Issue Summary: Welcome back to Coinstack, your favorite weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - The Merge, Beanstalk Hack, Terra

💵 Weekly Fundraises - Ava’s $350M, Voyager $210M, MoonPay $87M

📊 Key Stats - UST #3, Wormhole, Moonbirds

📝 Report Highlights - Stratmont Brothers: Theta Deep Dive

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

📈 Top Tokens of the Week - GMT, ZIL, GLMR

NFTs: LuvMonsters Collection

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting an upcoming 55-minute webinar on crypto investing for family offices, wealth managers, and financial advisors covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing, and mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

📅 Ethereum Merge Pushed to September As ‘Final Chapter’ of Proof of Work Looms - The Ethereum 2.0 upgrade that will see the network switch to proof of stake will come 'in a few months after June, according to devs. (Source)

🇰🇵 US Government Connects North Korean Hacking Group With Last Month’s $600 Million Ronin Exploit - The US government connected the North Korean hacking unit Lazarus Group and last month's exploit of the Axie Infinity's Ronin sidechain network. (Source)

💰 Terraform Labs Gifts $880 Million in LUNA to Luna Foundation Guard - Terraform Labs has gifted 10 million LUNA ($880 million) to the Luna Foundation Guard to help boost the stability of the stablecoin UST. (Source)

📈 Digital Funds Seeks to Launch Tokenized S&P 500 Fund - Digital Funds has filed to launch a Tokenized S&P 500 EW Index Fund that would primarily invest in the securities of issuers included in the S&P 500 Equal Weight Index, according to a regulatory disclosure filed last week. (Source)

⚠️ Attacker Drains $182M From Beanstalk Stablecoin Protocol - Beanstalk Farms, an Ethereum-based stablecoin protocol, was exploited for $182 million Sunday. (Source)

🇵🇹 Portugal Grants First Crypto License to Bison Bank - The Banco de Portugal, the competent authority responsible for registering virtual asset service providers in Portugal, has granted a license to Bison Bank to act as the first crypto bank in the country. (Source)

⚡ SEC Amendment Is Unconstitutional, Advocacy Group Says - A new rule proposed by the SEC to expand its definition of “exchange” will unfairly subject developers and publishers to registration requirements and violates the US Constitution according to nonprofit research group Coin Center. (Source)

🇨🇦 Canadian Crypto Firm Considers Aiding US Spot Bitcoin ETF Hopefuls - The Federal Deposit Insurance Corporation (FDIC) issued a financial institution letter – a letter sent to CEOs of FDIC-insured banks – requesting that banks notify their regional FDIC director of their crypto activities. (Source)

⚖ Class Action Lawsuit Accuses Uniswap Labs, Its Investors of Allowing Fraudulent Activity on the DEX Protocol - A new class-action lawsuit from a Uniswap user alleges that Uniswap Labs and its investors are culpable for her losses due to a failure to comply with securities laws. (Source)

♻️ Polygon Commits to Going Carbon Neutral in 2022 - The Polygon network announced last Tuesday its commitment to going carbon neutral and climate positive this year by releasing their “Green Manifesto: A Smart Contract with Planet Earth.” (Source)

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🧵 Thread of the Week - ETH Weekly Stats

1/11) What does ETH do when no one is looking? The answer may surprise a lot of you…

2/11) ETH is fuel for the network, required to execute txs on smart contracts, and burnt once used. There are an average of 1M+ txs a day, worth ~$20.1B in value. When you look at it this way, the picture begins to change entirely…

3/11) Let’s take a look at some stats. The Ethereum network has 193M wallets, with 500K or so active daily. There are about 100,000 new addresses added every day. These people are all looking to buy NFTs, earn yield, and participate in DeFi.

4/11) To add on top of that, are the millions upon millions of txs executed every day by each of these users. We can view all txs on-chain, to reveal some pretty unreal numbers. eth daily txs - 1M+ uniswap daily txs - 70K opensea daily txs - 66.9K external contract calls - 658K

5/11) What are all these txs for? Using smart contracts! There are 400K contracts deployed a month, with DEXs, NFTs, tokens & more. The highest gas consumers this hour are: OpenSea: Marketplace 1 hr fees - 23 ETH Uniswap: V3 Router 1 hr fees - 31 ETH Wrapped ETH 1 hr fees - 12 ETH

6/11) NFTs are hot. The average secondary sales per week for NFTs is around 220k. Even more impressive, we have mint sales this week at 42,808 NFTs. That’s 246,232 users trading NFTs, making up a combined 636,125 txs this week.

