Issue Summary: This week we share our thoughts on why 2022 may be a great year for digital assets. We also review the top news and reports and preview our upcoming crypto investing webinars for family offices and wealth managers.

In This Week’s Issue:

Market Thoughts: 2022 The Supercycle Year by Ryan Allis

This Week in Crypto

📺 Upcoming Webinars: Crypto Investing for Family Offices

🗞️ Top Weekly Crypto News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Crypto Podcasts

📈 Top 10 Tokens of the Week

NFTs: LuvMonsters Collection - $2 Special NFTs 👀

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our Headline Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto quant fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month since inception. They also have a major social impact mission and are building a regenerative engine for funding philanthropic efforts. Learn more at www.heartrithm.com.

📈 Market Thoughts - 2022 The Supercycle Year? By Ryan Allis

About the Author: Ryan Allis is a Managing Partner at HeartRithm and the Publisher of Coinstack, the leading weekly institutional crypto newsletter

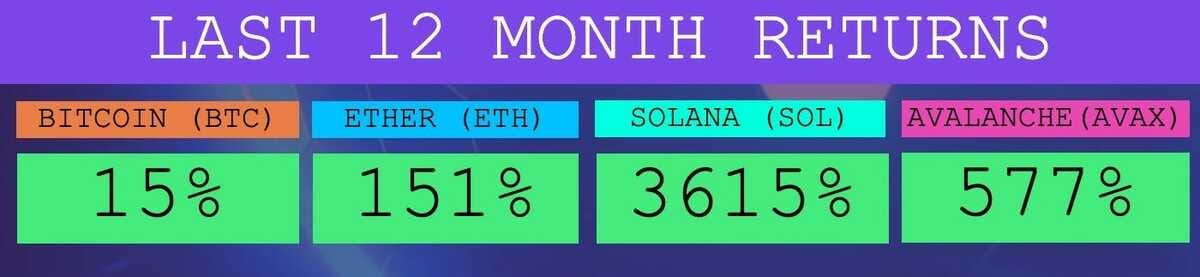

During a bullish 2021 we saw Bitcoin increase in price 58% and Ether increase in price 400%.

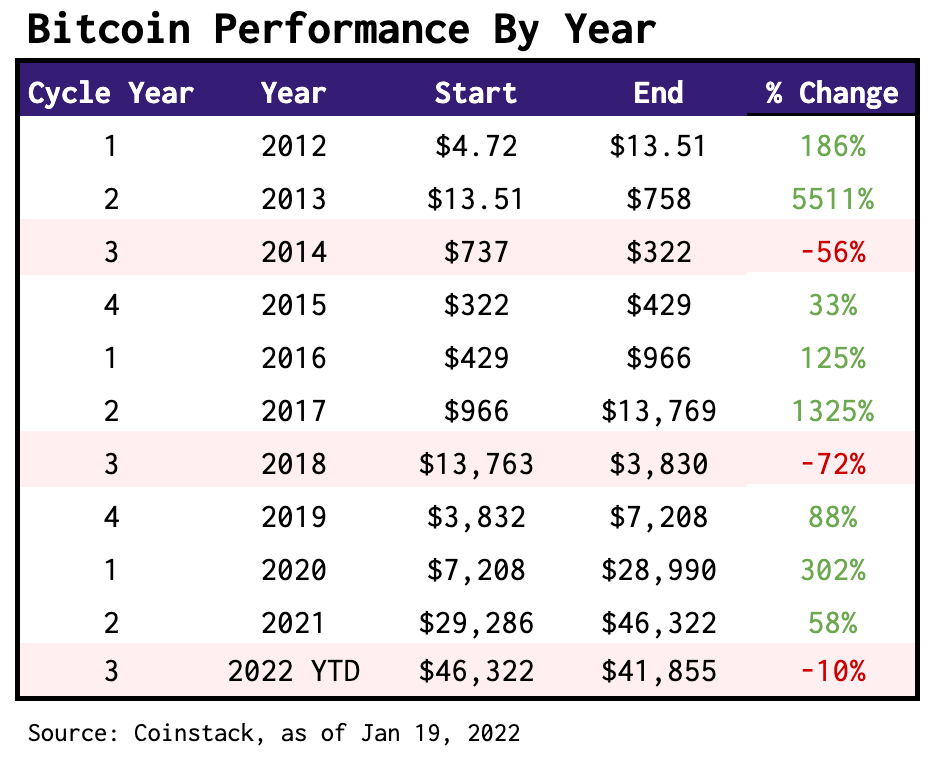

However, both Bitcoin (BTC) and Ether (ETH) are currently ~35% off from their November 2021 highs. Historically, the 3rd year after a Bitcoin having (the last one was in May 2020, so this is year 3 in the cycle) has been the worst year for digital asset prices. This usually happens because after the supply crunch at the time of the halving the price increases in the following 12-18 months, eventually into a speculative area — then comes tumbling back to Earth in year 3 of the cycle — correcting from prior irrational exuberance.

