Welcome to the CoinStack Newsletter. This issue explains that we are all still extremely early in the inevitable process of all financial assets moving onto the blockchain the next 10-15 years — and explains what this may mean for your crypto investments. I also write about the process of becoming a top performing crypto investor and share my total crypto portfolio returns to date (+416% YTD). I recommend you read this full issue to learn how I achieved this.

Yep, We Have Another 200x To Go…

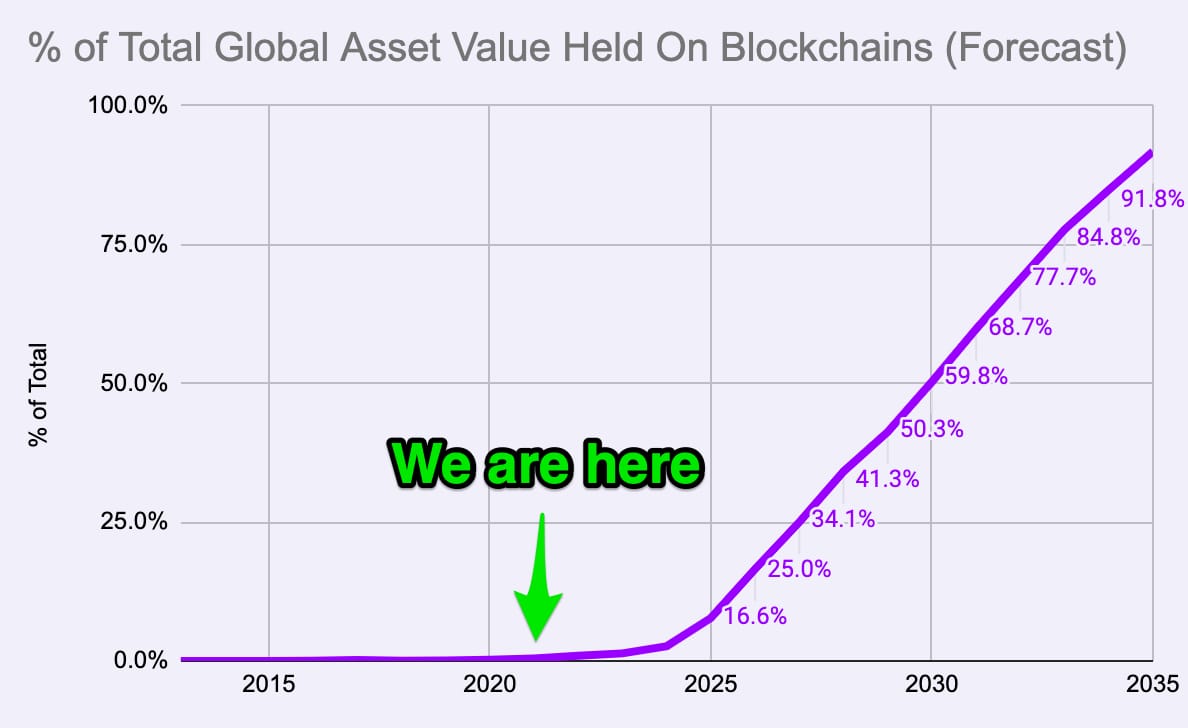

My macro thesis is simple, yet non-obvious: It's clear to me that nearly every financial transaction as well as the ownership record of almost all global assets (real estate, money, stocks, options, derivatives, bonds, commodities, art, everything) will all be computed and stored on a cryptographically secured blockchain by 2035. I believe 90%+ of the world's assets will be exchanged and stored on a blockchain by then.

This process is inevitable as every country moves to Central Bank Digital Currencies (CDBCs), as blockchain technologies scale, and as it becomes clear that conducting financial transactions and storing financial data, real estate titles, and company ownership records on a blockchain is optimal for ensuring trust and exchangeability among multiple parties across space and time as well. Today in April 2021, 0.45% of the world's assets are stored on blockchains. We're at 0.45% and we're going 90%+ within 15 years. It's going to be a wild ride.

