Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, spot bitcoin ETFs saw highest single-day inflow since July, Kraken’s motion to dismiss, Telegram responds to Founder and CEO’s arrest, and big new venture rounds for PIP Labs ($80M) and Space and Time Labsy ($20M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

📈 Spot bitcoin ETFs see highest single-day inflow since July, continuing seven-day streak opposite to ether: The combined value of the spot bitcoin exchange-traded funds based in the U.S. has reached its highest value so far in the month of August—about $58.4 billion—after a seven-day streak of positive inflows continued on Friday.

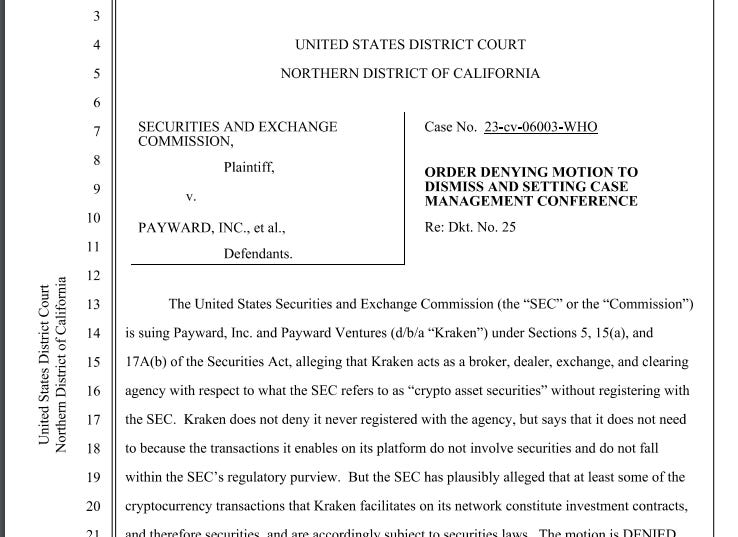

⚖️ Crypto exchange Kraken’s motion to dismiss US SEC case denied:U.S. crypto exchange Kraken has failed to dismiss the case against it brought by the Securities and Exchange Commission.

📈 Bitcoin sees $543 million in inflows after Powell’s dovish remarks: According to CoinShares’ latest weekly fund flow report, crypto investment products saw their largest inflows in five weeks, with $533 million pouring into the sector.

⚖️ Telegram Responds to Founder and CEO Pavel Durov's Arrest in France: Telegram has hit back against the stunning arrest of its CEO and founder, Pavel Durov, claiming he has "nothing to hide" in a statement posted to the messaging platform's official news channel.

🚀 Vitalik Buterin Touts Ethereum’s Strength, Sets AI Event:Ethereum co-founder Vitalik Buterin on Thursday highlighted the blockchain network's robust fundamentals, calling them “crazy strong” before expounding on artificial intelligence.

💬 Tweet of the Week

Source: @CryptoCon_

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Since the arrest of Telegram founder Pavel Durov over the weekend, TON futures open interest has surged 60% to all-time highs of $364M while token price has decreased by 18%.

