Social Links: Twitter | Telegram | Podcast | Newsletter

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news, stats, fundraises, and reports in the digital asset ecosystem. Things are getting heated this week — with Cameron Winklevoss of Gemini calling for the removal of Barry Silbert in a new open letter to the DCG Board over the missing $900M owed to Gemini Earn users — only to be responded to later the same day by Barry himself. We’d also like to welcome our new sponsors Connect Financial and Viridius DAO. Hey it’s a new year. Let’s build!

Among top L1s, Solana has outperformed in terms of price since we began writing this newsletter two years ago

Thanks to Our 2023 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Connect Financial empowers people and businesses to do more with their digital assets. Their flagship crypto credit cards allow users to enjoy their crypto spending power, without selling their digital assets while earning rewards on everyday purchases. Learn more at www.connect.financial.

Viridius is a Decentralized Autonomous Organization (DAO) building a modern, community-driven carbon credit registry that solves the massive problem of transparent carbon credit verification. Learn more at www.viridius.iowww.viridius.io.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors, app builders, and brands. Learn more at www.wemetalabs.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size… let’s get that capital flowing because it’s time to build…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

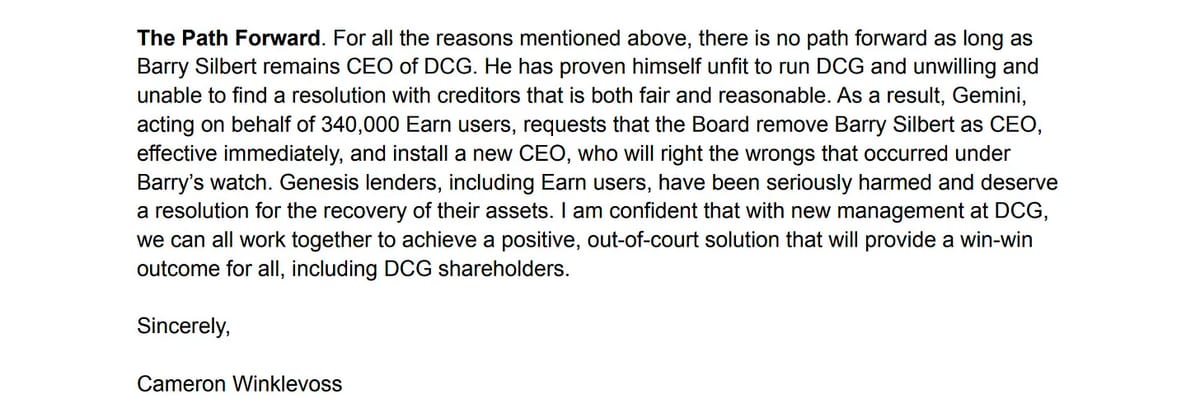

1) ⚖️ Gemini Head Winklevoss Escalates DCG Spat, Demands Removal of Silbert - On Tuesday, Gemini President Cameron Winklevoss demanded the removal of Digital Currency Group CEO Barry Silbert in a new open letter. DCG called the letter a “desperate and unconstructive publicity stunt.”

2) 🚩Barry Silbert Defends DCG in Response to Gemini’s Winklevoss - Barry Silbert laid out a rebuke of accusations made by Gemini President Cameron Winklevoss in an open letter. The letter surprisingly makes no mention of the fact that DCG/Genesis owes Gemini Earn users over $900M and isn’t paying up.

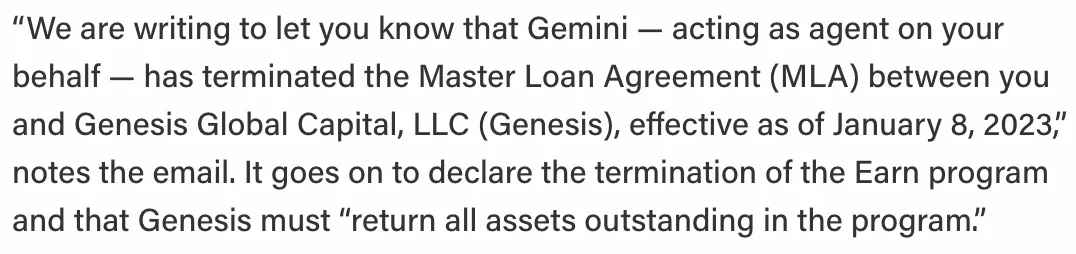

3) ⚖️ Gemini Terminates Genesis Loans, Officially Ends Earn Program - Gemini told clients in an email today that it is terminating customer loan agreements with Genesis Global Capital as it winds down its Earn program.

