Social Links: Twitter | Telegram | Subscribe | Coinstack Fund | Web Site

This issue covers countries using Bitcoin as a legal currency and discusses why Ethereum (ETH) is currently beating Bitcoin (BTC) in terms of price, usage, revenue, apps, trading volume, and settlement volume.

In This Issue:

Bitcoin for Countries by Ryan Allis

Understanding the Big Picture by Ryan Allis

This Week On-Chain by Mike Gavela

Ethereum Fundamental Value Model (FVM) Now Live

My Top 30: A Long-Term Crypto Portfolio by Ryan Allis

Top Performers Last 7 and 30 Days by Ryan Allis

Join Our Tuesday Crypto Advice Calls

Featured Art NFTs by Mrs. Bubble

Who I’m Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

Bitcoin for Countries

El Salvador’s popular 39 year-old President Nayib Bukele announced on Saturday at Bitcoin Miami that he will be submitting a bill to the El Salvadoran congress this week which would make Bitcoin legal tender and have zero capital gains taxes.

Bukele’s political party, Nueva Ideas, holds 56 of 84 seats in the assembly making it likely that Bukele’s bitcoin initiative is enacted into law.

Here’s what Bukele tweeted after the announcement:

It appears that soon El Salvador will become the first country in the world to enact a law deeming Bitcoin as legal tender and become the world’s first “Bitcoin country.”

How could this make a difference?

It could on board millions of new users onto the Bitcoin network, using services like Strike to send and receive crypto remittances at a fraction of the cost of Western Union and bank transfers.

It creates a precedent for other countries to adopt Bitcoin as a legal currency. Currency doesn’t have capital gains taxes. Property does.

This new classification may bring many investors and entrepreneurs to El Salvador and places like it, creating new innovation centers.

It increases the likelihood that countries’ central banks will begin to purchase Bitcoin to store in their national reserves.

It creates a precedent for countries to experiment with moving off of using currencies where the supply is controlled by central banks to cryptocurrencies where supply is controlled formulaically, reducing inflation and allowing billions of people around the world to save their money without the value of it getting inflated away over time.

Here’s a short excerpt from the proposed bill.

It’s an important piece of context that El Salvador currently uses the U.S. dollar and does not have its own national currency.

This means that the two legal currencies in El Salvador are soon likely to be the U.S. dollar and Bitcoin.

This move will allow El Salvador’s 6 million residents to easily send and receive Bitcoin remittances around the world without worry.

According to the BBC, “El Salvador's economy relies heavily on remittances, or money sent home from abroad, which make up around 20% of the country's gross domestic product (GDP). More than two million Salvadorans live outside the country, but they continue to keep close ties to their place of birth, sending back more than $4bn (£2.9bn) each year.”

Will other countries follow El Salvador’s lead?

Similar efforts have been discussed in the last week by government leaders in Panama, Argentina, and Paraguay so it seems probable other countries will follow.

What will this mean for Bitcoin’s price? Well if this bill goes through, the narrative of “Bitcoin for Countries” could become a major catalyst to the Bitcoin price in the 2nd half of 2021.

The only entities with bigger pockets than institutions are nation-states. And someone needs to take the buying mantle from Microstrategy, which announced a $400M new bond this week in order to buy more Bitcoin.

If much of Central and South America gets on board and starts legally authorizing Bitcoin as currency and buying it up from their treasuries, we could see a Bitcoin price above $100k by the end of 2021. This trend will be an important one to track.

As I’ve been saying since January, the countries that embrace Bitcoin and Ethereum and the programmable money revolution will thrive this decade and become the epicenter of the next financial growth sector for the world.

Can Ethereum Replace Bitcoin as a Main Crypto Store-of-Value?

Eventually, I see Ethereum taking a side-by-side role with Bitcoin as a main store-of-value (SoV) in the crypto-ecosystem -- but this won’t happen overnight and will require Ethereum to first becoming a deflationary asset -- which is set to happen in early 2022 with the release of ETH2.0.

We’re still 6-9 months away from Ethereum having a lower annual supply increase than Bitcoin.

As of today Bitcoin has a 1.8% annual supply inflation rate and Ethereum has a 4.3% annual supply inflation rate, which is on track to go to around -1.0% by early 2022 with the burning of transaction fees as well as the move to lower-issuance proof-of-stake system.

