Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.wemeta.world, and www.investdefy.com

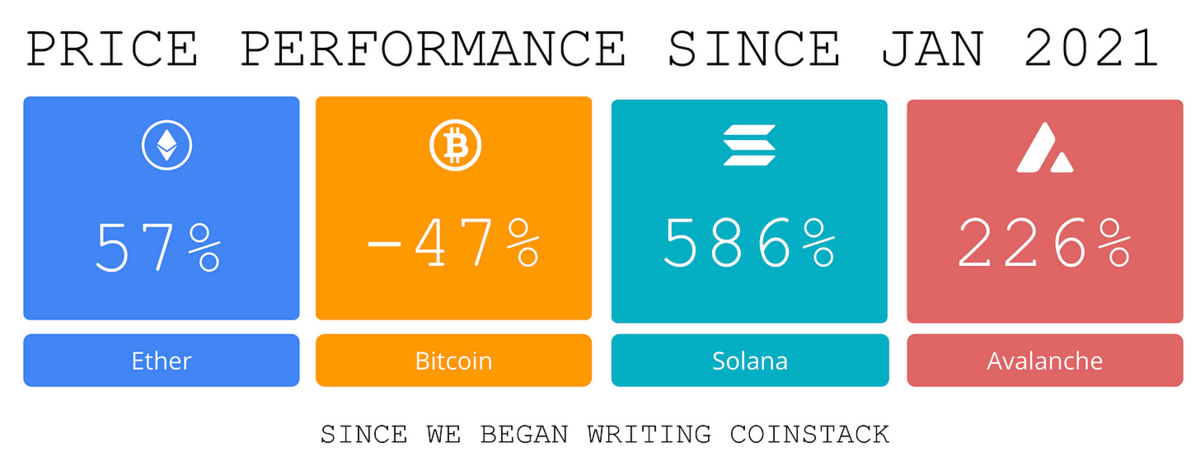

Issue Summary: Welcome back to Coinstack, the best weekly newsletter for crypto investors and industry insiders, where we review the top news and reports in the digital asset ecosystem. The large venture funding rounds this week for Amber Group ($300M led by Fenbushi) and Aztec ($100M led by A16Z) show us that institutional investing in the web3/crypto space is alive and well. Following these big rounds and Binance’s rescue of Voyager, there’s a distinct feeling here that November 2022’s madness was the bottom of the bottom and that 2023 will be a year of building and investments followed by a strong 2024/2025.

Thanks to Our 2022 Coinstack Sponsors…

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms for Series A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

WeMeta is the Bloomberg for web3 and the metaverse, combining on-chain data, social data, and news data from many sources into a single dashboard and API source designed for web3 investors, app builders, and brands. Learn more at www.wemetalabs.com.

InvestDEFY bridges TradFi regulatory and risk management with CeFi’s liquidity and DeFi’s innovation. InvestDEFY has deep expertise in quantitative trading, digital assets, technology, AI, risk management, derivatives, global equities, regulatory compliance and investment banking. Learn more at www.investdefy.com.

We have one open sponsorship spot available for your firm - please see our sponsor deck and schedule a call to discuss.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top stories of the week…

1) ⚖️ Binance.US Announces Deal to Acquire Assets of Bankrupt Crypto Firm Voyager - In a deal valued at $1.02B, Binance.US has entered an agreement to acquire the assets of the insolvent cryptocurrency brokerage Voyager. In a press release, the California-based company says the move should free up customer funds that have been locked up in the bankrupt Voyager Digital. Voyager had to file for bankruptcy in July after failed hedge fund Three Arrows Capital defaulted on a $650M loan in June.

2) ⚖️ Grayscale To Consider Tender Offer If ETF Conversion Fails - Grayscale Investments may seek to launch a tender offer for GBTC shares in the event a court rejects the company’s attempt to turn the world’s largest publicly traded crypto fund into an ETF. CEO Michael Sonnenshein expects a court decision in late Q1 2023 in their lawsuit against the SEC, which has been preventing a conversion to a Bitcoin ETF, hurting over a million investors.

The Grayscale Bitcoin Trust (GBTC) holds almost $11B in bitcoin, but shares in the trust are trading far below the value of the bitcoin they represent, with a market capitalization of just $5.6B, as the trust’s legal structure precludes investors from redeeming their shares for the underlying bitcoin.