4) 🔗 Three Arrows Capital Founders Subpoenaed by Tweet - Three Arrows Capital founders Kyle Davies and Zhu Su were served subpoenas using their “frequently-used Twitter accounts.” The unusual tactic comes after liquidators struggled to reach the leaders of the defunct crypto hedge fund.

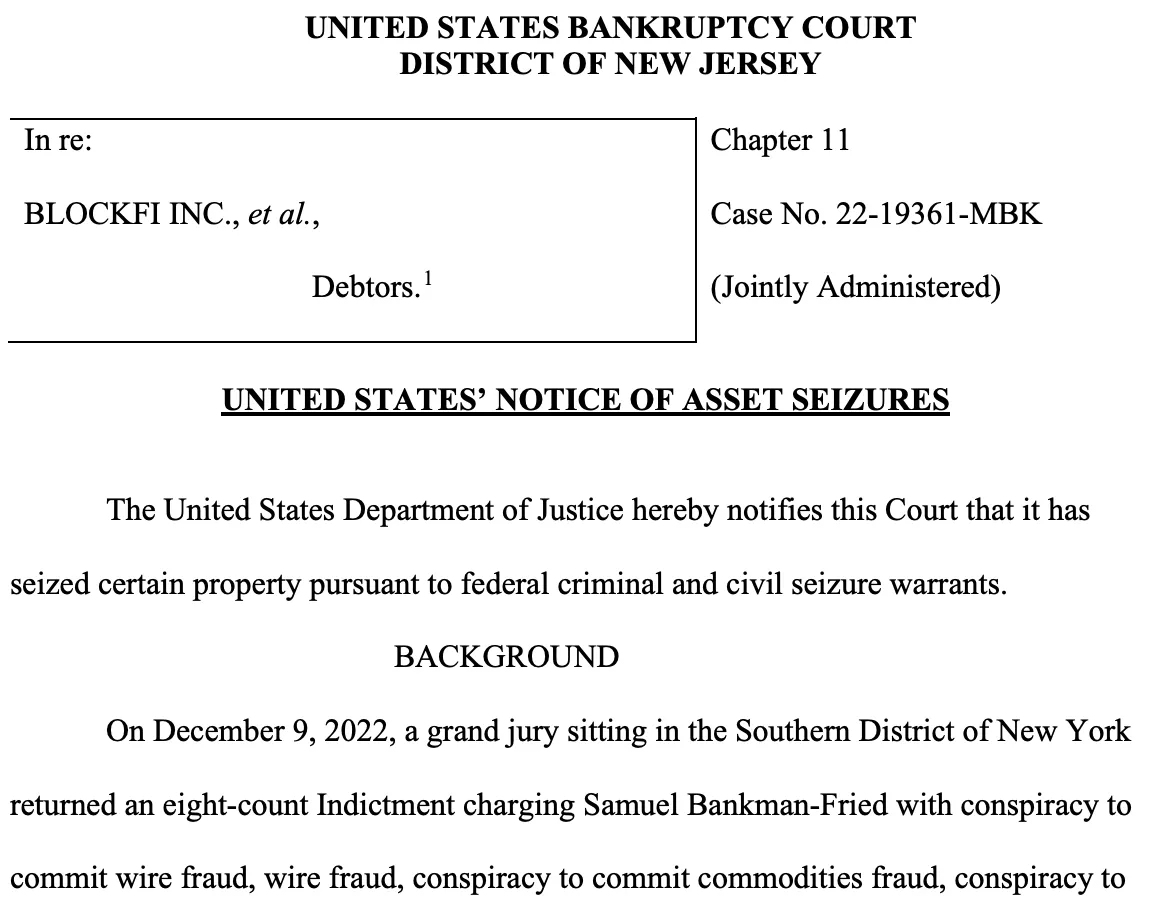

5) 🟩 Robinhood Shares Worth Nearly $500M Seized in FTX Case - The U.S. Department of Justice (DOJ) has seized more than 55 million shares of Robinhood (HOOD) stock owned – via a holding company – by Sam Bankman-Fried and FTX co-founder Gary Wang, according to a court document.

