Learn More at www.hypelab.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 270k weekly subscribers. Today we cover the Trump victory leading to a new ATH for BTC, Michigan adding ETH to their pension funds, Blackrock IBIT inflows hitting new records, Solana seeing its highest monthly active addresses and big new venture rounds for Glow Labs ($30M) and Vlayer ($10M).

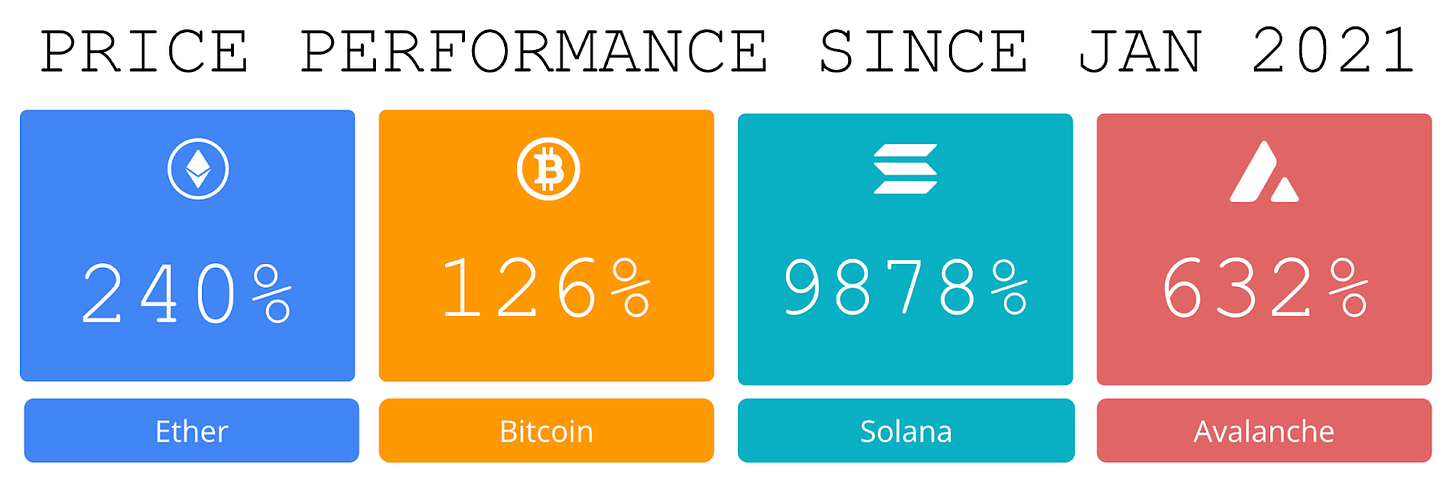

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 270,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🐘 Bitcoin hits new $75K high as Trump takes early election lead - Bitcoin hit a new all-time high of over $75,000 on Nov. 6, well above its previous $73,800 high in March as traders piled into crypto with pro-crypto candidate Donald Trump winning the U.S. Presidency for the second time.

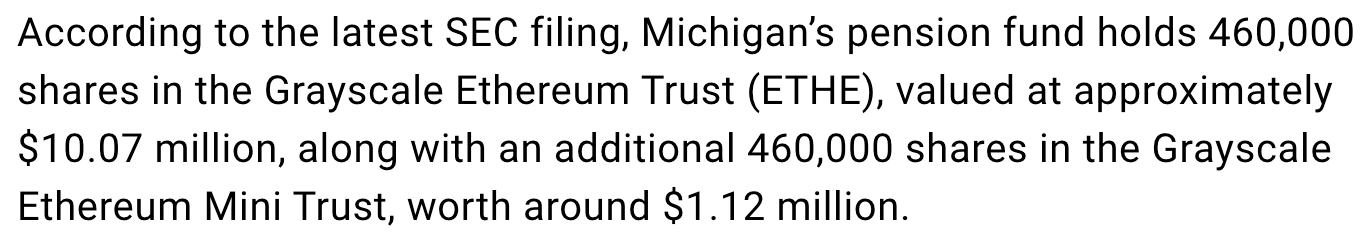

🚀 Michigan becomes first state pension fund to invest in Ethereum ETFs with $11M stake: The State of Michigan Retirement System has become the first US state pension fund to invest in an Ethereum ETF, disclosing an $11 million stake in Grayscale’s Ethereum trusts in an SEC filing.

