Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - Terra Buying $3B in BTC, Axie Hack

💵 Weekly Fundraises - Blockchain.com, Blur, Fuel, ZkLend

📊 Key Stats - Ethereum, L2s, Near

📝 Report Highlights - The Crypto Intelligence Report: The Sandbox

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top 10 Tokens of the Week - APE, GMT, WAVES

NFTs: LuvMonsters Collection - NFTs for 0.002 ETH on OpenSea

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance revenues to fund philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting two upcoming 55-minute webinars on DeFi and crypto investing for family offices, wealth managers, and financial advisors. Register for free below.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

💸 Terra’s Luna Foundation Raises $2.2 Billion to Buy BTC as a Reserve Asset for UST Stablecoin — Do Kwon of Terra has announced a purchase of $3B of Bitcoin as further backing for its UST stablecoin. $2.2B has already been raised and is now being put to work, driving BTC prices and the whole market upward. (Source)

⚡ Axie Infinity’s Ethereum Sidechain Ronin Hit by a $600 Million Exploit - 173,600 ETH (worth roughly $590 million) and 25.5 million worth of the stablecoin USDC were lost. (Source)

😮 U.S. Treasury Wants to Include Crypto in Foreign Accounts Reporting Rules - The Treasury's new proposal suggests that offshore crypto accounts with more than $50,000 should be reported to the IRS. (Source)

🏧 President Biden Eyes $5 Billion Revenue From Crypto in 2023 - US Treasury Department is specifically targeting the crypto industry because it can be used to evade taxes. (Source)

💰 Indian State Government Uses Polygon to Issue Verifiable Caste Certificates - In partnership with LegitDoc, the Maharashtra government is in the process of rolling out 65,000 caste certificates to aid the process of delivering governmental schemes and benefits. (Source)

🤑 US Treasury Secretary Janet Yellen Says Upcoming Crypto Regulations Will Nourish Healthy Innovation - Yellen admitted being skeptical, acknowledged the benefits, and emphasized the importance of healthy innovation in finance. (Source)

Democrat U.S. Congressman Richie Torres Publishes, “The Liberal Case for Cryptocurrency.” Says that there should be more Dem support for digital asset innovation and huge benefits for the economy and consumers. (Source)

💬 Tweet of the Week

🧵 Thread of the Week

By @JustinBons, Founder & CIO of CyberCapital

1/6) Ethereum is in a race to scale onchain Competitors will overtake ETH if it does not deliver in time Block space is a valuable resource that is in no way exempt from the laws of the market There are several blockchains scaling onchain now, I will cover some in this thread:

2/6) LUNA is based on DPoS with a larger validator set compared to predecessors: DPoS lends itself to scalability, sacrificing some decentralization The line of decentralization on this spectrum is unknown The native stable coin which also contributes to security is brilliant!

3/6) AVAX has made multiple breakthroughs: The network is split into several chains under the same validator set, allowing for greater parallelization The C-chain is based on AVAX consensus, which gives it scalability advantages Isolating use cases avoids congestion spill over

4/6) EGLD has already fully implemented sharding: The holy trinity; state, execution & data sharding! All fully interoperable, exactly what ETH is trying to build! EGLD has already developed much of the technology Now they just need to build up their ecosystem to catch up

5/6) NEAR has also developed sharding: Not fully live now, but their roadmap does beat ETH in the deployment of full sharding! Having also solved the holy trinity with full interoperability Instead of multiple chains NEAR is a single chain where blocks are split into parts

6/6) With all of this legitimate competition building up ETH cannot just sit on its laurels, it has to scale through sharding I am a proponent of "monolithic scaling" as opposed to "modular scaling" Layer 2's will not save ETH from this predicament, just as it did not save BTC

