Learn More at www.sdm.co and www.plutus.it and www.usefundex.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Uniswap governance approved a major “UNIfication” proposal aimed at streamlining protocol governance, while Eclipse founder Neel Somani stepped down as Executive Chairman. Trust Wallet users suffered losses of at least $6M following a security breach, and the SEC charged the operators of a $14M crypto investment scam that targeted users via social media. Meanwhile, former Alameda Research CEO Caroline Ellison is set to be released from federal custody next month. On the fundraising front, Architect, a fintech firm building high-throughput, low-latency trading infrastructure for traditional and tokenized assets, raised $35M in a Series A led by Tioga Capital, while octra, a blockchain network focused on Fully Homomorphic Encryption, raised $20M in a public token sale led by multiple investors.

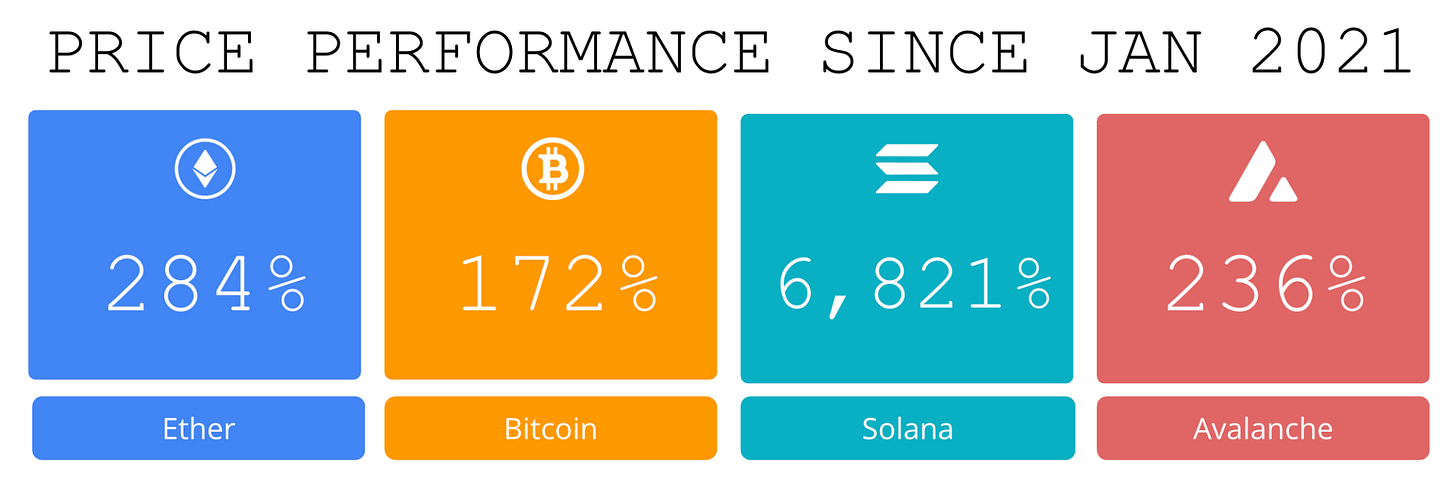

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Secure Digital Markets (SDM) is a full-service crypto dealer offering spot trading, derivatives, and collateralized lending. We serve HNWIs, institutions, miners, protocols, and OTC desks, providing deep liquidity across 40+ assets with T0–T+1 settlement. Clients can borrow up to $250M at 7.5%–10.5% with 65% LTV on select top 50 assets. Our U.S.-based derivatives desk offers TRS, NDFs, options, and structured products designed for hedging, yield generation, or directional strategies.

Learn more: www.sdm.co

Contact: [email protected]

Get out Free CFO Briefing: https://treasuries.sdm.co/

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world’s leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Plutus is a Web3 rewards platform where everyday spending earns PLUS, a merchant-funded reward token with a guaranteed £/$/€10 in-app value. Redeem PLUS for gift cards, cashback, travel rewards, or miles across 400+ global brands. With 250k sign ups and powering $40M+ in monthly spend, Plutus brings real utility to digital rewards.

