Social Links: Twitter | Telegram | Newsletter

Learn more at www.sntnldigital.com, and www.momentofans.com

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover the Ethereum “Shapella” upgrade, ETH staking withdrawals, USDC stabilizes peg, and new rounds from Sei Network ($30M) and RACA ($16M).

Price changes since we began writing Coinstack in January 2021

Thanks to Our Coinstack Sponsors…

Sentinel Digital aims to be one of the world’s leading B2B2C, white-label, digital asset-friendly, financial services provider. They provide a faster and more cost-effective alternative to traditional finance. Learn more at www.sntnldigital.com

Momento allows creators to create valuable digital collectables of their best social media content and build a thriving community that rewards their biggest fans. Join the only platform that allows creators to own and sell limited-edition content to their community. Learn more at www.momentofans.com

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size

🗞️ Crypto News Recap: The Top Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

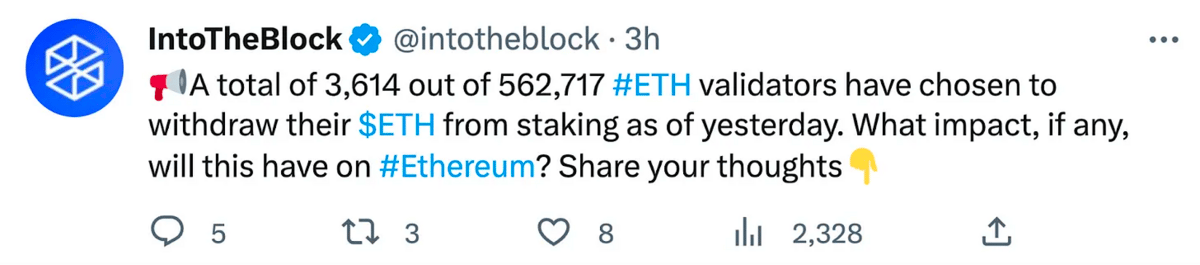

⚖️ Everything You Need To Know About the Ethereum Shapella Upgrade- Shapella, the first major update since the Merge, is scheduled to take place this Wednesday. The upgrade will allow validators to withdraw staked ether for the first time. Shapella is a portmanteau of Shanghai and Capella, referring to two network upgrades that will happen simultaneously allowing users to unstake their ETH from the network.

🔬 Etherscan Reconfigures Blockchain Explorer Settings to Filter Out Potential Scams- Zero-token value transfers will no longer be visible by default as a way of preventing “address poisoning” hacks.

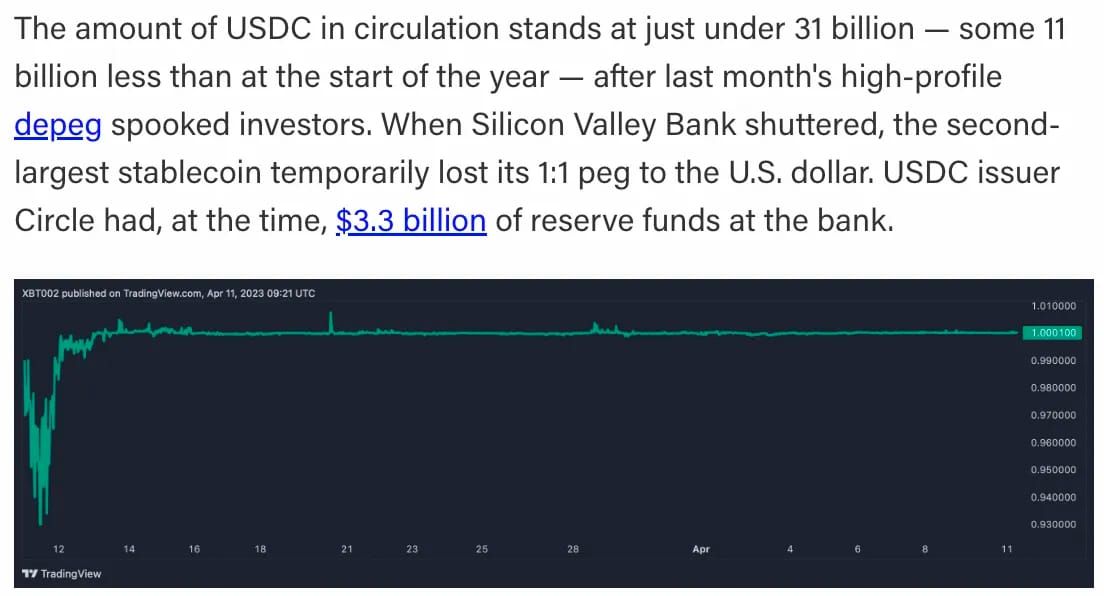

💸 USDC Supply Stabilizes Following Silicon Valley Bank Bank Woes As Tether Cements Its Stablecoin Dominance- The supply of USDC on Ethereum has stabilized at just under 31 billion, some 11 billion less than at the start of the year.

