Social Links: Twitter / Telegram / Newsletter

Learn More a www.oeth.com and www.tokenx.ist

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 105k weekly subscribers. This week we cover the updates on the SEC suing Coinbase, the SEC suing Binance, the SEC names more tokens as securities, and big new venture rounds for Anoma Foundation ($25M) and Transak ($20M).

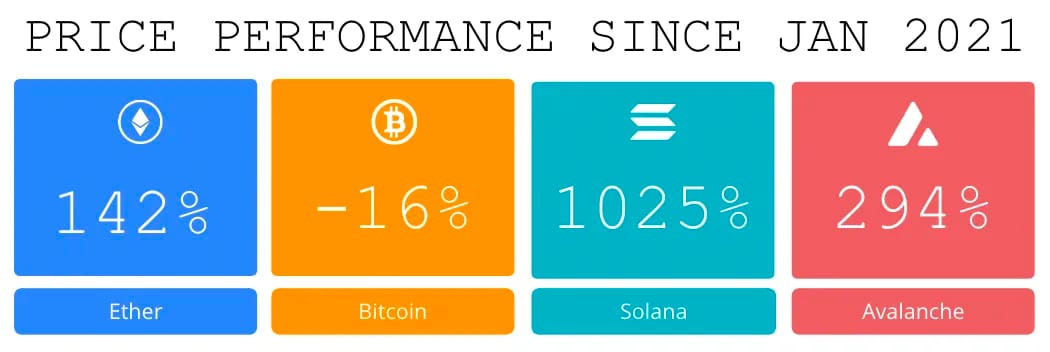

Price performance on major L1 tokens since we began writing Coinstack in January 2021

Thanks to Our 2023 Coinstack Sponsors…

At a trailing 7-day APY of 12%, Origin Ether offers the best liquid staking yield on the market. Users can deposit ETH or liquid staking tokens for OETH to earn over twice the yield from liquid staking tokens. The protocol has already accrued over 7,200 ETH ($13.5M+) in deposits from holders of stETH, rETH, frxETH, and ether. Origin Ether is audited by leading auditor OpenZeppelin, the team responsible for security audits of Coinbase, Aave, and The Ethereum Foundation. To learn more and to start stacking ETH faster, head over to www.oeth.com.

TokenX streamlines Web3 tokenization for Web2 companies, simplifying integration of blockchain technology into existing applications. Powerful APIs tokenize assets with on/off blockchain metadata, policies, and authentication. Leveraging TokenX, Web2 companies can access the benefits of decentralization, ownership, authentication, and transparency provided by Web3, unlocking new opportunities for growth, customer engagement, and innovation. Learn more at www.tokenx.is

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

To reach our weekly audience of 105,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

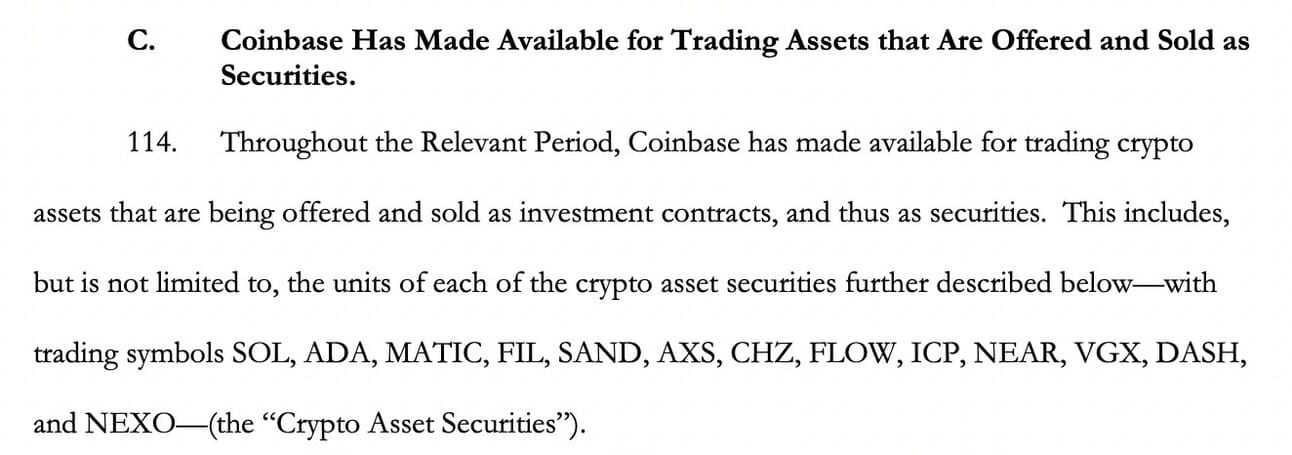

⚖️ SEC sues Coinbase, alleges multiple securities law violations- The U.S. Securities and Exchange Commission (SEC) is suing Coinbase, America’s biggest cryptocurrency exchange, for allegedly breaching securities laws.