The percentage of total global wealth stored in cryptographic-based blockchains including the value of all cryptocurrencies, stablecoins, and NFTs. Total global wealth as of 2021 is $420T per Credit Suisse and total crypto market cap is $1.9T, equal to 0.45%. See source data.

And Where We’re Going...

Yep… we’re at 0.45% and we’re heading asymptotically toward 100% in roughly 15 years. We've got another 200x to go.

Soon home titles, car titles, voting, stock trading, company shares, supply chains, and yes, even all national fiat currencies will be on the blockchain -- through CBDCs. China’s already testing theirs. Every type of financial transaction and every type of ownership record and medical record will live on a cryptographically-secured, decentralized, blockchain that completely cuts out the middleman. Bye-bye two-sided marketplaces that take 15% fees (like AirBnB and Uber). You about to get disrupted by a decentralized version that takes a 1% fee and gives it back to its token holders.

Yes, the suits will arrive in 2024 when all this becomes obvious to Wall Street. But by then, the weirdos wearing unicorn shirts and black hoodies will be the ones who the suits are working for.

Next week’s Coinbase IPO is just the beginning. Just watch.

The next Clayton Christensen (he was truly one of a kind and is missed), is going to have a lot of new case studies to write at HBS.

Modeling Disruptive Technologies

People generally don't understand how to model the disruptive nature of exponential technologies that are 100x better than what's come before (see the books Abundance and The Future is Faster Than You Think by Peter Diamandis and Stephen Kotler). They are very hard to mentally model using linear thinking. It takes 10 years for something to go from 0.003% to 0.45%... and then only 10-15 more to go from 0.45% to 90%. You don’t really notice it till it’s well, already everywhere.

So, congratulations, you are super early my friends. We're all gonna make it.

It will be volatile, especially the next 2-3 years, but the general direction is way up. It will get less and less volatile as the asset class approaches its intrinsic value and those in the financial capitals of the world realize that all financial assets will be operating on a blockchain by 2030. They probably won’t realize it until 2024/2025, but when they do, watch out.

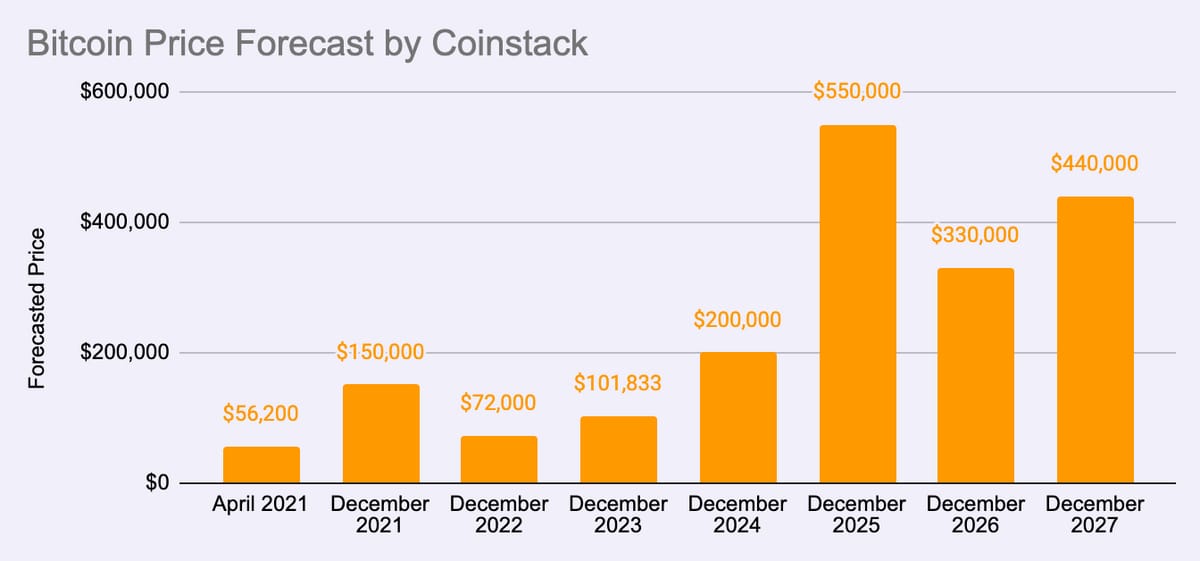

This isn't to say Bitcoin has another 200x to go (I think Bitcoin will peak around $500k to $1M before being completely disrupted by Ethereum).