🎭 Sushi DEX Recovers 100 Ether After Millions Lost on Weekend Exploit- Decentralized Finance protocol SushiSwap has recovered $186,000 worth of ether (ETH) that a hacker drained from one of its users’ wallets following a $3.3 million exploit this weekend.

🚩 Staked Ethereum Withdrawals Could Take Weeks After Shanghai Upgrade: Analyst- According to the Ethereum Foundation, a maximum amount of 16 withdrawals can be processed within a single block, totaling a maximum output of 115,200 per day. Today, there are 564,000 validators on Ethereum’s Beacon Chain.

Ethereum’s Shanghai Upgrade Will Permanently Alter ETH Economics — Being able to unlock staked ether will not cause a mass exodus or price collapse for the cryptocurrency, Amphibian Capital CEO James Hodges says.

💬 Tweet of the Week

Source: @intotheblock

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Without Incentives, Solana Still Maintains a Distinct Lead in Terms of Daily Transactions, Though Arbitrum Seems To Be Closing That Gap – Even Post-Airdrop

Source: @MessariCrypto

2. LidoFinance Has Established Itself As the Market Leader in Liquid Staking Protocols, Contributed to by Its Attractive Incentives

Source: @MessariCrypto

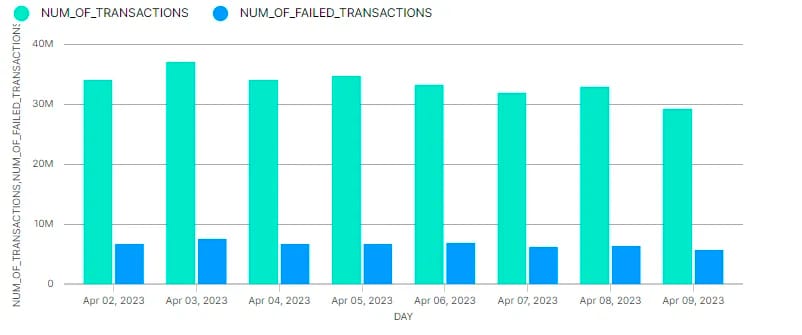

3. 19–20% of the Daily Transactions on Solana Are Failing on a Daily Basis

Source: @pandajackson42

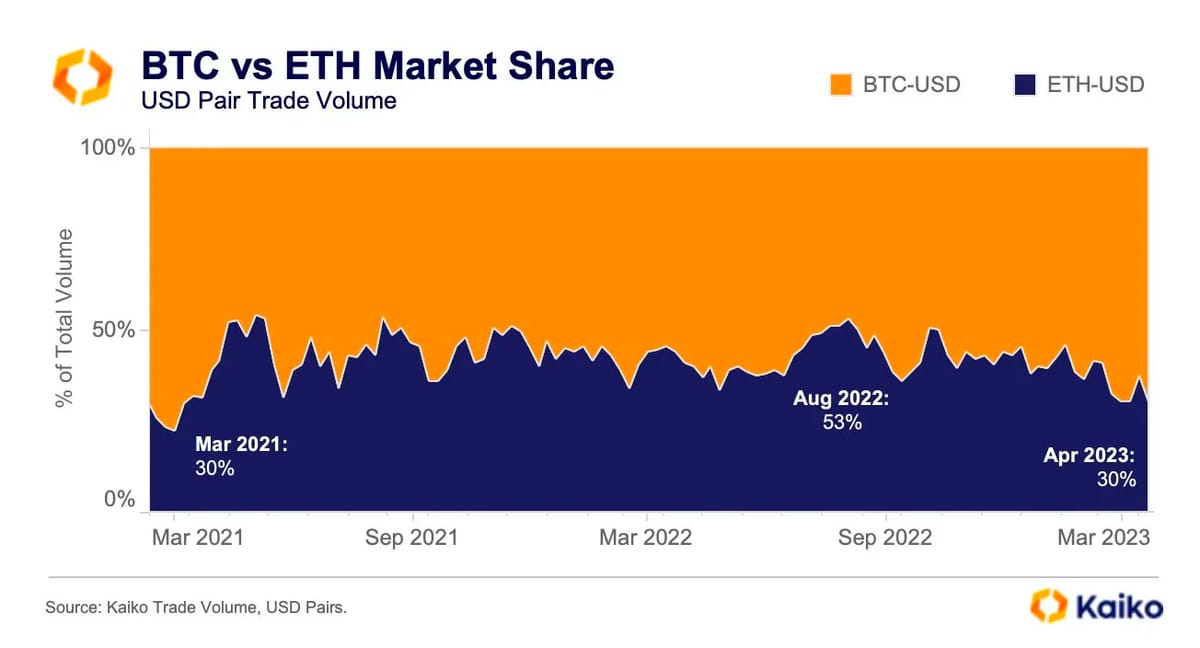

4. ETH’s Market Share Relative to BTC Is at 2 Year Lows of Just 30% Ahead of the Shanghai Upgrade

Source: @Clara_Medalie

5. Tokenized Gold Stablecoins Hit a Combined $1Bn in Market Cap Last Week

Source: @KaikoData

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The rights and responsibilities of TradFi asset holders (equities and debt) are largely standardized across geographies and issuers. On the other hand, crypto allows the issuer to craft unique rights and responsibilities for each token, allowing different degrees of value capture, even between similar protocols. These rights and responsibilities form part of the tokenomics and play a role in determining the success of the token as well as the protocol.

ARB’s Tokenomics

ARB is the governance token for the ArbitrumDAO that exercises significant control over the Arbitrum One and Nova networks. Per the protocol documents, the DAO controls the following:

upgradeability and technical future of the chains

the DAO treasury

token inflation

sequencer profit - i.e., the net difference between fees collected by on-chain operations and L1 fees paid by the sequencer

all Arbitrum social media platforms and accounts

While the protocol is still in its growing stages, the protocol and DAO are protected by a Security Council of elected superusers that can move quickly through a multisig to address risks from any potential exploits or vulnerabilities. The DAO is empowered to change the composition of the Security Council by electing and removing members.

