Welcome back to Coinstack, the weekly institutional crypto newsletter where we summarize the top news, stats, and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Crypto Podcasts

📈 Top 10 Tokens of the Week

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Headline Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto quant fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week...

⚡ Jump Trading Backstops Wormhole’s $320M Exploit Loss - Wormhole’s parent company has stepped in to prevent chaos across the Solana DeFi landscape. (Source)

🏧 US Government Seizes $3.6 Billion in Bitcoin Tied to the 2016 Hack of Crypto Exchange Bitfinex - The US Department of Justice said Tuesday that it has seized $3.6 billion worth of bitcoin tied to the 2016 hack crypto exchange Bitfinex. (Source)

😮 EU Weighs Potential Metaverse Regulation - Authorities need to understand the metaverse better in order to decide the best course of regulatory action, according to one of the EU's commissioners. (Source)

💰 FDIC Includes Evaluating Crypto Risks on the 2022 Priorities List - The Federal Deposit Insurance Corporation (FDIC) has included evaluating crypto-asset risks on its list of priorities for the year. (Source)

🤑 DeFi Project Aave Launches Decentralized Social Media Platform on Polygon - The developers behind Aave have created Lens Protocol, an open-source, "Web3, smart contracts-based social graph" based on dynamic NFTs. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

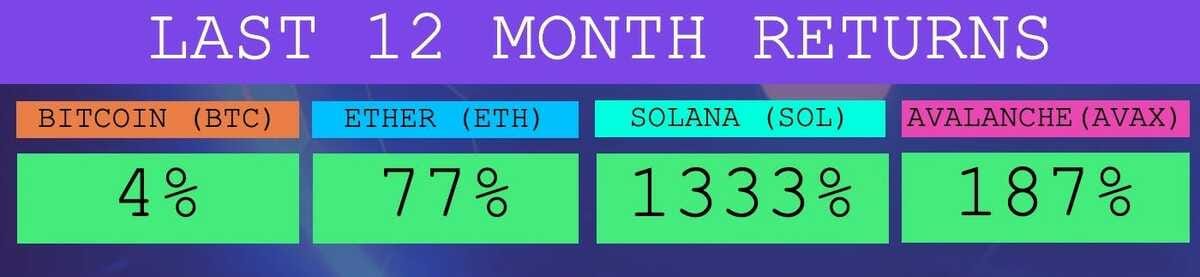

Here are the most important and interesting stats in crypto this week...

1. NFT Activity Accounted for Over 40% of ETH Being Burnt in the Last Month

2. Us Crypto Lobbying Expenditure Doubles in 2021

3. Gold-Backed Tokens Are Growing Faster Than the Overall Crypto Market

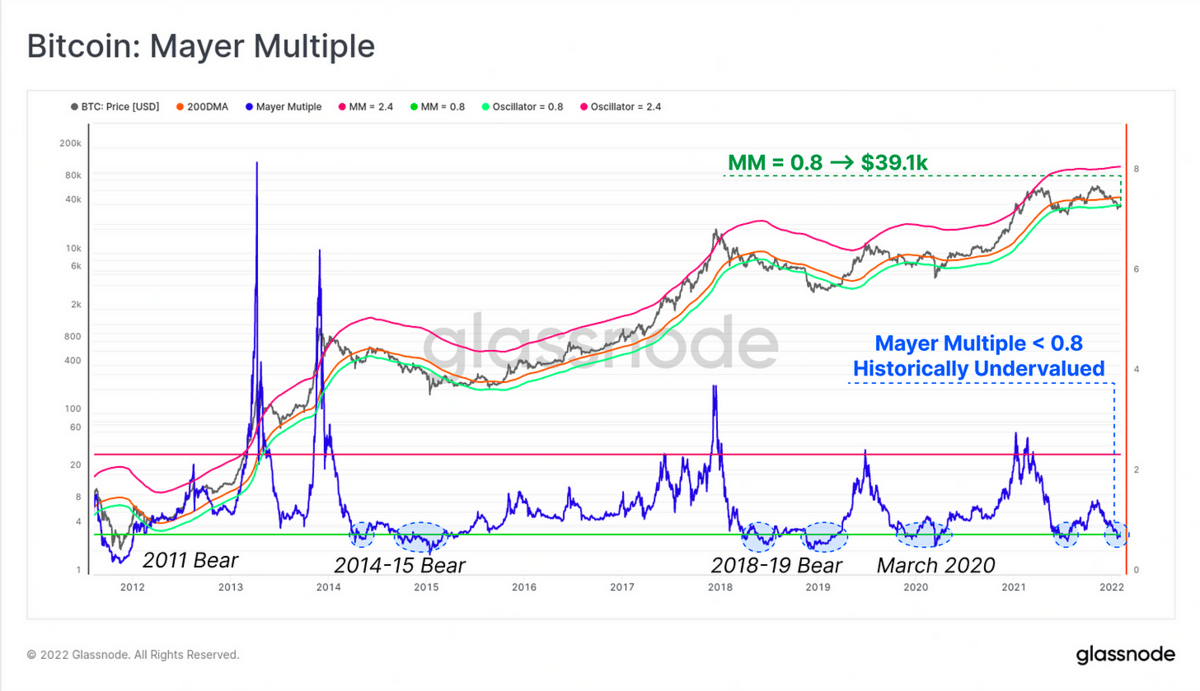

4. BTC’s Mayer Multiple Traded Below 0.8 This Week, Representing a 20%+ Discount Relative to the 200DM Signaling a Potential Bottom

