Issue summary: We cover the most important crypto news, stats, and reports of the week. This week we’re writing from Miami where events like DCentral, Regenaissance, BitBasel, and Qrypto Queens have helped make NFTs and digital assets a central part of pop culture during Art Basel.

In This Week’s Issue:

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Podcasts

📈 Top 10 Performers

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ Ethereum Founder Vitalik Buterin Proposes a Fix for High Gas Fees - Vitalik suggests a new short-term solution to curb soaring gas prices on Ethereum that involves a new network upgrade that reduces the transaction call data cost and limits the total transaction call data in a single block. (Source)

😮 StarkWare Launches New Product Offering 100x Ethereum Gas Cuts - StarkNet Alpha, a highly-anticipated Layer 2 scaling solution for Ethereum, has launched its alpha version on mainnet. (Source)

🏧 Peter Thiel-Backed Institutional Exchange Bullish Goes Live - Bullish, an institutional exchange backed by some of the biggest names in traditional finance and Block.one of EOS fame, has launched in Gibraltar. (Source)

💰 Grayscale Launches Solana Trust Product - The product will offer exposure to SOL, the native token used on the Solana blockchain. (Source)

🤑 India’s First Crypto Unicorn Seeking IPO Pending Government Approval - India’s first cryptocurrency unicorn, CoinDCX, intends to pursue an initial public offering just as soon as the government allows it. (Source)

🏦 CZ Hints That France Is Running As the New Binance Global Headquarters - Binance boss Changpeng Zhao (CZ) said France stands out as a “natural choice” to locate a regional or even global headquarters. (Source)

🇺🇸 Senate Banking Committee Chair Seeks Answers on Stablecoins From Tether, Centre, Paxos, and More - Senator Sherrod Brown is calling on stablecoin operators to open up about their processes. (Source)

🎆 Ethereum Payments Are in the Works for Twitter - The addition of Ethereum payments follows the introduction of Bitcoin tipping to the social media platform earlier in the year. (Source)

📈 Citigroup Appoints New Head of Digital Assets for Institutional Clients As It Eyes Up to 100 New Hires - American banking giant Citigroup has promoted Puneet Singhvi from the head of blockchain and digital assets in the global markets division to lead its. (Source)

💳 MicroStrategy Buys More Bitcoin for Over $414 Million in Cash - MicroStrategy now holds a total of 121,044 bitcoins, worth nearly $7 billion at current prices. (Source)

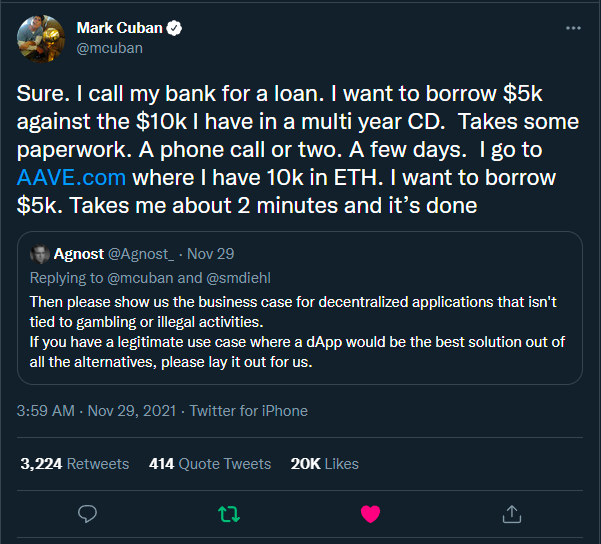

💬 Tweet of the Week

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Celo is fully compatible with Ethereum, so you can run smart contracts built in solidity. It uses proof-of-stake consensus, has high throughput, and five-second transaction finality. Celo is now the fourth fastest-growing blockchain in all of DeFi. Learn more about Celo and its family of stablecoins by visiting http://celo.org.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

