Issue summary: The crypto bull market structure remains intact as we prepare for a major Fall 2021 run-up, with lots of activity happening in the Solana, Arbitrum, Avalanche, and Fantom ecosystems. Today, Coinstack Analyst Mike Gavela takes a deep dive into the Solana ecosystem and its Dapps.

In This Week’s Issue:

Latest Crypto Market Forecast

Solana Deep Dive by Mike Gavela

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

🚀 Coin Of The Week - FTT Up 36% in 30 Days

The Coinstack Alpha Fund

Coinstack Podcast Episodes

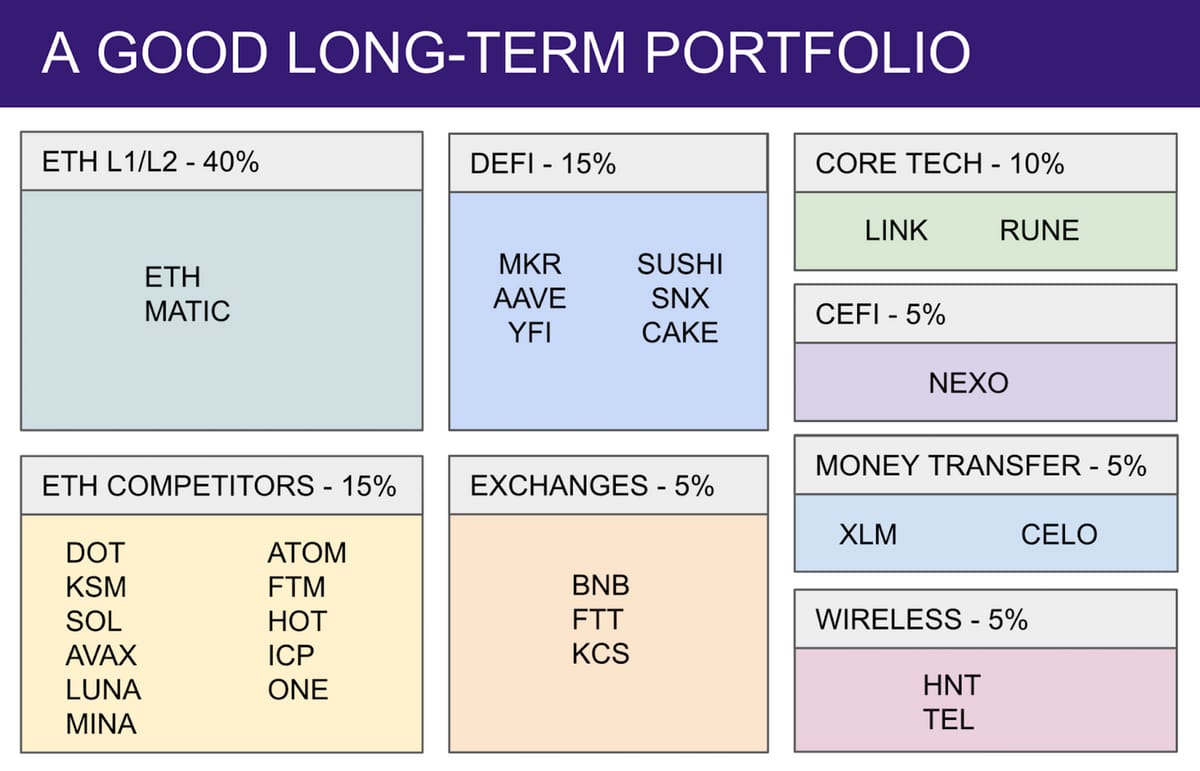

Top 30: A Good Long-Term Crypto Portfolio

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

📈 Latest Crypto Market Forecast

It’s almost Fall 2021 -- the time we’ve all been waiting for. Based on on-chain analytics and the amount of capital coming into the space from institutional investors, crypto markets appear headed toward a double market peak as we first predicted July 5. We expect to see new all-time highs in October or November for both Bitcoin and Ethereum. While things could always change, we expect to see $80k+ BTC and $6k+ ETH by the end of 2021. We’re also keeping a close eye on the rapidly developing Solana, Arbitrum, Avalanche, and Fantom ecosystems — and the pending launch of Polkadot’s parachains.