The Arbitrum Foundation, a legal entity in the Cayman Islands, also supports the DAO. It handles responsibilities such as entering into off-chain agreements, allocating funds toward the growth of the protocol, and managing its social media. The DAO has the ability to change the directors that manage the Arbitrum Foundation.

The token launched with a supply of 10 billion tokens with a maximum inflation of 2% per annum. From the initial distribution, 7.5% of the total supply, or 750 million ARB tokens, was transferred from the DAO treasury to the Foundation's wallet. The transfer of 750 million ARB was not disclosed in the initial token allocation. This became a sore point among tokenholders and was the primary reason AIP-1 was rejected.

Taking Control

The fact that AIP-1 was a ratification of actions already undertaken generated concerns about whether the ARB token had any governance power. However, the fact that the tokenholders rejected the proposal, which led to improvements in transparency and clarity in protocol design, precisely shows the token’s governance power. The Foundation has taken multiple steps to address tokenholders' concerns, including:

publishing a Transparency Report that gives more details on the Foundation’s setup and costs,

proposing an alternate AIP-1.1 that adds a budget and a vesting schedule to the funds transferred to the Foundation,

proposing an alternate AIP-1.2 that updates the documents of incorporation for greater clarity of the role of the Foundation and the DAO’s control over it.

Separately, a community member, Alex D., proposed AIP-1.05, which asks the Foundation to return all funds transferred to it. However, per the current vote tally, it seems likely that this proposal will fail.

With direct improvements coming from active governance, concerns over the token’s lack of governance power do not seem grounded in fact.

Cash Flows

Layer-2 (L2) protocols generate cash flows through two primary revenue streams:

Sequencer profits are the difference in fees revenue generated from L2 users and fee expense paid to the base layer. Arbitrum’s sequencer profits will be transferred to the DAO treasury going forward.

Sequencers can generate maximal extractable value (MEV) by reordering user transaction requests. The Arbitrum sequencer currently does not capture MEV, but the DAO may be able to monetize MEV by auctioning off rights to block production once decentralized sequencing is live. Offchain Labs, the primary developer team for Arbitrum, has reservations regarding MEV auctions and is alternatively exploring ways to minimize MEV.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.sntnldigital.com, and www.momentofans.com