Issue summary: In this week, we talk about the rapid rise of Avalanche into the fastest-growing major blockchain in DeFi. We also highlight the most important news and highlights from the top reports in our industry, as Bitcoin passes $54k and ETH passes $3600.

In This Week’s Issue:

Is Avalanche the New Solana? By Ryan Allis

Avalanche Deep Dive By Mike Gavela

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 Is Avalanche The New Solana?

By Ryan Allis, Coinstack Publisher & HeartRithm Managing Partner

A few weeks ago I was on a call with one of our DeFi partners and they mentioned a new DeFi strategy they were earning good returns on. This strategy happened to be on the Avalanche (AVAX) blockchain -- and it got me looking very closely at the Avalanche DeFi ecosystem, wanting to understand why so much Total Value Locked (TVL) was moving into Avalanche.

I was curious, what was it about Avalanche that was causing it to take share from Ethereum and Solana?

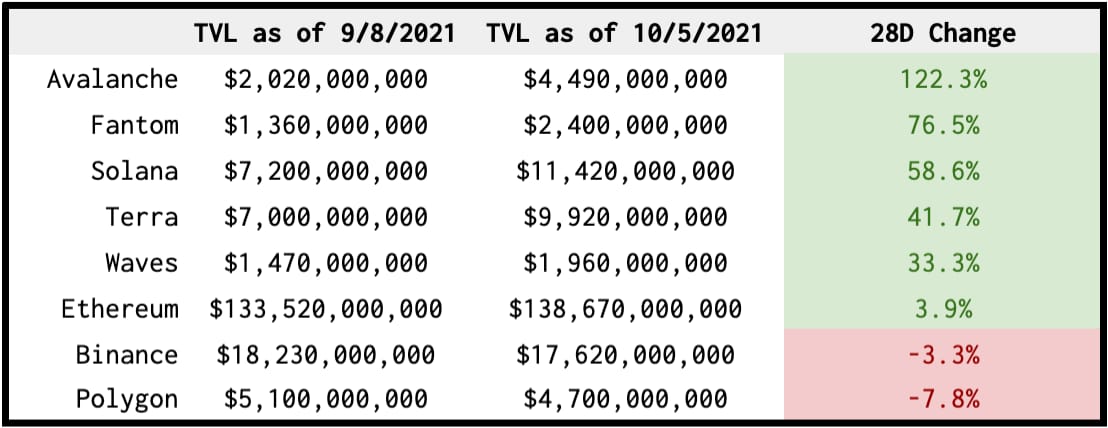

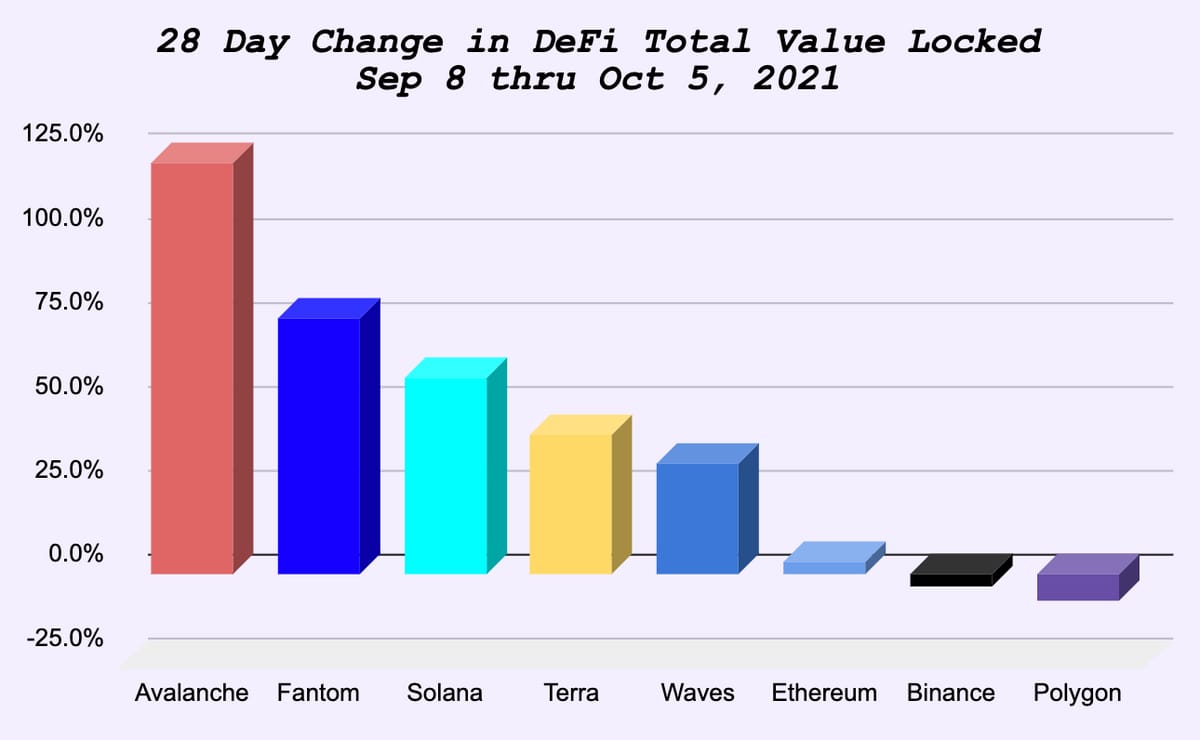

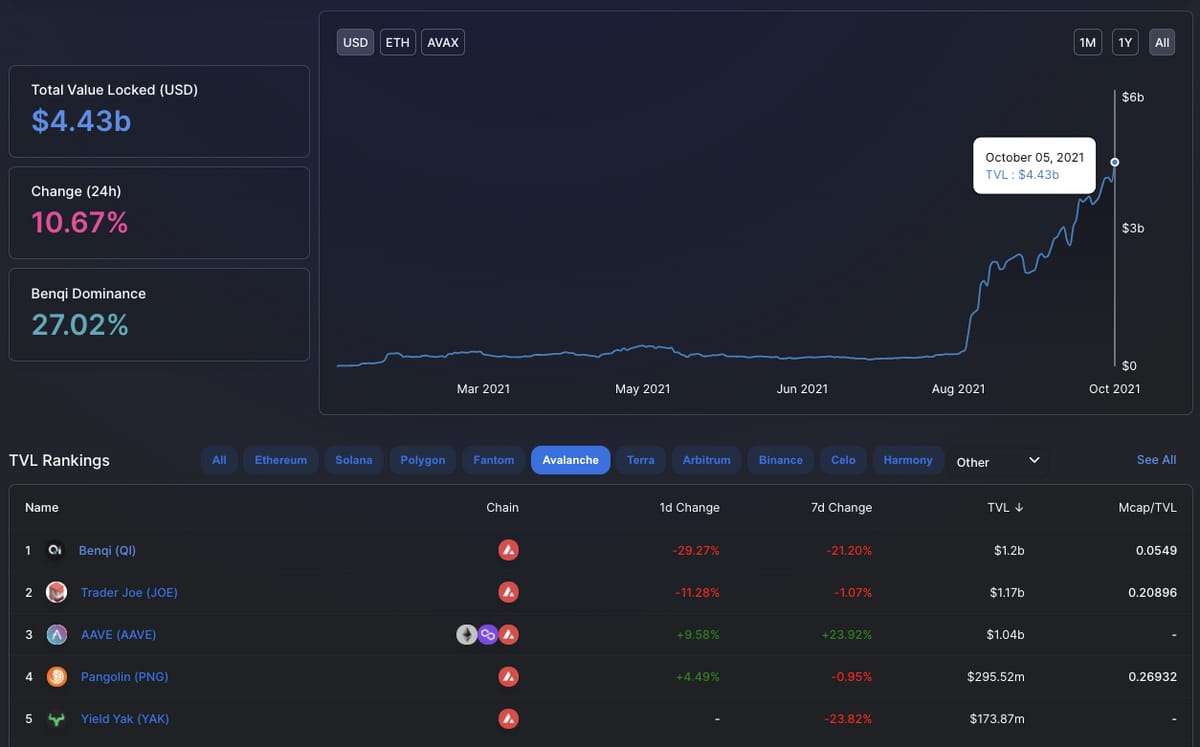

Below is the TVL on Avalanche over the past four weeks. Take a look at how much faster Avalanche is growing than Solana right now…. more than twice as fast.

