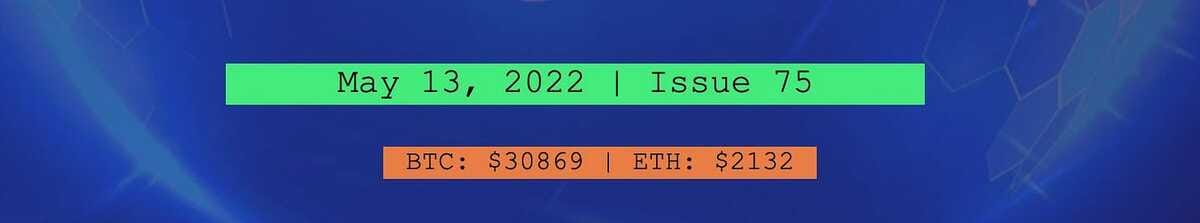

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem. This week we saw the UST stablecoin depeg, the LUNA token collapse, and the Terra blockchain get halted. It was a week for the history books in the land of programmable money.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - UST De-Pegs, Luna Crashes, El Salvador Acquires More BTC

💵 Weekly Fundraises - Spice VC ($250M), KuCoin ($150M), Talos ($105M)

🌕 Understanding the UST Depegging

📊 Key Stats - Rainbow Bridge, Ref Finance, GMX

🧵 Thread of The Week - The UST Depeg Thread

📝 Stratmont Report Highlights

🎧 Best Crypto Podcasts - Coinstack, Bankless, RealVision

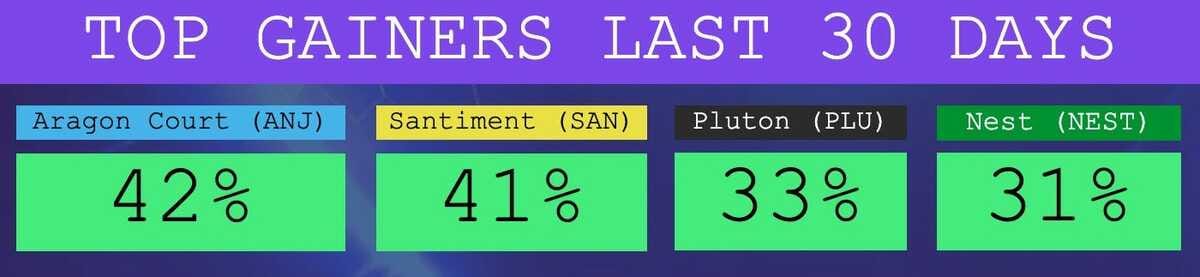

📈 Top 10 Tokens of the Week - ANJ, SAN, PLU

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

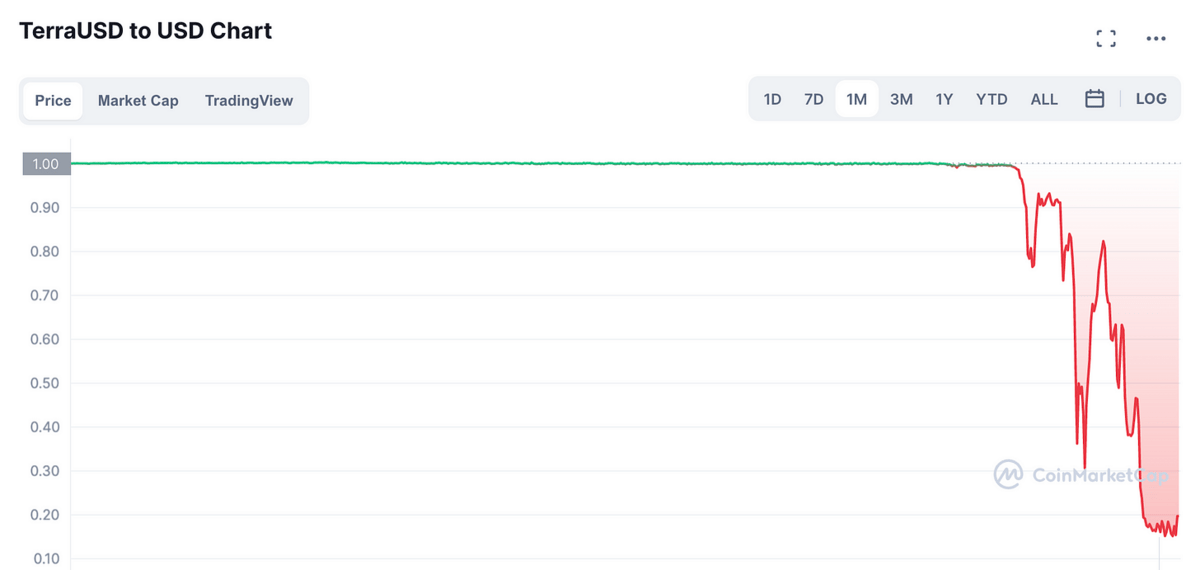

🌙 UST Stablecoin De-Pegs, Crashing Luna - The price of Terra’s algorithmic stablecoin, TerraUSD (UST), dropped from $1 to about $0.20 this week, while LUNA token dropped over 99%, leading to a halt in the Terra Blockchain. $14B in UST value has nearly evaporated this week. If there’s one thing blockchains aren’t supposed to do — it’s to stop producing blocks. Here’s a good post-mortem.

🇦🇷 Argentina Central Bank Bans Their Banks from Facilitating Crypto Trading - Once regarded as a crypto-friendly country, the pendulum has swung has Argentina banned crypto trading after the International Monetary Fund (IMF) reportedly pressured policymakers. We think the IMF is on the wrong side of history, here. Time will tell.

🇸🇻 El Salvador Acquires 500 Additional Bitcoin Amid Market Drop - The government of El Salvador has continued its bitcoin buying spree with the purchase of an additional 500 tokens for roughly $15.3 million, President Bukele tweeted on Monday.

⚠️ US Punishes Blender.io for Helping North Korea Launder Millions in Stolen Axie Crypto - The US Treasury Department announced on Friday that it’s sanctioning Blender.io, essentially cutting the Bitcoin mixer off from the US financial system. (Source)

🇯🇲 Jamaica to Launch CBDC this Summer - Following its successful pilot program, Jamaica’s central bank digital currency is set to become publicly available this summer, Central Bank of Jamaica governor Richard Byles told Blockworks. (Source)

