Learn More at www.rootstock.io and www.crowdcreate.us and invest.modemobile.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 315k weekly subscribers. This week, Canary Capital filed with the SEC for the first SUI ETF, acting SEC chair Uyeda directed staff to reexamine proposed crypto custody rule, Strategy issued 5 million-share ‘perpetual strife’ preferred stock offering and big venture news for Binance ($2B) and RedotPay ($40M).

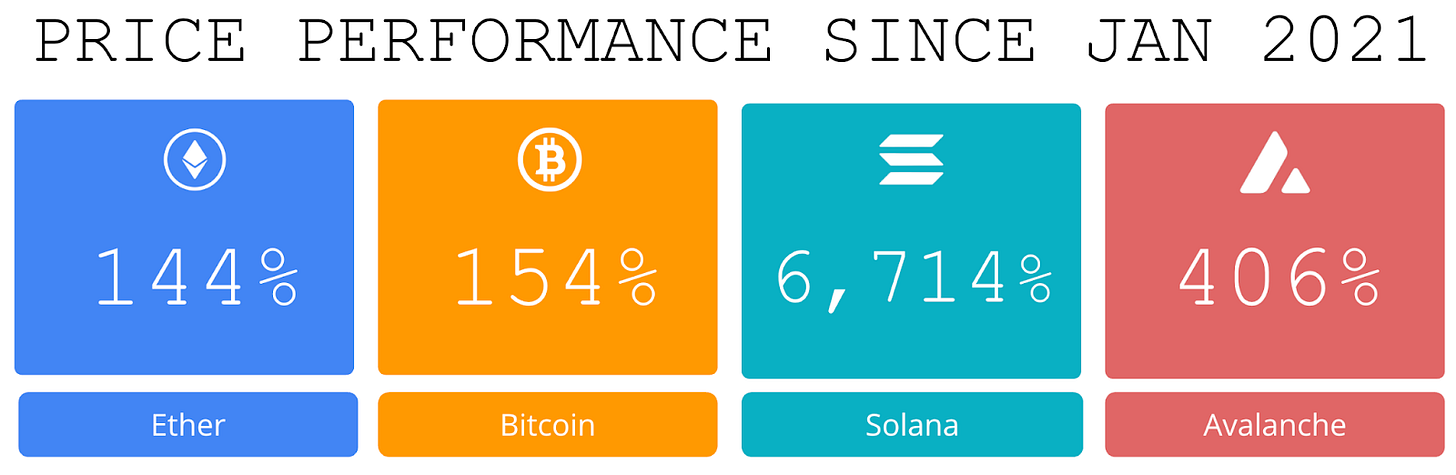

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 80%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

This tech company grew 32,481%...

No, it’s not Nvidia—it’s Mode Mobile, 2023’s fastest-growing software company according to Deloitte. Their EarnPhone and EarnOS helped +45M users earn $325M+, driving $60M+ in revenue. Mode just secured its Nasdaq ticker $MODE, and you can still invest in their pre-IPO offering for a limited time.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