⚖️ US SEC sues Binance, CEO Zhao for breaking securities rules- The U.S. Securities and Exchange Commission has sued Binance Holdings Ltd. and CEO Changpeng Zhao, citing a federal court filing. The suit accused them of breaking U.S. rules, Bloomberg said."Our team is all standing by, ensuring systems are stable, including withdrawals, and deposits," Zhao said on Twitter. "We will issue a response once we see the complaint. Haven't seen it yet. Media gets the info before we do."

⚖️ SEC names more tokens as securities, including Chiliz, Flow, Near and Nexo-The SEC reiterated its stance that well-known crypto assets, including Solana, Cardano and Polygon, are securities under U.S. law in a lawsuit against Coinbase — while adding further tokens to the list as well.

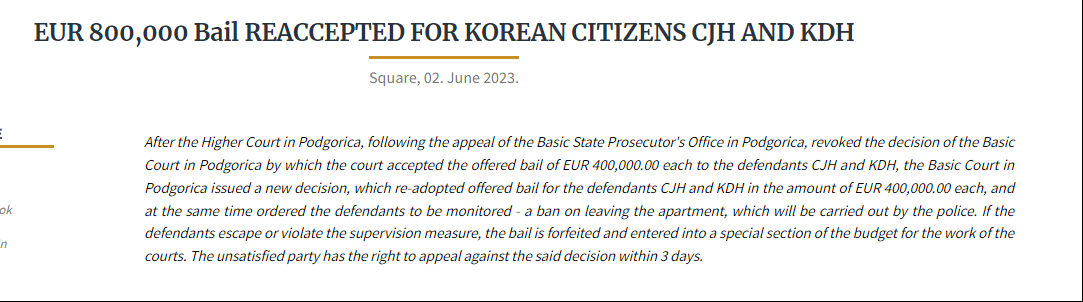

⚖️ Do Kwon out on bail under house arrest after successful appeal- Terra LUNA co-founder Do Kwon successfully appealed against the prosecution’s request to keep him in custody, and is out on bail as of June 5. The Podriga Basic court overseeing the case granted the bail request and accepted the initial amount of $400,000. Will he run? We shall find out.

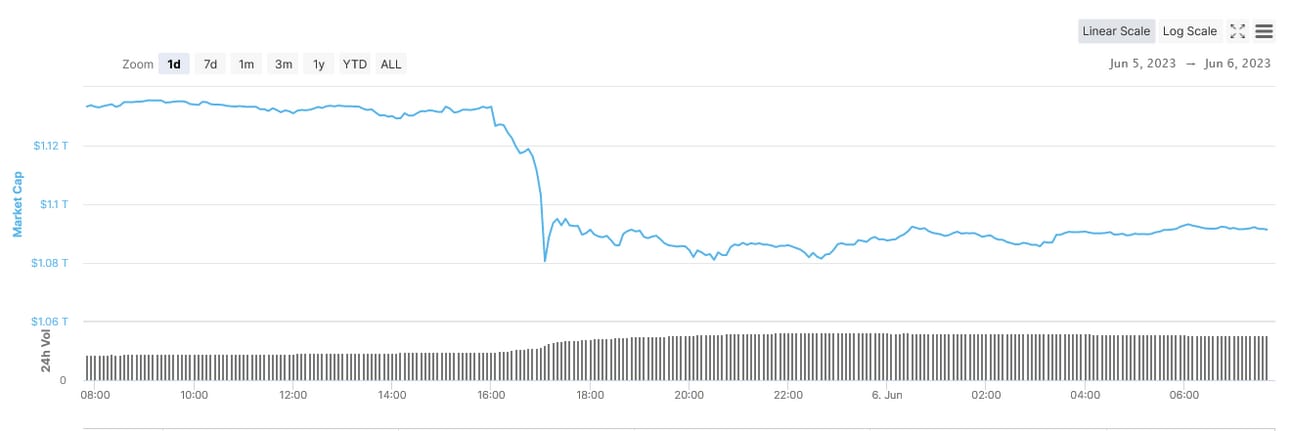

⚖️ SEC-induced panic saw $53 billion wiped from crypto market- The total crypto market cap fell $53 billion as news of the U.S. Securities and Exchange Commission (SEC) filing against Binance came through. On June 5, the SEC charged Binance, its CEO Changpeng Zhao, and related entities with 13 violations, including wash trading, evasion of regulations, and offering unregistered securities.

