Social Links: Twitter | Telegram | Newsletter

Learn More at www.rootstock.io and www.crowdcreate.us and invest.modemobile.com

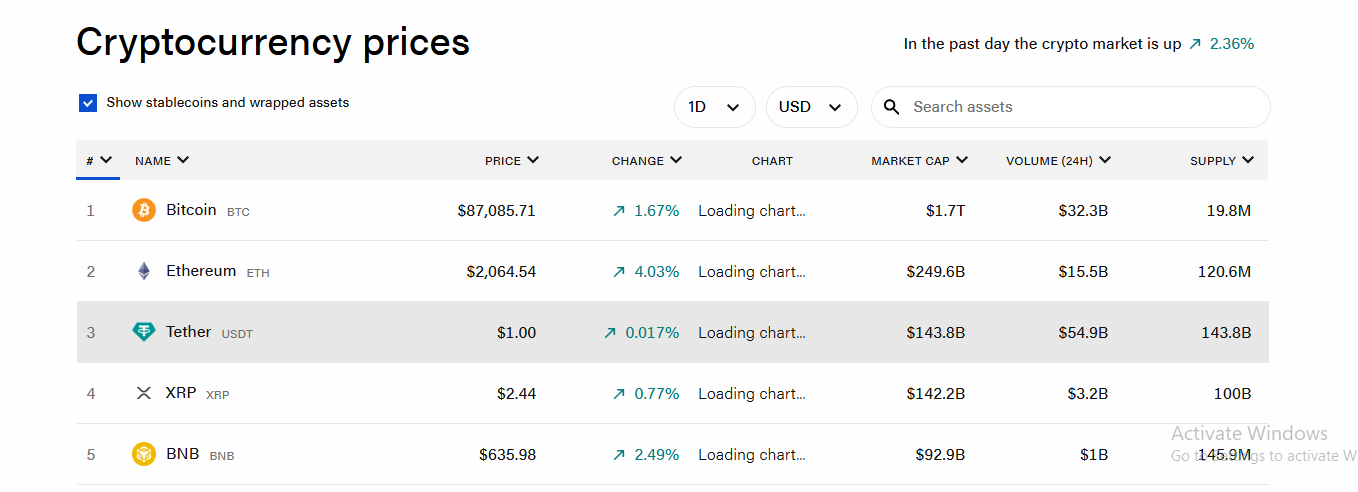

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 315k weekly subscribers. This week, Bitcoin price passed $88k, the US Treasury lifted sanctions against Ethereum mixer Tornado Cash, Pump.fun launched a DEX called PumpSwap and big venture news came in for the Walrus Foundation ($140M) and Rain ($40M).

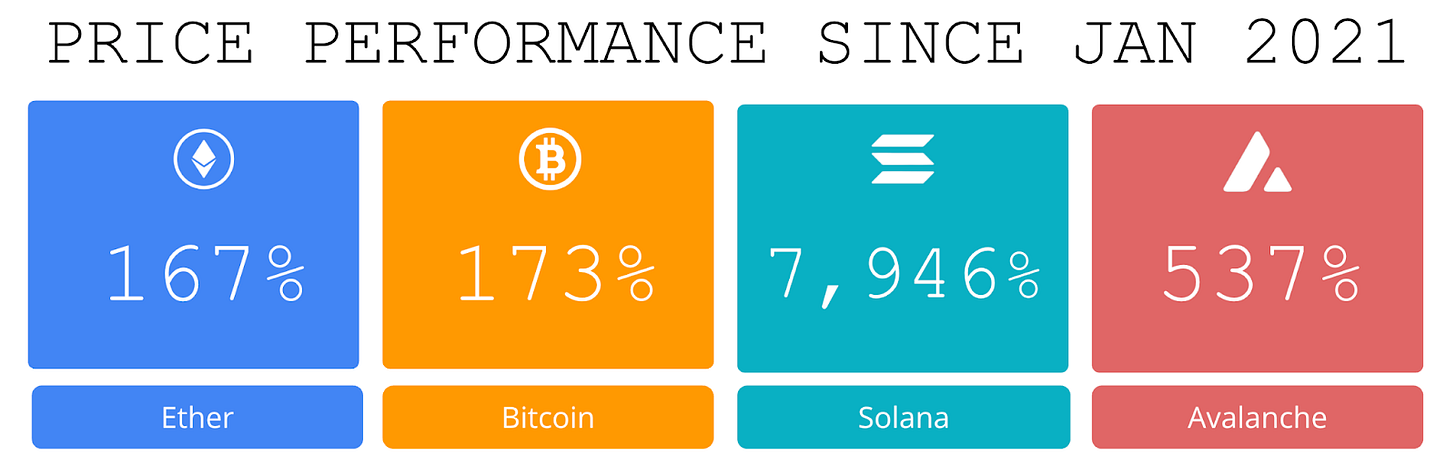

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 80%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

This tech company grew 32,481%...

