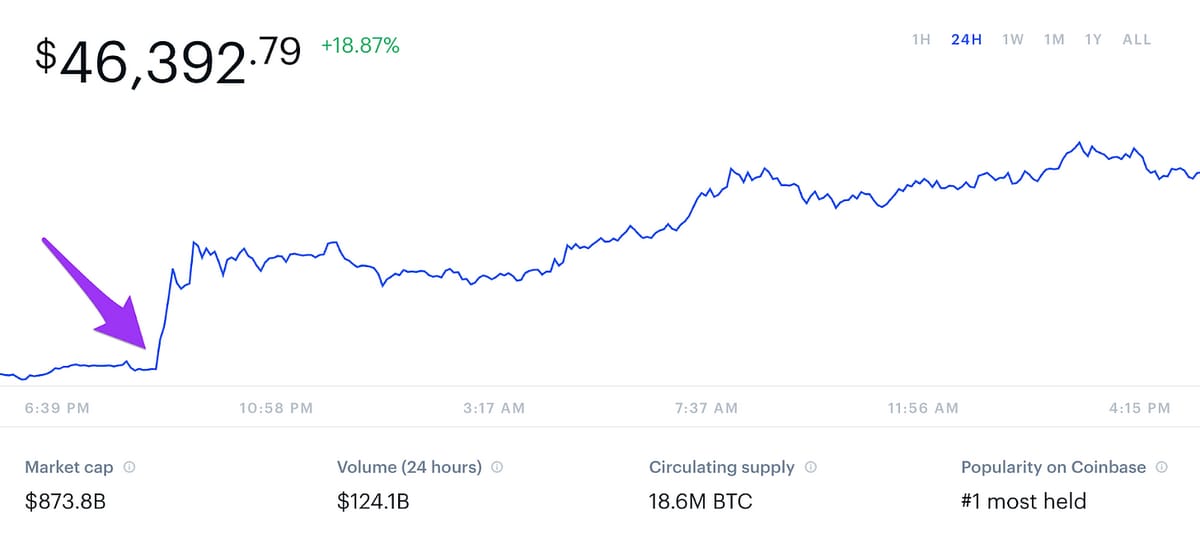

The Impact of Tesla’s Purchase of $1.5B of BTC

Is Bitcoin In a Bubble? Nope. Here’s Why...

Many people are wondering why the value of Bitcoin, Ethereum, and other digital assets have increased so much in the last year. Most mainstream journalists, frankly, don’t have a clue yet what drives the fundamental value of Bitcoin.

The reality is, we are just in the beginning stages of a 10-15 year long increase driven by massive new adoption of blockchain technology that will drive the price of Bitcoin to around $500k by 2025 and around $1M by 2030.

I want to explain why this is all happening in a way that anyone can understand it.

Here’s what is happening…

There are 21 million Bitcoin tokens that will ever exist. It is impossible to create more.

Because the amount of Bitcoin can’t be increased (always 21 million), it is inflation proof.

18.4 million of them have already been mined. The rest are being mined between now and year 2140, at a rate that decreases by 50% every four years.

It’s becoming commonly understood that Bitcoin is better than gold at being a long-term store of value and a medium of exchange.

Bitcoin is more divisible

Bitcoin is way faster to send to others

Bitcoin is easier to secure than gold

Bitcoin is easier to spend than gold

Central Banks are creating/printing lots of new fiat currency every year, destroying their value. In 2020 alone, the U.S. money supply (M1) increased by 65%, dramatically reducing the value of what one dollar will be worth and leading to coming significant price increases in asset prices, especially after the U.S. economy rebounds from COVID this year and the velocity of money increases. We started 2020 with $3.9 trillion in circulation and ended 2020 with $6.5 trillion in circulation. This same trend happened globally.

This policy of “print more money” is rapidly enriching those who own homes and stocks, and deeply hurting the lower classes who don’t, creating major unrest in across all sides of the political spectrum. We saw this play out in 2020. The creation of the fake QAnon narrative that sadly captured so many is a direct response to the theme that “the elite control the poor.” Trump capitalized on this populist sentiment -- but never took the time to explain what was really going on to the people -- and encouraged policies that just printed more money to keep the stock market artificially inflated.

Central banks are doing this (increasing money supply) because their goal is low unemployment and they think if they just keep printing money we will have low unemployment. Sadly, by printing all this money they are raising the prices of everything, hurting the very people they are trying to help. Since 2008 the purchasing power of the dollar has declined by 18.89% (using official government statistics), and this doesn’t even factor in the asset inflation in stocks and housing.

It’s even worse in other parts of the world. In Nigeria, the purchasing power of the Naira for example, has fallen 71% since 2008, due to massive central bank printing (and that’s against the U.S. dollar, and way more against Bitcoin).

