Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we share updates on the continued fallout from FTX, 3AC, and Terra’s collapses, cover Keyrock, Fleek, and Bitwave’s big new venture rounds and share a Binance Research piece on “2022: The Year Institutions Evolved Into Crypto.”

In This Week’s Issue:

🗞️ Top Weekly Crypto News - SBF Puts Off House Testimony on FTX, SBF at Dealbook Summit: 'I Didn’t Knowingly Commingle Funds', Sen. Warren demands answers from Silvergate Bank about FTX/Alameda banking relationship

💵 Weekly Fundraises - Keyrock ($72M), Fleek ($25M), Bitwave ($15M), Catapult ($8M)

📊 Key Stats - 12.8% of All Circulating ETH is Staked, Stablecoin Active Addresses At All-time High, Alameda/FTX Ventures Invested $5.3B in VC Investments

🧵 Thread of The Week - Blockworks & Binance: 2022: The Year Institutions Evolved Into Crypto

📝 Report Highlights - Messari: Layer-1 Value Thesis: The Expected Demand for Security Model

🎧 Best Crypto Podcasts - Coinstack, Bankless, Real Vision

📈 Top 10 Tokens of the Week - CAP, GXC, TWT

👂 Coinstack Podcast Episodes

💬 Join Our Telegram Group

📚 How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

Coinstack Partners helps web3 and crypto companies raise funding from venture capital firms for Series A/B/C rounds of $1M to $100M. The firm has relationships and access to the top 300 crypto and fintech venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors and brands building in the metaverse. Learn more at www.wemetalabs.com.

Amphibian Capital recently launched the Amphibian ETH Alpha Fund, with the goal of outperforming staking Ether. The fund offers a way for accredited investors and institutions who are large holders of Ether (150+ ETH) to invest in a diversified portfolio of ETH quant trading funds that pay out returns in ETH. Learn more and see fund results at www.amphibiancapital.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot available - please see our sponsor deck and schedule a call to discuss.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week…

1) ⚖️ Bankman-Fried Puts Off House Testimony on FTX - Former FTX CEO and founder Sam Bankman-Fried (SBF) said Sunday he would be willing to testify before congress, but only once he has “finished learning” about the implosion of his crypto empire. SBF was asked by chairwoman of the House Financial Services Committee, Maxine Waters, to attend a hearing on Dec. 13 to explain his side of events.

2) 🚩 SBF at DealBook Summit: ’I Didn’t Knowingly Commingle Funds' - As the collapse of FTX continues to cast a shadow over much of crypto, former Chief Executive Sam Bankman-Fried stepped into the media spotlight. The befallen crypto tycoon fielded a series of questions from Andrew Ross Sorkin of The New York Times at the publication’s annual DealBook Summit. SBF attended the conference virtually from the Bahamas. SBF also said in a head scratching moment, “I didn’t ever try to commit fraud.”

3) ⚖️ Sen. Warren Demands Answers From Silvergate Bank About Its Business Dealings With FTX - Silvergate is one of the few U.S. banks that let customers move dollars onto crypto exchanges. FTX and related firms, like Alameda Research, had 20 Silvergate accounts.

4) 🔗 Arrest Warrant Sought for Terraform Labs Co-founder Over Cryptocurrency Collapse - Prosecutors said Wednesday they have sought an arrest warrant for Daniel Shin, co-founder of Terraform Labs, for allegedly gaining illegal profits before the massive collapse of the blockchain firm's cryptocurrencies.The Seoul Southern District Prosecutors Office said the warrants were also sought for three other Terraform Labs investors and four engineers of the firm's cryptocurrencies -- TerraUSD and Luna.

5) 🟩 BlackRock’s Fink Says Crypto Technology Still Relevant Despite FTX - BlackRock Inc (BLK.N) Chief Executive Larry Fink said on Wednesday that there appear to have been "misbehaviors" by the now-bankrupt FTX crypto exchange, but that the technology behind crypto is relevant for the future. "We're going to have to wait to see how this all plays out (with FTX)," Fink said. "I mean, right now we can make all the judgment calls and it looks like there were misbehaviors of major consequences."

6) ⚖️ Three Arrows Founders Have One Week to Provide Key Financial Documents - The co-founders of defunct crypto hedge fund Three Arrows Capital, Su Zhu and Kyle Davies, reemerged recently on Twitter and in media interviews with no shortage of opinions about the collapse of Sam Bankman-Fried’s FTX. But neither they nor their Singapore-based legal team have been cooperating with requests for documents related to their firm’s liquidation.