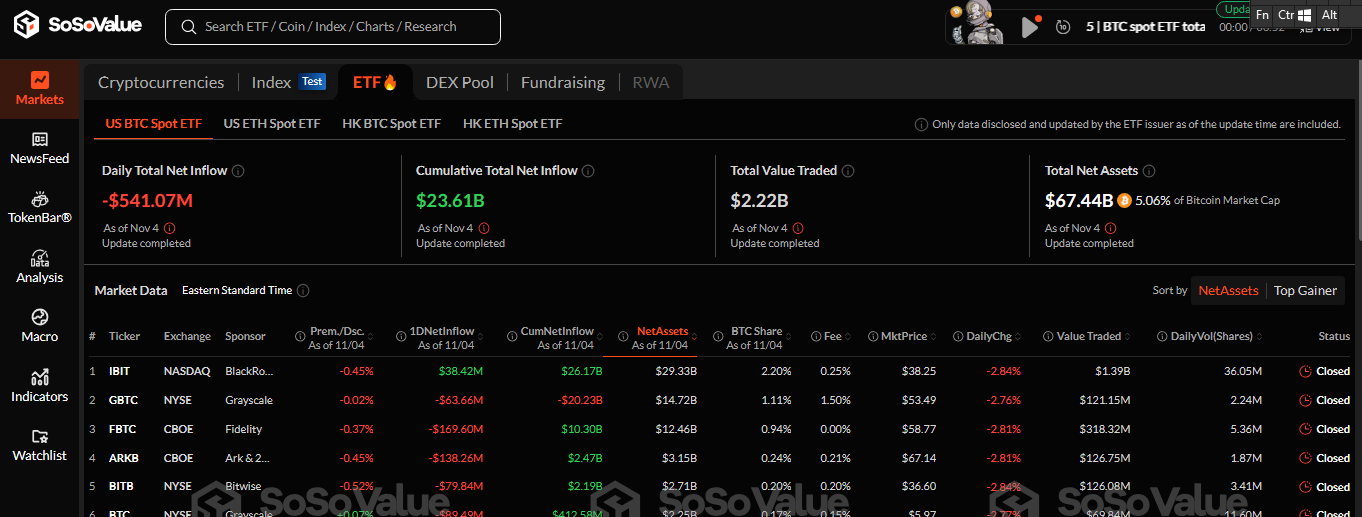

🎉 BlackRock’s IBIT dominates as spot bitcoin ETFs record $870 million in daily inflows, largest since June:The 12 spot bitcoin ETFs in the U.S. reported total daily net inflows of $870 million on Tuesday, the largest since the first week of June. This was mainly driven by $642.87 million in net inflows into the IBIT ETF, its largest daily inflows in over seven months.