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

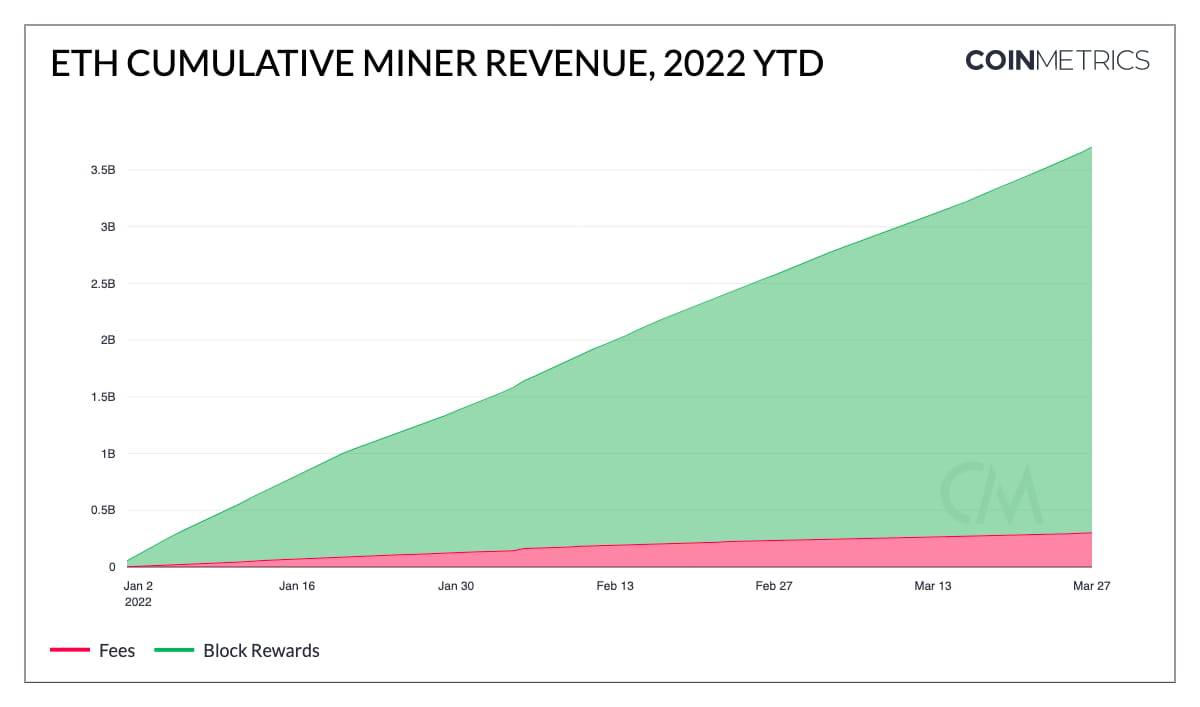

1. Ethereum Miners Have Earned $3.7B While Recording Over $1B/Month in Revenue in Q1 2022

2. 30D Correlations With Stock Indices Like SPX Remain High (0.78) With the Cryptomarkets

3. Digital Asset Investment Products Saw Inflows Totaling $193M Last Week, the Largest Since Mid-December 2021

4. NEAR Led the L1 Recovery by Growing by ~50% Over the Past Month

5. There Is Now $7.08B Locked in Layer 2’s on Ethereum, a 40% Increase Over the Past 30 Days

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Crypto Intelligence Report: The Sandbox

About the Author: Stratmont Brothers is a European crypto investment fund that invests in meaningful disruptive innovations, with an emphasis on Web 3.0, De-Fi, cryptocurrencies, tokens, and blockchain companies reshaping trillion-dollar markets. Their mission is to create a better world for our next generations. They are known for challenging long-standing assumptions, predicting macro trends, and identifying early-stage technologies that will reshape the world. You can subscribe to their Substack here.

Short Introduction

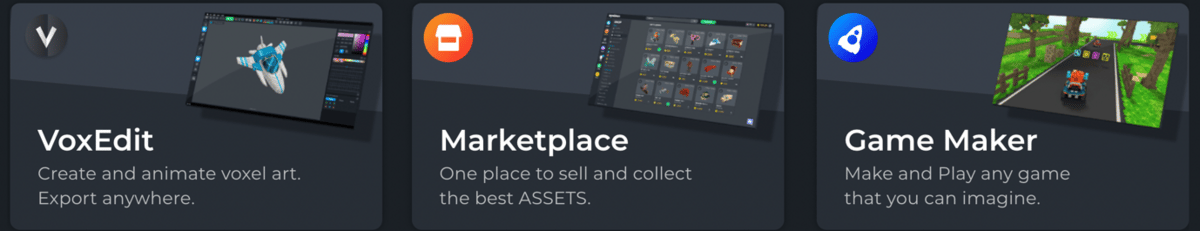

The French project The Sandbox was born in 2012. Initially available in two dimensions, the project migrated in 2017 to the Ethereum blockchain. It offers a decentralized ecosystem co-constructed by users of the metaverse. The platform allows users to create NFTs that can be used in the metaverse. These NFTs can take two different forms:

Objects to be used in the metaverse game

Plots of land on which the player can create mini games for example.

Note that these two types of NFT can be resold on NFT marketplace platforms such as Opensea. In terms of market cap, The Sandbox project represents today the second metaverse project with a capitalization of 3.65 billion dollars. A capitalization that allows The Sandbox to be in the thirty-eighth position of the main crypto projects. The SAND token, at the heart of The Sandbox project, is a governance token. This means that the owners of these tokens can have a say in the management of the project. The community of SAND token holders can vote for the different evolutions of the platform.