By 2023, I sense the story will be nation-states buying up Ethereum. For now, it will be Bitcoin.

Hopefully these efforts will give a boost to the overall market picture over the next few months.

Legalized programmable decentralized money is coming. And now it appears it’s coming this year in El Salvador. What a great moment.

Understanding the Big Picture in Crypto

While stories like El Salvador adopting Bitcoin as legal currency are super bullish for the crypto sector over the long term, there’s really just one statistic you need to know to understand the macro picture right now.

Over the last 90 days (March 9-June 8, 2021):

ETH is up 37%

BTC is down 41%

And year-to-date (Jan 1 - Jun 8, 2021):

ETH is up 241%

BTC is up 10%

Yes, that’s right, ETH has outperformed BTC 24-to-1 in the first 160 days of 2021.

Why Has ETH Outperformed BTC by 24x YTD?

Well there is a major difference between Ethereum and Bitcoin. Ethereum is a decentralized computer that can run applications on top of it. Bitcoin is a decentralized spreadsheet that can just keep track of balances of Bitcoin but can’t actually execute code.

It’s like the difference between a 1994-era landline phone (Bitcoin) and a 2021 iPhone (Ethereum). One allows you to do one thing on it. The other allows you to create entire universes.

There’s a lot more demand for Ether than Bitcoin as Ether (ETH) is needed to perform transactions within the DeFi ecosystem, which is the future of global finance.

Here’s what Bloomberg reporter Joe Weistenthal wrote yesterday in Bitcoin Vs. Ethereum & Defi: There’s A Big Difference:

“In addition to being a cryptocurrency, Ethereum is also a token. What’s a token? It’s a kind of money that is redeemable for goods and services within a very specific environment. In the Ethereum world, the currency (ETH) lets you pay a network of computers to run various applications that are built on top of it. There’s something important that happens when you move from being a currency to being a token, which is that the necessity of pure belief starts to fade.”

At the end of the day, Bitcoin is only worth what people are willing to pay for it. It has no cash flows to holders and therefore doesn’t have much fundamental value.

Bitcoin is on track for about $35M in transaction revenues in June 2021, all of which go to miners.

Ether (ETH) on the other hand, is on track for $150M in transaction revenues in June 2021, and 100% of these revenues will soon be directly (via staking rewards) or indirectly (via token burning) be going to long-term holders.

Over the last year ETH has outperformed BTC by 3.8x (see below change in the last year)…

I expect the ETH outperformance to continue over the next year.

Follow the developers, the usage, and the market... and be sure you have a sufficient part of your portfolio allocated to ETH.

I’m closely watching (and have small investments in) some promising Ethereum competitors like Solana (SOL), Binance Smart Chain (BNB), Polkadot (DOT), and Mina (MINA) -- but as of yet nothing has come anywhere close to the amount of apps, dollars, and usage on top of the Ethereum network.

And if they do, I will for sure write about it.

This Week On-ChainBy Coinstack Analyst Mike Gavela

This is a new series by Coinstack analyst Mike Gavela that uses on-chain metrics to provide commentary on what’s happening in crypto. This week, Mike explains why on-chain metrics indicate that Ethereum is likely to outperform Bitcoin over the next few weeks.

Welcome to the Summer of 2021!

We are now in June which means it’s a new season for the crypto market.

Now that we are more than two weeks from the major selloff in May we can see whether Bitcoin or Ethereum have recovered better, and which asset is likely to appreciate more in the next few weeks.

The best way to forecast price is to see the investor activity and user activity on the blockchain.

Based on our analysis below, we expect to see stronger price momentum for ETH over the next few weeks than Bitcoin.

First, let’s take a look at the 2021 market price chart for both BTC and ETH.

Now that we are a couple weeks out from the May 15-23 big selloff we can see where these two cryptoassets are trending.

Ethereum Has Recovered Faster Than Bitcoin

Not only did Ethereum recover faster from the May sell off compared to Bitcoin but it’s also trending upwards from its lows of $1.8-$2k while BTC continues to move sideways around its lows of $30k to $34k.

Those who purchased Bitcoin (BTC) at the beginning of 2021 are essentially breakeven on their investment while those who purchased Ether (ETH) are up 3x.

Bitcoin Sellers Still Selling at a Loss

SOPR stands for Spent Output Profit Ratio. When SOPR > 1, the owners of the sold coins are selling at a profit. And when SOPR < 1, the owners of the sold coins are selling at a loss.

