Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com and www.gryphondigitalmining.com and www.dimitra.io

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, SBF was sentenced, KuCoin laundered $9B, Bitwise filed for spot Ethereum ETF, and big new venture rounds for Xion ($25M) and Peaq ($15M).

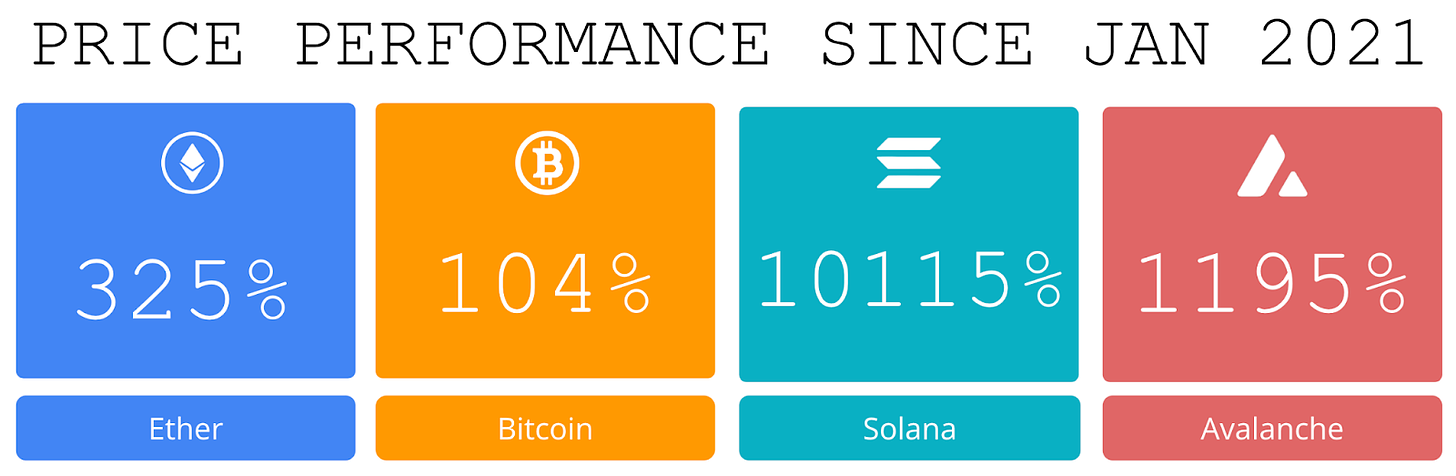

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 7.11% net for Q1 2024, 202%+ net (pro-forma) since '19 and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. Deck here: www.amphibiancapital.com

Gryphon Digital Mining (NASDAQ: GRYP) is the industry leader in green Bitcoin mining. They use 100% renewable energy and were one of the first to receive the Sustainable Bitcoin Certificate. Gryphon is also a leader in Bitcoin Efficiency, posting 68 BTC/EH, and is headed by a team of former executives of the industry’s top public bitcoin miners. To learn more about Gryphon Digital Mining visit www.gryphondigitalmining.com or follow @GryphonMining.

Dimitra is enhancing agricultural productivity for smallholder farmers worldwide, setting the Agtech standard with cutting-edge AI, blockchain, and real-world application technologies that ensure transparency and optimized yields. Visit their website at dimitra.io or follow them on X for more information @dimitratech.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