⚖️ Tether Invests in El Salvador’s $1B Renewable Energy Project- Stablecoin issuer Tether has announced that it will be partnering with Bitcoin-friendly nation El Salvador to invest in a planned $1 billion dollar renewable energy initiative.

💬 Tweet of the Week

Source: @brian_armstrong

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

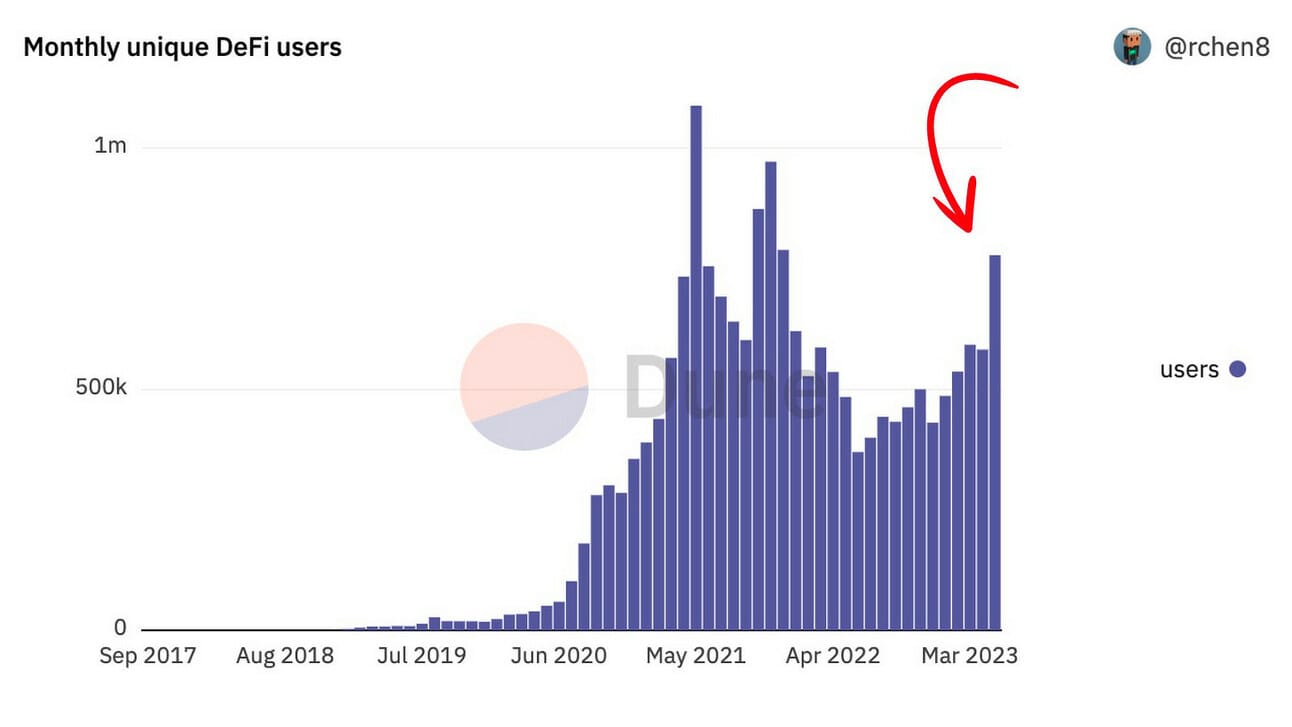

1. May 2023 saw 778k unique DeFi users

Source: @DuneAnalytics

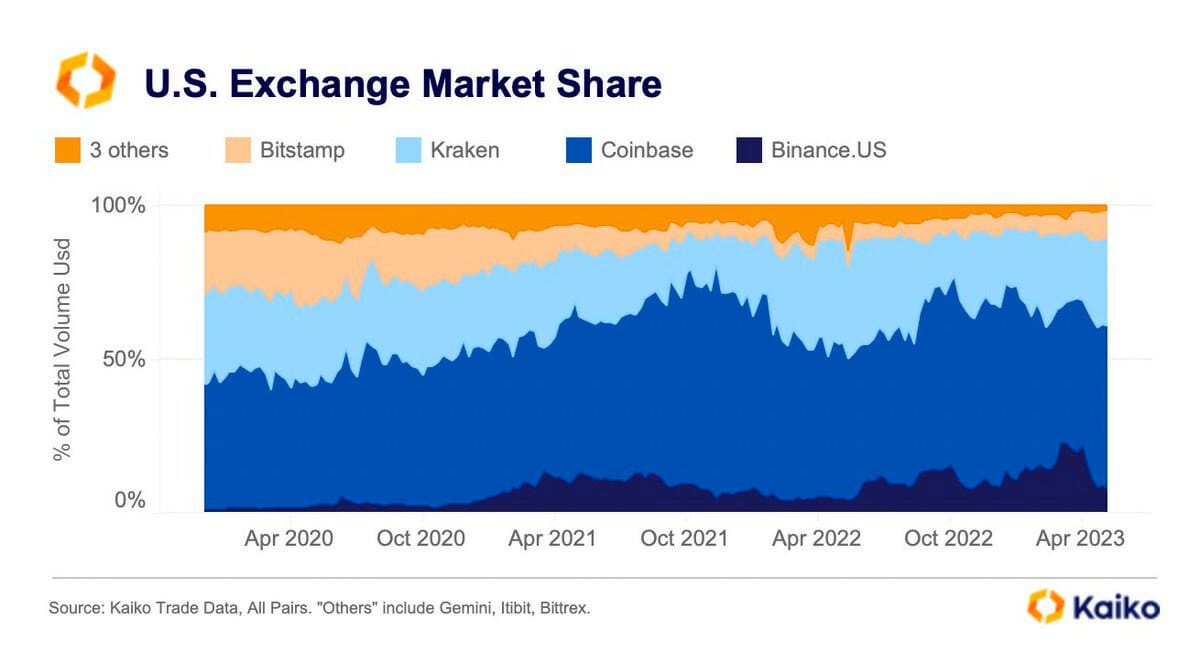

2. Coinbase may account for just 6.5% of global volume, but U.S. market share is a whopping 53%

Source: @KaikoData

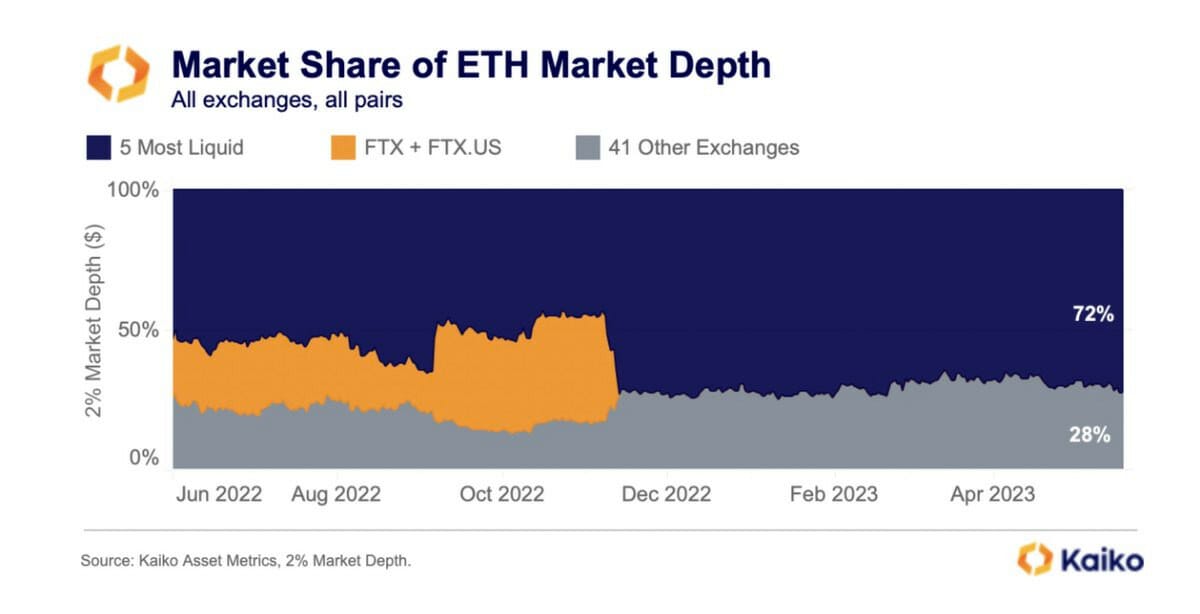

3. 72% of ETH Liquidity is Now Concentrated on Just 5 Exchanges.