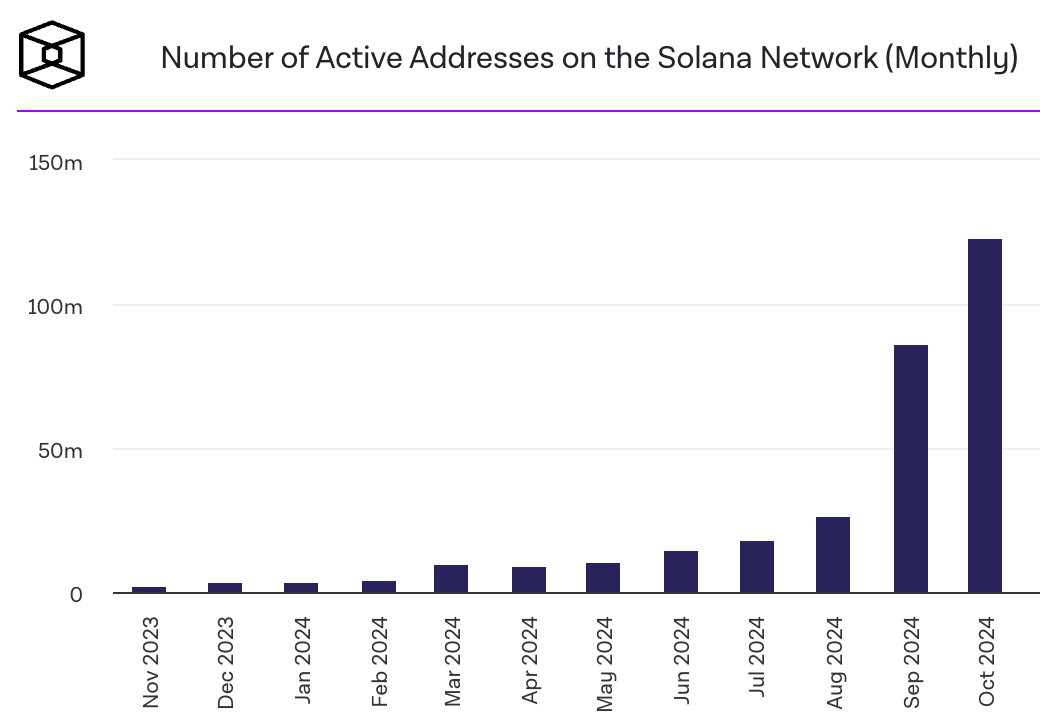

🥳 Solana saw its highest monthly active addresses, surpassing 120 million in October: According to The Block's data dashboard, the number of unique addresses that signed transactions across Solana increased by over 42% from September's figure. The network had less than 12.7 million active addresses in January this year.

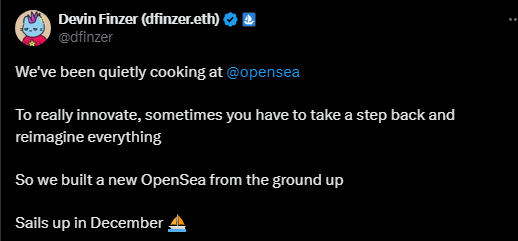

🔥 OpenSea CEO teases new platform built 'from the ground up' a year after talk of version 2.0:Prominent NFT marketplace OpenSea is aiming to reinvent itself as non-fungible token trading volumes have shrank to their lowest levels in more than three years.

⚖️ SEC crackdown continues with Immutable latest to receive Wells Notice:The SEC has issued a Wells notice to blockchain gaming platform Immutable in what has become a widespread crackdown on crypto companies ahead of the US election.

💬 Tweet of the Week

Source: @jameslavish

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

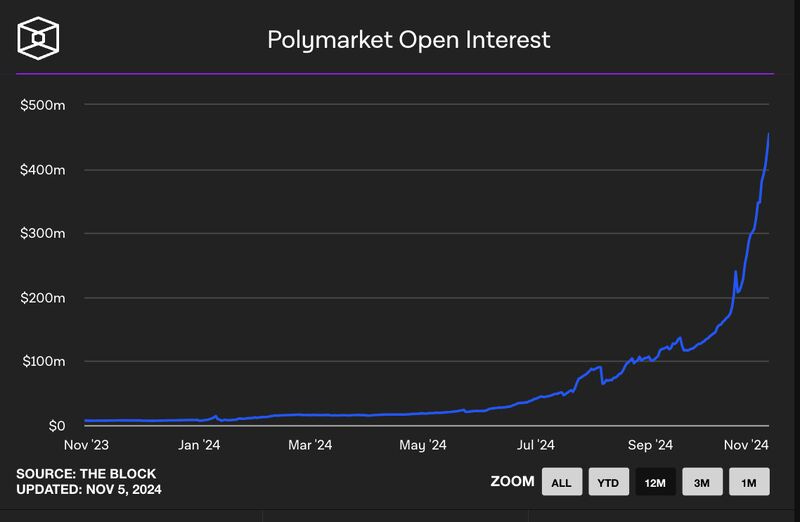

1. Election Day is upon us and open interest on Polymarket has just surpassed $450M for the first time ever and continues to surge to record levels, now at $463M. The presidential election winner now represents 54% of all open bets on the platform, followed by the popular vote winner at 17%.

Overall, open interest has increased by 228% over the last month, while the platform handled over $2.5B of volume in October (up 368% from September).

