Social Links: Twitter | Telegram | Read Online | Subscribe | Enzyme Fund

I lost $1M in a Nexo liquidation this week. I was at what I thought was a “safe” 40% loan-to-value ratio on May 11 but the temporary market crash last week caused Nexo to liquidate me. I am grateful for the lesson. Below is the post-mortem, my lessons learned, and my new game plan as we enter the 2nd half of the 2021 Bull Cycle.

In This Week’s Issue:

The $1M Crypto Lesson - Lessons Learned Getting Liquidated on Nexo 😬

Introducing Ethereum’s Fundamental Value Model (FVM)

Did You Buy The Dip? The Bull Market Resumes.

Using RSI To Time The Market

Invest in the Coinstack Alpha Fund - Up 13% Last 30 Days

The Engineered Crypto Flash Crash - By Two Comma Pauper

Portfolio Update - Still Up 125% YTD 👀

My Top 30: A Long-Term Crypto Portfolio

The Shit List: What NOT to Invest In

Join my Tuesday Crypto Advice Calls

Featured NFTs of the Week by Mrs. Bubble

Who I’m Following Closely on Twitter

How to Get Started in Crypto Learning

The $1M Lesson - Getting Liquidated on Nexo

This weekly newsletter is a journey. I’m going to keep writing about what happens and what I learn each week, up or down.

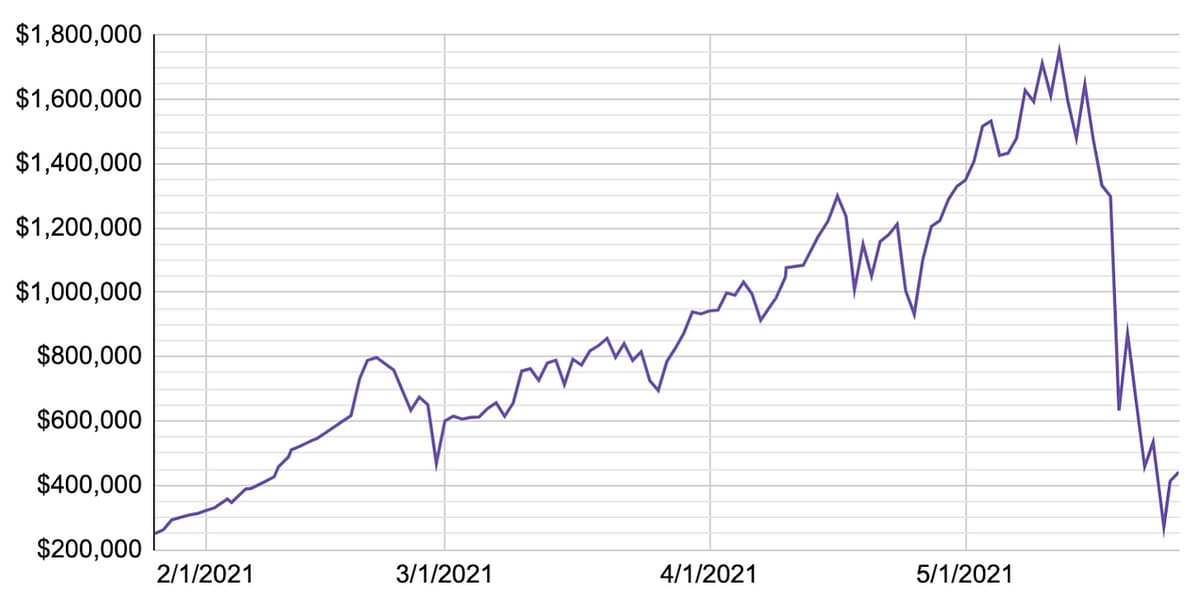

My friends, below is what happens to your crypto portfolio when you use too much leverage. And by your crypto portfolio, I mean my personal crypto portfolio. 😬

What was a $1.75M crypto portfolio on May 12 has turned into $441k today. I’m still up 125% year to date, but ouch.

A total of 280 ETH, 18,000 XLM, 423 LINK, 100 BNB, and handful of other crypto assets were liquidated from my Nexo account over the weekend. That’s about $1M under current market prices.

Why did I get liquidated? Because my loan-to-value ratio on Nexo got temporarily above 83% (their maximum amount) during the temporary downturn driven by China Bitcoin mining concerns and whale manipulation that brought ETH down to $1750 for a few moments on Sunday in a series of cascading liquidations.

When your NEXO portfolio loan-to-value ratio reaches above 83% they liquidate whatever they need to in your portfolio to pay back the loan -- usually leaving you with roughly 10-15% left of what you had originally.

The painful part is they force-sell your crypto at exactly the lowest possible price during a temporary market flash crash, which you would never do yourself if you had a choice.

The only way around it would have been to put more crypto or USDC into Nexo to reduce the loan-to-value ratio, but I was concerned that would have just been liquidated too.

If I had $500k available in USDC I could have easily prevented the liquidation. But I didn’t.

I had designed my Nexo portfolio intentionally to be able to withstand a 55% drop without getting liquidated. But we had a 58% market drop in 11 days. And so, poof.

Thankfully I had other crypto assets elsewhere so I didn’t get completely wiped.

So yes, NEXO is great for earning interest on your crypto holdings -- but not so great for taking loans out in a market where 60%+ crashes happen.

In the long-term, Nexo and other similar tools like BlockFi and Celsius would be well served to limit their clients to 25% loan-to-value ratios instead of 50%. That way their clients can still survive a 60% crash.

And they should start partial liquidations at 75% not 83%, so that when loan paybacks happen the client still at least has some of their crypto left.

Regardless, it was a very very important lesson -- always expect and plan for Black Swans in crypto.

And always de-risk when RSI is over 80 (more on that below).

Emotionally, I’m handling it pretty well, just focusing on the lessons and grateful that I’m still up YTD.