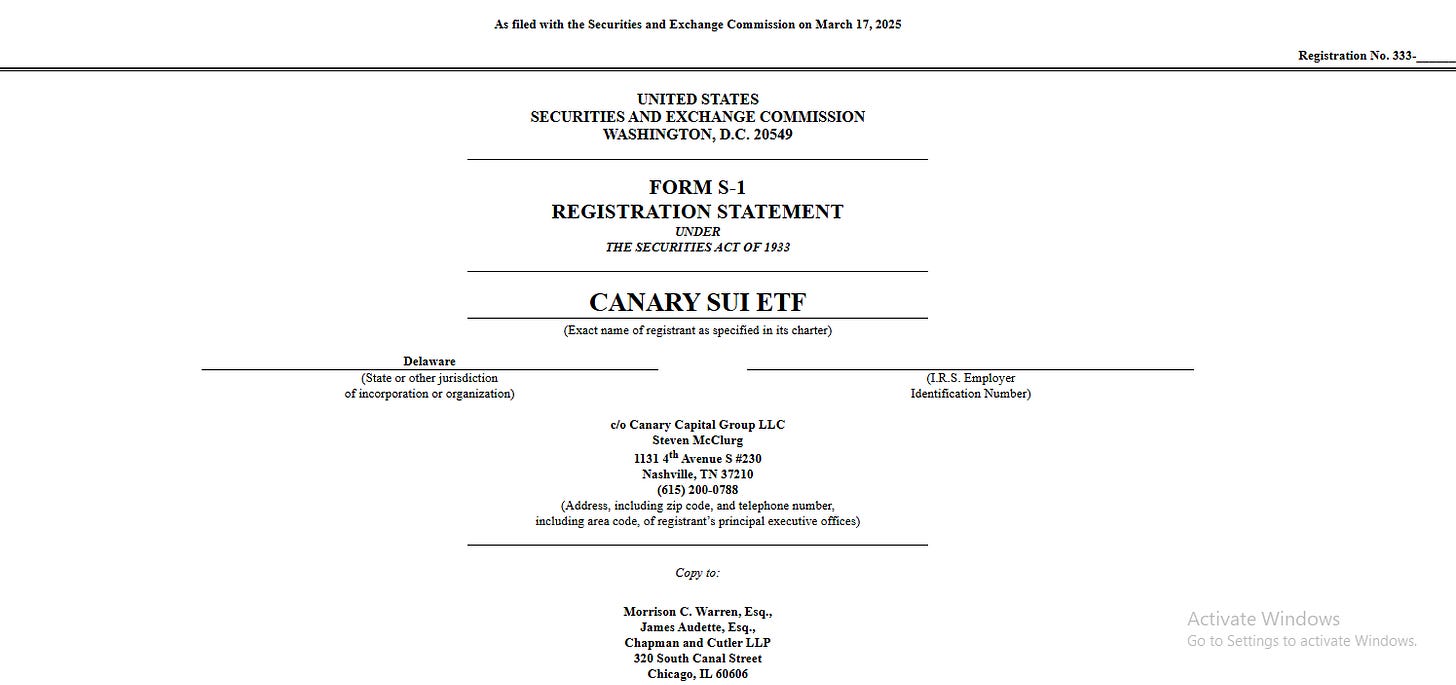

⚖️Canary Capital files with SEC for what could be the first Sui ETF:Canary Capital Group, an institutional crypto trading and management firm, filed for a Sui exchange-traded fund (ETF) with the Securities and Exchange Commission, according to a Mar. 17 filing with the agency.

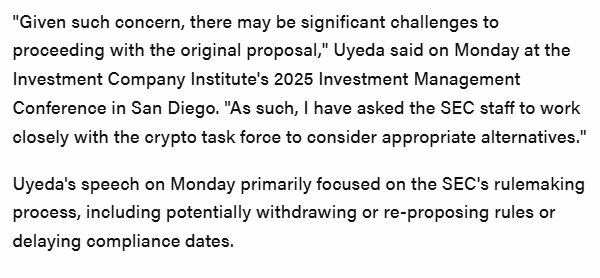

⚖️Acting SEC chair Uyeda directs staff to reexamine proposed crypto custody rule:The U.S. Securities and Exchange Commission is considering walking back a proposal to tighten cryptocurrency custody requirements, marking the acting chair's latest move under the Trump administration.

⚖️Strategy issues 5 million-share ‘perpetual strife’ preferred stock offering to fund more bitcoin purchases: Strategy would use proceeds from the offering for general corporate purposes such as buying more bitcoin, possibly adding to the firm’s nearly 500,000 BTC holdings.

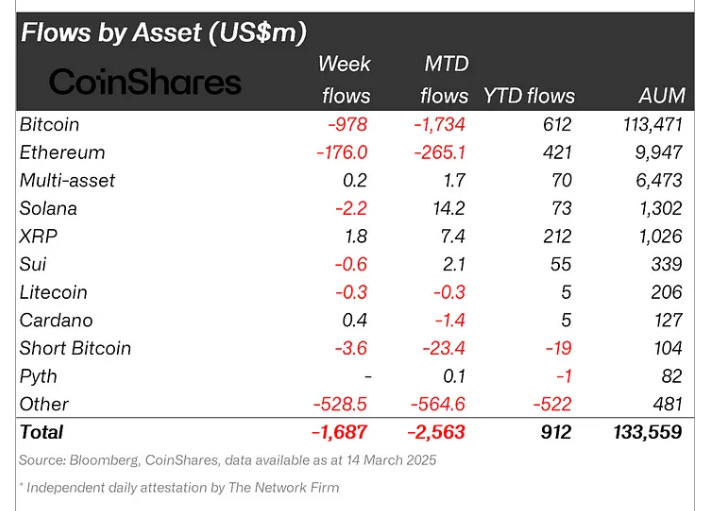

📉Global crypto funds' worst-ever weekly outflow streak reaches $6.4 billion:Global crypto investment products run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares witnessed net outflows of $1.7 billion last week, according to CoinShares data.