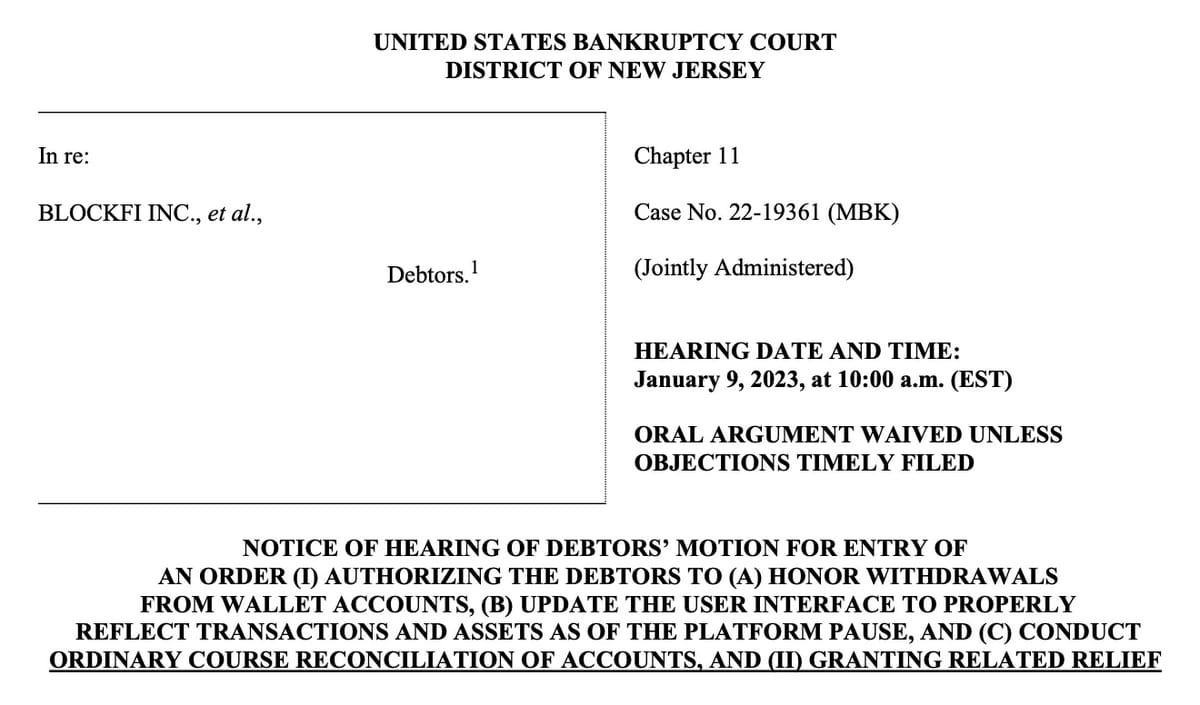

3) 🔗 BlockFi Files Motion To Allow Wallet Users To Withdraw Crypto - BlockFi hopes the bankruptcy court will let users withdraw crypto from Wallet accounts, although yield-seeking creditors might not be so lucky.

4) 🚩Visa Teases Ethereum Collab, Aims to ‘Actively Contribute’ to Crypto Development - Global payments giant Visa signaled its stronger, sustained interest in crypto on Monday, releasing a paper outlining how the firm could one day collaborate with the Ethereum network on automatic payments.

5) 🟩 Web3 Startup Yuga Labs Names Former Activision Blizzard President as New CEO - The Bored Ape parent company said Alegre's previous gaming experience will help advance the brand's Otherside metaverse and propel its ambitions for an "immersive Web3 world."

💬 Tweet of the Week

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Binance now has 80% of BTC volume and 55% of ETH volume across exchanges

Source: @dunleavy89

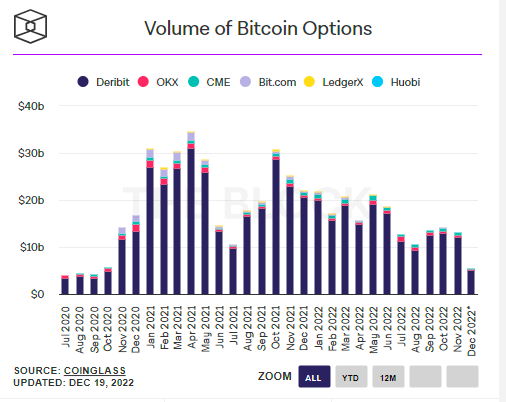

2. Deribit has 92% of crypto options volume

Source: @dunleavy89

3. bETH, Binance’s ETH staking token, is trading at its largest discount to ETH since June

Source: @KaikoData

4. Bitfinex and Huobi currently holding a majority of their treasury reserves in their own token

Source: @cryptoquant_com

5. Global decentralized exchange volume growing from 9% in September to 11.7% in November following FTX collapse

Source: @_LewisHarland_

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Introduction

With the successful completion of The Merge, Ethereum development pushes forward with new technologies. Next up on Vitalik’s roadmap is Distributed Validator Technology (DVT), a solution that enables multiple non-trusting parties to collectively operate a validator, resulting in fewer single points of validator failure. It can fortify the operations of at-home validators, institutions, and staking services alike.

