Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Vitalik Buterin unveiled Kohaku, a new privacy-focused framework for Ethereum, Aave Labs announced plans for a high-yield savings app offering insurance-backed protection up to $1 million, and Canary’s spot XRP ETF debuted with $58 million in first-day trading—surpassing Bitwise’s SOL ETF launch total. Meanwhile, OKX expanded in-wallet DEX trading across Base, Solana, and X Layer, and the Czech central bank purchased bitcoin for the first time as part of its digital asset test portfolio. On the fundraising front, Acurast raised $11M for its decentralized verifiable compute network and Kyuzo’s Friends raised $11M for its AI-enhanced Web3 social game built around the DNAxCAT IP.

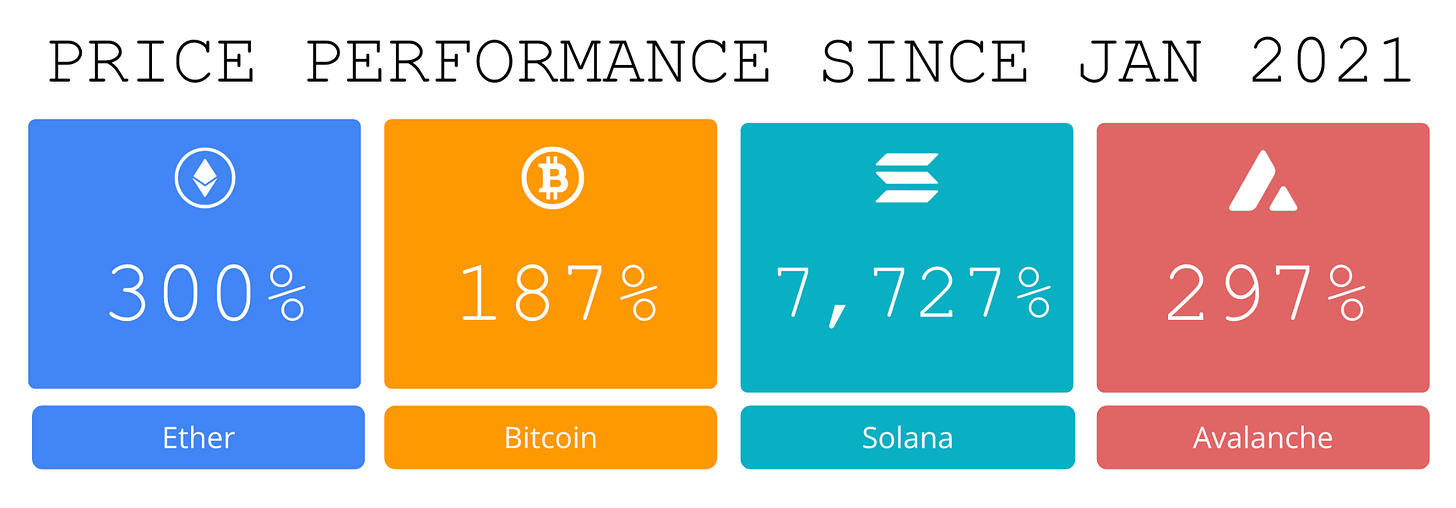

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world’s leading hedge funds. *+20.4% net 2024 approx with their USD fund, *+14.1% net BTC on BTC in 2024 (*+152% in USD terms), and *+17.3% net ETH on ETH in 2024 (*+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Register for their November performance & 2025 outlook webinar below:

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Vitalik Buterin unveils Kohaku, a privacy-focused framework for Ethereum: On stage at Devcon, Ethereum founder Vitalik Buterin gave a live look at Kohaku, a suite of privacy-preserving crypto tools to enhance privacy and security in the Ethereum ecosystem.

