Welcome to the CoinStack Newsletter. This issue provides a detailed price forecast for Bitcoin for 2021-2027 as well as 13 indicators to time the top of the current market cycle. This issue not only tells you where the price is going, but when to sell, and also what to do when you sell (convert part of your portfolio to stablecoins to get 10-25% annual interest in DeFi). Feel free to save and share our detailed Bitcoin Price Forecast Google Sheet.

If you like this newsletter please follow @RyanAllis on BitClout.

Bitcoin Price Forecast #1 (2021-2027)

By now you may know that Bitcoin is likely to surpass that market capitalization of gold ($11T) sometime this decade, which would make Bitcoin worth around $550k per token. I call this the “fundamental value of Bitcoin.”

I believe it’s just a matter of time before the market catches up to the fundamental value. While it may be a bumpy ride with lots of volatility along the way, the general price direction for Bitcoin this decade is clear... from $7,193 on Jan 1, 2020 to $550k+ by December 31, 2029. It’s looking like it’s going to be a great decade.To help myself gain confidence and reduce anxiety in my personal crypto investing, I’ve spent much of 2021 building an in-depth price forecast for Bitcoin for 2021-2027 that builds upon the work of many of the great cryptoquants who have come before me.

This Bitcoin forecast builds on the work of Willy Woo, Plan B, Dan Morehead, Benjamin Cowen, and Philip Swift and is built using data and models from Glassnode, CryptoQuant, The Block, Pantera Capital, Rekt Capital, BlockChain Center, CoinMetrics, and Look Into Bitcoin.

So, let’s get right to it and start with my Bitcoin price forecast for 2021-2027.

As you can see, I am expecting a cycle top around December 2021 of $150k and for BTC to reach the market cap of gold by December 2025.

What Happened in The First Three Bitcoin Cycles (2008-2019)?

To see how I came up with this forecast, let’s look at the historical data, showing the cycle tops and bottoms for each of the past three cycles.

You can see that Bitcoin grew from a market cap of $205 million in 2010 to a market cap of $335 billion in December 2017 to a market cap of $1.1 trillion today in March 2021.

Now Let’s Look at the Current & Next Cycle

I am forecasting that we will grow from a market cap of $1.1 trillion today to $10.5 trillion by 2026.

Understanding The Four Year Cycle of Bitcoin

The most important elements to understand when forecasting Bitcoin price are:

Where we are in the four year cycle (currently in year 2 of the fourth cycle)

Retail demand (almost as high as it has ever been)

Institutional demand (by far the highest it has ever been)

On-chain metrics (all trending in a positive direction)

If you can understand these, you can make a pretty good forecast.

We’ll talk about all of these in this newsletter, but we’ll start with where we are in the four year cycle.

As you can see from the below Asset Returns table from Charlie Bilello, the only two years that Bitcoin has ever been down for a year is in Year 3 of its cycle (2014 and 2018). This is why so many people expect 2022 to be a pull back year for Bitcoin after a major growth phase in 2020-2021.

We are currently in the 4th Bitcoin market Cyclh, which began in May 2020 at the last halving event (the moment when the block reward for Bitcoin miners gets cut in half, reducing the rate of new supply). Here are the dates for the first four cycles.

Cycle 1: 2008-2011

Cycle 2: 2012-2015

Cycle 3: 2016-2019

Cycle 4: 2020-2023

Bitcoin was created on October 31, 2008 and so the first cycle didn’t have a block reward halving until the end of it at the first ever halving event on November 28, 2012.

Each Year in the Cycle Has a Theme & Return Profile

This four year cycle has four distinct phases to it.

Year 1 - Halving Years (2012, 2016, 2020) - Avg. Return: +204%

Year 2 - Cycle Peak Years (2013, 2017, 2021) - Avg. Return: +3419%

Year 3 - Pullback Years (2014, 2018, 2022)- Avg Return: -65%

Year 4 - Recovery Years (2015, 2019, 2023) Avg. Return: +65%

Right now we are in late-March of the Cycle Peak year and are up 107% YTD ($58k vs. $28k). I expect we will see at least another 150% rise this year (which would give us a peak of somewhere around $150k).

Here’s a great graphic from Rekt Capital sharing historical actuals (2011-2020) as well as what they are expecting for 2021-2024.

Rekt Capital forecasts we will reach $160k prior to a pull back to $50k. I’m personally expecting slightly lower on the top ($150k) and slightly higher on the bottom ($60k) due to more institutional inflows than ever, stabilizing the market.

