Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com, www.hypelab.com, and www.alchemy.family

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week the Ethereum Name Service integrates with PayPal and Venmo, Coinbase secures partial victory over SEC, Uniswap Labs settles with the US CFTC for $175,000, and big new venture rounds come in for Safe Superintelligence ($1B) and WSPN ($30M).

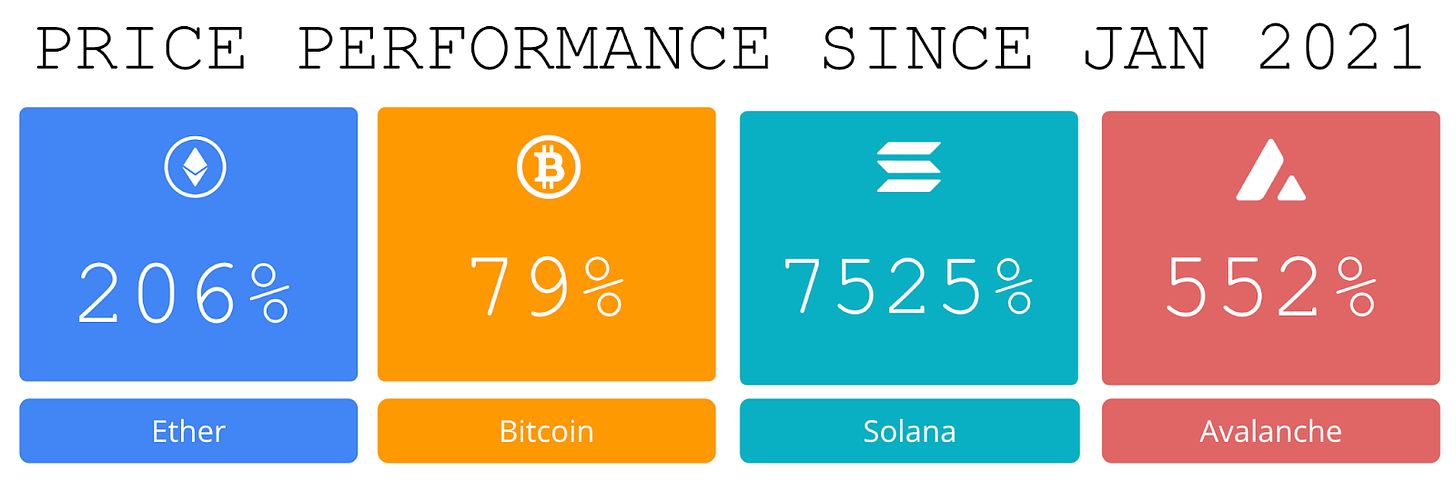

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

The Alchemy Family is an exclusive, invitation-only club for elite leaders in algorithmic trading. With only 165 lifetime members, it offers unparalleled networking, insights, and transformative experiences. Members enjoy access to Magnum Opus, a luxurious retreat in the Seychelles from November 2-6, 2024, featuring thought leadership, wellness, and immersive discussions that shape the future of finance and technology. Apply to join

