Social Links: Twitter / Telegram / Newsletter

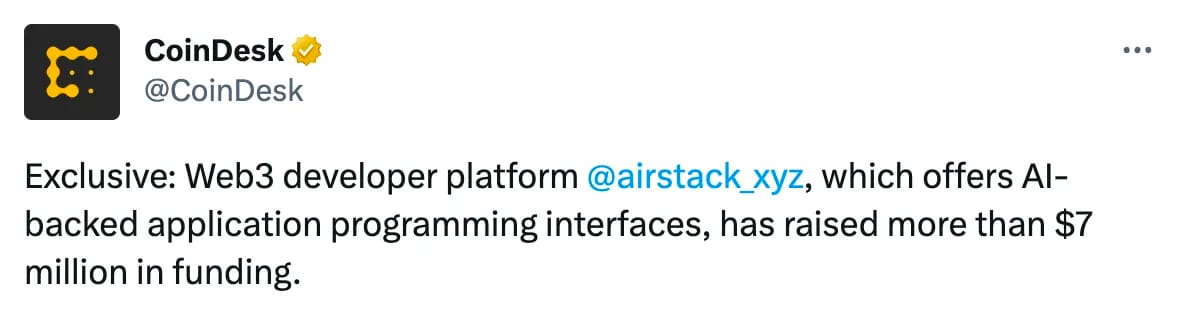

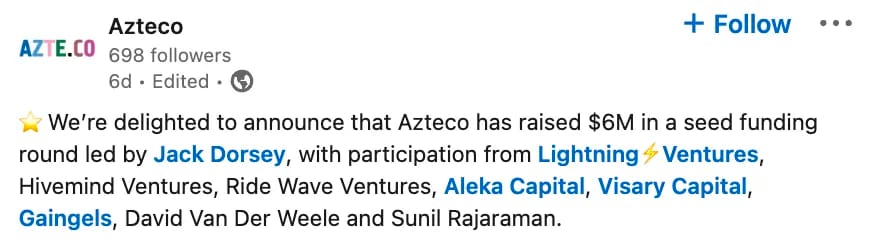

Issue Summary Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders, where we review the top news, stats, and reports in the digital asset ecosystem. This week we cover Binance denying commingling, Do Kwon’s bail release overturned, Solana launching a ChatGPT plug-in, the US lawmakers bill to clarify digital assets, and new rounds from Airstack ($7M) and Azteco ($6M).:

