Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Yi He—widely regarded as the most powerful woman in crypto—was appointed Binance’s new Co-CEO, Bitcoin fell below $86,500 erasing $144 billion in total crypto market cap, and exchange trading volume slipped to $1.6 trillion in November, its lowest level since June. Meanwhile, Ethereum raised its block gas limit to 60M ahead of the upcoming Fusaka upgrade, and Grayscale filed with the SEC to launch the first-ever Zcash ETF. On the fundraising front, Pruv Finance raised $3M, Nexton secured $4M, and Ranger Finance raised $6M through a public token sale, while SpaceComputer raised $10M in a seed round led by Maven 11 and Gonka led the week with a $12M strategic round backed by Bitfury.

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world’s leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Yi He, Arguably Crypto’s Most Powerful Woman, Becomes Binance’s New Co-CEO: The new leadership role was announced by the current Binance CEO Richard Teng at Binance Blockchain Week in Dubai.

📉 Bitcoin slides below $86,500, wiping out $144 billion in crypto market cap:Bitcoin dropped below $86,500 on Sunday night, as macroeconomic pressure and Yearn Finance’s hacking incident drove investors toward risk-off positions.

👇Crypto exchange volume drops to $1.6 trillion in November, lowest since June:Crypto exchange monthly spot volume fell to $1.59 trillion in November, the lowest level since June.This is a 26.7% drop from October’s $2.17 trillion, making November the weakest month in volume since June’s $1.14 trillion, according to The Block’s data dashboard.

🔼 Ethereum raises block gas limit to 60M as ecosystem throughput hits new records ahead of Fusaka upgrade: Ethereum’s block gas limit has been raised from 45 million to 60 million following calls from decentralized finance users and builders alike for expanded capacity

🥳 Grayscale files with the SEC to launch first-ever Zcash ETF:A Wednesday filing with the Securities and Exchange Commission shows that Grayscale wants to convert its Grayscale Zcash Trust into an ETF. If approved, it would be the first ETF giving investors exposure to the coin.

