Learn More at www.ceek.com and www.firstblock.ai

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 340k weekly subscribers. This week, Ripple CEO Brad Garlinghouse said the “ship has sailed” on the U.S. returning to a hostile crypto climate under Chair Gensler, Binance reimbursed $283M following a market crash and asset depegging issues, Ethereum stablecoin activity hit new highs with weekly unique senders topping 1 million, Hyperliquid moved to activate HIP-3 to enable permissionless perp market creation, and Coinbase integrated DEX trading for U.S. users directly within its exchange on the Base network. On the fundraising front, Coinflow raised $25M in a Series A led by Pantera Capital, TransCrypts secured $15M in seed funding led by Pantera Capital, and CipherOwl closed $15M led by General Catalyst. Rounding out the week, Galaxy Digital raised $460M as part of its AI expansion and Kalshi raised $300M to scale its CFTC-regulated prediction market platform.

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉 Learn more at www.ceek.com

First Block’s vision is clear: a world where every stock, bond, fund, and real asset can be tokenized, traded, and settled in real time. By merging the discipline of Wall Street with the innovation of blockchain, First Block is creating the infrastructure for liquid, compliant, and borderless capital markets. Learn more at www.firstblock.ai

Become a Coinstack Sponsor

To reach our weekly audience of 340,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚢 ‘Ship has sailed’: Ripple CEO Brad Garlinghouse says US won’t return to hostile crypto climate under Gensler: The sector won’t be going back to a time when former Securities and Exchange Commission Chair Gary Gensler led that agency, Ripple CEO Brad Garlinghouse said on Wednesday.

📉 Binance Reimburses $283M After Market Crash and Asset Depegging Issues: Crypto exchange Binance said Sunday afternoon it had reimbursed users affected by the October 10 depegging of several Earn assets, later clarifying that the sharp price drops seen during Friday’s market crash were caused by a display error rather than actual token failures.

💰 Ethereum stablecoin activity hits new highs as weekly unique senders top 1 million:The number of unique stablecoin senders per week on Ethereum has increased at an exponential rate in the last 12 months.From January 2020 to July 2024, there was an average of ~400,000 stablecoin senders on Ethereum per week. Since August 2024, this figure has grown by over 1.7% per week on average, consistently setting record highs.

🌕 Hyperliquid to activate HIP-3 upgrade enabling permissionless perp market creation: Hyperliquid is expected to activate HIP-3, a major protocol upgrade that will enable the permissionless creation of perpetual futures markets, later today.

🚀 Coinbase integrates DEX trading within its exchange for US users on Base network:Crypto exchange Coinbase has officially launched DEX trading within its app for U.S. users, excluding those in New York.The exchange first teased the feature in August, when it was available to select users, and officially rolled it out to the public on Wednesday, according to a company blog post. Coinbase users can now trade tokens before they’re considered for traditional listing on the exchange.

💬 Tweet of the Week

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. 📈 Barter’s Intent-Based Routing Unlocks Efficient Access to Fragmented EVM Liquidity, Driving Rapid Volume Growth Across Integrated Protocols.

Source: @OurNetwork

2. Binance has paid about $283M in compensation after three Binance Earn assets USDe, BNSOL, and WBETH depegged during Friday’s market crash. The payouts covered users affected in futures, margin, loan markets, and Earn redemptions.

Binance denied claims that the depeg triggered the broader sell-off, stating that market prices collapsed first, with depegs occurring later.

Source: @Launchy

3. During Friday’s historic collapse, Hyperliquid shattered records with $28.7B in trading volume, nearly 100,000 unique daily users, and over $20M in daily fees.

Source: @DavidShuttleworth

4. Over $910M (-15%) of stablecoin outflows on Hyperliquid since Friday’s market crash, including a daily record of $656M on Friday. Lots of traders PACKED UP for the fall season 🍂

Source: @DavidShuttleworth

5. Deposits into Lighter have tripled month-over-month and now stand at $1.17B. Since mainnet launched on October 2nd, more than $432M has already poured in.