So, are we at the start of an 18 month bear market (I don’t think so) or are we simply getting ready for the next big leg up in the market and are in a time of much shorter cycles?

I see 2022 as different than 2018 — and I’m not expecting a -72% down year like we saw then — and I expect this may actually turn out to be a positive year for the assets with the most growth, utility, and cashflows.

The Supercycle Theory

I’ve personally come to subscribe to the Supercycle theory, advanced by Zhu Su, that we have mostly broken out of the four year market cycles that led to 2014 and 2018 being down years for digital assets -- due to how much utility and institutional capital is in the space now that wasn’t present in 2018 — that will keep price floors in place for core assets like ETH that can now be valued based on their cashflows (directly from staking rewards and indirectly from token burns).

I no longer subscribe to the theory that every four years we will see a blow off top for the digital asset market and then enter an 18 month winter.In fact, I expect prices for digital assets like Ether (ETH) and its smart contract platform competitors like Avalanche (AXAX), Solana (SOL), Fantom (FTM), Terra (LUNA), NEAR (NEAR), and Polkadot (DOT) to be higher at the end of this year than the beginning. Here’s why…

Ten Reasons I Expect 2022 May Be A Great Year for Digital Assets

Here are ten reasons I think that 2022 may be a great year for digital assets:

Back in December 2017 at the end of the last market peak, Bitcoin Dominance was 70%. Its market cap was more than 2/3rds of the total crypto market cap. Today, Bitcoin dominance has declined to 40%. Bitcoin is a much smaller part of the overall cryptoeconomy, and because of this, its four year supply halving cycle has less of an impact on the overall digital asset market. Further, as we saw in the Jan 18 article “Blockchains Are Cities” there are other smart contract platforms like Solana, Avalanche, and NEAR that are providing great alternatives to Ethereum with even faster transaction speeds--creating a tsunami of innovation and apps in the space.

The amount of total value locked in DeFi (crypto’s killer app) is now over $230B. This is up from $0 four years ago. There is real utility now (DeFi, web3, payments, NFTs, gaming) in crypto while four years ago it was simply too early.

The amount of venture capital being invested in digital assets and blockchain companies is substantially higher than four years ago. We saw over $60B invested in the space in 2021, versus less than $8B in 2017.

Traditional financial yields remain extremely low (0-3%), driving substantial institutional capital on a global hunt for yield into DeFi where investors can earn 12-18% annual yields providing liquidity in stablecoin pools. Why invest in a corporate bond at 3% with a negative real rate of return when you can invest in a diversified portfolio of 10-15 DeFi protocols (either yourself or via a market neutral crypto fund like HeartRithm) when you can potentially earn 4-5x traditional fixed income yields in stablecoin DeFi Yield farming? This yield arbitrage question is what every large fixed income investor globally is asking right now who is tracking the DeFi space. Hundreds of billions of dollars of capital is flowing this year from the old system into the new system. We may even surpass $1 trillion in DeFi TVL in 2022.

Inflation is at a 30 year high in the USA (now at 7% per year). In high inflation environments, monetary assets with fixed or declining supplies tend to do well. Now that Ether has a lower annual supply increase than Bitcoin (0.9% vs. 1.4%) and will soon have a negative annual issuance after the PoS launch in July 2022, I expect Ether (ETH) to begin to gain a reputation as sounder money in the 2nd half of 2022. Last week, Ether’s total supply change was negative for the first time ever, a preview of things to come with ETH as sound money.

Existing financial market systems remain rather broken. It still takes 2 days to send an international wire on the SWIFT system. It still takes 2 days to settle an equities trade. Traditional markets are only open 6.5 hours per day, 5 days per week. The world needs better financial technology that can deliver 24/7 markets -- and that is being delivered through asset tokenization and blockchain technology. Soon enough, all financial assets will be tokenized and trade on transparent blockchains -- equities, bonds, and real estate included.

DeFi, built on top of blockchains with smart contracts, solves many of the above issues with the current legacy financial system.