No, it’s not Nvidia—it’s Mode Mobile, 2023’s fastest-growing software company according to Deloitte. Their EarnPhone and EarnOS helped +45M users earn $325M+, driving $60M+ in revenue. Mode just secured its Nasdaq ticker $MODE, and you can still invest in their pre-IPO offering for a limited time.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Google paid Apple $20B to be the default search engine on iPhones — and both companies hoped to shield it from the public.

The deal continues to fuel Google’s ad revenue engine, which made an eye-popping +$250B in 2024.

Mode Mobile wants smartphone users to get their piece of that money.

They’re flipping the data industry on its head, splitting the profits with their users by turning smartphones into an income-generating asset. Here’s what that looks like:

Paid over $325M to over $45M users.

Generated 32,481% 3-year revenue growth.

Ranked #1 fastest-growing software company by Deloitte in 2023.

📲 Their EarnPhone could be considered the Uber of smartphones, and they’re gearing up for a potential IPO on the Nasdaq (ticker: $MODE).

And as companies desperately seek to extract more data, you can invest in Mode’s pre-IPO offering at just $0.26/share.

Disclosures

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Bitcoin gains alongside XRP, SOL as Trump tariff concerns ease: Bitcoin and other major cryptocurrencies made gains this week as investors found some relief from the White House taking a more moderate stance on reciprocal tariffs and gained confidence from recent economic data.