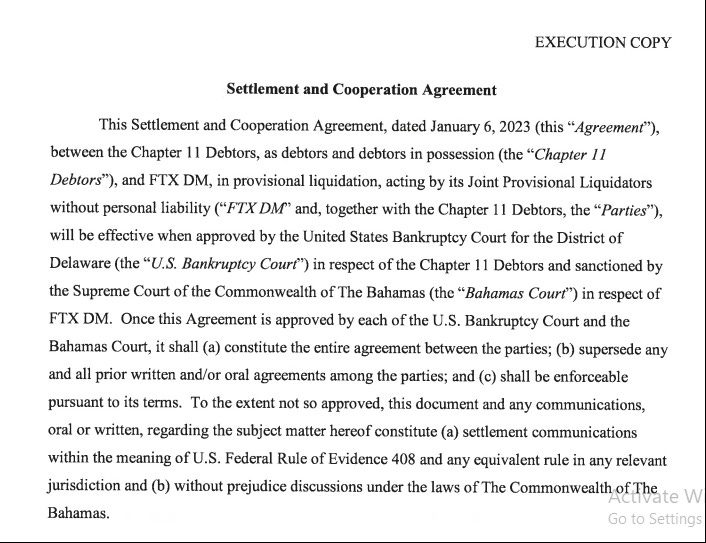

⚖️ FTX Founder Sam Bankman-Fried Was Sentenced To Serve up to 25 Years in Prison: FTX founder Sam Bankman Fried was sentenced to nearly 25 years in prison on Thursday, marking the conclusion of a criminal fraud trial involving the loss of $8 billion by retail investors. He is likely to actually serve between 18 and 22 years based on potential credit for good behavior. Above all — it is a strong lesson to people in the space to not co-mingle customer exchange deposits with a risky trading hedge fund — a needed lesson.

The question remains: since many FTX creditors are on track to get back much of their money by the end of 2024 (at least based on Nov 2022 values at the time of bankruptcy) due to crypto prices rising and the rapidly rising FTX venture investment in Anthropic — was 25 years too harsh of a sentence? And was the real shame the forced selling of all the FTX assets by the bankruptcy firm at the bottom of the market rather than simply HODLing until the inevitable bull cycle. If only Terra UST wouldn’t have crashed, would FTX had made it? Questions we may never know the answer to.

⚖️ Crypto Exchange KuCoin “Laundered $9B, Flouted Anti-Money Laundering laws”: DOJ indictment: The DOJ unveiled the indictment on Tuesday against KuCoin and two of its founders Chun Gan and Ke Tang over charges related to operating an unlicensed money-transmitting business and and violating the Bank Secrecy Act. The Department says the exchange failed to maintain an adequate anti-money laundering program and failed to have "reasonable procedures" in place to confirm customers' identities and also failed to file suspicious activity reports.

⚖️ Bitwise files for spot Ethereum ETF amid SEC approval uncertainty:Bitwise has filed for the right to issue a spot ether exchange-traded fund even as questions continue to swirl around when the Securities and Exchange Commission might give such products the green light.

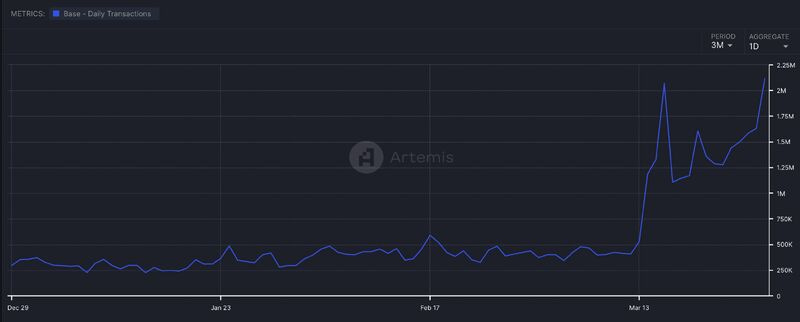

💸 Base Transactions and DEX Volumes Surge to New All-time Highs: Activity on the Coinbase-incubated layer two blockchain Base remains hot as March nears its close, with daily transactions and trading volumes surging to record highs.

⚖️ FTX Bankruptcy Estate Aiming to Begin Repaying Creditors by the End of 2024: The FTX bankruptcy estate has set a goal to begin repaying customers by the end of 2024, according to notes from a meeting of FTX Digital's Joint Official Liquidators in the Bahamas.