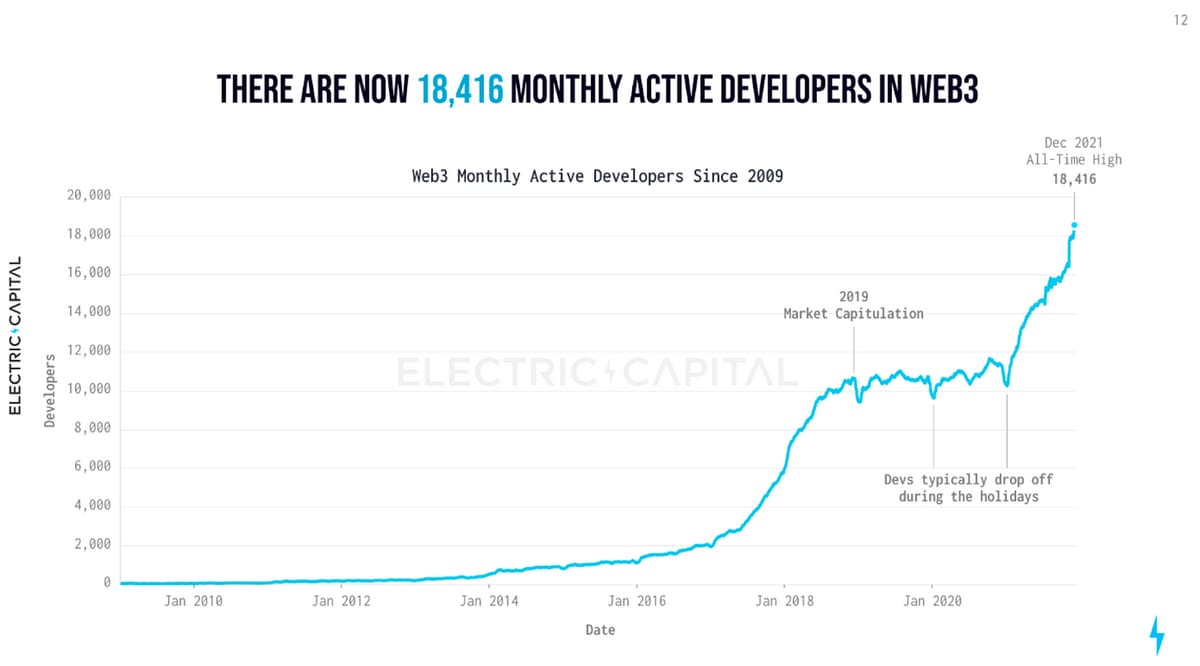

We’re at an all time high with the number of developers in the blockchain and Web 3 space. If you want to know what’s about to grow -- follow the developers.

We think that Ethereum and its smart contract competitors like Avalanche, Terra, and Fantom are going to have great years in 2022. You can see below just how fast Fantom, Avalanche, and Terra are growing their TVL in DeFi over the last 100 days.

Ethereum is on track for a major upgrade in July 2022 to Proof of Stake (PoS), which will substantially reduce new supply further. Once this is successfully completed, there’s nothing I see stopping Ethereum from reaching $10k per Ether and trending down in supply from 118M to 100M ETH over time. Our DCF model has Ether currently valued at $11,300 per ETH.

Expecting a Strong 2022 for Digital Assets & Crypto Yield

Summing it all up, I think 2022 is going to be a good year for digital asset investing, especially for the blockchains that are growing fastest in TVL and developers: Ethereum, Terra, Avalanche, Solana, and Polkadot. I could also see a strong year for NEAR and Harmony (ONE) as they climb the TVL ranks.While we may continue to see volatility and 30-50% pullbacks in the digital asset market every 6-9 months, I’m no longer expecting the 85% drops we saw in 2014 and 2018 -- and I sense the overall direction is up.At these current price levels and with how much growth we’re seeing in usage, venture investment, and TVL in DeFi, I’m a buyer.

We’re seeing the entire global financial system being rebuilt this decade on top of smart contracts, open source code, and blockchains. It’s exciting to be part of chronicling this evolution. And for anyone wanting to reduce volatility in their overall crypto portfolio, you can always park a part of your capital in USDC and earn 8-10% on Blockfi, Celsius or Nexo or for qualified investors put capital to work in a market neutral crypto yield fund like HeartRithm. Join our webinars over the next two weeks to learn more.

📺 Upcoming Webinars for Institutional Investors

HeartRithm Managing Partner and Coinstack publisher Ryan Allis is hosting two upcoming 55 minute webinars on crypto investing for family offices, wealth managers, and financial advisors covering our thoughts on crypto investing in 2022, how to invest in DeFi, which smart contract platforms are growing faand mapping out the crypto hedge fund ecosystem. Register for free below.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week...

⚡ BitMEX Group Plans To Acquire a 268-Year-Old German Bank - BitMEX Group has signed a purchase agreement with Bankhaus von der Heydt, a 268-year-old German bank. (Source)

😮 The Subcommittee on Oversight and Investigations Will Hold a Hearing Entitled,”Cleaning Up Cryptocurrency: The Energy Impacts of Blockchains.” - The hearing will examine the energy and environmental impacts of certain blockchains used in cryptocurrency mining. (Source)

🏧 Coinbase Partners With Mastercard for NFT Marketplace Purchases - The agreement aims to allow non-crypto natives to get into NFTs without using a wallet and first buying Ether or other tokens. (Source)

💰 Brazilian Asset Manager Hashdex To Launch DeFi ETF Including Uni, Aave and Comp - Brazil-based crypto asset manager Hashdex will launch an exchange-traded fund (ETF) following 12 decentralized finance (DeFi) tokens. (Source)