5. dForce, Euler, and Trader Joe Have Seen the Largest Asset Inflows Into Their Smart Contracts in the Last Seven Days

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Pulse of Fintech H2’21

KPMG operates in 145 countries and territories across the globe, offering audit, tax, and advisory services. KMPG published its biannual Pulse of Fintech report, where the firm tracks and analyzes developments and investments within the financial technology sector.

"Interest in cybersecurity skyrocketed in 2021, driven by disruptions that gained international attention, including major ransomware attacks and the use of exploitable malware on non-traditional IT infrastructure. Between 2020 and 2021, investment in cybersecurity more than doubled, although the $2.7 billion acquisition of Verafin in H2’21 accounted for more than half of this total. H2’21 saw a combination of M&A and VC investment in the space, including a $310 million raised by US-based Fireblocks, the $250 million mergers between Switzerland-based zero-knowledge rollup blockchain company Hermez and India-based crypto company Polygon, and the acquisition of Israel-based cybersecurity firm GK8 by Celsius Network."

"Both global investment and the number of wealthtech deals reached new highs in 2021, largely driven by increasing VC investment. After an H1’21 characterized by several large VC raises (e.g., Canada-based Wealthsimple — $600 million, US-based CleanCapital — $325 million) and the $989 million acquisition of UK-based Nutmeg by JP Morgan, H2’21, saw more moderate deal sizes, including $125 million and $104 raises by Germany-based wealthtechs Moonfare and Liquid. A number of acquisitions were also announced during H2’21 — most notably, the acquisition of Interactive Investor by Aberdeen for approximately $2 billion."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