It is simply to say that the core technologies that enable programmable decentralized blockchain-based computation (like Ethereum, Polkadot, Cosmos, Solana, and Avalanche) have a LONG way to go and can very realistically grow in usage and value by another 50-100x this decade.

Programmable money, decentralized banks, autonomous vehicles, quantum computers, renewable energy, and genome-customized synthetic biology. Welcome to the 2020s.

Let’s build a beautiful society together, friends. One that works for everyone and brings opportunity to all.

Learning to Time The Crypto Market

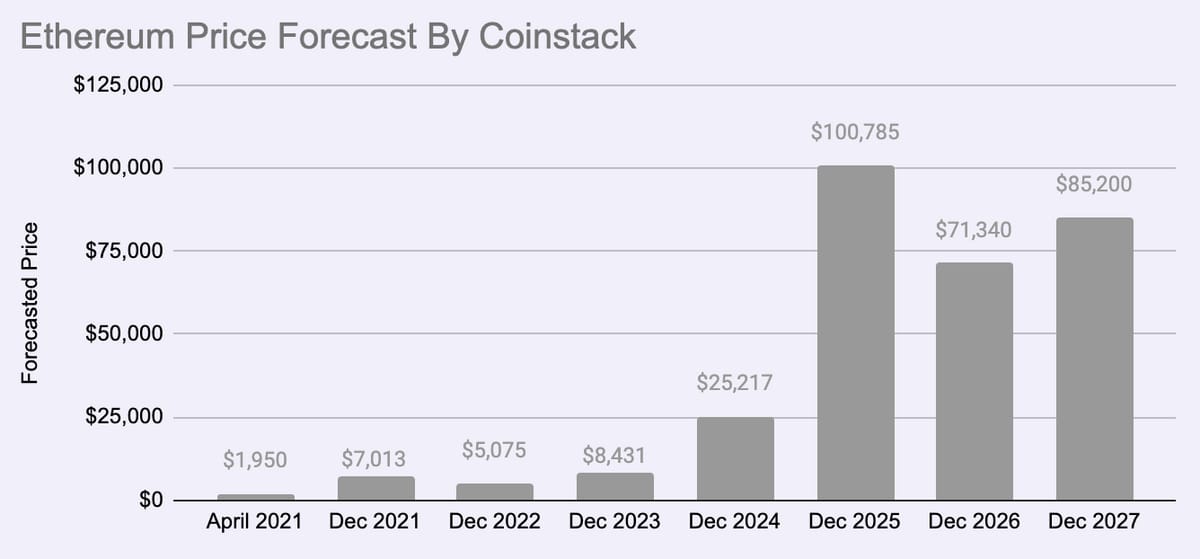

Yes, I do believe by 2035 we are going up another 10x-20x for Bitcoin, another 50x for Ethereum, another 100x for other early and quality blockchain projects, and another 200x for total asset value stored on the blockchain. The overall sector is on the rise.

And for those of you who read last week’s issue, you know that all indicators are pointing toward the top of this current cycle being many months away. I’m expecting a late 2021/early 2022 cycle top of $150k for Bitcoin and $7k for Ethereum.

But for those who have a passive crypto investment strategy and a long time horizon, timing a market top really doesn’t matter.

Since it’s highly probable the cypto market cap will go up a lot over the next 10 years, so let’s just HODL and relax for a decade, right?

Yes, for MOST people who don’t want to actively think about crypto, HODLing some BTC, ETH, and DOT for 10 years is the best strategy. Buy some, go on with your life, check back in 2030.

Why I’m An Active Crypto Investor

But me? I’m not trying to passively turn a $25k investment into $250k this decade. I’m trying to turn $250k into $1B.

And I’m trying to find the projects that will change the world for the better and invest in them early.

My dream? Building a global crypto fund that has sufficient returns the next 15 years to be able to invest for generations in building a global community of purpose-driven leaders (Hive.org) and a network of global innovation and arts villages (Hive Villages) for us all to live in with our families.