We can see below that currently the average Bitcoin seller is selling at a loss while the average Ethereum seller is selling at a profit.

We can see this further illustrated by looking at all the addresses on each chain using Into The Block’s, In/Out of the Money indicator.

The In/Out of the Money classifies addresses based on if they are profiting (in the money), breaking even (at the money) or losing money (out of the money) on their positions at current price.

Being that we are two weeks out from the selloff we can see what the lasting impact was to both Short and Long Term holders of both chains. Keeping in mind that the selloff knocked Bitcoin investors back to early 2021 price range of $30k and Ethereum investors as a whole largely remain in profit assuming coins were purchased before mid-April 2021.

More Ether Holders Remain in the Green

As you can see below, as of yesterday June 7, 2021 72% of Bitcoin holders were “in profit.”

This compares to 92% of Ether holders being in profit.

Ethereum has outperformed BTC in the last two weeks and continues its upward trend while maintaining over 90% of its investors in profit and less than 5% of ETH holders at a loss.

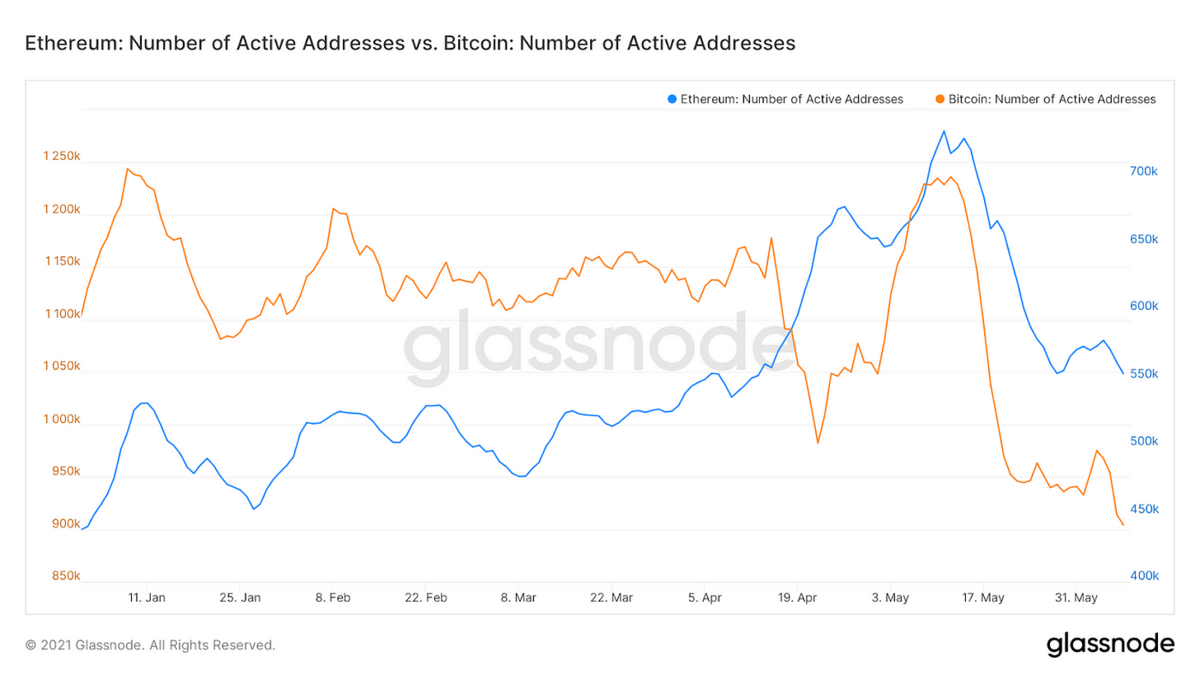

Bitcoin Active Addresses Declining While ETH is Up

As you can see below, the number of Daily Active Bitcoin Addresses has declined 18% from 1.1M in January 2021 to 900k today while the number of Ethereum Addresses has actually increased 22% from 450k in January 2021 to 550k today.

Any way you look at it, Ethereum is gaining major ground on Bitcoin. Here are some additional helpful data points.

Ethereum is Now The Most Traded Cryptoasset

The volume of Ethereum trading is also now higher than Bitcoin for the first time since 2018.