7/11) All of this activity, along with EIP-1559, has led to a tremendous amount of ETH being burnt. In 257 days, a total of $6.6B worth of ETH has been burnt. It is on pace to burn $9.3B this year. At current rate, it’ll be just 11 years before ETH gets below 100M supply.

8/11) That’s not the only thing eating up ETH. We’ll have to talk about stablecoins next. Stablecoins change the whole equation, as users aren’t exactly looking to “cash out.” USDC, USDT, DAI, & others have attracted hundreds of billions in value.

9/11) & we still haven’t mentioned staking. The ETH2 deposit contract has amassed 11.7M ETH from 364,000 unique validators on the network. That’s around 9.75% of the entire supply of ETH. This number will increase exponentially as the merge gets closer.

10/11) Last but not least, Layer Two is seeing promising growth. L2 Ethereum has more than $6B in TVL. Arbitrum has, on average, 64K txs a day. Optimism has, on average, 45K txs a day. How much do they pay for L1 security? Arbitrum - $43K/day dYdX - $16.7K/day Optimism - $16K/day

11/11) As I hope you can tell by now, there is a lot going on behind the scenes. Ethereum is not the same as it was a year ago. Enjoy!

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Terra’s Stablecoin UST Becomes Crypto’s Third-Largest Overtaking BUSD