Source: @KaikoData

4. Binance's version of staked ETH, bETH fell to its lowest level relative to ETH since April, while trade volume hit a yearly high.

Source: @KaikoData

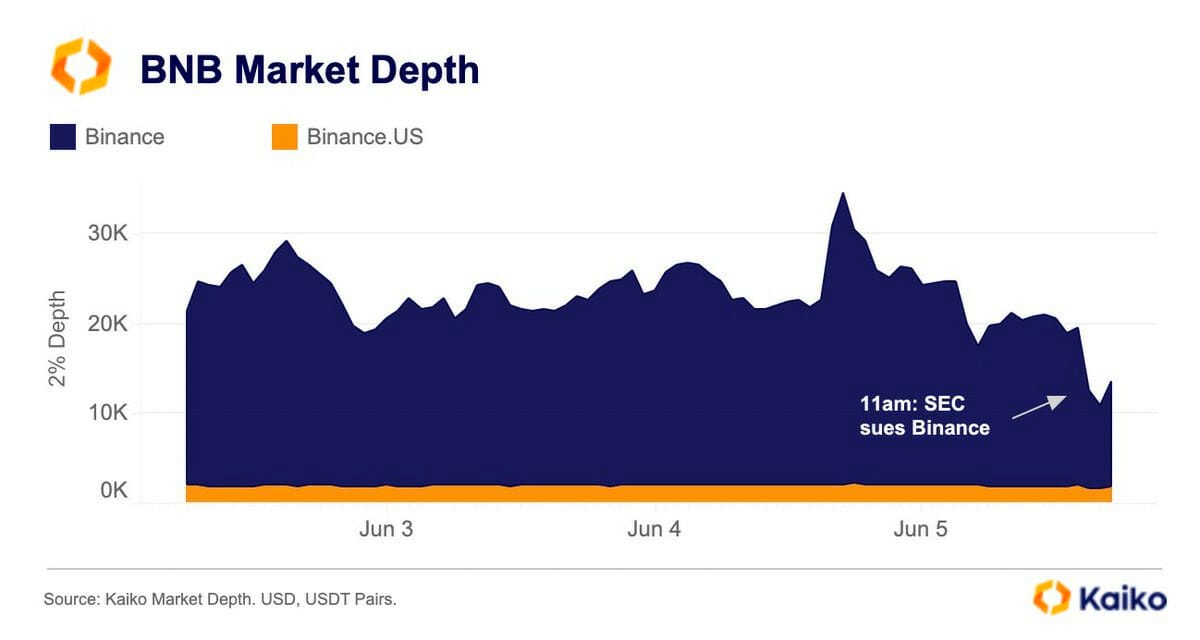

5. BNB market depth on Binance has more than halved since news of the SEC lawsuit.

Source: @KaikoData

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Firedancer Technical Analysis

Firedancer is a validator client aiming to 10x – or more – the scalability at which Solana may operate, from a current theoretical max throughput of 50,000 transactions per second (inclusive of voting transactions) to the 0.6–1.2 million transactions per second (TPS) range.

A million transactions per second on a monolithic, distributed network might sound far-fetched – at least at first glance. However, Jump Crypto already live-demoed these capabilities last year at Solana’s Breakpoint conference. That said, a production-ready validator client and a live demo are two different ball games.