I’ve been working on this since 2013… and only this year have I realized that the Golden Goose of all it can be smart crypto investing that can weather any market stage.

Yes, it’s a bold vision.

And I’m 36 -- I hopefully have another 30+ years of active effort to make all this real.

So I gotta be, well, active. No passive investing strategies here.

The Path I’m On...

Personally, I want to know the exact moment to convert 2/3rd of my crypto portfolio into yield-generating stablecoins (the cryptoland equivalent of bonds) - and the exact moment to convert back.

And so, to do that… I gotta get good. Like real good.

And to get good, I got study deep. I gotta become a Metrics Master. Like Neo, but on the blockchain.

To become the Neo of the blockchain, I’ve got to combine my knowledge of software, finance, economics, geopolitics, data analysis, and human psychology. And I’ve got to build relationships with the leaders of the best early stage blockchain funds, platforms, exchanges, and dapps.

And yes, I’ll write to tell you when too, as best as I can. It will be more of a gradual warning (starting to get overheated, once we get above $100k in Bitcoin price).

My Story

Yes, I am thankful for those 10 years building iContact in North Carolina, that undergrad economics major I never finished at UNC, and those 500 case analyses during that Harvard Business School MBA I just barely finished, and those 8 years living in Silicon Valley angel investing and Hive into building a global network of heart-centered leaders. It’s certainly helpful to have a global network of 3,500 purpose-driven leaders and combine our forces for good as we become the leaders of the 2030s and 2040s.

It’s almost like I’ve been preparing for the 2020s since 1997 when I coded my first line of HTML at age 13. 24 years of preparation for this moment. As Eminem says, you can capture it, or let it slip.

Who knew that money itself would become programmable software? It’s like all my interests get combined into one.

Like, am I writing this fairy tale of epicness from the beyond?

How I Almost Figured This Out in 2013

Life kept putting Bitcoin in my face. I bought a mining rig in June 2013 when living in San Francisco and never plugged it in (I gave it away to one of my engineers Addison who also never plugged it in). We would have made about $200M had we plugged the darn thing in.

Then in 2017 I almost sold my San Francisco house for Bitcoin until the buyer pulled out at the last moment.

Then I got a bad taste in my mouth from all the 2017 ICO scams, and didn’t even think about Bitcoin until December 16. 2020 when I saw the headline that Bitcoin had surpassed its previous all time high of $20,000.

I regret nothing. Life instead put me on a magical course to go to Burning Man seven times, study meditation, yoga, and community building, meet the love of my life Morgan Carson Allis, and teach finding your purpose in life to 3500+ global leaders.

Plus, had I plugged in that darn Bitcoin miner, I probably would have become one of those weird Bitcoin maxis (those who believe Bitcoin is the only crypto asset with value). They crack me up.

But over this past Christmas holiday I read the book The Infinite Machine by Camila Russo and finally understood that Ethereum wasn’t like Bitcoin (which is pretty useless computationally). Ethereum was programmable money. 🤯

Now, I was hooked.

Even though I had spent literally 22 years preparing by learning everything I could about software, databases, geopolitics, entrepreneurship, angel investing, and finance -- I still had a lot to learn about cryptography and blockchains to update my internal mind map.

I took the $8k I had in Bitcoin from a small 2017 investment put in another $192k from selling some SpaceX stock that had been locked up for 8 years -- and started with $200k investing in early January 2021.

My Crypto Investing Results So Far (+371% in Q1 2021)

As I first wrote about in the February 26 issue, “How I Got a 161% Return in 30 Days” things have gone pretty well. Here’s the update as of today..

January 10, 2021 - $200,000 invested

February 1, 2021 - $321,815

March 1, 2021 - $600,487

April 1, 2021 - $942,673

Today: $963,464

Here’s the actual chart since I started tracking daily figures on January 26, 2021…

Yes, I am up 371% in Q1 2021 (and up 416% YTD). Let’s see what I can do in Q2.

Through active crypto investing I’ve turned $158k into $942k in 90 days. My portfolio? Here is what it looks like as of today:

I own over 200 different tokens, most at 0.2 to 1% of my portfolio. Only these 10 above cryptoassets have more than 1%.