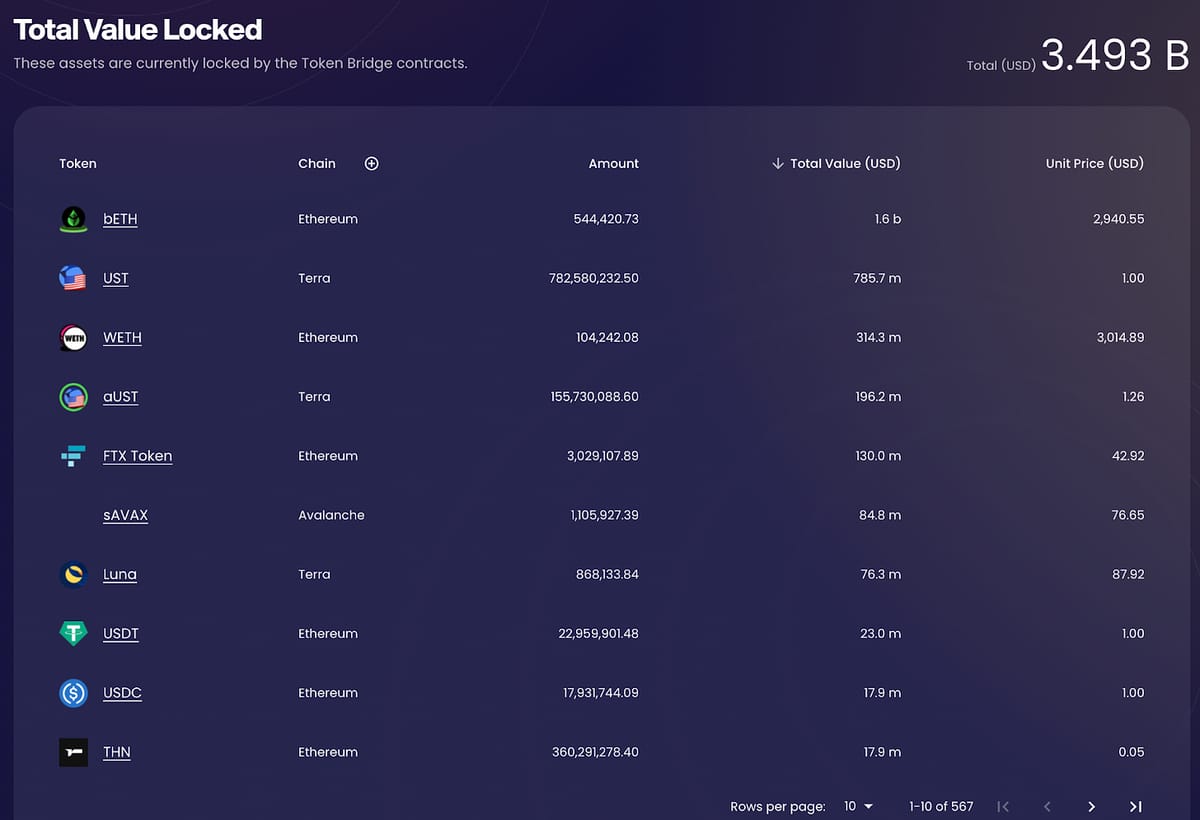

2. Wormhole Nears $3.5B TVL Bridging Assets Across Several Blockchains

3. GMX, a Spot and Perpetual Exchange on Arbitrum and Avalanche, Continues to Grow AUM Across Protocols

4. Moonbirds Makes a Mark Amidst Biggest NFT Sales of the Week – Top 10 NFT Sales

5. Total Value Deposited Into NEAR Has Grown to New ATHs $425M

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

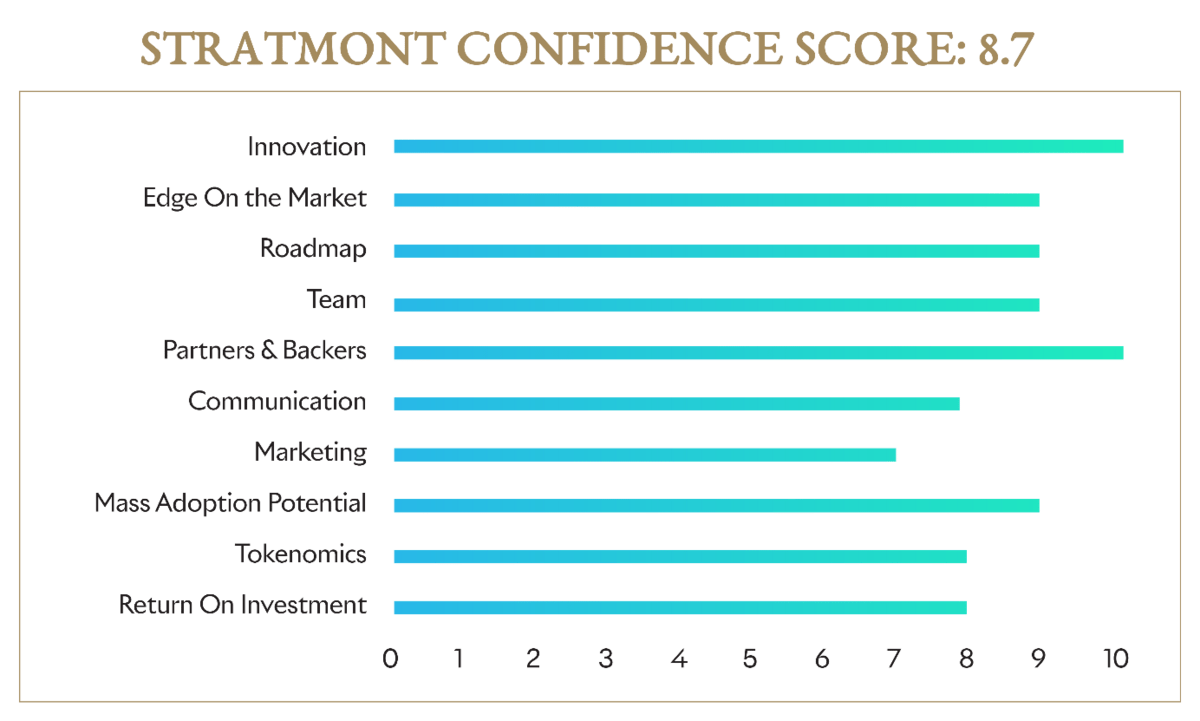

Theta: The Next Generation Video and Entertainment Blockchain

About the Author: Stratmont Brothers is a European crypto trading fund achieving outsized returns with low drawdowns. They are known for their superior digital asset trading strategies that provide a secure vehicle for institutional investors. Equipped with a world-class intelligence department, they stay ahead of the curve and openly share their valuable insights. Stratmont Brothers mission is to create a better world for the next generations. You can subscribe to their Substack here.

About the Article: This is an excerpt from the full article which you can find here

Introducing Theta

Theta Network is the leading video delivery network powered by blockchain technology. Theta allows users to simultaneously watch video content and earn token rewards for relaying video to other users who are also watching the same content. In the same vein as other sharing economy models, users opt-in to volunteering their spare bandwidth and computing resources to relay video to other users and earn token rewards for their contributions. Users can contribute to Theta Network on any PC, mobile device, or smart TV.