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

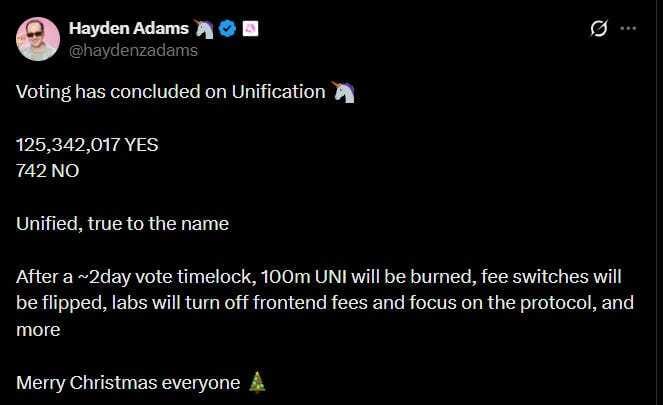

🚀 Uniswap governance passes major ‘UNIfication’ proposal: The Uniswap governance voted to pass the UNIfication proposal, a major initiative that fundamentally shifts the protocol’s economics to a more deflationary road.

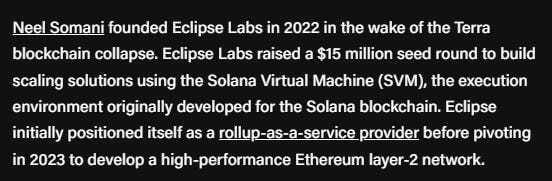

🤝 Eclipse Founder Neel Somani Steps Down as Executive Chairman:Neel Somani, founder of Ethereum layer-2 protocol Eclipse, has stepped down as Executive Chairman effective October 2025, according to a joint statement from the company and Somani. He said the move reflects a desire to focus full-time on machine learning and other intellectual pursuits.

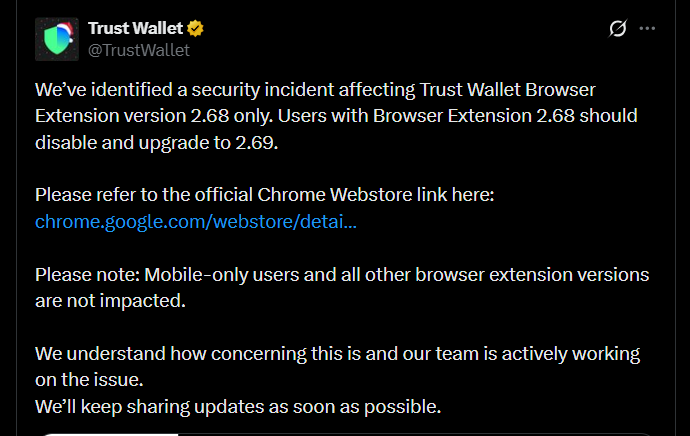

🎭 Trust Wallet users lose at least $6 million in security breach:Crypto wallet provider Trust Wallet said it has identified a security incident affecting a specific version of its browser extension, with onchain sleuth ZachXBT estimating initial losses of more than $6 million.

⚖️ SEC charges $14 million crypto investment scam targeting social media users:The U.S. Securities and Exchange Commission has charged three purported crypto asset trading platforms and four investment clubs for allegedly running an online investment scam that defrauded more than $14 million.

⚖️ Former Alameda CEO Caroline Ellison to be released from federal custody next month: Caroline Ellison, the former co-CEO of Alameda Research, is scheduled for release from federal custody on Jan. 21, 2026, according to U.S. Federal Bureau of Prisons records.