As you can see below, Ethereum has averaged $11.7 billion in daily trading volume the last 30 days compared to $11.3 billion for Bitcoin.

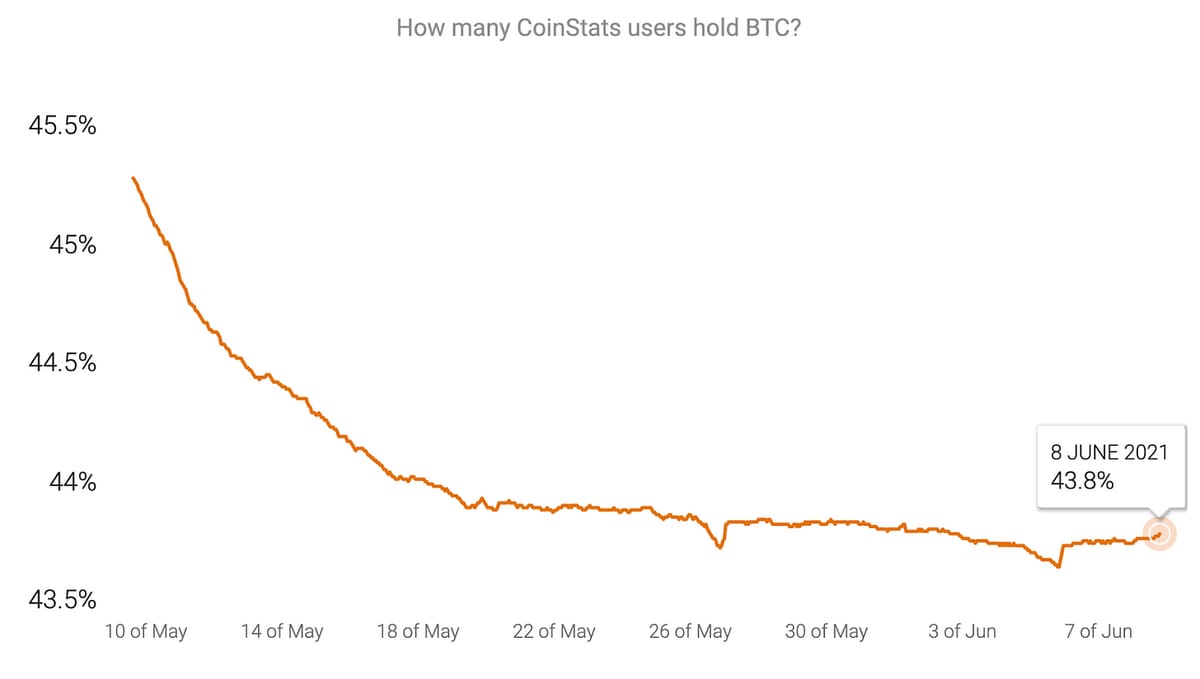

Ethereum The Most Held Crypto Asset

As of June 8, 48.8% of Coinstats users hold Ether (#1 overall) while just 43.8% hold Bitcoin (#2 overall). Coinstats tracks portfolio for crypto investors who hold coins across multiple exchanges and wallets.

Ethereum Is Now Settling More Than 4x The Daily Volume of Bitcoin

According to Money Movers, Ethereum is now settling $52.1B per day in value compared to $12.2B for Bitcoin. This means Ethereum is settling 4.2x more value than Bitcoin each day.

Ethereum’s Transaction Revenues Are More Than 4.5x Bitcoin

Further, according to Crypto Fees, Ethereum has averaged $6.5M in daily transaction revenues compared to $1.45B for Bitcoin.

Ethereum DeFi Has Grown 38% In the Last Quarter

We are now at $59.34B locked in ETH DeFi TVL up 38% from $43B ninety days ago in early March.

Ether Locked in Smart Contracts At a New Cycle High

And yesterday June 7 Ethereum reached a cycle high with 23.22% of its ETH supply locked away in smart contracts, up from 22.3% on May 11.

Looking at Exchange flows, Bitcoin has had a net outflow of $1.3 billion of BTC move off exchanges in the last week, which is a positive sign for the next 7 days of price action as when coins move off exchanges and they are less likely to be sold in the near term.

Ethereum on the other hand has had a net outflow of $1.4 billion of ETH move off exchanges in last week (which is also a bullish sign).