Where We Are in the Current Cycle (Day 836)

This wonderful below market cycle graph from Benjamin Cowen of @intothecryptoverse shows us where we are in the current cycle, based on days from the last bottom. As of March 30, 2020 we are now 836 days after the 2018 bottom, which occurred on December 15, 2018 at $3225 per Bitcoin.

A small note is that Benjamin’s chart only went through day 700 so I have added in the approximate price movement for the last few months in order to show where we are currently.

The overall takeaway from the below graph is that we are still somewhere between 200 and 300 days away from the Cycle 4 market cycle top. We are at day 836 and I expect the top somewhere near day 1100.

Based on past cycle timings show above this market cycle is likely to peak between day 1000-1250 after the last bottom on December 15, 2018 which would be September 30, 2021 at the earliest and May 18, 2022 at the latest. Cycle 3 peaked at day 1069, and I expect this cycle will last a bit longer. Many analysts have pointed out the each cycle has lasted longer than the previous one.

Around Day 1100 is in my opinion the most likely top for this market cycle, which would be late December 2021, though it could reasonably last as long as Q2 2022.

So from my vantage point we have roughly 8 months left in this current bull market cycle. And with the amount of institutional capital now flowing into Bitcoin, there should be less of a severe crash than in the first three retail-driven cycles.

Lowest Imaginable to Highest Anticipated Ranges

In my expected case forecast, I anticipate Bitcoin will reach $150k+ in late 2021/early 2022 before we begin to go back down.

The chart above shows that my expected range for the top is between $100k and $225k and my expected range for the 2022-2023 bottom is $30k to $101k. My personal expectation, what I deem to be the most likely figures, is that we will top out around $150k in this cycle and then bottom out in late 2022 back around $60k to $70k (interestingly, just about where we are now) -- before starting to go up again in 2023, the Recovery Year.

I’ll make a prediction I expect to hold true indefinitely, barring any major Black Swan events. We will never ever again see Bitcoin below $30k.

There’s just too many people who get what Bitcoin actually is now and realize this isn’t just a speculative asset, but rather the globally-neutral currency of exchange that increases its value over time--powering an entire sector of emerging innovation.

It’s only volatile because people are figuring out what it is as it appreciates toward its long term intrinsic value somewhere north of the value of the market cap of Gold, making it worth above $500k.

What Are Other Analysts Saying for This Cycle Top?

Here’s what other cryptoanalysts and models are forecasting for the current cycle top.

Other forecasts for this cycle top range from $84k on the low end to $288k on the high end.

The $84k-$101k figures in 8-10 above aren’t actually max cycle top predictions, but rather what the stock to flow models say is the fundamental value for Bitcoin for this cycle is, based on the current stock-to-flow ratio. In every cycle so far, the bull market peak was substantially above the S2F model fundamental value. For example, in the 2017/2018 cycle the S2F model predicted a max fundamental value of $5675 and we ended up reaching $19498 by December 2017 before crashing back down to $3271 a year later in December 2018. The Glassnode stock to flow prediction of $101k in my opinion is the minimum I expect the current bull cycle will reach.

How the Stock Market May Affect the Bitcoin Market

The stock market right now is historically overvalued due to easy money from the Fed. As the Federal Reserve pulls back on low interest rates as we reach full employment in 2022, I do expect the stock market to pull back 20-30% to reach more sustainable valuation levels. This inevitable pullback may affect the Bitcoin price in the short term (due to lower paper net worth of investors, making them less likely to want to invest in the short term), but in the big picture over the course of 5-6 years I do not anticipate stock market fluctuations to affect the price of Bitcoin.

While right stocks and bitcoin are correlative due to easy money, I expect many people will be pulling capital out of fiat savings and stocks to put into the more productive cryptoeconomy and decentralized finance applications that generate 20-30% yield on stablecoins this decade.

I expect U.S. stocks to double this decade while I expect the crypto economy to go up 20x. Yes, it’s sort of obvious where to invest.

It’s going to get really exciting when Company Security Tokens from Polymath take off -- and start representing actual equity ownership in corporations and DAOs. Why deal with 2 day settlement and the old stock market when you can move onto the new stock market.

Yes, that’s right. The entire stock market will run on the blockchain -- along with the entire new banking sector. It’s gonna be a fun decade of innovation!

My Bitcoin Forecast for the 2024-2026 Cycle

I’ll also share my predictions for the 2024-2027 Market Cycle. For what it is worth, I’ve never seen anyone do this before. Few people are willing to publish a 6 year forecast.