DVT uses secret sharing and multi-party computation to split a validator private key into “key shares” and distribute them across machines. No machine can recreate the key or perform validator duties alone, and they do not need to trust each other to operate as a group. As long as a predefined majority threshold of key shares are signing appropriately, the validator will perform its duties as intended. It improves the security and uptime of an Ethereum validator while promoting network-wide resilience and decentralization. In this report, we will explore the nuances of DVT and its implications for Ethereum. But first, let’s review how validators function and the best practices to safeguard their operations.

The Components of an Ethereum Validator

Validators stake ETH to operate and secure Ethereum, and are rewarded in additional tokens for their efforts. However, they also risk losing ETH if they are inactive or take actions that could potentially harm the network. In severe cases, a validator can be slashed and lose up to its entire stake.

Validators generate two public-private key pairs: validator keys for participating in consensus and withdrawal keys for accessing funds. While withdrawal private keys can be secured in cold storage, validator private keys need to be online for validator signing duties, expanding the opportunity for theft. If a validator private key is compromised, an attacker can control the validator and potentially cause it to be slashed and lose ETH.

Operators have many choices to make regarding the management of private keys and the components they use to run a validator. Basic configurations include both software (clients and operating systems) and hardware (node hosting and physical location) components.

Each component represents a potential single point of failure. To put this in perspective, think about the risks of hosting validator nodes on centralized cloud services. If an operator using AWS forgets to pay their bill or, in a more extreme circumstance, is banned from using the service unexpectedly, the validator will go offline and start losing ETH. Luckily, inactivity penalties for individual validators are not very severe, but the network effects of validator downtime can be much worse.

Ensuring Liveness and Decentralization

If more than ⅓ of Ethereum validators go offline simultaneously, the network cannot reach finality and will stop working as intended. Slashing penalties grow in tandem with the number of offending validators to disincentivize such widespread failures. Ultimately, these penalties encourage operators to adopt a diverse stack of components to ensure validator uptime and network liveness.

Component Diversity

But while component diversity is incentivized, it isn’t always guaranteed. Prysm is the dominant validator client used by ~40-70% of validators since Beacon Chain genesis. When that figure was closer to 70% in April 2021, Prysm had a bug that caused ~14% of validators to go offline and ~70% of blocks to be missed for nearly two hours (18 epochs). The majority of validators running Prysm could not produce new blocks, cutting into their profitability. Operations returned to normal following a hotfix and eventual full update. And while no validators were slashed, the event was a stark reminder of the risks of infrastructure concentration.

As the stakes of securing the beacon chain increased leading up to The Merge, and the training wheels of reduced initial slashing penalties came off, validator client diversity has improved over time.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

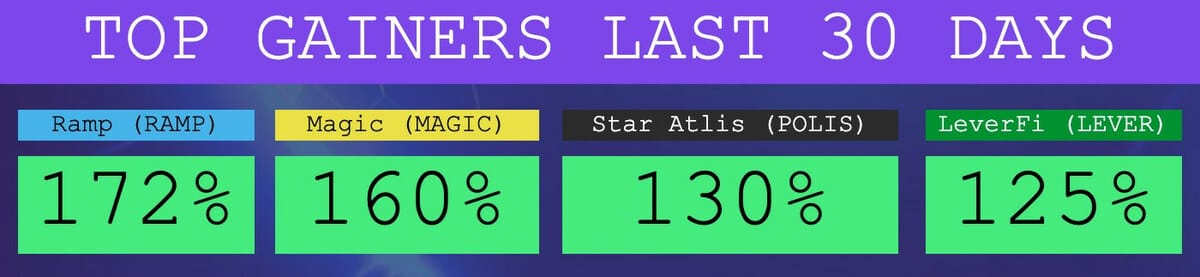

The Top Performers The Last 30 Days

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far, we’re at 34,072 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.wemeta.world, and www.investdefy.comSAVECROSS-POST