I wrote the following on the Coinstack Telegram group late Sunday night.

And here’s my recap of the situation in my own post-mortem slide deck.

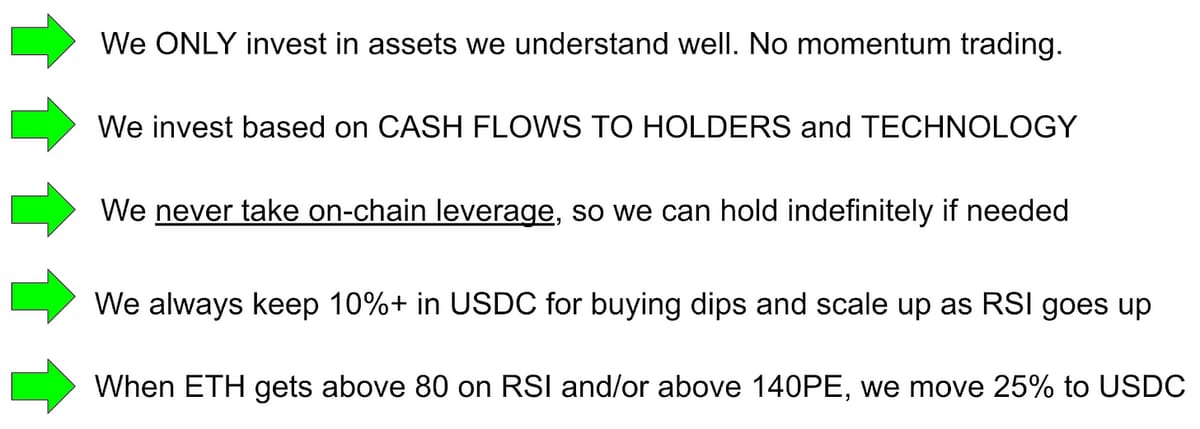

So, What Did I Learn?

Holy shit I learned a lot from this. I feel like I got my first real crypto stripes this week. We are now OGs...

So, what did I learn…

When ETH RSI goes above 80, that is the time to de-risk and pay back any loans you have taken out and move some of your portfolio into USDC so you can buy the eventual dip. (more on this below). Do NOT enter into a leveraged long position like I did when RSI is over 80. In hindsight = obvious. But I didn’t think to check RSI levels 2 weeks ago before I entered into a leveraged long ETH position at $3900 ETH.

NEVER use more than 10% leverage in your HODL portfolio. You need to always be able to withstand an 85% temporary crash without getting liquidated. Just buy hold -- and don’t try to get extra returns in what is already the best returning asset class in history. Had I used a max 20% loan-to-value ratio instead of 40% loan-to-value ratio I’d have an extra $850k in my crypto portfolio right now ready to ride up the 2nd half of the 2021 bull cycle. Long-term portfolio protection is just as important as short-term portfolio return maximization.

If you really want to take a long-term loan out to invest more in crypto, do it off-chain where you have a long time period for repayment. My friend has used a $300k ten year credit line with his bank at 4% annual interest. So he can wait out temporary market downturns easily and not be forced to sell during flash crashes or even a 2 year bear market.

I created this post-mortem Google Slide deck for myself and my analyst Mike for us to together review what we had learned.

Here is an excerpt from our lessons learned slide...

Introducing the The ETH Fundamental Value Model (FVM)

I have invented a new Ethereum price model to map out the price floor and fair value of ETH. I spent quite a lot of time this week building this model, driven by the $1M liquidation.

I wanted to know what the fair value price floor was for ETH — and I wanted to know what the max price was so that if we get back there I can take some chips off the table.

I call it the ETH Fundamental Value Model as it uses the actual cashflows of ETH to value Ethereum.

I think this model is going to become quite influential in the years ahead.

This means that for the first time ever, you can build a model for valuing ETH based on its CASHFLOWS -- which is why I created the below model this week which values ETH based on its cashflows it will have when EIP-1559 and PoS go live.

