Learn More at www.rootstock.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 315k weekly subscribers. This week, a US Crypto Reserve was announced, the SEC ended Kraken investigation, the SEC also dropped the case against MetaMask and big venture news for Ethena ($100M) and Mansa ($10M).

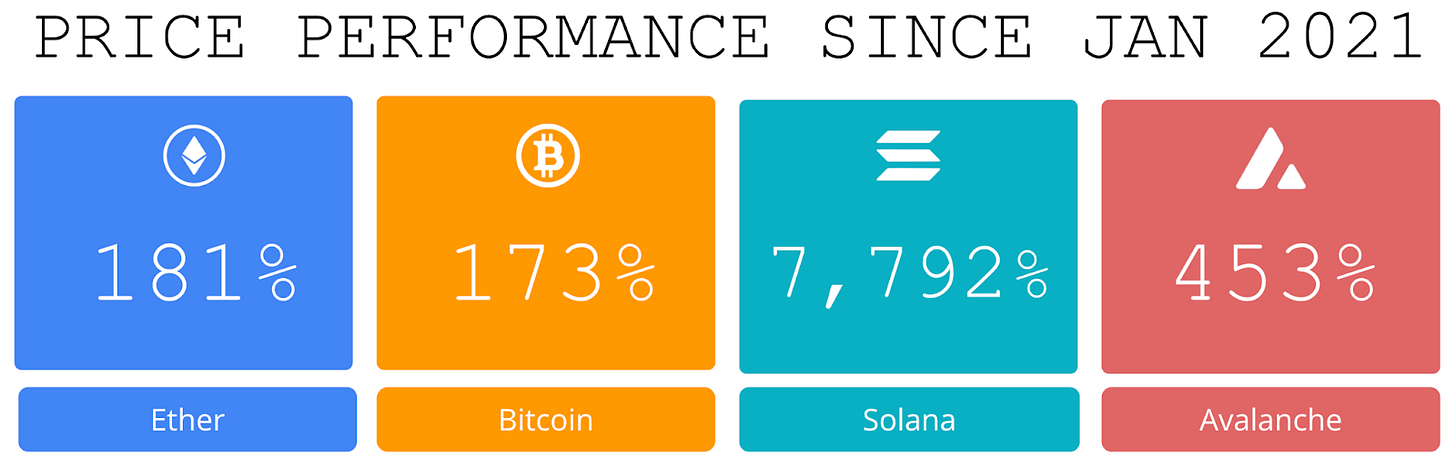

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 315,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ 'Trump floats US ‘Crypto Reserve’ Proposal, cites BTC, ETH, XRP,SOL,ADA: In a surprising turn of events, a tweet from U.S. President Donald J. Trump has emerged suggesting the creation of a “U.S. Crypto Reserve” that would include several prominent assets such as Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA).

⚖️ SEC agrees to drop case against crypto exchange Kraken, firm says:The staff of the U.S. Securities and Exchange Commission agreed in principle to drop its lawsuit against the crypto exchange Kraken. The agreement to dismiss the lawsuit comes without admission of wrongdoing, penalties paid or alterations to Kraken's business model, the company wrote in a Monday release.

⚖️ SEC will drop case against MetaMask, says Consensys founder Lubin: Consensys and the U.S. Securities and Exchange Commission have agreed 'in principle' to end the case against MetaMask, the company's founder Joseph Lubin said Thursday.

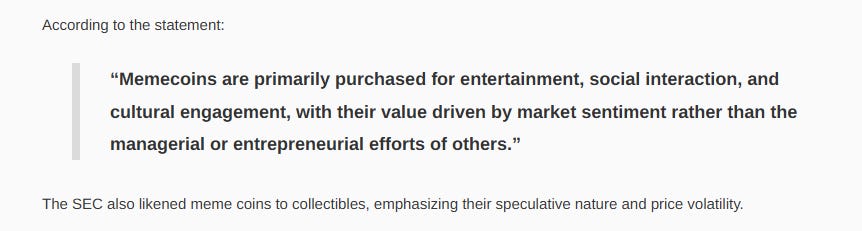

⚖️ SEC declares memecoins are not securities in landmark staff statement: The US Securities and Exchange Commission’s (SEC) Division of Corporation Finance clarified that memecoins do not constitute securities under federal law, marking a notable stance on a sector of the crypto market often fueled by speculation and internet culture.

🚀 MetaMask wallet to add support for Solana and Bitcoin: MetaMask will add support for Bitcoin and Solana this year as part of its near-term product developments to improve its user experience.The addition will give wallet users access to the two highly popular crypto ecosystems without having to use other crypto wallets or wrapped tokens.