7) 🟩 Galaxy Digital Wins Celsius Bankruptcy Auction to Acquire Crypto Custodian GK8 - Mike Novogratz’s Galaxy Digital has won the bid to acquire GK8, a self-custody crypto firm. GK8 was first acquired by Celsius in November 2021 for $115 million. After Celsius filed for bankruptcy, the self-custody firm was put up for auction as part of Celsius’ proceedings.Today’s acquisition cost was not disclosed, but a representative of Galaxy Digital told Decrypt that "the purchase price we agreed on was materially less than what GK8 was previously purchased for."

8) 💵 MetaMask Co-founder Wants to ‘Dump’ Apple, Calls iOS Purchase Tax ‘Abuse’ - MetaMask co-founder and ex-Apple employee Dan Finlay says he’s all in favor of the crypto industry ditching Apple’s App Store altogether, calling Apple’s 30% in-app purchase tax “an abuse of monopoly.” “I'll absolutely stand in solidarity here,” Finlay wrote in response to the news that Coinbase’s iOS Wallet app had previously been blocked by Apple until it removed NFT transfer features.

9) 🚀 Binance Acquires Japanese Crypto Exchange Sakura - Binance is getting back into the Japanese crypto market.The world's largest crypto exchange by total volume announced that it had acquired crypto exchange Sakura Exchange BitCoin (SEBC). As SEBC is already regulated by Japan's Financial Services Agency (FSA), the acquisition will allow Binance to reenter the country.The amount of the acquisition was not disclosed. "Having carried out a significant due diligence process in Japan, we believe SEBC shares our vision for the Japanese market," a Binance spokesperson told Decrypt via email.

10) 🚩 Bankman-Fried-Backed Bill on Hold Until Next Congress, Says Senate Chair - The Digital Commodities Consumer Protection Act, or DCCPA, whose association with Sam Bankman-Fried has come under added scrutiny following FTX's collapse, is on pause until next year. Senate Agriculture Committee Chair Debbie Stabenow, D-Mich., confirmed the delay after a hearing on the topic with Commodity Futures Trading Commission Chair Rostin Behnam, another proponent of the bill. "We look forward going into the new year, given the fact that this is December," Stabenow said.

💬 Tweet of the Week

Source: @Blockworks_

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Coinstack Partners helps web3 and crypto companies raise funding from venture capital firms for Series A/B/C rounds of $1M to $100M. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. There Is Now 15.5M ETH Locked in the Deposit Contract. That’s Over 12.8% of All Circulating ETH