You can also see above I’m heavy on NEXO and ETH. They’ve both performed incredibly well this year, especially for how established both are. I started out with equal ETC and BTC, but ETH has performed better so it’s now a higher percentage of my portfolio and I’ve bought more ETH this week as I gain more and more understanding of the timeline for EIP-1559 (July) and ETH 2.0 (early 2022).

I like Nexo because it’s given me a $300k loan at 6% annual interest so I can invest more in crypto. So my actual portfolio is $1.3M, with $300k debt, making the net portfolio value roughly $1M now. Every August, they also take 30% of their total profits and distribute it as a dividend to their token holders, like a dividend. They have the first legally compliant security token registered by the U.S. SEC. Pretty cool. The future for legally-compliant security tokens is very, very bright. On-chain auto dividends, now we talkin.

And yes my actual portfolio above is a slightly different than my recommended portfolio below as I have 25% in lower to mid market cap alt coins in order to generate maximum returns at this stage of the market cycle. I only recommend doing this if you know what you’re doing, want to be active, and can handle things like Uniswap, PancakeSwap, and Metamask with grace.

How I Win With Altcoins During This Phase of the Market Cycle

Every day, I invest $1000 in the 3 tokens that grew the most that day according to the Gainers List from CryptoDiffer and Messari.io. About 1/3rd are eventually losers and end up losing half their value. 1/3rd hover around the same area. But 1/3rd are big winners that continue to go up 5x-10x. My best investment so far, DENT, has gone up 26x since February 10th when I invested in it.

I love to find those sub-$100M market cap gems with the potential to 30x.Here are my top five 2021 investments so far (and it’s only April 8th).

Yes, eventually, the bull market phase will slow and I’ll move some of my portfolio into stablecoins and DeFi assets that generate 40-80% annual yields, while using Zignaly to auto copytrade crypto traders who have successful bear market strategies.

My Goal In Ten Years

My goal is to generate a 100%+ annual return every year of this decade, regardless of market cycle. We shall see. If I do, we’ll turn $1M into…2022: $2M2023: $4M2024: $8M2025: $16M2026: $32M2027: $64M2028: $128M2029: $256M2030: $512M2031: $1.02BAhh, the magic of compounding returns. We shall see if I can do it.

My goal is by 2031 to be where Sam Bankman-Fried of Alameda Research is today. To have $1BM AUM. And to build a firm that uses its profits to invest in projects that change the world for the better.

The main ingredients needed to achieve this are an accurate macro thesis, consistency, relationships, analytical chops, the ability to learn quickly, passion for a field, and the ability to program trading strategies that work under multiple market conditions and know when to switch between them.

Of course, I know my $1M could turn into $100k in a 90% market downturn this quarter. I’m fully aware of this… and am only investing money I can afford to risk. Rule #1 of crypto is never invest money you can’t afford to lose in crypto. I have another role advising SaaS companies and building Hive.org (which helps leaders find their purpose in life) and both help me support my family and cover monthly expenses.

Preparing to Built a Great Crypto Fund

To keep up this performance for a decade, I’ve got to source the best analyst reports from places like Messari and Delphi and build my own team of analysts.

I want to find the Mira Christanto's of the world (she’s the best crypto analyst I follow) and combine their analytical chops with the on-chain models of Willy Woo and Benjamin Cowen, with the early stage relationships of Paradigm and Alameda Research.

Yes, I’ve got to hire a team of developers to build a custom analytics platform and an automated machine learning crypto investment platform.

And yes, I’ve got to develop an edge. A multi-strategy edge that will stick around through up markets, sideways markets, and down markets.

It’s not like crypto is going anywhere. We’re literally at the starting line right now.

Our entire global financial system is being rebuilt on the blockchain this decade. All of it. The new code-based financial system is being built just as much in Switzerland, Singapore, Hong Kong, and Miami as it is in the power centers of the last 40 years NYC and Silicon Valley.

It no longer matters where you are. It only matters what you build.

And so, I study, I read, I listen, and I build models.

And I build a team of analysts and programmers to help me.

