Learn More at www.hypelab.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 270k weekly subscribers. This week, Stripe acquired Bridge, Vitalik shared details for ‘The Surge’, Buenos Aires launched ZK proofs for privacy and big new venture rounds came in for Yellow Card ($85M) and zkPass ($22M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 270,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

💰Stripe's Acquisition of Bridge Validates the Usage of Stablecoins: Stablecoins have emerged as the main use case for blockchains, especially for cross-border payments, the report said.

🛠️Vitalik Buterin Lays Out Grand Vision for Ethereum Layer-2s With ‘The Surge’ Roadmap: Ethereum co-founder Vitalik Buterin has shared detailed plans for the next step in the network’s evolution, known as “The Surge.”

🚀Buenos Aires launches blockchain-based ID for 3.6M residents, adds ZK proofs for privacy: The Buenos Aires government has incorporated zero-knowledge proofs into its app for accessing city services.

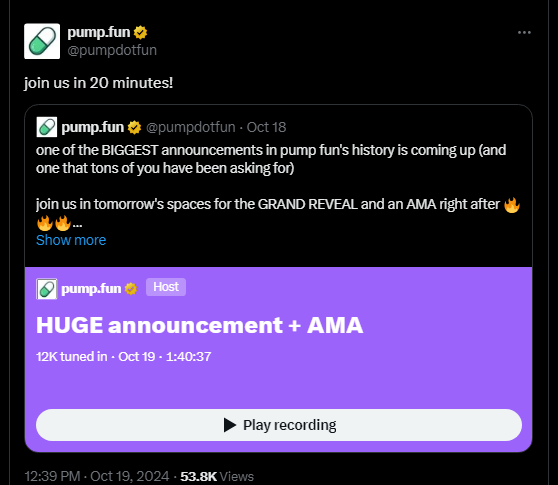

🔥Pump.fun launches ‘Advanced’ terminal to rival Photon, confirms token launch: Solana-based memecoin launch platform Pump.fun teased a new token and potential airdrop following its most successful week to date.

⚖️CFTC chair says agency is ‘handcuffed’ as crypto regulations stall:Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam reportedly said the agency was “handcuffed” as crypto regulation talks have reached a standstill in the United States.

💬 Tweet of the Week

Source: @0xMert_

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

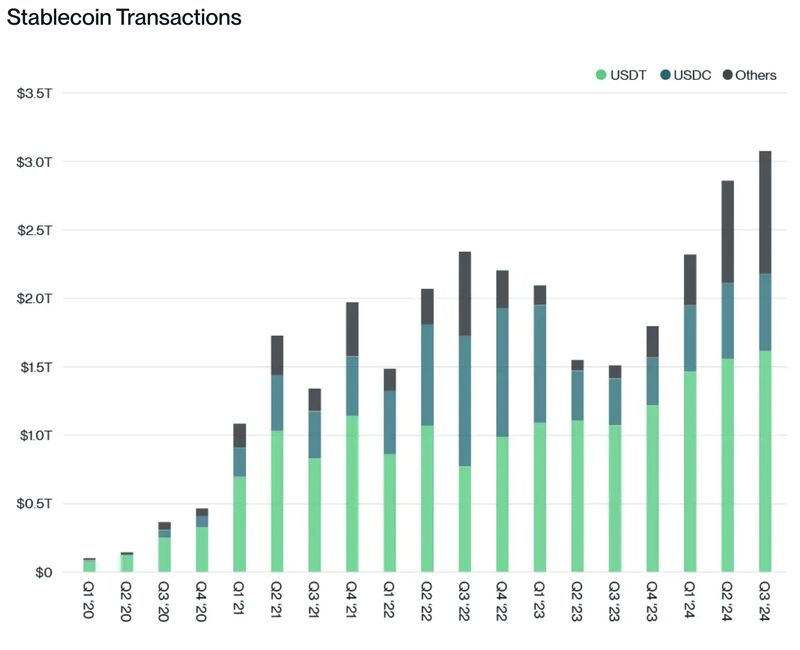

1. Stablecoins continue to operate as one of the the most powerful applications in the entire blockchain space. The current market cap for U.S. dollar-backed products has grown to $177B, but perhaps just as importantly, usage and adoption have grown with it. Tether.io's USDT, Circle's USDC, and others like DAI and FDUSD have now combined to settle more than $3.1 trillion of global transactions in Q3 alone. To put this into better perspective, Visa settled about $6.5T of transaction volume in the first half of 2024.