📰 Solana Deep Dive

By Coinstack Analyst Mike Gavela

Almost 20 Hours of Downtime Tuesday

Solana, the fastest Layer 1 blockchain promising 50,000 TPS and 400ms block time latency, experienced a large transaction load on Tuesday that peaked at 400k TPS, causing the network to overload and have its validator community elect to reset the network. At 5:00 AM ET, the price of SOL was $170, according to CoinMarketCap, but it fell to as low as $151 at 2:39 PM, before recovering. It’s trading at $159 as of late afternoon Wednesday.

The protocol remains down at the time of writing while also maintaining itself in the $150’s price level, which can only be explained by bullish investor sentiment, which then begs the question, why have so much faith in a protocol that went dark for almost 24hrs? This Deep Dive analyzes Solana’s founder, initial vision, engineering decisions, and the Dapps that weaved this powerful narrative for investors to remain bullish even in SOL’s darkest of times.

Founder’s Background

Anatoly Yakovenko, founder and CEO of Solana, began his decade-long career at Qualcomm as a performance optimization engineer. At Qualcomm, Anatoly gained a reputation for being able to solve the most complex engineering problems. He ended up as a lead in the advanced technologies group and built a stack to take full advantage of the hardware semiconductor chips. One of the standout projects he led was developing tech that made Project Tango (VR/AR) possible on Qualcomm phones.

Come 2017, Anatoly and a friend started a deep learning hardware project to mine crypto to offset the project's cost. This became Anatoly's first experience with Proof-of-Work, and he was immediately hooked,

"And that kind of like was the red pill for me or like the start of it. We started talking about how you would design this, making it more electricity efficient and thermodynamically efficient. We're talking about, single-threaded mining and I had two coffees and a beer, and I was like up till 4 in the morning. I had this like eureka moment that instead of measuring electricity, you can measure another physical constant, which is time."

Anatoly realized that he could take the same wireless protocol optimization skills he gained in the last 12 yrs from being an engineer at Qualcomm and apply them to blockchain technology.

Initial Vision

Anatoly describes Solana as an operating system because that was the kind of engineer he was bred to be during his career at Qualcomm. He initially built Solana and designed it with his team of fellow Qualcomm engineers. They thought an essential use case was financial information. It needs to be readily available, cheap to modify, and as low latency as possible or as coined, “The Blockchain at NASDAQ speed.” From the beginning, Anatoly’s vision was to develop a platform for developers with virtually unlimited potential, so speed, scalability, and low fees became the main focus when designing the Solana protocol.

Implementing Modern Engineering Practices

In a recent interview with FTX, Anatoly goes in-depth about the programming language and design choices he and the team for developers looking to build on Solana.

"I think one difference that was surprising to me that made, I believe, a very unexpected, and massive impact over the last year was that we built this thing with what we thought would be the best possible development environment for devs. And this was using traditional tools like LVM as a compiler, designing the interfaces to look a lot more Linux, like drivers, operating systems interfaces. And these are folks that engineers like out of FTX immediately recognize, and we're able to go and build something as complicated as central limit order book exchange in four weeks.

Granted, they're fantastic engineers. But I will take some credit there that we pick the right tools that are scalable for senior devs. And that's a critical differentiator than trying to build the easiest way to build software. Instead of trying to think, "what are the most scalable tools, which are the ones that it's easiest for devs to unblock themselves, even if it takes a bit more skill initially, that allows the software that's been developed to scale rapidly. And over the last year, we've seen the libraries that people have built. Some of the folks over at Serum, like Armani, solve very complicated problems using Rust, which is a modern language and scale it out to an entire ecosystem. We use modern-day languages, modern-day compilers, modern-day debugging tools because what we're leveraging are the things that folks at Apple at Mozilla Google are developing alongside us."