Avalanche’s TVL is up 122% in the last 28 Days, while Solana is up just 58%, making Avalanche the fastest-growing major blockchain in the world right now.

In the chart above I included all blockchains with $1 billion or more in total value locked. Bitcoin remains a laggard in DeFi at $157M in TVL.

Here is the rate of TVL growth of each of the major blockchains the last 28 days, showing Avalanche and Fantom growing the fastest:

Avalanche has gone from $2B to $4.5B in TVL in less than a month.

Yes, in the last year, Avalanche (AVAX) has seen a meteoric rise outpacing its other L1 competitors, with its native token up over 1500%.

Here’s a chart showing where Avalanche users came from, showing many are coming from Ethereum and Binance Smart Chain, based on a poll the Avalanche DEX Pangolin conducted on October 5 for Coinstack, with 1,025 respondents.

Even our friends at Republic are bullish on Avalanche, citing its speed and lower transaction costs.

We continue our in-depth analysis on AVAX below with Coinstack analyst Mike Gavela…

⛰️ Avalanche Deep Dive

By Mike Gavela

In this deep dive, we break down what makes Avalanche so unique as a layer 1 by looking into its core elements, subnet capabilities, and the DeFi applications we recommend worth looking at on the protocol.

Avalanche is a chain that is focused on speed and lower transaction costs.

Avalanche’s Background & History

Avalanche is an open-source platform for launching decentralized applications and enterprise blockchain deployments. Avalanche's founder, Emin Gün Sirer, developed the protocol while a professor at Cornell University. Sirer and his research group developed an alternative blockchain technology for the financial sector shortly after publishing his paper, "Majority is not Enough, Bitcoin Mining is Vulnerable," in 2013.

