Social Links: Twitter | Telegram | Newsletter

Learn More at www.wiselending.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 150k weekly subscribers. This week, we cover SBF’s testimony, SBF’s cross-examination, Do Kwon’s trial continues, and big new venture rounds for Neon Machine ($20M) and Layer2 Station ($12M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Thanks to Our 2023 Coinstack Sponsors…

Wise Lending is a fully decentralized liquidity market that allows users to supply crypto assets and start earning a variable APY from borrowers. Wise Lending has merged lending platform technology with yield aggregator technology to create higher APY opportunities for borrowers, which ultimately raises the interest paid to lenders across the platform.

Become a Coinstack Sponsor

To reach our weekly audience of 160,000 crypto insiders and daily audience of 55,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Inside SBF’s Trial: Bankman-Fried Tells The Court He Didn’t Know What His Team Did: Sam Bankman-Fried, the CEO of the collapsed crypto exchange FTX, finally took a stand following three weeks of testimonies by his former employees. His account of what happened at FTX seems to differ from that of his subordinates. The verdict from the 12 person jury could come as early as Thursday.

⚖️ Sam Bankman-Fried Grilled by Prosecutor, Who Points Out Contradictions in His Testimony: Following dozens of questions from Assistant U.S. Attorney Danielle Sassoon, Bankman-Fried said he did not remember telling FTX customers that his exchange was a safe place to trade, that customers would be protected or that Alameda Research (his trading firm that played a central role in the former billionaire's demise) did not have special privileges on the platform.

⚖️ Do Kwon and Terraform Labs' lawyers urge judge to nix SEC's allegations: Lawyers representing Terraform Labs and its co-founder Do Kwon asked a New York judge to make a decision in a case brought by the Securities and Exchange Commission without a full trial, arguing that they didn't do anything wrong.

⚖️ Gemini Sues Bankrupt Lender Genesis, Its Former Partner, Over $1.6B Worth of GBTC: Cryptocurrency exchange Gemini has sued Genesis Global, its former business partner for its Gemini Earn product, over 60 million shares of the Grayscale Bitcoin Trust (GBTC) that were pledged as collateral.

⚖️ Crypto exchange Bittrex's U.S. shutdown approved at bankruptcy court: Crypto exchange Bittrex received court approval for its revised bankruptcy plan to wind down its U.S. operations.

💬 Tweet of the Week

Source: @AutismCapital

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. After a week of institutional inflows, increased trading volumes, and spot ETF speculation, Bitcoin futures open interest is now at $13.45B, the highest amount of open interests in the past 12 months and the most since June 2022.

Source: @DavidShuttleworth

2. $300m went into crypto funds this week. Biggest inflow in almost 18 months.

Source: @dunleavy89

3. DEX volume has reached $18.9 billion, marking its highest point since June.

Source: @DeFi_hawk

4. Onchain options trading volume has also seen a significant increase, with the notional volume surpassing $100 million after three consecutive weeks of gains.

Source: @DeFi_hawk

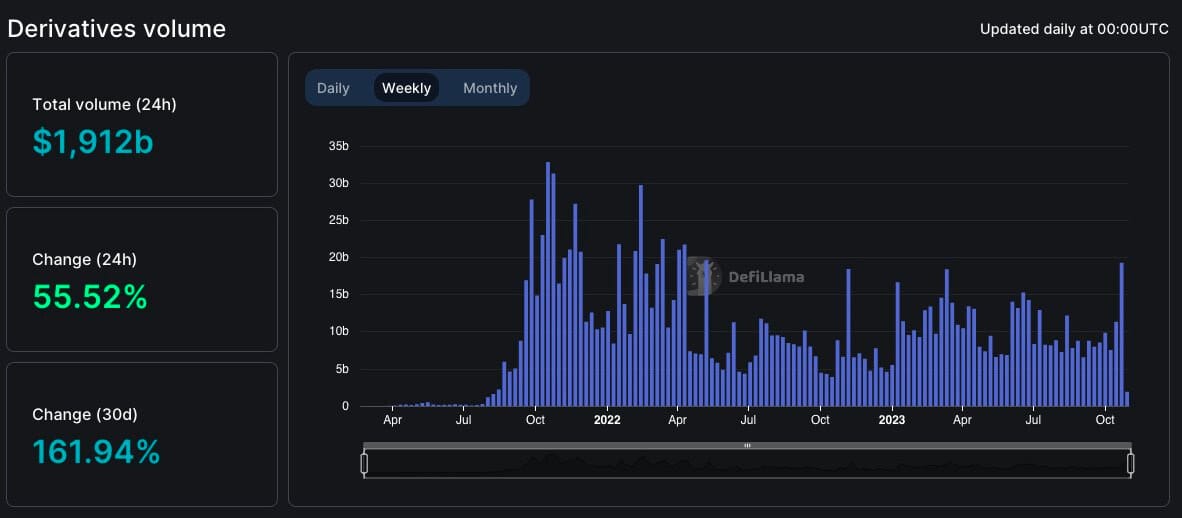

5. October saw derivatives volume highs last seen in early 2022.

Source: @DeFi_hawk

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

A few weeks, I spent a week traveling through Seoul for Korea Blockchain Week and Singapore for Token2049.

During my time in Korea, I learned that gaming, NFTs, and IP are pretty big areas of focus for the ecosystem there. One example is WEMADE, creator of the extremely popular video games series, Legend of Mir, which has sold over 500 million copies to date, has developed WEMIX, which is their web3 gaming platform. Another example is Story Protocol which is building an open IP infrastructure to grow the creativity of the internet era. Lastly, listing on Korea crypto exchanges continues to be an early go-to-market strategy for token distribution, Upbit, Bithumb, and Coinone.

In Singapore, regulations has been a bit more positive than in the past. Crypto licenses exist. Areas of interest include tokenization of real world assets, financial infrastructure/asset wealth management for crypto, and payments. In addition to Singapore being a fintech hub, there is co-working space exclusive for crypto startups. The ecosystem that has been fostered makes Singapore attractive as a center for an Asian hub for crypto startups looking to scale and execute on business development with developers, trading firms, and institutions.

Check out my panel at Token2049 (video and transcript below)

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.wiselending.com