, reaching nearly $6B.

Source: @DavidShuttleworth

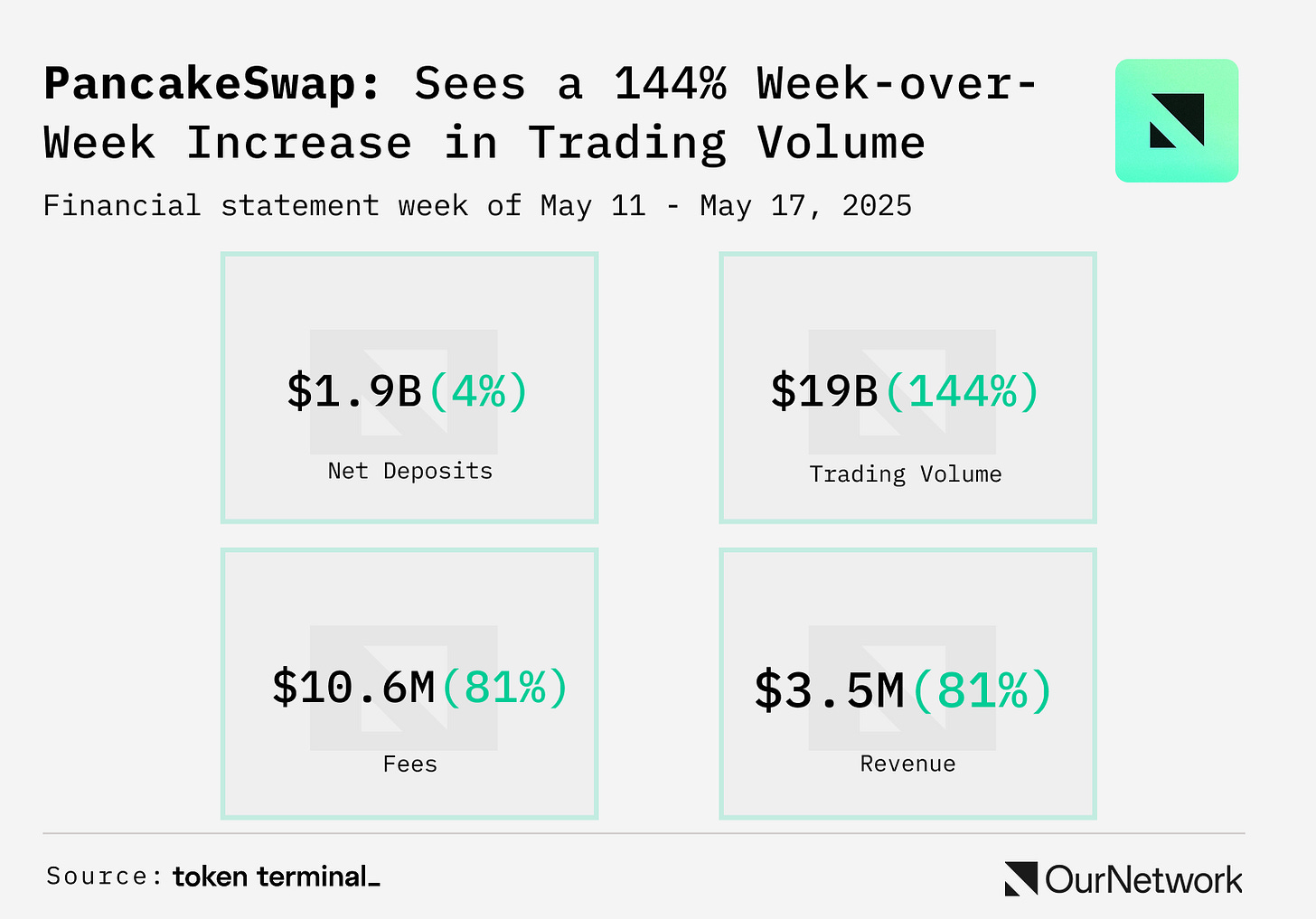

4. 📈 PancakeSwap Leads BNB Chain in Revenue Despite Low CAKE Minting and Reduced Chain Activity

Source: @OurNetwork

5. 📈 Uniswap at Forefront of DEX Ecosystems with Multi-Billion-Dollar TVL, Diversified Fee Capture Across Layer 2s and Developer-Focused v4 Launch

