This issue covers 7 more countries looking into using Bitcoin as currency, crypto as economic empowerment, how to unbank yourself, the rise of the Polygon sidechain, Ethereum fees, and the latest on-chain metrics that are predicting a strong crypto recovery in 2H 2021.

SPONSOR SEARCH: We are seeking a sponsor/partner for Coinstack. Here’s our sponsor deck. Thanks for any industry connections you may have.

In This Week’s Issue:

7 More Countries Exploring Bitcoin As Currency by Ryan Allis

How to Unbank Yourself by Ryan Allis

The Rise of the Polygon Sidechain by Ryan Allis

ETH Fees Down 92% by Ryan Allis

This Week On-Chain - Bullish Signs Continue by Mike Gavela

The Brilliance of Yield Farming by Marc Cuban

My Top 30: A Long-Term Crypto Portfolio

Top Performers Last 7 Days

Join Our Tuesday Crypto Advice Calls

Featured Art NFTs by Mrs. Bubble

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

Seven More Countries Exploring Bitcoin As Currency

Last week’s move by El Salvador to make Bitcoin legal tender has made me more bullish on Bitcoin.

In the last week the following leaders of seven other nations have gone public and are encouraging a similar move:

Panama - Congressman Gabriel Silva

Paraguay - Congressman Carlitos Rejala

Argentina - National Deputy Francisco Sánchez

Tanzania - President Samia Suluhu Hassan

It’s just the beginning. I expect Bitcoin (or some alternative form of decentralized digital currency) to be legal currency in the majority of the world’s countries by the end of this decade.

Bullish on Bitcoin for Nation-States

It’s no surprise that countries where inflation has been pretty high (like Argentina with 36% inflation in 2020) are interested in a monetary supply that can’t be inflated.

Inflation primarily hurts the poor and the unbanked who don’t own stocks or homes. With the value of their cash declining every week, their incentive is to spend money now.

Bitcoin changes this.

Here’s what Bitcoin Beach founder Mike Petersen said this weekend about how Bitcoin was being used by the local population in El Zonte, El Salvador for savings.

“Only 10% of these people have bank accounts... These are people who have never had access to financial markets. When they got money they would just spend it right away because why not it was just going to go down in value right away so savings seemed pointless. We’ve seen that Bitcoin changes people’s outlook on life… now you see hope on their faces and that they can build a future.”

And here’s what Mike said about how Bitcoin was preferred for not just inflation-proofing their savings, but also for paying for transactions at local stores using Strike.

“We were paying the youth in Bitcoin to clean the rivers or clean the beach. Once they started using it it only took a couple days to click that wow, this was so much better than using dollars--I can send it to my friend across town. I don’t have to worry about putting it in the bank. It’s always with me because I always have my phone.”

It’s important to note that traditional financial apps like Venmo, Paypal, or Cash App still require bank accounts and credit cards to work. And many of the businesses in these local communities can’t qualify for the merchant accounts needed to accept credit cards.

Crypto As Economic Empowerment: An Inclusive System

Two billion people worldwide are considered unbanked/underbanked. That’s 40% of the world’s adult population who are STILL without access to basic financial services -- in 2021.

As Acuant writes in The World’s Unbanked Population,

“Banks are still utilizing multiple forms, paper files, manual compliance checks and in-person identification checks, a process which has long been considered archaic, time-consuming and creates a poor user experience. Relying on traditional data to verify identity doesn’t just alienate the modern digital consumer, it also leads to huge demographics being unable to access the services that they want. Reliance on traditional application processes prevent underserved or unbanked populations who may not have formal identity documents from creating accounts, applying for loans or mortgages, or gaining access to other potentially life-changing opportunities.”

A technology that can allow for savings and sending money instantly for those who don’t have access to bank accounts or credit cards (i.e. Bitcoin) can be truly transformative for economic empowerment -- from El Salvador to Nigeria to Indonesia.