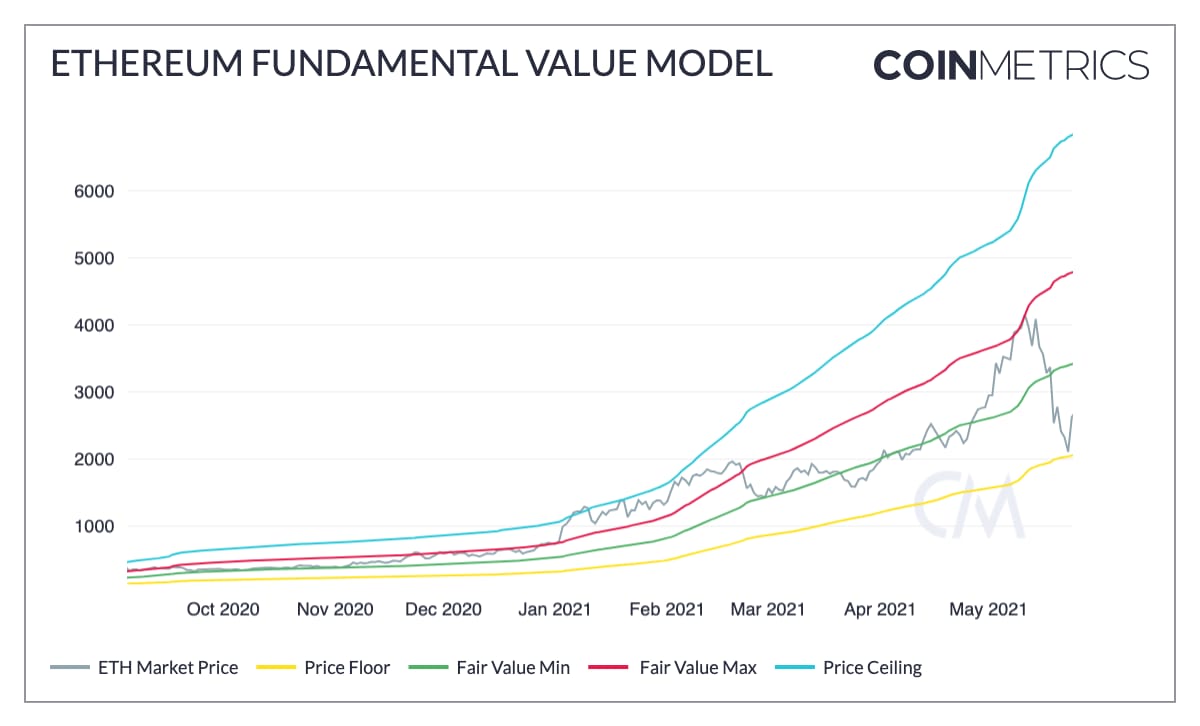

Here’s what the model shows.

You can see that ETH was exceptionally undervalued three days ago when it reached sub-$2k temporarily. I bought as much as I could with what I had left.

And here is the same model going back to the beginning of ETH. As you can see, during the last bull market peak in January 2018, ETH was heavily OVERVALUED, but today, since revenues have grown so much since then, ETH is substantially UNDERVALUED.

How to Use The ETH Fundamental Value Model (FVM)

Whenever price goes below the green line (the minimum fair value of ETH based on its last 12 months of cash flows), you acquire more of it.

The green line is the last year of ETH revenues x 100. Since 100% of revenues will soon be cash flows to holders, this effectively represents a PE of 100, which is quite low for an asset that has grown its revenues by

The yellow line is the price floor. It’s calculated by using the last 365 days of Ethereum transaction revenues and multiplying them by 60. In the entire 6 year history of Ethereum, the price of Ether has only once fallen below the price floor -- in December 2018 -- and only for 3 weeks. If the price ever goes near or below the price floor, you buy it up like crazy.

Whenever the price goes near or above the red line (the maximum fair value of ETH based on its last 12 months of cash flows), you de-risk, pay down any loans, and move a portion of your portfolio to stablecoins (USDC or USDT) in order to be ready to buy the next dip. There will always be another dip to buy.

And if the price ever gets near or above the blue line, you exit around half of your position and wait for the price of ETH to come back down to a reasonable level to buy back in.

Yellow Line = 60 Price to Earnings Ratio

Green Line = 100 Price to Earnings Ratio

Red Line = 140 Price to Earnings Ratio

Blue Line = 200 Price to Earnings Ratio

A PE ratio of 100-140 is quite appropriate (and perhaps even low) for an asset whose revenues have grown by 13,918% in the last 12 months.

Compare that to Tesla with a PE ratio of 600 and only 46% year over year growth.

The inspiration to create the above model only came after losing the $1M in the Nexo liquidation this week.

I have a feeling that we’ll make more than $1M using the above model in the years ahead… so it’s a very worthwhile learning lesson.

The only thing that could make the fair value lines for ETH fall is if revenues fall to a level that is below 365 days ago. That’s unlikely to happen as Ethereum revenues yesterday were ~$12M while 365 days ago in May 2020 before the start of the big DeFi revolution they were only ~$400k per day.

As long as ETH revenues stay above what they were 365 days ago, the fair value of ETH in this model will keep going up.

While I invented this model this week using my experience from my MBA days, I wouldn’t be surprised if analysts at the big crypto funds and institutional investors begin using it or something similar over the next six months as awareness of ETH’s incredible cash flows comes into the picture. I certainly plan to keep sharing this model and to popularize it.

Over the next week I plan to put up a real-time version of the model on a new web site that I’ll share in the next issue.

I expect revenues for ETH mainnet to continue to increase substantially the next 10 years, even with L2s/sidechains taking some volume away and future sharding efforts allowing more transactions at a lower price.

Why Am I Using Ethereum Revenues as a Proxy for Cash Flows?

We must keep in mind that as a decentralized protocol, 100% of Ethereum’s revenues will soon be cash flows to its holders - either directly via staking rewards or indirectly via token burns.

While Ethereum does give cash flows to holders quite YET, by the end of 2021 100% of the revenues that the Ethereum network earns will be going to long-term holders.

You can begin staking your ETH on RocketPool or Lido now -- but the real staking returns will start when the PoS merge happens toward the end of this year or early in 2022 - so you don’t have to hurry to do it. Plus once you stake your ETH is locked up until the merge happens, which is still ~6-8 months away.

Staking returns are expected to reach 10-25% for a while after the PoS merge, incentivizing many more people to buy into ETH, which will predictably increase its price well above where we are now.

And even sooner starting in July 2021 via EIP-1559 around 70% of ETH transaction fees will be used to reduce ETH supply, which operates like a stock buyback.