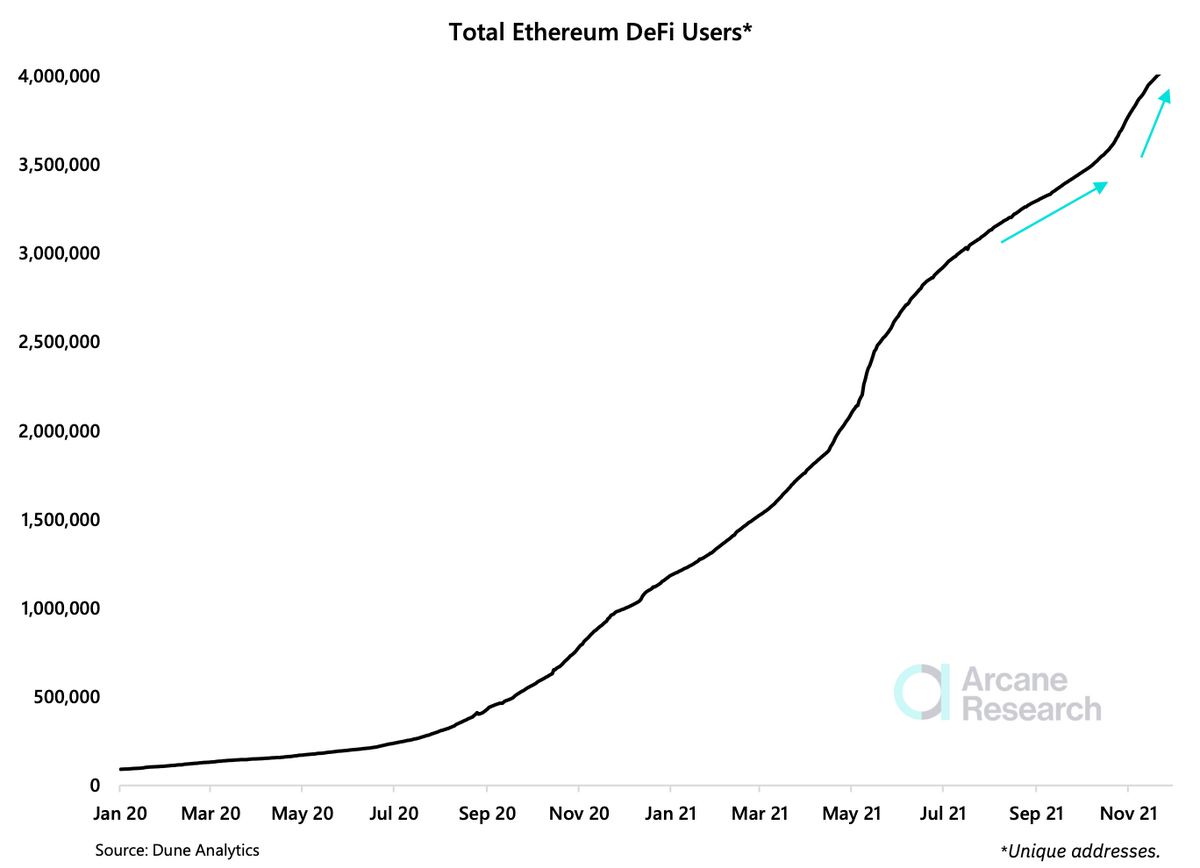

1. Total Ethereum DeFi Users Reach 4 Million

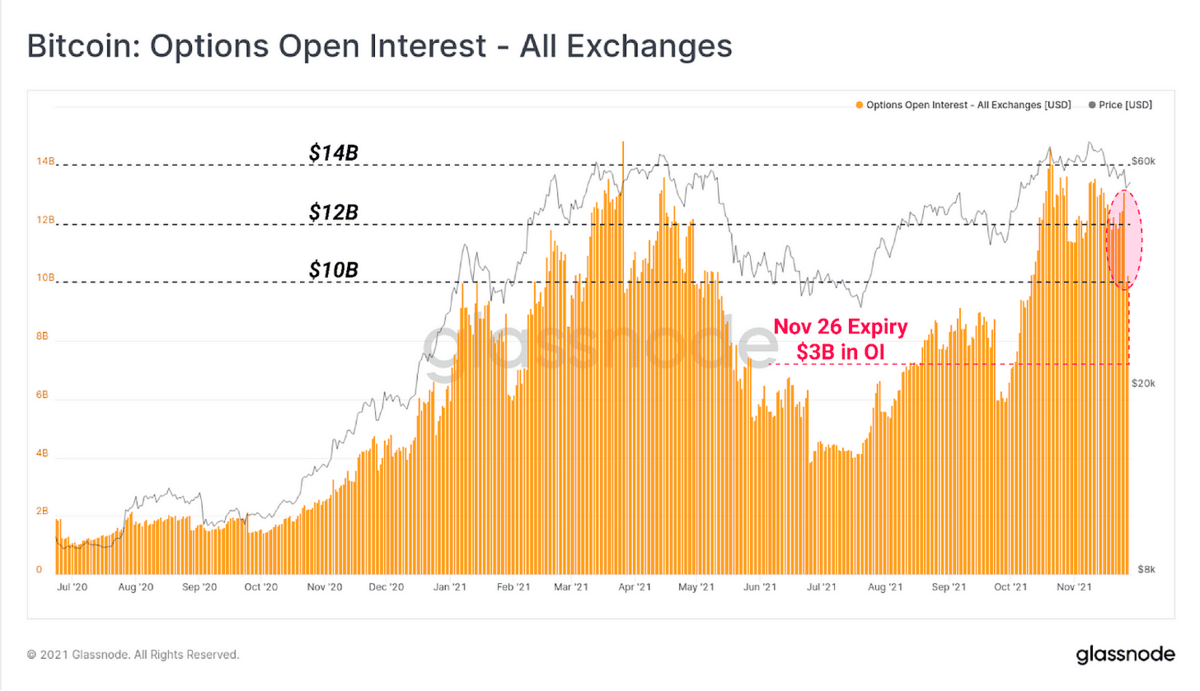

2. BTC Total Open Interest Comes Off Highs Down $10B Following the Expiry of the 26–November Contracts