Given all the metrics we conclude that this week Bitcoin will continue sideways price action in the near term while Ethereum continues its slow and steady climb back up recovering from May’s massive selloff.

Ethereum Fundamental Value Model (FVM) Now Live

The Ethereum Fundamental Value Model (FVM) that we introduced two weeks ago is now live on our new web site at www.coinstack.co/ethvalue.

You can now see a live always up-to-date picture of the Ethereum FVM. This model uses the actual cashflows of ETH over the last 12 months to provide a price floor, price target range, and price ceiling for ETH. The fair value price target range per the model is currently $3500-$4900 (between the green and red lines).

Many thanks to Coinstack community member Sank Kulshreshtha for his contributions in creating this new website for us and putting the live model up.

As you can see, per the model, it is a good time to buy ETH.

My Top 30: A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 5-10 years, I would be absolutely sure to include my top 5: ETH, DOT, KSM, RUNE, & MATIC. Here’s my top 30…

I have added MINA to this list this week as it recently began trading and is a potential Ethereum competitor.

To see which exchanges to buy these on, use Coinmarketcap or Coingecko.

Here is my current portfolio by percentage. Note that I still have a higher than usual percentage of Nexo tokens as those are locked in Nexo and I can’t sell them until I close out a loan I have with them.

Top Performers Last 30 Days

Here are the top performing crypto assets the last 30 days according to Coin Market Cap.

Top Performers Last 7 Days

Here are the top performing crypto assets the last 7 days according to Coin Market Cap.

What NOT to Invest In…

In crypto there’s a lot of coins that have zero fundamental value, unlimited supply, or no longer have any active development.

Here’s a list of what’s on my shit list right now and that I do NOT recommend investing in…

Dog Tokens

Doge (DOGE) - A PoW fork of Luckycoin. No development team. No apps. No supply cap. Lots of inflation. Being pumped as a pet project by Musk who doesn’t yet grok that scalability requires a lot of focus and effort and that the future is PoS.

Shiba Inu (SHIBA) - Same as above. Include any doggy token with this list.

Safemoon (SAFEMOON) - Scam ponzi project. No actual value.

Bitcoin Cash (BCH) - Failed Bitcoin fork

Bitcoin SV (BSV) - Failed Bitcoin fork

Ethereum Classic (ETC) - A failed Ethereum fork. No apps, no usage, and staying on PoW. Being completely left in the dust as ETH 2.0 launches and moves to PoS.

Join Our Tuesday Crypto Advice Community Zoom Calls

Every Tuesday Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 9am PT / 12pm ET / 5pm GMT. All buyers of Mrs. Bubble’s NFTs (and investors in the Coinstack Alpha Fund) are invited to join and ask questions and share learnings with each other.

Just buy any Mrs. Bubble NFT on OpenSea and then let me know by replying to this message or sending me a Telegram message and I’ll add you to our weekly call invite.

You can think of buying the NFT as supporting beautiful joyous art AND a ticket into our community. We had 10 callers on last week’s call.

Join our weekly calls by getting a Mrs. Bubble NFT or investing in the Coinstack Alpha Fund.

Mrs. Bubble’s NFTs of the Week

You can buy a Mrs. Bubble NFT here and join our community for weekly crypto Zoom calls. We use these funds to be able to create more art. Mrs. Bubble the artist is my wife Morgan, so supporting her work directly supports our family, her art, and this newsletter being able to continue.

Here are the featured Mrs. Bubble art pieces for this week. Mrs. Bubble is putting up a new piece each day and plans to build a long-term NFT following. You can think of her NFTs as both beautiful art that uplifts the world AND your digital ticket into our live weekly crypto advice calls.

Here are a few of Mrs. Bubble’s newer art pieces...

And here are her most viewed art pieces so far out of her first 134 NFTs...

Thank you so much for joining the Coinstack community and supporting Mrs. Bubble’s art.

Join The CoinStack Telegram Community

Joinour Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1500 members on our Telegram.

The People I’m Following Closely on Twitter

Mrs. Bubble The NFT Artist (my wife Morgan Allis)

How To Get Started With Crypto Learning

Bankless - The DeFi community (Substack + Podcast + Discord)

The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Website at Coinstack.co

Substack at CoinStack.substack.com

Twitter at Twitter.com/ryanallis

Coinstack Twitter at twitter.com/coinstackcrypto

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Please share with your friends and colleagues.