Social Links: Twitter | Telegram | Newsletter

Learn More at www.rootstock.io and www.kuladao.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 320k weekly subscribers. This week, Tether passes the $1B in quarterly profit mark, a Clanker employee was outed as Velodrome thief, Vitalik wants to make Ethereum ‘as simple as Bitcoin’, the Arizona governor vetoes bitcoin reserve bill, and big new investment rounds come from dao5 ($222M) and Dinari ($12.7M).

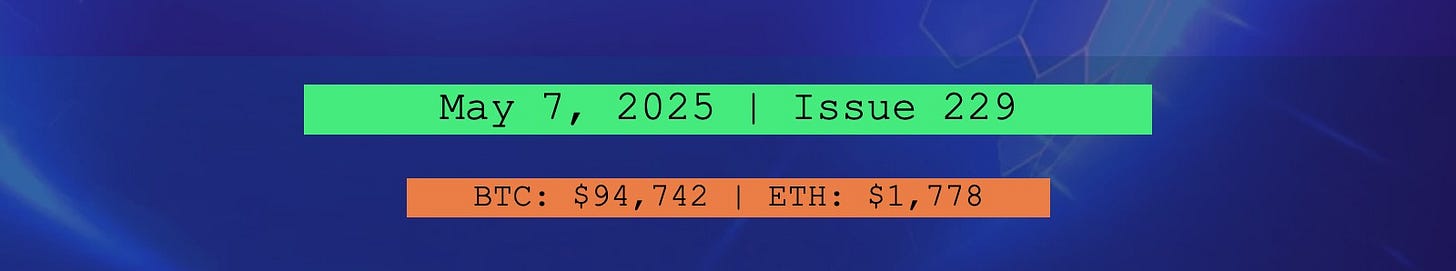

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 320,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

Tether Reports Over $1B in Q1 2025 Profit: Tether notched a profit in excess of $1 billion in Q1 2025 including $149B in assets and over $5.6B in excess reserves.