This more efficient way to deliver content that Theta Network created is called a peer-to-peer mesh network. Tokens on the Theta blockchain are used to encourage individual users to share their idle computing and bandwidth resources as caching or relay nodes for video streams. This design aims to improve the quality of stream delivery and solves the "last-mile" delivery problem, which is the main bottleneck for traditional content delivery pipelines, especially so for high-resolution, high bitrate 4k, 8k, and next-generation streams. With sufficient network density, the majority of viewers will pull streams from peering caching nodes, allowing video platforms to significantly reduce content delivery network (CDN) costs. By introducing tokens as an end-user incentive mechanism, the Theta Network aims to allow video platforms to deepen viewer engagement, drive incremental revenues, and differentiate their content and viewing experience from their competitors.

Growth Narrative

Nowadays data consumption, especially via streaming, is omnipresent on the Internet and therefore in our daily lives. Whether it is video streaming platforms like Netflix, Prime Video, Hulu, Disney+, live streaming platforms like Twitch and YouTube, or even music streaming platforms like Spotify, Deezer, Tidal, Apple Music, bandwidth usage reaches new heights every year. Live video streaming accounts for over two-thirds of all internet traffic today, and systems must adapt quickly to be able to offer increasing quality, at a constant or even increasing speed, and at the same cost. However, with the current architectures, the users growth, and the increase in video and audio quality, it is more and more difficult to offer a quality service for the same price, to anyone in the world.

Content Delivery Networks (CDN) play an important role in the video streaming ecosystem. It provides the backbone infrastructure to deliver the video streams to end viewers. Today's CDN lack reach, causing video re-buffering, and high load times in many parts of the world. One major limitation of today’s CDN networks is the so-called “last-mile” delivery problem. Typically, CDN providers build data centers called Point-of-Presence (POPs) in many locations around the world, with the expectation that these POPs are geographically close to the viewers. However, the number of POPs is limited, hence are not near enough to the majority of viewers, especially in less developed regions. This “last-mile” link is usually the bottleneck of today’s streaming delivery pipeline and often leads to less optimal user experience including choppy streams, bad picture quality, and frequent rebuffering.On top of that, the data needs are sky rocketing, users demand 4k, 8k, and higher quality streams create infrastructure bottleneck. In addition, the centralization of these services means less reliance, less revenue flowing back to content creators and platforms, and an architecture that is not very adaptable to demand variations.