International Monetary Fund (IMF) spokesperson Gerry Rice said the following on Thursday:

“The adoption of bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis.”

Yes, careful analysis is indeed needed.

The IMF Should Be Encouraging The Use of a Currency That Can’t Be Inflated Away

The IMF, which was set up in part to “encourage sustainable economic growth and reduce poverty around the world” should soon come around and be in more public full support of nation-states allowing opt-in usage of a digital currency with a fixed supply that cannot be inflated away by Boomer bureaucrats.

No offense, but I’m listening to the 30-somethings on the future of digital money -- not the 60-somethings.

It is the current system that has led to massive income inequality within countries between those who own assets and those who do not who are being actively incentivized by the very structural design of the debt-based inflation-prone fiat currency petrodollar system to spend quickly before their cash declines in value.

I’ve seen this “savings disincentivization” effect first hand in my travels to Nigeria, Ghana, Kenya, Uganda, Rwanda, the DRC, and Nicaragua.

Give me the El Zonte residents or the Lagos youth over the Geneva technocrats, any day.

And give me Bitcoin over the petrodollar, any day.

It’s time for a new Bretton Woods -- and time for a globally-neutral decentralized digital currency that doesn’t favor one country over another and whose supply isn’t controlled by a few.

Bitcoin (and crypto more generally) creates incredible opportunities for distributed and inclusive economic opportunity and financial access.

As Nathaniel Whittemore said on The Breakdown podcast Sunday, “Bitcoin is economic empowerment.”

Here’s to a world in which everyone has the right to choose whether to use fiat currency or digital decentralized currency.

It’s clear to me which one will win by 2035.

Centralized currencies created by nations that keep inflating their supply to reduce their debt burdens have no chance in the long run against decentralized and programmable internet money with fixed or deflationary supplies.

Decentralized internet money > Centralized Nation-State Money

How to Unbank Yourself

So the question remains for the 70% of the global population that current using traditional banks, how exactly would you completely get rid of your bank if you wanted to?

Could you go fully bankless?

Let’s take a look…

While the user interfaces of some of these crypto and DeFi solutions leave something to be desired today, I expect that by 2022 the UI/UX of DeFi will be substantially better than legacy banking and financial systems.

The best UI/UX and software engineers in the world are leaving places like Google and Facebook and going to build the future of finance.

What are the tools you love the most for going bankless? Let us know in the comments section or in our Telegram group.

Neobanks Are Taking Over

The biggest banks in the world today are:

JP Morgan Chase

Industrial and Commercial Bank of China

Bank of America

Wells Fargo

These incumbents are about to get massively disrupted by branchless, crypto-first upstarts like Revolut and Nexo.

Neobanks that run on the crypto rails of stablecoins in addition to the legacy SWIFT system are about to take over the world…

Wherever you live around the world, the banks that add on cryptorails first (using backend platforms like Fireblocks) will be the ones that become the new banking leaders of 2030.