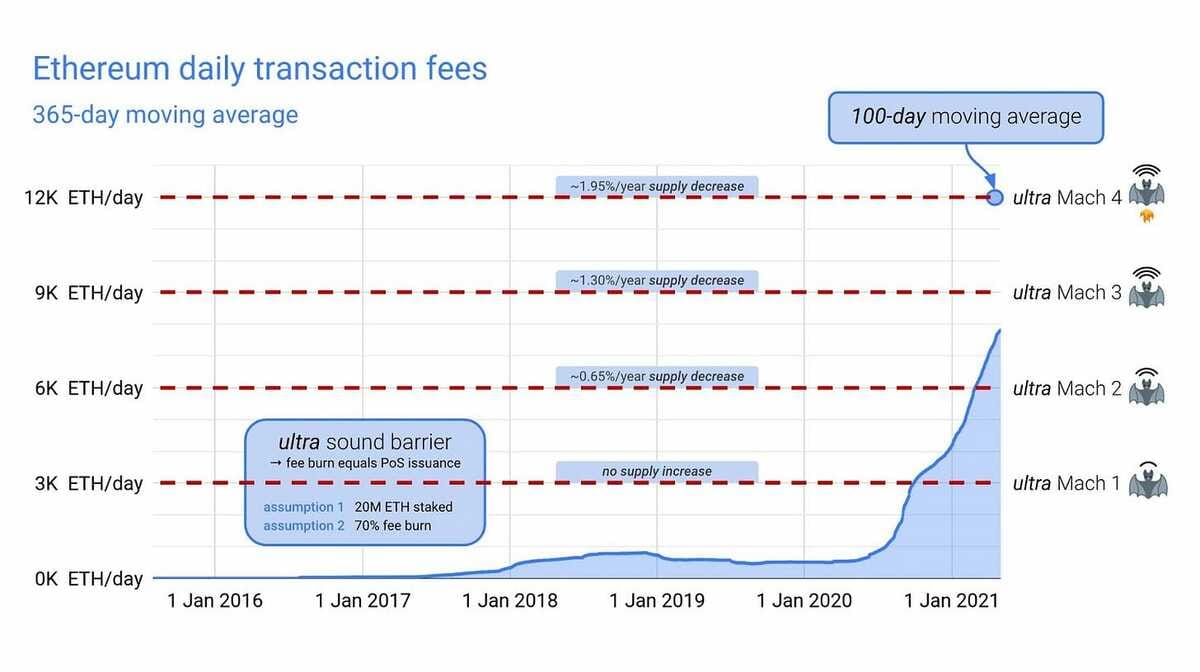

Referencing Justin Drake’s chart below (which is a few months old), we are now nearing the Mach 4 level with 11,180 ETH/day in revenues over the 100 day moving average.

This means once PoS goes live ETH will be decreasing in supply by around 1.9% per year if current transaction revenues in ETH terms stay steady (and more if they increase).

And in December 2021 when the PoS merge goes live, stakers will start receiving the other ~30% of ETH transaction fees, plus new issuance rewards, plus MEV. This essentially operates as a daily dividend to stakers.

Long story short… make sure you have enough ETH… and HODL it till 2025.

So many people thought the market was crashing on Sunday and going into a ~2 year bear market.

I knew it was temporary, driven by forced liquidations, and one of the best ETH buying opportunities we’ll ever see.

As Sam Trabucco from Alameda Research, a crypto quant fund, said on the Profit Maximalist podcast on Monday, “I wanted to buy all the forced liquidations.”

Sub-$2k ETH? The institutions and smart money ate it up in hours.

Yep, Alameda Research or a similar firm probably now owns my 280 ETH that Nexo force liquidated for me. A very good lesson for me to not take so much risk when RSI is so high.

Don’t worry about “bear markets” when you have on your side the fundamentals and a wave of institutions that now understand the true value of ETH -- and obvious market patterns that show this bull market is likely to continue until at least Fall 2021.

People who think we’re in a bear market right now are very simply quantitatively incorrect. ETH is up 23% in the last month.

Not a bear market, lol. We’re in pretty much the exact middle of the biggest crypto bull market in history -- and for ETH, one that is thankfully driven by fundamentals not speculation...

The temporary 58% drawdown in now just a 34% drawdown and I expect we’ll reach new ATHs by mid-July.

Just remember next time we get above $4k ETH to start taking a little off the table so you can buy back in for a future dip.

I plan to move about 5% of my portfolio into USDC for every week ETH is above $4.5k in 2021 until I reach 50% in USDCs.

Using RSI with the Fundamental Value Model To Time Entering & Exiting

RSI is starting to play a bigger role in us knowing when to invest… let’s learn more about it and add it as a layer to our Ethereum fundamental value model.

Relative Strength Indicator (RSI) is a “momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.”

The RSI oscillates between 0 and 100. Anything over 80 is a good time to de-risk or sell -- and anything under 40 is a good time to invest -- as long as fundamentals (revenues, earnings, and usage) support the continued growth of the asset.