It will be fascinating to see what actually happens.

By the late 2025/early 2026 market top I expect we will reach around $550k per Bitcoin before tapering back 50% to $275k by late 2026 before resuming to the upside.

The Combined Bitcoin Forecast for 2021-2027

When you bring all the forecasts together, here’s the overall forecast for the end of each of the next six years:

And finally we can show what impact this will have on market capitalization. You can see that I am projecting that we will grow from the current $1.1 Trillion Bitcoin market cap to $10.5 Trillion by 2025-2026.

Will This Forecast be Accurate?

It is guaranteed to be wrong in some way. It may take till the 2028-2031 cycle to equal gold’s $11T market cap, or perhaps even longer.

At the end of the day, all I know is this. Bitcoin is likely to be worth a lot more in 2030 than it is today.

On a year-to-year basis, what I’m mostly focused on is only whether my forecast is directionally correct as a general guide -- as I can use on-chain indicators and market indicators (that I explain below) to have more granular awareness of when we are getting near the tops and bottoms. I plan to keep this forecast updated and post any major changes in my thinking to this newsletter and Telegram group.

Be warned, there is nothing perfectly predictable in life except unpredictability. By the crypto market going up this decade as the entire financial and legal world gets rewritten on top of smart contracts -- that one seems extremely obvious.

Institutional Buying Making Dips Less Severe Than Before

According to the Coinbase’s recent S1 filing, Coinbase’s volume for example has gone from 80% retail in Q1 2018 to only 36% retail in Q4 2020.

This means that 64% of Coinbase’s volume in Q4 2020 was from institutional buyers, compared to just 20% four years ago.

These Bitcoin buying institutions (ranging from Mass Mutual to Square to Microstrategy to Tesla to sovereign wealth funds) now get the Bitcoin story and will scoop up any coins that get listed below $50k.

How to Time the Top of the Cycle - 13 Indicators

So now that I know generally where are going, it’s really about using more granular metrics to determine if we are nearing the market top.

How will I know when we’re getting close to the top of this Bitcoin market cycle? Well, there are thirteen indicators I use to track whether we are getting overheated or not. All 13 of them currently are saying “hold” and not to “sell.”

These metrics are:

Now let’s add in their Buy/Sell/Hold recommendations as of today, March 30, 2021:

What are these indicators saying? You should hold your existing Bitcoin and if you don’t own any yet, you should buy some now before we go up another 100-150% in 2021. These models indicate we are quite a few months away from the cycle top. We’ve gone from $3225 on December 15, 2018 (the last cycle low) to $58,000 today -- and are likely well on our way to above $100k this year.

Cycle Top Indicator Example - Bitcoin RSI

The Bitcoin Relative Strength Indicator above can be used to know when to sell and when to buy. Buy/accumulate when it’s under 55 and sell if it ever goes above 95. You can create this chart yourself on Trading View by pulling up the RSI indicator on the Bitcoin chart. Make the indicator timeframe 1 month and the rolling timeframe 12 months.

As you can see, we are currently at a RSI of 90. When we hit RSI 90 in July 2017 we still had six months left in the bull market cycle.

I plan to write about the other indicators in future issues… (this one is long enough!)

You can look through all the other indicators for yourself by clicking on each one:

When We Get Near the Top, Do I Sell for USD or Stablecoins?

So now that we know the indicators to use to tell if we are getting near a Bitcoin cycle price top, the question becomes, what do I do when we inevitably get there?

Well, you could cash out to fiat and go back to cash that declines in value every year.

Or you could just convert to USDC stablecoins, use them in either Nexo or Aave, and earn 10-20% annual interest on them in the 12-18 months while the market corrects.

Here are the top annual yields you can get currently in NeoBanks:

Nexo - 10-12% on USDC

Celsius - 10.5% on USDC

Voyager - 10% on USDC

BlockFi - 8.6% on USDC

Gemini - 7.4% on DAI

How to Make 15-35% Annual Interest on Stablecoins Using Defi

And here are the top annual yields you can get in well-known DeFi protocols, which operate as decentralized organizations.

The above six platforms are the ones recommended most by Bankless, the top Ethereum community, which has its own podcast, newsletter, and discord channel.

Right now there is a lot of desire to borrow stablecoins (since you can use them to invest more in crypto). As the market cycle shifts, there will more demand to buy them and less demand to borrow them -- so these yields will come down a lot. But they will likely stay above 20% on some strong DeFi platforms.