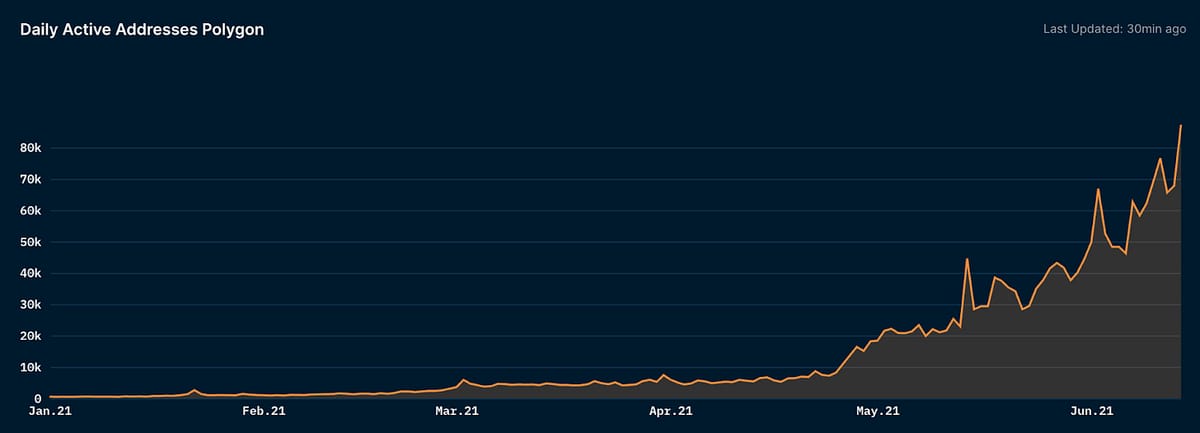

Three months ago on March 14, 2021 Ethereum had 1.29M daily transactions compared to 154k for Polygon (MATIC). Ethereum did more than 8x as many transactions per day than Polygon.

Just three months later on Sunday June 13, 2021 Ethereum had 1.12M daily transactions compared to 7.1M for Polygon.

Polygon now does more than 6x as many transactions per day as Ethereum mainnet -- as it has taken over much of the volume from Aave, SushiSwap, and Zapper.Fi.

You can see that Polygon flipped Ethereum in terms of the number of daily transactions on May 1, 2021.

I first wrote about Polygon (MATIC) in the context of a Ethereum scaling solution on February 18, 2021 when it was trading at $0.12 per token.

Now it is trading at $1.45 per token.

Yes, Polygon now has more than 6x the number of daily transactions than Ethereum and now has 87,000 DAUs up from 5,000 three months ago. Fantastic growth!

But will the rapid growth of Polygon last beyond this summer? I doubt it.

Major DEXes (which currently support Matic) like Aave, Curve, and Uniswap, have already declared their support for ZKsync (Curve), Arbitrum (Aave) and Optimism (Uni).

Polygon’s a great intermediate patch for another 2-3 months, but sidechains like Polygon have less security than L2 scaling solutions like Optimism, Arbitrum, and ZKSync, which all utilize Ethereum’s native security layer.

I sense that most of the volume on Polygon will move over to Optimism, Arbitrum, ZKSync, and ZKPorter by the end of 2021.

While it’s winning temporarily, I expect Polygon will have to adapt or die in the competitive world of blockchain scaling solutions.

Ethereum Fees Fall 92% in 3 Weeks

Users think of them as usage fees. Holders think of them as revenues.

Regardless of how you think about them… Ethereum’s gas fees are down 92% in the last three weeks, from $69M per day in mid-May to $5M per day today.

Why? Well, there’s less demand for Ethereum’s mainnet blockspace.

Why is there less blockchain demand? Two big reasons.

Sushi, Aave, Curve, 1Inch and others have moved over to using the Ethereum sidechain Polygon (see above article).

Uniswap, which was generating a lot of the ETH mainnet usage previously, trading of worthless dog/meme tokens has slowed since May 12 when Vitalik Buterin started burning and giving away his Shiba Inu that had been summarily given to him without his permission. Since that moment, ETH gas fees are down 90%+

The fees on Ethereum mainnet haven’t been this low since January 1, 2021.

According to The Block, May 2021 Ethereum total fee revenues came in at $1.03B.

For June 2021 we are on track for just $160M.

If this were a company, we would be dealing with losing 85% of our monthly revenues overnight and having to lay off most of our workforce.

Fortunately, this is crypto -- and there aren’t any centralized costs to pay for. 100% of revenues go to miners (and soon to stakers).

Also when prices for blockspace go down 85% all kinds of new use cases become possible, which is great for the industry.

Now that we have L2 scaling solutions and can do 5000+ TPS at pennies per transaction, I predict DeFi will truly be able to be brought to the masses in 2022.

We were never going to eat Wells Fargo’s lunch when it cost $100 per Ethereum transaction. But at $0.01 per L2 transaction, it’s inevitable.