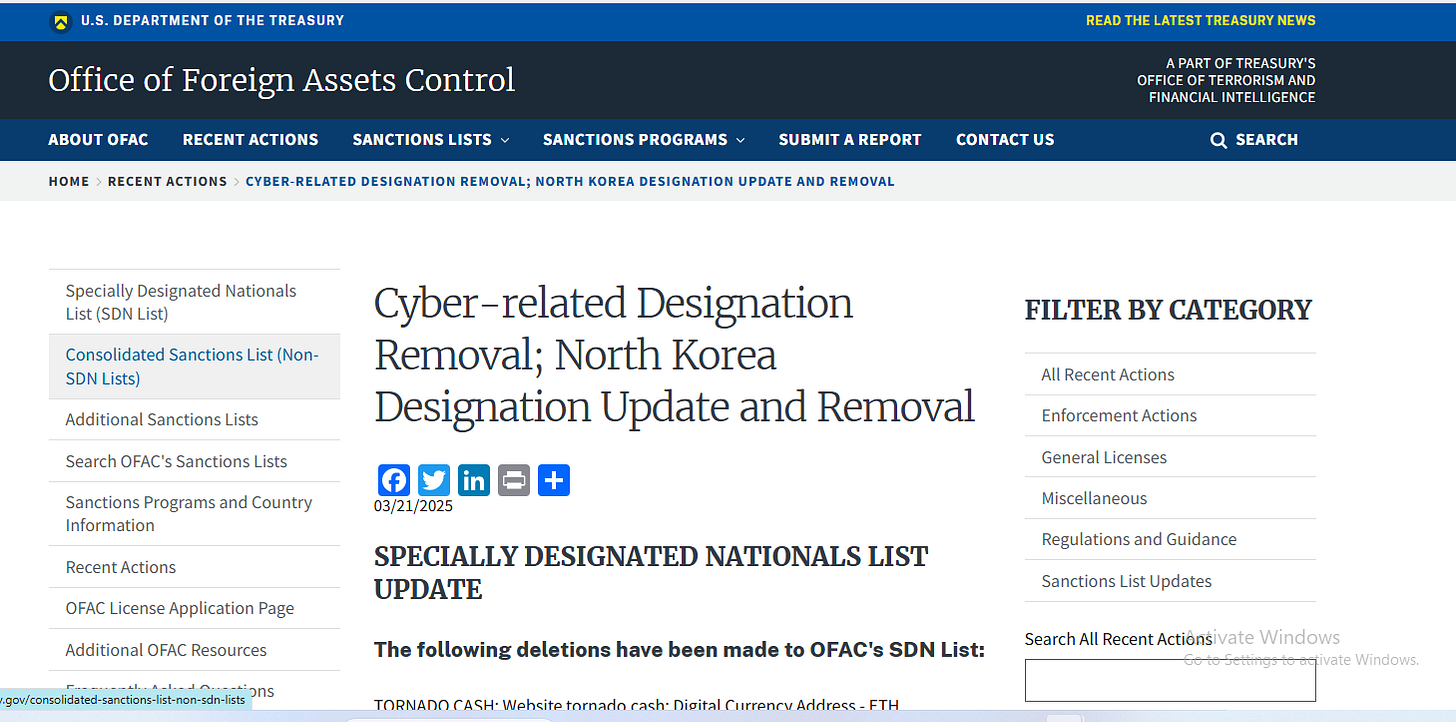

⚖️ US Treasury Lifts Sanctions Against Ethereum Mixer Tornado Cash:The United States Treasury announced Friday that it has delisted Ethereum coin mixing service Tornado Cash from its list of parties sanctioned by the Office of Foreign Assets Control, or OFAC, reversing course after first blacklisting the service in 2022.

🚀 Pump.fun launches DEX called PumpSwap to instantly migrate graduated tokens:Pump.fun tokens will now move directly onto PumpSwap once they've completed their bonding curve, seemingly forgoing the migration to the Solana-based DEX and automated market maker (AMM) Raydium. The move also eliminates the 6 SOL migration fee and opens up the opportunity for creator revenue sharing in the future, the platform wrote on the social media platform X.