Solana Dapps

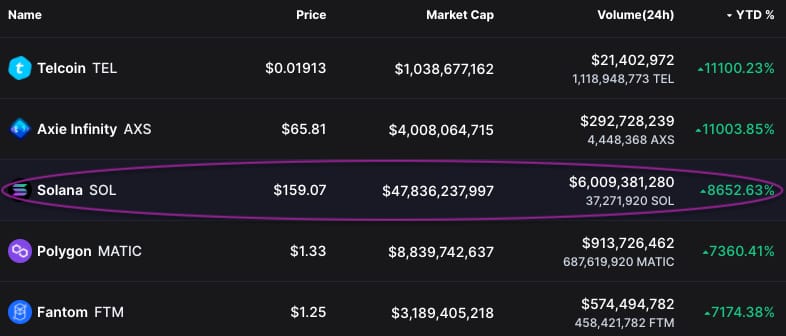

Solana remains the 3rd largest gainer in 2021 with over 8k% returned YTD and its Dapp ecosystem may be ready to pump as well. Below are the top 5 projects we are following by TVL.

#1) Saber

Saber is the first automated market maker optimized for trading pegged assets on Solana.

Symbol: SBR

Price: $0.5117

FDMC: $5.1B

TVL: $3.8B

#2) Sunny

Sunny is a composable DeFi yield aggregator powered by Solana.

Symbol: SUNNY

Price: $0.06925

FDMC: $1.3B

TVL: $3.08B

#3) Raydium

An on-chain order book AMM powering the evolution of DeFi.

Symbol: RAY

Price: $12.86

FDMC: $7B

TVL: $1.62B

#4) Mango Markets

A DEX for Options and Futures trading.

Symbol: MNGO

Price: $0.365

FDMC: $3.6B

TVL: $60M

#5) Serum

A fast DEX with cross-chain support, order books, and the ability to create custom and novel financial products.

Symbol: SRM

Price: $10.51

FDMC: $105B

TVL: $600M

Final Thoughts

Sam Bankman Fried (SBF) has become an ambassador of sorts for the Solana blockchain, “There’s been a lot more interest institutionally,” Bankman-Fried said. Solana is “one of the only blockchains that have a compelling long-term road map” that will be eventually able to support industrial uses of crypto, he added in a recent interview with Bloomberg. SBF chose Solana as the blockchain for FTX to build their NFT marketplace on top of derivatives DEX, Serum. FTX has also funded Solana.

Solana was created to be the enterprise chain of the future in a multi-chain world. That was the vision their founder, Anatoly, had from inception. A high-speed, scalable playground for seasoned engineers to develop anything at any scale their imaginations take them.

In conclusion, if you don’t already have some, you may be wise to invest in some Solana and some of the Solana Dapps like Saber, Sunny, and Raydium.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ Gary Gensler Urges Crypto Exchanges To Register With SEC Saying Investors ‘Will Be Protected’ - Gary Gensler, chairman of the SEC, appeared before the Senate Banking Committee Tuesday morning to testify about the SEC's work. In a prepared statement, Gensler asked crypto exchanges operating under his radar and within the country's shores to ensure the safety of the investments of their investors by registering with the SEC. (Source)

😮 El Salvador’s Bonds Suffer As Bitcoin Law Takes Effect - Moody's downgraded El Salvador's creditworthiness post legalizing BTC as legal tender. (Source)

💳 SEC Opposes Ripple (XRP) Request Relating to the Controversial Howey Test - In its recent filing, the US Securities and Exchange Commission (SEC) opposed the request made by Ripple and its co-founder Chris Larsen to answer interrogatories regarding the agency’s application of the Howey test for determining the status of XRP. (Source)

💰 El Salvador To Establish Bitcoin Tax Exemptions for Foreign Investors - Foreign investors will now be exempt from taxes on bitcoin profits, says government officials of El Salvador. (Source)

🤑 Virginia Public Pensions Make a Direct Bet on Cryptocurrencies - Several Virginia Public Pensions are planning to invest, pending board approvals, a total of $50M in Parataxis main fund, which buys various digital tokens and cryptocurrency derivatives. (Source)