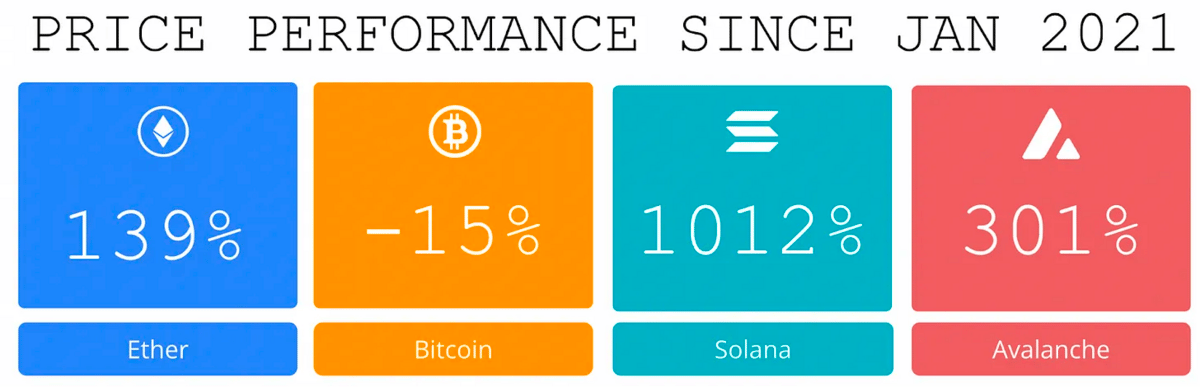

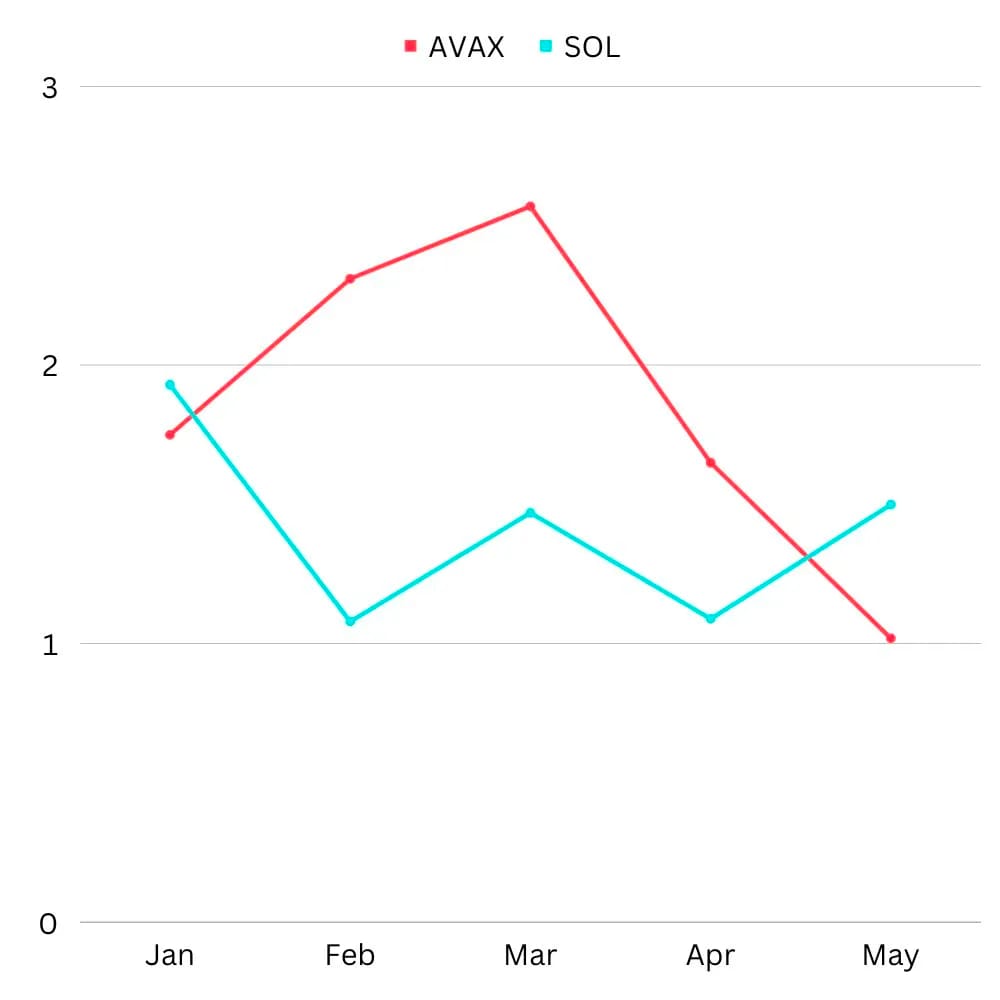

The price performance of the top L1 tokens since we began writing Coinstack in January 2021

Brought to You By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Become the Headline Sponsor of Coinstack

To reach our weekly audience of 101,000 crypto insiders with 40%+ open rates, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

1. ⚖️ Binance Denies Commingling ‘Billions’ in Customer Funds, Calls Reuters Report Xenophobic - According to a Reuters Report, Binance’s stablecoin, Binance USD (BUSD) was used to credit customers' accounts when they were really depositing U.S. Dollars. Patrick Hillman, Binance’s chief communications officer, said on Twitter that the details in the report are false.

Montenegro High Court Says No Bail for Terra's Do Kwon in Fake Passport Case - Prosecutors appealed a previous decision by a lower court in the country to let the disgraced founder go free while he faced trial. A Montenegro high court has annulled a decision by a lower court to release Terraform Labs co-founder Do Kwon on bail as he faces charges of attempting to travel with falsified documents, Bloomberg reported on Wednesday.