Because of the massive printing of money since 2008, global stock markets have entered into a major bubble where prices are literally at the highest levels they have ever been at except just before the 2000 dot com crash, 18% higher than just before the 1929 crash. Central Banks have enriched the rich, while debasing the poor.

Fortunately, there is a solution to this mess that will help people protect and grow their savings over the long-term...

On October 31, 2008, a technology was invented that allows people to store their savings and transact for goods and services in a currency that cannot be debased by anyone. This technology is based on 1) cryptography and 2) distributed ledger technology (DLT). It is called Bitcoin.

Because who owns Bitcoin is kept track of in a decentralized system across 9,768 nodes (and growing) it is trustable. The bitcoin ledger is even beamed back to Earth by satellite.

Upon it, the world is creating a new financial system that is fundamentally fair to the poor and middle class, where their wealth can’t be taken away by the rulers.

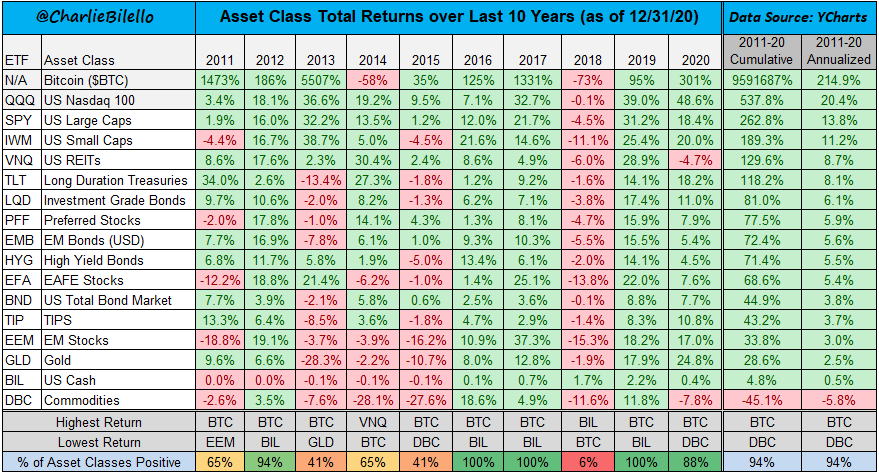

Bitcoin is the world’s best store of value and will soon become the world’s best medium of exchange. This is why it has increased in value an average of 214% per year from 2011-2020.

You can buy any amount of Bitcoin you want. You don’t have to buy a whole bitcoin for $47,000. You can invest $1 in Bitcoin.

You can buy Bitcoin on Coinbase, Coinbase Pro, Cash App, Paypal, Robinhood, Binance, Kraken, Huobi, FTX, and many other exchanges.

Bitcoin is likely to become to world’s primary currency for global goods and services exchange by 2030-2035. It’s the people’s money.

While Bitcoin is great for storing value and getting better at being a medium of exchange, it has some technological flaws that make it hard to use for other blockchain use cases that require trust across people who don’t know each other (like voting, supply chains, stock exchanges, anything in finance).

Bitcoin doesn’t allow for smart contracts, making it a “dumb blockchain” that can’t be programmed to do much other than keep track of who holds it. Bitcoin also uses a very slow Proof of Work (PoW) verification system that takes about 30 minutes to confirm transactions.

In July 2015, Ethereum, a new blockchain technology, was launched and introduced smart contracts. Ethereum is the first “smart blockchain” that is programmable. Unlike Bitcoin, Ethereum is Turing-complete, which means it can do anything a computer can do. Ethereum has by far the largest and best developer community.

Ethereum uses Ether (ETH) to run. You have to use Ether to use the Ethereum blockchain, which has increased the price of Ethereum by 12,429% in the last four years (4x the return of Bitcoin over the same time period).

Ethereum is being rapidly improved and the first phase of Ethereum 2.0 launched on December 1, 2020. Since then, the value of Ethereum has increased by 189% (in 68 days!) from $605 to $1750. Ethereum is on track to reach $10k per Ether by 2025 (potentially sooner at current rates of growth due to the implementation of EIP-1559 and ETH 2.0) and I expect ETH will reach $50k per ether by 2030.

The entire new global banking system and monetary system is now being built on top of Ethereum. It’s called Decentralized Finance, or DeFi. Leaders in the DeFi space include Maker, Aave, and Compound. You can invest in the top ten DeFi projects all at once by investing in the DPI token on Transak, Uniswap, or Bilaxy.