🏦 South Korean Crypto Exchange Closures Could Leave Investors Empty-Handed - As two-thirds of South Korea’s cryptocurrency exchanges brace for closure due to regulatory overhaul, investors could lose up to KRW 3 trillion ($2.6 billion). (Source)

🇺🇦 Ukraine Adopts Draft Crypto Law Even As the IMF Sounds Alarms -The Ukrainian Parliament has adopted a draft law legalizing and regulating cryptocurrencies and other digital assets. (Source)

📈 Biden’s CFTC Picks Include Crypto Law Scholar Kristin Johnson - Johnson, a professor at Emory University School of Law, has been examining the implications of “emerging innovative technologies including distributed digital ledger technologies that enable the creation of digital assets and intermediaries.” (Source)

🎆 Consulting Firm EY To Work With Polygon on Ethereum Scaling - The company said the move would enable a future transition to public networks that are less risky and more efficient. (Source)

🏧 Lawmakers Move To Close $16.8 Billion Crypto Tax Loophole - Lawmakers have proposed a bill that will make holders of cryptocurrencies accountable to the same, “wash sale” rules as investors in the stock, bonds, and securities markets. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Total TVL for the Entire Crypto Market Hit a New ATH of $189B on Sept 6 Before Crashing 8% on El Salvador Tuesday