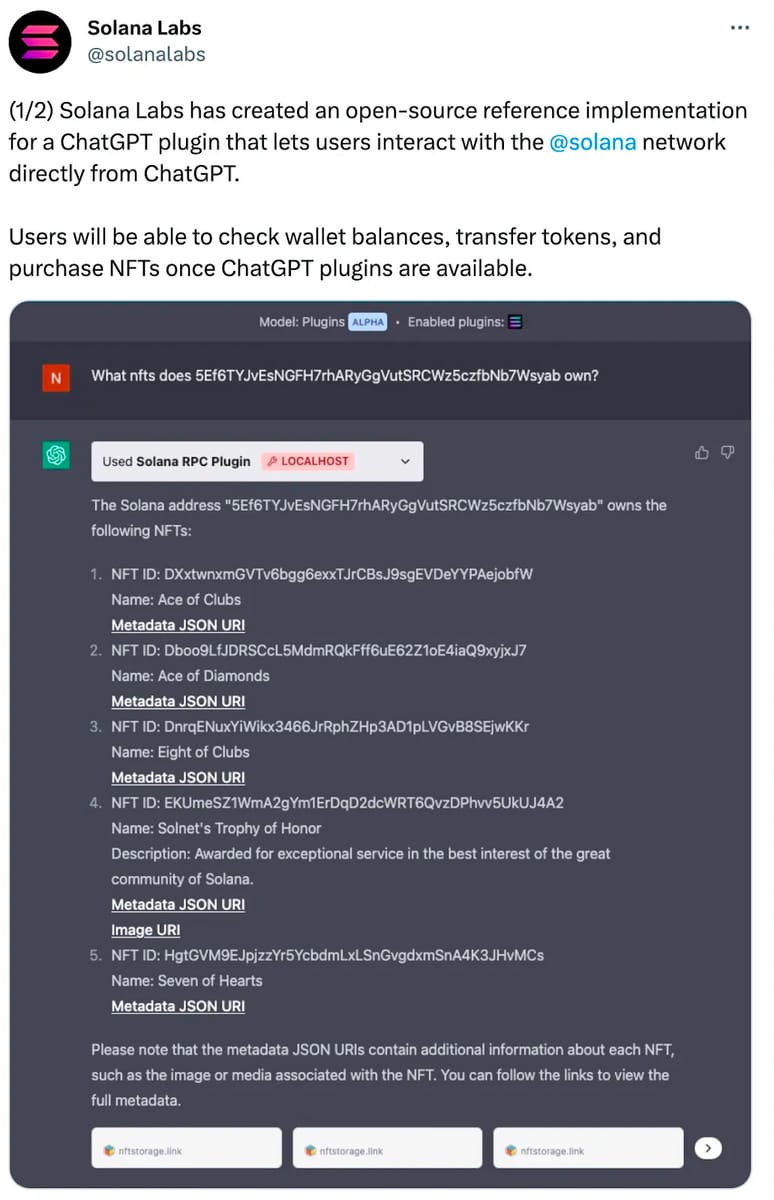

🤖 Solana Launches ChatGPT Plug-in to Help Users Interact With Its Network- The Solana Foundation launches AI accelerator program and ups grant program to $10 million

⚖️US Lawmaker Introduces Bill to Clarify Digital Assets Classification-U.S. Congressman Tom Emmer introduced a new bill to clarify the classification of digital assets and specify the jurisdiction of each regulator.

⚖️ Paradigm Argues Against New York’s Attorney General Classification of Ethereum As Securities- Crypto venture capital firm Paradigm filed an amicus brief in the case between the New York Attorney General (NYAG) and KuCoin because the regulator described Ethereum (ETH) as securities in the lawsuit.

🚀 Strike Integrates Tether’s USDT for Payments-Digital payments platform Strike has integrated dollar-pegged stablecoin Tether’s USDT into its platform. According to a May 22 press statement, the integration aims to enable fast, safe, and efficient payments for Strike users and further increase the use and adoption of USDT.