It will be interesting to see what DeFi can do using Arbitrum, Optimism, and ZKSync and how that will impact the overall settlement value on Ethereum as well as Ethereum’s monthly revenues.

My guess is that it may be 2-3 years until we see Ethereum get back over $1B per month in revenues like we saw in May 2021. We’re going to need to see an explosion of usage on L2 to make that happen -- especially with sharding in late 2022 further enabling scalability.

Welcome to crypto -- the only industry in the world where you can reduce usage prices 90% in a month and everyone’s cool about it.

Hey, even with the 92% decrease the last three weeks in revenues, ETH has still grown its revenues by 1860% in the last 12 months!

So, what does this mean for my Ethereum DCF model… well, it means that ETH’s fundamental value (for now) is more like $4.5k not $15k.

You can see our Ethereum Fundamental Value Model (FVM) chart updated daily at coinstack.co/ethvalue.

This Week On-ChainBy Mike Gavela

This is a weekly series by Coinstack analyst Mike Gavela that uses on-chain metrics to provide commentary on what’s happening in crypto.

As prices begin to move upwards again we are seeing more and more evidence supporting our original thesis from last week. We are not in a bear market. We are in a longer-term bull cycle and the on-chain activity for BTC, ETH, and the current state of DeFi prove this to be true.

Let’s start by taking a look at BTC’s Stock to Flow Chart.

The Stock to Flow (S/F) is a model that assumes that scarcity drives value. Stock to Flow is defined as the ratio of the current stock of a commodity (i.e. circulating Bitcoin supply) and the flow of new production (i.e. newly mined bitcoins).

Bitcoin's price has historically followed the S/F Ratio and therefore it is a model that some say can be used to predict future Bitcoin valuations. The following chart below is Bitcoin’s Stock to Flow with analysis done by Philip Swift an analyst at Decentrader.

As Swift points out, the current price of BTC is deviating away from the Stock to Flow line pretty drastically. Within Swift’s chart he uses a divergence tool at the bottom to show how far the price is moving from either side of the stock to flow level and points it out with orange arrows. BTC’s price has been trending below the line and has been for the last couple of weeks.

What’s significant about this metric is that BTC’s price has only done this three other times back in 2012, 2013, and 2017 which Swift highlights in orange using orange arrows. Each time when BTC's price was trending below Stock to Flow, BTC’s price had a hard rebound and eventually caught up with the stock to flow price level.

As Swift puts it, “While we may not rally so hard and fast this time, fundamentally nothing has changed with how Bitcoin works. Nothing is broken, we are just experiencing a lot of bad media coverage after a strong rally at the start of the year. So we may well see price make its way back up to the stock to flow line in the coming months. This would mean new all-time highs for $BTC before the end of this year, as the Stock to Flow line is currently sitting at $85,000.”

With Taproot reaching 90% consensus over the weekend by miners, BTC will see it’s first major upgrade in four years which will allow for greater transaction speeds as well as increased privacy and is set to launch in November which correlates with Swift’s price prediction.

Moreover, a similar macro trend can be seen when looking at BTC’s Realized Price against Stock to Flow and the current market price. Realised Price is understood in the industry as the, “Cost Basis” for investors in the network as it values coins by when they were last moved vs. what price they were last traded. The following chart was developed by @digitalikNet and demonstrates the strong correlation between Stock to Flow and Realized Price.

Similarly when we look at Ethereum’s Realized Price Chart we see a similar pattern forming that matches the price action in 2017 before the bull market peak in Green.

As the market price continues to move sideways we can see Realized Price forming a new bottom base. While the Yellow Circles show the last time when the market price went below the Realized Price signaling the entry point of a new bear market. Considering both Coin Days Destroyed and Dormancy have been trending down since mid-May, we know we are not seeing Long Term Holders dumping their positions and that it’s mostly short term holders that have been shaken out.