💬 Tweet of the Week

Source: @MerlijnTrader

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

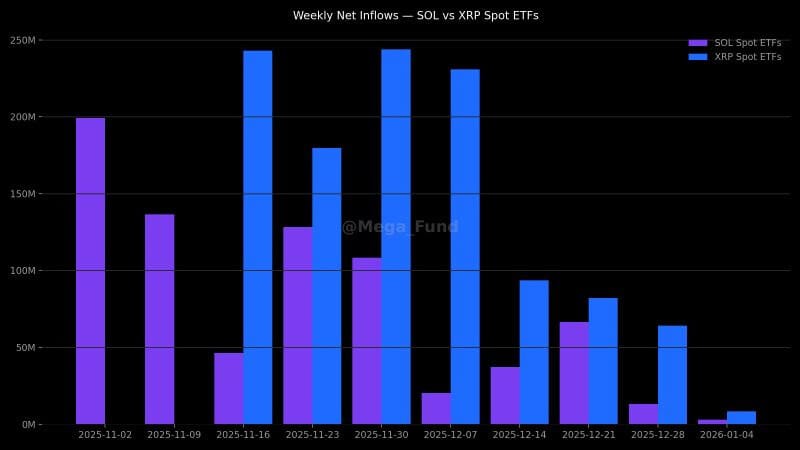

1. One under-indexed dynamic: XRP spot ETF inflows have outpaced SOL every single week since launch.

Despite debuting two weeks later, XRP spot ETFs have already accumulated $1.15B in net inflows, compared to $759M for SOL.

Source: @DavidShuttleworth

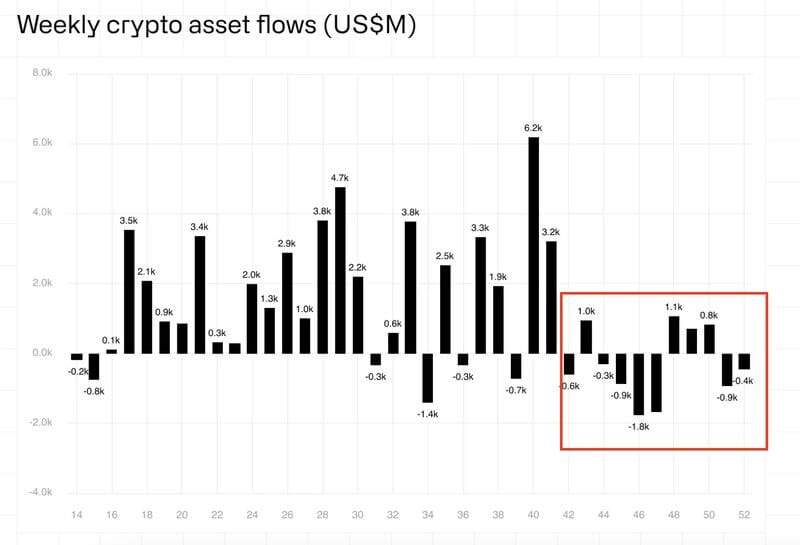

2. Despite multiple relief rallies, digital assets end 2025 with a second straight week of outflows ($446M). Since the October market crash, $3.2B has left the market, with outflows in 7 of the past 11 weeks.

Source: @DavidShuttleworth

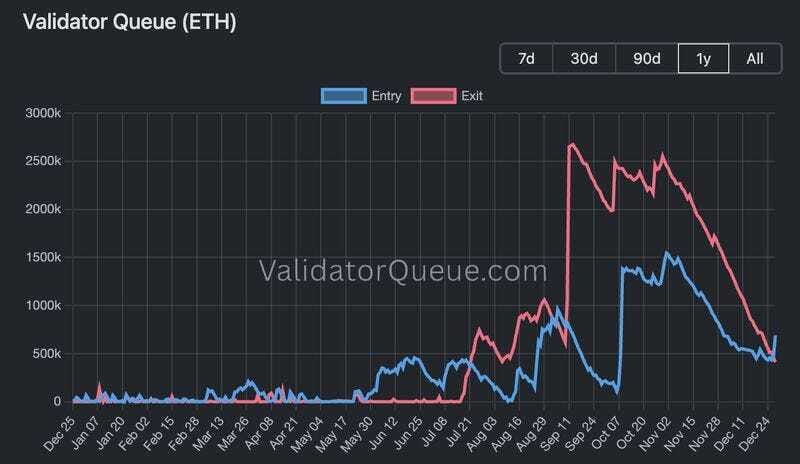

3. Year-end inflection for Ethereum staking: the validator entry queue has flipped the exit queue for the first time since September.

There are now 691K validators are now joining mainnet versus 411K exiting (exits down 84% from November).

The earlier spike in exits followed Pectra, which raised the max validator balance from 32 ETH to 2,048 ETH, triggering consolidation across large operators, alongside Kiln exiting all validators after a security incident in September.

That restructuring phase now appears complete. Ethereum’s validator set has stabilized into a more consolidated, optimized, and resilient network.

