Learn More at www.rootstock.io and www.amphibiancapital.com and www.token.cryptocasino.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 280k weekly subscribers. This week, US spot Bitcoin ETFs surpassed Satoshi's estimated 1.1M BTC holdings, El Salvador’s Bitcoin gains topped $300M, Kamino launched a new swap feature and big new venture rounds for Interlace ($10M) and Lava ($6.5M).

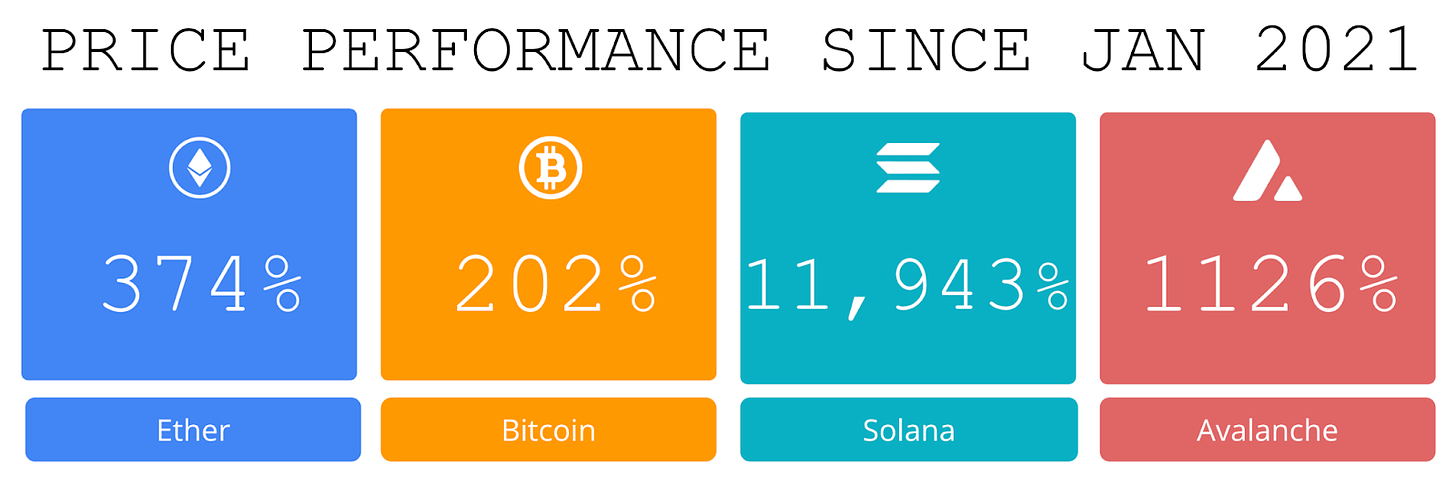

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. +14.92% net YTD approx with their USD fund, +11.00% net BTC on BTC YTD (90.93% in USD terms), and +14.39% net ETH on ETH YTD (33.01% in USD terms) through 10/31. They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. Approximate estimates through 10/31/24

CryptoCasino.com is a leading GameFi project featuring an online and Telegram casino. Launched by a team of iGaming industry experts that turned RakeTheRake.com into the world's largest poker affiliate, the platform is designed to capture the next generation of online bettors. Learn more at token.cryptocasino.com

Become a Coinstack Sponsor

To reach our weekly audience of 280,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 US spot Bitcoin ETFs surpass Satoshi's estimated 1.1 million BTC holdings:The combined 12 U.S. spot Bitcoin exchange-traded funds have surpassed the 1.1 million estimated to be held by the cryptocurrency’s pseudonymous creator Satoshi Nakamoto for the first time.

📈 El Salvador’s Bitcoin gains top $300M — President: Salvadoran President Nayib Bukele highlighted the country’s unrealized gains from its Bitcoin investments on social media after the cryptocurrency surpassed $100,000 for the first time.

