Inside This Issue:

Latest Bitcoin Forecast

This Week in Crypto...

🗞️ Weekly News

💵 Weekly Fundraises

📈 Top 10 Performers

🎧 Best Podcasts This Week

📊 Stats of the Week

📝 Report Highlights

Binance Reducing Daily Withdrawal Limit for Non-KYC’d Users

The Coinstack Alpha Fund - Up 16% in Last Week

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

Latest Bitcoin Forecast: We remain in the Summer Doldrums in between an expected double market peak. We expect another month of sideways to slightly up consolidation in the Bitcoin price within the $30k to $42k band until a breakout after Labor Day. We expect to see new all-time highs by Fall 2021, reaching $80k+ BTC by End of 2021.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚖️ SEC Chairman Gary Gensler Demands Sensible Regulation - SEC Chair Gary Glenser has asked Congress to pass a law that could give the agency the legal authority to monitor crypto exchanges. He likens the crypto industry to the automobile industry by laying out that things didn’t start taking off until driving rules became regulated. Gensler stated, “Speed limits and traffic lights provided public safety but also helped cars become mainstream. It’s only with bringing things inside—and sort of clearly within our public policy goals—that a technology has a chance of broader adoption.” This means clearer crypto regulation may be coming in the USA -- AND that this might actually make it easier to operate. (Source)

⚖️ New Bill Proposed for U.S. Stablecoin & DeFi Regulation - Following Gensler’s call for clearer regulations, Rep. Don Beyer’s (D-Va.) has introduced a new bill that would allow the U.S. Treasury Secretary to veto the creation of stablecoins, direct regulators to define rules for decentralized finance (DeFi) and possibly create a charter for crypto exchanges, among other measures. The 58-page “Digital Asset Market Structure and Investor Protection Act,” which Beyer introduced Thursday, seeks to create an exhaustive regulatory regime for digital assets. It would do so in part by defining which sorts of cryptocurrencies might be securities, which can be treated as commodities, and bolster tax data collecting for reporting purposes. (Source)

😅 Crypto Faces Potential $30 Billion Tax Threat - In an updated draft of a pending infrastructure bill with a component to increase tax compliance by crypto holders, U.S. Senators narrowed the definition of, “brokers” as "Any person who, for consideration, is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person." Coin Center’s Executive Director Jerry Brito goes into detail via Twitter. (Source)

📶 EIP-1559 Is Set For Aug 5 Around 430am PT - DARMA Capital’s Managing Partner Andrew Keys told Reuters, “Ether's current price has yet to factor in the looming software upgrade.” Given the expected software adjustments from the London Hard Fork, ETH has now seen a 12-day winning streak as reported by CoinDesk. EIP-1559 is scheduled to take place at Block 12,965,000 and you can follow the countdown using Etherscan’s Block Countdown here. (Source)

⚡ Wells Fargo Officially Begins Offering Crypto Exposure To Wealthy Clients - Wells Fargo has opened up its actively managed Bitcoin and crypto strategy offerings to its qualified investor base with an income over $200k/yr. Darrell Cronk, the president of Wells Fargo Investment Institute said, "We think the cryptocurrency space has just kind of hit an evolution and maturation of its development that allows it now to be a viable investable asset. For those investors who qualify and have an interest, there's some good academic and money-management work to suggest that it can be a nice diversifier to portfolio holdings." (Source)

💰 El Salvador Officially Adopts Bitcoin As Legal Tender Sept 7 -Outlined originally by Triple A, starting Sept 7 every business in El Salvador will accept Bitcoin as payment for goods and services alongside the U.S. dollar. El Salvador has a population of 6.5M and over 1/3rd of Salvadorans live abroad. It is currently estimated that nearly 20% ($4B+) of the country’s GDP is made up of remittances or money sent home from abroad in El Salvador’s economy. By moving to BTC as an official currency, the 70% of Salvadoreans who do not have bank accounts will now have a quick and cheap way to send money across borders without relying on traditional remittance firms. (Source)

🏟️ FTX Launches NFT Sports And Entertainment Marketplace FTX has partnered with Dolphin Entertainment to create an NFT marketplace for major sports and entertainment brands. Given the recent boom from #NFTSummer this comes to no surprise. (Source)

The below CryptoPunk sold for over $5.4M this week, making the OpenSea founder Devin Finzer quite happy on Twitter...