Broadly speaking, Solana validators are responsible for the following operative functions behind Solana:

Transaction Propagation: Send transaction data from network users to leader validator / receive transaction data as the leader validator

Transaction Processing: Run the computation needed to execute transactions, update, and maintain account state

Transaction Broadcasting: Broadcast transactions to validators across the network

Transaction Verification: Verify transaction validity and finalize transactions

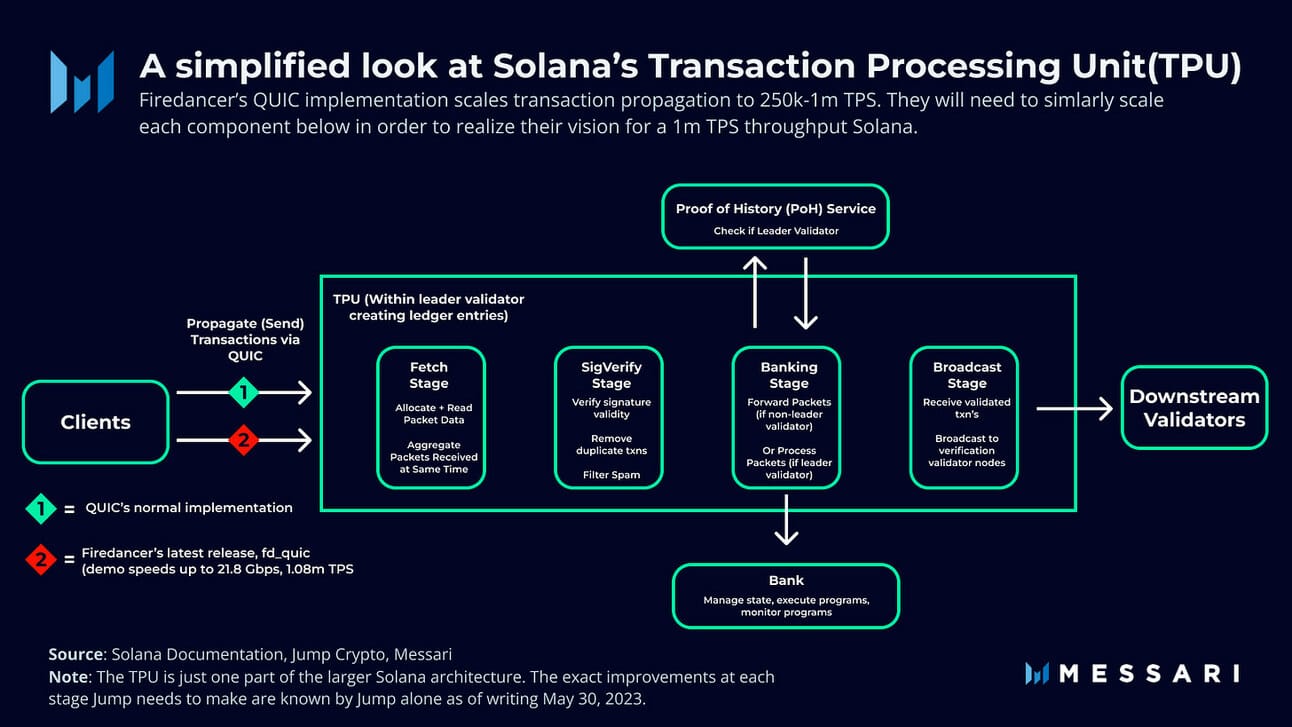

Jump has committed to a component-by-component release of Firedancer, releasing optimized versions of each function to the public once they’re live and ready. The first major milestone was fd_quic, the Firedancer implementation of the QUIC transaction propagation protocol.

We first covered QUIC and its importance in our Solana Ecosystem Overview last December – here’s the executive summary:

QUIC handles transaction messaging from clients to the lead validator client (who produces the current block).

It replaced UDP, Solana’s previous transaction propagation protocol. This choice was made to combat past downtime issues that resulted from spam filtration issues UDP couldn’t handle.

fd_quic scales the original QUIC to the throughput Firedancer is shooting for. After all, A network can only process transactions as fast as it can receive them. If 1 million transactions per second is the goal, transaction propagation has to match that speed.