Source: @DavidShuttleworth

2. Coinbase Base: Daily active addresses have surged to new all-time levels of 2.4M (up 50% on the month)

Daily transactions followed suit and now stand at 6.3M (up 22% on the month)

TVL has surpassed $2.5B for the first time ever (up 44% on the month)

Daily stablecoin transfer volume recently reached $17.6B, while weekly volume is now over $99B - both new record levels of activity

Source: @DavidShuttleworth

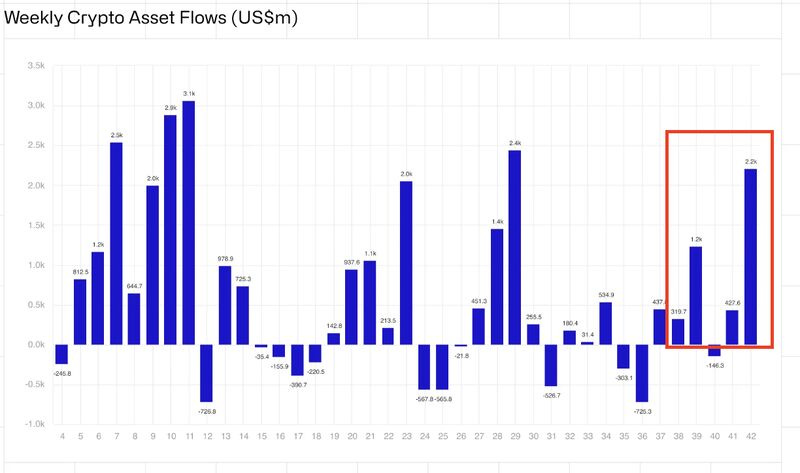

3. We head into the week coming off of more than $2.2B of digital asset inflows, the most since July ($2.4B), and with trading volumes increasing by 30%. This marks the 4th week (out of 5) that we've seen net inflows since the Fed cut rates in September.

Yet despite market conditions improving, BTC continues to lead the way ($2.13B) while BTC was second with just $58M of inflows. As on-chain activity continues to ramp up, however, this could begin to shift significantly.