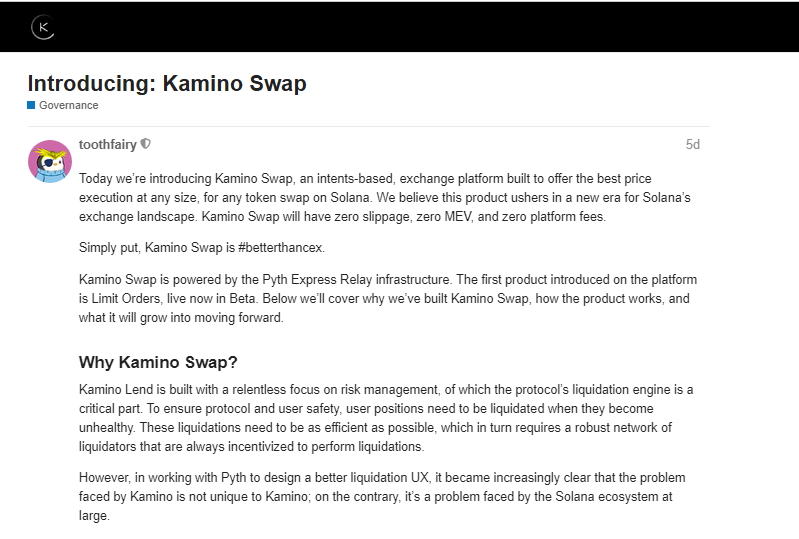

🚀 Solana's largest decentralized exchange unveils new swap feature, promises lowest prices for traders: Kamino, the largest decentralized exchange on Solana,is launching new swap feature, according to Kamino co-founder Marius Ciubotariu — who shared the news on stage at The Block’s Emergence conference in Prague on Thursday.

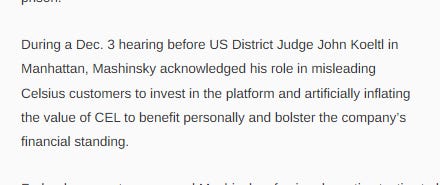

⚖️ Former Celsius CEO Alex Mashinsky pleads guilty, agrees to 30 years in prison:Alex Mashinsky, the former CEO of crypto lender Celsius, has pleaded guilty to two charges related to fraud and market manipulation, agreeing to a sentencing guideline of 30 years in prison.

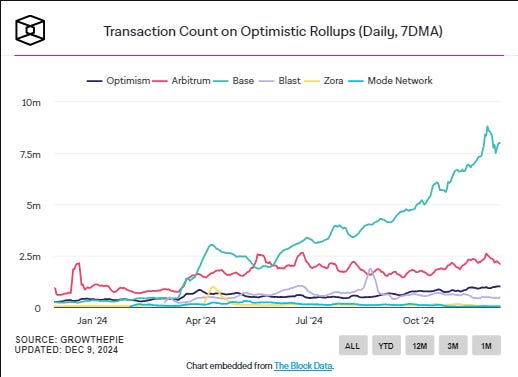

📈 Base reaches another all-time high with 8.8 million daily transactions on its network: Base has reached another all-time high with 8.8 million daily transactions on its network, leading the optimistic rollup ecosystem while maintaining strong growth metrics across multiple indicators.

💬 Tweet of the Week

Source: @BritishHodl

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. More than $1.7B in liquidations today, by far the most all year, with a staggering $1.55B in long positions liquidated.

Interestingly, ETH liquidations outpaced BTC, $240M to $178M.

XRP and SOL also suffered some of their worst daily levels of liquidations, with $67M and $60M, respectively.

Source: @DavidShuttleworth

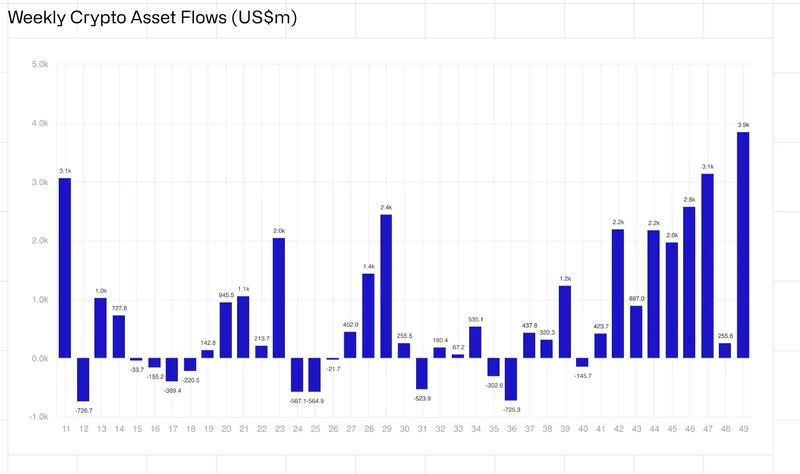

2. As Bitcoin reached its $100K milestone last week, institutional inflows into digital assets surged to record levels, with more than $3.85B pouring into the space. Interestingly, however, ETH benefitted greatly from this and had $1.16B of net inflows, by far its most weekly volume ever. This represents 35% of all ETH inflows throughout the entire year and pushes the YTD total to $3.36B.

