Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week, Sony’s L2 blockchain Sonieum goes live, Bitcoin rebounded above $96,000, Japan, South Korea, and the US issued a joint warning over North Korea-related crypto thefts, and big M&A news for Helio ($175M) and Chainalysis ($150M).

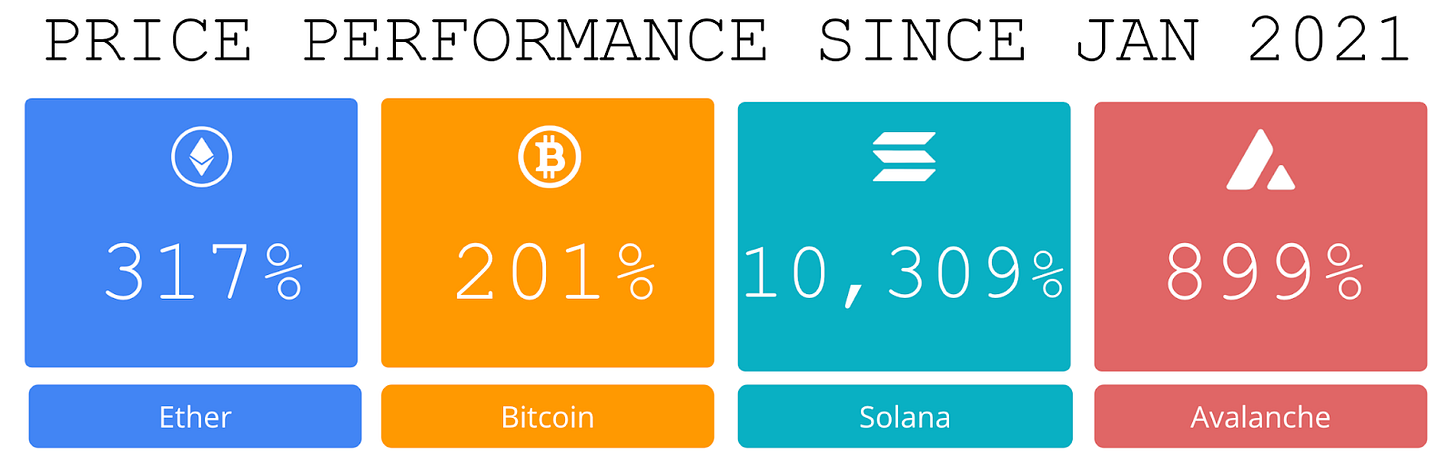

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Amphibian Capital, managing $120M+ AUM, is a fund of the world's leading hedge funds. *+21.19% net YTD approx with their USD fund, *+16.12% net BTC on BTC YTD (*+155.53% in USD terms), and +19.23% net ETH on ETH YTD (+73.74% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. *Approximate estimates through 1/13/25

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Sony’s L2 blockchain Sonieum goes live amid community backlash: Sony’s Soneium mainnet launched, aiming to simplify Web3 with NFT-driven fan engagement, but it got off to a rocky start.

📈 Bitcoin rebounds above $96,000 amid global stock gains as investors focus on key US inflation data: Investors are now focused on upcoming U.S. inflation data, which could shape investor expectations for the Federal Reserve’s next policy meeting.

⚖️ Japan, South Korea, and the US issue joint warning over North Korea-related crypto thefts: The trilateral cooperation highlighted the usage of malware and social engineering vectors in the attacks.

🚫 Solana-Based DEX Mango Markets Shutting Down Following SEC and CFTC Enforcement Actions: The Solana (SOL)-based decentralized exchange (DEX) Mango Markets is shuttering after dealing with a slew of regulatory issues last year.