Growth Narrative

Originally the sandbox game was developed on mobile by Onimatrix but the project quickly attracted investors and a first application was launched in 2012. At that time, the idea was already to create a digital universe with blocks. Four years later, a V2 of the application is born, but an even bigger project is in preparation. Wanting to move into 3D Voxel and offer a more complete gaming experience, Sebastien Borget (the director of The Sandbox) then partnered with Animoca Brands in 2018. That's when The Sandbox adventure begins. The Sandbox is not limited to one game. It is made up of many standalone games, environments, and other experiences. The team has left the universe open so that creators and players can ultimately build, own, and monetize the metaverse. In other words, it disrupts existing game makers such as Minecraft and Roblox, by offering creators real ownership of their creations in the form of non-fungible tokens (NFTs).

“In today's gaming market, centralized ownership and control of user-generated content limits the rights and ownership of creators. Centralized control of the exchange of player-generated virtual goods prevents players from generating fair value for their creations. With The Sandbox, we aim to overcome these limitations while accelerating the adoption of blockchain to grow the market for blockchain-based games.”

Team & Partners

Sébastien Borget is the Co-founder and COO of Pixowl (acquired by Animoca Brands in 2018) as well as The Sandbox (40M players). Passionate for blockchain technology, gaming and education, he is a very active speaker and evangelist on the opportunity Non-Fungible Tokens brings to gaming. He is now building the metaverse with The Sandbox

Arthur Madrid is also the Co-founder and CEO of Pixowl and The Sandbox. He is Board Member of Animoca Brands and a longtime social gaming entrepreneur. He sold two software companies (Wixi Inc. and 1-Click Media) and is an advisor for startups in gaming, social media, and software.

The Sandbox has just completed a $93 million round of financing led by SoftBank. It must be said that this success has allowed the Sandbox project to benefit from quality partnerships with major brands. We can mention True Global Ventures, Liberty City, Samsung Next, Galaxy Interactive and Polygon Studios. In addition, the company reports that its user base and trading volume have exploded in a short period of time. Sandbox's trading volume is now in the $144 million range.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

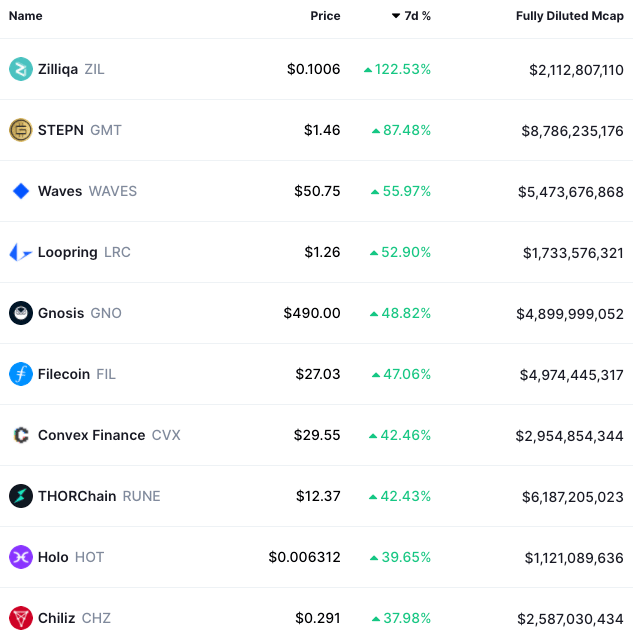

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: ApeCoin is a Governance token, Stepn is a Web3 Dapp, Waves is an L1, THORChain is an Exchange token.

🎨 NFTs of the Week: Our Featured Collection

Here are the new LuvMonster NFTs from our official Coinstack featured artist Mrs. Bubble that you can buy at our special pre-sale prices.

We are now working on narrowing down our choice of manufacturer for creating Llamacorn Angel into a stuffed animal as we work on making these the Beanie Babies of the 2020s.

These NFTs are individually hand painted and then digitized for some added magic — with special sound added. We now have 317 unique LuvMonster owners.

For early notification on drops, so you can get them daily at the earliest possible pre-sale prices, join the Discord and the Telegram Channel.

We will continue to feature these joyous NFTs here in Coinstack, building the community and collector-base each week.

These are on the Polygon network on OpenSea, so there are no gas fees.

New NFTs This Week - Limited Pre-Sale Available Starting At $7 on OpenSea

Here are the new NFTs launching this week. All of these have been handpainted by the artist and then digitized, with sound and motion added.

You can also join our Telegram group here and Discord group here for early NFT drop announcements.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 20,985 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, LUNA, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.