🤠 Chinese Miners Land In Texas - Argo Blockchain’s CEO Peter Wall said that what’s driving the migration is low-cost renewable power. He stated, “There’s lot’s of power. It’s low cost. It’s a business friendly state. It’s a pro-Blockchain state and that’s what’s driving a lot of people.” (Source)

📈 Thorchain Surges After Recovering from Hacks - After hackers drained 2,500 ETH from Thorchain’s liquidity pools then faced a second and third exploit shortly thereafter. Thanks to the latest rally, RUNE’s market cap went back to nearly $2 billion. (Source)

💸 The American Bankers’ Association (ABA) Urges Banks To Adopt Defi - In a 20-page report, the ABA encouraged banks to partner with notable Crypto firms to increase consumer access. Forbes’s Jason Brett goes in detail outlining the 10 use cases the ABA lists in their latest report. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📈 Top 10 Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100:

Some of our favorites like RUNE, PERP, SOL, and DOT had an especially great week.

The Top Performers This Month from the Top 100: Axie is a game, Terra and Quant are L1 blockchains, and Perpetual Protocol is a DeFi futures platform.

🎧 Top Crypto Podcasts of This Week

Here are the crypto podcasts that are worth listening to this week...

Queue them up for your daily workout or ride to work.

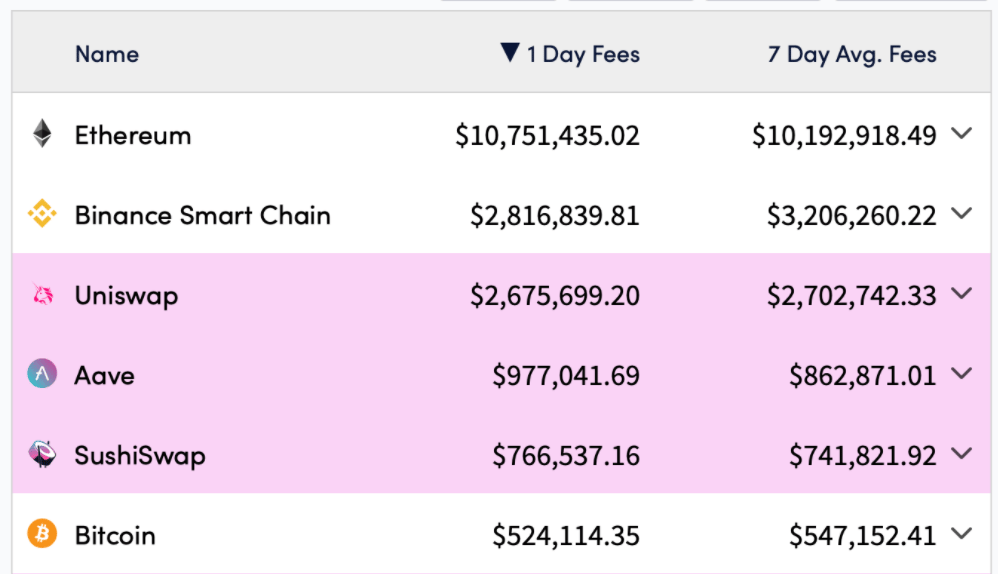

📊 Key Stats of the Week

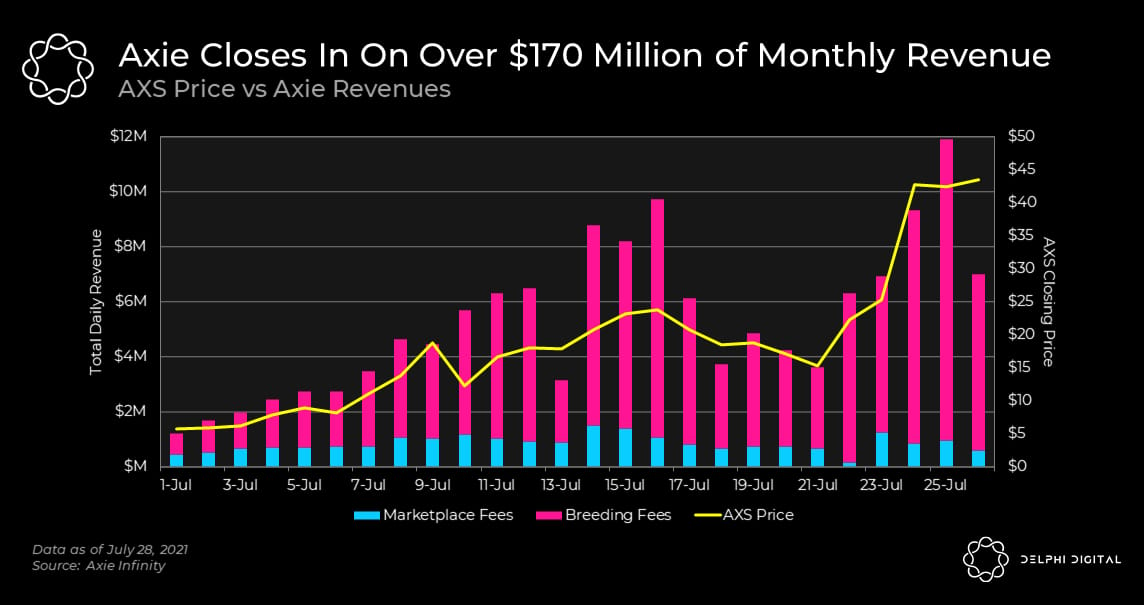

Axie Infinity is now doing more revenue per week than the entire Ethereum blockchain. WTF.