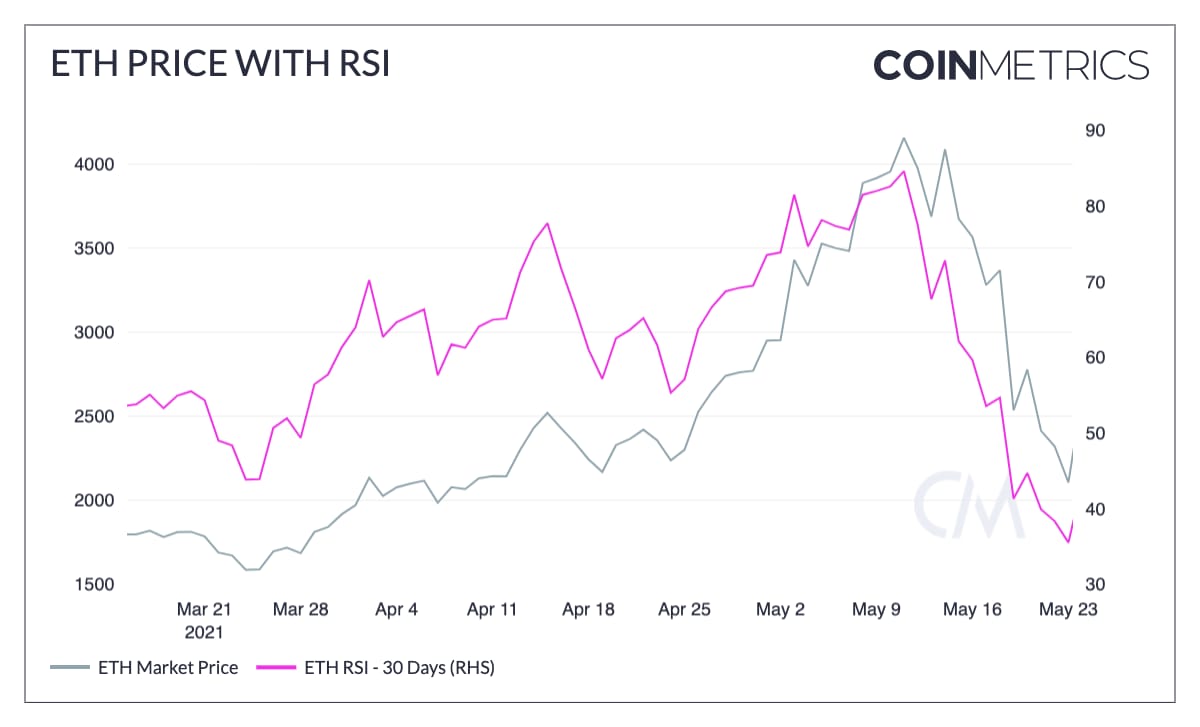

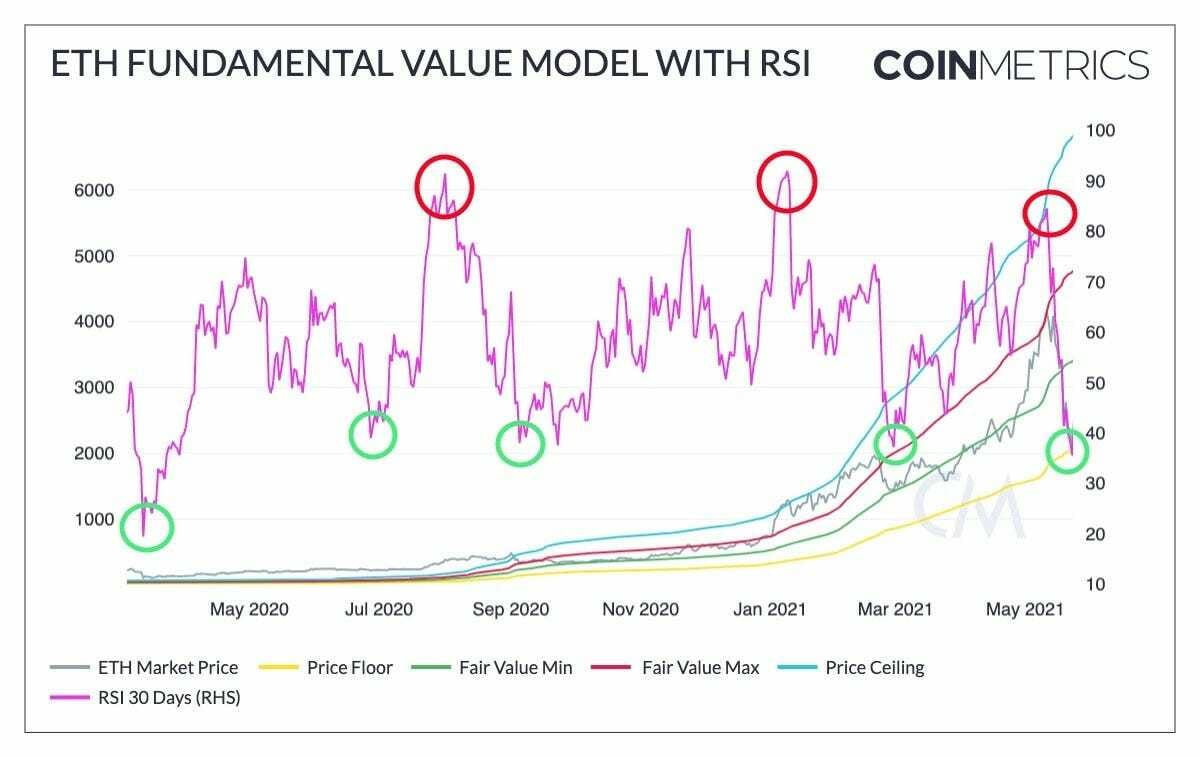

Here’s the 30 Day RSI ratio for ETH the last few weeks shown in pink.

Buy when RSI Is Under 40, Sell A Bit Over 80

You buy when the 30 Day RSI is under 40 (like it was 2-3 days ago) and you sell some to stablecoins when RSI is over 80 like it was on May 9-12.

So when to buy in if you’re not already into ETH… well the RSI is still under 50 which is a good time to get long (but not as good as it was 3 days ago).