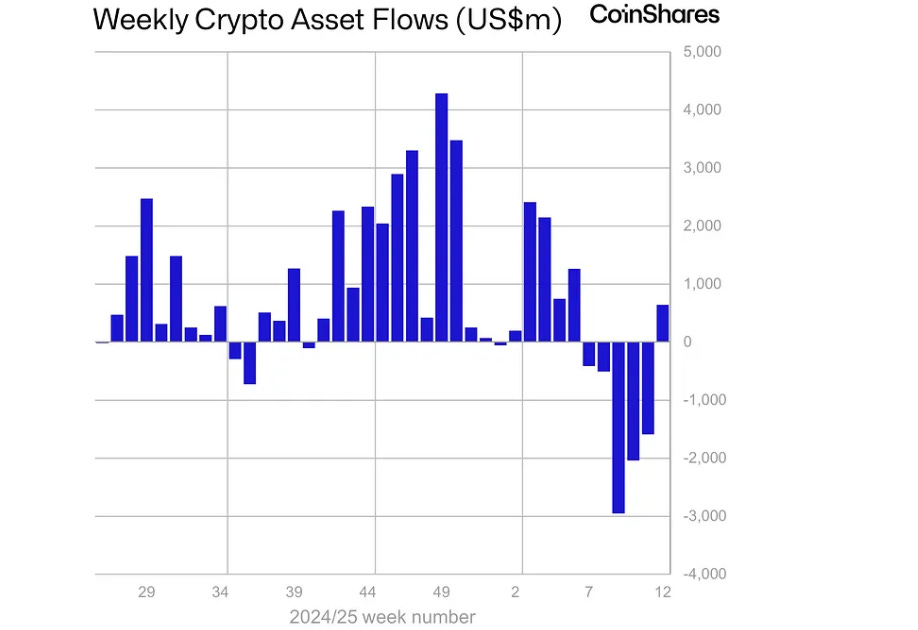

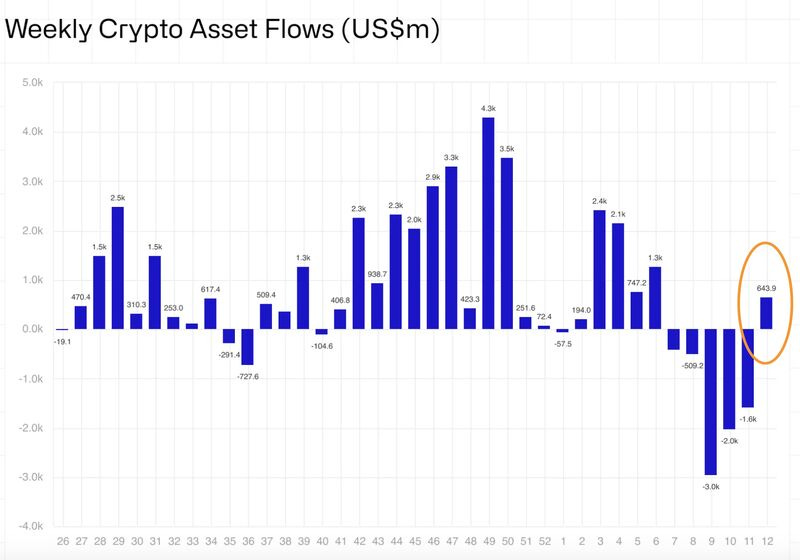

📉 Crypto Investment Products Reverse 5-Week Outflow Streak, Adding $644 Million in Assets:Inflows to Bitcoin exchange-traded funds largely led the shift, followed by flows to Solana, Polygon and Chainlink investment products, CoinShares Head of Research James Butterfill said Monday in a report. Meanwhile, total assets under management for crypto investment products rose 6.3% from their low point on March 10, according to CoinShares’ data.

⚖️ Crypto Startups Should Be Allowed to Raise Money With NFTs, Says SEC Leadership: SEC Crypto Task Force lead Hester Peirce said Friday that crypto projects like Stoner Cats—which used NFTs as a fundraising mechanism to fund their work—should be exempt from securities regulations, and may soon receive that clarity from the powerful regulator.

💬 Tweet of the Week

Source: @gamestop

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. After 5 consecutive weeks of net outflows totaling more than $6.4B, including 17 consecutive days of outflows, we finally have some upward momentum.

Overall, $644M inflows occurred last week with BTC leading the way ($724M) and ETH still bleeding out (-$86M).

Source: @DavidShuttleworth

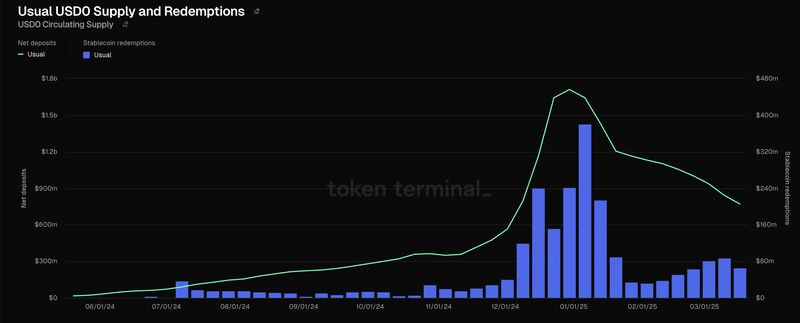

2. Net deposits into Usual quickly grew to $1.7B heading into 2025, but have since declined by 57% YTD. Meanwhile, total circulating supply of the protocol's stablecoin USD0 has fallen by 42% and its native token USUAL is down 86% YTD.

The stablecoin market is more competitive than ever, integrations and usability are key. Build on Coinbase Base and ship on Solana Solana Foundation.