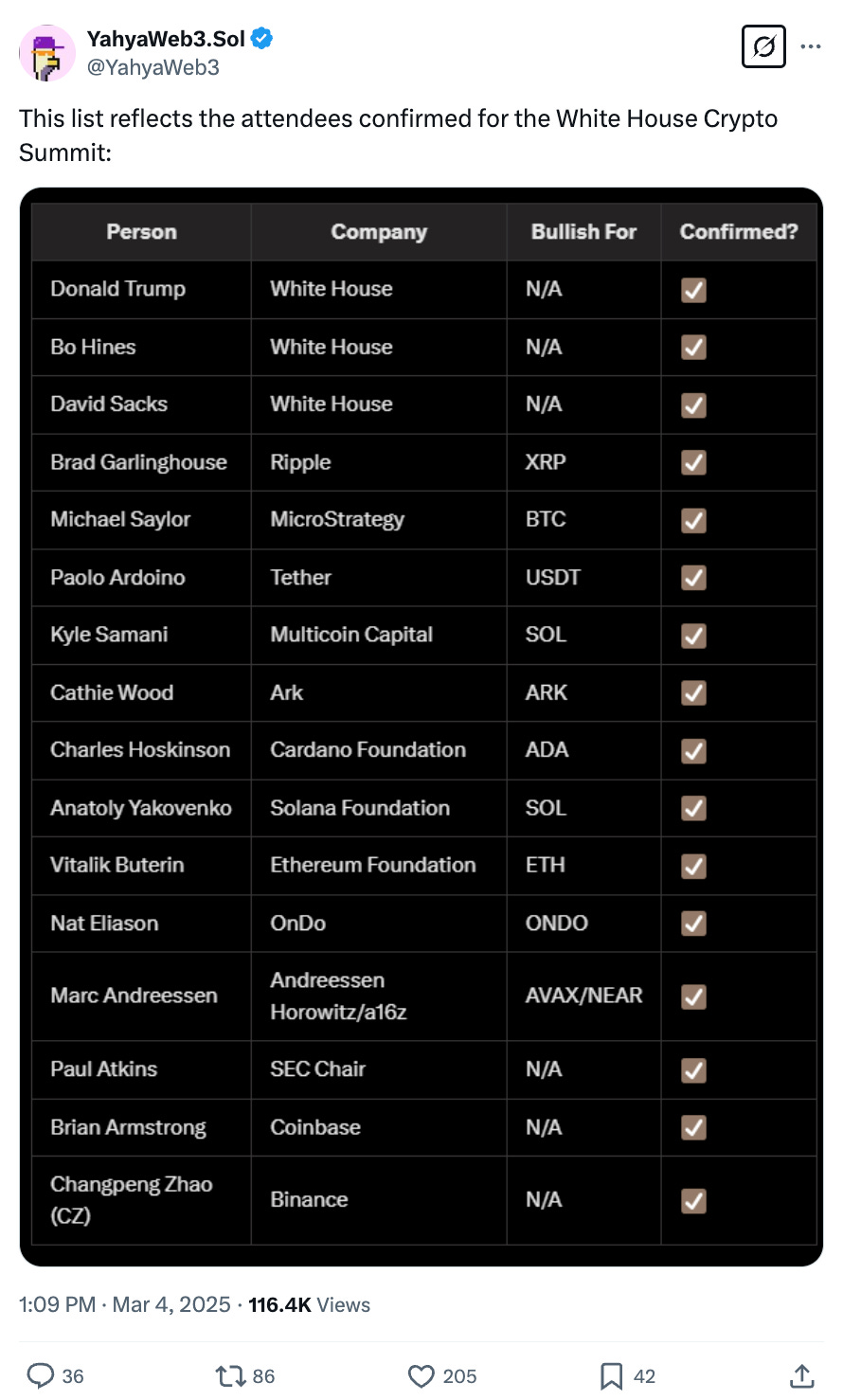

💬 Tweet of the Week

Source: @YahyaWeb3

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

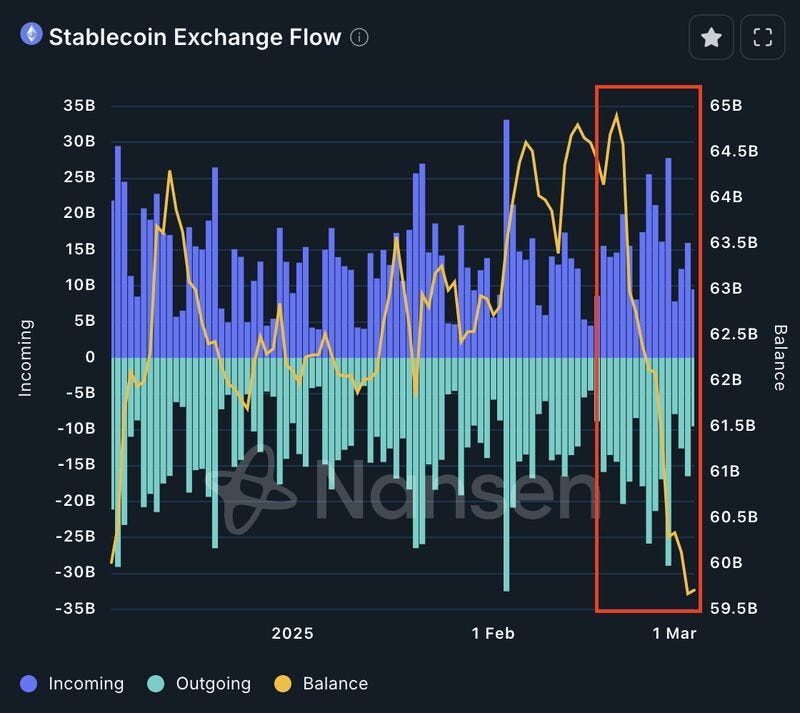

1. State of the current market: Ethereum-based stablecoin liquidity on exchanges surged to historic levels in February ($65B), but has quickly declined by $5.2B (8%) over the last two weeks. Absolutely brutal reversals, liquidations, and general exhaustion.