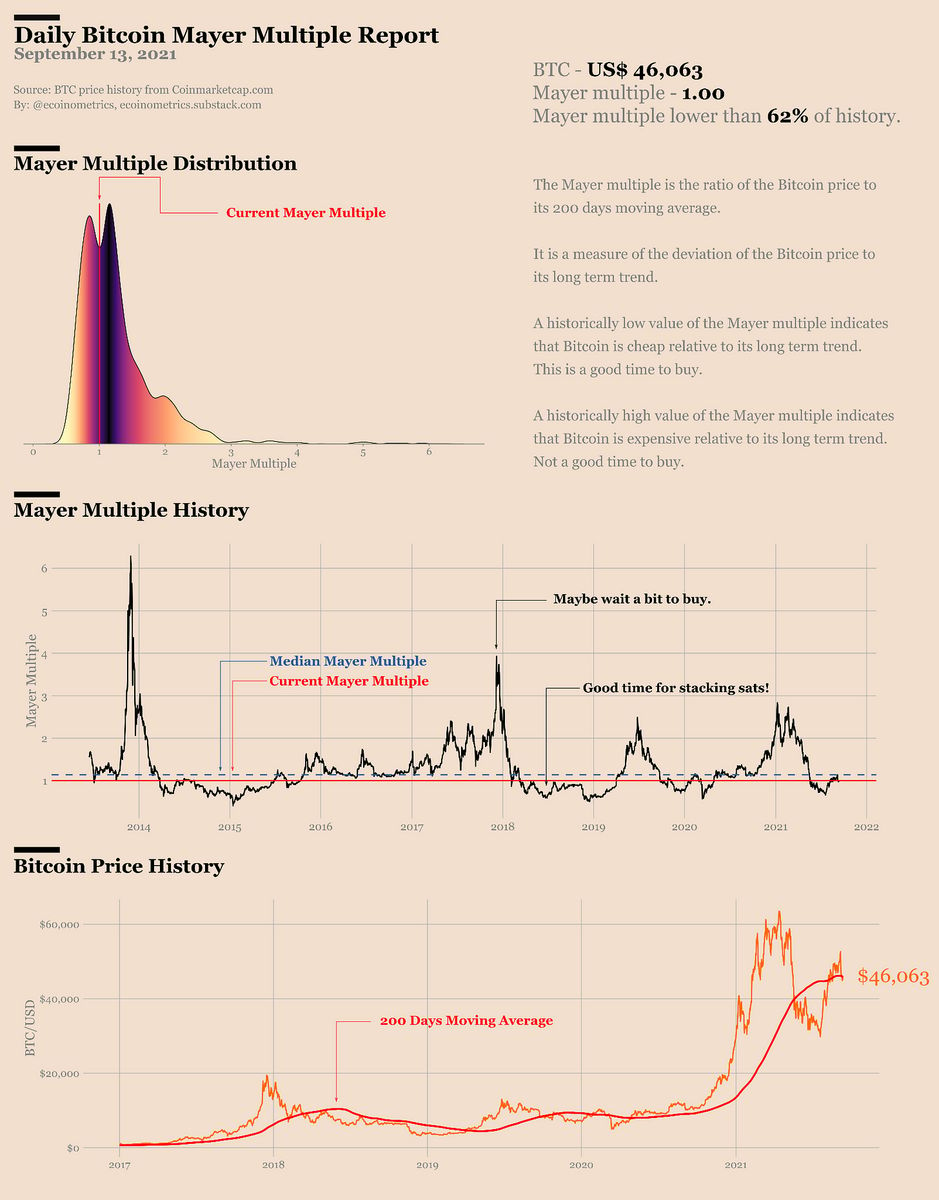

2. With BTC at a Mayer Multiple of <1, Ecoinmetrics Now Signals an Excellent Opportunity To Stack Sats As BTC Is Cheap Relative to Its Long-Term Trend

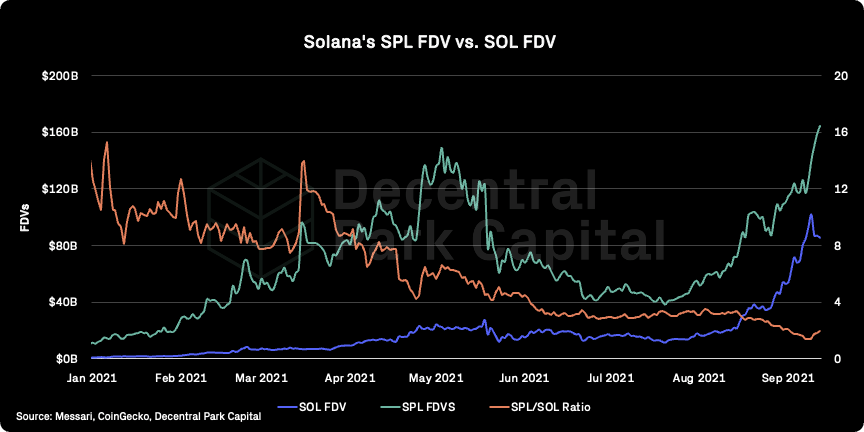

3. Solana Dapps Are Carrying an ‘Institutional Premium’ Given That Its Aggregate Value Remains Higher Than the Fully Diluted Value of Solana Itself

4. Loot NFTs Lose Momentum As the Floor Price and Reduction in Daily Volume Continues To Trend Down

5. A Recent Survey by Compound Advisors Shows Sentiment Remaining High for Solana As Investors Choose To Continue to HODL