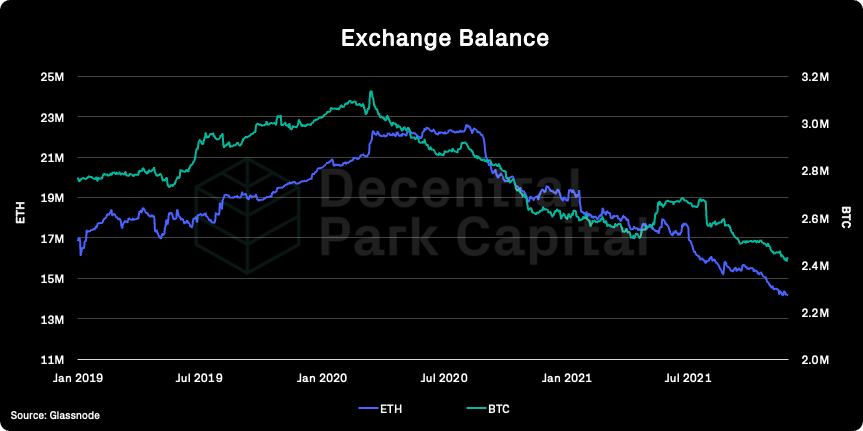

3. Exchanges Showing Continued Outflows From BTC and ETH Indicating a Macro Bull Market Is Still in Effect

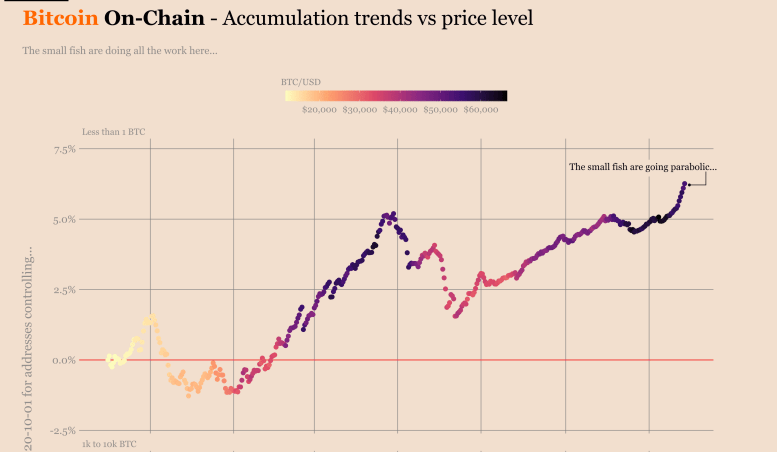