Source: @DavidShuttleworth

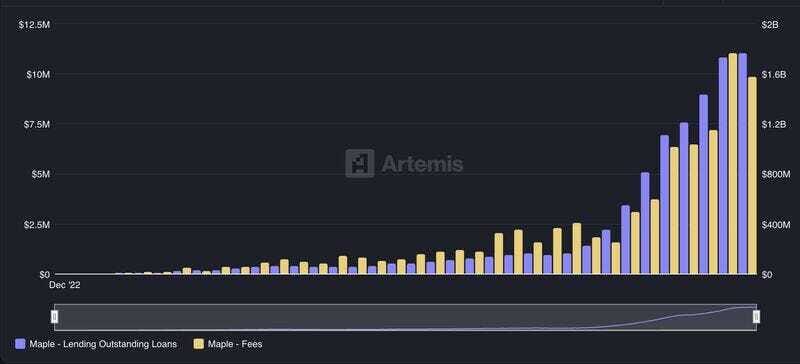

4. As we close out the year, Maple has quietly built out one of the most successful onchain banks in the space, servicing over $1.8B in active loans and generating $10M in monthly fees.

Maple has grown its lending business by nearly 1100% year-over-year and is now the 4th largest onchain lending platform.

Source: @DavidShuttleworth

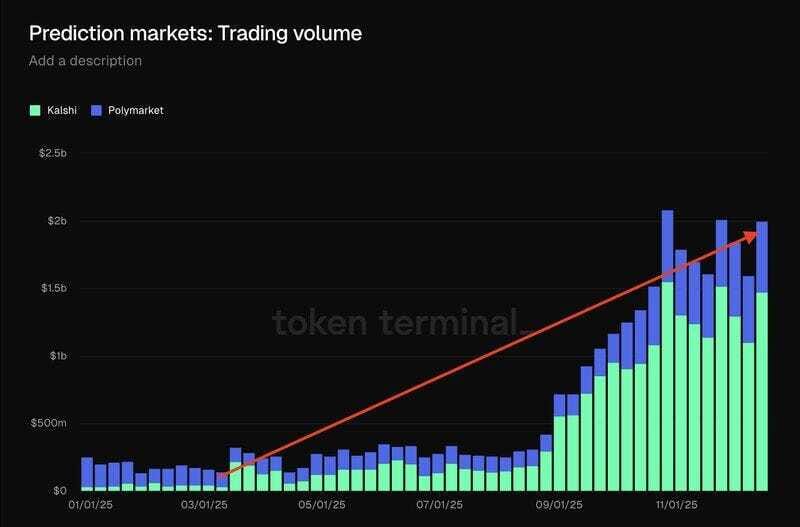

5. Broader crypto is dragging, but prediction markets keep gaining traction.

Weekly volume just topped $2B (the third-highest level ever), and December has already seen $5.4B in volume after a historic November ($8.2B).

Distribution is now the real moat.

Source: @DavidShuttleworth

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest and last issue of 2025.

In this installment, we’re highlighting four subsectors of crypto whose growth defined the year: stablecoins, real world assets, perp DEXs, and prediction markets. While crypto’s overall market cap dropped 11% to $3.06T in 2025, these four subsectors showed exciting progress.

We’d like to thank RWA.xyz, Token Terminal, Chaos Labs, and OurNetwork’s Diego Cabral for contributing to the newsletter to close out the year.

And finally, thank you for reading our contributors’ work. We look forward to continuing to improve in 2026.