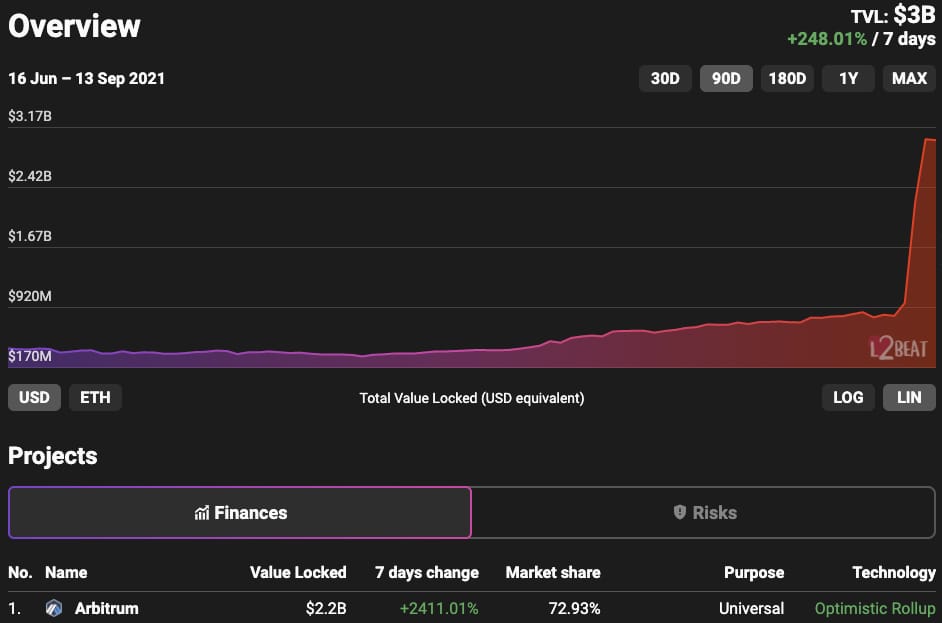

6. 6. Arbitrum Now Represents 72% ($2.2B) of TVL in ETH L2’s After Launching to Mainnet Earlier This Month

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. Funding Rates Once Again Neutral

Arcane Research, a data-driven research firm out of Norway, released their latest Weekly Update highlighting the impact of “El Salvador Tuesday.” On Tuesday, Sept 7, El Salvador’s President Bukele introduced BTC as legal tender, which became a massive sell the news event with BTC and ETH down ~13%.

“The legal tender Tuesday did indeed lead the markets to move. On September 7, at least $1.2 billion worth of longs in Bitcoin Futures and Perpetuals were liquidated as bitcoin crashed from $50,000 to $42,000 in 30 minutes. Approximately 50% of these liquidations originated from Bybit.

The September 7 liquidation data is likely an underestimation and is not directly comparable to the $4.87 billion of April 19 and $3.19 billion of May 19, which is caused by Binance adjusting its API, leading the liquidation data from the exchange to be underestimated. In the next slide, we examine the changes in the open interest across the various markets, illustrating how Binance and Bybit took the most severe hit amid the crash.

Overall, the futures market seems healthy following the violent deleveraging event. With the open interest denominated in bitcoin sitting at 310,000 BTC, basis premiums resuming to August levels, and funding rates reaching neutral territory, the market seems less exposed to sudden squeezes.”

2. Bitcoin Hashrate Recovering As Forecasted

Pantera Capital’s Dan Morehead writes a monthly letter on the state of the Crypto economy and the trends he and his firm see emerging. Morehead reports that as predicted, 68% of BTC’s drop in hashrate has been recovered, giving us one more data point that BTC continues its momentum to new ATH’s.

“Chinese policy is shutting down mining in China. Our models show that up to 56% of the change could not be explained by price alone. 56% of a 45% drop is 25% of the previous total hardware power that has been shut in by policy action.

The fallout of this ban was a sign outside context event (p<0.00001).

Command economies can shut in capacity by edict. Not in the free world. Bitcoin mining is hyper-competitive. The void will be replaced – and probably very quickly. Here we’ve graphically represented it as three months.

The shaded area of shut-in mining capacity is worth $2.0 billion annually. That “free money” will be soaked up with mining rigs outside of China.”

3. Eth To Continue To Consolidate Further Before a Final Breakout To Explore All-Time Highs

In his latest report, famed on-chain analyst Willy Woo outlines his latest short-term market forecast while ensuring that his macro forecast remains unchanged. Willy forecasts a potential consolidation between the $3.4k-$3.5k price range for ETH before beginning its ascent to new ATH’s later this year.

“Ethereum’s fundamental demand and supply have not been climbing as much compared to Bitcoin. That said, it’s in a general region of historical strength. Below I’ve plotted ETH’s dominance against the total crypto market. Under technical analysis, it’s in a very well-defined consolidation forming an ascending triangle. This price action is typically bullish. My expectation is for ETH to continue to consolidate further before a final breakout to explore an all-time-highs. I suspect it has been oversold, and the next short-term move is bullish, both against USD and BTC.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