4. On-Chain Metrics Showing Retail Investors Buying the Dip

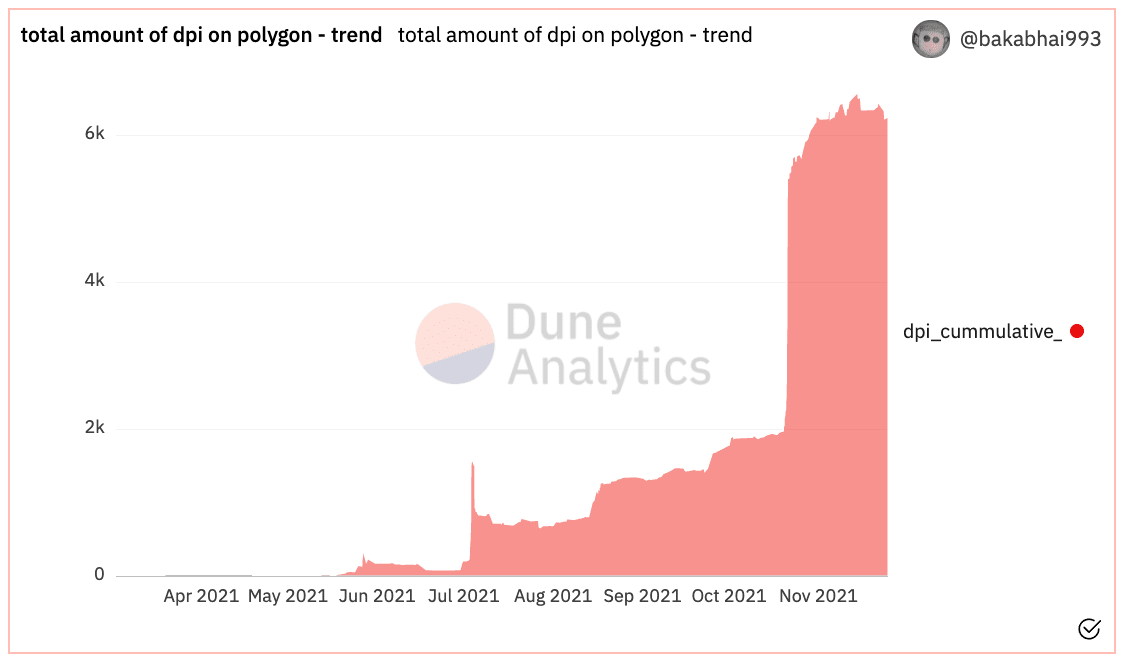

5. 6260 DPI Worth ~2.2M USD Currently Sit on the Polygon Network Since the WETH-DPI Contract Was Introduced