💬 Tweet of the Week

Source: @CGasparino

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. 70% of Invested Venture Capital into Crypto Sector in November and December Went to CeFi and Infrastructure Companies

Source: @eshita

2. Tron Has Essentially Built Its Business as a Low Cost Chain to Transfer Tether

Source: @dunleavy89

3. Between Nov. + Dec. Last Year, 23% of Total Deployed Capital Went Towards Infrastructure, Which Increased to 42% This Year

Source: @eshita

4. SOL Daily Active Wallets 3x Pre FTX Levels

Source: @dunleavy89

5. In 2022, 49% of VC Dollars Went Towards DeFi, Scaling Solutions, and Alt-L1s Last Year

Source: @westfellow7

📝 Thread of the Week - DCG Letter to Shareholders

By: @BarrySilbert

Happy New Year. I’ve been reflecting quite a bit recently about the past year, the state of the industry, and where things go from here.

I’m incredibly proud of the role that DCG & I have played as pioneers & builders over the past decade. We’ve invested in >200 companies that have developed & shaped the industry, we’ve helped build the first publicly-quoted BTC fund, the largest asset manager in the space..(2/10)…the most influential crypto media platform, #1 bitcoin mining pool, leading crypto prime broker, & a dominant crypto wallet/exchange in the emerging markets. DCG has also backed a group of emerging fund managers, crypto protocols, & cutting-edge blockchain projects. (3/10)I have fond memories of the early days of our industry, working hard to help educate & fighting in the trenches with fellow entrepreneurs & investors to gain legitimacy. Speaking to small audiences, being snickered at & dismissed was, I found, empowering & motivating. (4/10)This past year has been the most difficult of my life. Bad actors & blow-ups have wreaked havoc on our industry, w/ ripple effects extending far & wide. Although DCG, our subsidiaries, & many of our portfolio companies are not immune to the effects of the present turmoil...(5/10)…it has been challenging to have my integrity and good intentions questioned after spending a decade pouring everything into this company and the space with an unrelenting focus on doing things the right way. (6/10) DCG is committed to remaining at the forefront as we strive to build a better financial system. As this new year unfolds, we are hunkering down with our “lean and mean” mindset, and we are making meaningful changes to position the firm for long-term success. (7/10)The industry has a lot of hard work to do to re-establish its credibility & reputation, which have been all but destroyed by a wave of unprecedented fraud & criminal behavior. This is going to be a challenging year for all of us, but I remain optimistic. (8/10)To my peers in the trenches, now is a time to collaborate, cheer each other’s successes, and collectively take our industry to the next level. (9/10)Let’s all grow together, treat others with respect, and get back to having fun and making a dent in the universe. I can assure you that DCG is certainly committed to doing so. Please refer here for my full statement and Q&A. (10/10)See the full letter at: https://dcgupdate.com/

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Layer-1 Sector Brief

The rumors of Solana’s death seem to have been greatly exaggerated.

After being down almost 95% from an all-time high of $259, Solana experienced a recent bounce of ~100% off the lows of ~$8.25 to hover above $16.50 at the time of writing.

While there is no doubt now that FTX/Alameda supported total value locked (TVL), transactions, and token values throughout the Solana ecosystem, they were only a piece of the broader puzzle. The Solana ecosystem still has a network of builders, an ecosystem of applications, and a warchest of capital, as strong as almost any other L1. Solana rallied strongly on the back of these drivers as investors rediscovered fundamentals over the Christmas holiday.

Ok, unfortunately, that isn’t exactly true; the more likely cause of the recent bounce seems to be a supportive tweet from Vitalik along with the launch of a new dog-themed memecoin: BONK. The token launched in late December and quickly went viral. Inspired by Dogecoin and Shiba Inu, the token gained a circulating market cap of over $200 million before dropping below $100 million as of January 9.

Despite the recent price appreciation seemingly being driven by speculation, the underlying ecosystem remains quite strong. This should be the main story, not the sideshow.

Let’s focus back on those fundamentals.

Solana Fundamental Metrics Remain Strong

Network activity on blockchains has been known for quite some time to strongly correlate to price activity.