Source: @DavidShuttleworth

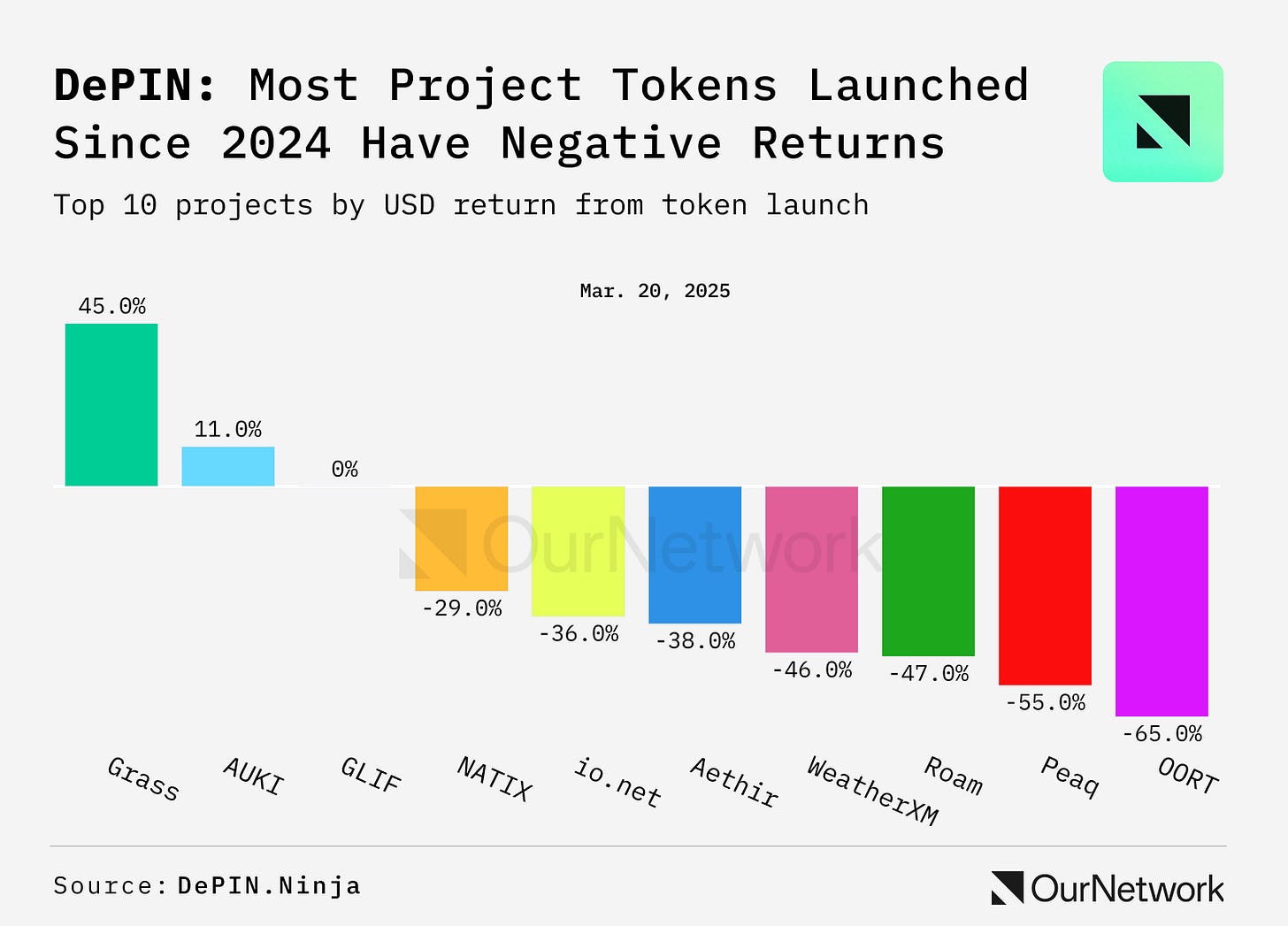

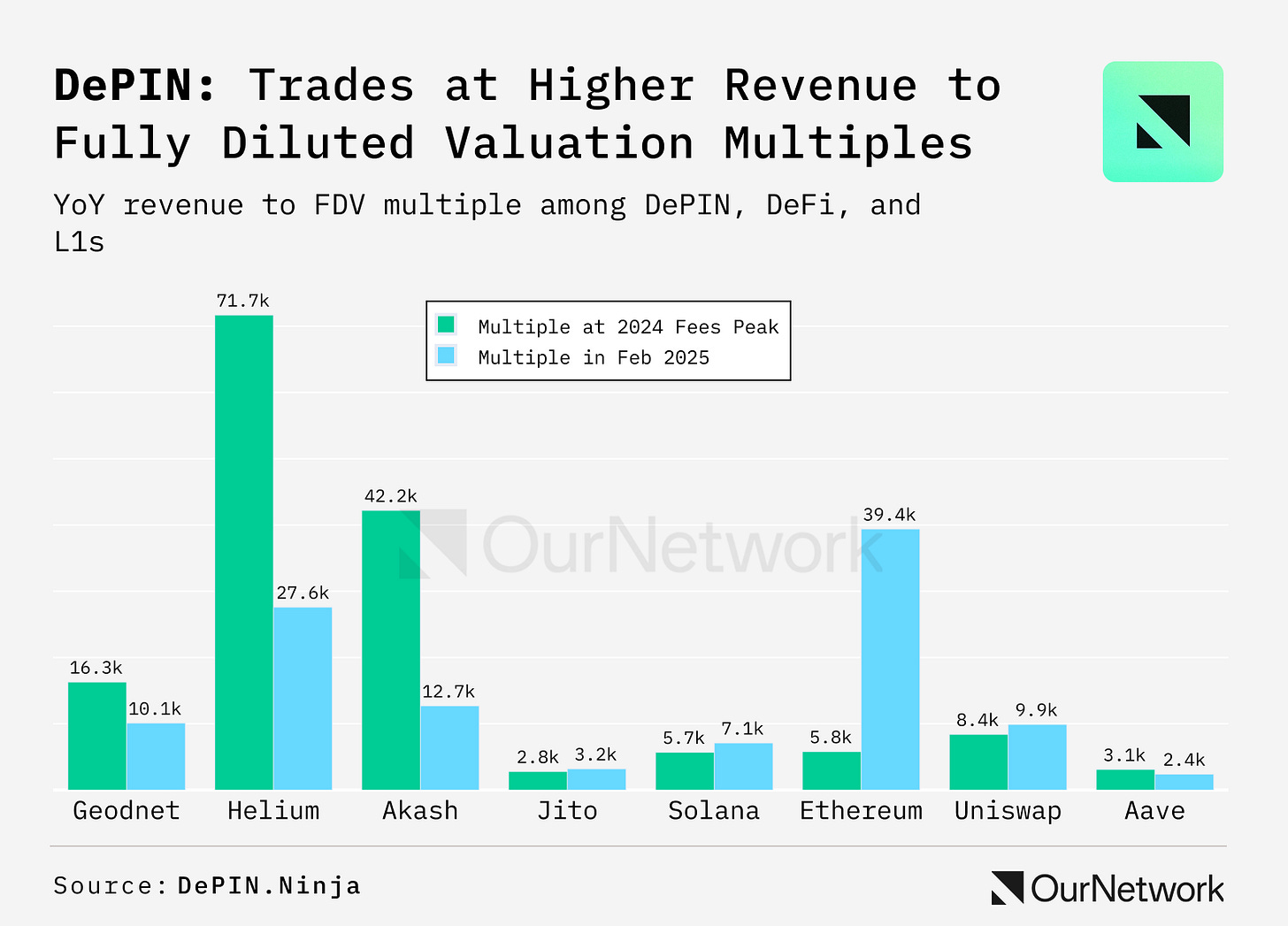

3. New DePINs are Trading Significantly Below their Token Generation Event Price — and Even VC round — Valuations, While Old DePINs are Growing Revenues Faster than DeFi.

Source: @OurNetwork

4. DePIN multiples are higher than the rest of crypto, but that doesn't tell the whole story — DePINs grow into their higher revenue multiples during bear markets. Crucially, Layer 1s and DeFi shrunk out of their lower multiples in bear markets, as onchain activity & revenues fall even faster than prices.