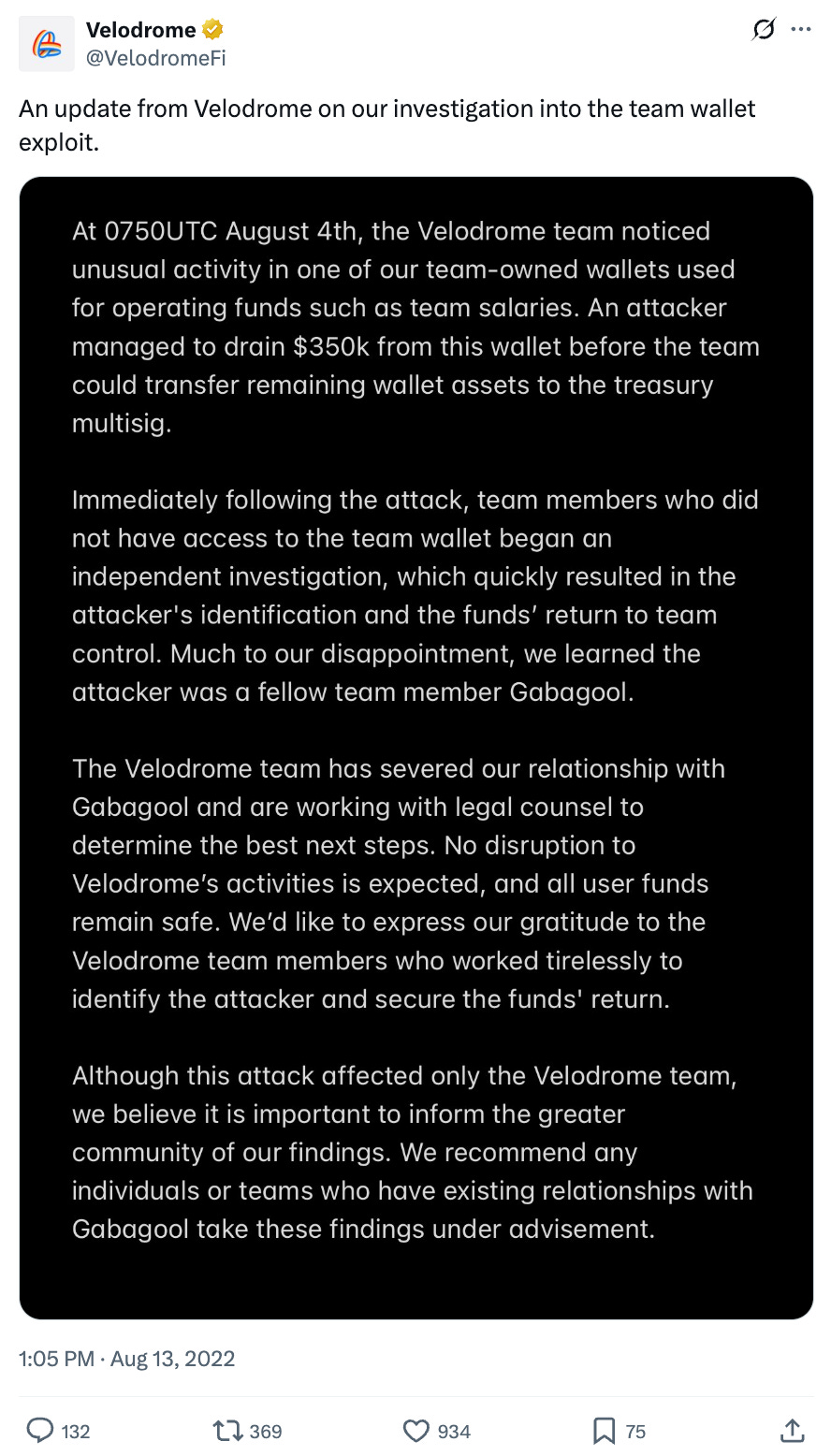

⚖️ Clanker Employee Outed as Velodrome Thief: Clanker, an AI agent launchpad on Coinbase’s Ethereum Layer 2, Base, has announced the departure of developer Proxystudio, who has been identified as a previous member of the Velodrome Finance team responsible for a $350,000 theft.

🧑💻 Vitalik Buterin wants to make Ethereum ‘as simple as Bitcoin’ by 2030: Ethereum co-founder Vitalik Buterin believes that the blockchain’s long-term resilience and scalability hinge on making it simple, like Bitcoin. In a blog post on May 3, he described how “Ethereum 5 years from now can become close to as simple as Bitcoin.”

⚖️ Arizona governor vetoes bitcoin reserve bill, calling crypto 'untested investment': Arizona Governor Katie Hobbs has blocked a bill passed recently by the state's legislature that would have allowed the state's treasurer and retirement systems to invest up to 10% of their funds in virtual currencies such as bitcoin.

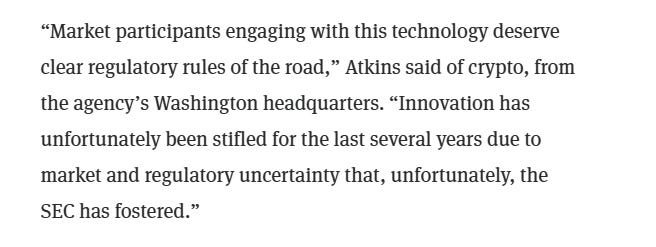

🚀 Kraken powers new crypto trading venture for Europe's second-largest neobank bunq: Bunq, the second-largest neobank in Europe after Revolut, is venturing into crypto trading, enabling users to invest in digital assets directly from the banking app — powered by crypto exchange giant Kraken.

⚖️ Nasdaq files to list 21Shares Dogecoin ETF, signaling mainstream crypto acceptance: Nasdaq has filed a 19b-4 form with the US Securities and Exchange Commission (SEC) to support the listing of a new 21Shares Spot Dogecoin (DOGE) Exchange-Traded Fund (ETF), according to an April 29 filing.The proposed fund would offer investors passive exposure to Dogecoin’s price without engaging in speculative trading activities like leverage, derivatives, or other financial arrangements.