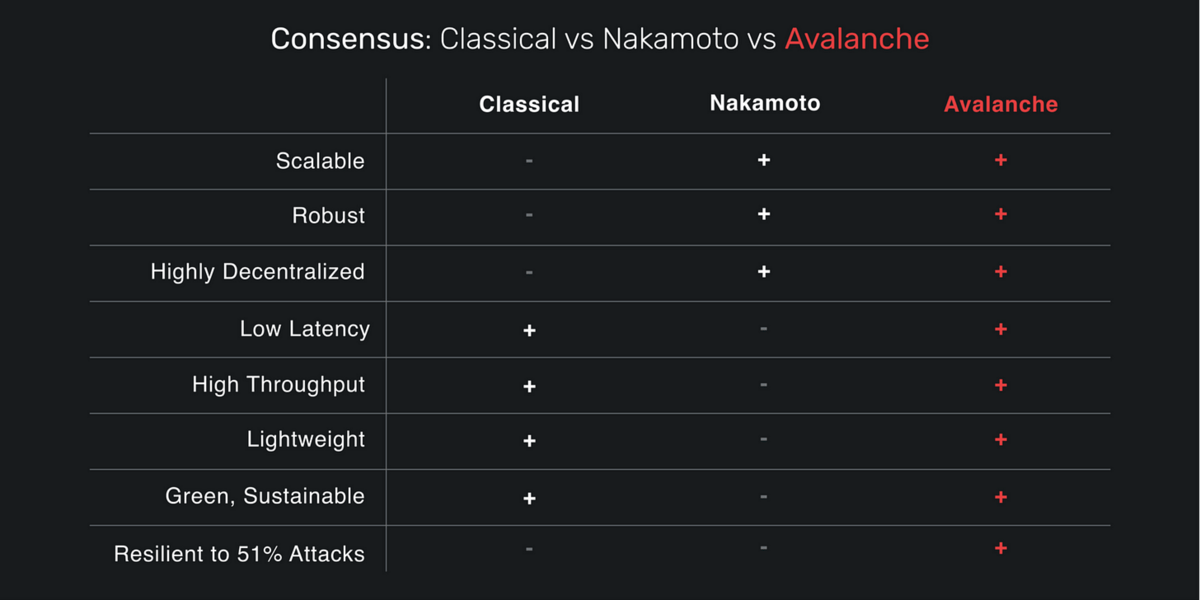

The fundamentals for Avalanche's consensus mechanism came from a white paper called "Snowflake to Avalanche: A Novel Metastable Consensus Protocol Family for Cryptocurrencies" developed by a pseudonymous group named Team Rocket in May 2018. The paper proposed the Snow family of consensus protocols and proved that it could work. It combines the best of both Classical and Nakamoto consensus. While the Snow consensus protocols are permissionless, there is no mining or high energy expenditure with its consensus systems.

Avalanche is often described as ‘Blockchain 3.0’, an iterative improvement on Blockchain 1.0 (Bitcoin) and 2.0 (Ethereum). The first generation of crypto-assets relied on Proof of Work while Avalanche compliments Ethereum as the transition to Ethereum 2.0 occurs. DeFi applications and stablecoins are already springing up on Avalanche as compatibility with the Ethereum Virtual Machine (EVM) allows the platform to capture Ethereum’s network effect.

Avalanche Overview

Avalanche was designed to be the base layer of decentralized applications.

Other blockchains that still suffer from some of the key challenges from the first and second generation of blockchains can pick up Avalanche as their base layer and immediately benefit from some of the critical breakthroughs that it brings to the table. Base layers are also known as Layer 0 protocols, such as Avalanche, Polkadot & Cosmos.

Layer 0s are used to improve performance and communication between multiple chains. Ethereum is a traditional Layer 1 protocol where assets can be minted. Our friends over at TheTie explain how Dapps can utilize Avalanche as a base layer using AMMs below.

One of the technical breakthroughs Avalanche has made was the development of their Primary Network, which validates Avalanche’s three built-in blockchains.

Exchange Chain: X-Chain

The X-Chain is a decentralized platform enabling the creation of new assets, the exchange of assets, and transfers between subnets, as well as being an instance of the Avalanche Virtual Machine (AVM).

The X-Chain enables anyone to create or mint other smart digital assets, such as stablecoins, utility tokens, NFTs, equities, and so on, which commands a fee paid in AVAX.

Platform Chain: P-Chain

The P-Chain is the metadata blockchain on Avalanche and coordinates validators, keeps track of active subnets, and enables the creation of new subnets.

The P-Chain is where tokens are locked for staking and coordinating validators to keep track of subnets and make other subnets possible.

Contracts Chain: C-Chain

The Avalanche Contract Chain (or C-Chain) implements Ethereum Virtual Machine (EVM) that allows developers to port over Ethereum applications seamlessly, such as the critical tooling that has fuelled DeFi’s growth to date, for example, MetaMask and Web3.js.

Using the C-Chain’s API, current Ethereum applications can pivot to Avalanche to take advantage of higher throughput, quicker finalization, meager gas fees, and Solidity tooling. All gas fees are paid in AVAX, which are also burned.

Subnets on Avalanche

Avalanche was designed to be customizable, scalable, and interoperable. Everything on Avalanche is a subnet, and every chain is part of a subnet, similar to a parachain on Polkadot.

Validators are required to be a member of the Primary Network; all other subnets are optional. Each subnet can have multiple blockchains, just like the primary network, and each blockchain can have its virtual machine. So you can copy the Ethereum virtual machine just like the direct chain did with the C-chain or develop your own and leverage Avalanche as the base layer as intended. Avalanche’s founder Emin Gün Sirer goes into detail about the various possibilities for subnets below.

“There is a big difference between us and every other coin. For every other coin, they have the same exact vision for the network. They have one coin, one scripting language, one network… That is not the vision of AVA. We are the only coin where we have the AVA coin, but we also envision having thousands of other coins. Every asset should be digital, and it should be a coin family on AVA. These coins themselves can pick and choose from a variety of scripting languages we support. There isn’t a single scripting language, and most importantly, you can actually define the set of nodes that host your state. So you can say something like, “Hey! I’m going to introduce X-coin; this X-coin is going to represent Real-Estate. It has special rules, and I would like to use the Bitcoin scripting language because I’m familiar with it, but I also like the 0x proofs on Z-cash, and I also like ring signatures from Monero.” You can do this mix and match with AVA coins.”