Source: @OurNetwork

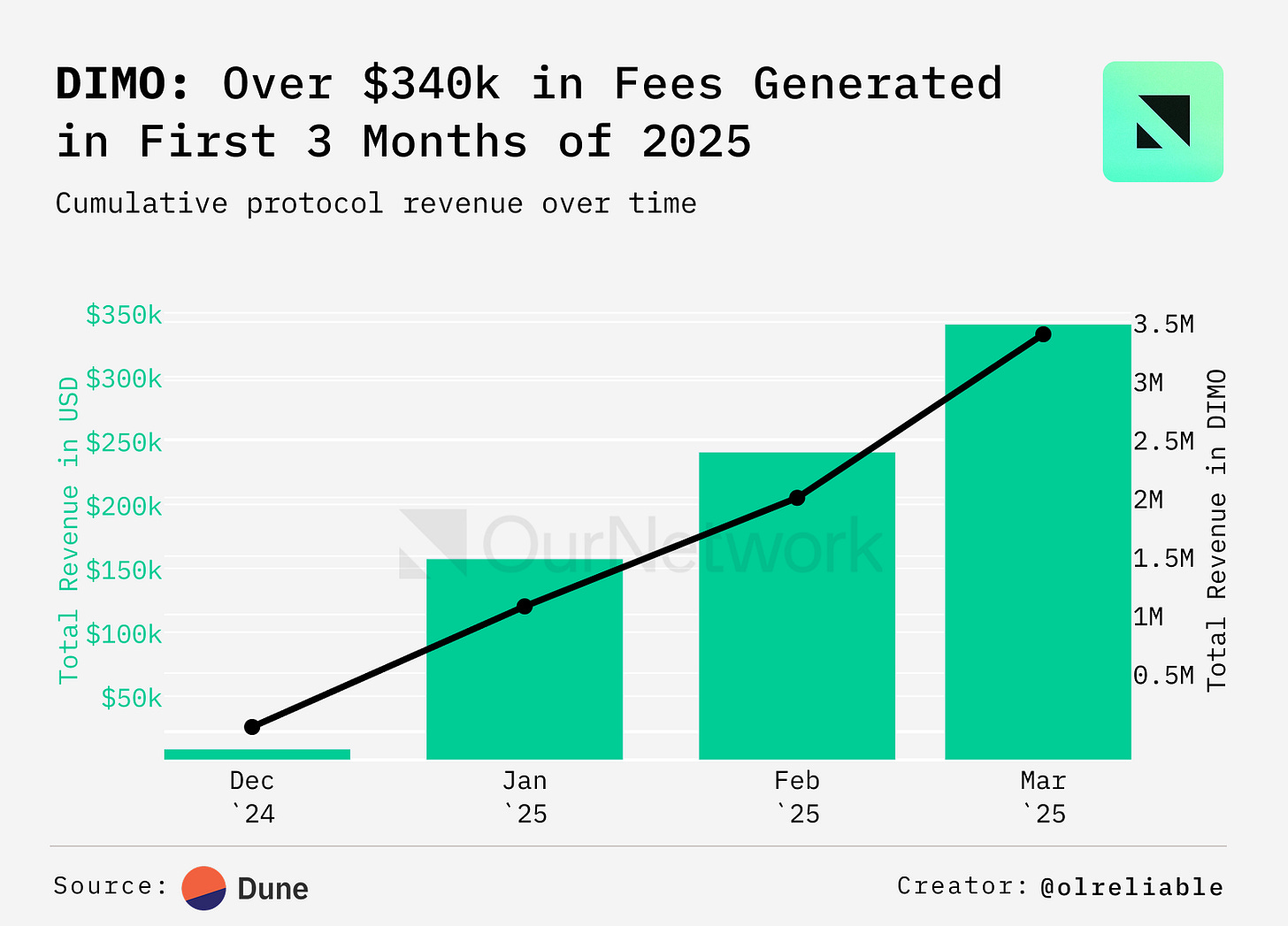

5. 170,000+ Vehicles Connected, with $20M+ in $DIMO Distributed to Drivers as Reward

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Frontier of Programmable Money

About the Author: David Shuttleworth, is a Research Partner at Anagram, a blockchain research institution. This is an excerpt from the full article, which you can find here.