Want to join? Send me a note with your skills. You know how to find me.

The Ethereum & Bitcoin Forecasts

Here’s the forecast for Bitcoin and for Ethereum. If anything close to this level of growth actually happens, all we have to do is just chill and we’ll all do pretty well this decade. Remember, ‘time in the market’ often beats timing the market (unless you really got skills and a deep passion for learning this stuff).

Yes, I’m forecasting a 10x return in the next 5 years for Bitcoin and a 50x return for Ethereum -- with both ending up at around the current market cap of gold ($10 Trillion) by then.

But I know humans. And humans like to worry.

Personally, I study this field so I can relax. And I write this all out to learn it better and so you can relax. Thank me later?

And, to be fair, some of us (like me) have decided to be active crypto investors and having a month or so warning before we reach the eventual cycle top would be super useful -- so we have time to move a portion of our portfolio to yield generating stablecoins and market neutral trading strategies.

For me, I’m all in. I now have 100% of my liquid net worth invested in crypto, outside of a couple private stocks from angel investments many years ago.

And so, knowing when we are getting close to the top matters quite a bit to me.

Well, I am here to tell you -- it’s highly likely that we aren’t there yet.

NFTs Keep Growing

NFTs did over $91M in sales in March 2021.

There’s been a lot of talk about NFTs this month. My favorite NFT artist is my wife Morgan Allis, whose NFT art collection which launched in February -- please buy one here with Ethereum if you want to support female crypto art and support Coinstack).

Morgan has officially come out of the closet as her artistic alter-ego Mrs. Bubble (which I wasn’t allowed to tell you when I wrote about her art last month in my NFT issue as she was still pseudonymous then).

If you appreciate Coinstack and want to bring a smile to my beloved’s face, consider getting one. It will help motivate both of us to keep creating! She still shrieks in joy every time she makes a sale!

You can also invest in her creator coin on Bitclout to further support her work.

She’s been a painter for 8 years and she’s painted over 500 unique pieces in that time. We plan to build a BIG following for her art in the next decade, so get some now.

Yes, she’s my wife and best friend and I want you to buy one of her NFTs and support her art coming into the world. She’s been publishing one new NFT every day for the past 88 days and she plans to keep this up for the next 10,000 days.

Above is her incredible painting of our alter-egos in the art and festival world, Mrs. Bubble on the left and Mr. Bubble (me) on the right. The original is on a 7 foot by 3 foot canvas and is acrylic on canvas. It’s available on OpenSea for 1.11 ETH. It’s one of the more valuable ones in her collection, as it is of her and I and we use it as our profile pictures to represent our avatar.

Left: Mrs. Love Bubble (her) with her trusty Llamacorn, rainbow whip, and dragon hat.

Right: Mr. Joy Bubble (me) with my lion, unicorn burger, and frog hat.

Yes, I love supporting artists (especially female ones) and I love NFTs. If you support artists and like collectibles, get one with your Metamask wallet just to see what the experience is like. They start at 0.1 ETH.

We’re building a team to help her become one of the top NFT artists in the world this decade. The female Beeple, perhaps -- but with a soft and joyful feminine touch that brings some needed magic to our over-masculine world.

I’m gonna keep writing about her and share what we’ve learned as she’s become a successful NFT artist making meaningful sales.

My belief? Consistency + talent + relationships = success. Let’s go!

DeFi vs. NFTs?