💬 Tweet of the Week

Source:@AFTXcreditor

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Polygon is the leading chain for GameFi activity in the past 90 Days.35% out of the 3.5 million of active wallets are on Polygon Labs.

Source: @KaronPangestu

2. NFT trading volume hits a new low since 2021, down 80% from last year's numbers.

Source:@StepDataInsight

3. Bitcoin has emerged as the second most dominant chain by NFT volume as the hype around Ordinals intensifies.

Source:@rebeccastev

4. Arbitrum hit a new peak for daily new addresses of 176k on May 15 + Optimism had their 2nd highest day of new addresses on May 18 at 54k.

Source: @rebeccastev

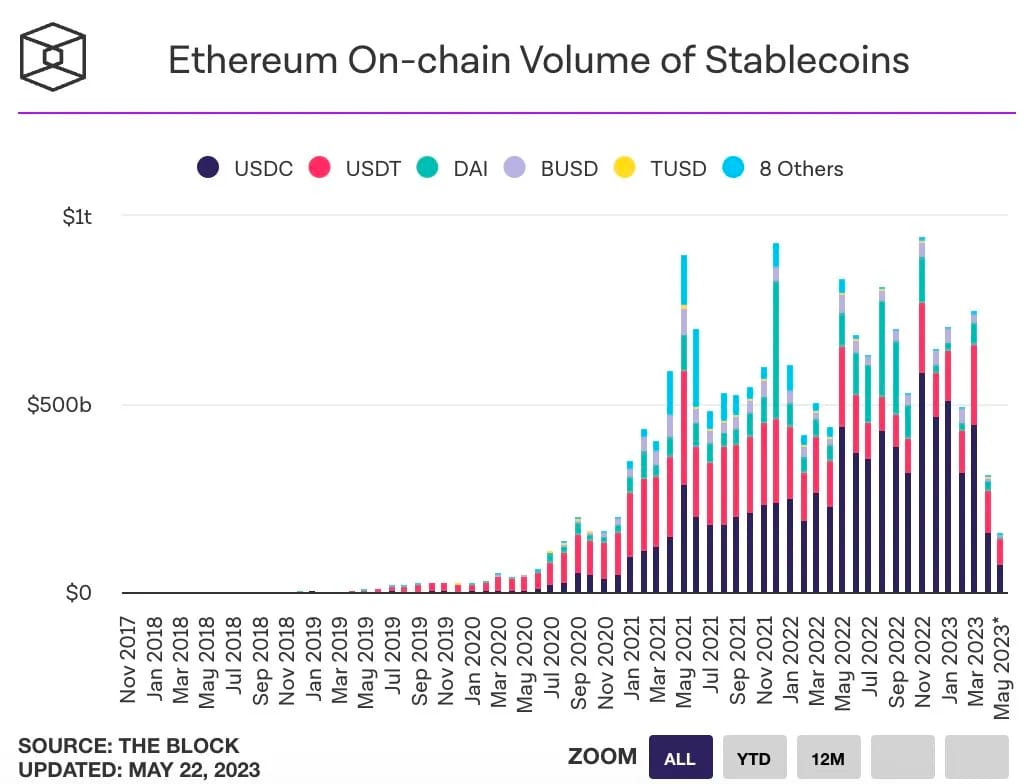

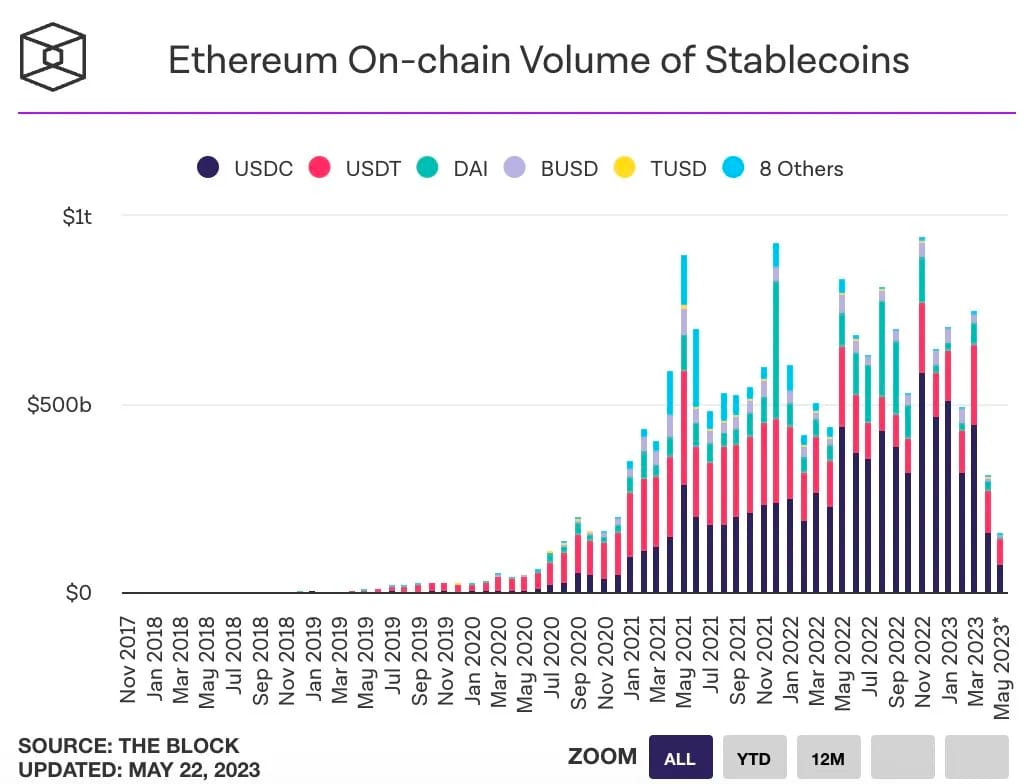

5. Ethereum on-chain stablecoin volumes are on pace to be the lowest since Dec 2020, with $159 bill in vol so far in May.

Source: @rebeccastev

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Bitcoin – The Latest Casino

Ordinals and Inscriptions have brought about a resurgence of interest and enthusiasm for the Bitcoin ecosystem. Before we get into the newfound implications, let’s understand what these terms mean.

Ordinal Theory, as proposed by Casey Rodarmor, is an off-chain method of serializing or numbering individual sats (the smallest unit of bitcoin) using a First-In-First-Out algorithm. These numbered sats or Ordinals can then be tracked by any Bitcoin full node running Rodarmor’s open-source software, ORD. The numbers assigned to Ordinals can make them seem more valuable, for example, Ordinals with round number serials. They hold a similar appeal as fiat currency notes with special serial numbers (like 000001 or 999999), which can command a premium from collectors.