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @jjcmoreno

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

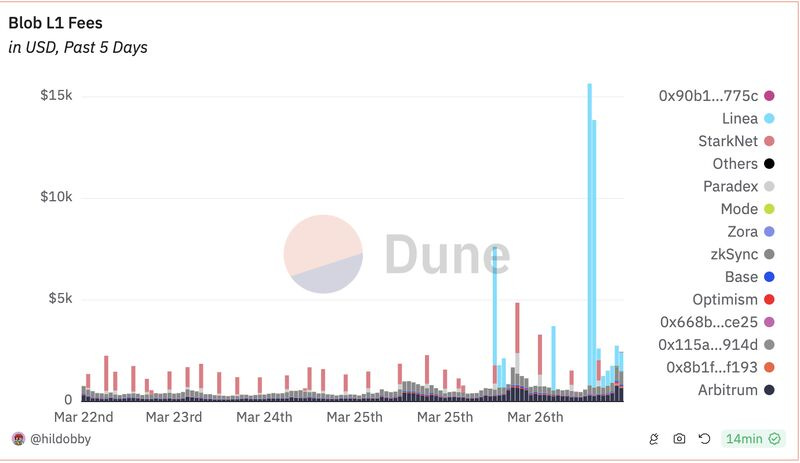

1. Consensys Layer 2 zkEVM Linea integrated blobs to their mainnet in an effort to reduce data availability costs and help drive scalability. Linea is now the second largest consumer of blobs, posting 1,700 today and trailing only Arbitrum (1,751). Overall, Linea accounts for 24% of all daily blobs posted.

Source: @DavidShuttleworth

2. The total amount of stablecoins in circulation on Coinbase Layer 2 network Base has now surpassed $1B for the first time ever, and has increased more than 275% over the past month.

Source: @DavidShuttleworth

3. Activity throughout the Coinbase Base ecosystem continues to accelerate, as Base has just achieved an all-time high in terms of daily transactions, handling over 2.16M transactions on the day.

Source: @DavidShuttleworth

4. Prior to Dencun going live on March 13th, about 1.23M daily transactions were settled on Ethereum with $28.7M in gas fees ($23.33/tx). Fast-forward two weeks later and we're still seeing 1.23M daily transactions being settled on the network, but with just $7.71M in gas fees being paid ($6.27/tx). This represents a 73% reduction in gas fees that users are paying to use the network.

Source: @DavidShuttleworth

5. Overall, Linea has just handled over 4.7M daily transactions (up 478% on the month) with 576K daily active users (up 136% on the month). Meanwhile, daily fees are down 71% on the month. Perhaps just as important, roughly 5,000 new contracts have been deployed to the network each week throughout March, an increase of 316% compared with February.