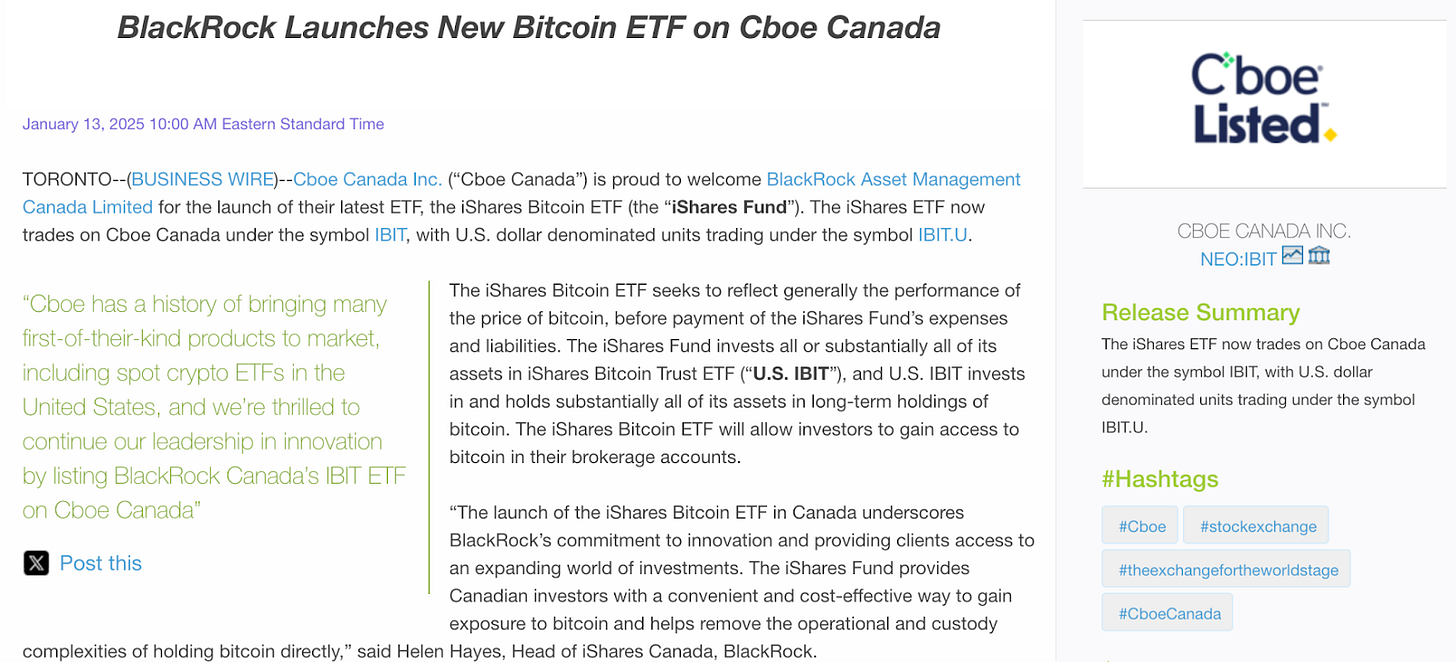

📈BlackRock's Bitcoin ETF Lands on Canadian Markets With Dual-Currency Trading: The iShares Bitcoin ETF now trades as IBIT (CAD) and IBIT.U (USD), offering Bitcoin exposure without the complexities of direct ownership.