Inscriptions are a way to attach arbitrary data to the Bitcoin blockchain using the witness data section, which was introduced in the SegWit upgrade in 2017 and whose scope was expanded by the Taproot upgrade in 2021. This data can then be assigned to an individual sat using Ordinal Theory, making it a digital artifact that can be tracked and transferred. This would be similar to a currency note that has a drawing on it by a famous artist.

All Your Favorite Memes, Now on Bitcoin

Since any arbitrary data can be inscribed, multiple data types have been used in Inscriptions, including pictures, audio, video, and text. In its first wave, pictures or JPEGs were primarily being inscribed on Ordinals. Prominent collections include Bitcoin Rocks, Ordinal Punks, TwelveFold by Yuga Labs, BTC DeGods, and Taproot Wizards by Udi Wertheimer. These Inscriptions have been highly sought after, with individual pieces trading at tens of thousands of dollars.

A more recent invention, the BRC-20, is a fungible token standard that uses Inscriptions. BRC-20s have been the primary catalyst for the latest wave of activity on Bitcoin. Created on March 10, 2023, by domodata, BRC-20s now dominate Ordinal activity.

Although named similarly to the well-known ERC-20 tokens, BRC-20s are more limited in their scope. ERC-20s can be programmed; for example, holders of Lido's stETH programmatically receive daily yield earned by Lido’s validators. This is not possible with BRC-20s. BRC-20s are more akin to the meme coin implementation of ERC-20s, with their key stats being ticker, total supply, and creator.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.