Source: @DavidShuttleworth

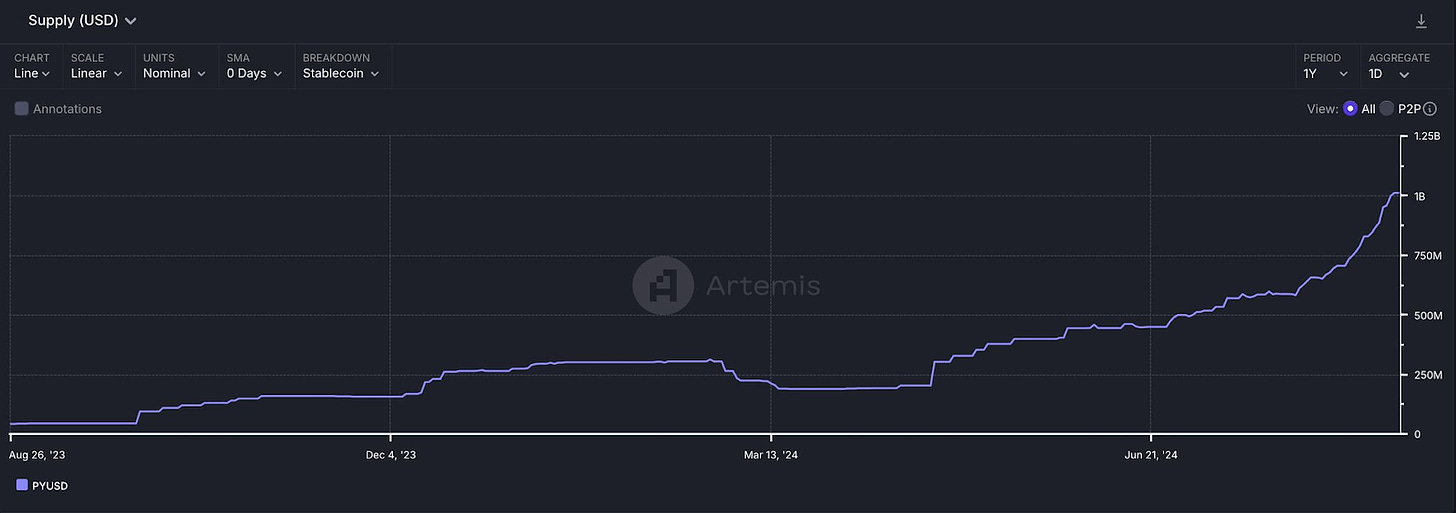

2. Total circulating supply of PayPal's PYUSD just surpassed $1B for the first time, growing by more than 155% since integrating with Solana in May. Solana now represents 64% of all circulating supply, while the remaining 36% is on Ethereum.

Since this integration, PYUSD has grown from the 13th largest to now the 5th largest stablecoin in terms of circulating supply.

Source: @DavidShuttleworth

3. Daily active addresses on Coinbase Base have just surpassed 1M for the first time ever and now stand at 1.1M, with more than 4.3M transactions occurring on the network today.

Moreover, daily stablecoin transfer volume also reached a new high of $4.1B recently, up 156% week-over-week.

Source: @DavidShuttleworth

4. Sui test shows max of 297,000 transactions per second, averages nearly 470k+ daily active addresses during three month span

Source: @OurNetwork

5. Sui DeFi continues to soar, surpassing $785M, TVL, $260M net value bridged

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Cole DeRousse serves as a Research Assistant at 1995 Digital Asset Research, where he blends technical research with social investing strategies. His primary focus is on fostering the growth of the Web3 community and ecosystem, aiming to awaken people to the transformative power of Web3 apps and technologies. This is an excerpt from the full article, which you can find here.

Introduction

Our previous report outlined how the current market is following the 2014-2018 cycle the closest. The chart below illustrates this to a tee, we can see that we are following a very similar cycle and if this theory were to play out we should get confirmation in the next week or so. The chart below overlays the 2014-2018 cycle with our current cycle, and you can see we are quickly approaching an inflection point. If we continue to mimic the 2017 cycle, we could see confirmation of alt season as soon as this week and by September 3rd at the latest.

Take another look at the chart above, and zoom in specifically on the October 11th, 2023 dotted line. You will notice that altcoins broke out a mere few days after and using this fractal has been one of the most lucrative insights for me personally in this cycle so far from a timing perspective. This fractal personally helped me nail the bottom back in early Oct 2023 when I bought $Fet for .22 and $Inj for $7. If history rhymes then we may be able to use this same fractal to forecast when altcoins could start another parabolic rise.

Now, let’s shift our attention to the chart below that is zoomed in on Bitcoin’s current price action in relation to 2017 right before we got that parabolic rise that sent the whole market soaring. This is the inflection point that we are referencing, you can see that we even had confluence with this fractal on the most recent 33% drawdown that happened earlier this month (Aug 5th). Yet again another data point to validate the idea that we are indeed following the 2014-2018 cycle the closest. So will it continue? It has been for over 1220 days, but what historical indicators could we look for that may give us an even higher degree of conviction that we are indeed on the precipice of ‘risk on’ and therefore alt season as soon as this week..

Could the answer lie within the Dino coins, coins like XRP (Ripple), ADA (Cardano)?

Will these coins start to wake up and show the markets hand? Historically this has been the case, especially in the lead-up to the 2017 altcoin rally.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com