Axie Infinity has achieved $170M in revenue the last 30 days and is on a $300M monthly run-rate. Has any crypto dapp ever seen growth like this. Are these numbers even real?

DeFi Total Value Locked (TVL) has now reached $120B across all chains, with the top dapps by total value locked by Aave, Curve, Instadapp, and Compound.

Ethereum is now averaging over $10M per day in revenues, nearly 20x Bitcoin.

Ethereum is now settling over $21.9B per day in value, over 3x Bitcoin.

In July 2021, there were 1,395 CryptoPunk sales for $135 million, according to CryptoSlam. The average sale was almost $100,000.

Polygon Transactions Per Day Topped Out at 9M in June 2021 And Are Now at 4-5M Per Day As Scaling Competitors like Arbitrum and Optimism Take Hold

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. Africa Now Has More P2P Volume Than N. America

Arcane Research Weekly Report - (password: p2pssa)

In the weekly Arcane Research Crypto Markets Report, they showed that weekly P2P crypto trading volume in Sub-Saharan Africa exceeded trading volume in North American for the first time -- with almost $20M in digital assets being traded through P2P marketplaces last week alone. This trend is driven by skyrocketing demand for digital assets in Nigeria, Africa’s largest country by population with 205 million people.

2. ETH Outperforming Both BTC and BNB

Arcane Research Weekly Report - (password: p2pssa)In the last week Ether (ETH) is up 12% while BTC is up 3%. Ether may continue to outperform the next few days as EIP-1559 goes live on Thursday.