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

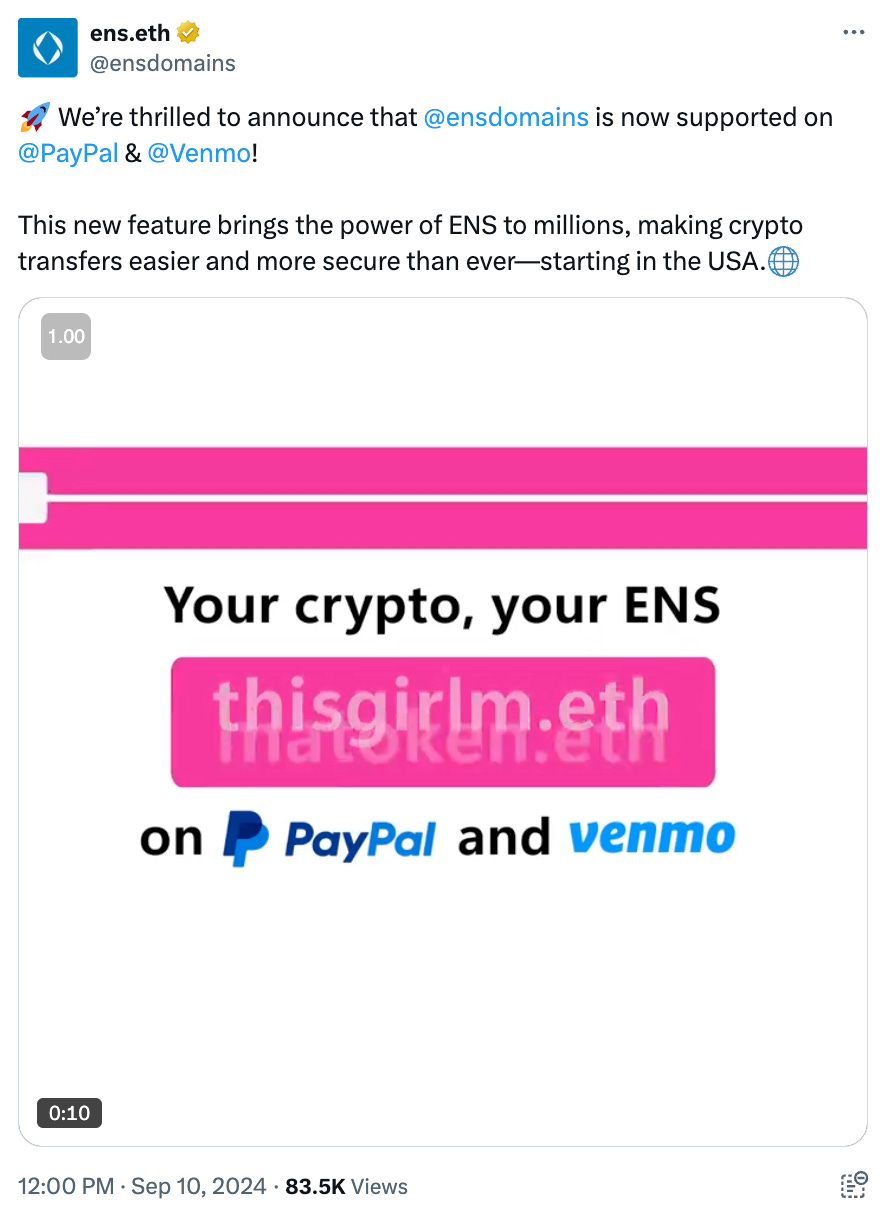

⚖️ Ethereum Name Service integrated with PayPal, Venmo for crypto transfers: The integration allows Venmo and PayPal users to transfer cryptocurrency using simple ENS names, replacing long wallet addresses.