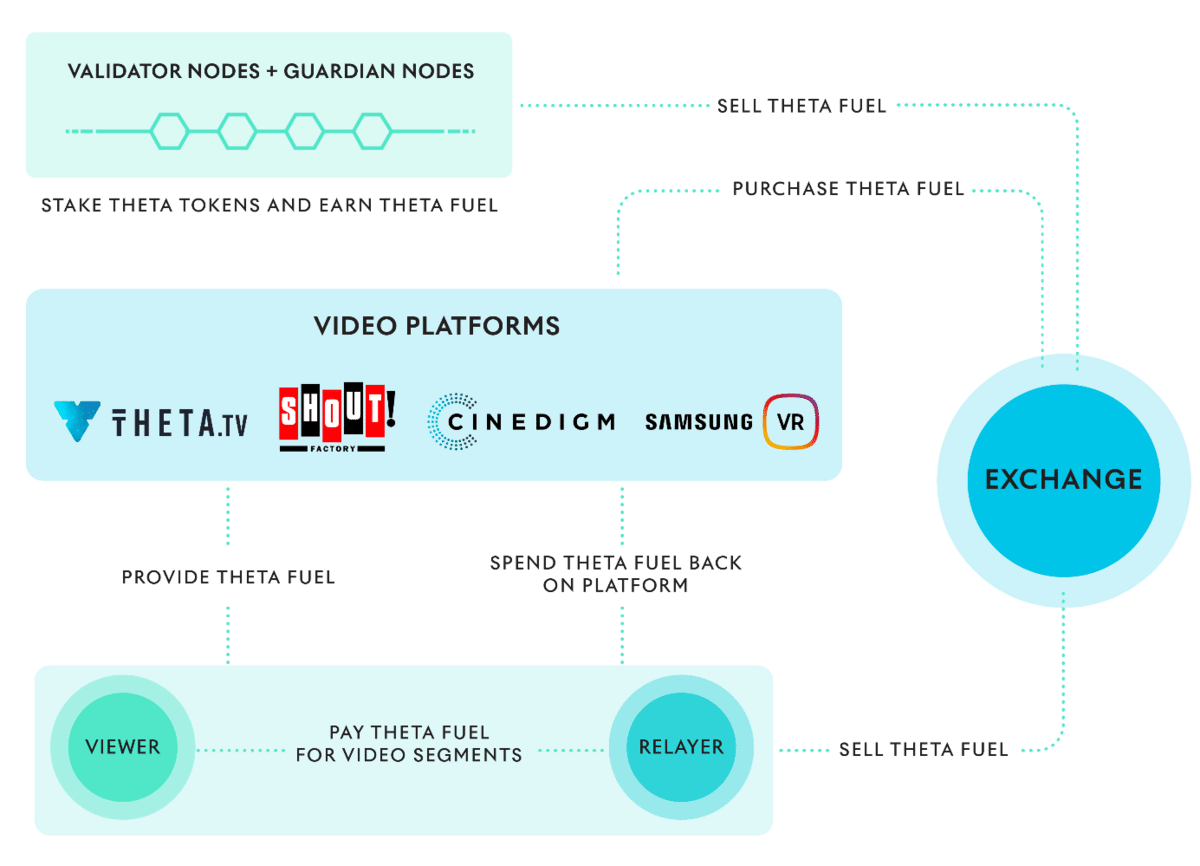

Theta’s solution is a decentralized peer-to-peer video delivery system; a native blockchain powered by users. Viewers earn rewards as Theta Fuel for sharing excess bandwidth and resources; viewers are rewarded to participate in the network. The tokens act as an incentive mechanism, as they relay video streams to other users. Not only does the Theta Token motivate viewers to join the network as caching nodes, it also greatly improves the streaming market efficiency by streamlining the video delivery process. Within the Theta Network, advertisers can also directly target viewers at a lower cost. This decentralized peer-to-peer network delivers streams efficiently globally, through the Theta Mesh Delivery Network made up by the Peers. The result is a higher quality and smoother video streaming.

Theta’s protocol is already used in several services such as Theta.tv for live streaming content, especially in esport, Samsung VR for VR content, Cinedigm and Shout for Broadcasting and Entertainment and PandoraTV for music, movies and media.

With Theta’s open-source network & protocol, all developers and partners can build their Dapps on it and benefit from its technologies and economic systems. From esports, music, TV and movies to distance learning and peer to peer live streaming, Theta has the potential to power the next generation of streaming.

Team & Advisors

Mitch Liu

Cofounder / CEO

Mitch Liu is a cofounder and the CEO of Theta Labs. He is an entrepreneur who previously cofounded Tapjoy, a successful mobile advertising and app monetization company still active to this day and with over 200 employees. He then cofounded a mobile social gaming studio before founding Theta TV, a blockchain livestreaming platform, that led to the founding of Theta Labs.

Jieyi Long

Cofounder / CTO

Jieyi Long is a cofounder and the CTO of Theta Labs. He has a Ph.D in computer engineering and a B.S. degree in microelectronics. Jieyi worked at Synopsys, an American electronic design automation, for over 3 years. He also cofounded a gaming studio before devoting himself to his new project, Theta TV.

Steve Chen

Co-founder of YouTube, Advisor for Theta

Steve Chen was the cofounder and chief technology officer of YouTube. Steve was instrumental in building YouTube into a viral video phenomenon. He helped lead YouTube through the Google acquisition for $1.65 billion, less than a year after launching the site. As the key technologist, Steve developed the company’s massive data centers and helped build YouTube into a premier entertainment destination, and one of the most popular websites on the Internet today.

Justin Kan

Co-founder of Twitch, Advisor for Theta

Justin Kan is a serial entrepreneur and investor. He is widely known for founding Twitch, a video game streaming platform acquired for $970 million by Amazon in 2014. Justin has founded various companies including Kiko, the first AJAX web calendar; Justin.TV, a live video streaming platform; Socialcam, a mobile video sharing app (Acquired for $60 million by Autodesk in 2012); and Exec, an on-demand home cleaning service (acquired by Handybook in 2014). He has additionally incubated two companies out of his home in the past 2 years: Alto (Formerly ScriptDash), a modern online pharmacy, and Whale, a video Q&A app. Justin personally invested in over 65 companies.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