Meanwhile, BTC had $2.54B of inflows on the week and now stands at $36.4B YTD. XRP also had another relatively strong performance with $134M of inflows.

Source: @DavidShuttleworth

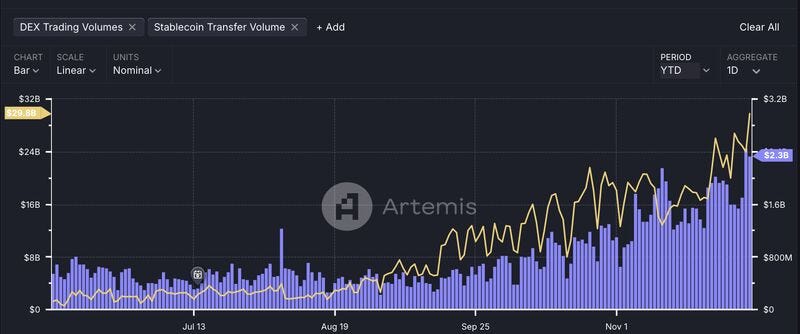

3. Meaningful user activity on Base is marching towards new record levels. The network recently handled over $2.5B in daily DEX volume along with $29.8B in daily stablecoin transfer volume. This represents an increase of 150% and 60%, respectively, month-over-month. Moreover, TVL on the network now stands a $4.97B, an increase of 67% ($2B) on the month.