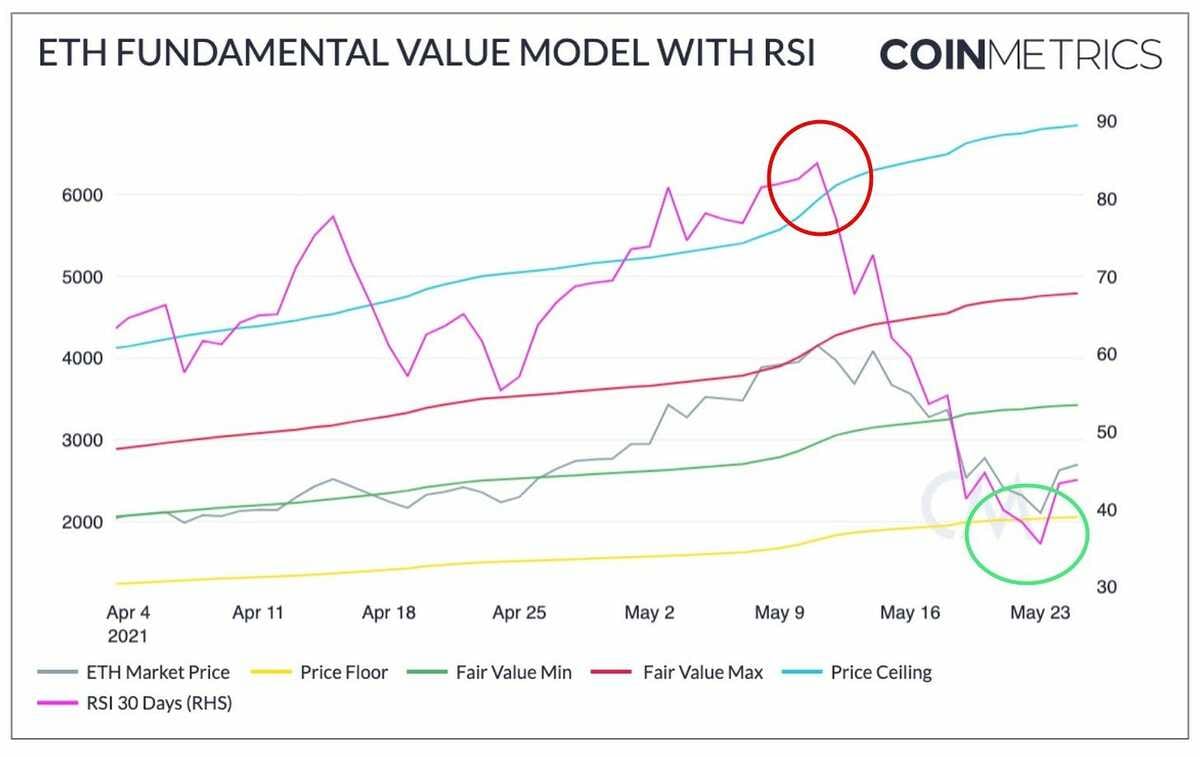

Now, what happens if you add in RSI onto the model? Let’s take a look.

The above model would have told you to sell at ETH $4300 on May 11 when RSI was 84 and bought back in at ETH $2000 on May 23 when RSI was 35.

Man, I wish I would have had this model back then. It would have saved me $1M. But at least we have it now!

Using RSI under 40 as your buy signal (the pink line) the last 14 months you would have made the following very well-timed buys of ETH.

ETH BUYS USING RSI UNDER 40

Here are the times when ETH was under 40 the last 14 months…

Mar 12, 2020 - $110 at RSI 19

Jun 27, 2020 - $220 at RSI 39

Sep 5, 2020 - $331 at RSI 38

Feb 28, 2021 - $1425 at RSI 37

May 23, 2021 - $2105 at RSI 35

There were ALL great times to buy.

In practice you might not have timed it as perfectly as the above if you buy right when it first goes under 40, but you’d be pretty close.So when RSI next drops under 40 for ETH if the fundamentals of revenue, cashflow, and usage are still holding up -- you know what to do. Invest. Even at today at ~45 RSI, it’s still relatively cheap.

The best time to buy was 72 hours ago at ETH $2k. The second best time to buy is now. IMHO, it’s time to accumulate before everyone realizes what’s coming with EIP-1559 and the PoS merge.

And if you’re out of fiat for now, just HODL. We’re headed up throughout 2021 as more and more people begin to actually understand the value of DEFI, a global neutral and trusted settlement layer and a global dapp platform.

As Packy McCormick said on Twitter this week:

“What if I told you about a business that:

- Has strong network effects

- Grew revenue 200x YoY

- Is preparing to offer a 25% dividend

- About to implement a permanent share buyback program?

That's pretty much Ethereum.”

Take a look here at Packy’s new bull case for Ethereum called “Own the Internet.”

In the article, Packy agrees with Justin Drake’s $13k price target for ETH.

We’ll get there, friends. Just a matter of time.

Coinstack Alpha Fund Update - Up 13% in Past 1M

It’s been a brutal month of May in crypto.

Yet even while Bitcoin is down 18% the last 30 days, the Coinstack Alpha Fund I manage on Enzyme is up 13%. Being up while Bitcoin is down comes from selecting great long term crypto assets that have advantages due to technology and cash flow to holders.

Now’s a good time to invest in the fund if you’re thinking about it. You can invest using USDT or ETH.

The minimum recommended investment is $10k.

Enzyme doesn’t allow using any leverage in its funds, so it weathered the storm of the last week pretty well and is now up 20%+ from the low point two days ago. It’s just a buy good assets and hold them strategy, with moving 25-50% to yield generating stablecoins later this year as we near the cycle peak.

The top holdings in the fund to date are:

ETH

RUNE

SUSHI

MKR

DOT

AAVE

PERP

YFI

I’ve done extensive research on each of these assets and believe they will outperform the general crypto market. As new opportunities arise from my research, I invest in them.

As of today I am managing $201,795 for 22 investors. Performance and holdings are shown transparently down to the minute.

As the bull market heats up later this year, I plan to rotate a percentage of the portfolio into yield generating stablecoins, protecting some of the downside during a future potential downturn.

Essentially I will be using the fundamental price model I wrote about above plus RSI to be able to **hopefully** know in advance when the bull market is slowing down, so we can move some of the assets into yield producing stables.

My goal is to beat the market during bull markets and to have less drawdown during any future bear cycles. Time will tell if we succeed, but I have my finger on the pulse of the market.

You get the returns of smart active management with a passive investment. And since you exchange ETH or USDT for fund shares, you only pay your taxes on gains when you exit the fund (not with each trade).

You can now invest yourself if you’d like me to manage some of your crypto portfolio for you. Enzyme holds your crypto and I invest it for you, hopefully generating a better return than you would on your own through passive investing.

The fee to invest is the standard hedge fund fee of 2/20, which is 2% annually of assets under management (AUM) and 20% of profits.

You use ETH or USDT to invest from Metamask or any crypto wallet that supports WalletConnect (like TrustWallet, Argent, RainbowWallet, etc.).

As always, know that crypto investing is risky no matter how good the investor is. You should never invest an amount you aren’t prepared to lose.

When you deposit you pay a gas fee of around $500 when you invest and when you withdraw, so only invest if you’re prepared to hold for a while. The exact cost to deposit and withdraw varies based on Ethereum network gas fee at that moment. I recommend investing and holding 5-10 years for optimal compounded results.