From a macro perspective the above indicators show that the crypto market as a whole remains in a longer-term bull cycle with some necessary corrections in the short term to ultimately achieve it’s cycle ATH price points.

Another way to look at it -- we got quite far on the “institutional adoption” trend and are now beginning our next leg up with the “nation-state adoption” trend.

While no one knows for sure, if this nation-state adoption narrative expands and the overall tech market stays strong, we still anticipate reaching BTC $80k+ and $ETH $7k+ later this year or early in 2022.

DeFi Protocol Revenues Flat Last 90 Days, But Up 239x Since Last Year

Now let’s look at what’s happening in the DeFi space...

The Defi Space is a “reflexive” market meaning every moving piece of the DeFi economy is interconnected. When token prices start to decline, some token holders sell their positions. When token holders sell, TVL in these protocols decline. We also see reductions in Daily Unique Borrowers on lending apps like Aave, Compound, and Maker.

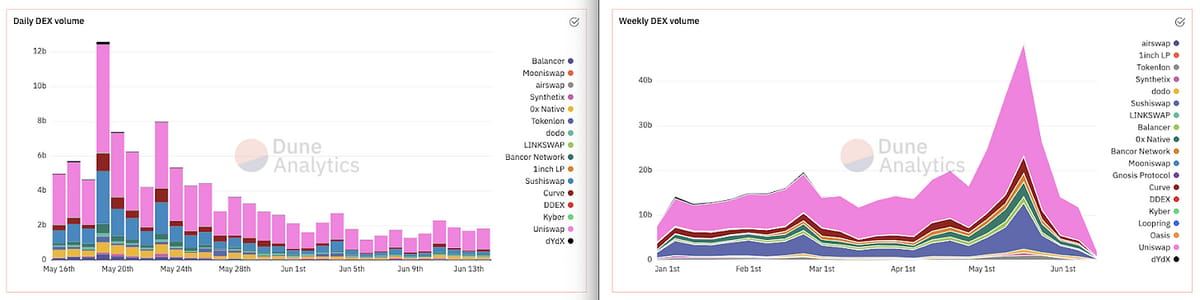

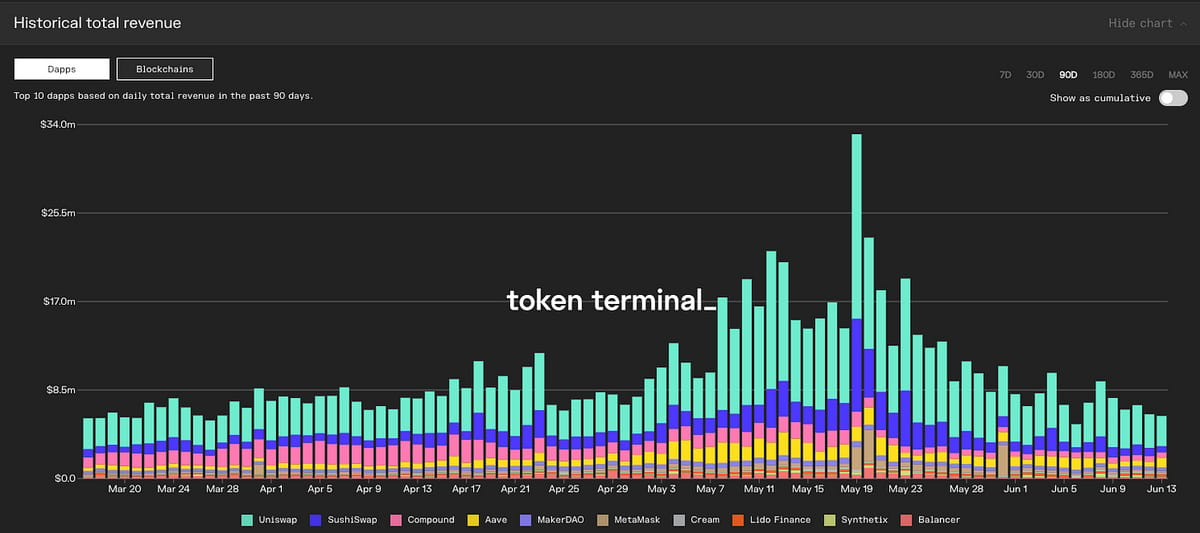

The same can be said when looking at the decline in volume for DeFi apps both on the Daily and Weekly Charts.