💬 Tweet of the Week

Source: @tokenterminal

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

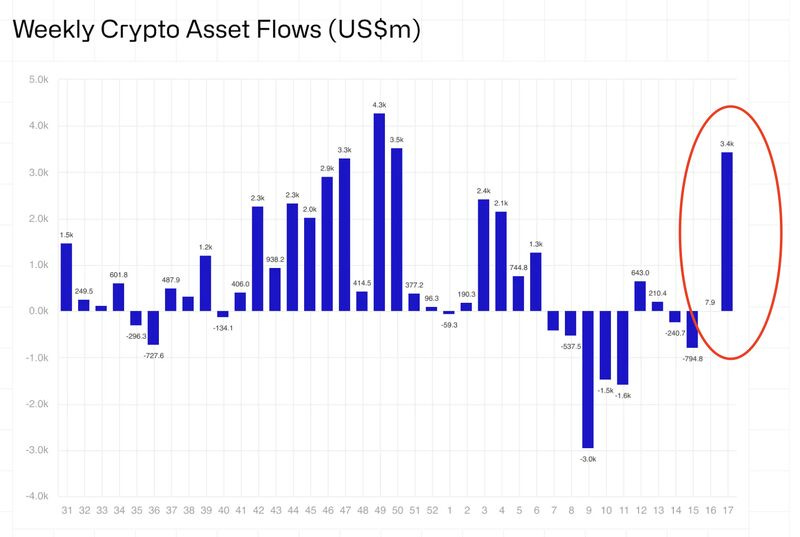

1. We enter the week coming off of more than $3.4B of inflows into digital asset investment products, the highest of 2025 and the 3rd largest ever.

Once again BTC dominated with $3.2B of inflows, while ETH had just $183M, pushing its YTD total to $398M. This is particularly interesting because the Pectra upgrade will go live this week, unlocking significantly better UX and network performance. My sense is that the market is not fully aware of the impact of these upgrades, rather than viewing it as a sell the news event.

Source: @DavidShuttleworth

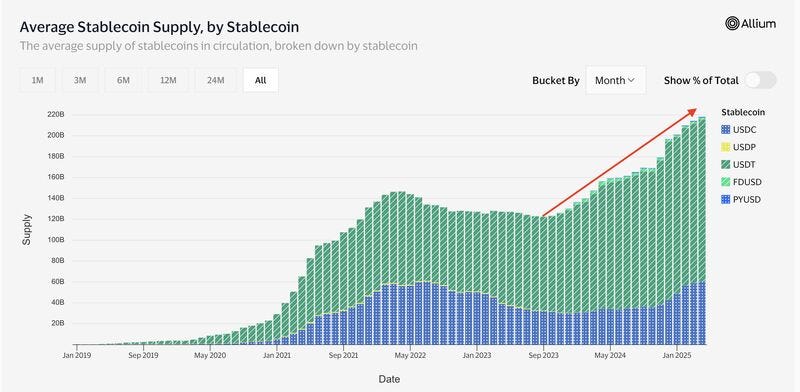

2. Fiat-backed stablecoins hit new records once again in April. Average supply reached $218B, growing by 2% month-over-month and 8% YTD. Meanwhile, monthly transaction volume surpassed $720B, also a new record.

Total supply has now grown in 19 consecutive months.