Source: @CryptoGucci

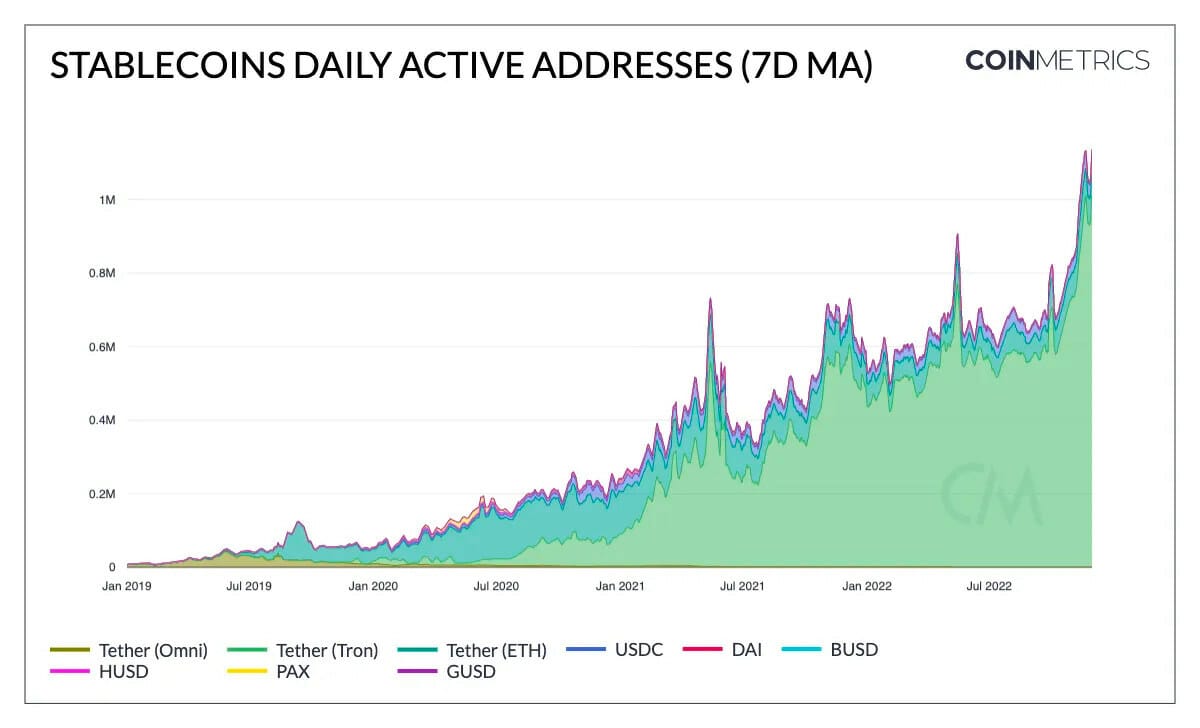

2. Stablecoin Active Addresses Are Breaching New Highs, Crossing 1m per Day

Source: @OurNetwork

3. The Total Amount Invested by Alameda/FTX Ventures Was Roughly $5.3 Billion

Source: @lawmaster

4. Chainlink Staking v0.1 Launched This Week

Source: @ChainLinkGod

5. Optimism’s L2 Grows 10x+ YoY

Source: @OurNetwork

6. Ethereum Number of Addresses Holding 32+ ETH Just Hit an ATH

Source: @CryptoGucci

7. Total Borrowing Volume Across Major Lending Protocols Has Declined ~75% From $32B to $8B Over the Past Year

Source: @TokenTerminal

8. Both Uniswap V3 and SushiSwap Have a Relatively Small Portion of Automated Bots (1–8%) Compared to Their Overall User Base.

Source: @MessariCrypto

9. There Has Been a Big Spike in the Number of Reddit Avatar Holders, Growing by 600K in the 1st Week of December to Hit Over 3.8M Holders

Source: @0xPrismatic

10. BENQI and Compound Currently Have the Highest P/S Ratios Out of All Major Lending Protocols at 167x and 163x, Respectively

Source: @TokenTerminal

🧵 Thread of the Week - 2022 The Year Institutions Evolved Into Crypto

1/ January

- CashApp offers lightning network access to users

- Twitter launches NFT integrations

- Robinhood starts crypto wallet testing

2/ February

- KPMG Canada adds BTC/ETH to balance sheet

- Twitter adds ETH tipping

- GameStop and ImmutableX launch a $100 million gaming fund

- ConocoPhillips launches Bitcoin mining operation

- BNY Mellon and Chainalysis to track & analyze crypto products- Intel launches crypto mining initiative

- JPMorgan unveils research on Quantum Key Distribution blockchain network

- Sling partners with bitpay for crypto payments

- Rakuten launches NFT trading platform

3/ March

- CVS Health files trademark application for NFTs and VR

- State Street and Copper offer digital asset custody

- JPMorgan and TRM use compliance tech to secure blockchain

- billboard and Univeral launch NFT based project

- Tencent files patent for Metaverse concerts

- Misfits Gaming reveals partnership with Tezos

- Baidu announces the launch of NFT platform

4/ April

- Fidelity allows 401k accounts to hold BTC

- Robinhood integrates Lightning Network

- Tesla, Blockstream and Block launch solar-powered bitcoin mining facility in Texas

- Stripe enables USDC payments

- LBMA uses blockchain for supply chain management and fraud prevention

- Mastercard, Nexo and DiPocket partner to launch crypto card

- Commerzbank applies for local crypto license

- Stripe and Polygon allow customers to make payments in USDC

5/ May

- Meta partners with Polygon to integrate NFTs

- Instagram supports NFTs on Ethereum, Solana, Flow and Polygon

- Cloudflare starts staking Ethereum

- LGT Bank to offer crypto

- De Beers launches NFT-based project

- Stripe and Opennode allow fiat-to-bitcoin conversions

- Moneygram and Stellar blockchain allows users to send & convert stablecoins

6/ June

- PayPal enables the transfer of BTC, ETH, BCH, and LTC to external wallets

- Citadel and Virtu Financial to build a crypto trading marketplace

- American Express launches product allowing users to earn crypto rewards

- Chipotle partners with Flexa to accept crypto payments in US stores

- Apple partners with Block to integrate Square payments with ‘Tap to Pay’ on iPhone

- Checkoutcom offers merchants instant fiat-to stablecoin conversion

- Splyt and Binance Pay partner to help Binance users in 70+ countries to book ride-hailing, travel & shopping experiences

- Shell, Accenture and American Express announce the launch of Avelia, a blockchain-powered digital sustainable aviation fuel SAF book-and-claim solution

7/ July

- Christie's launches a Web3 venture fund

- GameStop releases public beta NFT marketplace

- Dubai’s crown prince lays out the region’s most ambitious “Metaverse Strategy”

- BNP Paribas and Metaco partner to custody crypto

- SMBC to work with Hashport to develop Web3 projects

- Barclays takes a $2bn stake in crypto from Copper

8/ August

- BlackRock offers crypto to institutional clients

- DTCC releases its own blockchain

- Meta launches NFT integration through multiple wallets

- Reddit to integrate Ethereum purchases on Vault

- Binance and Mastercard launch crypto-to-fiat card in Argentina- Tiffany & Co announces sale of 250 pendants for CryptoPunk NFT holders