Source: @DavidShuttleworth

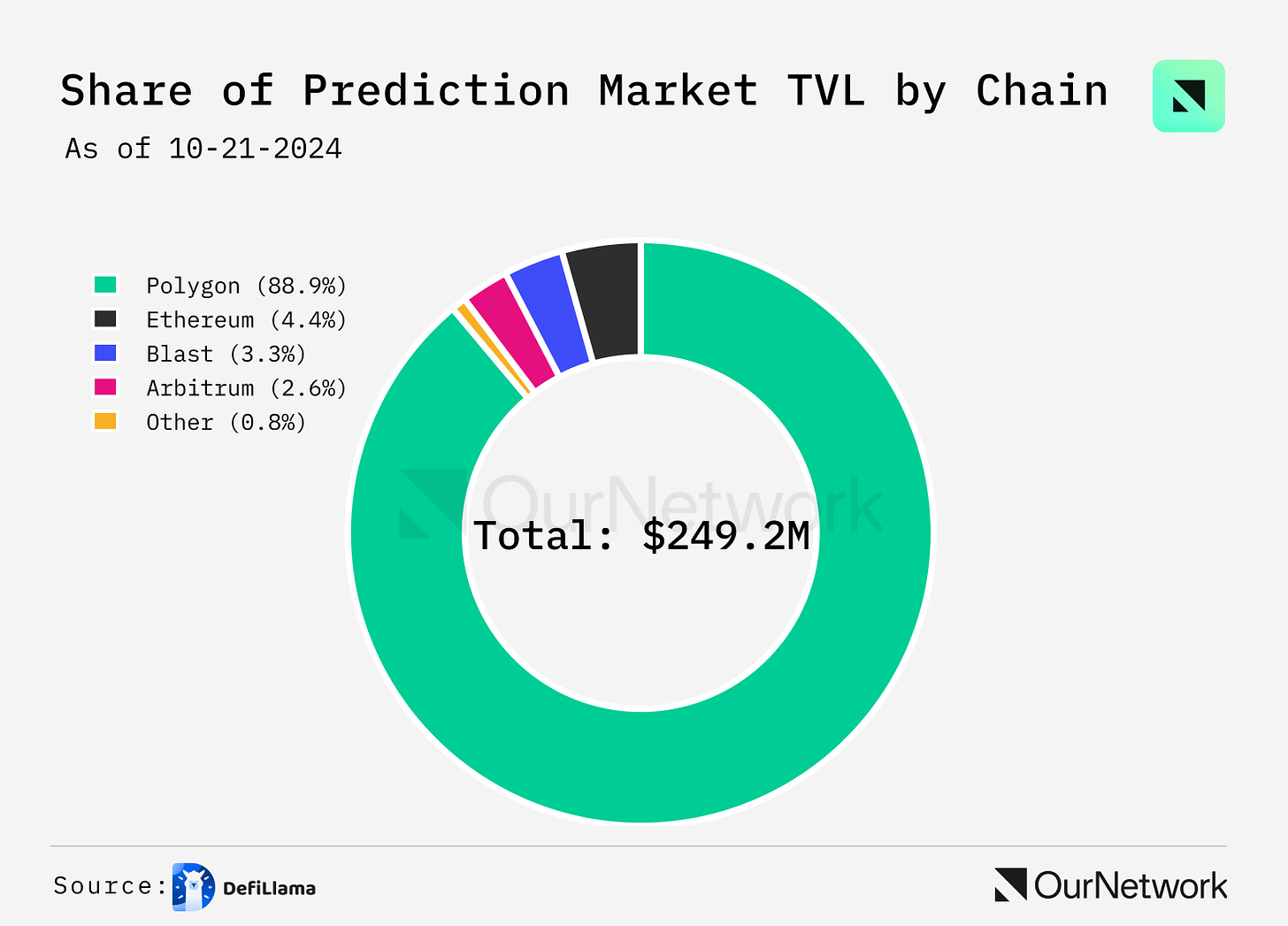

4. Polymarket Surpasses $1.3B in Monthly Betting Volume in October 2024 and reaches $221M in Total Value Locked

Source: @OurNetwork

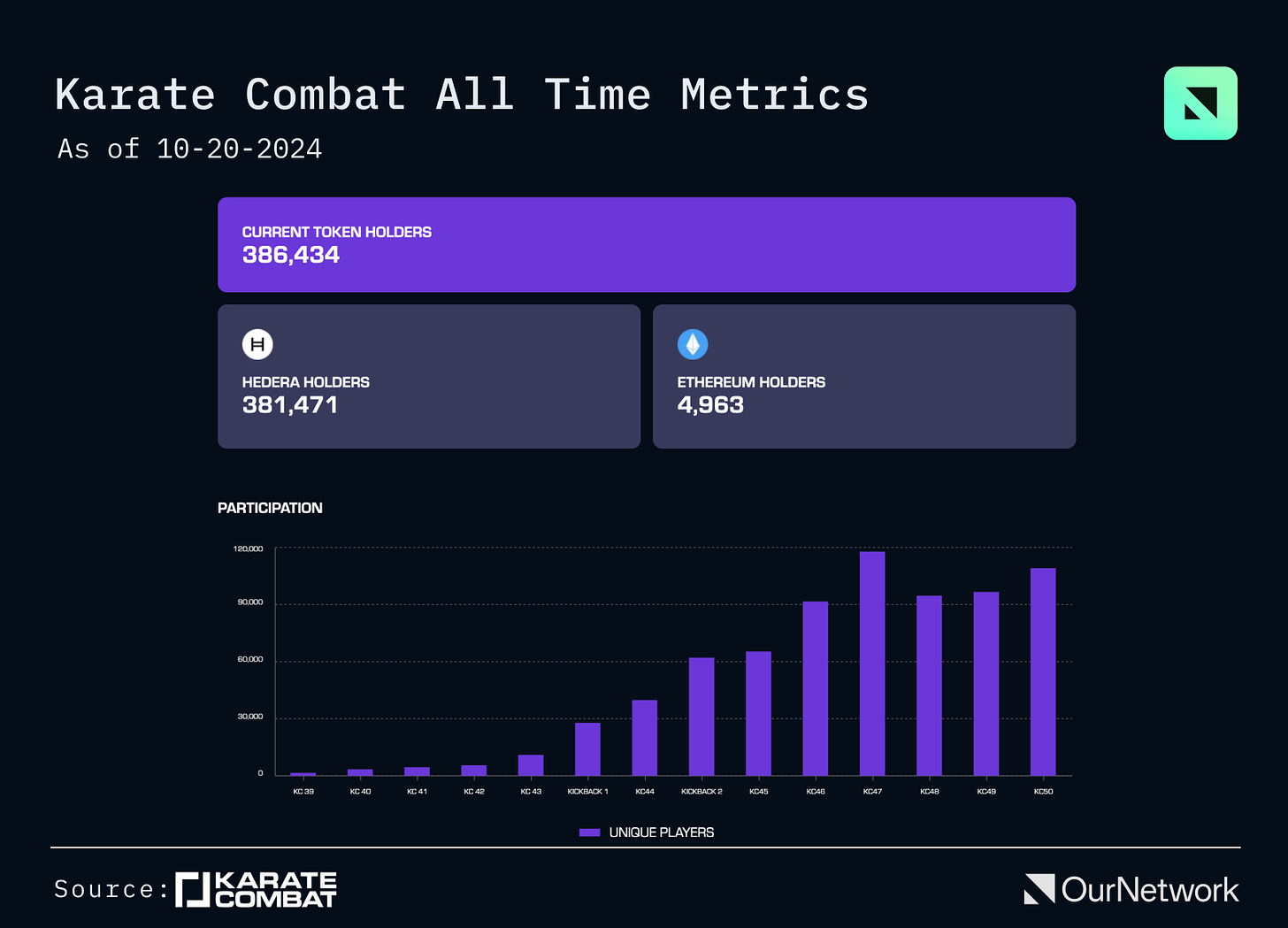

5. Karate Combat’s Fan-Driven Striking League Surges in Engagement with over 386K Token Holders and 109K participants at its Recent KC50 event; new UP Layer 2 Blockchain to Expand Up Only Gaming

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Pantera Capital is one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

CRYPTO: PICKS AND SHOVELS FOR THE AI GOLD RUSH

By Matt Stephenson, Research Partner and Ally Zach, Research Engineer

“AI is indefinite abundance and crypto is definite scarcity.” This observation by Sam Altman in 2021 has since become a mantra for enthusiasts of both technologies. And at first glance, abundance seems more impactful than enforcing scarcity, suggesting AI might be the more prudent investment. Indeed, Nvidia’s market capitalization is larger than crypto as a whole.

But Altman’s statement calls to mind Adam Smith’s “Diamond Water Paradox.” Smith noted that while water is essential for survival, its abundance makes it nearly worthless in exchange.

Conversely, diamonds, with little practical use, command high value due to their scarcity. This paradox suggests that even if AI becomes as vital as water, it might still have limited market value. Crypto’s scarcity, by contrast, is more strategically important and valuable than it might initially appear.

Large Language Models (LLMs) have achieved remarkable milestones, including passing the Turing test and reportedly outperforming humans on standard IQ tests. But this raises the question: if humans can’t tell the difference between humans and intelligent AIs (in the Turing test), can they tell the difference between intelligent AIs? If humans can’t discern, then future gains in AI performance can have diminishing returns in terms of perceptible benefits for a consumer.