Think about it.

When you can earn 10-20% annual yield on stablecoins, there’s no reason to ever take your money our of the cryptoeconomy again. If you ever actually need fiat for some reason, you can always take an instant loan against your holdings using the NeoBanks like Nexo, Celsius, BlockFi.

Or fire up your MetaMask wallet and get going with PoolTogether, KeeperDao, Curve, Compound, Yearn, or Aave.

If savings accounts pay 0.1% and DeFi pays 20% on USDC, I’m keeping my money in DeFi.

What Do I Plan To Do?

I’m still learning. My strategy will evolve the next year. I’ll keep you updated as it does. Here’s my current plan.

For each of the 13 above metrics that point to a “Sell” indicator, I will take 5% of my total holdings and put them into stablecoins, slowing going from 0% stablecoins to 65% stablecoins likely by early 2022.

I plan to HODL with around 1/3rd of my portfolio value and “Defi stablecoin” with 2/3rds.

Then I plan to buy back in strong when all the metrics point to buying (likely by the end of 2022/early 2023).

And yes, I do plan to keep people updated as to when these metrics point toward moving more into non-volatile stablecoins.

To defray risk without selling any of my holdings and creating a taxable event, I am also considering buying a put option on Bitcoin mining stocks like Mara and Riot sometime around September/October 2021. I’ll keep you updated.

Why I Learned How to Forecast the Bitcoin Price

I’ve spent the last four months obsessed with the question of “how does one forecast the Bitcoin price top and bottoms.”

Not the short term moves, but the big term macro cycle moves that happen every four years.

I care because if I can figure out how to do that reasonably well, I can know when to expand my crypto investments and when to be more cautious and move a higher percentage of my total portfolio into 20% interest-bearing stablecoins like USDC.

My crypto investing strategy can be summarized as:

Invest in Bitcoin (BTC)

Invest in Ethereum (ETH)

Invest in a number of other earlier stage projects including up-and-coming blockchain protocols, infrastructure plays, dapps, NeoBanks, and security tokens.

Learn how to properly forecast the Bitcoin market using both on-chain metrics and historical analysis.

Use that knowledge of market timing to know when to invest more and when to pull back.

I knew the price of these earlier-stage blockchain projects would be affected by the Bitcoin price. So I spent a lot of time investing in learning how to forecast the Bitcoin price.

I went deep, studying cryptoquants like Willy Woo and Plan B and crypto funds like Rekt Capital and Pantera Capital. I must have subscribed to 30 niche crypto newsletters, with Willy Woo’s Substack and Rekt Capital’s Substack being must reads.

The Summary of What I Learned in My Deep Dive

There is a max supply of 21 million Bitcoin. This number can’t be increased by anyone.

Bitcoin is a globally-neutral decentralized form of money.

Bitcoin is used to store your savings in a digital asset that over the long run increases in value instead of being inflated away like fiat cash.

Bitcoin can easily be used pay for things on the internet (ranging from newsletter subscriptions to Tesla cars) and to quickly and cheaply transfer money to people on platforms that integrate with it like Cash App, Square, Paypal, and now the Visa network.

Bitcoin is already held by 1.8% of the world population, with the pace of adoption being faster than the pace of the internet.

As a store of value and medium of exchange Bitcoin is 100x better than gold which is heavy and hard to split into pieces. Jerome Powell, the Chairman of the U.S. Federal Reserve said last week at a meeting of the Bank of International Settlement Innovation Meeting, “[Bitcoin] is essentially a substitute for gold.” (Note: he was trying to dismiss Bitcoin as being a thread to the dollar by calling it a substitute for gold).

Bitcoin is likely to be worth more the total market cap of gold ($11 Trillion) by the end of this decade.

When Bitcoin reaches the $11 Trillion market cap, it will be worth about $550k per Bitcoin.

As of today, the market cap of Bitcoin represents 58% of the total blockchain-based token market.

Money invested in Bitcoin trickles down into Ethereum and the other 4,501 blockchain-based projects that are currently being tracked on CoinMarketCap, especially the 350 projects where the market cap is over $100 million.

Ethereum has a 0.88 price correlation with Bitcoin currently. Generally speaking, when BTC goes up, ETH goes up, and vice versa. Also, when Bitcoin holders see their portfolio value go up, they get curious about what else is out there, and of course start discovering Ethereum, which is up 1289% the last year compared to Bitcoin’s 819% annual growth.