🐦 Binance Backs Elon Musk’s Twitter Acquisition Bid with $500M - Binance, the world's largest cryptocurrency exchange, has committed $500 million to Elon Musk's $44 billion bid to acquire Twitter, according to an updated 13D filing with the SEC. (Source)

📱 Meta to Start Testing Digital Collectibles on Instagram - Meta will start testing digital collectibles and NFTs on a small number of users on Instagram this week, according to chief executive Mark Zuckerberg. (Source)

⚖ DOJ Indicts Crypto CEO for Alleged $62M Fraud Scheme - The CEO of mining and investment platform Mining Capital Coin (MCC), Luiz Capuci Jr., has been indicted for allegedly orchestrating a $62 million fraud that affected thousands of investors. (Source)

🖊️ California Gov. Gavin Newsome Signs Crypto Executive Order - California Gov. Gavin Newsom earlier today signed an executive order directing multiple state agencies to examine cryptocurrencies and blockchain technologies and recommend ways to incorporate those into the functioning of the nation’s most populous state. (Source) Share Coinstack

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🌕 Understanding the UST Issue

Yes, this was a big week in the realm of programmable money. Suffice to say, that a lot was learned.

All was looking promising in Terra land until recently… It was the common market wisdom a week ago that Terra was a successful fast-growing blockchain with the second most TVL in DeFi, had the fourth largest stablecoin in the world after USDT, USDC, and BUSD, and had the fastest growth in their developer ecosystem.

What was learned after the crash?

Collateralization really matters. When USDT temporarily depegged this week during the height of the market crisis to $0.95 it came back in a few hours. Why? Because it is backed 100% by reserves that are audited and can be redeemed for $1 at any time.

Stablecoins that stabilize through a mechanism involving selling their native token can create a self-referential death cycle that is exploitable.

Ethereum gained a lot in reputation this week as Terra crashed. Maker’s DAI (which is over-collateralized by ETH) also gained a lot in rep.

Don’t invest more than 10% of your capital in an algorithmic stablecoin, even if it’s the fourth biggest stablecoin in the world with $14B in supply and huge ecosystem backers.

If the algorithmic stablecoin drops below 0.98, have a market order sell it. Get out. While it most historical cases stablecoin depegs have come back — it’s better to get out at 0.98 than wait and see.