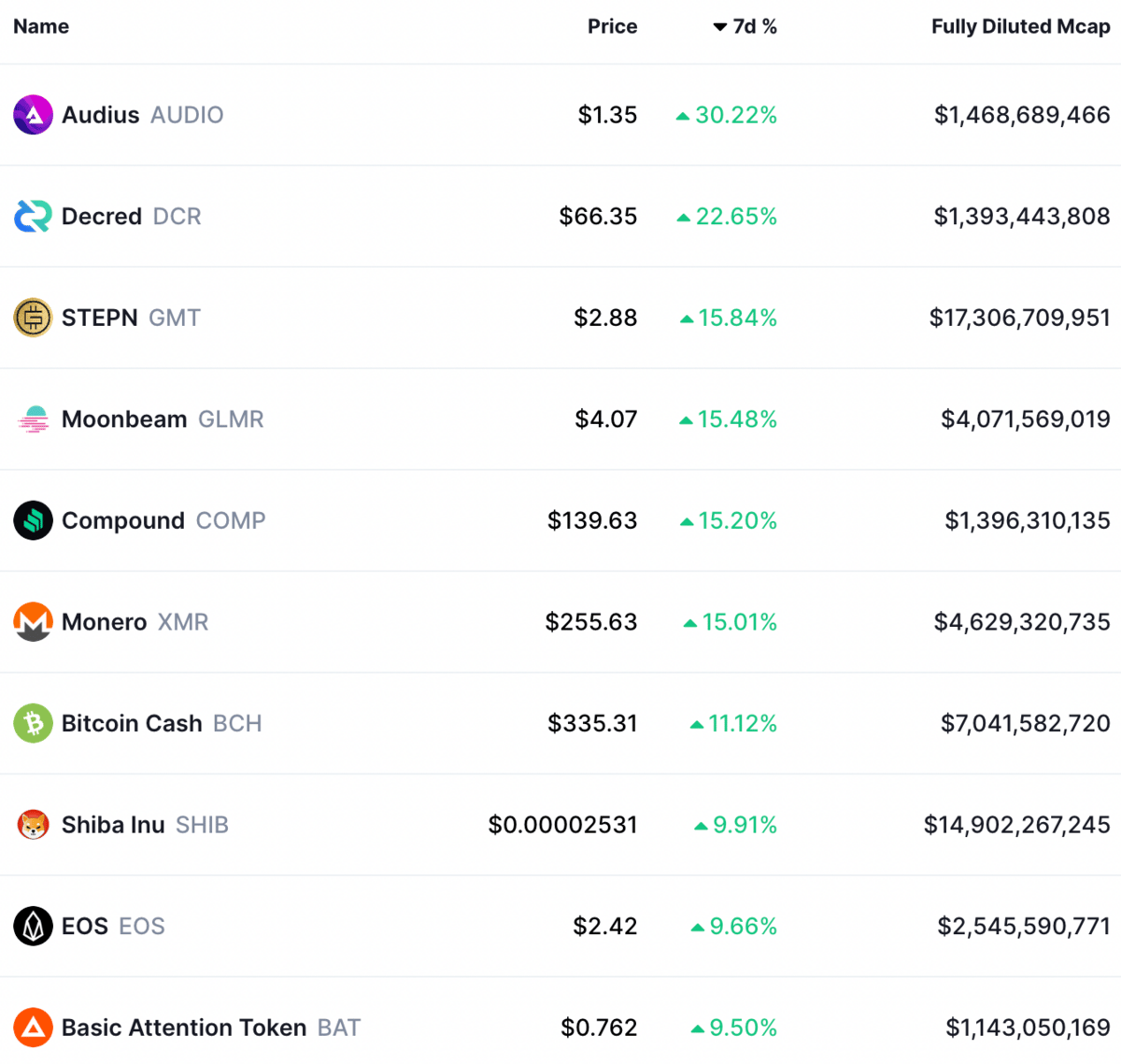

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

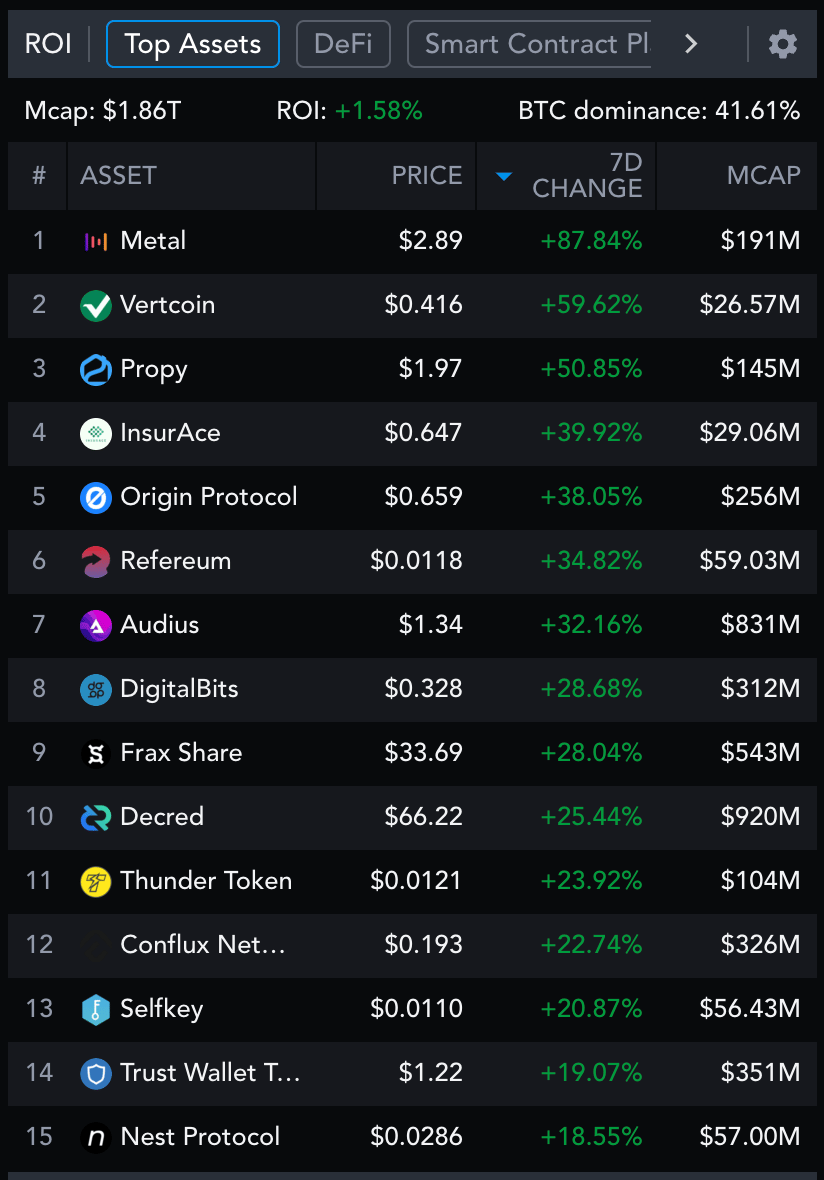

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

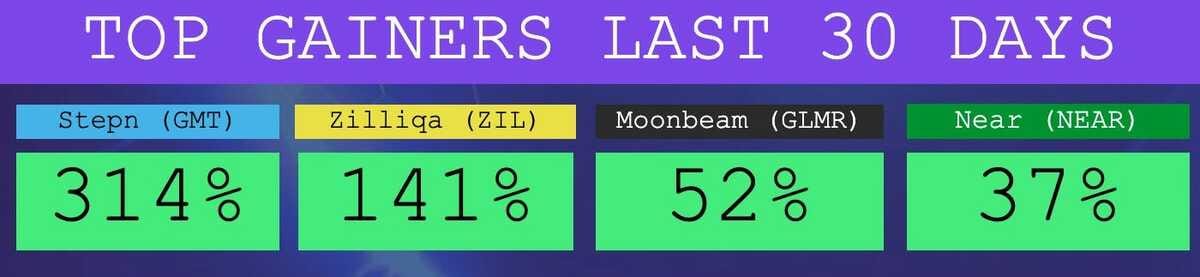

The Top Performers This Month from the Top 100: Stepn is a Web3 Dapp, Zilliqa is an L1, Moonbeam is a Parachain, Near is an L1.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