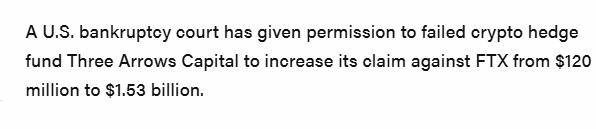

⚖️US court allows 3AC to expand FTX claim to $1.5 billion; FTX argues reorganization plan at risk:The U.S. Bankruptcy Court for the District of Delaware on Thursday ruled in favor of 3AC's amended claims despite the FTX bankruptcy estate's objection arguing that it came too late. The court said 3AC liquidators provided timely notice of their claim, and that the significant delay was largely caused by FTX debtors' delayed record sharing.

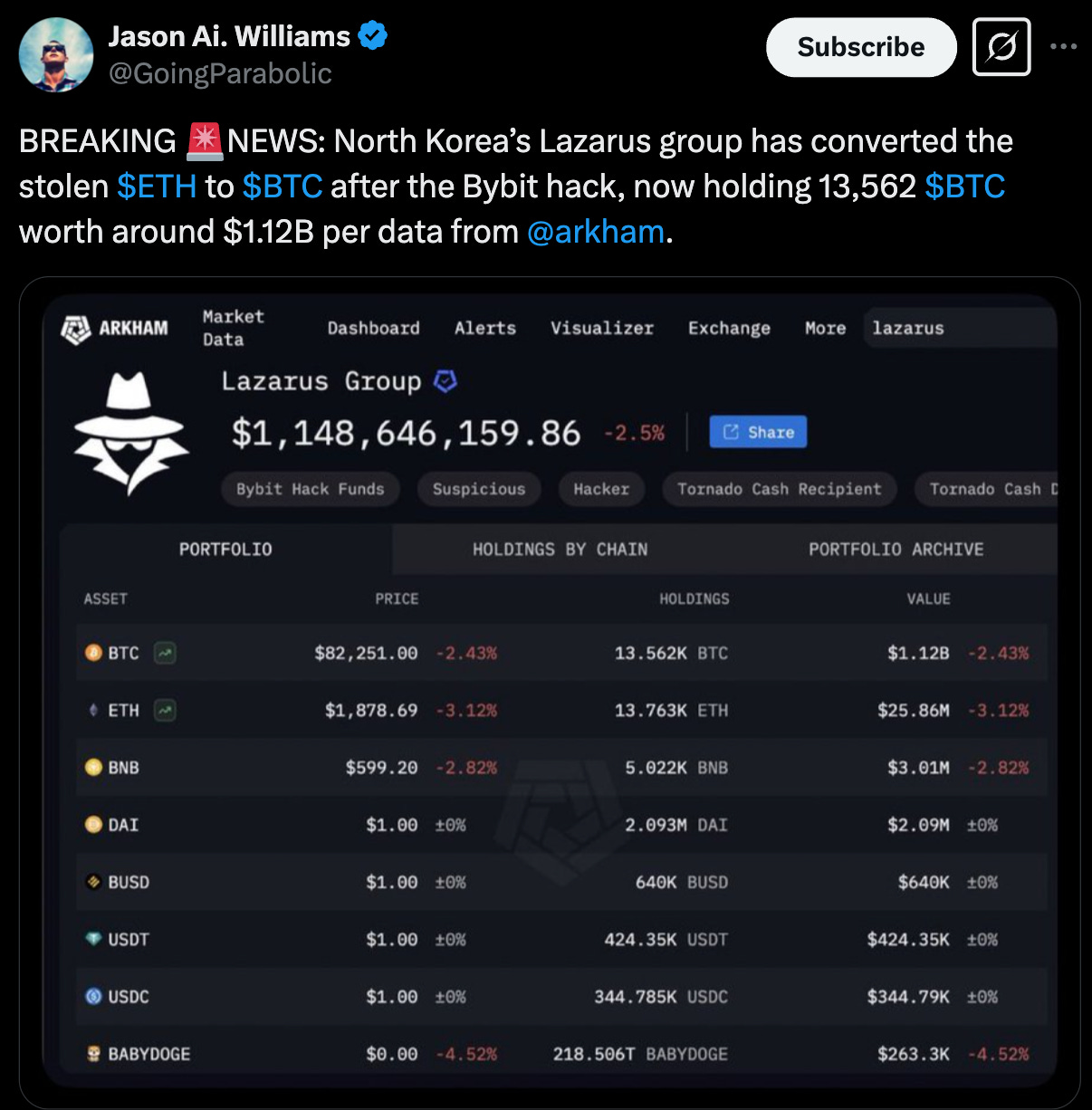

💬 Tweet of the Week

Source: @GoingParabolic

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