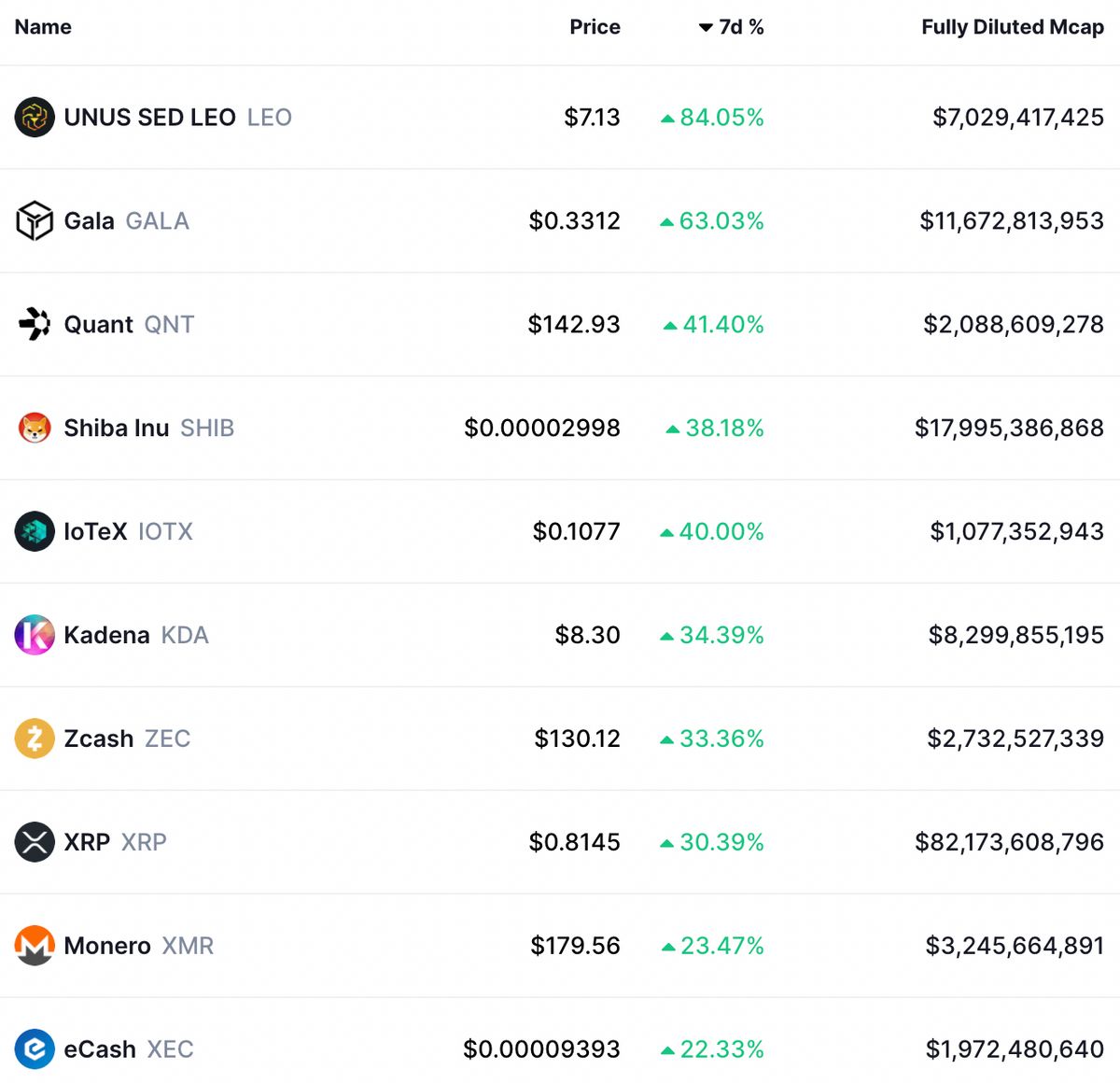

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Unus Sed is an Exchange Token, Bora is a Gaming Platform, FTX Token is an Exchange Token, and Theta Fuel is a Utility Token.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting an upcoming 55-minute webinar on crypto investing for family offices, wealth managers, and financial advisors covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing, and mapping out the crypto hedge fund ecosystem. Register for free below.

🎨 $3 LuvMonster NFTs - Collect Them Now

Here are the new LuvMonster NFTs from our Coinstack featured artist Mrs. Bubble that you can buy at our special pre-sale prices of $3.

These NFTs are individually hand painted and then digitized for some added magic. Many have sound as well. We now have 189 unique LuvMonster owners — and the community is growing. Join us!

New NFTs This Week - Limited Pre-Sale Available for $3 on OpenSea

Here are the new NFTs launching this week:

LuvMonster #64 - Alien Cat Hat - 5 remaining at pre-sale price

LuvMonster #65 - BundiBoo - Currently available for $1593

LuvMonster #66 - RainbowCorn - Currently available for $28.69

LuvMonster #67 - AlpacaFoxyCorn - Currently available for $63.76

LuvMonster #68 - ToadaBee Bear - Currently available for $25.50

You can also join our Telegram group here for early NFT drop announcements.

Additional Coinstack Sponsors

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 17,563 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

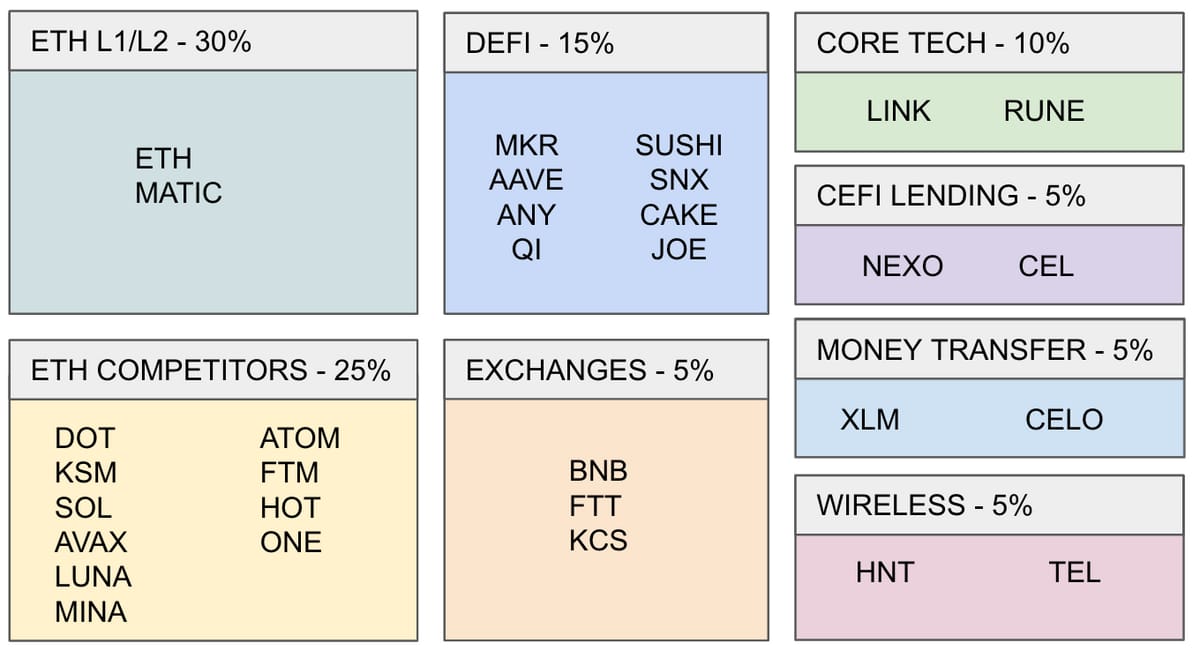

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.