Source: @DavidShuttleworth

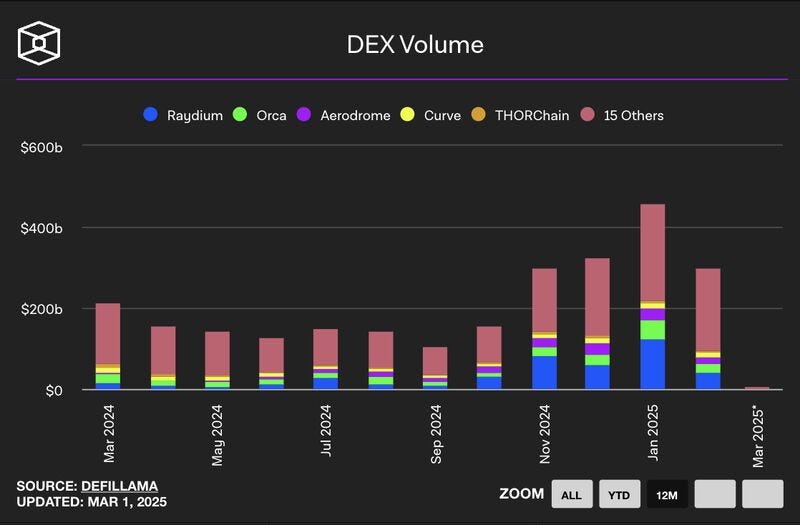

2. After 5 consecutive periods of growth, monthly DEX volume declined by $160B (30%) in February. Much of this was driven by Raydium, which saw a 66% ($82B) drawdown, while Uniswap volume declined by 22% ($22B).

Nevertheless, February finished as the 4th best month for DEXs ever. Moreover, DEX to CEX spot volume reached its second highest level ever (18%).