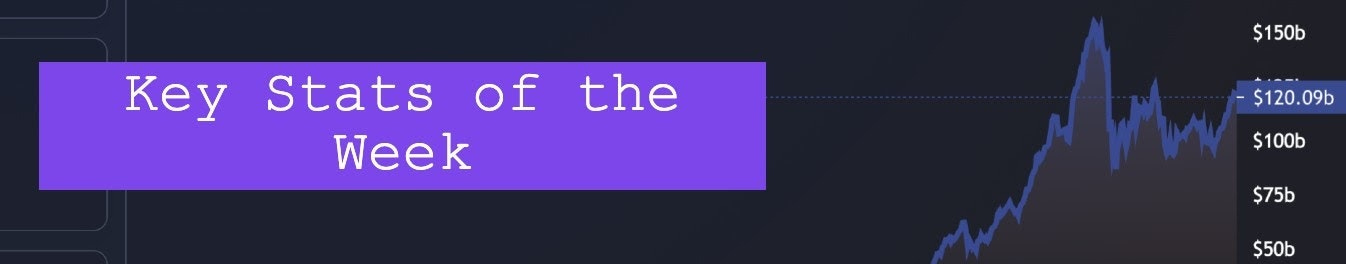

1. Markets are down, but RWAs are up. Tokenized Treasury products have reached a new all-time high of $4.4B in deposits, including BlackRock's BUIDL surpassing $1B for the first time. Overall, the space has grown by 490% year-over-year.

The age of programmable money is upon us.

Source: @DavidShuttleworth

2. It's been a very concentrated period of liquidations, with 9 of the last 16 days having at least $700M in total liquidations:

2/23: $880M

2/24: $1.15B

2/25: $759M

2/27: $898M

3/1: $800M

3/2: $813M

3/3: $791M

3/6: $715M

3/9: $753M

Overall, more than $10.5B has been wiped in roughly 2 weeks.