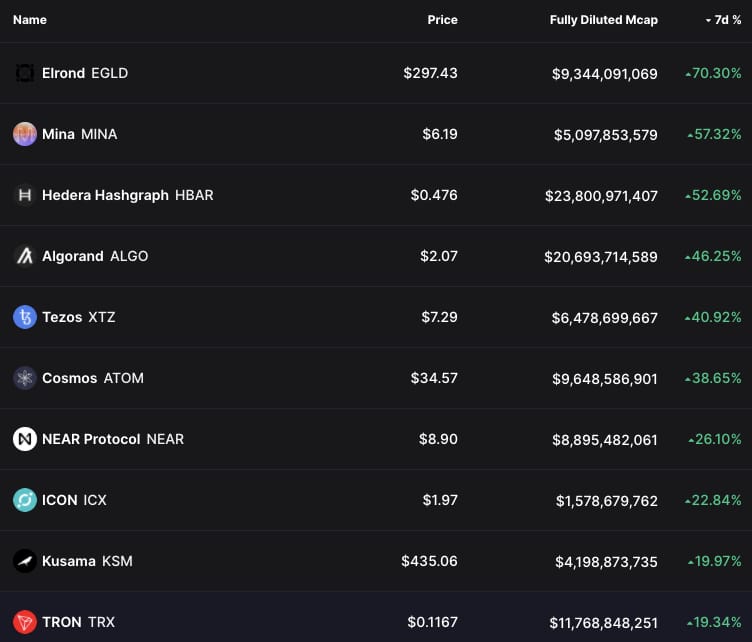

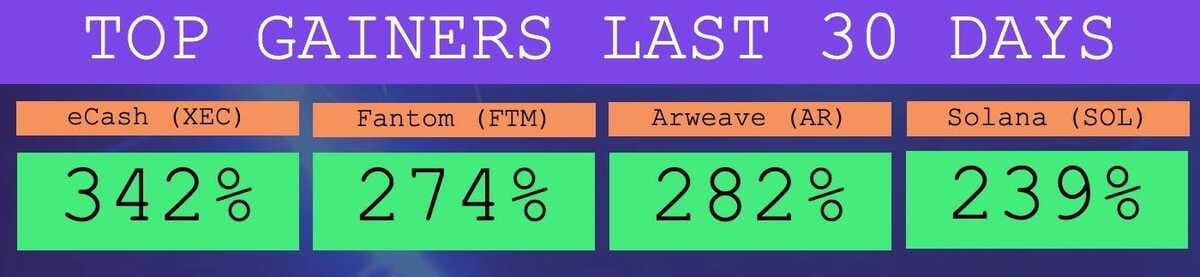

📈 Top 10 Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like FTM, FTT, and SOL had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: eCash is a BTC fork, Fantom and Solana are L1 blockchains. Revain is a blockchain-based review platform, and Arweave is a decentralised data storage app.