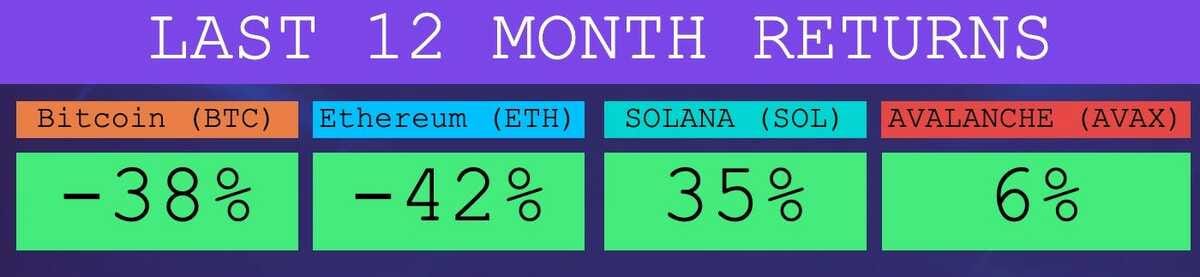

This failure was bigger than Mt. Gox ($460M) and Lehman Brothers ($46B). The total market cap of LUNA and UST at peak was $59B, larger than the $46B of Lehman Brothers that collapsed in September 2008. And yet we are still at BTC at $30k and ETH at $2k. Incredible.

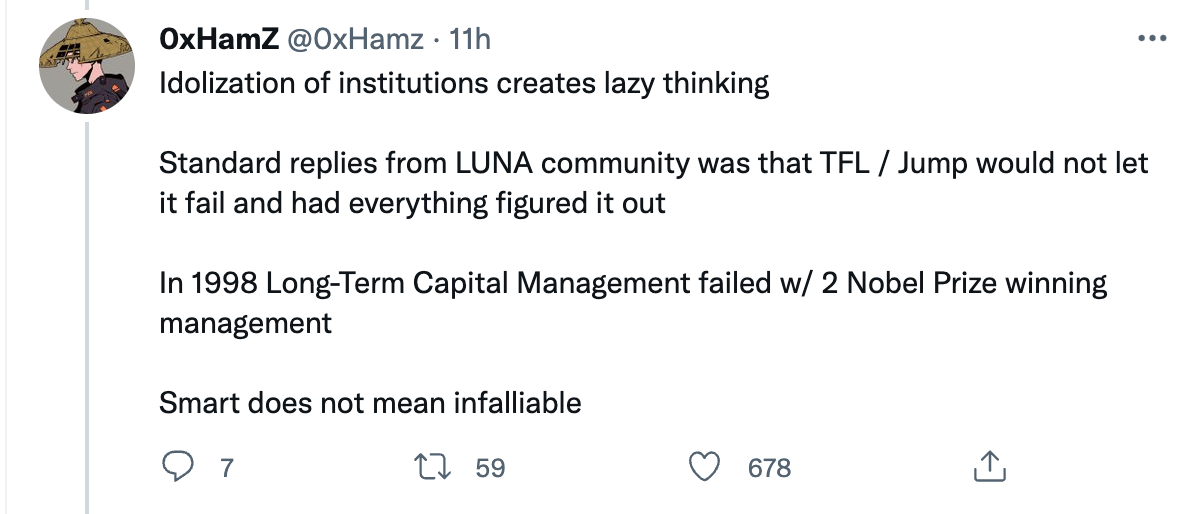

While these lessons are clear in hindsight, going into the week LUNA was worth $28 billion and UST was worth $14B, UST had amassed $3B in BTC and AVAX reserves, and it seemed like Three Arrows Capital and Jump Crypto were brilliant. Wow, a lot can change in a week.