Source: @DavidShuttleworth

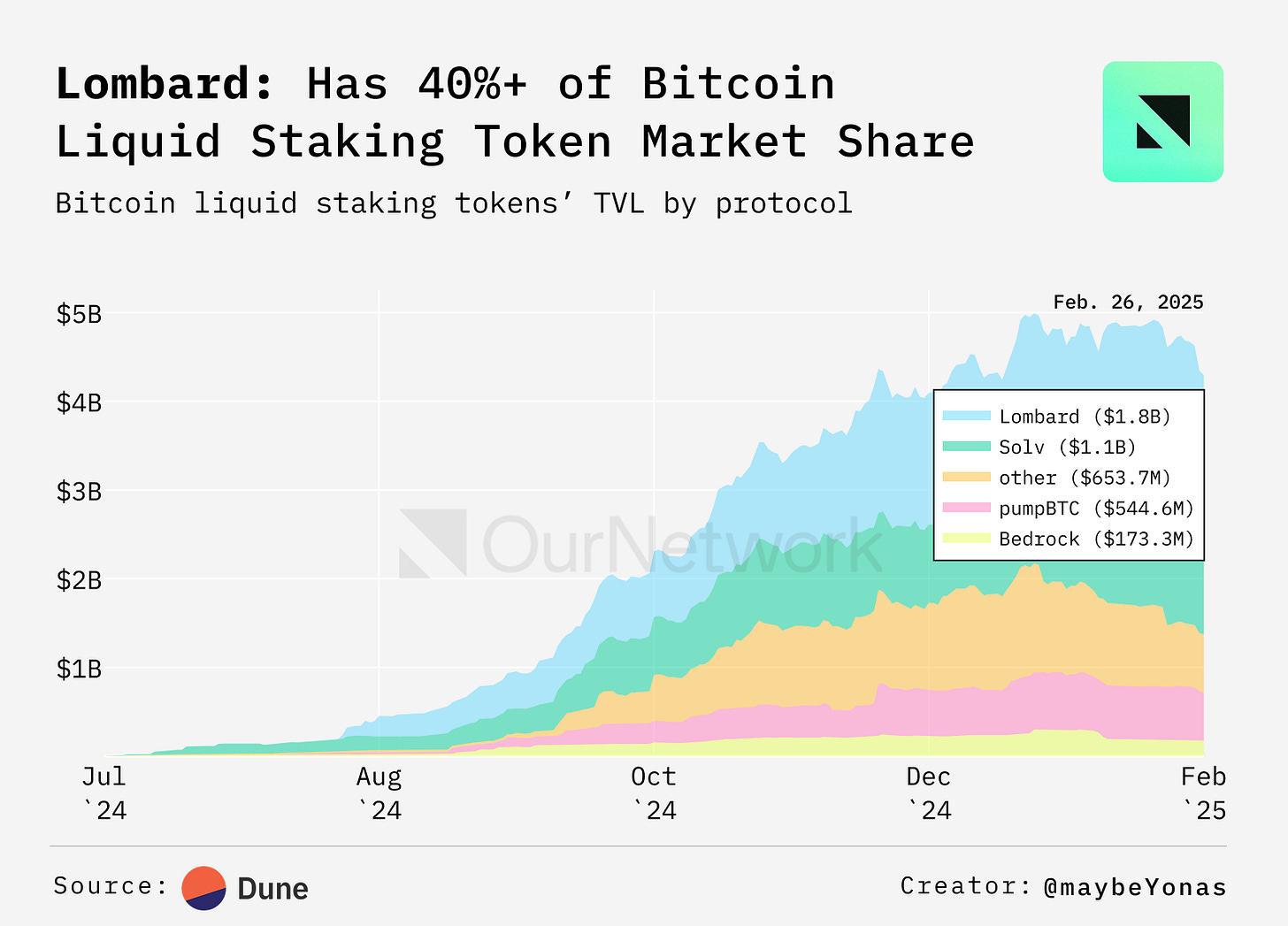

3. The Adoption of LBTC is on the Rise as 62% of the Token Supply — $1.2B — is Being Used in DeFi.