🤑 OpenSea Confirms Acquisition of Dharma, Sets Sights on Fiat Onramps - NFT marketplace OpenSea confirmed its acquisition of Dharma Labs on Tuesday, a deal that could help the $13 billion crypto firm expand its technological prowess. Dharma Labs will be shutting down its existing Dharma Wallet and their CEO Nadav Hollander will join as OpenSea CTO. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The 28-Day Market Realized Gradient, Which Compares the Momentum in Market Cap (Speculative Value) Versus the Realized Cap (Real Capital Inflows) Indicates the Market is Oversold

2. GMX, Ellipsis, and Osmosis Have Seen the Largest Asset Inflows Into Their Smart Contracts in the Past 7 Days

3. Since the Beginning of the Year, the Aggregate Stablecoin Supply Has Grown by 388% — From $29B to Over $140B, a Record High

4. The Supply of USDC Has Surpassed USDT on Ethereum

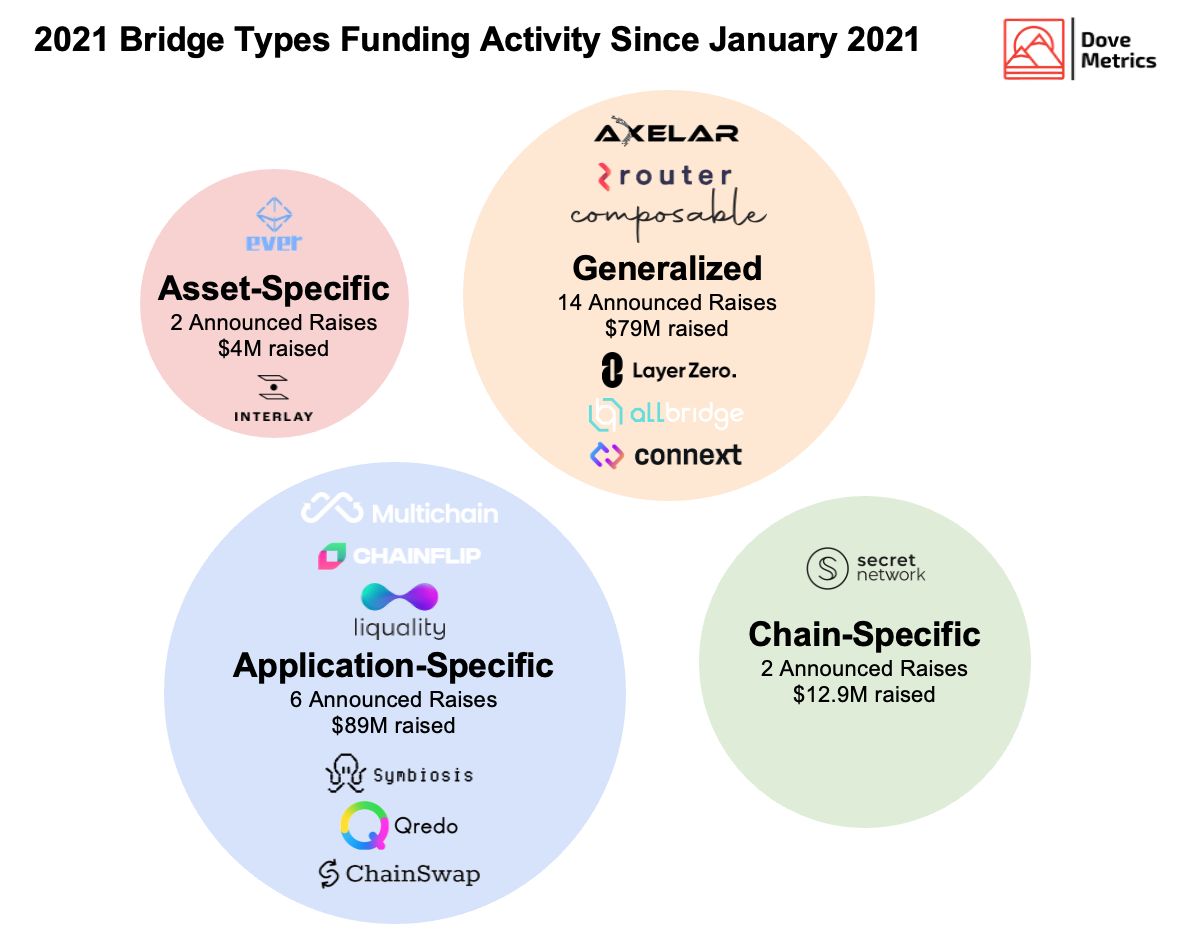

5. Over $184M Was Raised by Cross Chain Bridges Last Year, Signaling a Multi-Chain World in 2022

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

2022 Digital Asset Outlook: NFTs and Gaming

The Block Research delivers industry-leading research and analysis produced daily, covering an array of topics within the digital asset space. In their latest report, The Block goes in-depth on what they see as the trends in NFTs and gaming.