Source: @DavidShuttleworth

Source: @DavidShuttleworth

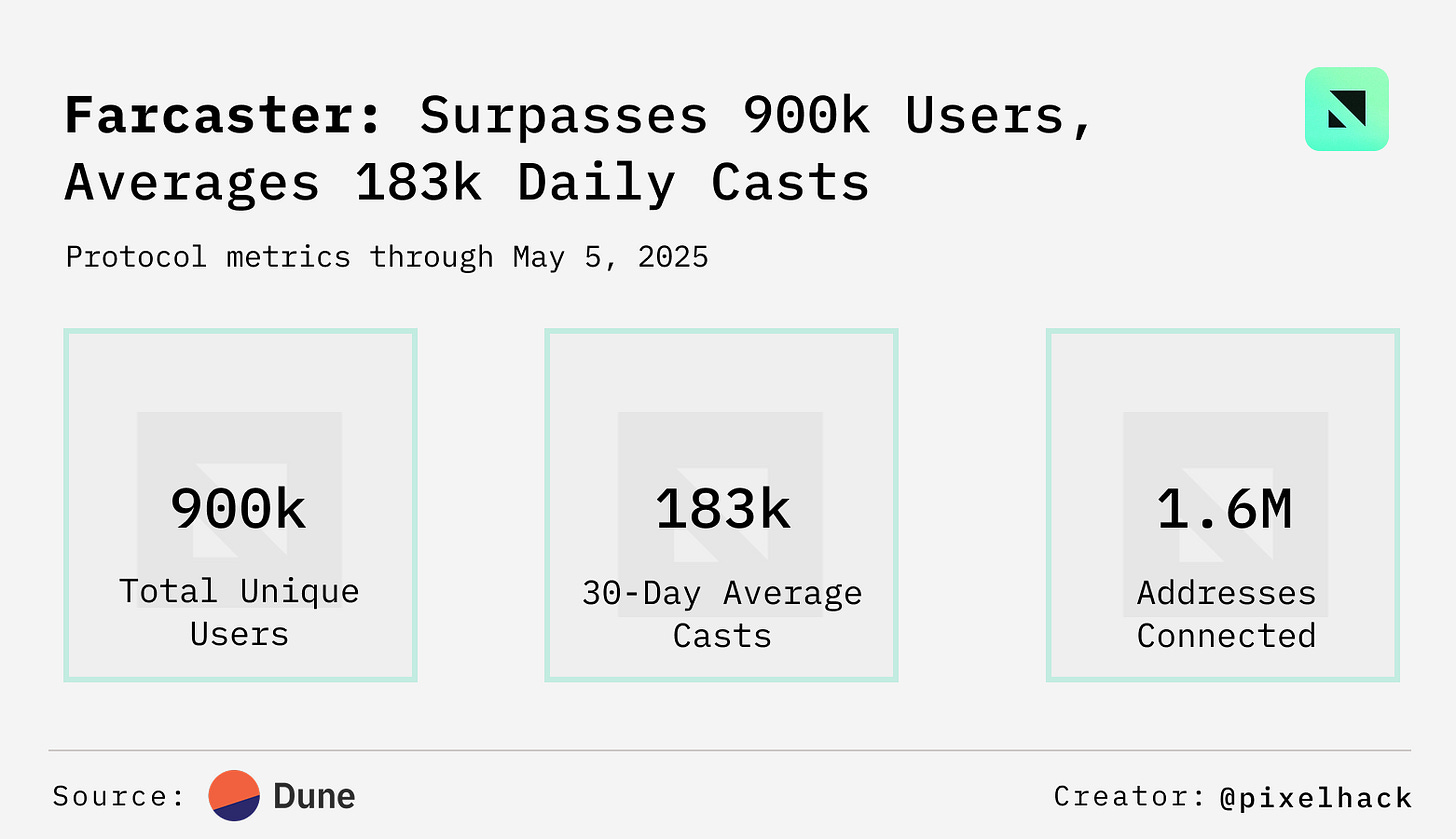

Source: @OurNetwork

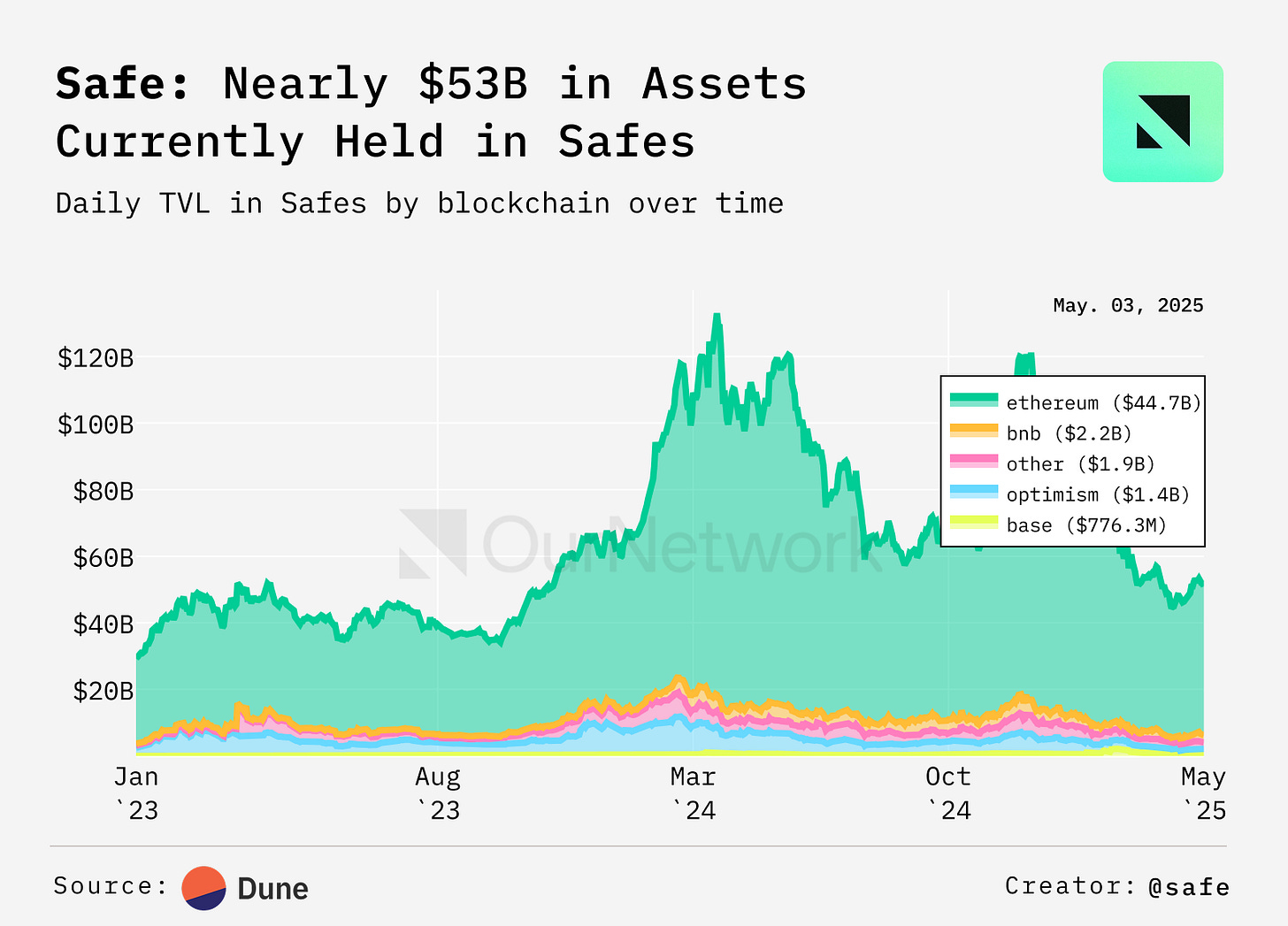

5. Safes are the most widely adopted smart accounts across Ethereum and Ethereum Virtual Machine (EVM) chains — they securing nearly $53B in assets and powering consumer apps like Brahma and Worldchain. In April 2025 alone, Safes accounted for 73% of all smart account transactions and captured 54% of total market share. Since 2024, they've processed over $630B in transaction volume — including $31B in April and $300B in stablecoin transfers alone.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest edition covering onchain culture.

In these issues we explore the less financial, more intangible sides of the crypto space. These applications are especially important as projects battle to make crypto relevant to everyday users, rather than those in the proverbial trenches.

This issue specifically features contributions covering two major players in the onchain social space, as well as consumer applications and key infrastructure.

Let’s get into it.