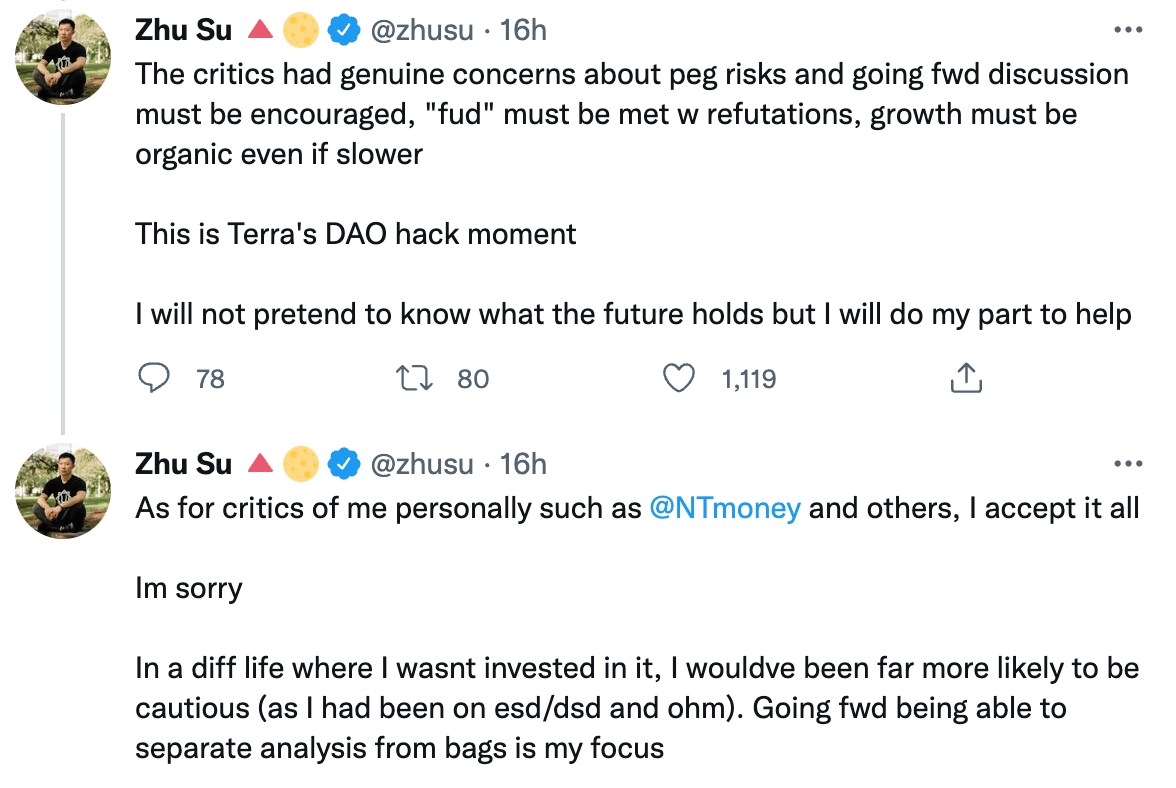

Some humble pie for many industry insiders like Zhu Su of 3AC…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The UST Chart This Month - From $1 to 0.20