"The total volume traded in both the categories stands at $8.8 billion, with 60% coming from Art and Collectibles category and the remaining 40% from gaming NFT volume as of November 30. NFT activity hit a peak in the third week of August with just over $1 billion in traded volume. Since then, the weekly volume has reduced significantly, particularly in the Art and Collectibles category, while activity within gaming NFTs seems more robust at around $150 million in weekly traded volume."

"Fundraising activity in the gaming industry has increased exponentially. 2021 has been a remarkable year for NFT and Blockchain related fundraisers, to say the least. The sector has witnessed nearly $28 billion in fundraises. And this does not include IDOs from games. The following table shows the top 10 fundraises of the year by companies in the space."

"With over 9.2 million lifetime transactions, Axie Infinity has almost twice the total secondary sales as the following best NFT collection, CryptoPunks. Ethereum remains the most dominant blockchain as far as secondary sales are considered. At $9.3 billion, it has almost three times the secondary market sales compared to Ronin’s second best. However, it is essential to note that these are all-time comparisons, and Ethereum has had a head start ahead of side chains or other layer ones. The following tables show all-time sales by different collections and blockchains."

The Investment Case for Ethereum, Web3 and Decentralized Finance

Tom Dunleavy, a VP at Meketa Investment Group, prepares an institutional grade investment case for Ethereum, Web3 and Decentralized Finance.

"Ethereum is well-positioned to be in the driver seat to capture the rapid growth and user adoption projected in the coming years. The protocol has the security and decentralization to rival the most secure protocols like Bitcoin while having the flexibility necessary to allow for innovation. Use cases for Ethereum like DeFi, DAOs, NFTs, and the like, have created real tangible demand for the network. As we review in this paper a price target of $10,000 or more for Ether by the end of 2022 is reasonable when put in context."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

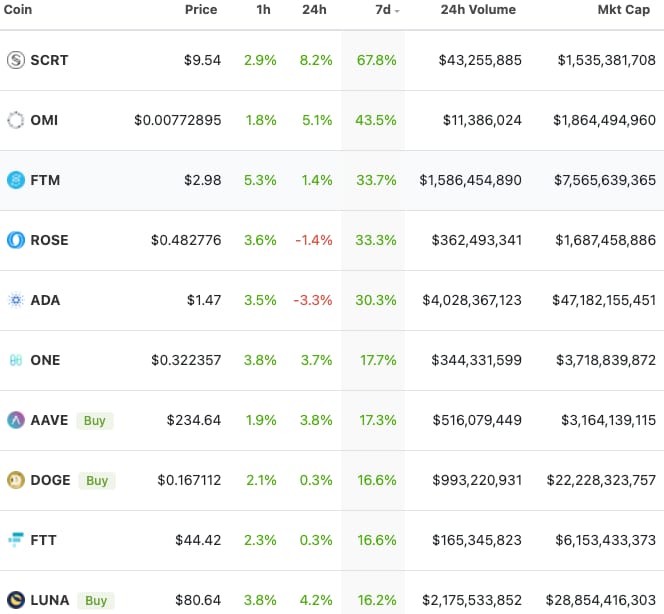

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like SCRT, FTM, and AAVE had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

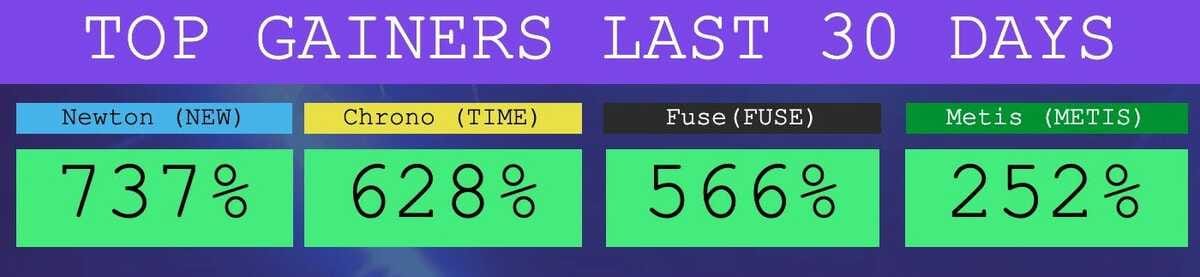

The Top Performers This Month from the Top 100: Newton is an L1, Chrono is an HR Dapp, Fuse is a payment rail, and Metis is an L2.