While many believe Solana activity fell after the FTX collapse in November, daily active wallets interacting on major Solana protocols stayed constant Post-FTX. In the past few weeks, activity tripled from Pre-FTX levels. It is certainly an open question as to how sticky this new level of volume is however, at the very least, a consistent level of volume with FTX exiting the ecosystem is a positive sign.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

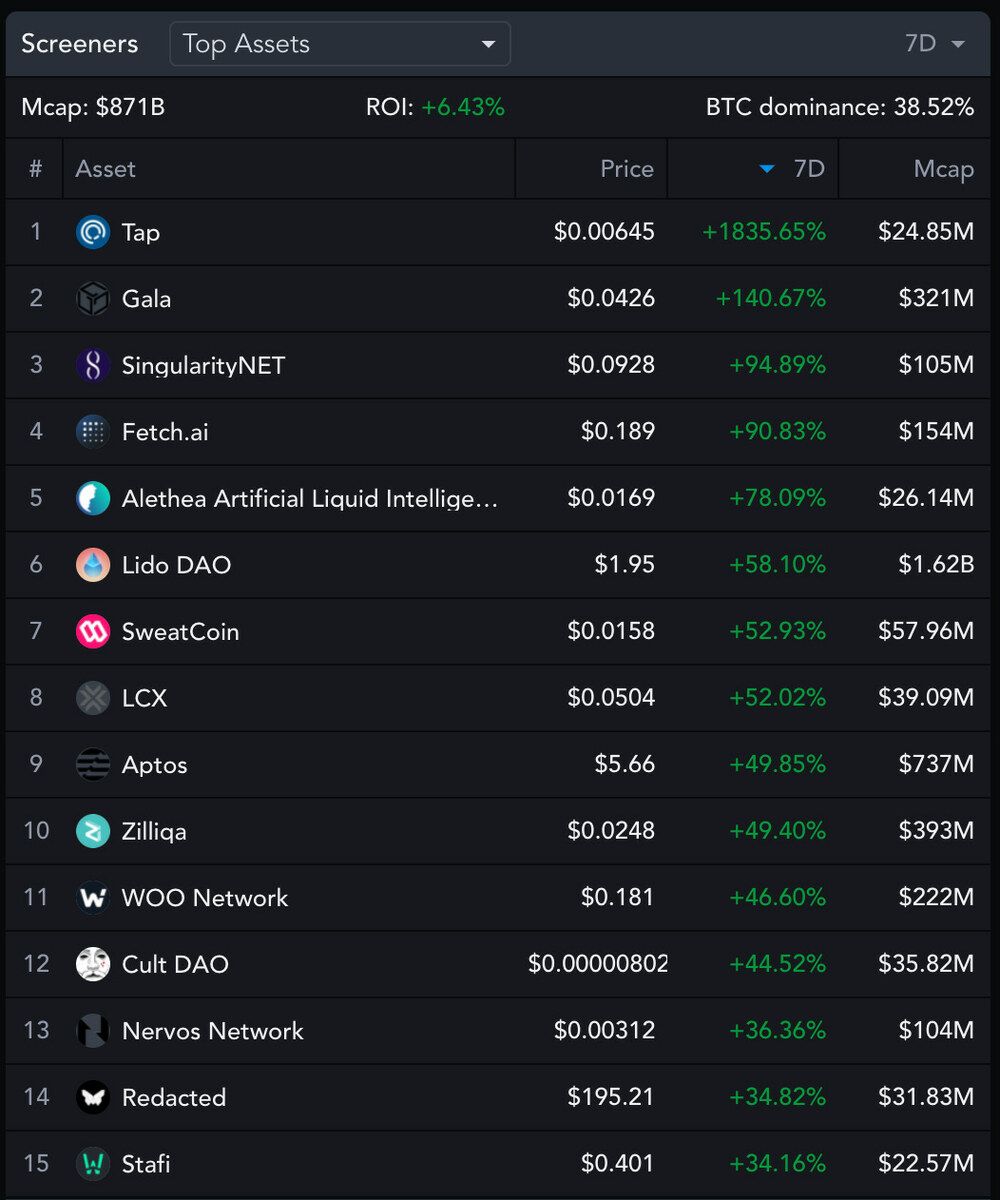

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 34,321 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.connect.financial, www.viridius.io, and www.wemetalabs.com