Lastly, when it comes to subnets, they can be permissionless or permissioned. This means they can either be public or private blockchains.

If you are a government, bank, or tech company and want the full power of a blockchain without developing the groundwork, you can add a subnet in the Avalanche ecosystem. In Avalanche, you can change the rules for each blockchain in your network and make it so that it is compliant across many different geographic or political requirements. For example, you could say every validator in your subnet needs to have a license, or maybe they need to fill out certain tax information.

Avalanche is built to be able to create and follow the rules like that. Keep in mind that to validate your subnet, you are also contributing to the validation of the entire network via the three chains. You need a minimum of 2,000 AVAX tokens to be a validator.

Avalanche’s DeFi Incentive Program

On August 18, the Avalanche foundation announced “Avalanche Rush”, a $180M liquidity mining incentive program to introduce more applications and assets to its growing DeFi ecosystem. The purpose of the program is to bring blue-chip DeFi applications to Avalanche.

After passing a community governance vote on Sept 15, the Aave community voted yes to deploy smart contracts in Avalanche’s C-Chain. The liquidity mining program went live on Oct 4, with the Avalanche foundation allocating $20M AVAX for users of the Aave protocol.

The Top Avalanche Dapps

Avalanche now rivals Fantom in the race for the L1 with the highest DeFi adoption. With a $4B+ TVL, Avalanche and its Dapps have room to grow during the last leg of Q4.

Here are the top 5 projects we are watching that are a part of Avalanche’s Incentive Program.

#1) Benqi

A non-custodial liquidity market protocol that enables users to effortlessly lend, borrow and earn interest with their digital assets.

Symbol: QI

Price: $0.51

FDMC: $766M

TVL: $1.2B

#2) AaveAn Open Source and Non-Custodial protocol to earn interest on deposits and borrow assets now on the Avalanche network.

Symbol: AAVEPrice: $310.07

FDMC: $5B

TVL: $1.19B (On Avalanche)

#3) Trader Joe

Trader Joe is your one-stop decentralized trading platform on the Avalanche network.

Symbol: JOE

Price: $2.64

FDMC: $1.3B

TVL: $1.17B

#4) Pangolin

A community-driven DEX that runs on Avalanche.

Symbol: PNG

Price: $1.52

FDMC: $817M

TVL: $295M

#5) Yield Yak

Auto Compound yield-farming rewards using Avalanche

Symbol: YAK

Price: $6,970

FDMC: $69M

TVL: $173M

Our Recommendation: Dive Deeper into the Avalanche

Overall, we are bullish on Avalanche (AVAX) and suggest diving into researching it further as you explore a potential investment.

The current fully diluted market cap for AVAX is $46 billion -- however, if this technology becomes “the next Solana” and achieves its potential as the foundation for the next generation of decentralized finance Dapps it could someday surpass Solana’s current fully diluted market cap of $83B.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚡ Gensler Says SEC Can’t and Won’t Ban Cryptocurrency - SEC Chairman Gary Gensler was questioned about the possibility of introducing a China-like cryptocurrency ban today. Gensler answered that this does not fall under the SEC's duties and that the U.S.'s approach is different from that of China. (Source)

😮 SEC Subpoenas USDC Stablecoin Backer Circle - Circle said it is “fully cooperating” with the subpoena but has declined to elaborate on its scope. (Source)

💳 Visa Develops Interoperability Concept for Central Bank Digital Currency Payments - Visa has developed a conceptual protocol that shows how various CBDCs can be interoperable for payments. (Source)

💰 SEC Rolls Decisions on Four Bitcoin ETF Applications to End of 2021 - Issuers Global X, Valkyrie, WisdomTree, and Kryptoin all received an extension on their proposals. (Source)

🤑 Grayscale Adds Solana to $494M Digital Large Cap Fund - The asset manager’s bitcoin-heavy fund allocated 3.24% to SOL on Friday and 1% into UNI. (Source)