Source: @DavidShuttleworth

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

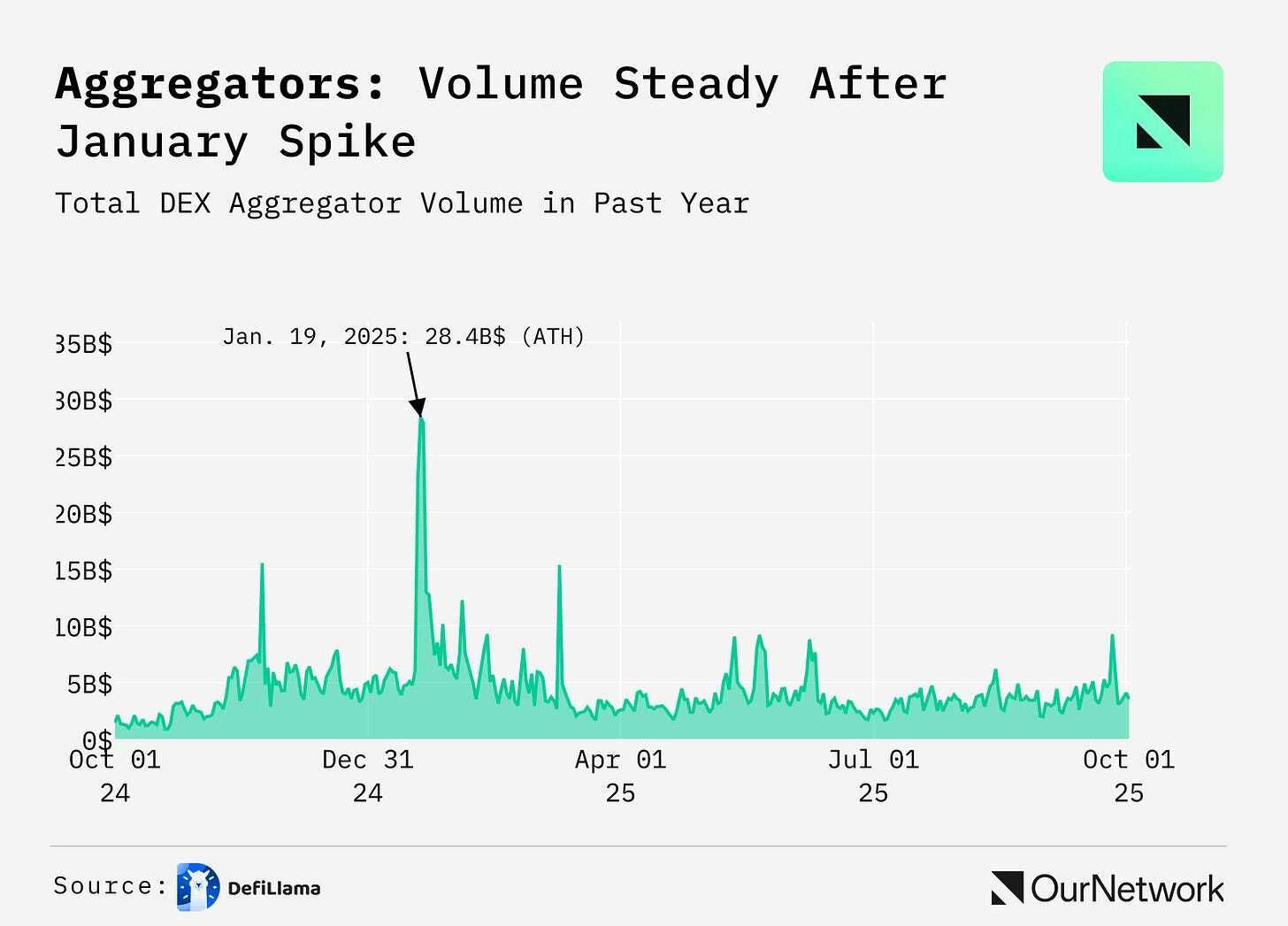

Welcome to OurNetwork’s latest. This week we’re covering aggregators, a space which has been relatively stable this year with a daily median of roughly $3.6B in trading volume.

The year’s major spike of over $28B in aggregator volume came on Jan. 19, within a day of U.S. President Donald Trump’s inauguration. At $23.8B, Jupiter, a leading aggregator on Solana, contributed the majority of volume on that day.

Early January was also a local high for crypto’s market capitalization, which was over $3.7 trillion at the time. Crypto has since eclipsed those highs, but aggregator volume has yet to return to its January peak.

Shout out to Pavel, Katerina, and Alex for covering some of the leading aggregators below.

– ON Editorial Team

📈 1inch Powers DeFi Infra with Native Cross-Chain Swaps, RWAs Via Ondo, and Recent Integrations like Coinbase, Leading in Volume and Adoption.

1inch cross-chain swaps were first introduced a year ago, on Sept. 18, 2024. Since then, the feature has gained strong adoption, with over 42,000 wallets executing over 128,000 transactions and generating $617M in total volume. The most popular directions include BNB-to-Ethereum ($137.3M), Ethereum-to-Arbitrum ($59.4M), Arbitrum-to-Ethereum ($47.2M), Ethereum-to-BNB ($44.1M) and Base-to-Ethereum ($23.9M).

In Q2 and Q3 of this year, a record share of swaps executed via external integrations (89.6% and 83.3%, respectively) — highlighting that 1inch functions as an infrastructure layer in DeFi, with many projects relying on it as their swap provider.

1inch leads RWA trading via Ondo, surpassing Uniswap, CowSwap, MetaMask, and Binance. Since launch in September, 1inch processed $16.8M volume with 53,000+ transactions, and more than 21,000 users, proving its dominance as the key onchain gateway to tokenized real-world assets.

📈 CoW Swap remains the leading intent-based aggregator in the EVM space with still high volume trades happening on Ethereum

Cow Swap hits $12.47B in volume last month. That’s 3x 2024’s monthly average. The volume is driven by transactions on Ethereum (89.7% in September), followed by Arbitrum (5.2%) and Base (4.3%). The number of transactions is also growing, jumping from 85.1k in August to 100.5k in September. Here, Base is responsible for the growth with 49.3% of trades happening there. This growth reflects continued trust in CoW Swap’s unique batch auction model protecting users from MEV and securing better prices.

User retention has increased from ~41% in 2024 to 50.7%. At the protocol level, new users are turning to Ethereum for their first transaction (31.8%) with Base leading closely (29.6%). Avalanche and Polygon saw the highest number of returning users (68% and 69%). Numbers on Lens are still trivial.

Looking at market share in the EVM space for 2025, Cow Swap holds its position with filling between 60% to 90% of all intent-based swaps. There are no strong signals that this position in the EVM space will change in the short-run.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and www.firstblock.ai