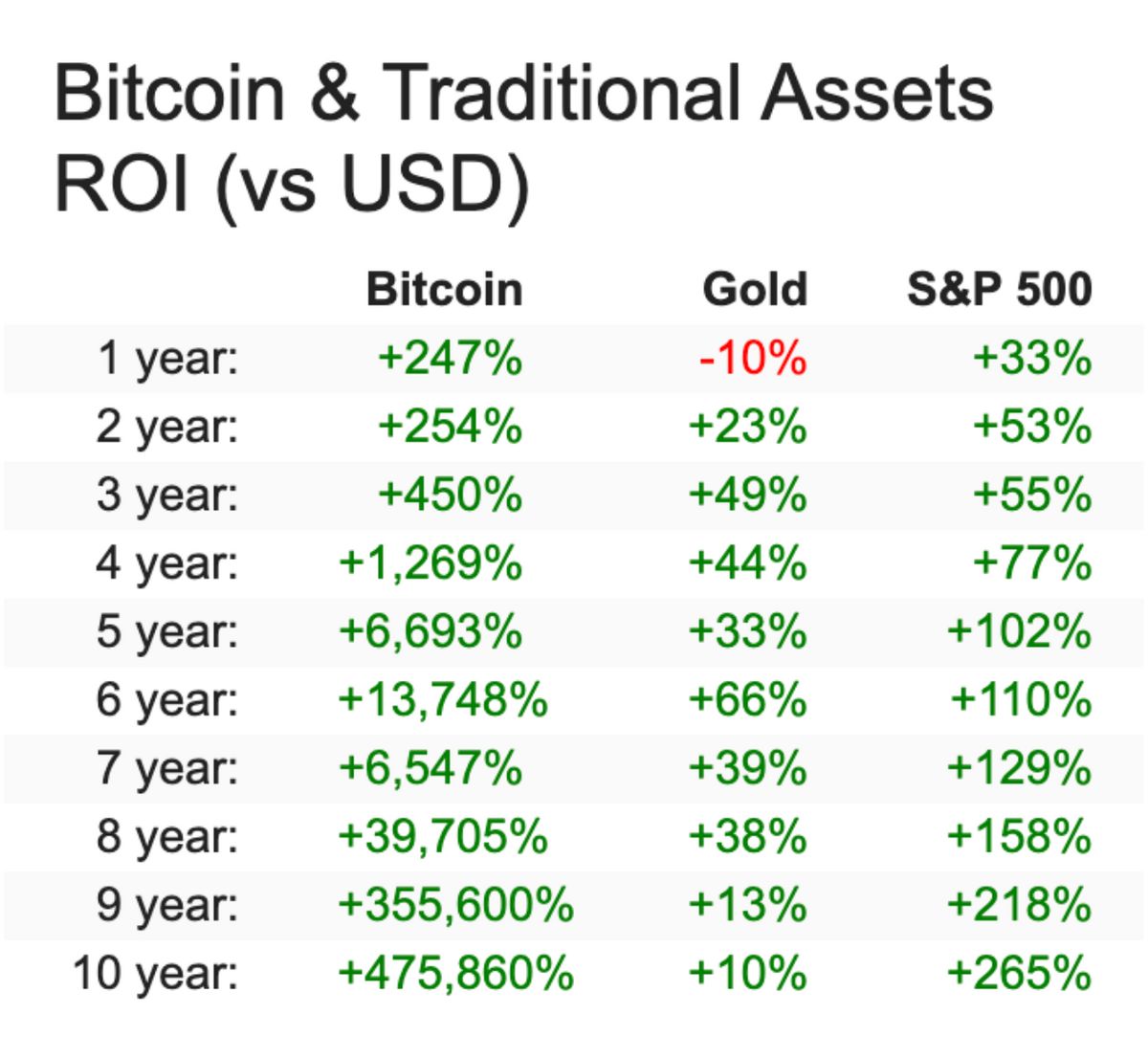

3. Bitcoin - The Best Performing Asset of the Decade

Had you invested $10 in gold ten years ago you would have $110 today. Had you invested $100 in the S&P 500, you’d have $365 today. Had you invested $100 in Bitcoin ten years ago you would have $475,960 today.

4. American Banking Association: What Banks Need to Know About Crypto (Read Report)

The American Banking Association created the below helpful graphic explaining the digital asset landscape.

5. Messari: The People’s Network: The Future of Mobile & Wireless - A Review of Helium (HNT)

Messari recently released a report for their Pro subscribers analyzing how blockchain is being applied to the wireless data space through Helium.

“The Helium network is operational today offering real-world solutions for end-users and businesses that Helium claims is up to 100x cheaper than legacy telecommunications networks like AT&T and Verizon. In just 18 months, Helium has built a functional network of more than 73,000+ wireless ‘Hotspots’ – the nodes of the Helium blockchain, which also serve as wireless base stations for an IoT network – in over 3,800 cities around the world (here’s a global coverage map). That makes Helium the world’s largest LoRaWAN – a low-power, low-bandwidth data transfer protocol – network already, and it’s just getting started.”

Binance Reducing Withdrawal Limits from 2 BTC to 0.06 BTC Per Day for Non-KYC’d Users

Binance has announced that betweek August 4 and August 23 (in staged rollouts), they will begin limiting the amount of withdrawals per day from non-KYC’d accounts from 2 BTC to 0.06BTC (about $2200 per day).

This policy change was announced on July 27 and has caused the amount of BTC held on exchanges to decline by over 100,000 BTC over the last week.

So--if you’ve been using Binance via a VPN and aren’t KYC’d, get your money out while you still can. If you don’t, you may either need to identify yourself by uploading your ID -- and if you’re in a country Binance doesn’t serve -- they usually give you 14 days to transfer your assets out and close your account.

For those in the USA, using an exchange like FTX, Gemini, or Coinbase Pro may be safer than Binance.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 2,065 plays and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.Here are the episodes we’ve released so far...

You can listen and subscribe on:

Thanks for listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

📈 Invest In The Coinstack Alpha Fund

In April 2021 we launched The Coinstack Alpha Fund, which is an on-chain fund on top of the Enzyme platform.

The fund is up 16% in the last week, driven by a resurgence in Ethereum, Polkadot, and Defi investments. Our holdings of RUNE, MLN, and PERP performed especially well this past week.

You can invest here in the Coinstack Alpha Fund. There is no minimum investment, although there is a gas fee you pay to Ethereum network to invest -- which has been around $50-$100 recently.

We are now up to $208k from 31 depositors in the Coinstack Alpha Fund. Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls

Every Wednesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 12PM PT / 3PM ET / 8pm GMT. All investors in our Coinstack Alpha Fund on Enzyme are invited to join and ask questions and share learnings with each other. After you invest, just reach out to Ryan Allis on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.