– ON Editorial Team

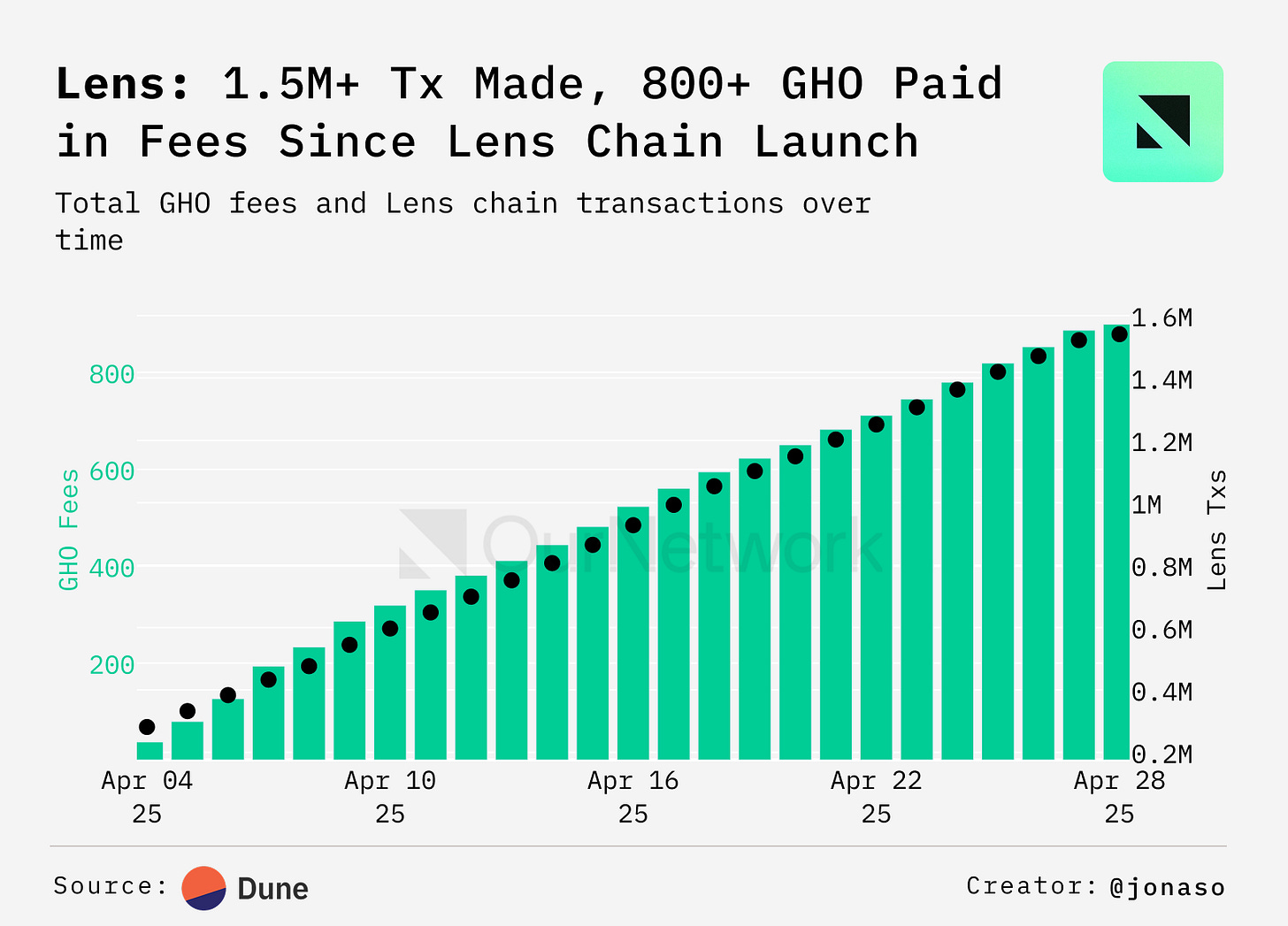

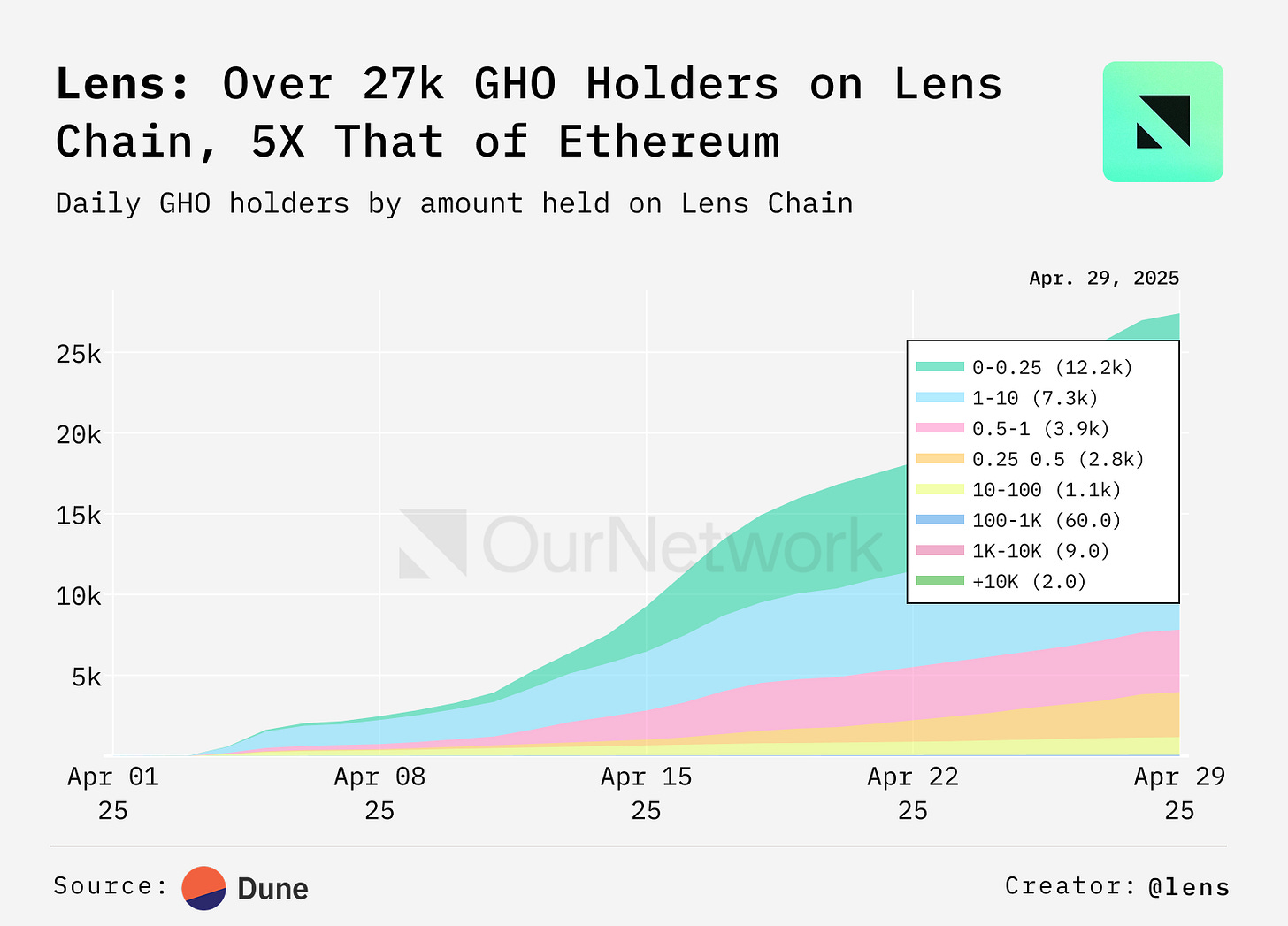

📈 Lens Chain and Lens V3 Launched Less than Four Weeks Ago as New Trends for SocialFi Emerge

Lens is a purpose-built platform for social finance (SocialFi), including chain, protocol and storage. Since its Apr. 4 launch, users have bridged more than 1M GHO, the decentralized stablecoin, to Lens Chain. Lens protocol, a set of primitives designed for social applications, has been live since 2022. GHO, backed by deposits in Aave, is the gas token on Lens Chain — users can also use GHO to collect and tip on Lens.

GHO adoption on Lens Chain has surpassed adoption on Ethereum's mainnet by more than a multiple of six. Total GHO holders on Ethereum mainnet are 4.3k at time of writing, while on Lens Chain there's 27k holders. This strengthens the case for stablecoins' use as gas tokens, a trend which would further GHO's adoption.