🏦 Coinbase Reports 6,000 Crypto Account Hacks After SMS Flaw - Over 6,000 Coinbase users saw their drained last week as hackers exploited an authentication bug to bypass the company’s SMS security feature. (Source)

🇺🇸 Republicans on House Financial Services Committee Introduces Bill for Digital Tokens - A new bill seeks to codify into law a safe harbor for digital asset issuers. (Source)

📈 DeFi Security Project ‘Lossless’ Helps Recover $16.7M From Cream Finance Hack - Lossless also plans to ship a security tool that will reportedly aid DeFi projects in preventing hacks and exploits on their platforms. (Source)

🎆 Hong Kong Exploring CBDC as Part of Fintech Strategy - A new study from Hong Kong regulators is expected to present initial thoughts and findings on CBDCs during the summer of 2022. (Source)

🏧 Biden Team Is Looking To Bank Regulation To Solve the Stablecoin Question - The Biden administration is contemplating how it wants to regulate stablecoin issuers (Source)

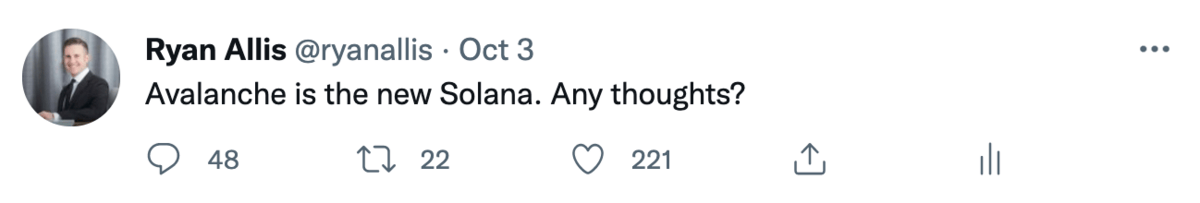

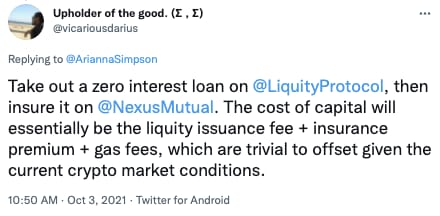

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

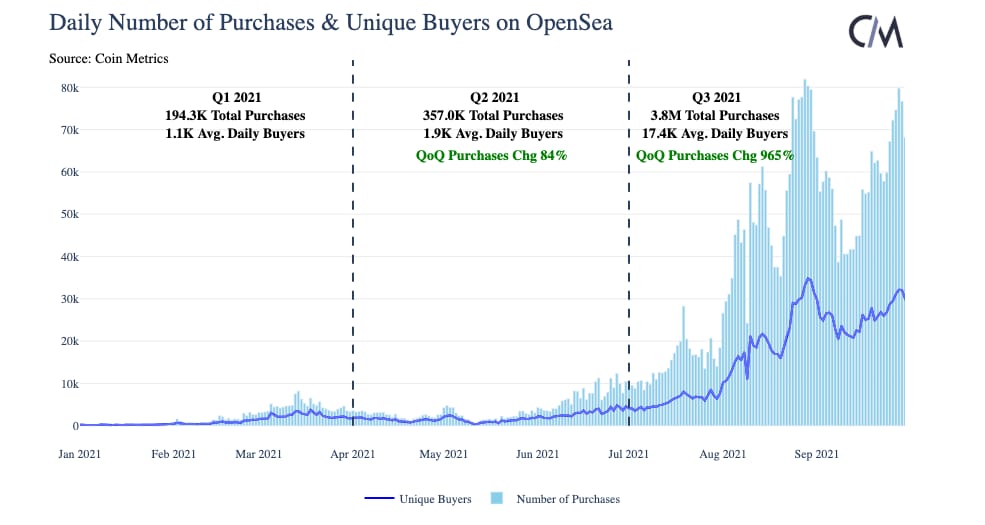

1. The Number of Unique Daily Buyers on OpenSea Averaged 17.4K in Q3, an 815% Increase Over the 1.9K Unique Daily Buyers in Q2