– ON Editorial Team

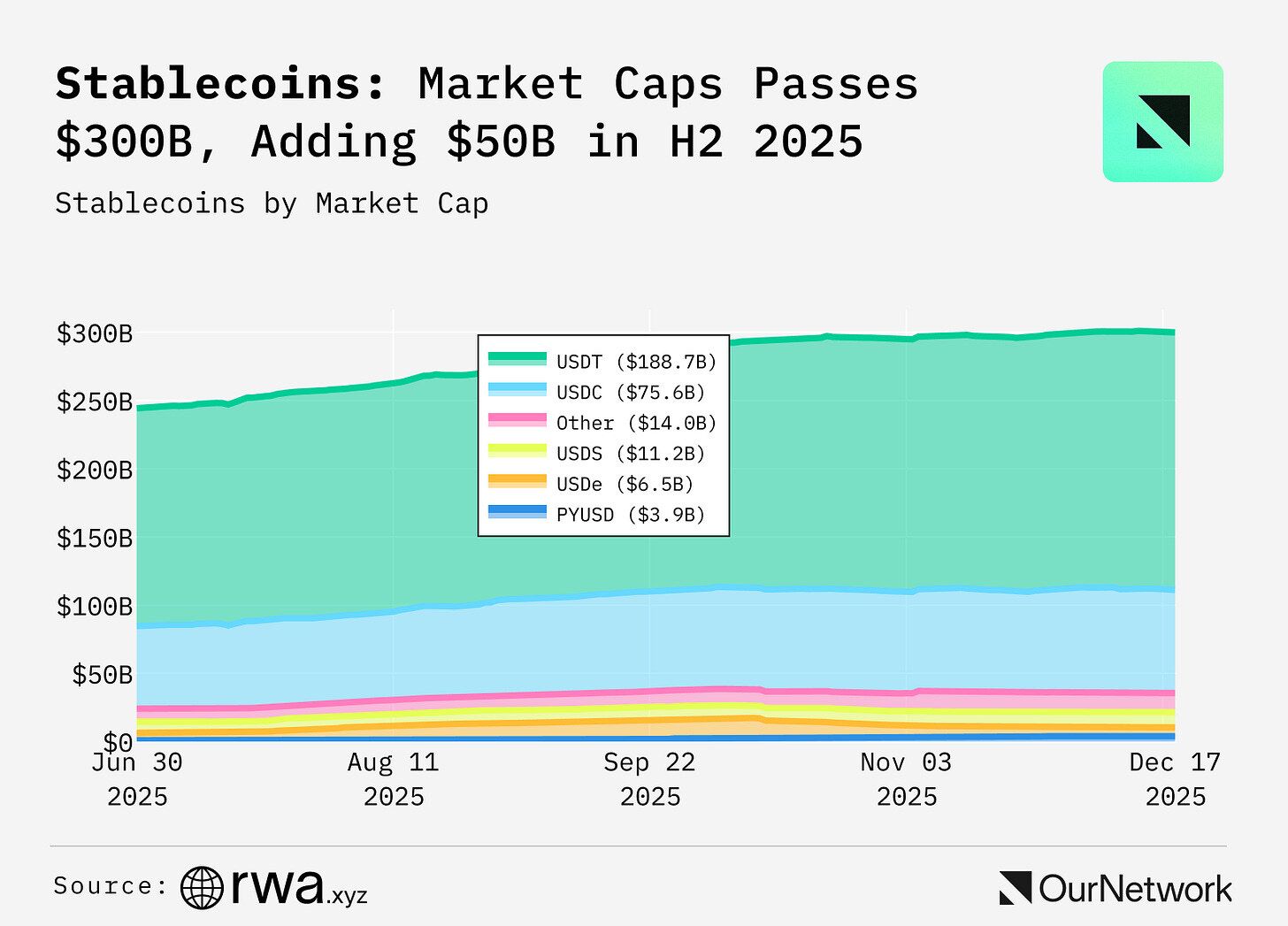

📈 Stablecoin Market Surpasses $300B, Up Almost $100B in 2025

Stablecoins had a breakout year in 2025, growing 50% to surpass $300B in market cap. Tether (USDT) and Circle (USDC) still dominate with 88% share, but the next eight products added $19B, led by Sky’s USDS. Other top gainers included PayPal’s PYUSD (+$3.4B), World LibertyFi’s USD1 (+$2.8B), and Falcon Finance’s USDf (+$2.2B). With regulatory clarity from the GENIUS Act, 2026 is shaping up as a pivotal year as neobanks adopt stablecoins for instant settlement, additional yield, and user growth.