We can see from the Daily/Weekly DEX volume that across the board volume has been on a steady decline since May 18. What’s also worth noting is that Uniswap has maintained dominance and managed to compress on average much less to its competitors.

Zooming out and looking at Revenues generated from DeFi protocols we see that the fees collected are reverting back to the mean before the top and subsequent selloff.

Revenues are falling in the short term because less people are using the protocols. Just like any economy with less people spending and participating in the economy, revenues start to fall. When revenues start to fall, that becomes a deflationary pressure. Because revenues and fees start to fall people will sell the token and because the token value is falling these other DeFi Altcoins with weak fundamentals get blown out and the market corrects itself eliminating all the froth before prices climb back up.

In terms of Total Daap Daily Revenues, we remain at the same place we were 90 days ago in mid-March, yet are still up 239x year-over-year from $25k per day in revenues a year ago to $6M per day today.

Yes, my friends, DeFi is here to stay. Below is the total revenue from DeFi protocols over the last 365 days.

So what’s earning all this money? The top apps by revenue over the last 30 days are Uniswap, SushiSwap, Aave, Compound, and Metamask, and Maker.

A Bullish Summer 2021 for BTC, ETH, & Alts

Overall, while we don’t know for sure and we note that we remain in choppy waters, with the background of countries now exploring legalizing Bitcoin for use as currency and Microstrategy putting its newly issued $500M in new bond cash to work buying Bitcoin we see a likelihood of a relatively strong next week for Bitcoin and then Ethereum, with other quality projects with strong revenues or strong technology following suit.

Keep in mind that EIP-1559 is only 6 weeks away (July 28), which keeps us relatively bullish for ETH over this time period.

The Brilliance of Yield Farming, Liquidity Providing and Valuing Crypto ProjectsBy Marc Cuban, June 13, 2021

I’m going to make this as simple and straightforward an explanation as I can.

Yield Farming via Staking and Liquidity Providing are a core feature of most, if not all Decentralized Finance (DeFi) projects. The principle behind why they are brilliant also applies to other crypto projects , but let’s put that aside. But first let me say that this is not investment advice. This is how I see the market and there may be things that I am wrong about or could change by the time you read this. Feel free to add your thoughts in the comments below.

What Business Are They In?

The first question you have to always ask about any De-Fi is the same question you need to ask about any business you may create a financial relationship with – “What Business Are They In”

Yes, every single DeFI project is at its core, just another business. They may or may not know what business they are in, but they are just another business that happens to be using a blockchain and smart contracts to host and program their business processes.

Let me give you an example of some DeFi and Blockchain projects I’ve placed some money with and how I view their business:

Polygon/Matic – They are a very simple business that is hard to execute on. Their job is provide tools that enable transactions using their Ethereum/Solidity smart contracts, built primarily by outside parties, to take place as quickly and in-expensively as possible while still being able to bring in more money than they spend. In order to do this, they charge a fee per transaction. That fee is paid for using their Matic token. Much like you buy your Dave & Buster tokens in order to play their games, you must buy Matic Tokens in order to use the features of their network and smart contracts.

But blockchain based businesses diverge quickly from traditional software and the difference is where the brilliance of crypto based businesses like Polygon/Matic and their competitors, from BTC to Eth and even to Doge coin come in.