2. Top Projects by P/E Trend in the Past 7 Days by Token Terminal With ‘E’ Being Protocol Revenue

3. Fidelity Showing a Portfolio With a 1% Position in Bitcoin Led to 2.60% in Additional Annualized Returns if Held 2015-2021, Showing That All Portfolios Would Have Benefited from 5-10% Exposure

4. 42% of Investors See Ethereum As Having the Most Compelling Growth Outlook

5. With Axie Infinity Opening Staking, You Can Now Buy Spot AXS To Stake While Shorting the AXS-Perpetual Futures for a ~79% APR Delta-Neutral Yield Opportunity

6. Bloomberg’s latest report highlighting Ethereum becoming, “the money of the internet”

7. Polygon Eclipses Ethereum Daily Active Users by Nearly 10%

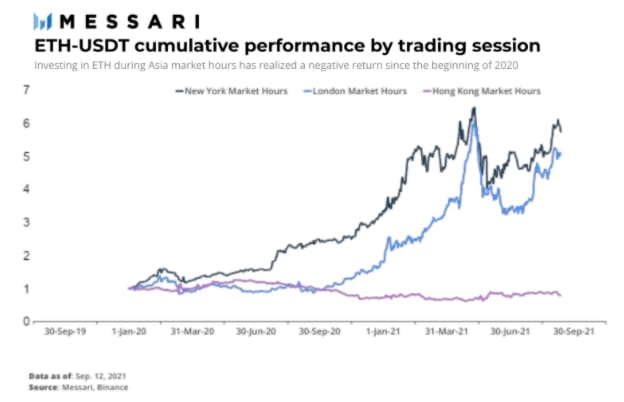

8. 'Were an investor to have held ETH since the beginning of 2020, they would have increased their initial investment over 26x (to 12 September 2021). However, if the same investor only held ETH during Hong Kong market hours, they would instead have realized a negative return.'

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. Global Cryptocurrencies and Digital Assets

The Bank of America Corporation (BoA) published a research report offering a bullish outlook for the long-term prospects of cryptocurrency. The report suggests that the cryptocurrency sector's $2.15-trillion market capitalization is "too large to ignore" and highlights the sector's various use cases.

“A digital form of cash (fiat currency issued by central banks) is inevitable for central banks as the world shifts to cashless payments. A sense of urgency is also emerging as private company-sponsored stablecoins gain adoption, potentially impacting central banks’ ability to implement monetary policy. CBDCs would also make transactions faster and less susceptible to counterfeiting and cheaper than printing and minting paper and metal currency. Digital money can also be tracked across wallets and potentially bring unbanked lower-income people around the world into the financial system. There are many good reasons to shift to digital currency, but the details will take time to work out as central and commercial banks accelerate CBDC and digital asset initiatives (Exhibit 15).”

2. Current Digital Asset Institutional Adoption Segments

Fidelity Digital Assets released their latest research this month, showing that US and European interest in digital asset investment products had increased by 12% YoY. Meanwhile, in Europe, high-net-worth investors and financial advisors invested most actively after crypto hedge funds and venture capital funds.

“The study validates what we’re hearing from Fidelity’s institutional and advisor clients – that demand for digital assets increases across segments. Family offices have been early adopters and view digital assets as a strategic allocation. There is now also a sense of urgency among financial advisors recognizing that digital assets have come of age, driven by increasing end-investor interest in these assets, particularly bitcoin.”

3. CoinDesk Quarterly Review

Third Quarter 2021, Oct 5, 2021CoinDesk Research presents its latest quarterly report, which outlines growing market interest from institutions, retail investors and regulators, and EIP 1559 and the impact it had on Ethereum and its ecosystem.