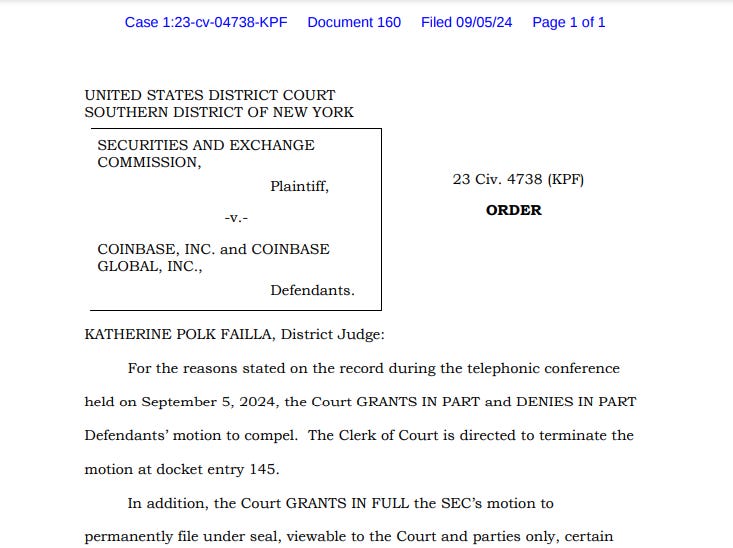

⚖️ Coinbase secures partial victory over SEC in motion to compel discovery: After a victory in federal court, lawyers for cryptocurrency exchange Coinbase may soon have access to United States Securities and Exchange Commission documents related to the regulator’s application of tokens as securities.

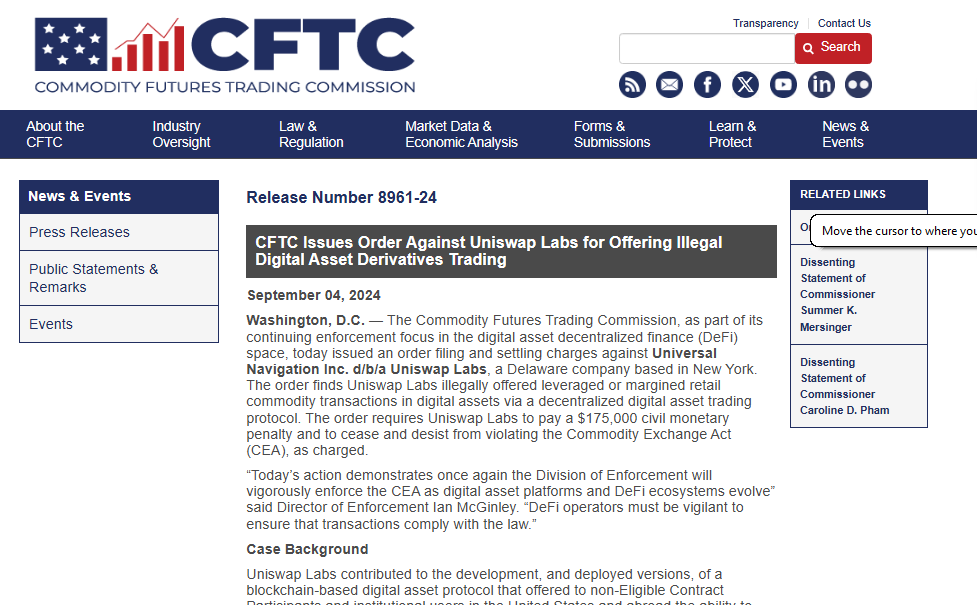

⚖️ Uniswap Labs settles with the US CFTC for $175,000 on charges related to derivatives trading: The U.S. Commodity Futures Trading Commission filed and settled charges against Uniswap Labs for $175,000 in connection to the firm's offering of "illegal digital asset derivatives trading."

🚀 Unstoppable Domains is expanding onto Ethereum Layer 2 Base:Unstoppable Domains, the blockchain-based platform that enables users to create human-readable names (rather than alphanumeric gibberish) for their crypto wallets using NFTs, is expanding onto the Ethereum Layer 2 Base built by Coinbase. This marks an expansion beyond Unstoppable Domains’ existing infrastructure on popular L2 Polygon and the Ethereum mainnet.