Source: @DavidShuttleworth

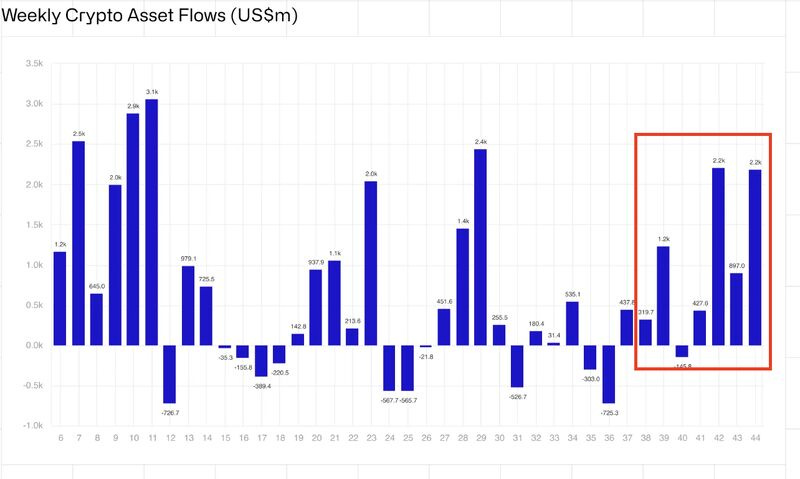

2. Last week there were over $2.2B of institutional inflows, including days of $870M and $893M (the second most ever) into Bitcoin ETFs. This marks the 4th consecutive week of positive digital asset inflows and brings the October monthly total to $5.73B. Moreover, 6 of the last 7 weeks since the Fed cut rates in September have now been met with significant institutional demand.

Overall, BTC dominated once again and accounted for $2.16B of all inflows, while BlackRock was once again the primary beneficiary with $2.14B of inflows into its IBIT product.

Source: @DavidShuttleworth

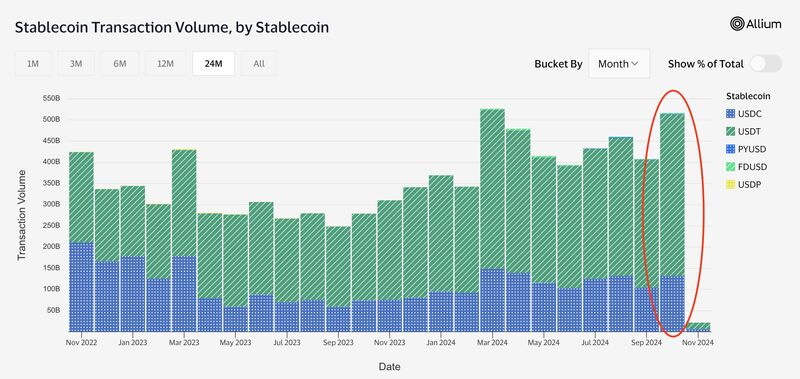

3. We closed out the month of October with $517B of transfer volume from fiat-backed stables, an increase of 27% from September and 85% year-over-year. One interesting takeaway is that there were 118M monthly stablecoin transactions accompanying this volume, the most ever and an increase of 63% from last year. So the sector continues to gain traction and attract users throughout the space. Moreover, Tether.io USDT led the way once again, but this time set a new record for both monthly volume ($380B) and transactions (98M).