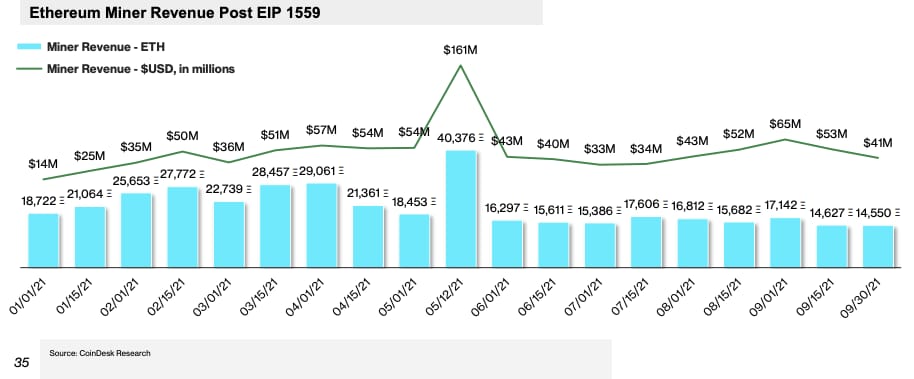

“A controversial impact of EIP 1559 was the transition to burning base transaction fees, directly taking away from miner revenue. Since Aug. 4, there has been no significant change in the USD revenue value, likely due to mania in NFT markets and an increase in ether price. Critics of the upgrade warn users of the consequences of alienating miners, especially as the network nears its transition to Proof of-Stake. It will be essential to keep an eye on miner behavior as those stakeholders are gradually left behind. Miners have still been buying millions of dollars worth of mining equipment, taking a large bet on a delay of the merge. Furthermore, China’s most recent crackdown has led SparkPool and BeePool, the second-and fourth-largest mining pools, to cease operations.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

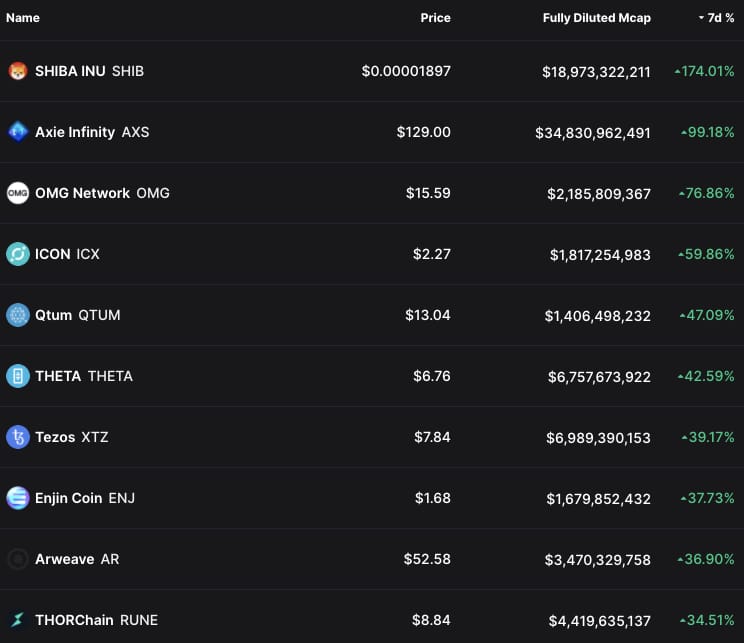

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like AXS, ENJ, AR and RUNE had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

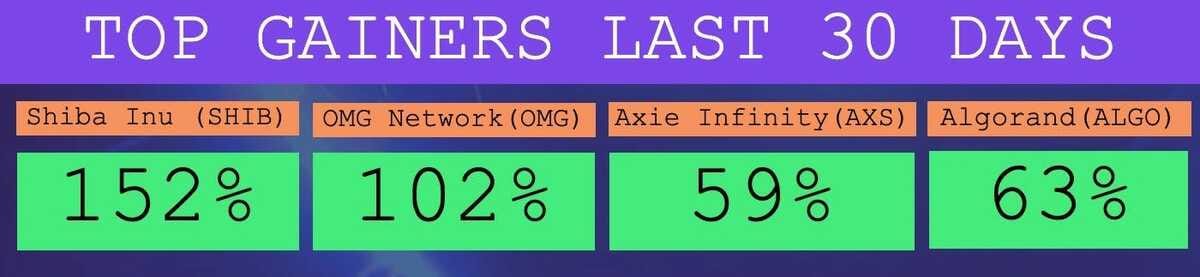

The Top Performers This Month from the Top 100: Shiba Inu is a meme coin, OMG is an L2, Axie Infinity is a game, and Algorand is an L1.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 6,026 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.