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

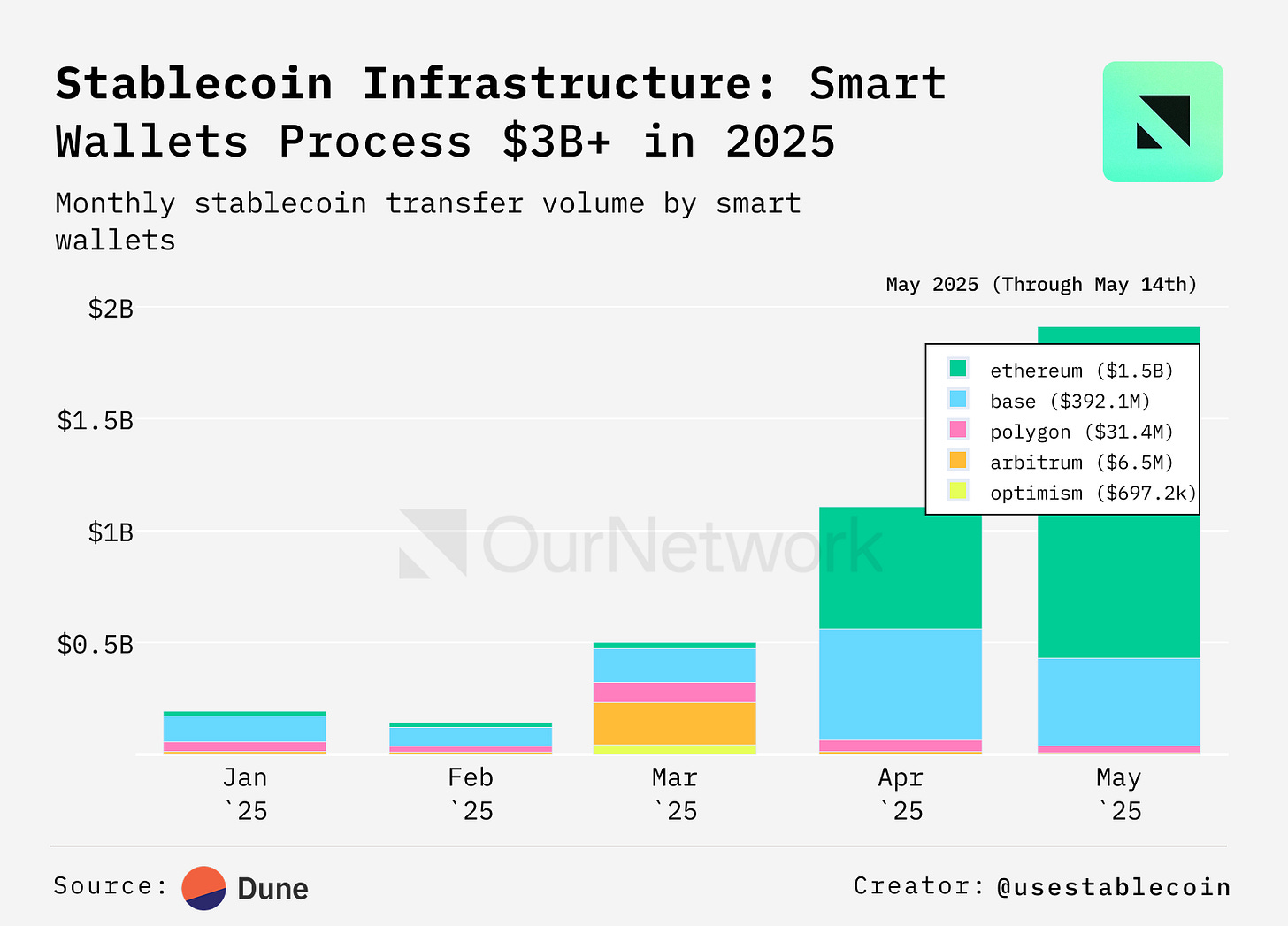

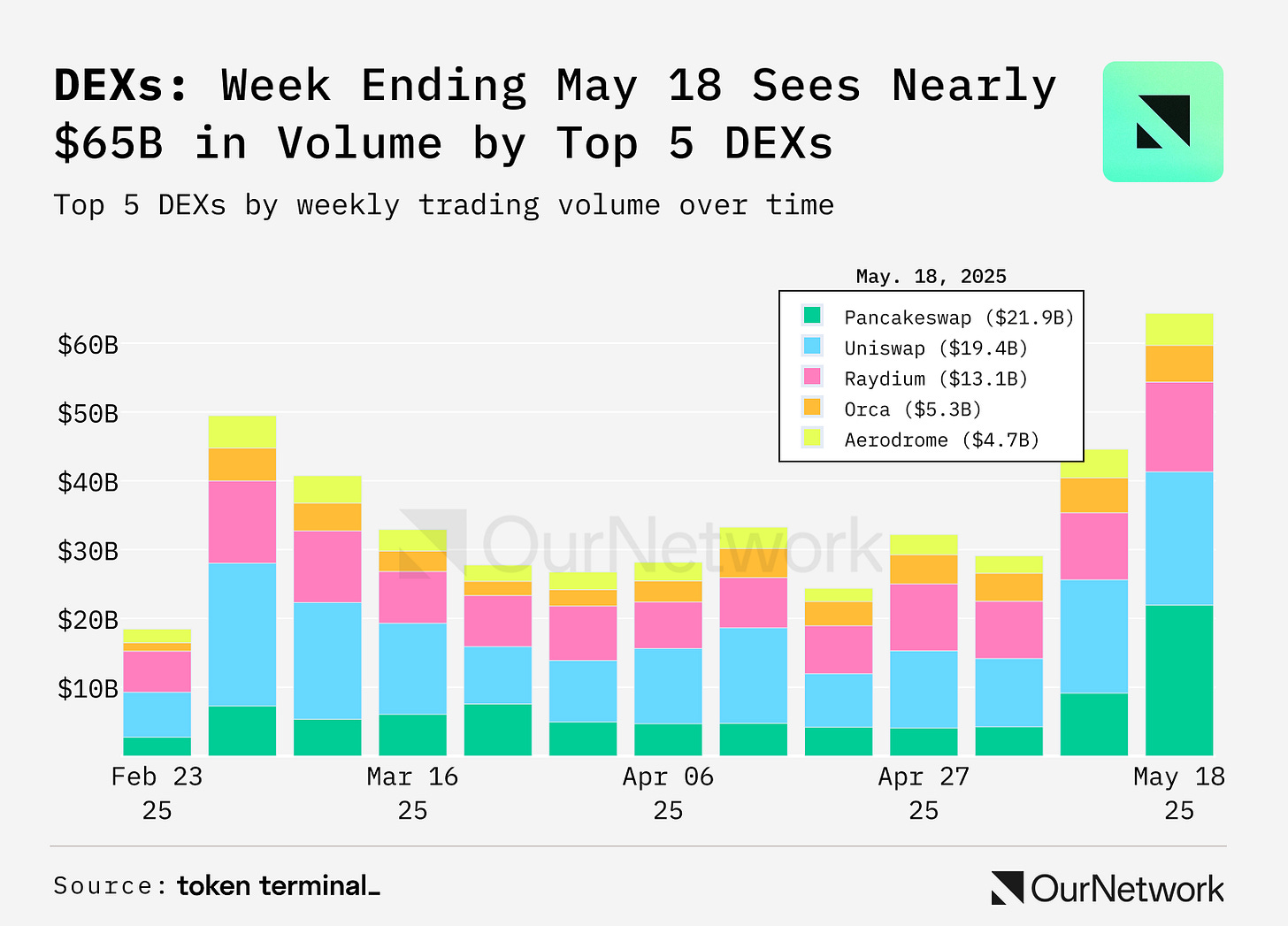

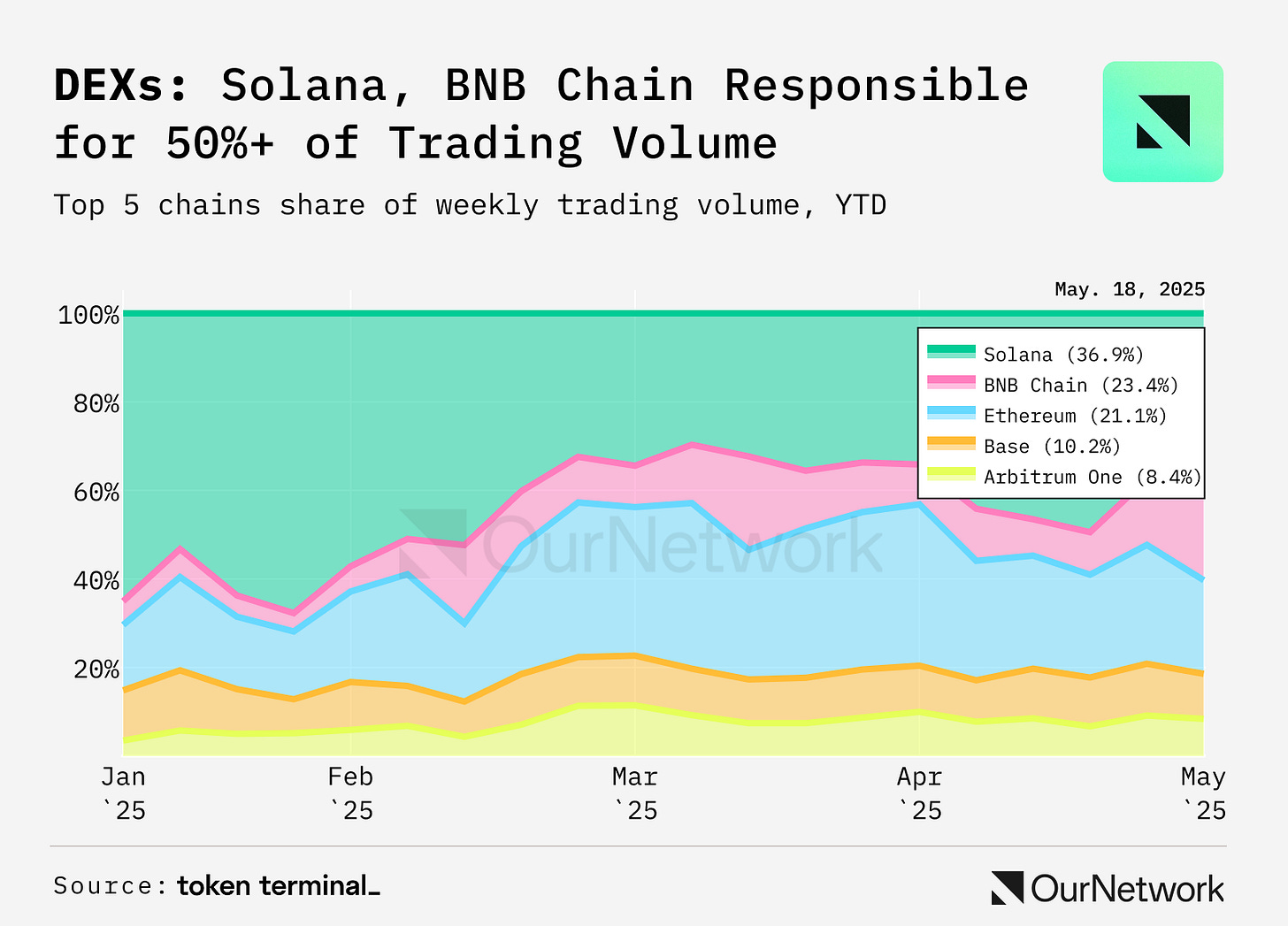

Today OurNetwork is checking on decentralized exchanges (DEXs), crypto's bread and butter sector which allows traders and investors to allocate their resources across liquid tokens.

Trading volume, driven partly by increases crypto prices, has picked up in recent weeks. The top fives DEXs, three of which OurNetwork analysts cover below, generated over $64B in the week ending on May 18. That's over 250% higher than 90 days ago, the week ending on Feb. 23.