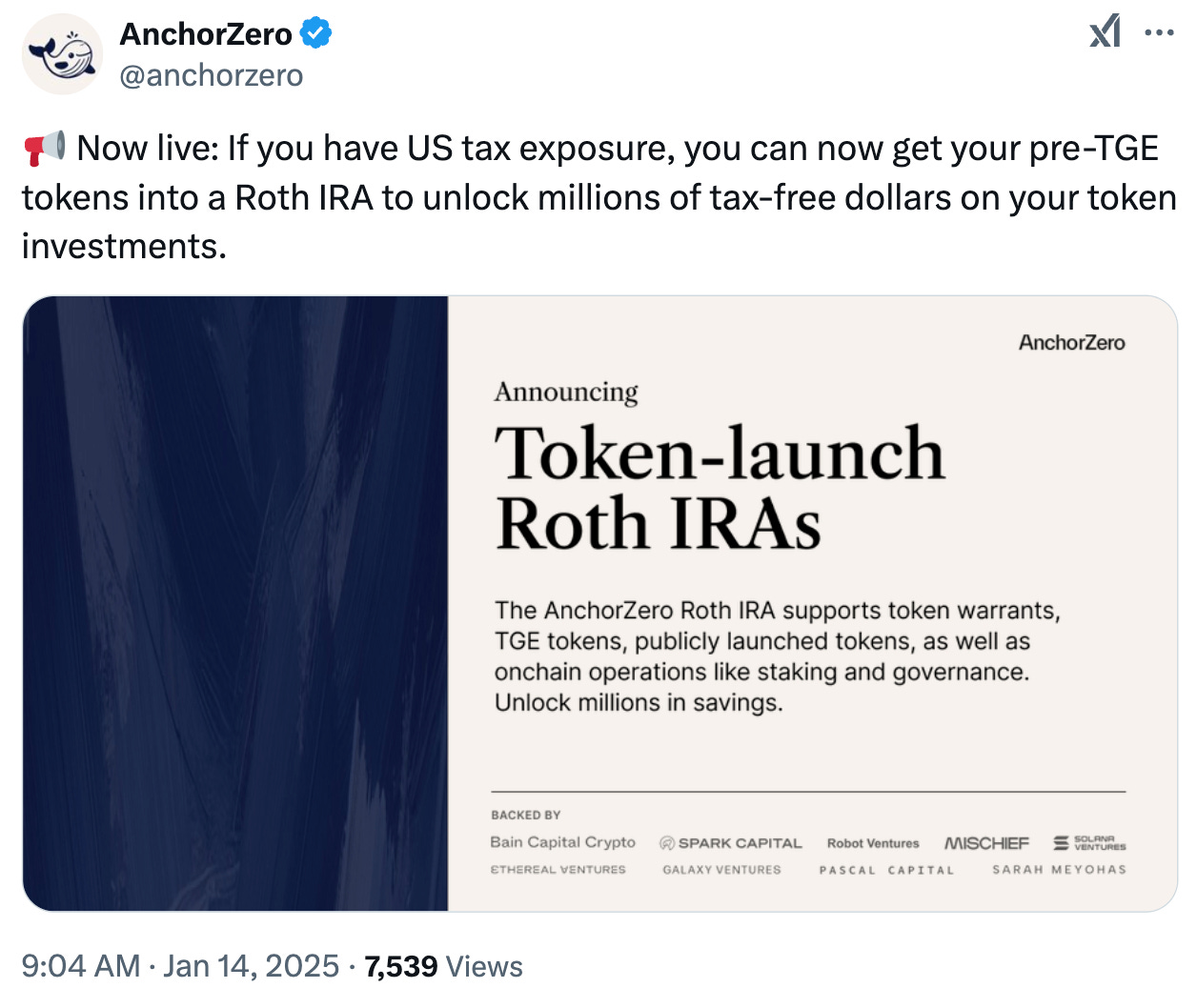

💬 Tweet of the Week

Source: @anchorzero

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

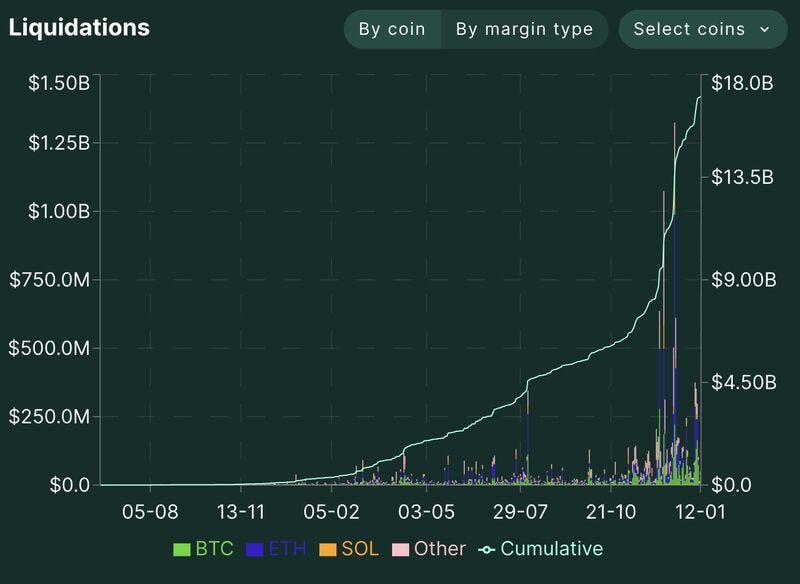

1. Liquidations on Hyperliquid are up by $8.85B (110%) since December and have now surpassed $17B in total. Meanwhile, the protocol has generated over $25M in fees during this time.