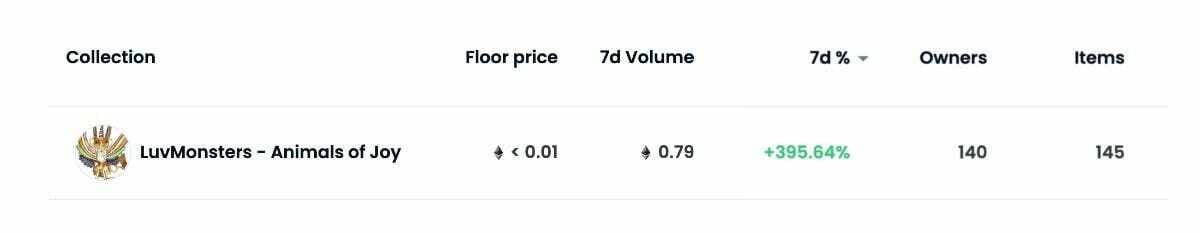

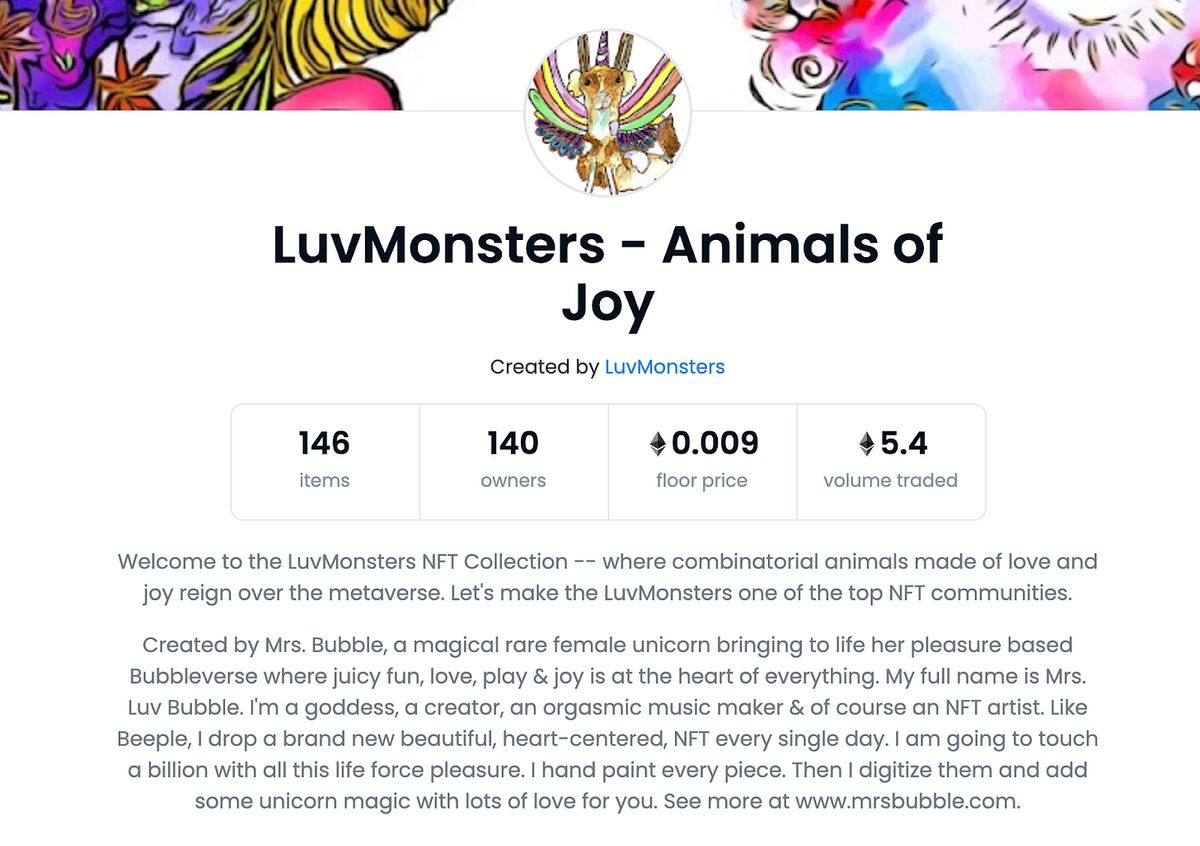

🎨 NFTs of the Week: $2 LuvMonster NFTs

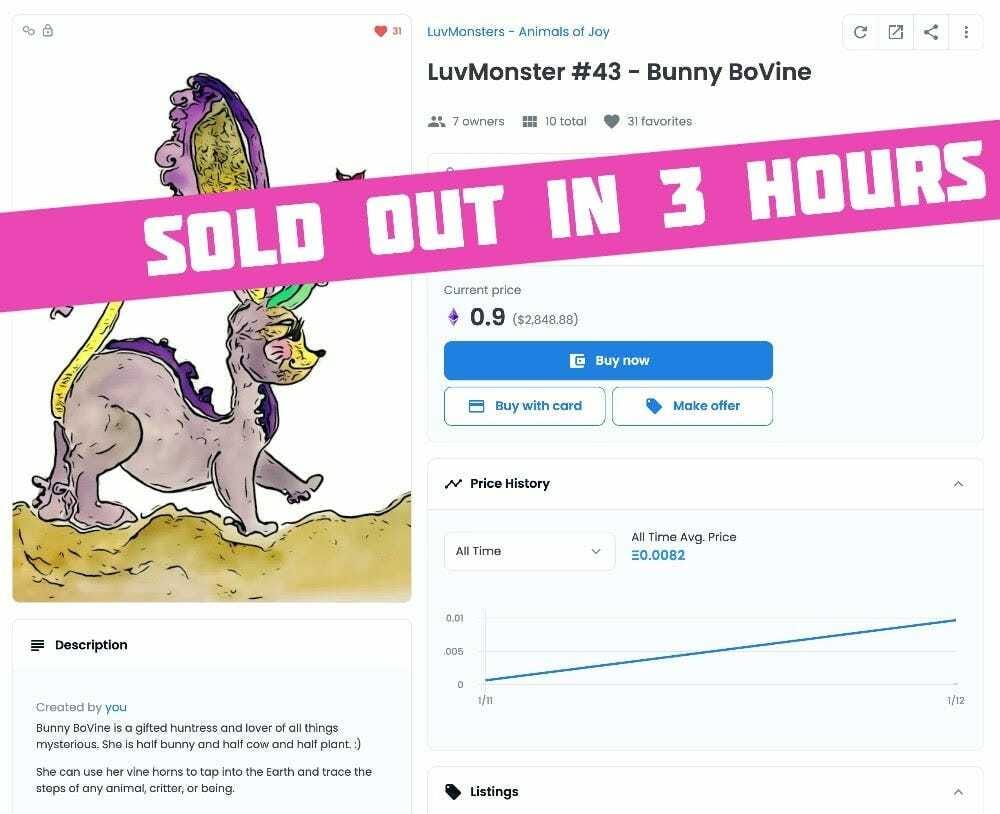

Last week, Mrs. Bubble launched three new NFTs. She sold out of 10 copies of LuvMonster #43 - Bunny BoVine for a special $2 early buyer price within three hours. Bunny BoVine then resold in the aftermarket for 0.06 ETH ($189), earning an early buyer a very nice profit -- and is now listed at $2817.

It’s been an incredible week. In the last week we’ve gone from 36 unique owners to 140 unique owners of the LuvMonsters NFT collection. We’ve sold 214 NFTs in the last week.

New LuvMonsters This Week - $2 Special NFTs

This week Mrs. Luv Bubble is launching 7 new LuvMonsters. They are all hand painted and then digitized. Some even have sound. She paints them each morning here in Austin. She plans to launch a new LuvMonster NFT each day, providing early access to the LuvMonster Telegram group and to Coinstack subscribers so you can collect them first.

Here’s the new LuvMonster NFTs that have launched this week. You can get them now for just $2 (but they may sell out fast). They are available here on OpenSea on the Polygon network ($0 gas fees for NFT purchases). To get one you’ll need to make sure you have some ETH on Polygon — or you can grab some of her original 1/1 mints on the Ethereum blockchain.

New LuvMonsters This Week - $2 Each Pre-Sale Price

Wow, aren’t they something!

Like Beeple, our goal with LuvMonsters is to build a highly active NFT community. We’re offering initial pre-sales (see below) for $2 to $10 to build our community into the 1000s of members, then build up the price floor as these become highly tradable collectibles. We are also planning a LuvMonsters stuffed animal line (photo below) and an animated NFT series.