Source: @DavidShuttleworth

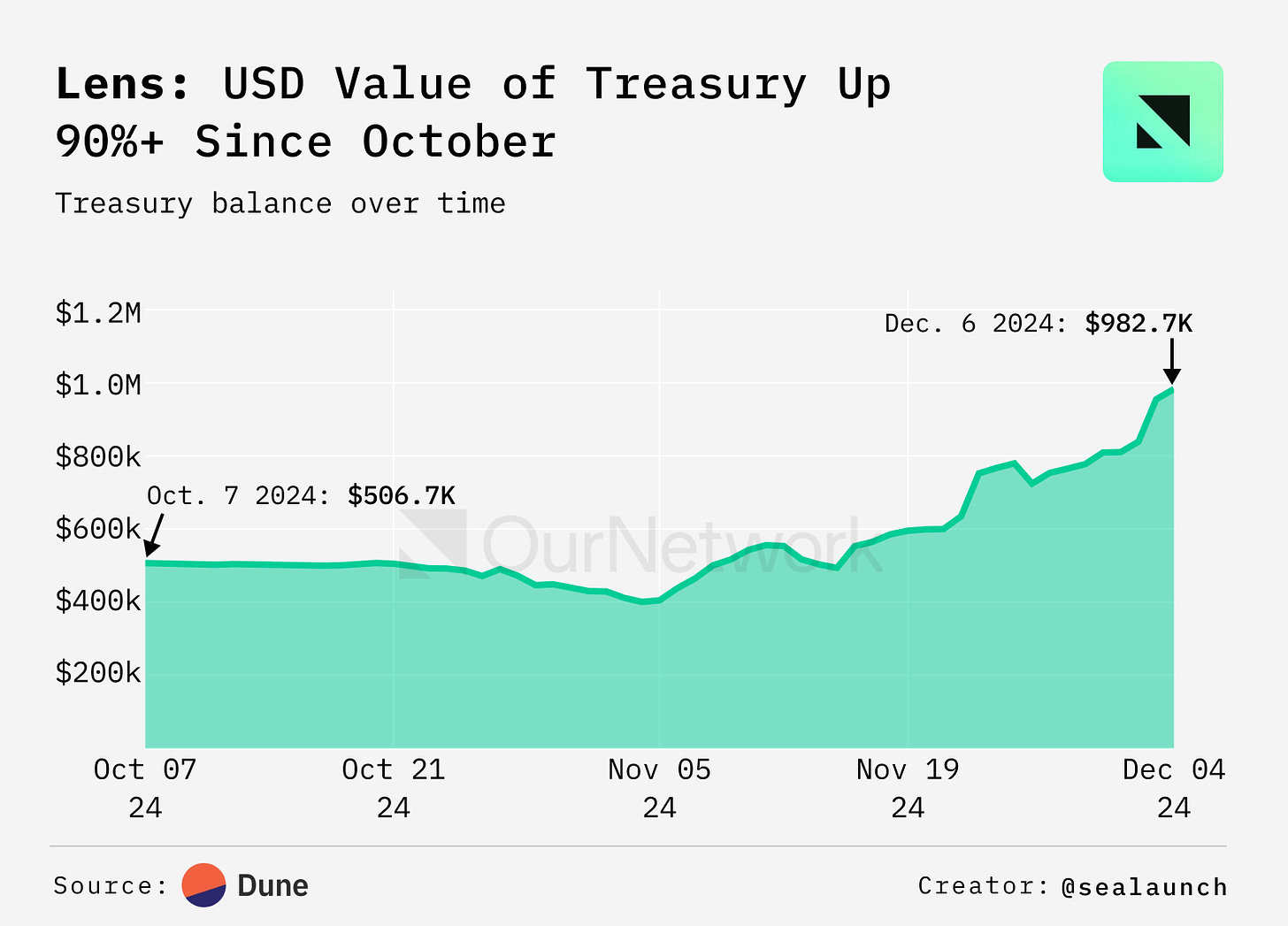

4. Lens' Treasury Passes $980K as Social Protocol Gears Up for V3

Source: @OurNetwork

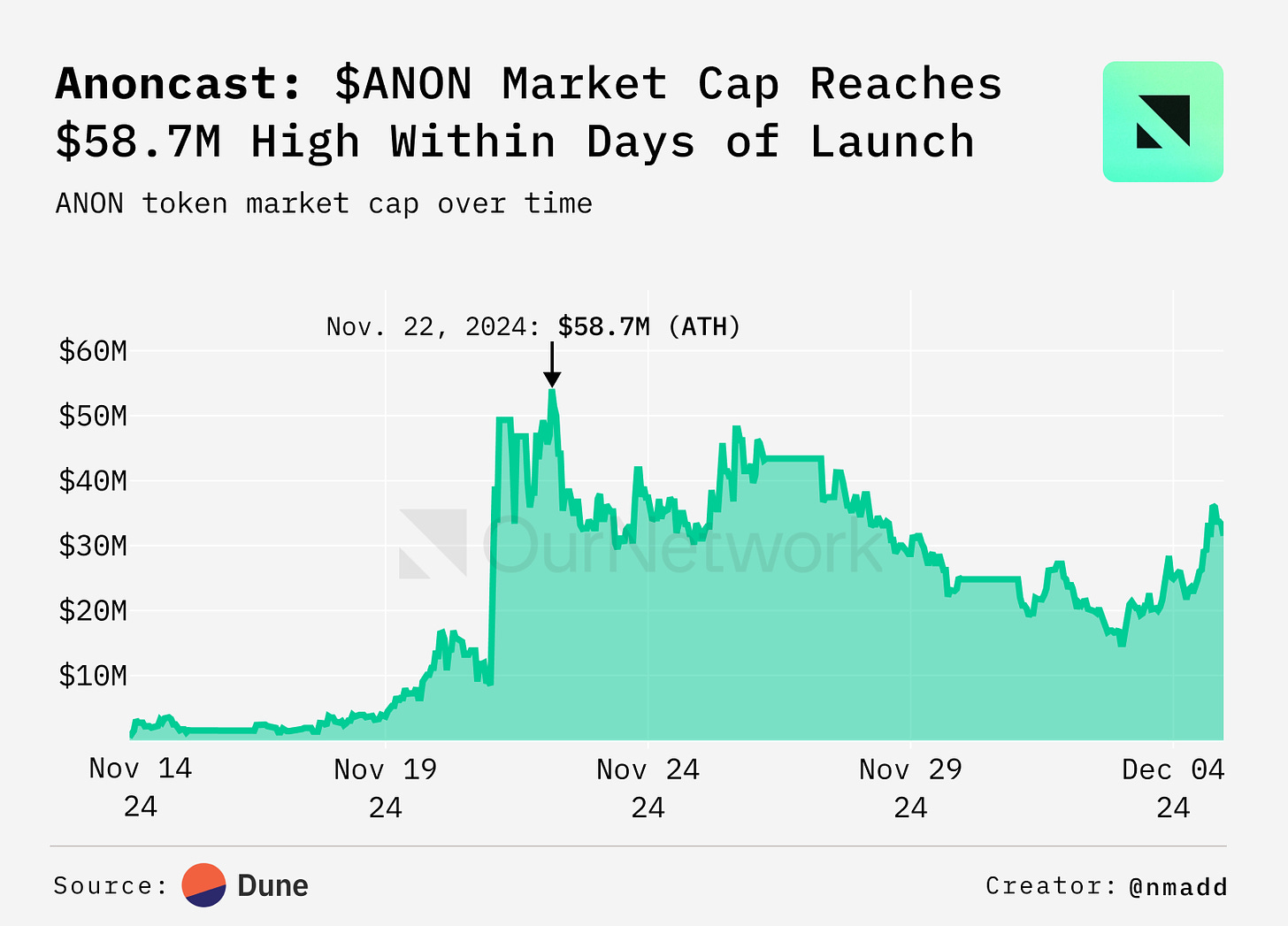

5. Anonymously Launched $ANON Token is Now Trading at ~$31M Fully Diluted Value After Reaching $60M Peak on Nov. 22 After Vitalik Purchase

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Authors: Ryan Barney, Mason Nystrom, are Partners at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

Stablecoins are a trillion dollar opportunity.

That is not hyperbole.

While crypto is often thought of for its volatility, tokens, and liquidity-profile, the other side of the crypto barbell that more silently carries the banner for crypto adoption is stablecoins. For folks that are new here, these are cryptodollars that are pegged 1:1 with their underlying fiat using either algorithms (less popular) or reserves (more popular) to maintain the peg.