Source: @DavidShuttleworth

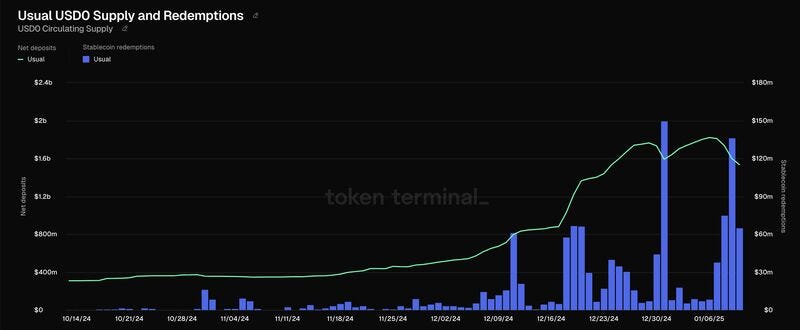

2. This week, stablecoin provider Usual officially announced the launch of a new protocol feature which enables users to unstake USD0 early and forfeit a portion of their accumulated USUAL rewards, effectively ending the 1:1 mechanism (USD0 : USD0++) which had been in place since launch.

The impact on USD0 has been quite pronounced. After growing by 275% since December to quickly become the 5th largest stablecoin in the space, total circulating supply has dropped by 16% in just a few days as nearly $300M has been redeemed.

In response, the protocol has also announced the early activation of the revenue switch. Starting January 13th, USUALx holders will begin to receive a portion of protocol revenue, which is currently projected at $5M per month.

Source: @DavidShuttleworth

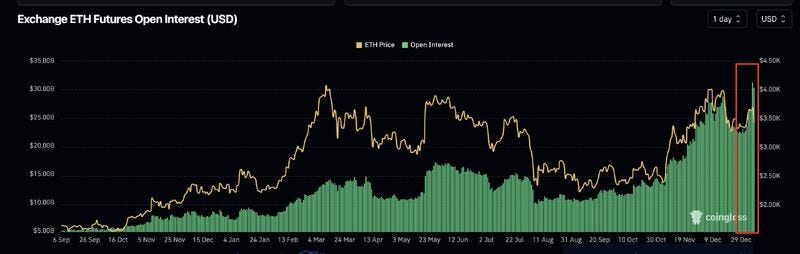

3. We enter the first week of 2025 with considerable volume and activity:

ETH futures open interest has grown by 40% ($8.8B) this week to reach $31.1B, its highest level ever.

SOL open interest experienced similar traction, growing by 50% to also reach a new all-time high ($6.4B).

Meanwhile, BTC open interest grew by 17% to $65B.