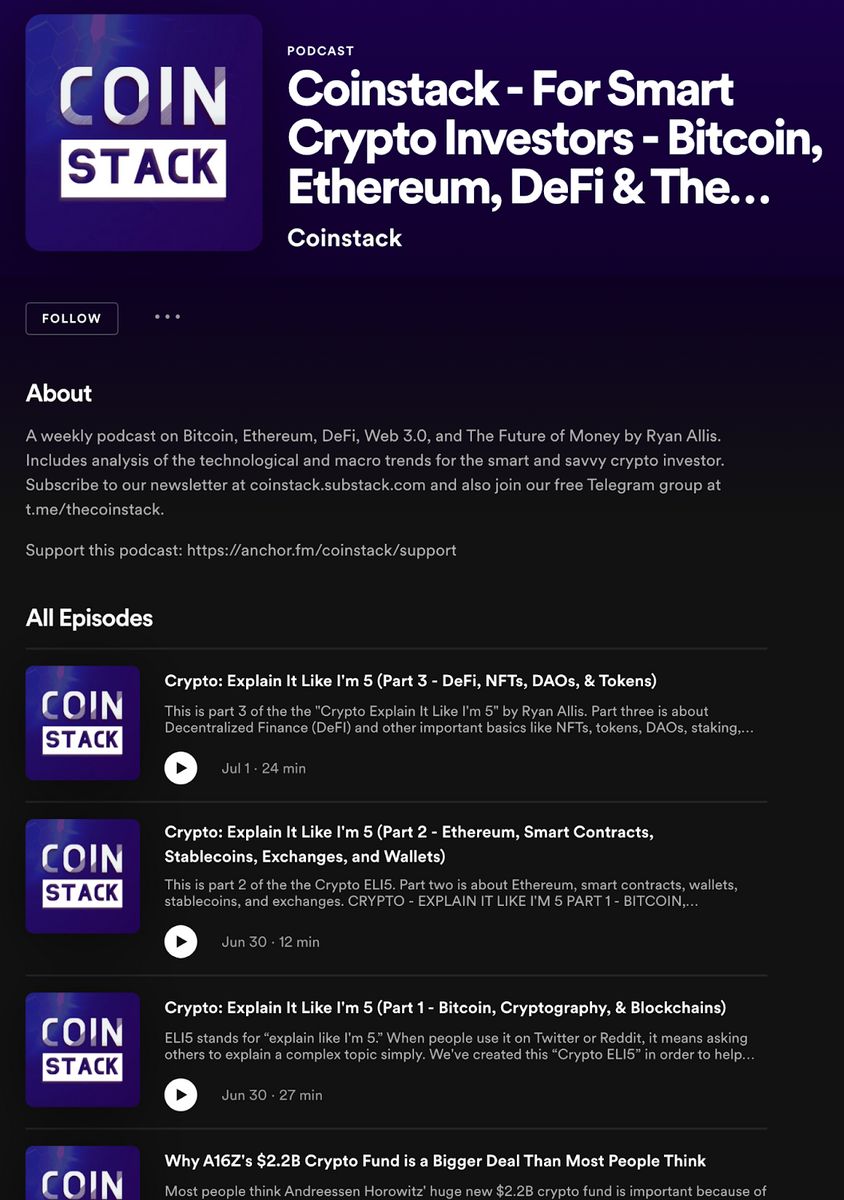

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 22,352 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

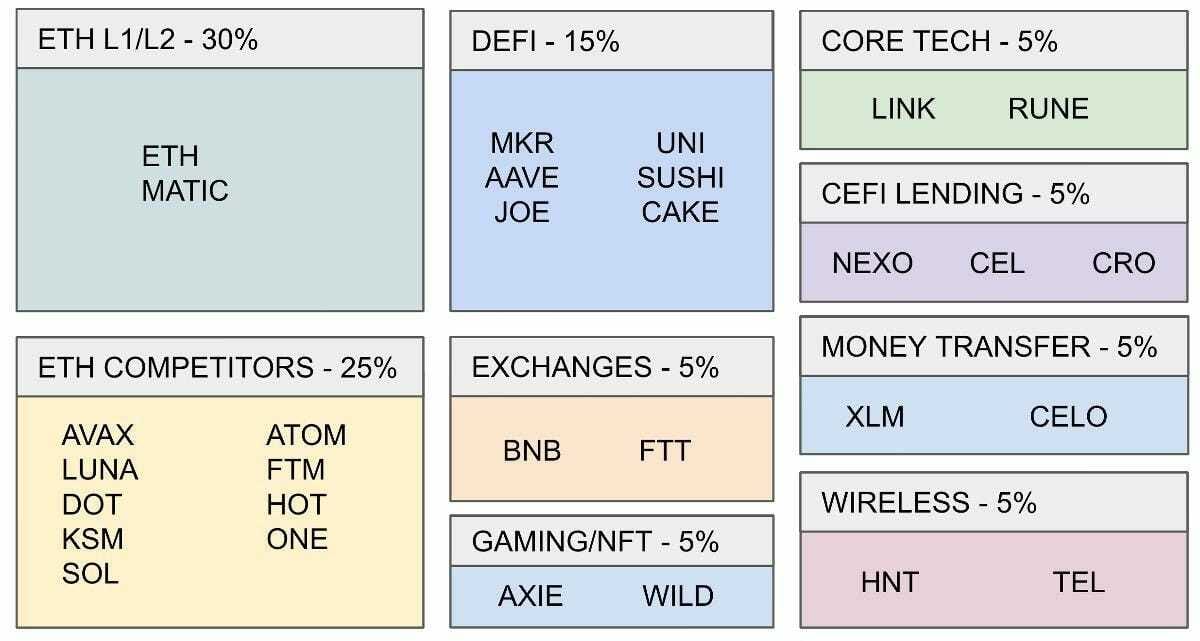

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, LUNA, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.