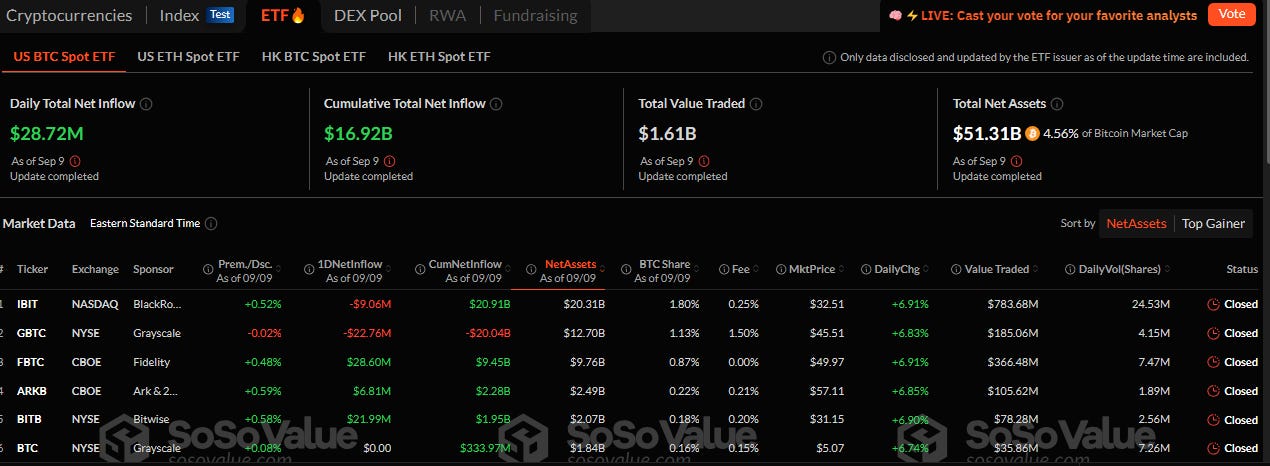

⚖️ US spot bitcoin ETFs return to positive flows, adding $28 million: Spot bitcoin exchange-traded funds in the U.S. ended their eight-day streak of negative flows on Monday, reporting $28.72 million in net inflows.