If you have any questions you can message me on Telegram. I’ll keep folks updated on our progress through this newsletter.

The Engineered Crypto Flash Crash by Two Comma Pauper

Some inside info on FUD & fucking with markets by someone who's had blood on their hands (many times) before.

This is going to be decently detailed, so sit down & take your time.

I'll also add some proof as I dig through some old drives (without doxing any clients obvs).

1st a quick intro. Prior to my move to crypto I was a Sr. exec in the dominant company in one of the most competitive sectors out there. My P&L alone was larger than that of some small nation states. We were also highly regulated with over 125 licences in ~100 jurisdictions.

in 2016 I YOLO'ed into crypto by launching a full service company covering:

Legal and regulatory - Meh

Solidity development - Pumping out those shitcoins you all love

Marketing & PR - Pumping your bags to the moon

OTC - For the smart money to exit with minimal rekage

In all we serviced ~50 clients, mostly vanilla ERC20s but also some early ERC721 (NFTs as the kids call them). Back then we were using them to build stuff like SKRs for physical gold for private banks in HK, CH, MC etc.

We also did a lot of sentiment management for our OTC desk.

So, say you're a fund wanting exposure to $BTC but think you missed the optimal entry. If only there was a dip you could enter in.

Cue us - What flavour of dip would Sir prefer this morning? Flash crash? Liquidity hunt? Ah, excellent choice! The End of the Bull Market it is!

So we're gonna crash the markets to allow you to scoop up cheap sats.

Step 1 the ground work - We pay several low tier media outlets to publish bearish news but not promote it on their channels. It just sits there for now.

Step 2 - Pay several contributors to Bloomberg/Forbes etc to publish hot takes on the story citing the article

It's easy as:

a) The starving writer meme is real

b) They're desperate for fresh content

c) Compensation is tied to the amount of traffic their stories generate

So now the content is on some low tier news sites & a few tier 1s. This is where you break out the rolodex and ping every pasty tech writer you ever bought drinks for at a conference & FOMO them in.

You're missing the story dude, it's on Reuters too FFS, you need to publish NOW

Story is gaining momentum & it hits the PR wires. Its on all sites from NewsBTC to Reuters so it's obviously legit.

Time to break out the CT Influencers. These guys all tweet out the story or variants of it with key words that sentiment algos pick such as "ban", "hack" etc.

It's now time to tie it all together by initiating the dump via our algo. This is the opposite of the standard OTC algo, in that it looks for the thinnest books on exchanges which comprise Futes price indexes (CB, Kraken, Gemini etc) and market dumps on them.

Retail sees the dump, rush to twitter to find that CT is engrossed in this new story. They panic as algos start to dump and liqs begin.

Retail sells, cascading SLs & Liqs finish the job & drive price to your orders. We dump on any rally to keep momentum high.

Bingo.

That's all for today. I hope this was educational, and when the next perfect storm hits crypto you'll remember that it's perfect because it's engineered with military precision by professionals.

Portfolio Update: Up 125% YTD 👀

As I wrote about above, I got absolutely rekt last week. Everything was fine until Sunday night when ETH dropped temporarily to $1750.

At that moment, my loan-to-value ratio temporarily reached 83% on Nexo and Nexo liquidated 88% of my Nexo portfolio (worth about $1M right now). I’d still be up 400% YTD had that not happened. Lesson learned.

Hey at least, I’m still beating BTC returns YTD.

After this Great Reset, here is my portfolio as of today.

Note that I am artificially heavy NEXO token as those tokens are both a) locked in Nexo as collateral for a small loan and b) were the ONLY token NEXO didn’t liquidate this week. I would reduce my Nexo holdings to more like 15-20% of my portfolio if I could in order to allocate more to ETH -- and I plan to do so as soon as I am able to.

Above is the actual daily progress of my crypto portfolio since I started tracking on January 26, 2021. The net value right now is $450k up from $200k on January 7.

That said, at one point I was up to $1.75M before getting $1M in my Nexo account liquidated on May 23 during the ~55% May market correction.

We shall see what the rest of the year brings… and no matter what I’ll keep writing what I learn.