Source: @DavidShuttleworth

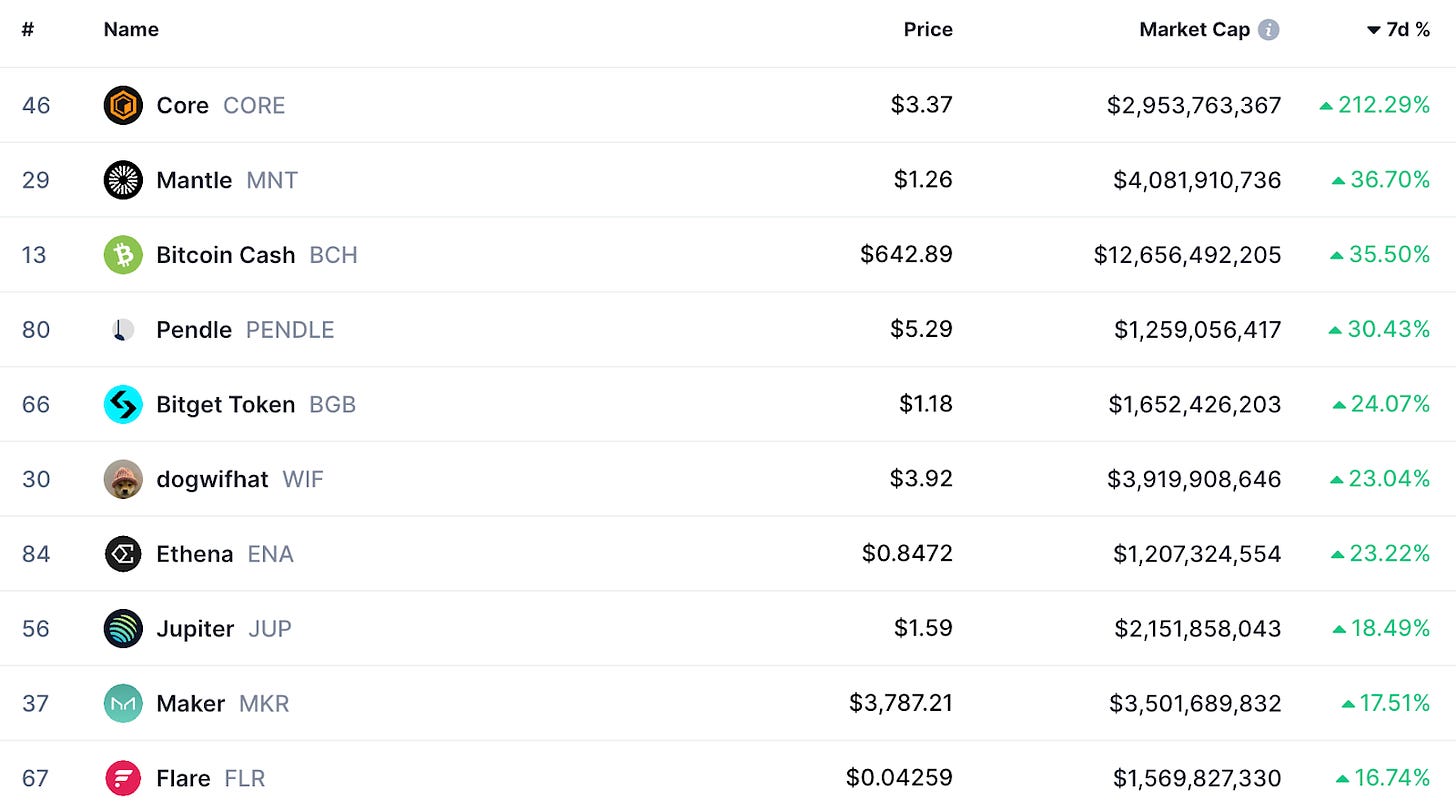

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Key Takeaways:

Pantera recently invested into Aevo, a decentralized derivatives exchange platform focused on options and perpetual trading. Previous investors include Paradigm, Dragonfly Capital, and Coinbase Ventures.

Aevo runs on Aevo L2, a custom Ethereum rollup built with the Optimism stack.

Aevo’s main products offered on the exchange are perpetual futures, options, and pre-launch tokens.

Introduction

Aevo is a decentralized derivatives exchange platform focused on options and perpetual trading. It runs on Aevo L2, a custom Ethereum rollup built using the Optimism stack. This enables Aevo to support over 5,000 transactions per second and handle over $30 billion in trading volume so far.

The exchange uses a hybrid model - an off-chain central limit order book for matching trades, combined with on-chain settlement of the actual trades using smart contracts on Ethereum L2. This allows Aevo to provide a high-performance, low-latency trading experience similar to centralized exchanges while maintaining the security and transparency of decentralized settlement.

Aevo offers three main products currently:

Perpetual Futures - Allows users to long or short crypto assets with up to 20x leverage. Aevo supports a variety of crypto perpetuals including BTC, ETH, SOL, AVAX and more.

Options - Provides an on-chain options order book where users can buy and sell call/put options on crypto assets with various strike prices and expires.

This includes ETH and BTC options with weekly, biweekly and monthly expiries

Pre-Launch Token Futures - Aevo offers futures markets for tokens that have not launched yet. Once the token launches on a CEX, the pre-launch future converts into a regular perpetual future.

These have special parameters like 50% initial margin, no index price, and no funding payments. Price is fully speculative, based on market demand.

Aevo is the go-to place for pre-launch markets now, earning the name the “Coingecko/Coinmarketcap of Pre-Launch tokens”. Recent successful pre-launches include Jupiter and Starknet.

Transition from Ribbon Finance to Aevo

Aevo was created by the same team behind Ribbon Finance, a pioneering DeFi options protocol that has processed over $10 billion in options volume through automated options vaults. Ribbon's options vaults have an all-time high TVL of over $350 million and have earned over $50 million in options premiums for depositors.

In late 2023, the Ribbon team decided to expand from options vaults into a full-fledged decentralized options and perpetuals exchange. This led to the creation and launch of Aevo.

The Ribbon team brought their deep experience and track record in DeFi options to Aevo. The exchange has quickly gained traction, with over $30 billion traded in just a few months since launch. Aevo aims to build on Ribbon's success to create the leading decentralized derivatives exchange.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.gryphondigitalmining.com and www.dimitra.io