2. The LUNA Chart The Last Year - From $4 to $118 to <$0.01

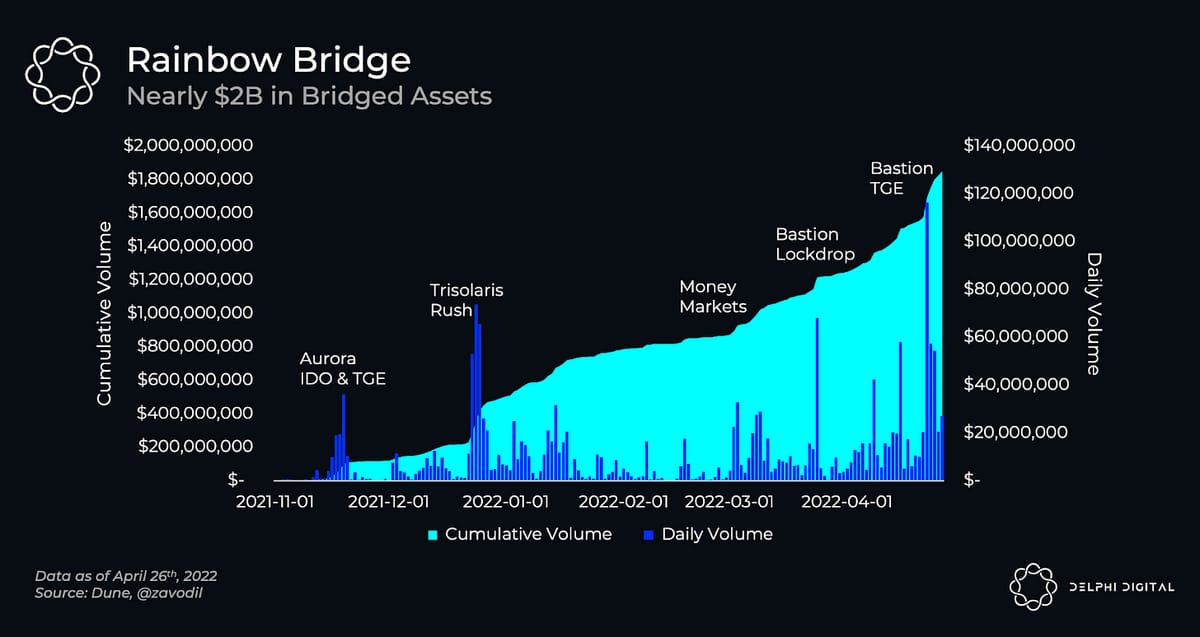

3. Rainbow Bridge Has Now Processed Nearly $2B in Bridged Assets

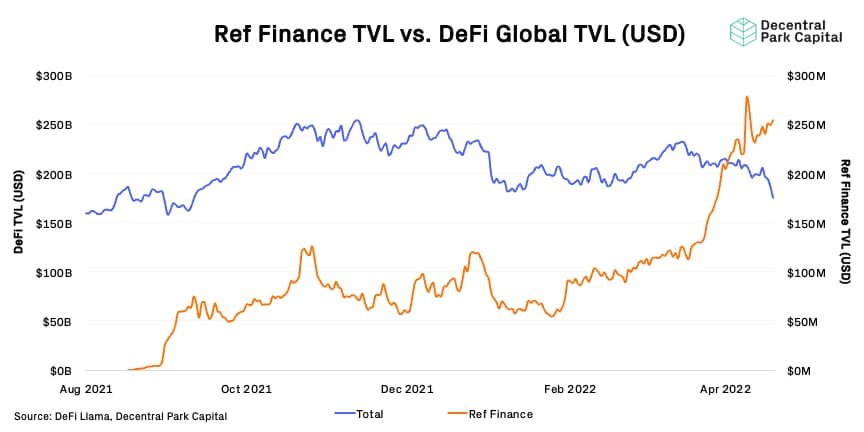

4. Ref Finance Reached $250M, 2x in Growth Since April

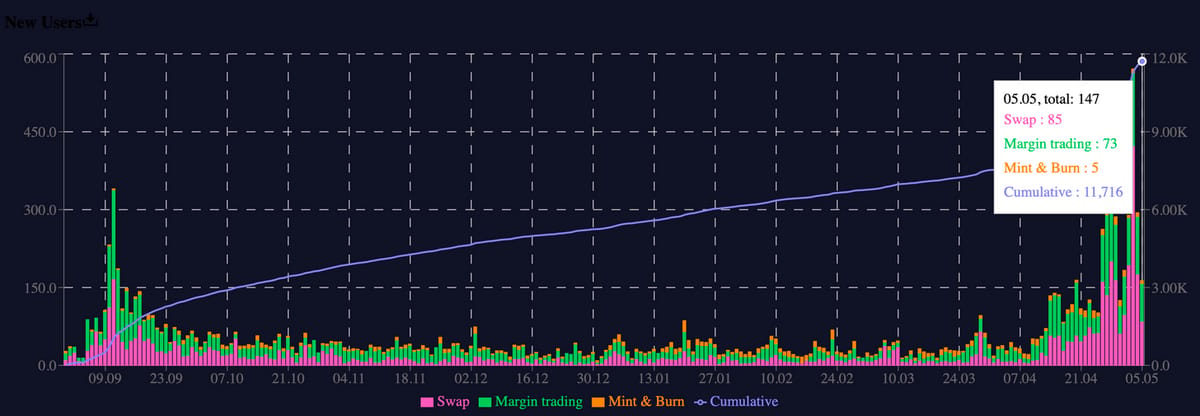

5. GMX Scales to 11.6K Users and $36.4m in total fees

6. Evmos Started Gaining TVL on Its Various Native Projects, With Diffusion Finance Taking the Lead As Its Native DEX

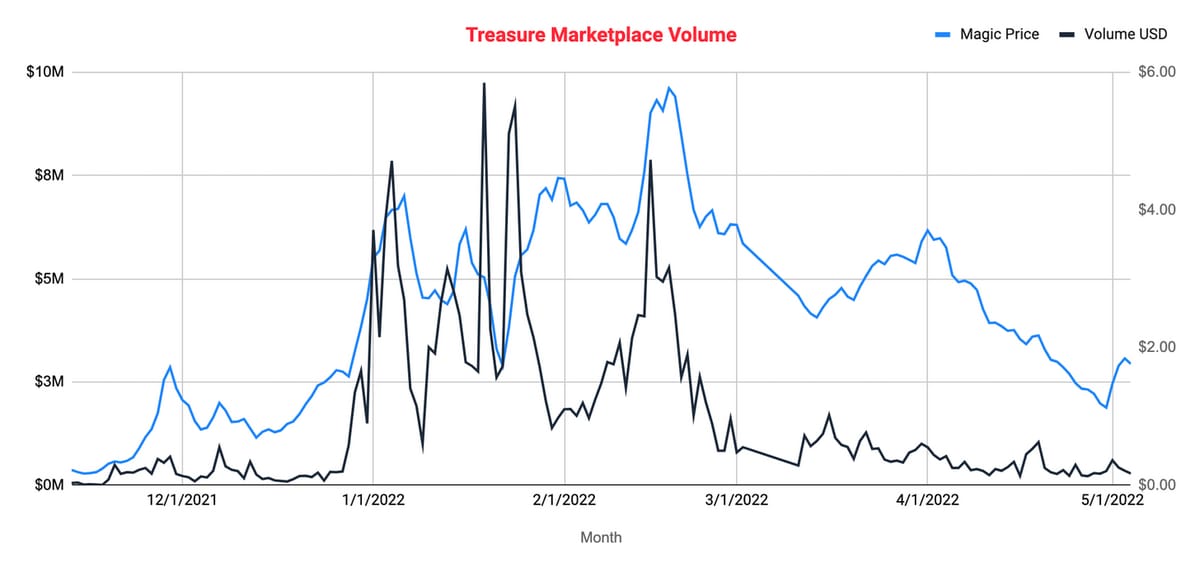

7. TreasureDAO Marketplace Exceeds $268M in Volume

🧵 Thread of the Week

1/ I’ve spent the last few days on the phone calling Terra community members – builders, community members, employees, friends and family, that have been devastated by UST depegging. I am heartbroken about the pain my invention has brought on all of you.

2/ I still believe that decentralized economies deserve decentralized money – but it is clear that $UST in its current form will not be that money.

3/ Neither I nor any institutions that I am affiliated with profited in any way from this incident. I sold no LUNA nor UST during the crisis.

4/ We are currently working on documenting the use of the LFG BTC reserves during the depegging event. Please be patient with us as our teams are juggling multiple tasks at the same time.

5/ There are multiple proposals on Agora on the best steps to move forward for the community – after having read many of them, I’ve put down my thoughts of what I think the best steps are.

6/ What we should look to preserve now is the community and developers that make Terra’s blockspace valuable – I’m sure our community will form consensus around the best path forward for itself, and find a way to rise again.