Source: @DavidShuttleworth

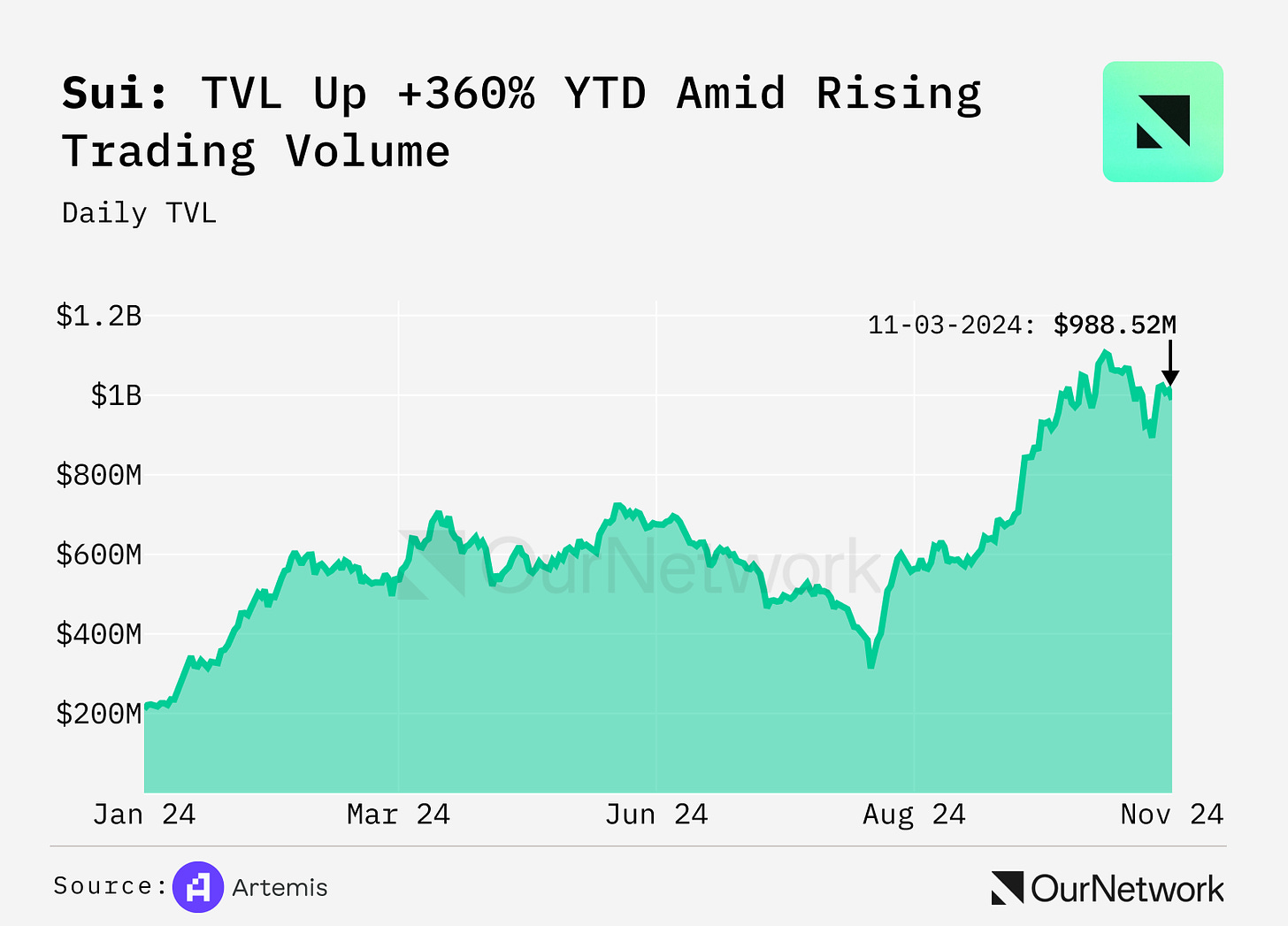

4. Multiple DeFi protocols on Sui Pass $100M+ Total Value Locked

Source: @OurNetwork

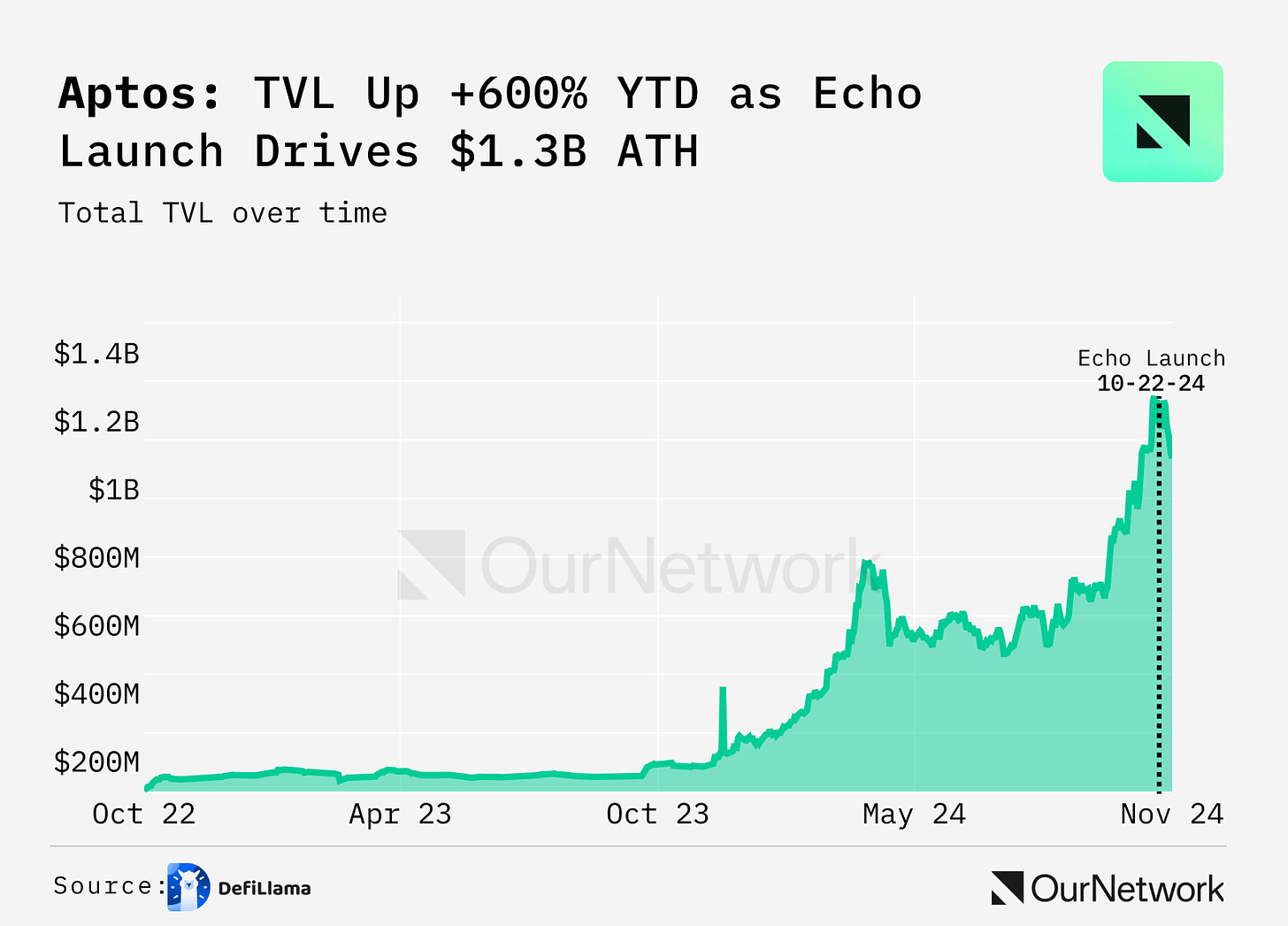

5. Aptos TVL Hits >$900M Record High Pre-launch of USDT on Network

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Intro

Time for the week everyone has been waiting for. The US presidential election will take place tomorrow and then on Thursday we will have a FOMC interest rate meeting.

As always when we get around elections markets like to get volatile and fool people into thinking that this time is actually different and the election does matter.

The outcome will drastically impact the price of assets across the board.

If Kamala wins it’s over and we will be in a decade long bear market. If Trump wins we will have the melt up of a lifetime.

These two statements couldn’t be further from the truth. It’s funny seeing people get so worked up on X saying that Trump has to win in order to save the markets.

But somehow it’s lost on people that bidenomics with Harris at the right hand side has given us record high asset prices across the board.

So tell me again how bad the Democrats are for the market?

It’s a completely baseless claim and shows you how much some of these people really know about the market.

As long as the government continues to spend and rack up debt the cycle will chug on no matter who is in office.

Whatever the outcome may be, the immediate impact of the election is likely to be short lived. It’s the public that is buying or selling the news and they will be wrong ten times out of ten.

Look at the 2016 election where Trump delivered, arguably, one of the biggest surprises in US election history when he won. According to the experts it was supposed to be armageddon and down for the rest of history.

What actually happened? The market immediately sold off for two to three days and then took off.

Also, notice where the RSI was at in the previous two cycles versus where we are currently. This is a great signal that the market has plenty of room to run before we can consider it getting overheated. RSI is still very low relative to 2020 and 2017. In fact, it looks much more like it did in 2017 which tells us calling a top using this indicator may be a very tricky task going forward.

To drive the point home I shared this post on X last week. Here we had the prodigal son SBF in all his smarts short that election low to the tune of $300 million. Of course, Wall Street knew Trump was a disaster for the market. So much so that they took it in the shorts on all their quant models.

Could we see a similar setup with a Harris win?

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com