💬 Tweet of the Week

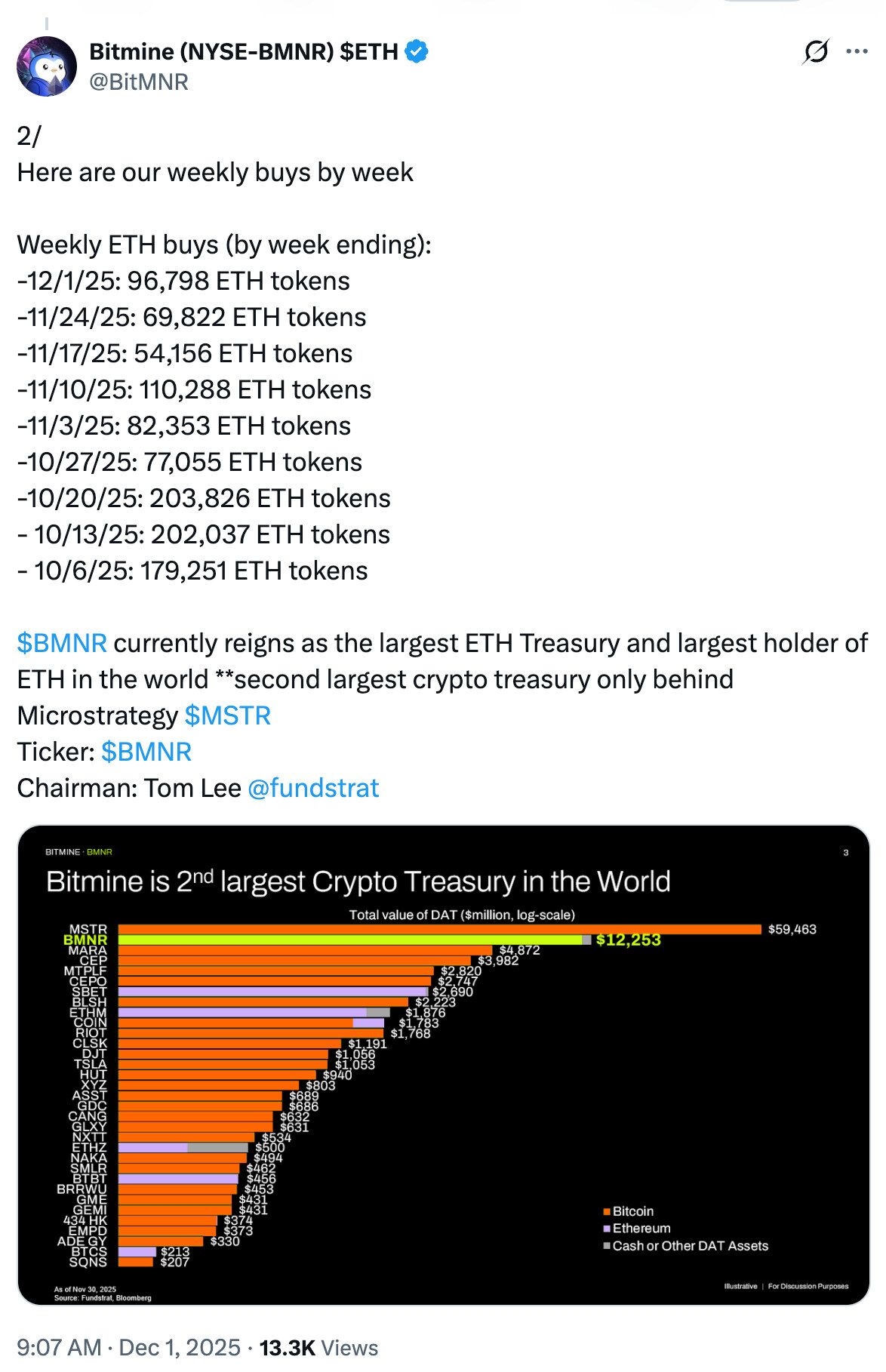

Source: @BitMNR

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Within the last 30 days, BitMine Immersion Technologies has now accumulated 413,500 $ETH ($1.2B), pushing its treasury to 3.1% of the entire supply.

Source: @DavidShuttleworth

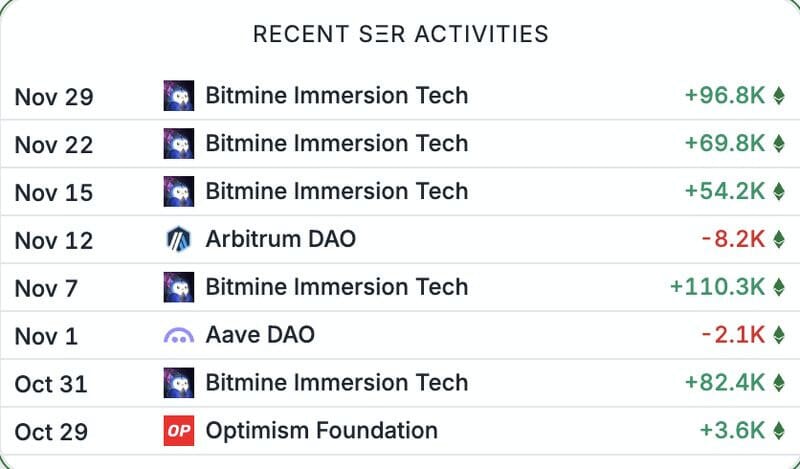

2. Despite heavy macro headwinds and fallout from massive liquidations in October, total supply of fiat-backed stablecoins still grew for the 17th consecutive month, reaching a new all-time high of $273.2B in November. This represents a 50% increase year-over-year, underscoring just how relentless the demand for onchain dollars has become.

Over the same period, PayPal’s PYUSD grew by more than 500% to $3.9B while other emerging products like Ripple’s RLUSD scaled from $50M to $1B in under a year.

Source: @DavidShuttleworth

3. After hitting yearly highs in October ($456.5B), monthly DEX volume declined sharply in November, falling 33% to $307B and losing nearly $150B in total volume.

Lots of retail completely exhausted after the October liquidations, no new capital inflows.

Interestingly, however, Solana prop AAM HumidiFi ($30B) claimed 10% of the entire market, the highest share of any Solana DEX for the second month in a row.

Source: @DavidShuttleworth

4. Odds of a December rate cut have snapped back to 85% and now we have euphoria.

Just two weeks ago, cuts were repriced to 50/50. BTC immediately unwound 20%+, dropping from $105K to $82K with over $3.6B in liquidations along the way.

Today, BTC jumped 3% and is back above $90K for the first time since.

Macro leads, crypto follows.