- PayPal offers crypto support

- F1 files crypto trademark for 2023 Las Vegas Strip Circuit Grand Prix

9/ September

- Nasdaq announces crypto custody service

- T-Mobile and Helium sign a five-year agreement

- Charles Schwab, Citadel and Fidelity announce crypto exchange EDX Markets

- Swift and Symbiont announce corporate data blockchain pilot

10/ October

- Google Cloud partners with Coinbase to allow Web3 companies to make crypto payments

- Mcdonald's starts to accept Tether and Bitcoin in Swiss town Lugano

- Mastercard partners with Paxos to provide crypto trading capabilities to banks

- Mastercard partners with Ciphertrace to detect and prevent fraud

- Fidelity adds an Ethereum Index Fund

- JPMorgan and Visa team up to streamline cross-border payments using Liink and B2B Connect

- BNY Mellon enables customers to custody bitcoin and Ether

- Flamengo to launch a number of Web3 products via MoonPay partnership

- Rio de Janeiro to accept crypto payments for property taxes

- Google to launch a cloud-based node engine service for Ethereum developers

11/ November

- Arweave and Meta to archive creators’ digital collectibles

- JPMorgan and Singapore's Central Bank to make first DeFi transaction

- Sony to explore NFTs and blockchain for gaming

- Nike and Polygon launch of a new “digital wearables” platform

For the Infographic see Binance Research’s Original PDF: https://research.binance.com/static/pdf/Institutional_Adoption_2022.pdf

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

Native blockchain assets are a new asset class and require a new model to model their value. So far, attempts to model these assets have forced a traditional asset class perspective with comparisons to gold, oil, equity, debt, or currency.

The (in)famous Stock-to-Flow model looked at the price of BTC solely as a function of supply. The model ignores demand factors entirely and recently failed.

Chris Burniske’s adapted equation of exchange (MV=PQ) primarily attempts to value crypto assets as currencies. They are more than that. Other currency models like interest rates or relative purchasing power parity do not fit such young ecosystems well.

Discounted cash flow models erroneously ignore the fact that cash flows are only relevant when they are generated in an asset other than the one being valued. Similarly, commonly used financial metrics like revenue, total value locked (TVL), or maximal extractable value (MEV) are also price dependent and, as such, not useful for modeling value.

I propose a new model which treats the native assets of a blockchain in a crypto-native way. It explains how a native asset accrues value, what its key drivers are, and the place it holds within the network's ecosystem.

The Expected Demand for Security Model (EDSM)

The EDSM proposes that the key driver for the price of a native blockchain asset is the gross demand for security by all present and future infrastructure, applications, assets, and users on its network.

In a nutshell, the demand for security grows as new use cases are unlocked and new users are onboarded. These new use cases and users put pressure on the network to provide higher security. Since network security is primarily dependent on an asset’s price in both Proof-of-Work and Proof-of-Stake networks, the price increases to meet the higher demand for security. As investors price for the future, changes in anticipated demand for security also have the same effect.

Breaking it Down

Price of the Asset

The EDSM proposes that the key driver for the price of a native blockchain asset is the gross demand for security by all present and future infrastructure, applications, assets, and users on its network.

The key role of the market cap of a native asset is to provide network security.

For Proof-of-Work (PoW) networks, higher miner revenue (sum of the dollar value of block rewards and transaction fees) translates to greater hash power to secure the network. SEBA Bank’s Miner Parity Model shows a direct relationship between price and hash power.

In Proof-of-Stake (PoS) networks, the relationship is even more direct as the staked market cap directly impacts the economic cost of attacking the network. The percentage of the market cap that is staked is assumed to be steady for the purpose of the argument, so the only change in security comes from price.

There are other factors that matter for security too. Blockchains can be attacked through non-economic means. Additionally, different consensus models may translate value to security differently.

However, for the sake of simplicity, we ignore these other factors and equate the security provided by a blockchain with its market cap — to increase the security, the price must increase, and vice versa.

Gross Demand for Security

The EDSM proposes that the key driver for the price of a native blockchain asset is the gross demand for security by all present and future infrastructure, applications, assets, and users on its network.

The model proposes that the demand for security is the key driver of price. It is important to understand that while the most quantifiable aspect of security demand is the commercial value or economic activity, security demand can also come from non-commercial activity like a public good providing censorship-resistant social media.

It actually may be the case that a non-revenue generating public good may have a higher security requirement than a highly profitable application. For example, users of a censorship-resistant social media public good on the blockchain may collectively require more security than the owners and users of a profitable gaming company.

Infrastructure, Applications, Assets, and Users - “Apps Together Strong”

The EDSM proposes that the key driver for the price of a native blockchain asset is the gross demand for security by all present and future infrastructure, applications, assets, and users on its network.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 33,661 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.wemeta.world, www.amphibiancapital.com, and www.investdefy.com