Source: @DavidShuttleworth

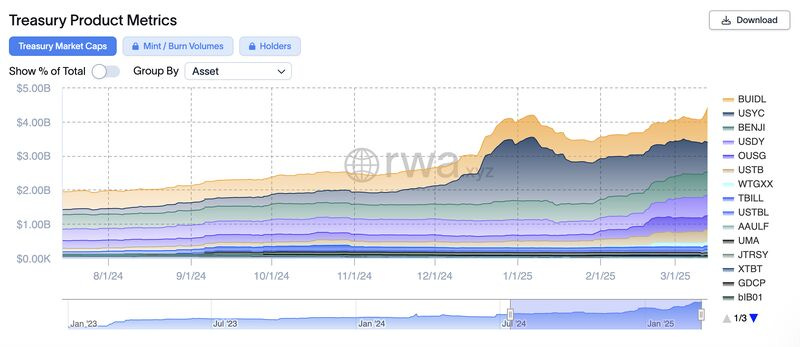

3. After Solana's Milestone January 2025, February has been a Month of Consolidation with a Sharp Fall in Volumes.

Source: @OurNetwork

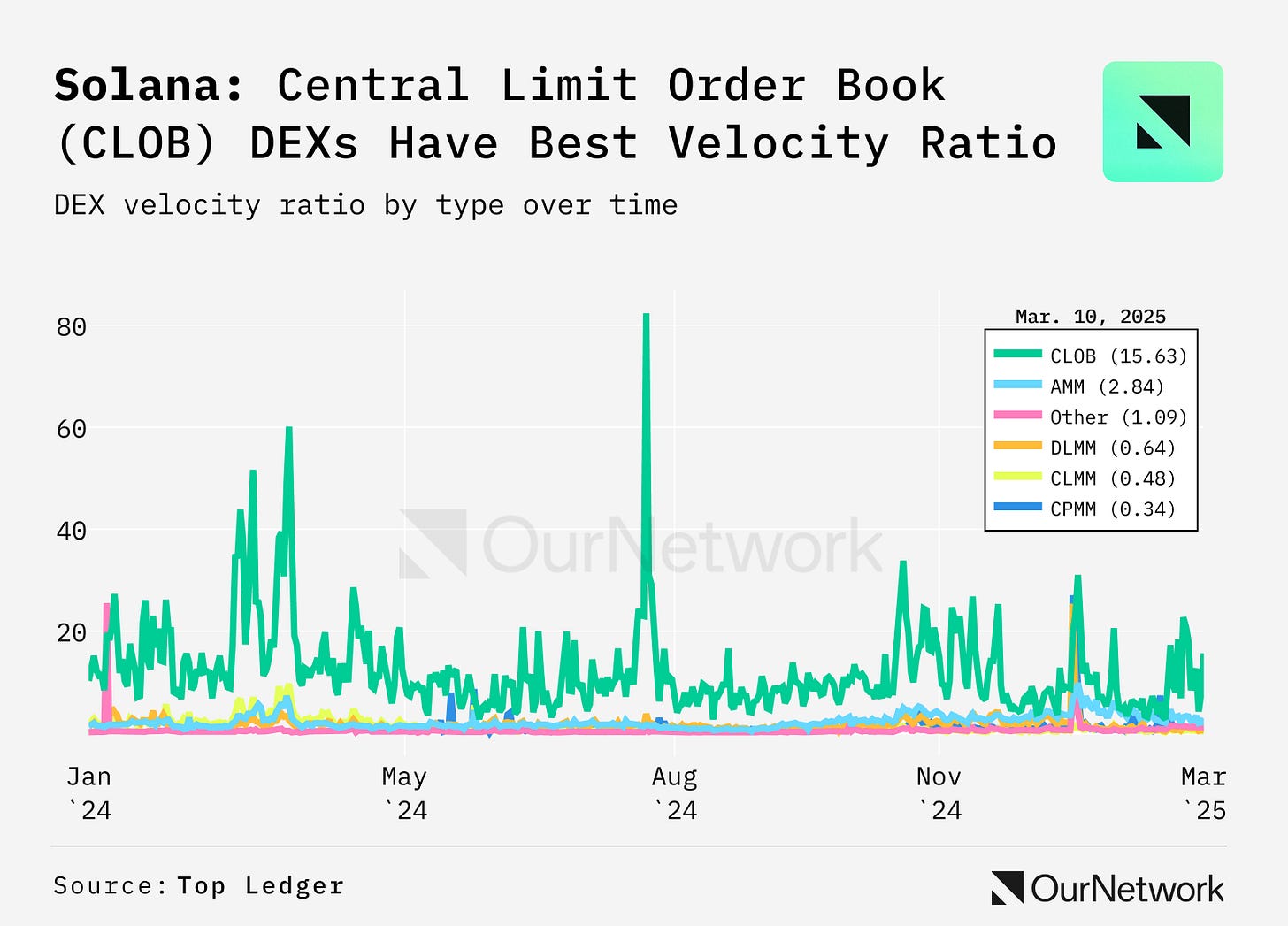

4. Onchain Liquidity and Volume Showing Strong Signs of Growth Across Stablecoins, RWAs, and DeFi on Arbitrum One

Source: @OurNetwork

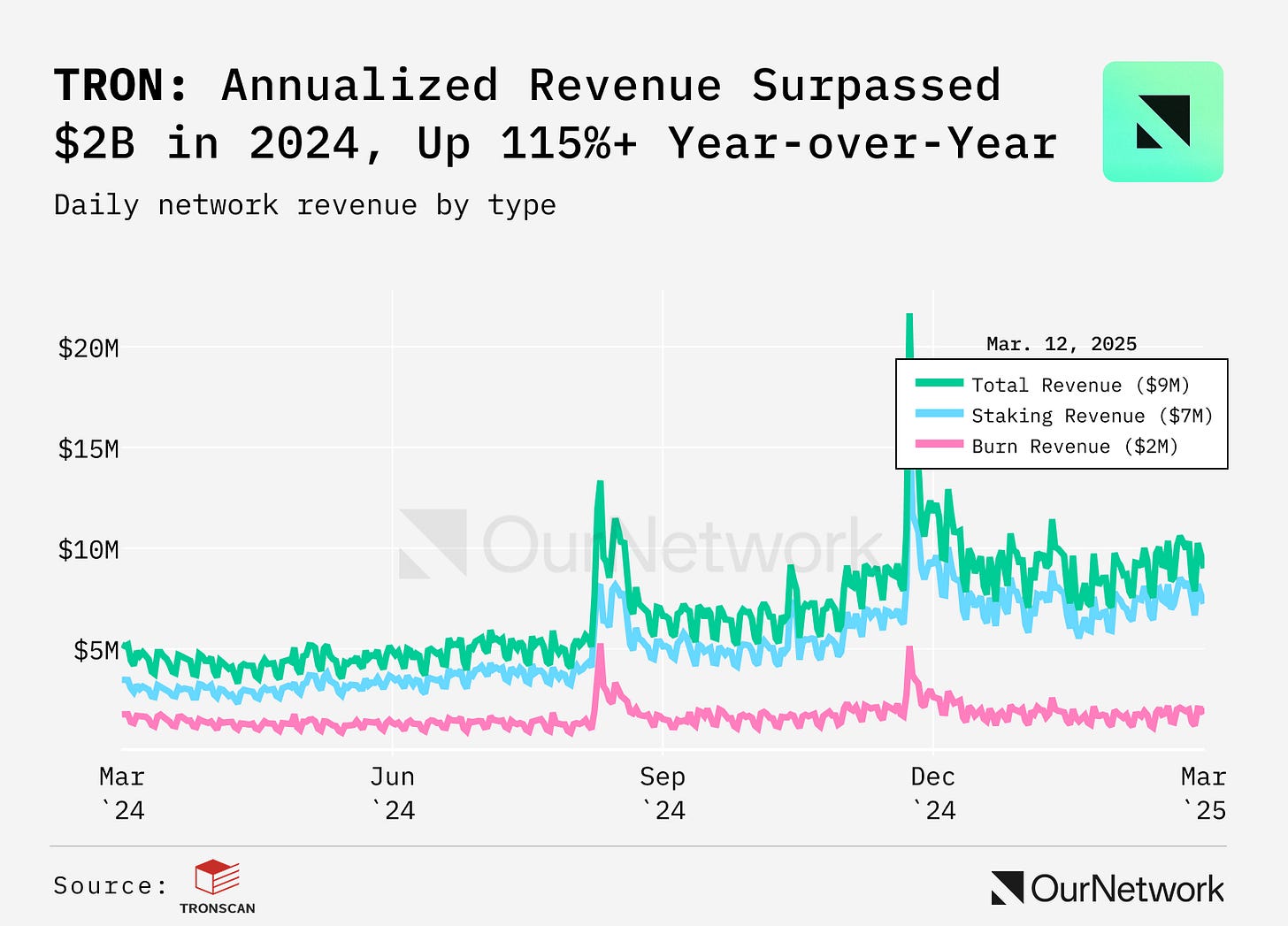

5. TRON has $18.5B+ TVL, $2B+ in Revenue, 294M Total Accounts, and a $63.9B Stablecoin Market Cap

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

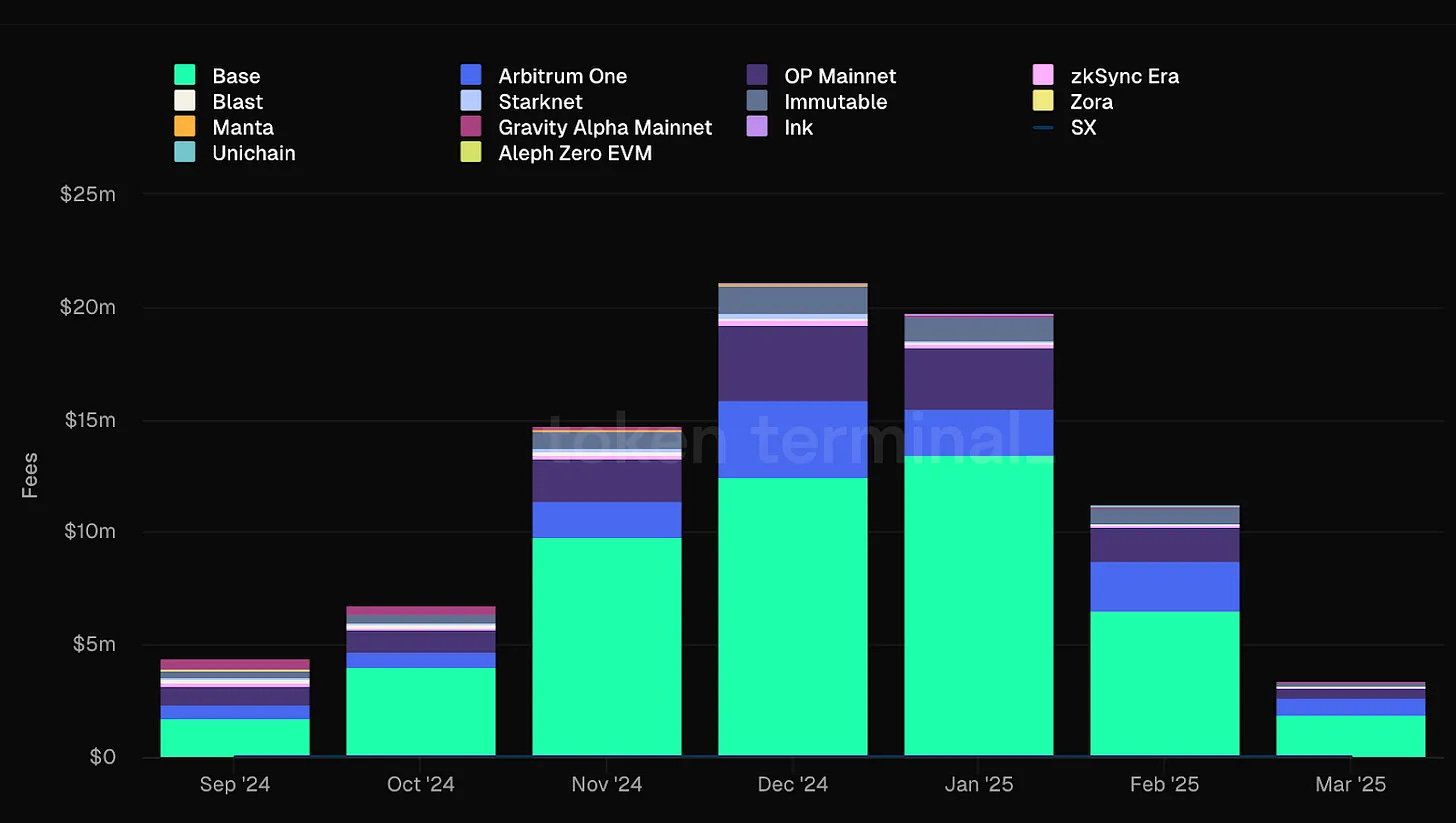

I’m excited about the explosion of purpose-built chains that are designed around a specific company or brand solving a specific problem. For example, Blackbird, a restaurant loyalty program app/chain recently announced that they are building an L3 powered by Conduit, using the Arbitrum DA and settling on Base. Soneium, a rollup on Optimism made by Sony Block Solutions Lab is another example. Worldcoin, a rollup using Alchemy’s RaaS, verifies identities. There are over 50 Arbitrum Orbits chains and over 29 OP stack chains in its Superchain. There are dozens of others that use their own tooling or other interoperability solutions.

Many projects have turned to building their own chains because of:

How straightforward it is to build chains (with RaaS and straightforward frameworks)

Additional revenue, primarily from node auctions and sequencer revenue

Having full ownership of a chain purpose-built for their use case

These trends have created its own set of problems: further fragmented liquidity, poor user experience, and limited revenue streams. Stakeholders all want pieces of the pie; rollup operators, infrastructure providers, liquidity providers, market makers, and apps. The environment for operators is oppressive and broken. Pantera has invested in two companies trying to solve different parts of this problem: Radius and Altius.