🥹 Aave Labs to launch high-yield savings app with ‘insurance-backed protection’ for deposits up to $1 million: Aave Labs is launching a new savings app that’s designed to go toe-to-toe with traditional banks and higher-yield fintech options. The platform will offer interest rates of up to 9% and “insurance-backed protection” on deposits up to $1 million, according to its website.

🔥 Canary’s spot XRP ETF generates $58 million in day-one trading volume surpassing Bitwise’s SOL ETF launch total:Canary Capital’s XRP ETF (ticker XRPC) began trading Thursday morning and generated $58 million in volume, the biggest debut for an ETF this year among nearly 900 ETF launches, according to Bloomberg senior ETF analyst Eric Balchunas. XRPC generated $26 million within the first hour of trading alone, Balchunas noted earlier in the day on X.

👀 OKX launches in-wallet DEX trading, tapping Base, Solana and X Layer: Centralized crypto exchange OKX is launching a new trading feature on its OKX App, offering users improved access to DEXs on Base, Solana, and its incubated X Layer. The feature will be available worldwide, including in the U.S.

🎉 Czech central bank buys bitcoin for first time as part of digital asset ‘test portfolio’: The Czech National Bank (CNB) has made its first purchase of digital assets, creating a $1 million “test portfolio” of blockchain-based instruments that includes bitcoin, an unnamed USD stablecoin, and a tokenized deposit.

💬 Tweet of the Week

Source: @haydenzadams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Since the November 2024 election, Solana has shed over 5M daily active users, grinding down 60% from highs of 8.3M to 3.2M today.

Over the same period, Base DAUs are down 37%, while Ethereum mainnet is actually up 15%.

All the little buds in Brooklyn got sent to oblivion trading “memes.” Back to work, bucko!

Source: @DavidShuttleworth

2. Opinion is Now the 3rd Largest Prediction Market Platform Surpassing Limitless and Myriad on all Metrics

Source: @OurNetwork

3. Usage Picked Up in Q3 2025 Following Points Campaign, Fundraising, and Token Generation Event. Airdrop S2 Farming Continues to Drive Current Activity.

Source: @OurNetwork

4. Aave and other DeFi lenders increasingly position themselves as viable alternatives to traditional banks.

One useful comparison is net interest margin (NIM) — the share of borrower interest kept by the platform.

Aave’s NIM has historically ranged from ~0.3% to 1.3%. Large U.S. banks typically operate with NIMs greater that 2%, and regional/community banks often exceed 3% (Fed St. Louis).

From a depositor’s perspective, a low NIM is exactly what you want — more of the lending spread flows to suppliers instead of being captured as platform margin.

That’s a fundamental structural advantage DeFi lending protocols like Aave have over traditional banks.