Prelude

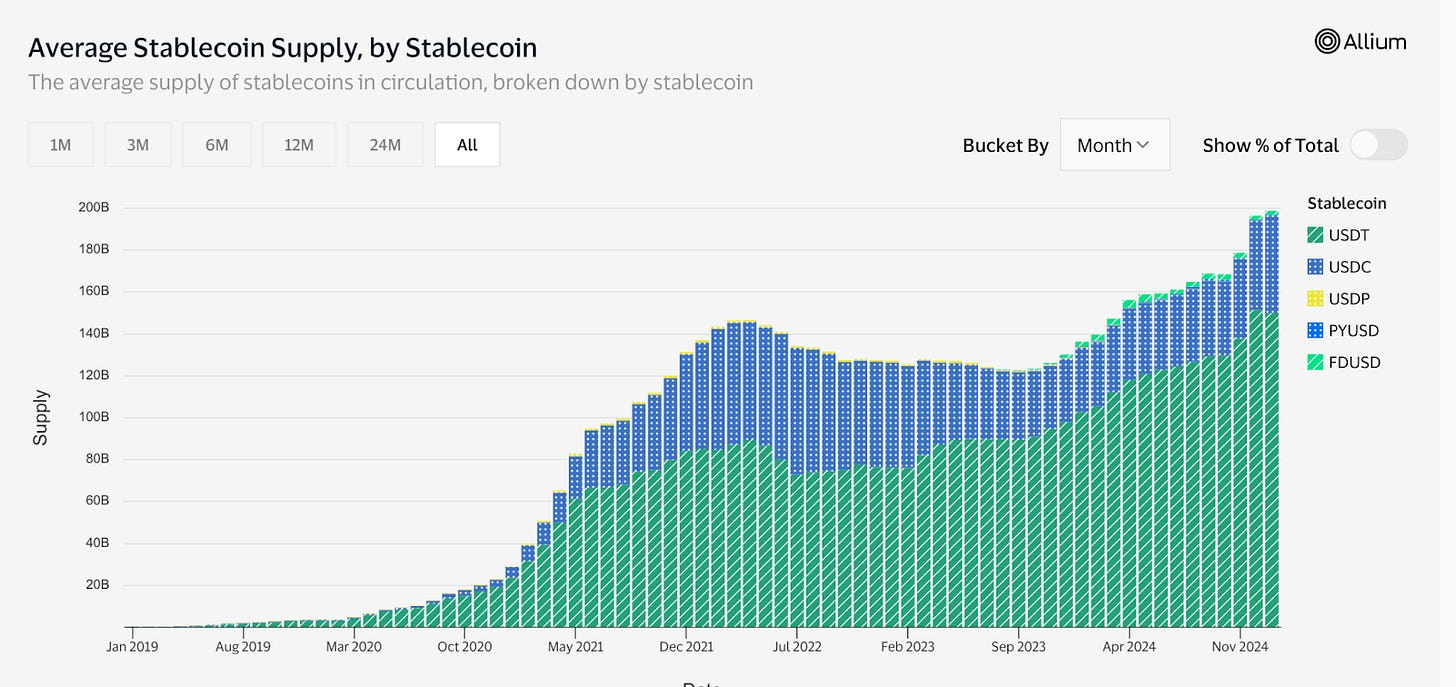

The proliferation of stablecoins has been massive and with haste. In 2024 alone, the average supply of fiat-backed stablecoins grew by 53% to reach an all-time high of $200B. Moreover, stablecoins have handled more than 4.7B total transactions and have settled $5.8T in total transaction volume this past year. To put this into perspective, Visa settled $15.7T of volume in 2024. The stablecoins USDC and USDT now account for more than a third of Visa’s transaction volume. This does not account for decentralized versions such as Ethena’s USDe and Maker’s DAI, which represent $5.7B and $4.7B in circulating supply, respectively.

Stablecoins are now ubiquitous and long term product market fit and adoption. To this point, however, their application has been overly simplistic and that’s okay, it’s part of their beauty. Users deposit $1 of fiat and receive $1 worth of a given stablecoin onchain, pegged 1:1, redeemable at any time. USDT and USDC have largely controlled the market, but this is beginning to shift. Traditional payments giants like Stripe, PayPal, and Revolut have taken heed and are rapidly entering the space. In October 2024, for instance, Stripe acquired the stablecoin payments platform Bridge for $1.1B along with the web3 wallet infrastructure provider Triangle. Payments giants are not just operating as the middleware, they are becoming the very gateway into the space.

Yet the new frontier of digital money is not simply a store of value, it is programmatic. It has form and function beyond that of traditional fiat. It performs specific tasks for the end user. It is never idle. It is always at work. In a word, the digital dollar is beginning to take agency.

Circle’s acquisition of Hashnote, the largest tokenized money market fund with over $1.5B in deposits, highlights this. Hashnote’s infrastructure functions as a building block between Circle’s USDC and onchain, yield-bearing collateral. Users can now seamlessly move between simply holding a vanilla fiat-backed stablecoin (USDC) to earning yield through tokenized short-term T-bills (USYC) and vice versa, accessible 24/7. Fundamentally, it is moving between cash and yield.

Franklin Templeton’s tokenized money market fund and its BENJI token, which functions like a stablecoin in many ways, further signal the way forward, particularly with the recent deployment to Solana. Pairing this product with Solana Pay, for instance, enables users to hold a money market fund as a default instead of a vanilla stablecoin, earn passive yield on idle capital, and then make purchases directly with their assets whenever they choose. So digital money can move between cash and yield, but with the additional core utility of instant payments.

These are just a few of the many steps towards the new frontier. The design space is wide open, and many different new classes are beginning to take shape, integrating yield and agency in novel ways. Towards the bleeding edge of this are stablecoins that generate yield through arbitrage and MEV, stablecoins that generate yield through aggregation, and the holy grail of contemporary DeFi, stablecoins backed natively by Bitcoin. CAP, Perena, and Yala have emerged to build these applications from the ground up, creating a host of new use cases.[1]

Moreover, blockchains themselves are moving directly down this path. At the heart of digital money are the smart contracts that power them. Every digital dollar onchain is governed by a set of rules that run independently of any human interaction. This is what begins to give them agency. At its very core, it enables developers to embed highly customizable features and functions directly into digital money.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and paid ads services. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.crowdcreate.us and invest.modemobile.com