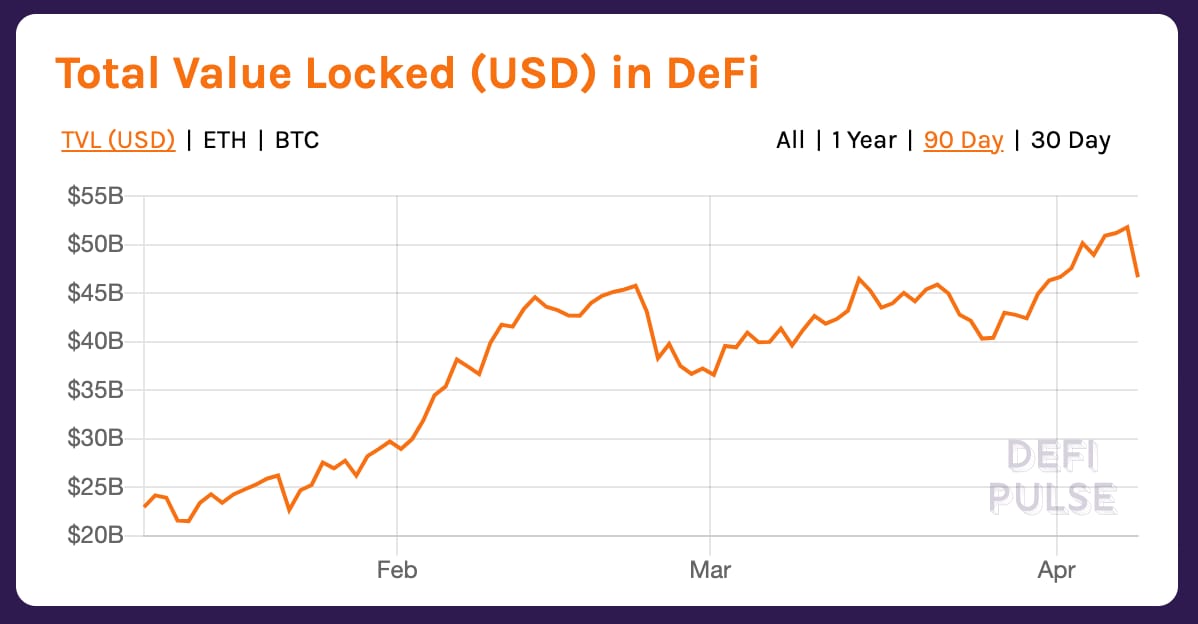

But the biggest use case so far of Ethereum isn’t NFTs (even though they did $91M in sales last month)...It’s by far DeFi…

While NFTs did $91M in sales in March 2021, DeFi apps on Ethereum now have over $45B locked in them, which grew by $2.5 billion in the last month (and by a LOT more than that if you include DeFi on Binance Smart Chain)

Ethereum Now Bigger Than AT&T

And Ethereum? Well it’s now the 46th largest asset in the world. It’s recently surpassed Cisco and AT&T and is about to overtake Coca-Cola. Warren Buffet my friend -- better get on that ETH train quick. Ethereum is just like Coke, but without the high-fructose corn syrup. It’s actually good for you.

Yes, the value of Ethereum can be modeled like a growth stock. It has $1.3B in monthly revenues between mining revenue and transaction fees. Currently those revenues go to the miners. However with EIP-1559 the transaction fees will go to reduce token supply and the staking revenue will go to the stakers (the coin holders who stake their coins). That’s one of the big reasons why ETH is likely to increase in value so much the next year as people realize this (and as layer 2 solutions help the network scale and reduce gas fees).

So yes, you can model the value of Etheruem using traditional financial metrics.

$16B in annual profits

1000%+ year-over-year growth

100x PE ratio (TSLA’s is 1000+ for comparison, most companies are around 20-40x)

Gives you a $1.6 Trillion in fair market value

I believe the actual market value of Ethereum based on its cash flows is around $1.6 trillion. Yet it’s trading at $230 billion. Time to load up!

By 2025 everyone will have figured this out. You’re probably one of the first 25,000 in the world to understand this at this level of detail. Make good use of the timing advantage you have.

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

80% of Portfolio

Ethereum (ETH) 20% of portfolio

Bitcoin (BTC) 10% of portfolio

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 10% of portfolio

Nexo (NEXO) 10% of portfolio

ThorChain (RUNE) 5% of portfolio

20% of Portfolio - About 1.5% Each

Voyager (VGX)

Uniswap (UNI)

Chainlink (LINK)

Terra (LUNA)

Cosmos (ATOM)

Polygon (MATIC)

Decentraland (MANA)

Ocean Protocol (OCEAN)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Origin (OGN)

PankcakeSwap (SWAP)

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

Start Here If You’re Getting Started With Crypto

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The CoinStack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

Substack at CoinStack.substack.com

Please share with your friends and colleagues. Help us spread the monetary revolution.