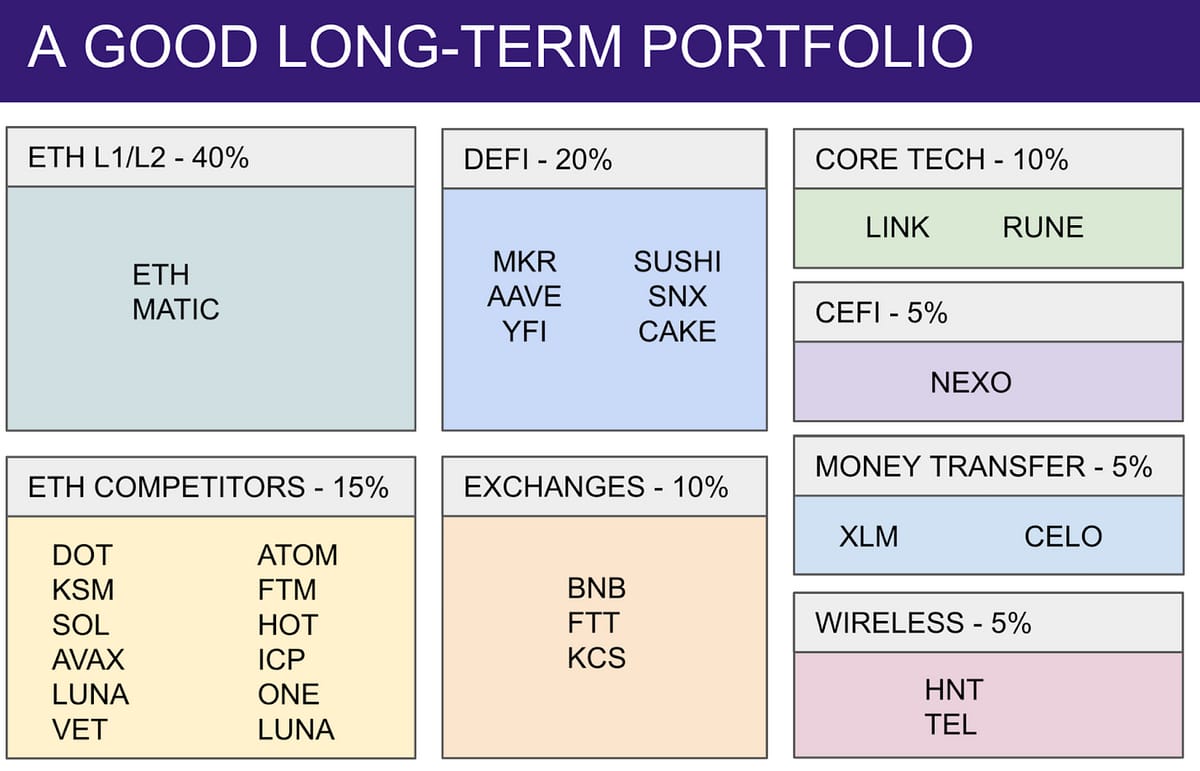

My Top 30: A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 5-10 years, I would be absolutely sure to include my top 5: ETH, DOT, KSM, RUNE, & MATIC. Here’s my top 30…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko.

The Shit List: What NOT to Invest In…In crypto there’s a lot of coins that have zero fundamental value, unlimited supply, or no longer have any active development.

Here’s a list of what’s on my shit list right now and that I do NOT recommend investing in for long-term returns.

Doge (DOGE) - A PoW fork of Luckycoin. No development team. No apps. No supply cap. Lots of inflation. Being pumped as a pet project by Musk who doesn’t yet grok that scalability requires a lot of focus and effort and that the future is PoS.

Shiba Inu (SHIBA) - Same as above. Include any doggy token with this list.

Safemoon (SAFEMOON) - Scam ponzi project. No actual value.

Cardano (ADA) - A serious project, but not launched yet after 5 years of work, no smart contracts, no apps, a difficult to use programming language (Haskell), a 33 year old founder who often picks Twitter fights with people, and an incessant army of pumpers who don’t seem to understand technology. Wait till it launches to see if it’s real.

Bitcoin Cash (BCH) - Failed Bitcoin fork

Bitcoin SV (BSV) - Failed Bitcoin fork

Ethereum Classic (ETC) - A failed Ethereum fork. No apps, no usage, and staying on PoW. Being completely left in the dust as ETH 2.0 launches and moves to PoS.

Ripple (XRP) - Money transfer service run by a centralized company. Under investigation currently by the SEC that may last another 12-18 months. Invest in open-source decentralized versions Stellar (XLM) or Celo (CELO) instead. Price may pump in the short term by a digital army (known as the XRM/ADA army), but overvalued in my opinion. The future is decentralized and open source.

Remember in the short-term the prices of the above may pump, but I don’t think any of the above will do as well as simply holding ETH or the tokens listed earlier in my top 30.

Get a Mrs. Bubble NFT And Join Our Tuesday Crypto Advice Community Zoom Calls

Every Tuesday I do a live 30 minute Crypto Advice Zoom call at 9am PT / 12pm ET / 5pm GMT. All buyers of Mrs. Bubble’s NFTs (and investors in the Coinstack Alpha Fund) are invited to join and ask questions and share learnings with each other.

Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

You can think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 5 callers on this week’s call and we went deep on perpetuals, leverage trading, Ethereum, Polkadot, and timing the market cycle. Join our weekly calls by getting a Mrs. Bubble NFT or investing in the Coinstack Alpha Fund.

Mrs. Bubble’s NFTs of the Week

Mrs. Bubble the artist is of course my wife Morgan Allis, so supporting her work directly supports our family and this newsletter -- and makes her shout with joy with every sale notification!

Here is the featured Mrs. Bubble art pieces for this week. Mrs. Bubble is putting up a new piece each day and plans to build a long-term NFT following. You can think of her NFTs as both beautiful art that uplifts the world AND your digital ticket into our live weekly crypto advice calls.

This week we will feature some of Mrs. Bubble’s new art from the last week…

Bubble #127 - Ponce the Duckacorn - 0.11 ETH

I’m Ponce the Duckacorn. I am really good at doing me in any scenario. All life rolls like water around me. And when I want to play, it plays joyously with me. Even Wiwi rides around on me and I pay no attention unless it’s time to play. So fun to be a free Duckacorn.

BUBBLE #128 - Caterphantafly BobbieMo - 0.11ETH

Hello, I am squishy and soft, strong, and can flow. My wings delicate and fast, I zip around as fast as I can. My trunk is fluffy and can shoot out smells of all your favorite foods just by rubbing it and thinking of your favorite snuuzeberry. I have lots of feet who dance on their own, it has nothing to do with where I need to go.Bubble #129 - DuckStar Rellareela - 0.11 ETH

I dance and mingle, my hair stands on edge with every tingle. I love hearing all the songs of the universe and making it my own. Rearranging the words to be in my joyous glow. This kind of flow makes sure that all the songs I sing make my soul flow. Let's do the chicken leg, and bounce our hips in delight to the beat.

A big thank you to our 18 Mrs. Bubble NFT buyers from all over the world. You’ve single handedly paid for all the painting supplies and canvases that Mrs. Bubble has used the last two months. We don’t do it for the profit. We do it to make more art that brings joy to the world.

You can see Mrs. Bubble’s full art collection here to see which one you’d like to buy.

Join The CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1500 members on our Telegram.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

Coinstack Twitter at twitter.com/coinstackcrypto

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at https://charts.coinmetrics.io/formulas/#1256

Substack at CoinStack.substack.com

Please share with your friends and colleagues.