Thankfully, even the St. Louis Fed is starting to realize the future is in decentralized finance writing in a February 5, 2021 research paper:

An entire new generation of web apps that are censorship resistant and can’t be shut down by anyone are also being built on top of Ethereum. This is called Web 3.0. Remember when Parler got banned from the app store last month? Well, future social networks will be decentralized and won’t be able to be censored by Apple and Google.

When you run a transaction over a blockchain (distributed database verified by many instead of one) instead of a regular centralized database, it enables trust and verifiability between two parties that don’t know each other.

Remember two weeks ago when RobinHood stopped its customers from buying GameStop (GME) stock, just as it was rising to new highs? That happened because everyone in the old school stock market uses a clearinghouse that takes 2 days to settle transactions. On the blockchain, transactions are verified in minutes not days (and soon seconds).

The future of blockchain-based stock trading may be Polymarket, which has solved this issue.

In addition to Ethereum, by far the most used blockchain in the world, other highly promising blockchain technologies like Polkadot, Cardano, and Cosmos are also being built right now enabling even more applications and utility. The most promising one besides Ethereum is by far Polkadot, which is now only months away from public launch.

Central Banks are moving toward Central Bank Digital Currencies (CBDCs), which will use stablecoins. A stablecoin is a digital representation of either a dollar, a basket of fiat currencies, or a basket of cryptocurrencies, algorithmically created to always be stable in value.

However, new Central Bank Digital Currencies will still be centralized and controlled by the few -- with still uncapped supplies, leading to massive debasement. Thus, the people will continue to move into Bitcoin.

Today the market cap of Gold is $11.7 Trillion. Bitcoin is 10x better than gold. Bitcoin will eventually (probably by 2030) be worth more than gold. When that happens, Bitcoin will be worth $500k per coin.

Now you can understand why Tesla, a company run by the world’s richest person Elon Musk, bought $1.5B worth of Bitcoin last month. They won’t be the last major Fortune 500 company to add it to their balance sheet to diversify, increase returns, and reduce the risk of fiat exposure. Many more will follow this year. Ironically, Tesla’s announcement of their purchase of Bitcoin made the value of Bitcoin more than the value of Tesla for the first time in history.

Bitcoin is volatile as an asset (it’s price varies a lot from month to month). This is because it is in price-discovery mode on a long term trajectory to around $1M per token (about 2x the value of Gold). Bitcoin operates on a four year cycle based on supply and demand (the halving cycle). It’s best to not try to time the market and just buy and hold for 10-15 years. It will go up and down in relation to the dollar, but the amount of Bitcoin you hold stays the same.

See if you can get more than 1 Bitcoin saved up while they are still very cheap. There’s only 21 million of them in the world and there are 46.8 million millionaires (in USD). There aren’t even enough Bitcoins for every millionaire in the world to own one. If you can save up 1 Bitcoin, there’s a good chance you will be a millionaire yourself someday.

Based on the Stock to Flow model, the price of Bitcoin in this current bull cycle (2021) will likely go up to around $100k-$150k by Fall 2021 before cooling off for a couple years until April 2024 when the next four year halving and growth cycle begins. In that cycle, we may reach $1M. We still have a long way to go before Bitcoin reaches its intrinsic value.

If you got in before Elon Musk, you were really early. If you get in before $100k, you’re still early. The path ahead will be volatile, but this decade it’s massively upward.

So when someone asks you, “Is Bitcoin in a Bubble” tell them no and send them this article. As long as Bitcoin is priced at lower than $500k per coin, it’s really cheap. We have a LONG way to go to get there.

Yes, the world is changing. It’s getting better.

No longer will governments be able to take money from the poor to give to the rich through debasement of currency.

No longer will we have to deal with complicated and inefficient paper contracts. It will all be code.

No longer will it be cost prohibitive to send money to anyone. It will be free to send money to anyone, anywhere.

No longer will we have untrackable cash-based crime and corruption. Transactions will be visible and transparent. Cash is going away.

So what are the takeaways from an investment perspective?

Invest in Bitcoin (BTC)

Invest in Ethereum (ETH)

Invest in Polkadot (DOT)

Invest in the DeFi Pulse Token (DPI)

Hold and wait 15 years.

Keep reading this newsletter.

NEXO Token Up 28% Since Thursday’s Article

In CoinTimes #8 last Thursday, we wrote about Nexo, the NewFi Bank we love. At the time, the NEXO token was at $1.27. Now, five days later, it is at $1.62 (up 28%).

Nexo gives 30% of their net profits annually to their token holders, creating inherent value in holding the token for long term passive cash flow. Based upon the fundamental analysis we have done projecting out anticipated cashflows from their dividend payments, we believe the Nexo token is on a path toward being worth around $73 per token by 2030 and $183 per token by 2035. Take a look at the financial model we built.