Just as the leap from 4K to 8K TV resolution offers minimal visible improvement to the average viewer, the difference between a highly capable AI model and a slightly more advanced one may be imperceptible to most users. This could lead to commodification of much of the AI market, with the most advanced models reserved for specialized applications in research, industry, or government, while more cost-effective, “good enough” models become the standard for everyday use. Cutting-edge AI models might become “pricey, boutique items that mainstream consumers would never consider upgrading to.”

So even if we speculate on potential AI growth, we should also consider the alternative: the known, powerful, capabilities of current AI are here and will become increasingly commoditized. And here is where the intersection of crypto and AI (“Crypto x AI”) really comes into focus. Crypto has the potential to act less as a high beta bet on AI’s memetic value but as a pragmatic value capture mechanism for AI’s distributed future. Once everyone has a 4k TV in their house, the value lies in what we do with them.

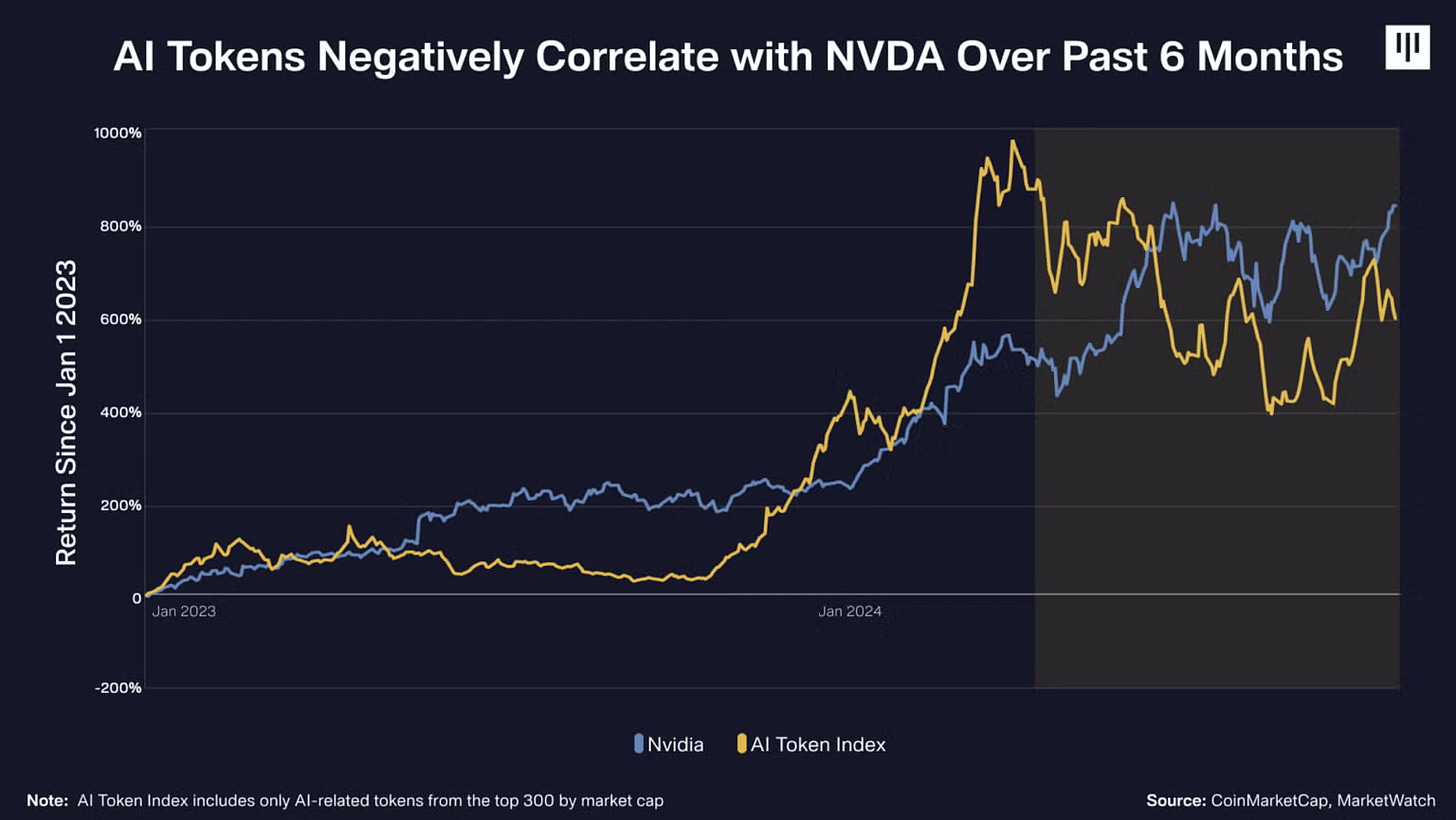

By acting as an essential and reliable input to AI and rails on which distributed AI coordinates and transacts, crypto is closer to the conservative “picks and shovels” bet on AI.[2] This may be surprising to investors who view Crypto x AI mostly as a volatile proxy for AI’s potential growth. But it’s intriguing that for the past six months, treating NVDA as a proxy for AI growth sentiment, crypto looks more like a hedge against AI growth sentiment than a high-beta play.

We will consider how by first evaluating the promising future of “AI agents” and how crypto is poised to play a role there. Then we will discuss crypto’s potential to support current inputs to AI: data, compute, and models.

CRYPTO: PICKS AND SHOVELS FOR THE AI GOLD RUSH

By Matt Stephenson, Research Partner and Ally Zach, Research Engineer

Last year, before most anyone was talking about AI agents on blockchains, I co-authored a paper on it that was accepted at the top U.S. AI conference, NeurIPS. Since then, I’ve had the honor of speaking and participating in events on crypto and agentic AI at universities including Stanford, Columbia, Cornell, and Berkeley in addition to numerous technical and investment conferences. Next week, I’ll give a talk with Oxford Professors, IEEE chairs, and members of GBBC on AI, all with the aim of better understanding, exploring, and communicating what an agentic AI future is and how it intersects with blockchains. And, of course, investing in that future, including investments in agent infrastructure such as Sentient and other undisclosed positions.