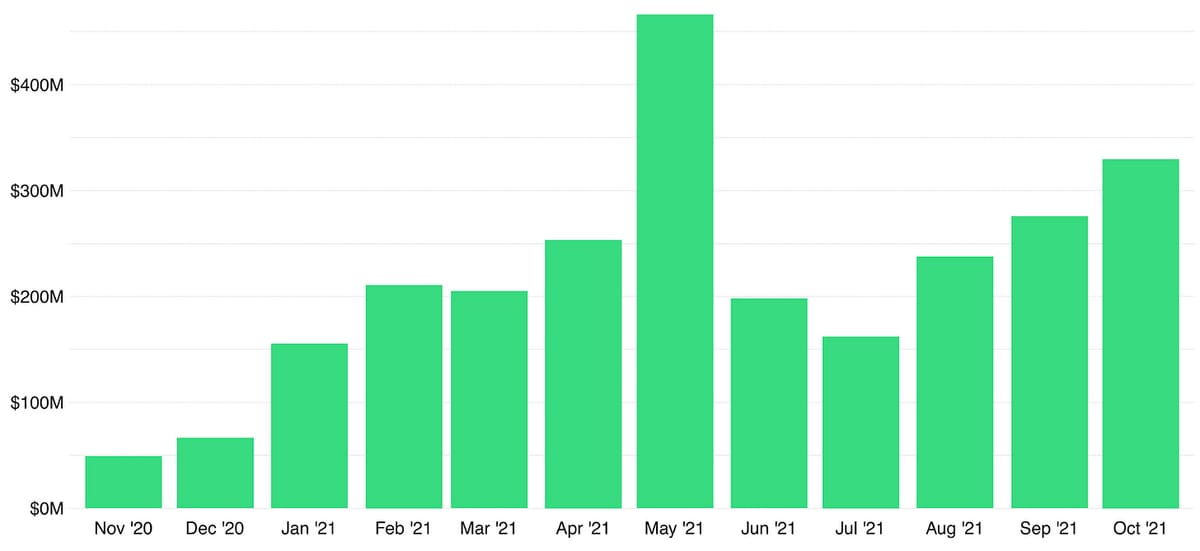

6. DeFi Dapps Generated Over $4B of Annualized Revenue in Oct

7. ETH/BTC Is Testing the Upper Trend Line for the Third Time in the Past Year

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

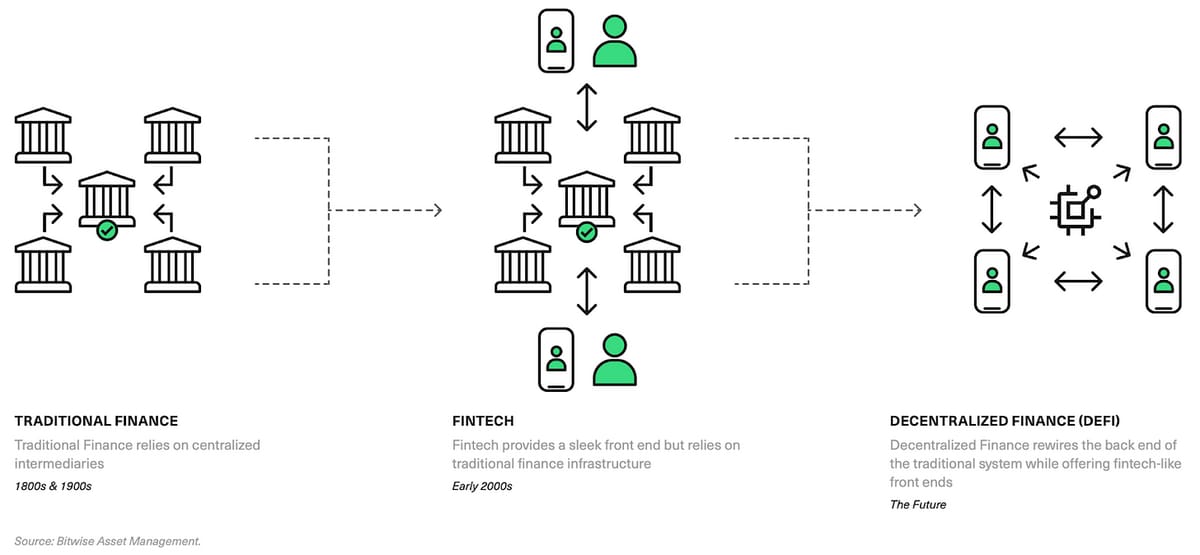

1. How DeFi Transforms Financial Services

Bitwise is an institutional asset manager in the DeFi space, and in their latest report, Managing Partners Ryan Rasmussen and David Lawant dive deep into how DeFi transforms financial services.

"In traditional finance, individuals who want to take out a loan from a bank first have to become a customer of the bank through a customized and often tedious application process. This typically requires disclosing personal information like their social security number and home address in lengthy forms specific to the lending institution. To receive the loan, the individual must typically drive to or call a bank during their business hours, meet with a loan officer, apply for and negotiate the loan terms, and, if approved, sign a variety of legal documents and contracts that are full of complex legal jargon. The process takes days and requires significant overhead."