The market cap of the Nexo token is up 77% in the last week and is about to pass $1B. We anticipate the Nexo market cap will reach about $100B within 15 years, about the size of a mid-sized U.S. bank (or roughly 2x what Coinbase is trading at today).

We love the ease of use of the Nexo platform, and that they pay you 6-8% annual interest for holding your crypto there and 10-12% for holding fiat (USD, EUR, GBP) or stablecoins like USDC or USDT. They also offer instant loans, collateralized by your crypto holdings, at 6-12% annual interest.

So if you want to invest more in crypto, or invest in the Nexo token, or need cash for living expenses and don’t want to sell your crypto, Nexo is a good option. Nexo offers a lower borrowing interest rate and a higher rate of return on savings if you hold their NEXO token in your account, creating even more demand for the token. Nexo competes with BlockFi, Crypto.com, and Celsius.

Nexo has announced plans to acquire a U.S. bank and European bank to further reduce their cost of capital and expand customer offerings. They also recently launched an exchange allowing customers to purchase crypto from within their accounts. Nexo is SEC compliant and is backed by Arrington XRP Capital and Credissimo, a major European fintech company that has been around since 2007.

You can buy the Nexo token for yourself within the Nexo.io app or on Huobi, Uniswap, HotBit, HitBTC, Bitmart, Changelly, or the Binance DEX. As always, please DYOR.

Here’s What the St. Louis Federal Reserve Wrote About Decentralized Finance on Friday Feb 5...

“Decentralized finance (DeFi) is a blockchain-based financial infrastructure that has recently gained a lot of traction. The term generally refers to an open, permissionless, and highly interoperable protocol stack built on public smart contract platforms, such as the Ethereum blockchain (see Buterin, 2013). It replicates existing financial services in a more open and transparent way. In particular, DeFi does not rely on intermediaries and centralized institutions. Instead, it is based on open protocols and decentralized applications (DApps). Agreements are enforced by code, transactions are executed in a secure and verifiable way, and legitimate state changes persist on a public blockchain. Thus, this architecture can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians, central clearing houses, or escrow services, as most of these roles can be assumed by "smart contracts.” - The St. Louis Federal Reserve Research Paper from Feb 5, 2021

My Crypto Portfolio Recommendations (Updated)

Here are my big picture recommendations for anyone getting started in crypto investing who wants a balanced mix of potential return and asset preservation. I adjust these each week or so based on what I learn and any changes in the marketplace.

Never invest an amount you can’t afford to lose. Crypto is volatile and downswings of 80%+ happen. Don’t invest more than 50% of your total net worth in crypto.

Be careful investing on borrowed money (margin). We don’t recommend it until you’re a professional.

Unless you’re an experienced and professional trader with many years of training, your best bet is to buy and hold for the long term (10-15 years) and not attempt to time the market. If you are going to attempt to time the market, be very familiar with the Stock to Flow model and the timing of BTC halvings and be very familiar with the research backing up the blue chips like BTC, ETH, DOT, etc.

We recommend Coinbase for those investing small amounts (<$10K) and the lower fee Binance (use a VPN if needed), Coinbase Pro, Gemini, or Kraken for those investing larger amounts ($10k+). You can also use the no-fee Voyager or Nexo which give you no-commission trades and 6-8% annual interest in exchange for holding your cryptodeposits.

Certain tokens don’t yet trade on Coinbase. Binance has most of them. Uniswap has anything Binance doesn’t have.

You can do your research here and here.

For a mix of long-term capital preservation and growth, we recommend keeping 33% of your holding in BTC, 33% in ETH (“The Blue Chips”), 10% in Polkadot (“The New Ethereum”) and around 23% in up-and-coming blockchain tokens (<$100B market cap). For the alternative asset exposure, here’s what we like (the 10 we like the most are bolded):

We like these blockchain techs: ETH,DOT,KSM, ATOM, ADA, SOL, HBAR

We like these NewFi Banks: NEXO, VGX

We like these DEX Exchanges: UNI, SUSHI,1INCH, BURGER

We like these DeFi protocols: AAVE, COMP, SNX, CRV, BAL, REN, CAKE, PPAY

We like these Oracles: LINK, BAND

We like these Web 3.0 Tools: BTT, THETA, GRT, FIL

We like these Insurance Tools: WNXM and ARMOR

We like these Payment Platforms: EGLD, XLM, CELO

See the well researched ratings at Simetri Research and Flipside Crypto for even more due diligence.

The People We’re Following Closely on Twitter

If You’re Just Getting Started With Crypto, Start Here

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coin Times: Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published 2x per week. Published and written by Ryan Allis.

Comments and thoughts welcome:

Telegram channel at t.me/thecointimes

Substack at TheCoinTimes.com