Source: @DavidShuttleworth

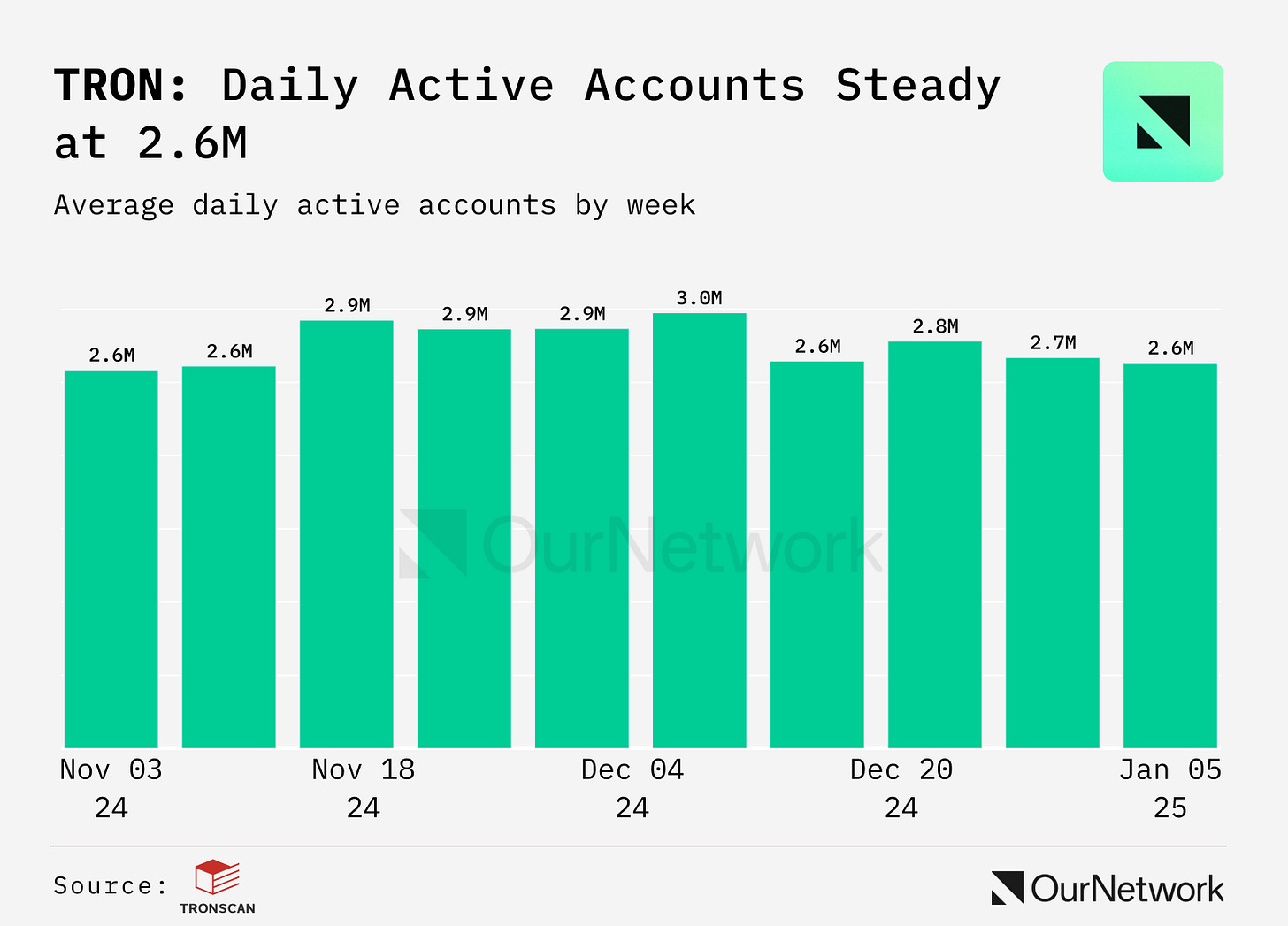

4. TRON: $23.4B+ Total Value Locked, 282M+ Users, $15.8T+ Total Transfer Volume

Source: @OurNetwork

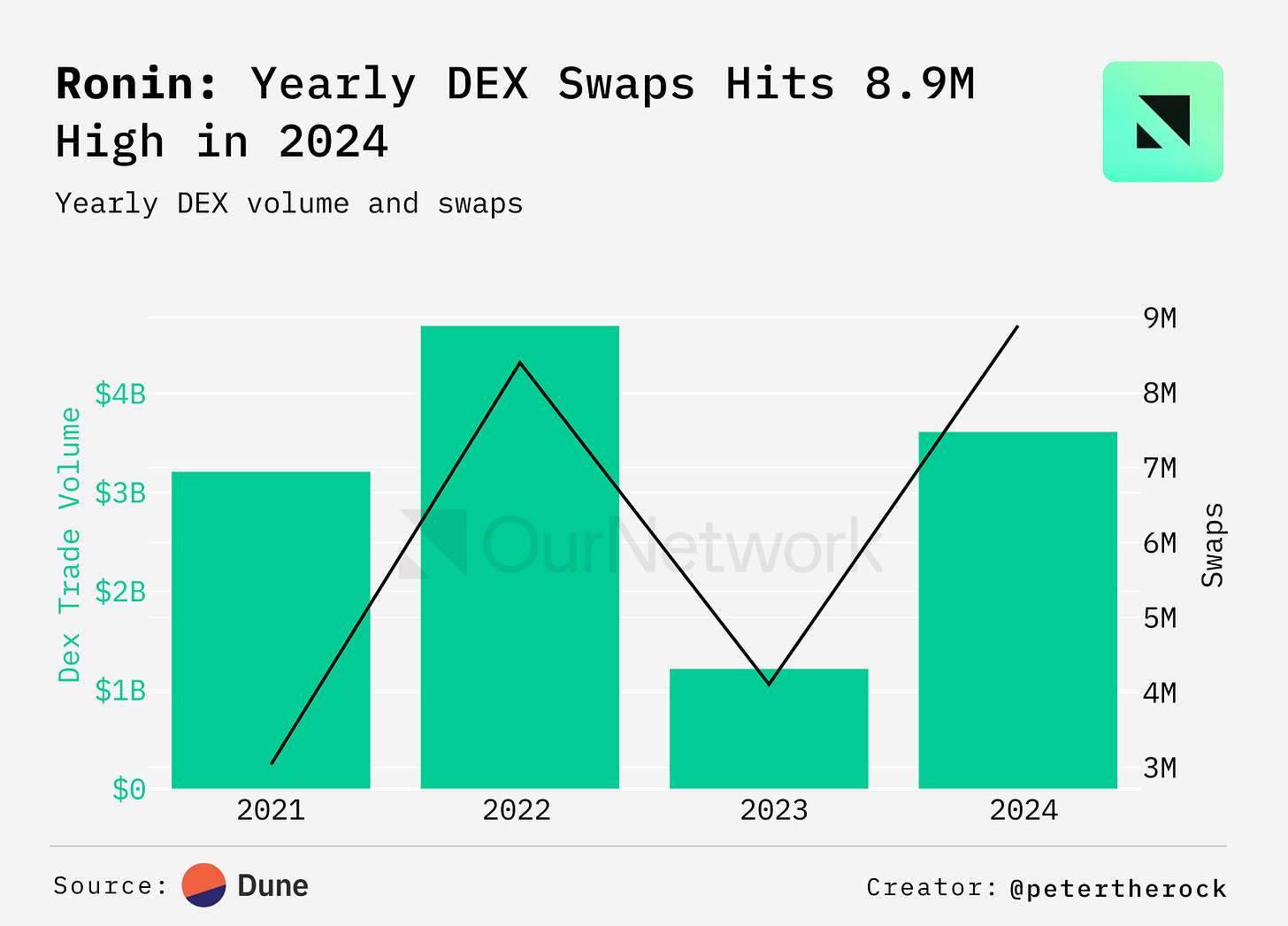

5. Ronin Closes the Year with a Yearly All-Time High of 17.5M Wallets, 616M Transactions and New Games

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is made possible by a community of contributors who actively participate at the forefront of this emerging data landscape. This is an excerpt from the full article, which you can find here.

Introduction

Decentralized Physical Infrastructure Networks or DePin for short, is the integration between blockchain and infrastructure networks. DePin currently exists in industries like energy, telecoms, storage, AI, and data collection.

During the last crypto cycle, many projects rode the DePin hype by identifying problems that had large market opportunities but turned to crypto tokenomics when the core product failed to gain traction, in either demand and supply.

However, to those that survived, many companies took the time to build out their infrastructure, to the point where many generate sustainable revenues by solving existing problems, even independent of tokenomic flywheels. Let’s go through some of them!

Geodnet (real-time kinematics)

Core Problem Being Solved

Traditional GPS systems often lack the precision required for advanced applications which demand centimeter-level accuracy rather than meter-level precision. Geodnet’s solution improves positioning accuracy by up to 100x compared to conventional GPS technologies.

Target Customers