Every business or financial software service or application business has cloud computing and operating costs that very often grow faster than their revenues. This is not a surprise, it is exactly why software companies raise significant amounts of capital in order for their “software to eat the world “

Companies like Polygon’s capital needs are very different. Why? Because rather than building their business exclusively on a cloud computing platform like AWS, their businesses are decentralized (I’m not going to argue the definition of decentralization or security, or speed here) . The foundation of decentralization is built upon an independent party, usually called miners in Proof Of Work Networks like BTC or validators in Proof of Stake Networks like Polygon Matic and a few other crypto descriptive words, putting up their own capital to provide computing resources in order to support the network platform.

Brilliant.

Any other business you have to raise a shit load of money in order to host your own servers, or more likely pay for cloud computing costs which can be insanely expensive for compute intensive applications and just as expensive for scaling heavy use applications. Plus you have to hire all the people , have the CapEx to support them, etc.

In the decentralized crypto world these 3rd parties (miners, validators, etc) provide the computing power that effectively run the platform in exchange for rewards in the token of that network.

In the case of Polygon, they have validators. These 3rd parties are willing to make this investment if they believe the network platform can grow the numbers of transactions on the network significantly. If they can, that pushes demand for the Polygon tokens they earn. That allows them to earn revenue from the sale of the tokens they earn or they can hold the token and hope it appreciates if demand exceeds supply.

Even better, platforms like Polygon will allow pretty much anyone to STAKE their Matic tokens with those Validators and share in the earnings of the Validators ! Here is a nice guide from Coinbase on what Staking is. Validators love Stakers for a variety of reasons, but they are willing to share their earnings because the more they have staked the more rewards they can collect. It’s a symbiotic relationship that also helps secure the network.

My Top 30: A Long-Term Crypto Portfolio By Ryan Allis

If I were creating a portfolio from scratch right now that I didn’t want to touch for 5-10 years, I would be absolutely sure to include my top 5: ETH, DOT, KSM, RUNE, & NEXO. Here’s my top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko.

Here is my current portfolio by percentage. I still have a higher than usual percentage of Nexo tokens as those are locked in Nexo and I can’t sell them until I close out a loan I have with them.

Top Performers Last 7 Days…

Below are the top performing crypto investments the last 7 days (with a minimum market cap of at least $20M)...

And here are the top performing crypto investments the last 7 days (from the top 100 by market capitalization, i.e. the more mature investments)...

Join Our Tuesday Crypto Community Zoom Calls

Every Tuesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 8:30am PT / 11:30am ET / 4:30pm GMT.

All buyers of Mrs. Bubble’s NFTs (and investors in the Coinstack Alpha Fund) are invited to join and ask questions and share learnings with each other.

Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

You can think of buying the NFT as supporting beautiful joyous art AND a ticket into our community.

Join our weekly calls by getting a Mrs. Bubble NFT or investing in the Coinstack Alpha Fund.

Mrs. Bubble’s NFTs of the Week

You can buy a Mrs. Bubble NFT here and join our community for weekly crypto Zoom calls. We use these funds to be able to create more art. Mrs. Bubble the artist is my wife Morgan, so supporting her work directly supports our family, her art, and this newsletter being able to continue.

Here are the featured Mrs. Bubble art pieces for this week. Mrs. Bubble is putting up a new piece each day and plans to build a long-term NFT following. You can think of her NFTs as both beautiful art that uplifts the world AND your digital ticket into our live weekly crypto advice calls.

Here are a few of Mrs. Bubble’s newer art pieces...

And here are her most viewed art pieces so far out of her first 134 NFTs...

Thank you so much for joining the Coinstack community and supporting Mrs. Bubble’s art.

Join The CoinStack Telegram Community

Joinour Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1500 members on our Telegram.

The People I’m Following Closely on Twitter

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Website at Coinstack.co

Substack at CoinStack.substack.com

Twitter at Twitter.com/ryanallis

Coinstack Twitter at twitter.com/coinstackcrypto

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Please share with your friends and colleagues.