Source: @JackMandin

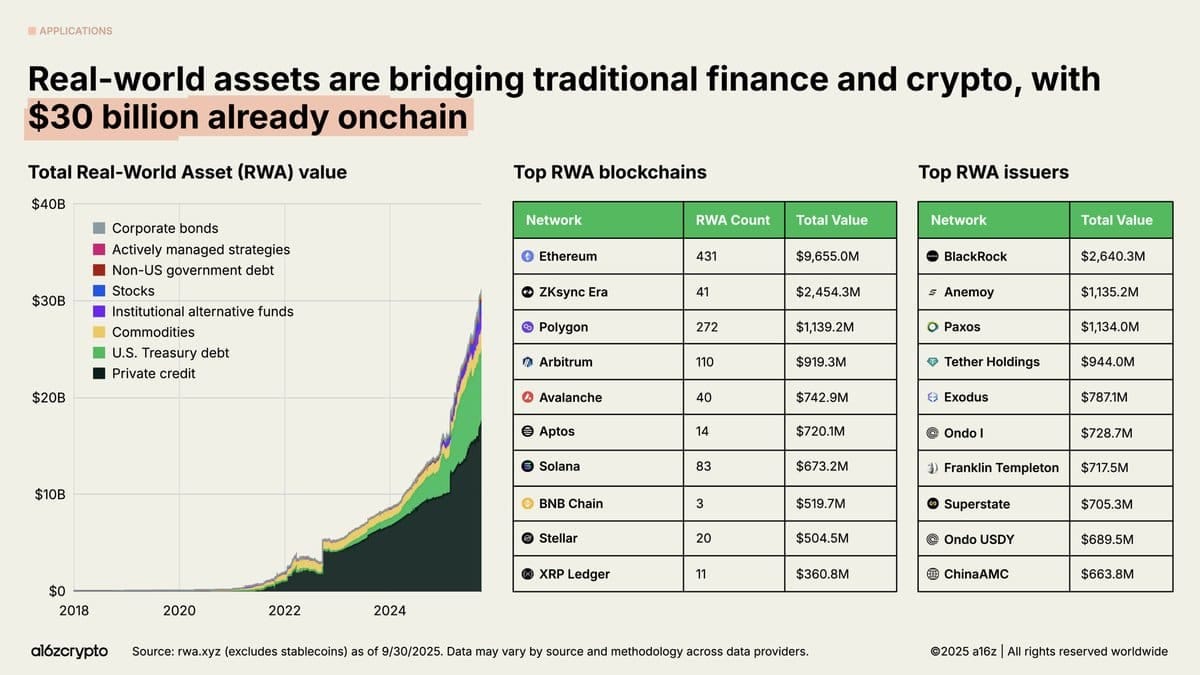

5. Real-world assets (RWAs) — traditional assets such as U.S. Treasuries, money-market funds, private credit, and real estate that are represented onchain (“tokenized”) — bridge crypto and traditional finance.

The total market for tokenized RWAs sits at $30 billion, up nearly 4x in the last two years.

Source: @a16zcrypto

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

The prediction-market space has entered a new era.

Volumes that peaked during the 2024 U.S. presidential cycle are now being surpassed, with industry data showing combined weekly notional trades across platforms topping $2B. Total value locked (TVL) across all prediction market platforms, has crossed $300M for the first time since last November.

At the center of this surge are Polymarket and Kalshi. Intercontinental Exchange (ICE) — owner of the New York Stock Exchange — has committed up to $2B in investment in Polymarket, the leading player in this space, valuing it at roughly $8-9B. ICE will also become the global distributor of Polymarket’s event-driven data, signaling institutional finance’s growing endorsement of prediction-market infrastructure.

Although not onchain yet, Kalshi has publicly confirmed plans to move onto blockchain rails. The company has already launched partnerships with Solana and Base through its “KalshiEco Hub,” paving the way for on-chain market integration.

Other emerging platforms — including Opinion, Limitless, and Myriad — are also competing for users in what’s shaping up to be one of the most dynamic, data-driven frontiers of modern finance.

In short: what began as a niche arena for election speculation is rapidly maturing into a full-fledged financial-market infrastructure — bridging the worlds of blockchain and institutional capital.

– ON Editorial Team

📈 Polymarket Is Winning Prediction Markets. Capital Efficiency Is Next.

Polymarket has led onchain prediction markets with $23B+ in cumulative volume since its launch, including a peak of $371M traded in a single day during the 2024 US presidential election. Its USDC-powered platform has attracted hundreds of millions in capital, fueling growth that extends beyond election hype. Yet, much of this USDC remains idle in wallets and smart contracts, resulting in low capital efficiency and limited value creation for both the protocol and its users.

Polymarket requires users to create proxy wallets to trade on the platform. These wallets currently hold $324M USDC in ready-to-deploy capital. This balance has climbed steadily since the protocol’s launch with explosive growth accelerating in late 2024.

With $229M in open interest and $324M in proxy wallets, over $550M USDC sits in Polymarket’s ecosystem earning zero yield, and this capital has steadily grown 106% year-over-year. Putting these idle balances to work could be a key competitive differentiator as the prediction market space heats up.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com