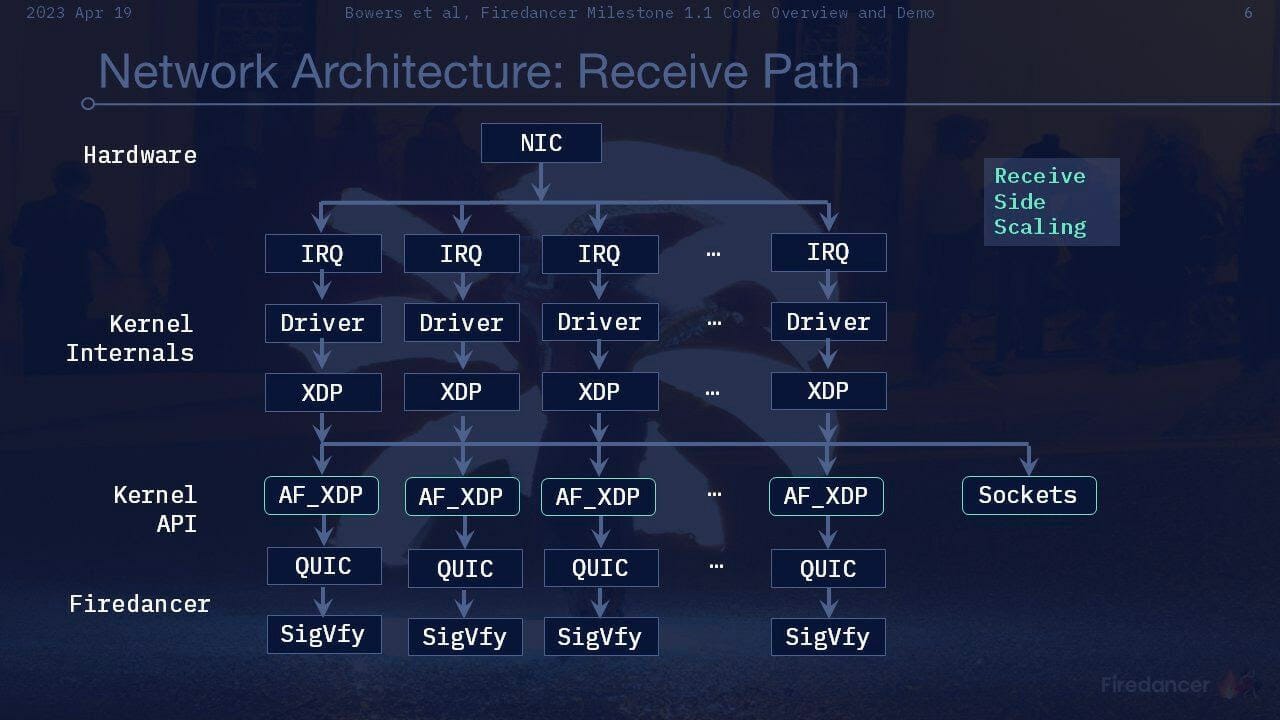

To handle transaction propagation of any speed, let alone 1 million TPS, networks need to “load balance.” In other words, to split up processing requirements in some way. Historically, this has been done at the software level – splitting up processing across several CPU cores within one validator, for example.

Firedancer leverages both hardware and software-based upgrades to scale load balancing to the 1 million TPS mark.

Hardware: On the hardware side, fd_quic handles load balancing by splitting up the work across multiple tiles on the same validator and optionally across multiple validators.

Software: Jump Crypto then combines this approach with software specified for Solana with the latest algorithms and optimized data structures – in tandem with the hardware-based load balancing approach, which is called “Receive Side Scaling,” or RSS.

Source: Jump Crypto

The results of this approach look promising. Jump Crypto’s performance demo showed transactions coming through fd_quic at 1.08 million TPS off of just four CPU cores. For reference, Solana validators are recommended to run 12 cores or more.

The upper bound on scaling fd_quic is unknown. The relationship between additional CPU cores and performance was mostly linear throughout testing until it tapered off at ~23 Gbps. The tapering was primarily a result of the network capabilities used in the test, which maxed out at around 25 Gbps.

What Jump Crypto has accomplished so far is impressive, but there’s a long way to go. The QUIC implementation is only one key step in a series of key steps needed to create the Firedancer client in full. The exact path Jump Crypto will take in terms of upcoming releases is unknown, but the final Firedancer will have to rewrite each validator component for scale.

After all – a network may only process transactions as fast as its slowest component, which is why Firedancer is also tackling the other two major components next to the networking layer, namely the consensus and execution layers.

Firedancer is addressing consensus scalability through hardware-accelerated signature verification (1 million sigverify per second on accessible off-the-shelf integrated circuits) and is currently working on improving execution throughput.

The above represents the current set of components responsible for Solana transaction processing. Jump Crypto will have to recreate each to scale Solana’s transaction processing to the throughput levels Jump Crypto is shooting for. But the buck doesn’t stop there – Solana’s transaction validation unit will require its own additional set of component optimizations.

So far, so good – but still a long way to go.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.oeth.com and www.tokenx.is