Geodnet serves industries that depend on high-precision geospatial data, including:

- Autonomous Vehicles

- Agriculture

- Smart Cities

- Defense and Security

- Space Exploration

Revenue Model

- Data Licensing: Selling geospatial data to commercial clients.

- Node Participation Fees: Fees associated with miner installations and usage.

- Partnerships: Collaborating with industries such as agriculture and autonomous systems to integrate Geodnet services into existing workflows.

In 2024, Geodnet reported revenue growth of over 500% YoY, reaching $1.7M with a run-rate exceeding $2.2M by the end of the year

Tokenomics

Geodnet uses its native GEOD token to incentivize participants:

- Miners earn tokens based on data contribution and network uptime.

- Burn Mechanism: Tokens are burned during data transactions, adding deflationary pressure.

- Daily Earnings: Average daily earnings per miner are approximately $4.30, with an estimated payback period of 3-4 months.

- Circulation: Tokens are distributed to ensure liquidity while incentivizing early adopters.

- Token Utility: Used for payments, staking, and governance within the network.

Participation and Contribution

1. Becoming a Miner:

- Purchase a miner device (cost ranges from $500–$700).

- Set up and connect the miner to the network, uploading 20-40GB of data per month.

2. Using the Network:

- Access RTK correction data through subscriptions or direct purchases.

3. Developing Applications:

- Build software leveraging Geodnet’s data for specific industries.

4. Governance:

- Participate in protocol governance by staking GEOD tokens and voting on proposals.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com