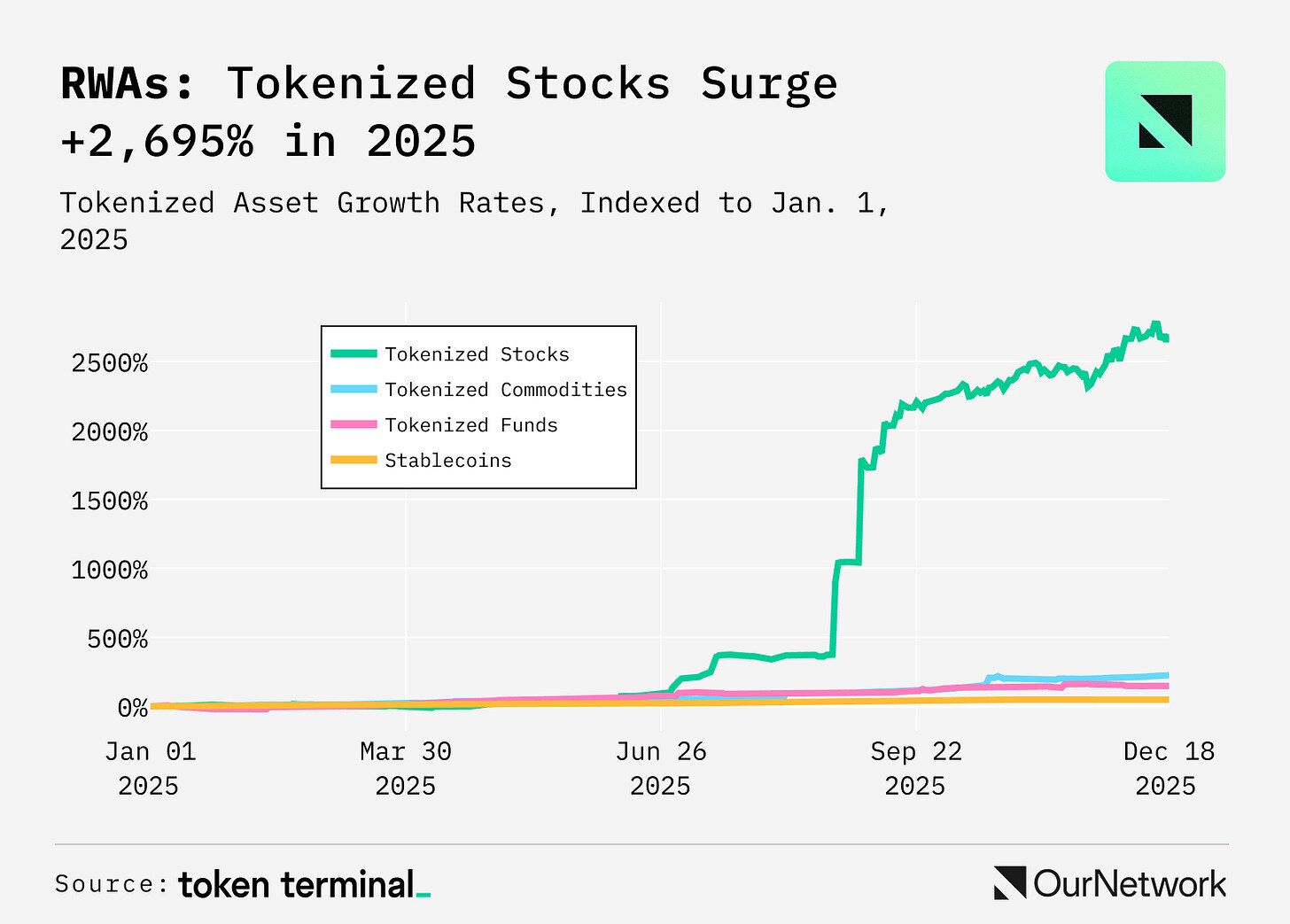

📈 Tokenized Stocks Grew 2,695% Year-to-Date, More Than Any Other Category of Tokenized Assets in 2025

2025 has been the year of tokenized stocks. The year-to-date market cap growth of tokenized assets: stocks +2,695%, commodities +225%, funds +148%, and stablecoins +49%. Issuers leading the charge: Backed, Ondo, Dinari, and Robinhood. With Robinhood already tokenizing hundreds of assets per week on Arbitrum, the tokenization playbook has been established. The next 12-18 months will show which issuer is able to capture the largest share of the ~$130T public equities market.