Source: @OurNetwork

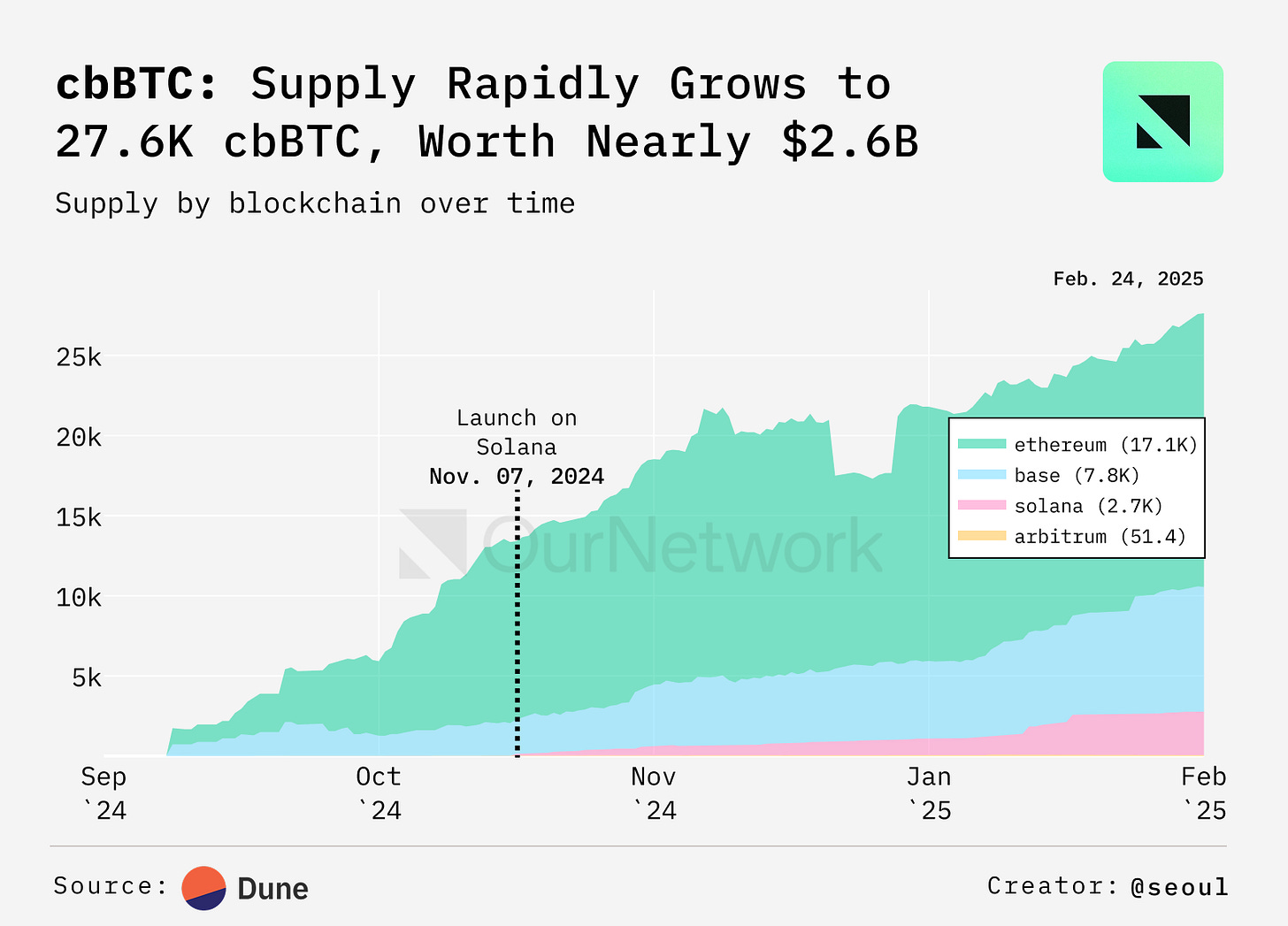

4. cbBTC Continues to expand its presence with 28k cbBTC Circulating Across Four Chains