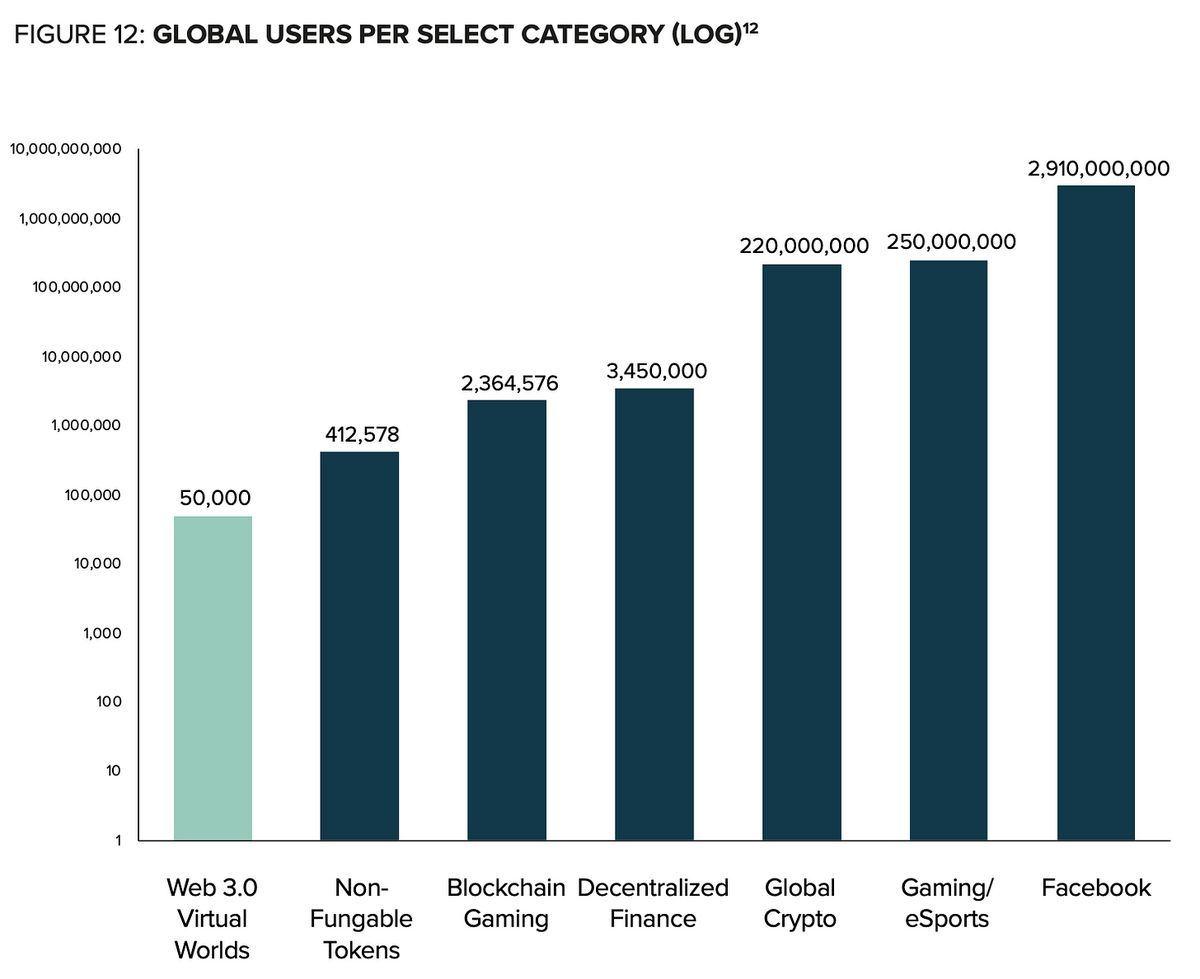

2. Metaverse Virtual Worlds Have Exponential Potential

Grayscale is behind a family of products that provides investors with access to the digital currency asset class. In their latest report, the team looks at the Web 3.0 landscape.

“Compared to other Web 3.0 and Web 2.0 segments, Metaverse virtual world users are still in their early innings, but if current growth rates remain on their current trajectory, this emerging segment has the potential to become mainstream in the coming years.

Web 3.0 Metaverse virtual worlds create real-world value for the developers, third-party creators, and users building these emerging market internet-native crypto cloud economies. All-time value spent on Web 3.0 Metaverse item sales such as virtual land, goods, and services has topped $200 million.”