Source: @DavidShuttleworth

5. As seen in the charts below, shielded usage has accelerated meaningfully, and supply that has been “transparent” is now rolling over – a sign that users increasingly prefer the full privacy features of Zcash. Outside of the token’s price – up 10x over the past two months at the time of writing – Zcash is delivering on its core value proposition: privacy.

Source: @PanteraCapital

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Cosmo Jiang, is a General Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Crypto Market Update

After a six-month rally from the April bottom, the digital asset market pulled back in October. Part of the pullback in risk appetite is attributable to building macro concerns – including the Fed striking a hawkish tone with regard to future rate cuts, the US government shutdown (as of this week resolved, for now), the brief US China tariff dispute, credit quality concerns rising as a number of large frauds were uncovered (see Howard Mark’s recent memo “Cockroaches in the Coal Mine”), and a more mixed earnings season than in prior quarters as investors balked at ever growing AI CapEx plans.

Digital assets performed worse than other risk markets due to additional idiosyncratic issues it faced, including the major selloff on October 10th when President Trump proposed China tariffs after markets closed. We’ve seen a few times now this year that, as the only market that trades on weekends, digital assets bore the brunt of the selling pressure.

Unfortunately, this resulted in the largest single liquidation event in the history of the industry (more than during COVID or after FTX’s collapse). The liquidations, while large in scope, were concentrated in tokens without fundamental support and that trade on less regulated offshore exchanges. Ultimately, we believe this washout sets the stage for a healthier base off which the industry can grow – particularly by accelerating a much-needed shift in focus toward protocols grounded in sound fundamentals. However, after such a severe event, the market will likely experience some near-term indigestion as the industry sorts through the losses.

Crypto Market Update

Another headwind has been the meaningful slowdown and valuation compression in digital asset treasuries (DATs). DATs have been the largest buyers of tokens with over $30bn of capital raised, either via PIPEs or follow-on offerings, over the last six months (the vast majority of that from MSTR and BMNR).

Pantera has been at the forefront of this emerging new industry. We developed the conviction to make what was then a non-consensus bet in early April of helping anchor and bring to life the first DAT launches in the US. This space has grown much faster than we could have possibly anticipated. At that time, we did an exercise of mapping out the white space for DATs, and on looking back today it is clear we are at the end of the genesis phase, or the initial phase when there are many startups tackling white space.

Capital Returns by Edward Chancellor (link) is an important read for students of market history, and the basic premise is that any industry with excess returns attracts incremental competition, which in turn lowers returns. We are seeing that play out now. The space has gotten crowded and it appears that, at least for now, the equity market demand for DATs has waned.

Now that the white space is largely taken, the industry is entering the execution and consolidation phase. This is where the strongest DATs will prove themselves and win out through execution. The vast majority of returns are created in the public markets, and we believe the best DATs can be amazing long-term outcomes for both shareholders and tokenholders. A larger number of DATs will be outcompeted and have uninteresting outcomes, ultimately resulting in healthy industry consolidation.

As we’ve outlined in our thesis, DATs can outperform the underlying token if managed properly. For example, Solana Company (HSDT) is the only registered SOL DAT that continues to trade at a premium to NAV and, since launch, has outperformed the underlying SOL price by around 20%.

With DATs no longer a buyer at the moment, the rate of change in flows for digital assets has shifted rapidly. DATs should trade with more reflexivity to the upside and the downside than the underlying token, so until the market turns more positive again, we don’t anticipate meaningful positive flows. It is interesting to note that, on a go-forward basis, with many DATs now trading below NAV, the risk/reward skew is favorable again.

Near-term Outlook

We remain optimistic about digital asset prices into year end, even after a weak start to November. The drumbeat of adoption continues – from Western Union and Zelle adopting stablecoins, to Morgan Stanley opening up crypto to wealth advisors, to the prediction market company Polymarket raising $2bn from ICE – and could accelerate after the passage of a Market Structure bill (we believe within months). Market structure is also a lot healthier now that leverage has been washed out, sentiment is back squarely in the “fearful” zone and RSI indicators near oversold levels. Bitcoin has been consolidating at the $100,000 round number level this last week.

That fact pattern leads me to believe that positive fundamentals are leading price, and I believe price will ultimately catchup. The digital asset market needs to digest some of the recent damage and some of the macro headwinds need to clear out, but we expect that after some consolidation that risk markets will successfully climb the wall of worry.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com