MEV and Radius:

The primary revenue source, user transaction fees, has proven unsustainable due to competition for rollups to drive fees down, and unpredictable fluctuations in Ethereum’s data storage costs (blobs).

Radius unlocks a new revenue stream for operators. The Lighthouse Network by Radius helps searchers find profitable MEV opportunities in rollups and submit bundles, competing for execution. Instead of charging rollups for the opportunity, they charge a portion of the searcher’s bid instead.

This lets rollups capture MEV revenue while preventing risks like censorship and transaction reordering. Read more about their technical implementation here.

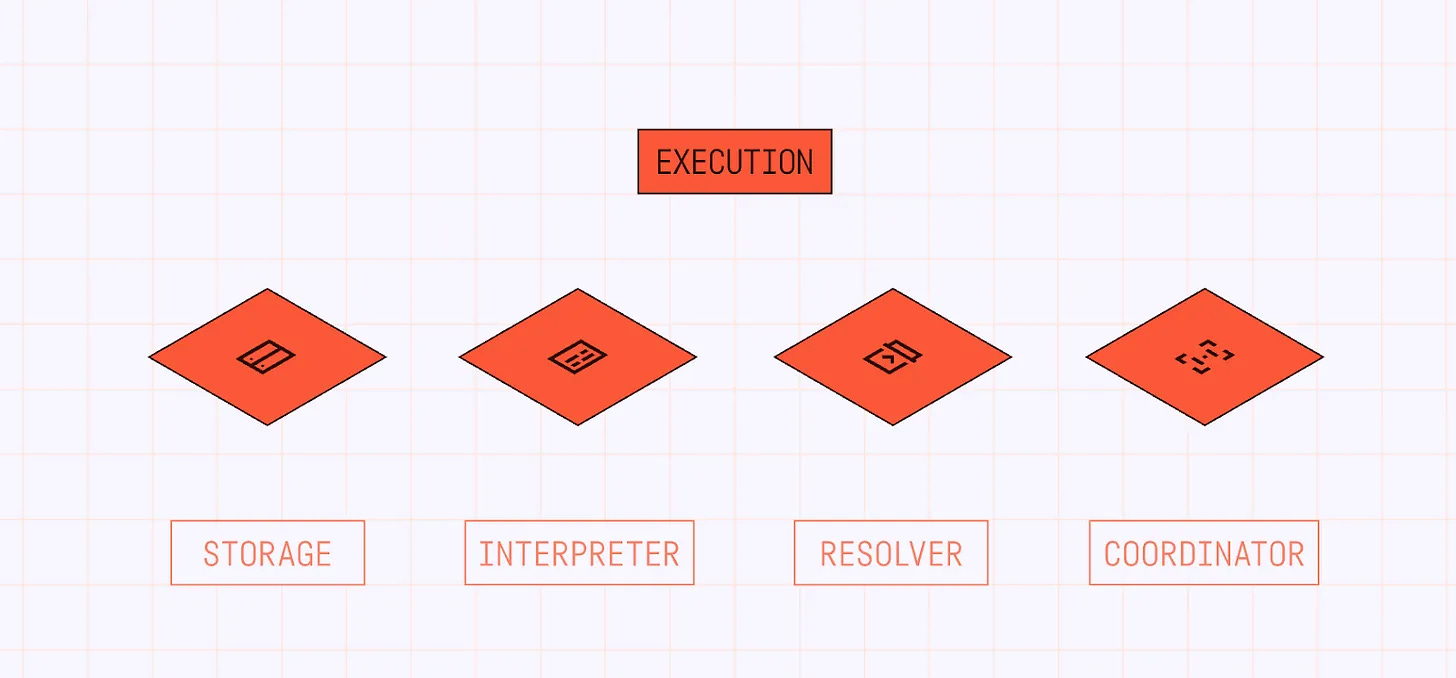

Execution and Altius:

Everyone wants parallelized execution but no one wants to give up their sequencer and rewrite consensus. Altius solves two challenges in the blockchain ecosystem: performance bottlenecks and interoperability gaps. The vast number of infrastructure diversity between chains means cross-chain interactions are extremely complicated. This fragmentation limits composability, where transactions across chains need to execute automatically. Current solutions, such as bridges or shared sequencers, provide only partial improvements, failing to work effectively across diverse VM environments.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.crowdcreate.us and invest.modemobile.com