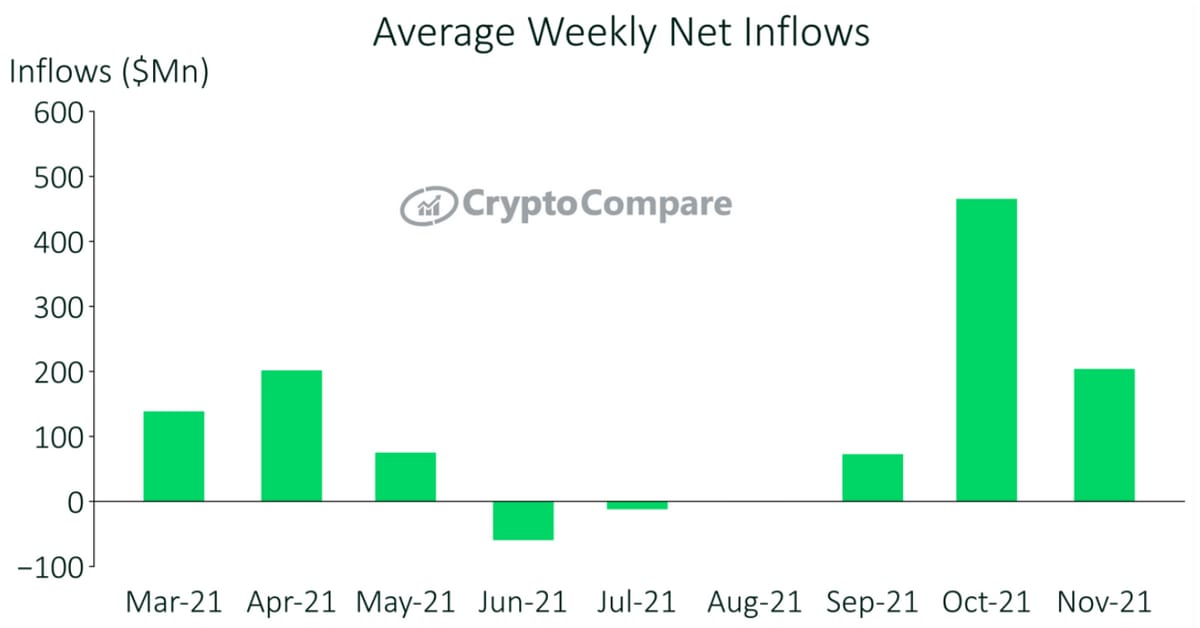

3. Net Inflows Were Positive in November for the Third Month in a Row

Digital Asset Management Review, Nov 30, 2021Crypto Compare is a global cryptocurrency market data provider, and in their latest digital asset management review, the team shares insights from November's market activity.

"Weekly flows into Bitcoin-based products in November averaged $94.4mn, while all others totaled $67.8mn. Of those, Ethereum-based products averaged $24.4mn, followed by Cardano-based products ($10.7mn) and Tron-based products ($10.5mn).”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

😂 Meme of the Week

📈 Top Performers This Week

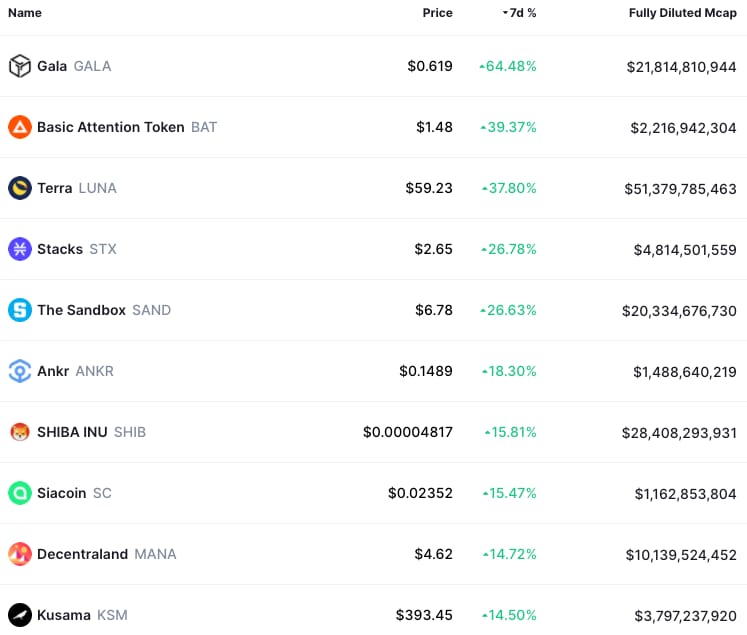

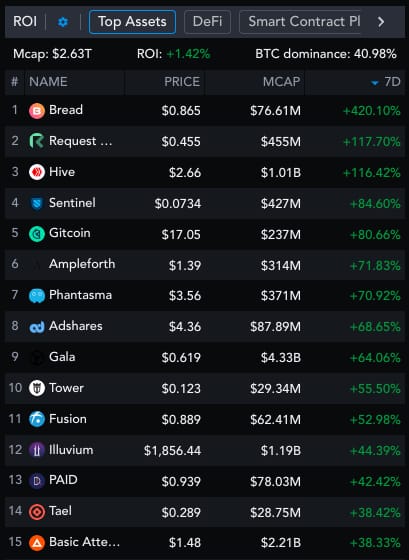

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like GALA, BAT, and LUNA had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