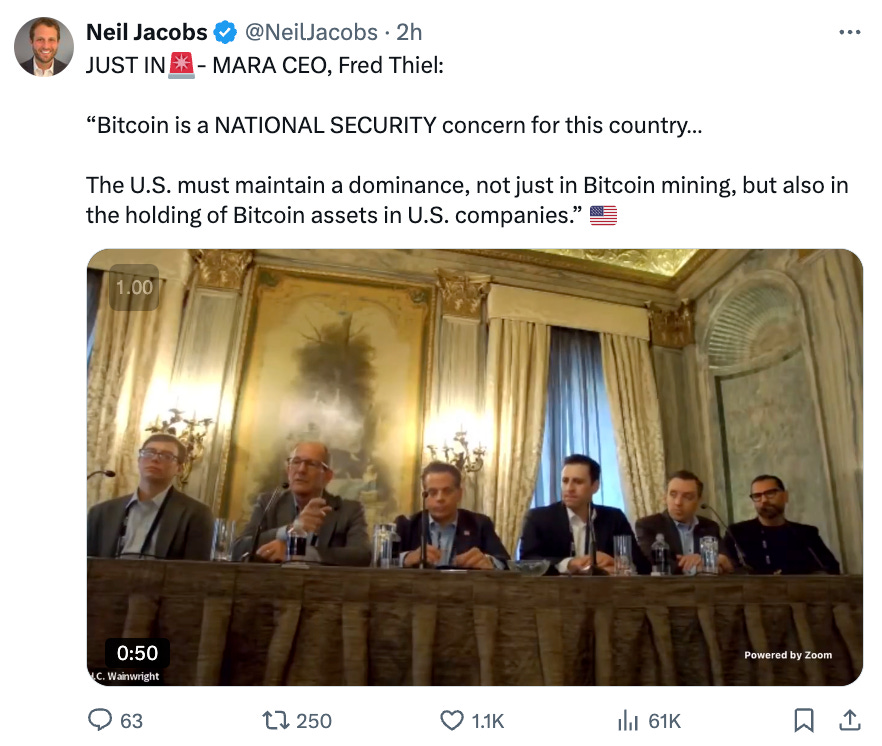

💬 Tweet of the Week

Source: @NeilJacobs

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

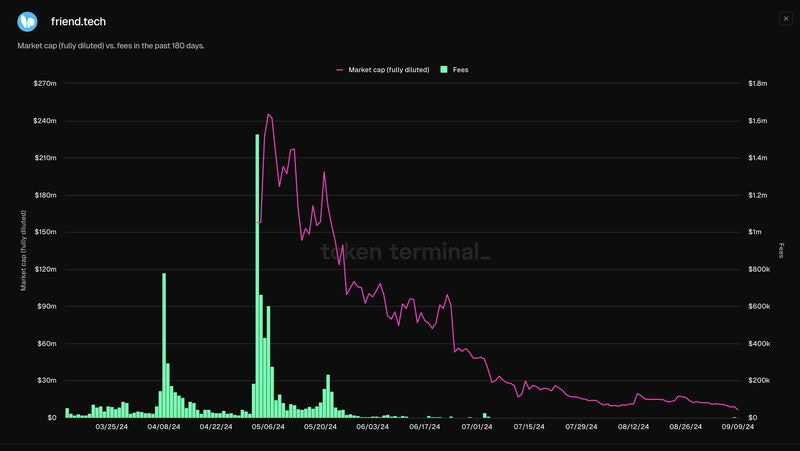

1. This week Friend.Tech is dead. Absolutely amazing activity, generating over $1.5M in daily fees with 37,000 users during its token launch in May, pushing its marketcap to $245M, and then quickly fading into oblivion. Overall, the protocol was able to collect $65M in fees from its users and closes down with $32M in revenue generated from onchain activity. Be careful to not get "nerd sniped" by the wrong thing and not to get punished by your favorite "CT KOL."

Source: @DavidShuttleworth

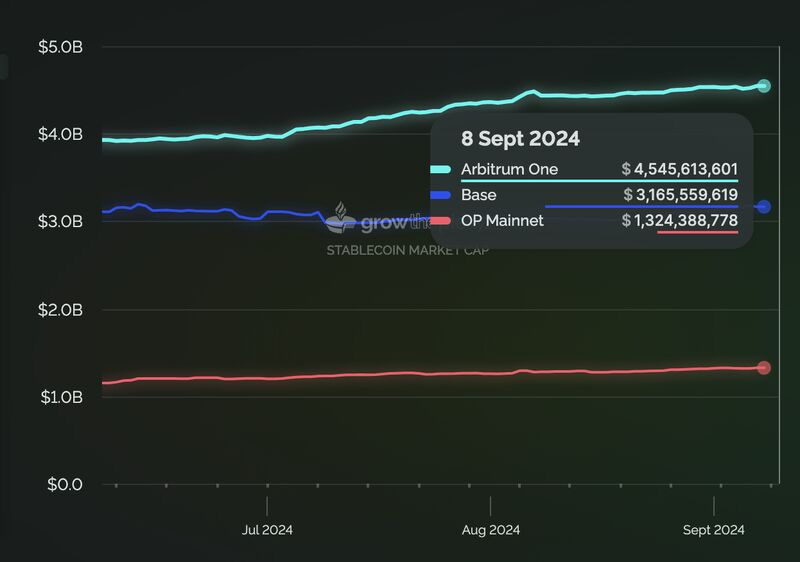

2. Markets continue to bleed, but Ethereum Layer 2s continue to gain more liquidity. Over the past month, $287M worth of stablecoins entered the L2 ecosystem. Coinbase Base led the way with $132M followed by Arbitrum ($112M) and Optimism ($43M).