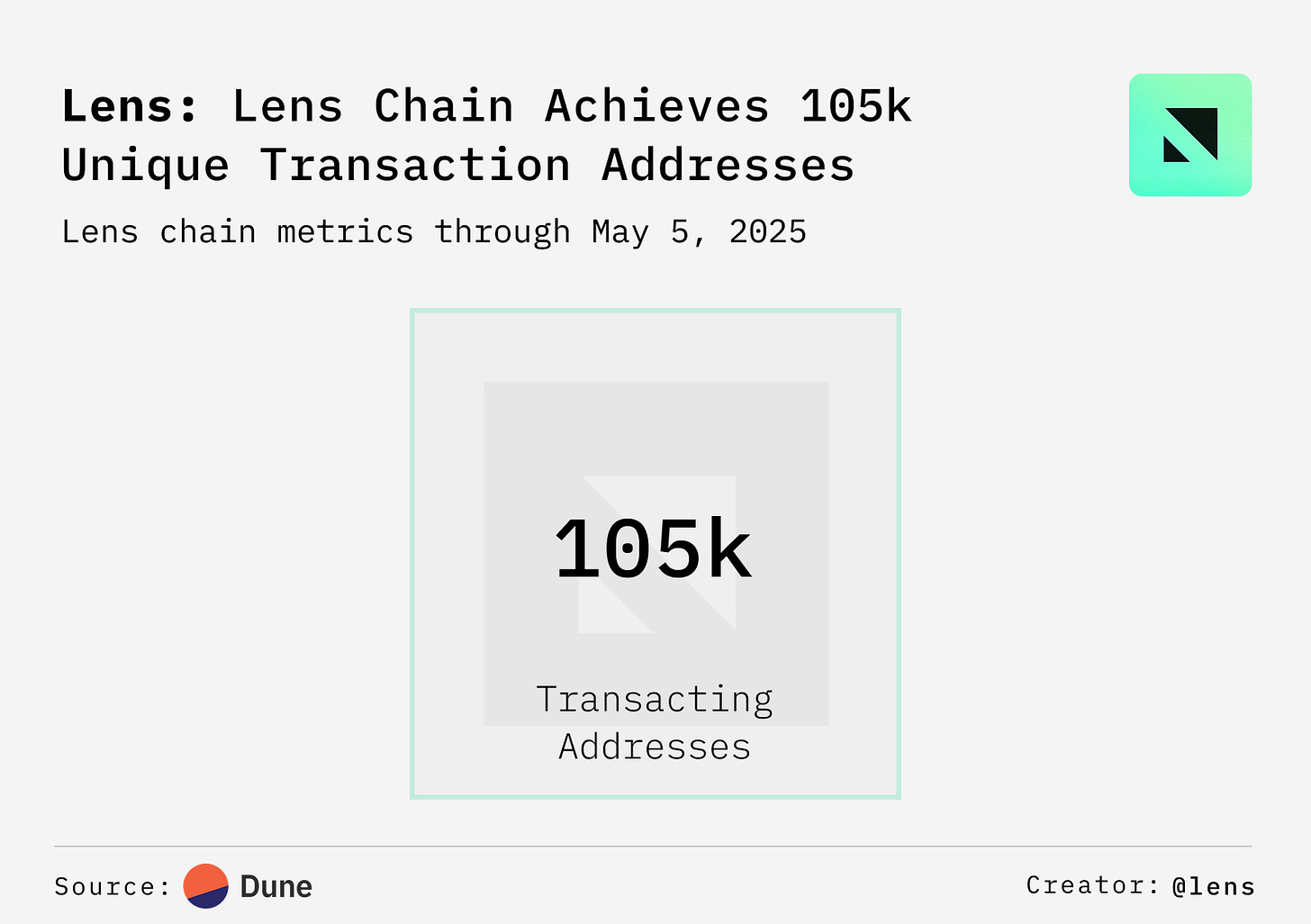

There have been more than than 100k transacting addresses on Lens Chain's first weeks.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.kuladao.io and www.crowdcreate.us