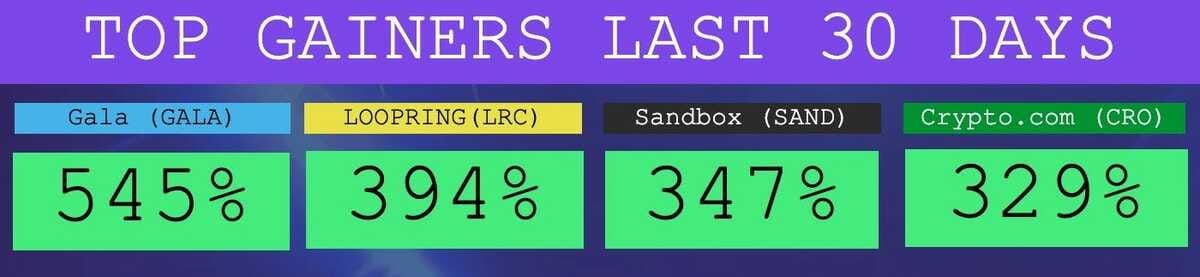

The Top Performers This Month from the Top 100: Gala is a game, Loopring is a zkRollup, Sandbox is a metaverse, Crypto.com is an exchange.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 12,443 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

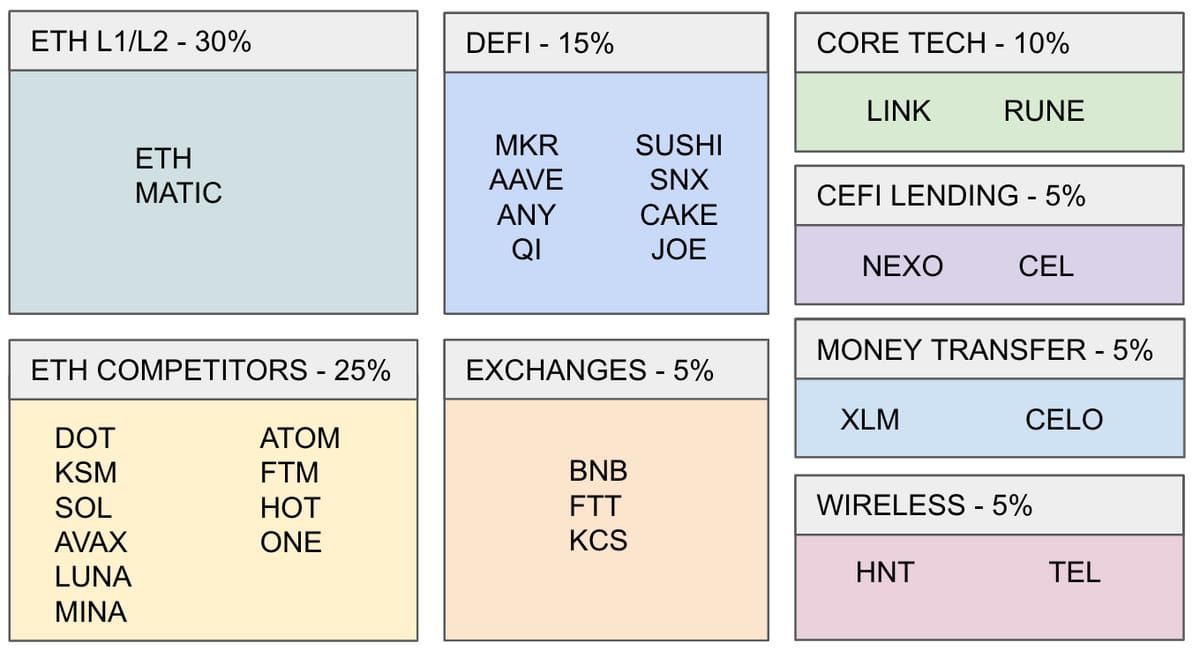

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.