And the future is here. While OpenAI indicated that AI agents would not be ready until 2025, in crypto we have AI agents now transacting on and exploring the blockchain space. One AI agent that has promoted its own token currently has around $300,000 and it’s possible that, by the time you read this, it will have become the first AI agent millionaire.

But what are these agents, and how are they different than the more familiar “bots”?

Agents Are More Than Bots

Defining an “agent” is more subtle than it seems. The field of artificial intelligence uses this less-than-helpful definition of agents: “anything that perceives its environment through sensors and acts upon that environment through actuators.” An economist’s view of an agent is closer to what we’d want: “an agent is one who acts on your behalf in some particular domain of decisions.”

If an agent acts on your behalf, a bot is essentially an agent that is hard to communicate with. For one, you have to write code for bots to execute, which means communicating in a (programming) language most people don’t know. And for those who know the language, they still have to program what the bot should do under various different conditions, which means specifying those conditions ahead of time. Both of these are communication costs.

To take an analogy, imagine you had a friend who’s headed abroad and you ask them to pick you up a souvenir. If your friend is like a bot, then he asks you to write a program specifying exactly what souvenir they should get you. What if your friend is like an agent? Then you could use words to make the ask, and you could trust your friend to get you something you’d like. Using words and not needing to specify your preferences among possible gifts in a foreign country is a reduction in communication costs. Clearly, this is a much better agent.

Having to know conditions in advance (since you have to program them in) limits the usefulness of a bot as an agent. And then the mere fact of having to program a bot at all means it is out of reach for those who don’t code. We model the shift to AI agents as being a reduction in these communication costs and a corresponding unlock in economic value.

Despite the high communication costs of existing bots, more than two trillion dollars of monthly stablecoin activity in crypto appears to be bot activity. As bots become better agents, able perhaps to trade in and out of USDC and USDT depending on relative risk as you would, we should expect this number to increase.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com