🚀 Coin Of The Week

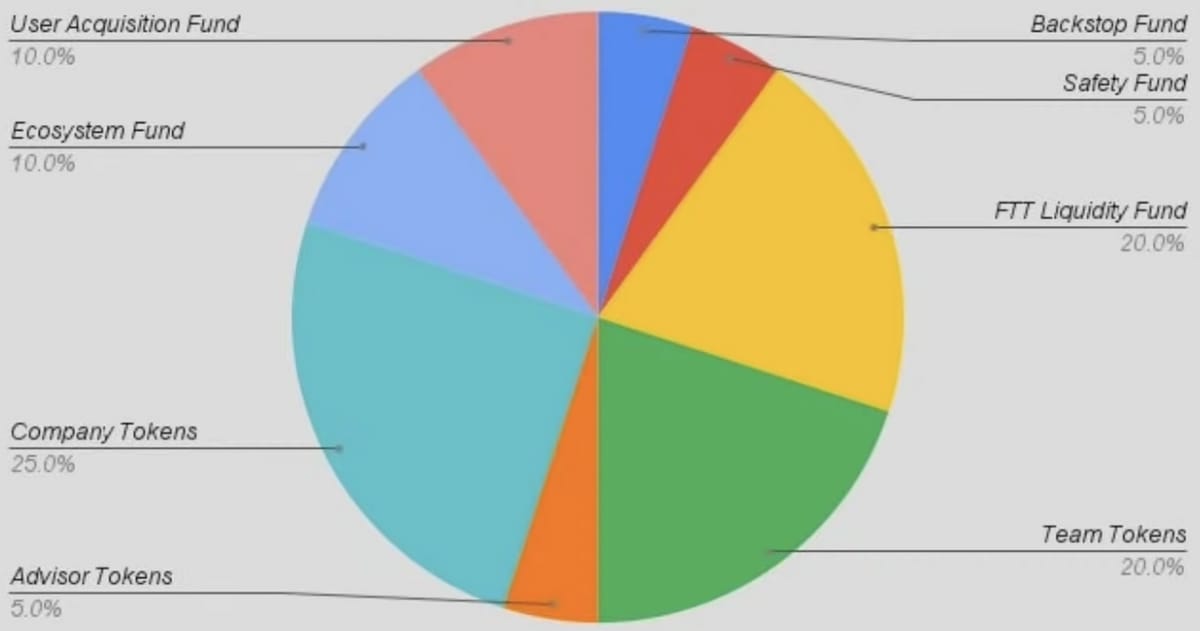

We write about a new token each week to help spread the word about new and upcoming projects. As always, investing in early-stage crypto projects is particularly risky with the opportunity for major gains and major losses.Coin: FTX TokenSymbol: FTTPrice: $70.90Available On: Binance, Uniswap, FTXFully Diluted Market Cap: $25BPrice Change Last 30 Days: +36%Coin Ranking: #23 by Market Cap

Background:

Sam Bankman Fried is the Founder and CEO of FTX. He founded Alameda Research in 2017, one of the world's largest liquidity providers, and was formerly a trader at Jane Street Capital. Sam had the vision to create a crypto exchange product designed by professional traders for traders. FTX is primarily a derivatives exchange and crypto trading exchange intended for experienced traders. 5th largest exchange by trading volume with $5B in daily trading volume. He raised over $900M in 2021 from some of the biggest backers in the Crypto space, such as Alameda Research, Paradigm, and Sequoia Capital. (Source)

Tokenomics:

FTT has a max supply of 352M tokens, with 34% (120M) circulating supply and 3% burned (9.8M). FTT has a token burn mechanism that will burn tokens equal to 33% of market fees, 10% of net additions to the insurance fund, 5% of other fees. By holding FTT holders unlock rebates through discounts on FTX trading fees. Their token distribution can be seen in the chart below. (Source)

Why It’s Pumping:

Sam Bankman-Fried (SBF) has been on a spending spree between acquisitions and various brand deals in the last month. The latest acquisition for FTX was LedgerX. An acquisition set to expand the crypto exchange’s product offerings to futures and options trading. FTX has also been making a string of sponsorship deals and celebrity endorsements to break into mainstream media. Starting with Tom Brady’s $20M Ad Campaign, then getting the naming rights to Berkeley stadium, and lastly bringing on Steph Curry as the Global Brand Ambassador for the exchange.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 4,500 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 4: ETH, DOT, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

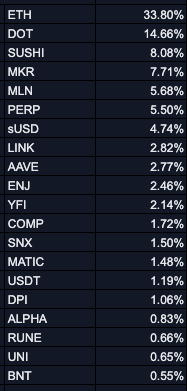

📈 The Coinstack Alpha Fund

In April 2021 we launched The Coinstack Alpha Fund, which is an on-chain fund on top of the Enzyme platform.

You can invest here in the Coinstack Alpha Fund. There is no minimum investment, although there is a gas fee you pay to the Ethereum network to invest -- which has been around $500-$700 recently. Because of this, we recommend minimum investments of $10k.

We are now up to $310k from 33 depositors in the Coinstack Alpha Fund. Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls

Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call every Wednesday at 12PM PT / 3PM ET / 8pm GMT. All HeartRithm investors, all investors in our Coinstack Alpha Fund on Enzyme and all owners of Mrs. Bubble NFTs are invited to join and ask questions and share learnings with each other. After you invest or buy an NFT, just reach out to us on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.