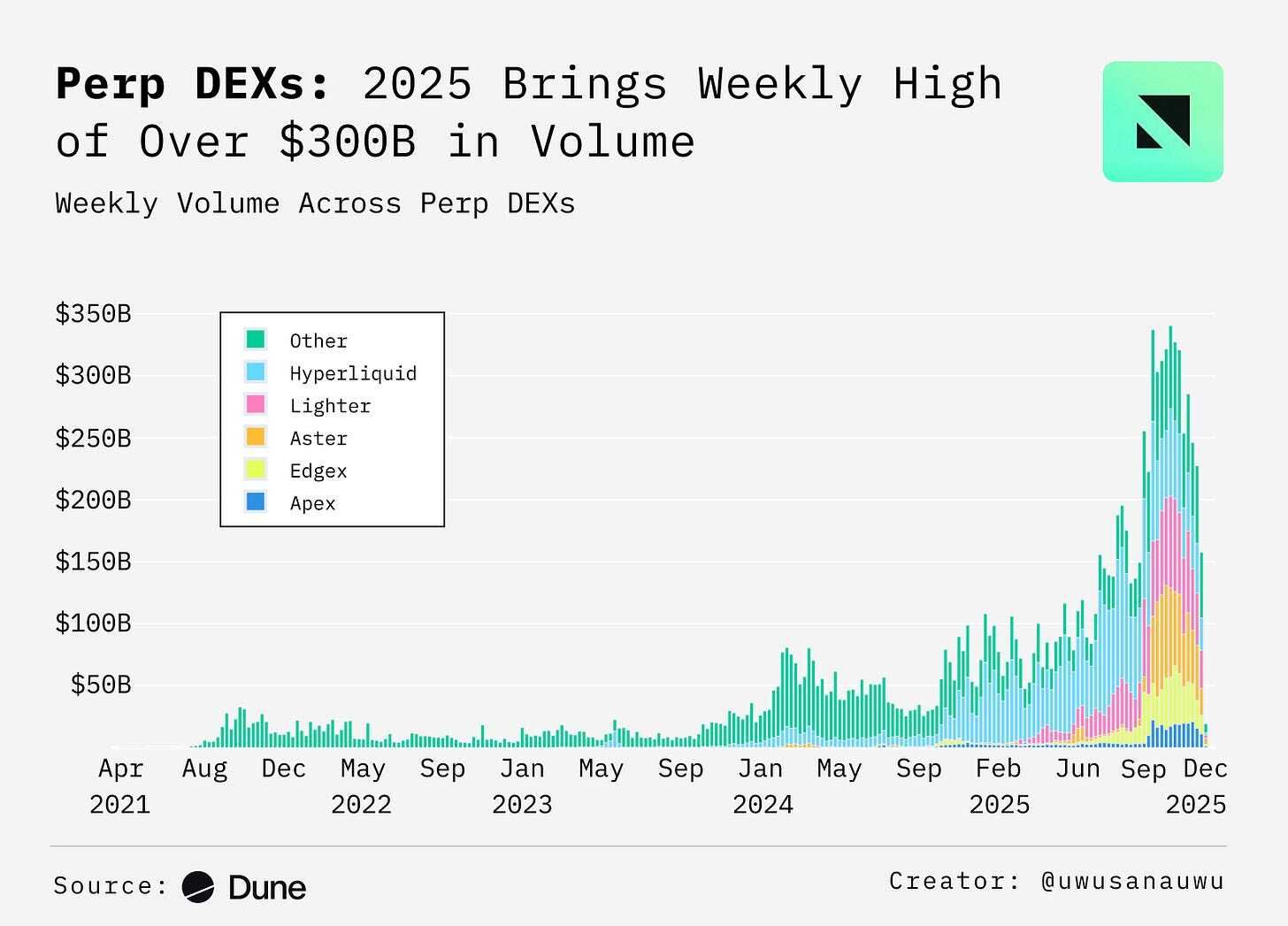

📈 Decentralized Exchanges Begin to Overtake Centralized Ones, Signaling a Shift in Perps Liquidity

One of the defining shifts of 2025 has been decentralized exchanges beginning to erode the dominance of centralized venues, particularly in perps. In the third quarter of 2025, Solana DEX volume surpassed CEX volume, a milestone driven largely by growth in onchain perps. The crossover highlights a structural change, where leverage and liquidity are concentrating. The trend is expected to extend to other chains, even as DEX perps face headwinds following the Oct. 10 flash crash. Market activity suggests these events slowed momentum but did not reverse the underlying shift.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.sdm.co and www.plutus.it and www.usefundex.com