Below, you'll read coverage of PancakeSwap, Uniswap, Raydium, establshed leaders on their respective home blockchains of BNB Chain, Ethereum, and Solana. Clujso also looked into PumpSwap, pump.fun's new DEX which launched in March and is already generating billions in volume per week.

Let's get into it.

– ON Editorial Team

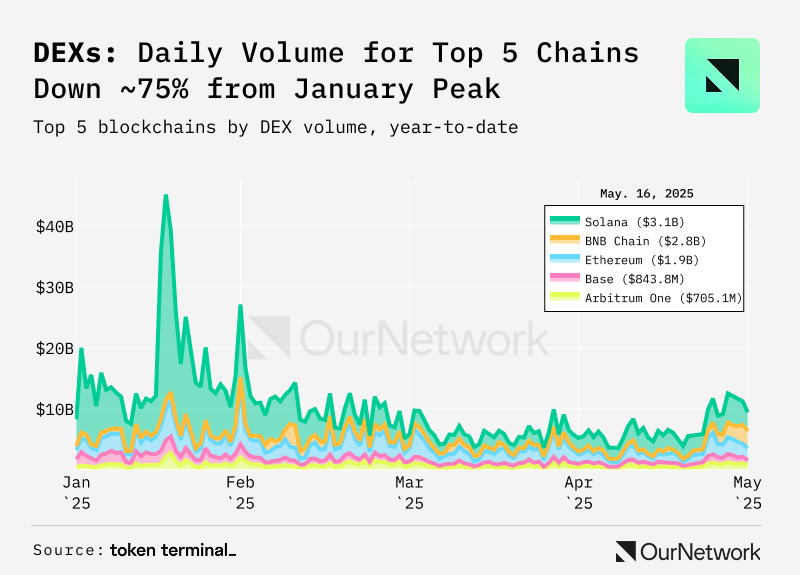

📈 Trading Activity Still Trails January Highs as Increased Asset Prices Send Volumes Up in May

The DEX market is extremely volatile. The combined daily trading volume for the top 5 chains is down ~75% from the January 2025 peak. Since the start of the year, the combined daily trading volumes have peaked at ~$45.1B and bottomed at ~$3.4B.

Token prices follow trading volumes. The token prices for the top DEXs are all down compared to the start of the year. DEXs with the biggest price drops are CoW Protocol & Uniswap, both down ~60%, while PancakeSwap & Fluid are down only ~15%.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.kuladao.io and www.amphibiancapital.com