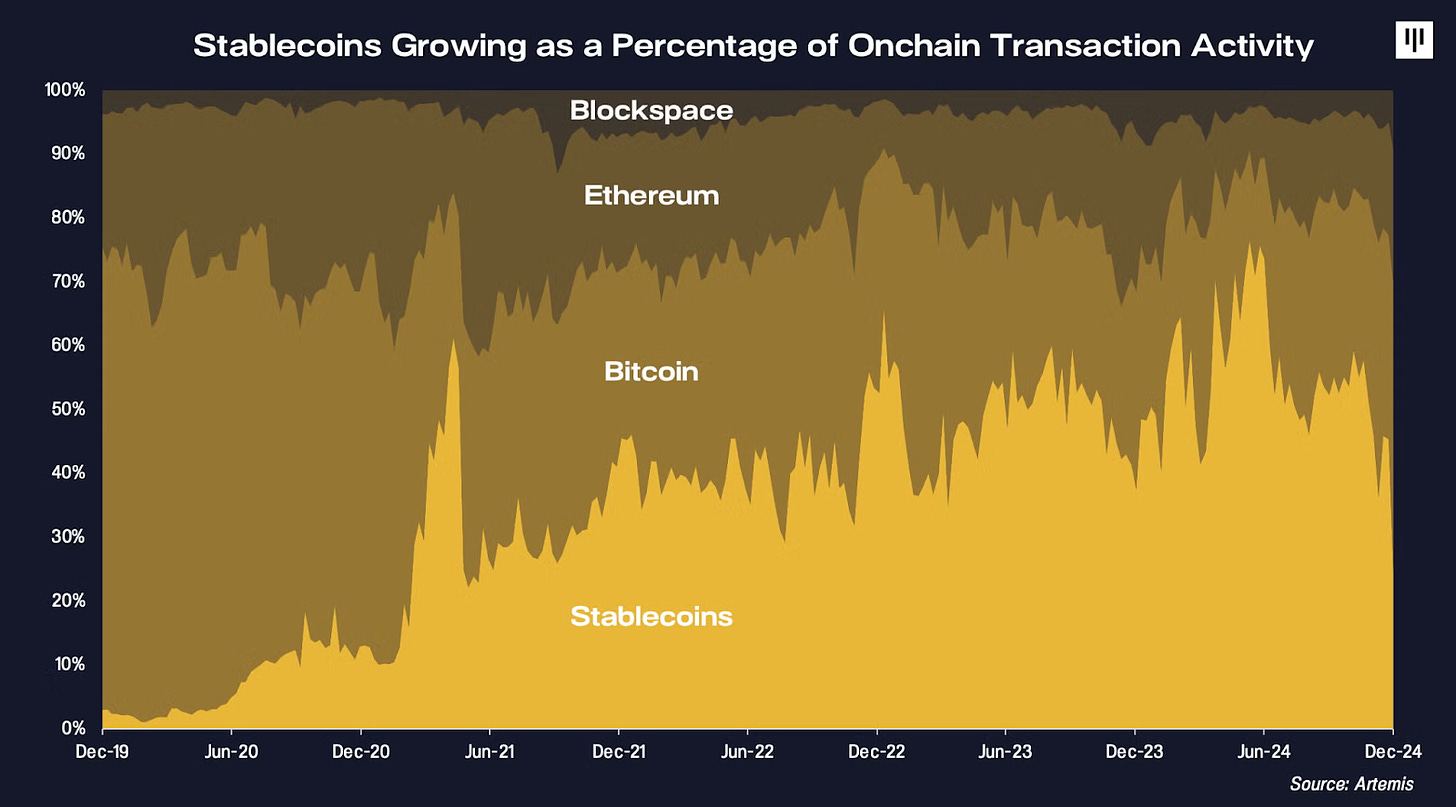

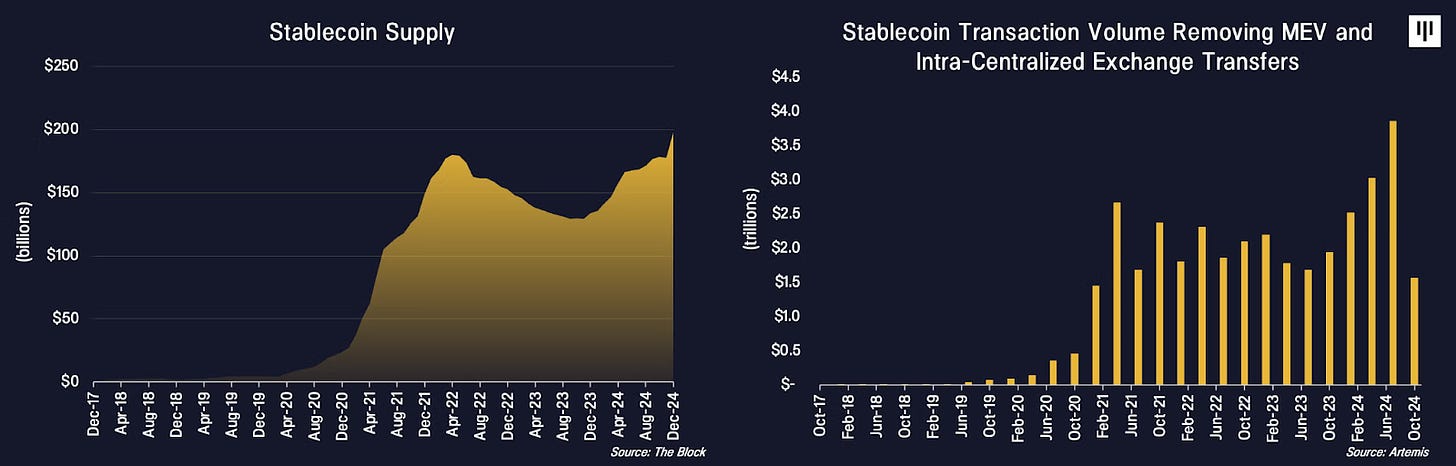

Stablecoins have gone from 3% of blockchain transactions in 2020 to now consistently representing over 50% of blockchain transactions. Stablecoins are crypto’s killer value proposition and unlike a lot of crypto are non-speculative in nature.

In a short period of time, stablecoins have showcased their ability to be one of the transformative innovations within crypto. And 2024 has been a breakout moment for stablecoins, transacting over ~$5 trillion in adjusted volume, over $1 billion transactions, across nearly 200 million accounts.

Stablecoins witnessed impressive growth during crypto’s last bull cycle, but this time around, stablecoins are being used beyond the DeFi ecosystem. Over the past few years, stablecoins have demonstrated the core value proposition – seamless cross-border payments, initially through access to U.S. dollars. Correspondingly, the geographies that see the greatest stablecoin growth are in emerging market corridors where access to dollars is in high demand.

Stablecoins offer a 10x value proposition to the traditional payment rails across both B2C payments (e.g. remittances) as well as in B2B cross-border transactions.