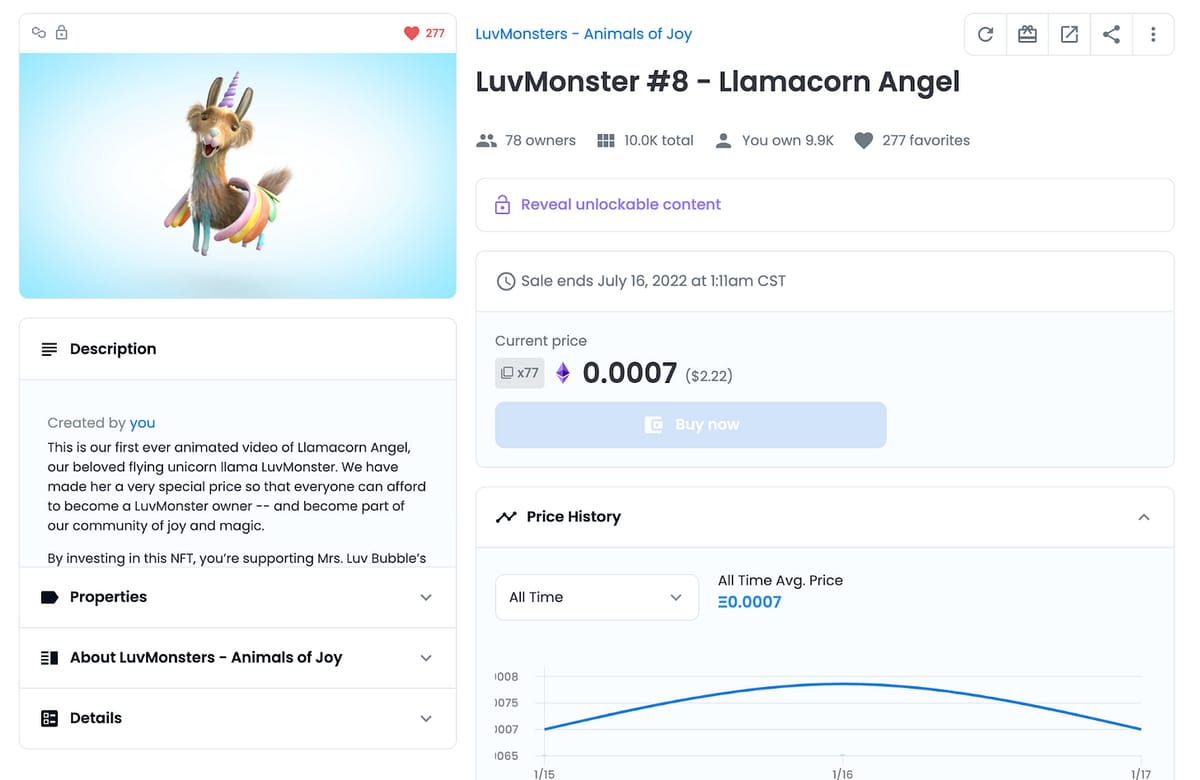

The First LuvMonster Animated Video - $2 NFT

We also launched our first ever video NFT LuvMonster - Llamacorn Angel complete with light language sound (watch the video -- it will make you smile). She’s available for just $2.22 as our goal is to first build up our unique collector base to 1,000 collectors, then to increase the price floor as we get the secondary sales and trading going. We’ve sold 133 copies of her so far. If we can sell 1,250 we will have enough to start our animated LuvMonster series. Thanks for helping us bring joy and smiles to the world!!

Here’s a preview of the first ever LuvMonster stuffed animal! Imagine being able to get one of these for your children. We want to build LuvMonsters to become the new Beanie Babies -- but for the 2020s! 💗💗💗

Mrs. Luv Bubble currently plans to keep doing 1 per day until we reach 5,000 LuvMonsters, so these first 100 may end up being quite something special. You can collect them here — and be sure to join our Telegram group here for early drop announcements.

Additional Coinstack Sponsors

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 16,136 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

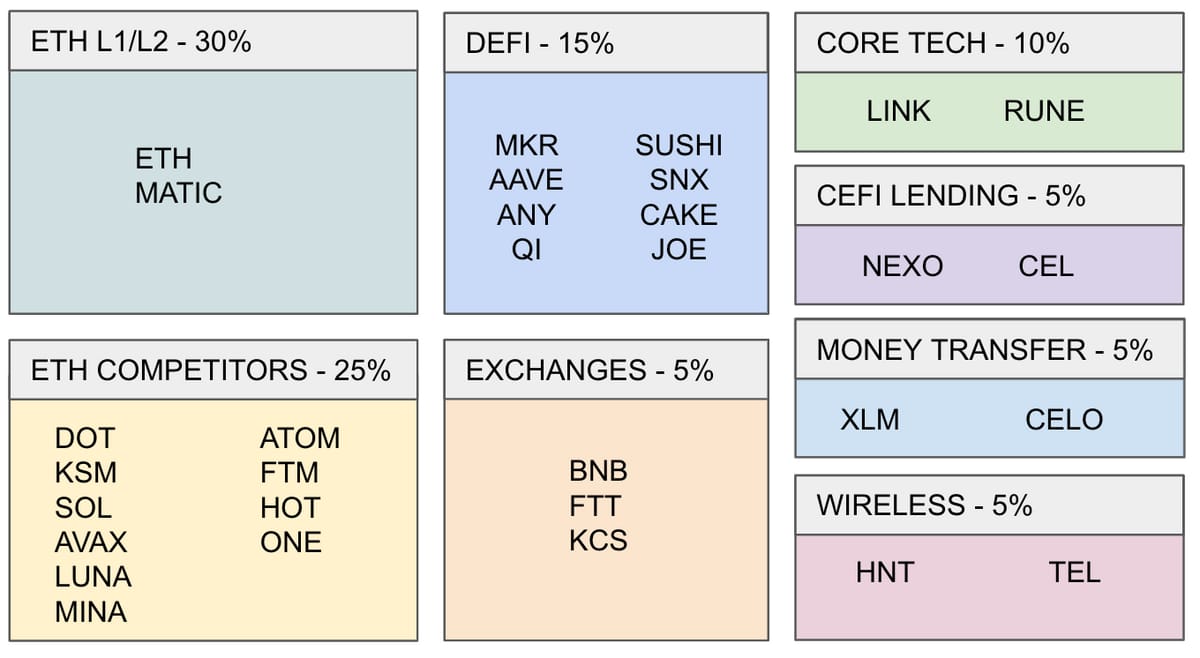

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.