Source: @DavidShuttleworth

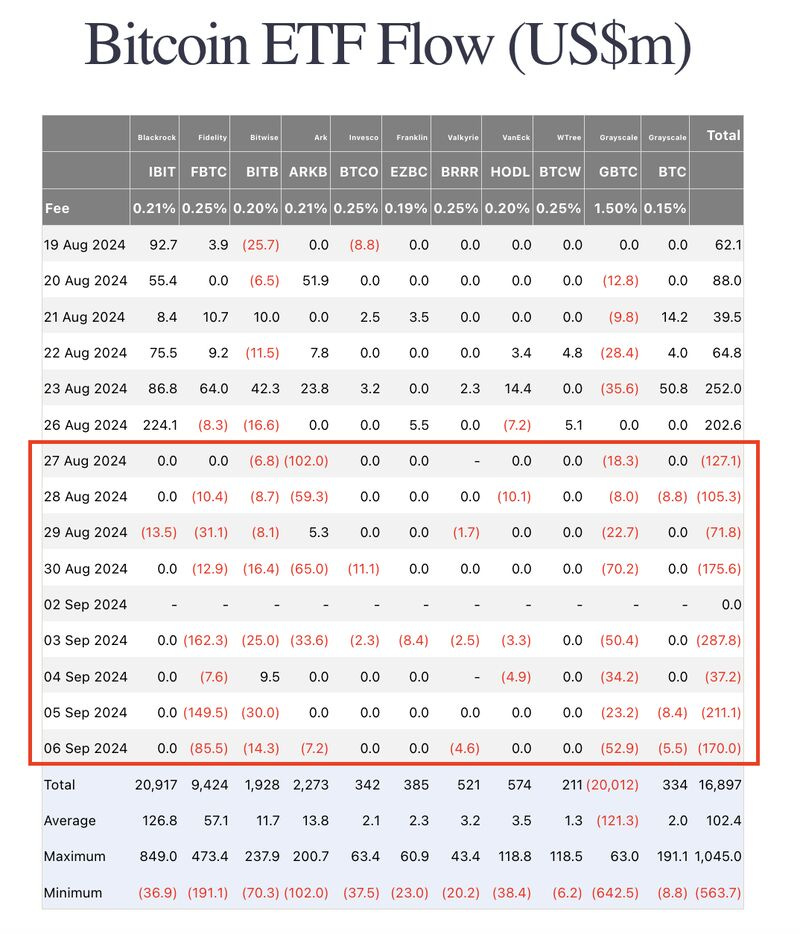

3. We closed out the week with 8 consecutive days of BTC ETF sell side pressure, pushing total net outflows to $1.19B during this time. ETH ETFs faced similar activity, with $90M of outflows.