Cryptocurrencies have long promised a solution for the trillion dollar cross-border payment market. In 2024 there will be ~$40 trillion cross-border B2B payments made via traditional payment rails (excluding wholesale B2B payments) (Juniper Research). Within the consumer payment market, global remittances account for hundreds of billions in annual revenues. And now, stablecoins offer the means by which to make global, cross-border remittance payments on crypto rails a reality.

Amidst this more rapid adoption of stablecoins among both B2C and B2B payments, the supply of stablecoins onchain and transaction volume are reaching all-time highs.

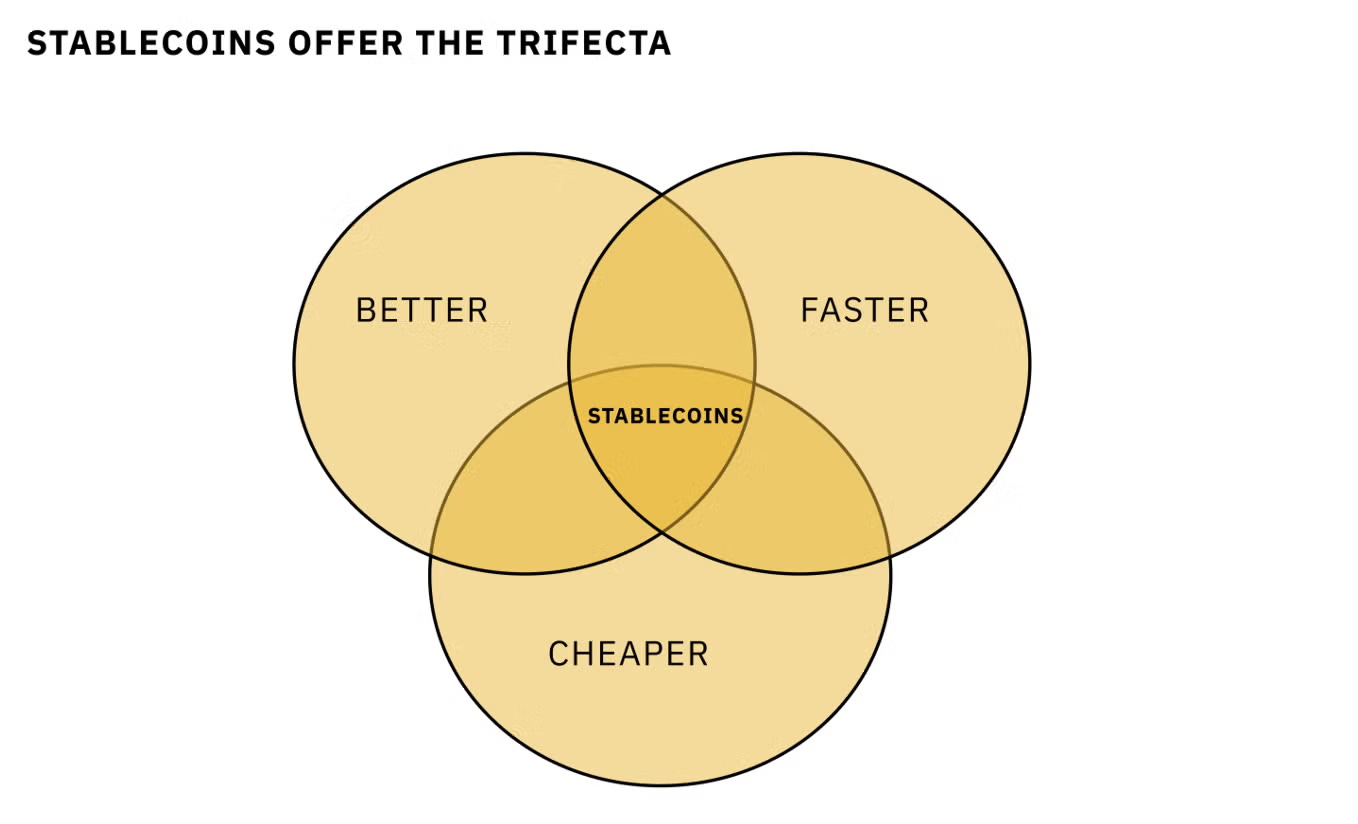

The Trifecta: Better. Faster. Cheaper.

There’s an old adage in business – It’s rare that a product comes along and is able to offer something that is better, faster, and cheaper. Oftentimes, the product can be two of those things, but not all three. Stablecoins offer a better, faster, and cheaper way to move money around the world.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.amphibiancapital.com and www.token.cryptocasino.com