Source: @OurNetwork

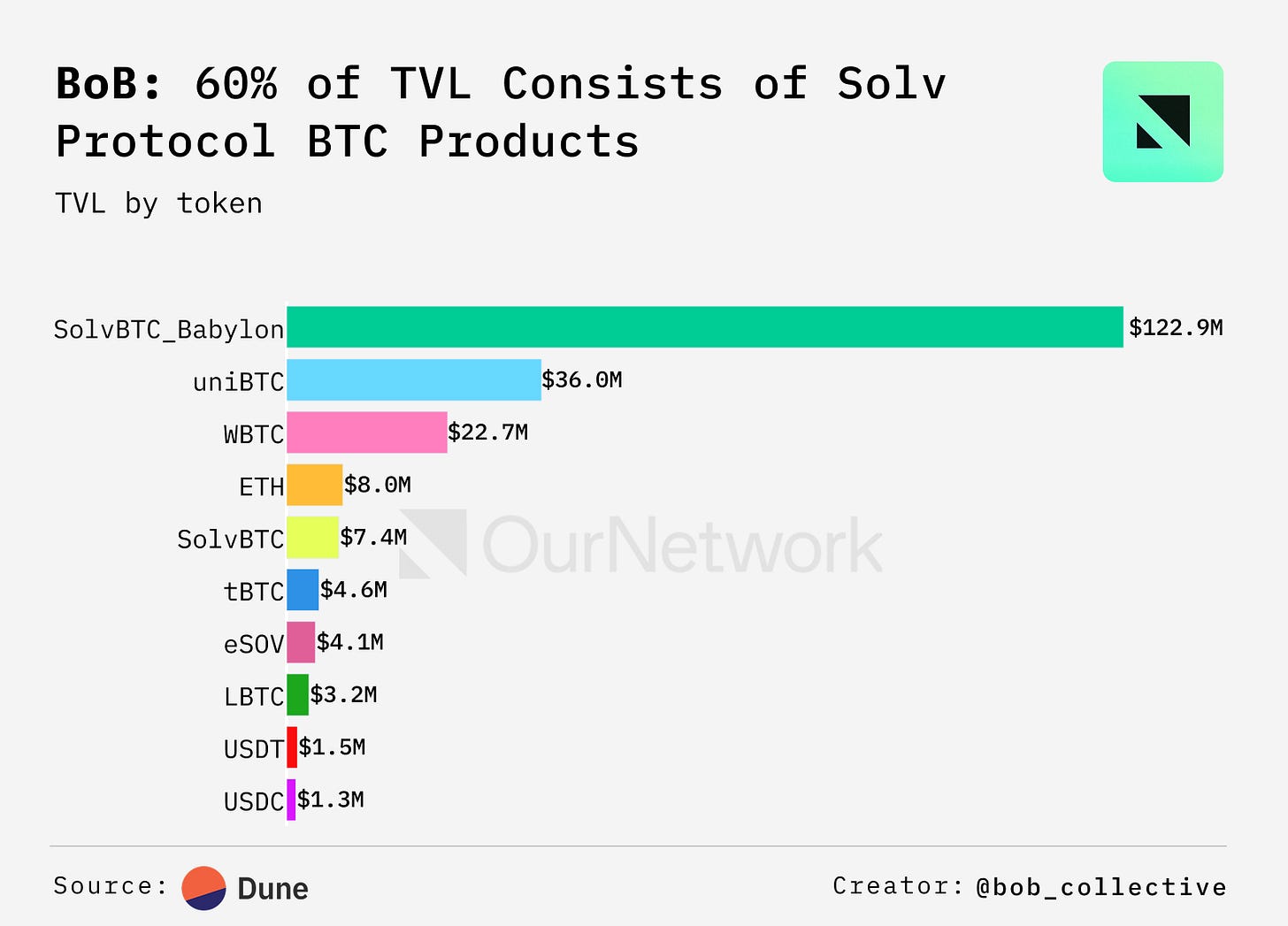

5. Despite Market Volatility and Downward Momentum, BoB's Onchain Activity Remains Steadfast, with the Protocol's TVL Putting it Among the Top 10 L2s

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

This past week, I was in Hong Kong and Singapore meetings with institutional investors, founders as well as attending events like a Trade Mission to Hong Kong, Consensus Hong Kong, and a panel with Amber Group on Web3 AI. Pantera is actively investing in APAC companies as well as scoping out interest in Fund V (venture-style fund investing in venture equity, private tokens, special opportunities, and liquid tokens) to launch June 30, 2025. It was a jam-packed week with lots to reflect on. Let’s get into it!

A highlight was attending part of the Trade Mission to Hong Kong, going to the “U.S. Consulate sponsored LP-GP Networking Reception”. Top family offices and institutional LPs were present, as well as GPs. The US Consulate hosted an excellent event bringing together a diverse group of people interested in investing in US businesses and funds.

Photo: At the Trade Mission to Hong Kong

Compared to previous years, I've seen a huge shift in institutional investor's interest in crypto. Their industry knowledge has deepened and their interest spans far beyond Bitcoin investments.

Topics of Interest

Stablecoins and DePin:

Stablecoins are a trillion dollar opportunity and appeal is just as high in Asia. Stablecoins are tangible and understandable to many with the idea that issuing stablecoins allows for issuers to collect yield. There was less excitement with tokenized stocks and equities, but there was huge interest in asking the investible parts of the stack. Pantera has invested in stablecoin projects like Ondo and Eco.

Especially now that institutions like Bank of America are preparing to launch its own dollar-backed stablecoin if U.S. Congress legalizes it. Stablecoins already process over $33 trillion in transactions annually—surpassing the combined volumes of Visa and Mastercard.

Limited partners (LPs) are particularly curious about how Pantera can replicate the growth we’ve unlocked in the U.S. market across Asia. With our extensive network, expertise, and resources in supporting and investing in stablecoin companies, we can drive success for those launching products in the Asian market.

The DePin (Decentralized Physical Infrastructure Networks) market is still nascent and grows step-wise with each new company. Behind closed doors, there was plenty of discussion about its potential.

I went over trends, use cases and success stories including our portfolio companies Geodnet and Hivemapper, to demonstrate the opportunities.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.crowdcreate.us