Source: @DavidShuttleworth

Source: @OurNetwork

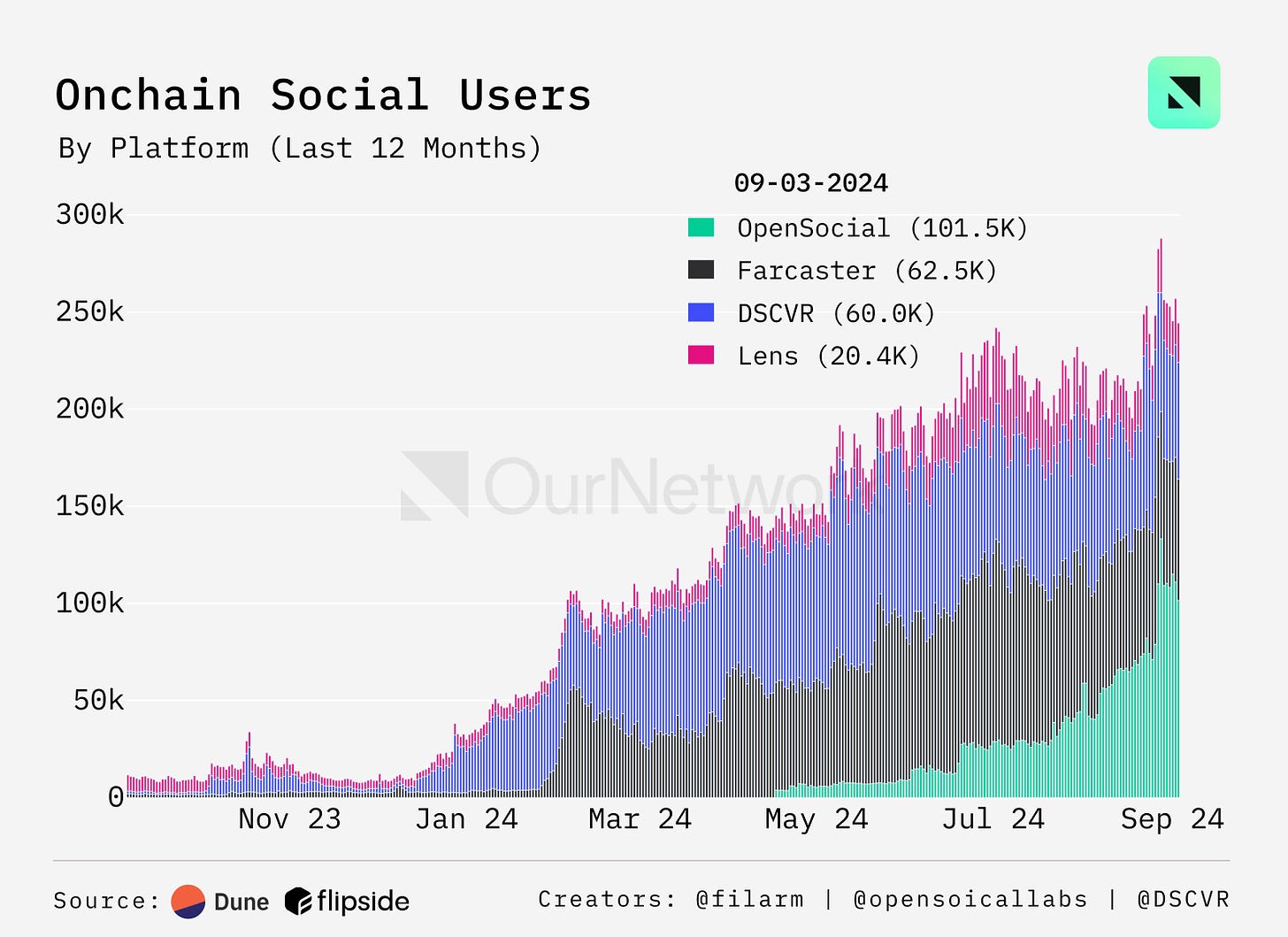

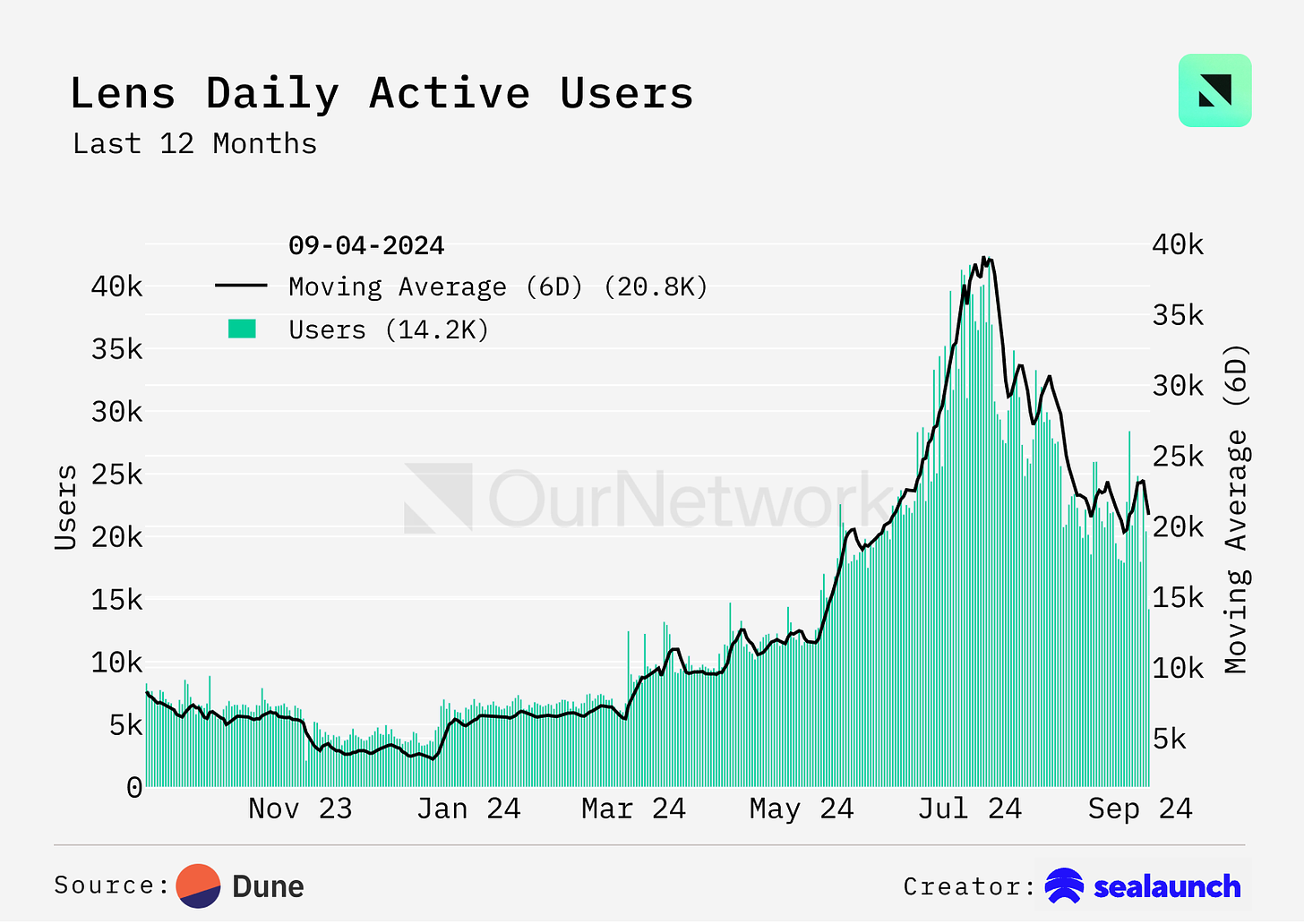

5. Lens has 20k Daily Active Users, Down -50% from All-Times-Highs, Users Generating ~65k Daily Posts

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

Time is the most important factor in any market. It’s how we have managed to cut through all the noise and call almost every major high and low over the last two years. This week will be no different. With everyone’s eyes on CPI this week we are strictly focusing on what will be the biggest time confluence since the August panic.

I’ll let everyone else guess and try to make sense of meaningless economic data while we focus on what time is telling us. And, once again, it is telling us we are at an inflection point while sentiment is reaching an extreme.

I know it may seem like every other week is a significant week but thats only if you are caught in the emotional trap of all the other market participants. We have maintained a consistent message that the August low was THE low to buy and any subsequent time factor would be a higher low.

I maintain that same stance even though the market is flirting with the lows here I do not believe they will be taken out. However, in reality it feels like we are at a lower low due to sentiment but if you follow us on X then you will know I talked about this psychology several weeks back.

This is something I have observed over the years and it’s very true today. The BTC fear and greed index is in fact lower than it was on August 5th and overall we are in full blown November 2022 sentiment or worse.

Just check out what the below graphic is telling us about fund flows.

Crypto funds saw nearly $600 million in outflows last week, the 2nd largest on record. This was only below the 2022 levels when crypto experienced a severe bear market. Yet, the high time frame structure of this market remains very much bullish. Remember, the mob CAN’T be right. It’s simply not how markets work. The majority will always be wrong.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com, www.hypelab.com, and www.alchemy.family