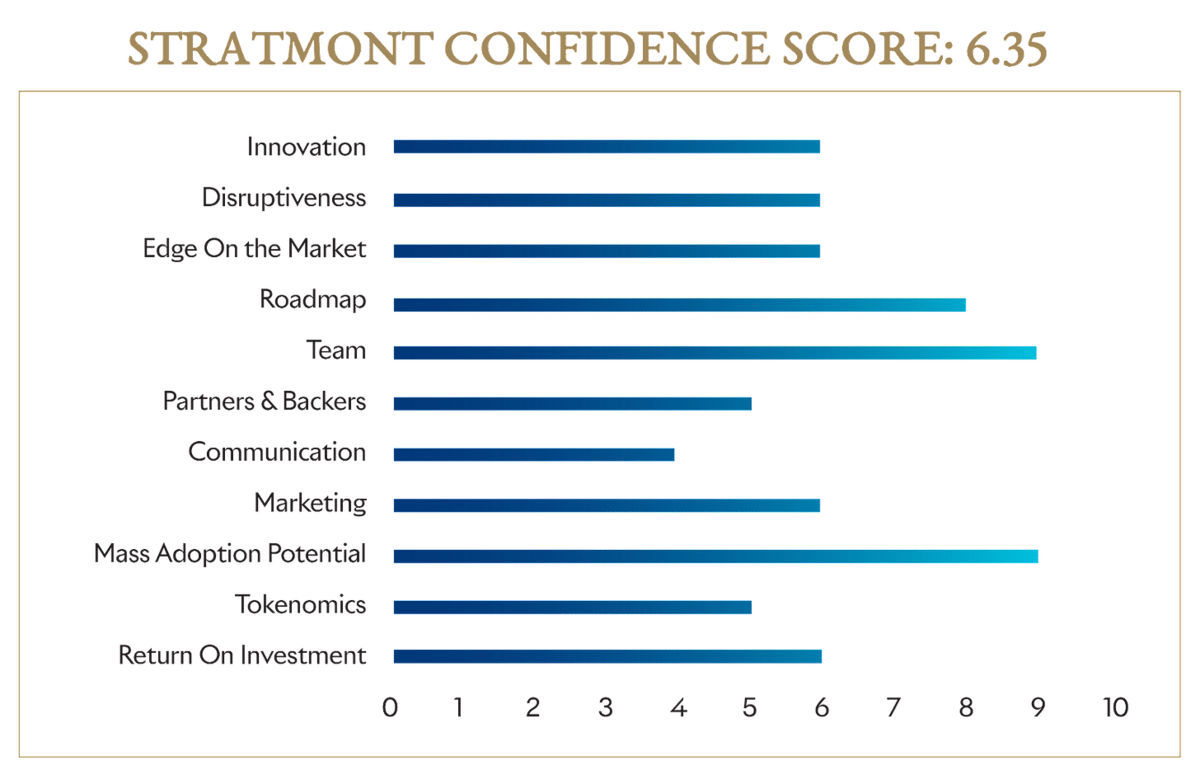

📝 Crypto Intelligence Report: TONCOIN

About the Author: Stratmont Brothers is a European crypto trading fund achieving outsized returns with low drawdowns. They are known for their superior digital asset trading strategies that provide a secure vehicle for institutional investors. Equipped with a world-class intelligence department, they stay ahead of the curve and openly share their valuable insights. Stratmont Brothers mission is to create a better world for the next generations. You can subscribe to their Substack here.

About the Article: This is an excerpt from the full article which you can find here

Short Introduction

TON is an ultra-fast and user-friendly blockchain designed to host individual users and enterprises. The project was created by Telegram founder Pavel Durov and his brother, Nikolai, in 2017, but three short years later, Telegram walked away from the project for good. TON is led by an open-source community of experienced developers consisting of some of the best programmers in the world and Telegram blockchain contest winners. Applying its existing ecosystem of communities, developers, publishers, payment providers, and merchants, TON is uniquely positioned to establish the first-ever mass-market cryptocurrency in history.

Apart from processing millions of transactions per second, TON blockchain-based ecosystem has all the chances to give rise to a genuine Web3.0 Internet with decentralized storage, anonymous network, DNS, instant payments and various decentralized services. TON architecture is designed to enable merging all existing blockchains into a single decentralized network.

Growth Narrative

According to the project’s whitepaper, “The Open Network (TON) is a fast, secure and scalable blockchain and network project, capable of handling millions of transactions per second if necessary, and both user-friendly and service provider-friendly.”

The project was initially developed by encrypted messaging platform Telegram and called the Telegram Open Network. Telegram planned to launch a token called Gram, but the development was banned by the US Securities and Exchange Commission in March 2020. The SEC prohibited the issuance of Gram, because the digital token sales would constitute securities offerings with no registration exemption available.

Telegram gave up on the project in May 2020, and two developers, Anatoliy Makosov and Emelyanenko, took over the development of TON through an open-source community called Newton. Within a year, the community voted to launch on Mainnet and renamed the Newton community as The Open Network (TON) Foundation.

By the third quarter last year, TON had launched decentralised bridges linking to the Ethereum (TON-ETH) and Binance smart chain (TON-BSC) networks, which enable users to transfer TON tokens to the two blockchain networks. In Q4, the network token was listed on cryptocurrency exchanges such as OKX, Bitget, FTX, Gate.io and HitBTC.

The project plans to launch more user-friendly features to expand the use cases of the TON ecosystem throughout 2022. According to the TON website, its micropayment platform (TON Payments) and DNS are 90% complete and are scheduled to launch in Q2 this year, while the 75% complete proxy network will be launched in Q3. The TON Payments feature will allow users to make “instant off-chain value transfers between users, bots and other services”, while TONS DNS will enable the browsing of blockchain to become similar to surfing the internet.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Aragon Court is a Dapp, Santiment is a Governance Token, Pluton is a Dapp, Nest is an Oracle.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 22,875 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.