By investing early in other blockchain related projects with market caps below $200M (you can find fast growing ones on Messari) in a bull market you can make even larger gains than just by holding BTC and ETH. Of course, key to this working is knowing when the bull market is getting close to ending -- which of course led me deep down the rabbit hole of forecasting Bitcoin.

Yes my friend, smart contracts are about to revolutionize both the financial and legal sectors. Get ready.

Why I Expect the Bitcoin Price to Deviate Under the S2F Model

While this forecast for Bitcoin to $550k by 2025 is quite bullish, the stock to flow model is predicting $1.26M by 2025.

While Plan B’s Stock-to-flow model is predicting a Bitcoin price of $1,266,000 by the end of 2025 -- I personally think it will take longer until 2029/2030 to break $1 million per Bitcoin.

Why?

I think more and more people are realizing that Ethereum 2.0 (going live in 2022) will have a lower annual inflation rate than Bitcoin (so Ethereum will win on being the soundest store-of-value) and on actually being useful for building Dapps due to have smart contract programmability. Many people don’t yet realize that Bitcoin’s annual rate of increase for this cycle is 1.7% while Ethereum 2.0 will be between 0% and 0.5% (and may even be deflationary due to the fee burning coming from EIP-1559).

You can watch this Bankless video on Ethereum as UltraSound Money to learn more.

I also think that the high-energy consumption of Proof-of-Work is becoming more and more societally unfeasible with each passing year due to climate change issues and that there will be a greater and greater trend during 2021-2030 toward more environmentally friendly proof-of-stake blockchains like Ethereum and Polkadot.

Polakdot (with 10% initial inflation) may ultimately have the best tech, but Ethereum has the best monetary policy and for now, by far the more developers and dapp users. So I ultimately think Ethereum will beat Bitcoin sometime between 2025-2030, as I wrote about last week.

Chart of the Week - Coinstats User Holdings

Coinstats is used to keep track of the values of your crypto portfolio when it is spread out across multiple wallets and exchanges.

48.5% of CoinStats users (professional crypto investors with multiple wallet and exchange accounts) hold Bitcoin in their portfolio as of today. This is the second most overall to Ethereum, which is in the wallets of 52.5% of CoinStat users.

NFT Artist of the Week - SwanVR

Check out SwanVR on OpenSea and on KnownOrigin. She is a VR artist who has minted four NFTs so far. She was a finalist in the Kusama Art Competition. She creates incredible 3D NFT art. She will be dropping her genesis piece on Foundation next week.

This week I met her here at an NFT meetup in Bali and purchased her 3D NFT called The Age of the Artist. She creates them in Oculus using TiltBrush.

What the Heck is BitClout?

I’ll be doing a full write up BitClout soon.

BitClout is the new Twitter. But it’s decentralized and all creators get their own token.

You can invest in anyone who you think will gain a good following. All the users on the platform own Bitcoin, as you have to use Bitcoin to get in.

You send in a little bit of Bitcoin and then you get BitClout’s token. You then invest the BitClout token in the creators you believe in -- both to support their work AND because their token will appreciate in value over time if more capital gets invested.

Here are two pro tips for Bitclout...

Pro Tip #1:Buy the @Ryanallis coin on BitClout to support this newsletter content and to have a chance for it to rise in value as others buy it. So far $26k has been invested in the @Ryanallis token by 32 different investors -- all in the last 24 hours and then token value has gone from $1 to $1400 per token. I’m going to be using BitClout as my main social network over the next decade. It’s sort of perfect for the type of analysis I’m putting out about crypto. I also will be giving out special Telegram access and early content to people who own at least 0.1 of the @ryanallis token.

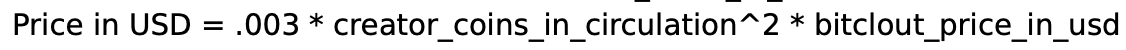

Pro Tip #2: As soon as you sign up, your token gets created. Put around $100 into your own token (or more if you plan to be a major user of BitClout). The first few tokens are really cheap. They go up for every token sold based on this formula.

You can sign up for BitClout here.

If you’re a content producer, community builder, or crypto enthusiast, you absolutely have to be on there.

And if the concept of a decentralized social network fascinates you, you can read the BitClout one pager here.

CoinStack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

A Long-Term Crypto Portfolio

If I were creating a portfolio from scratch right now that I didn’t want to touch for 10 years, I would be absolutely sure to include:

60% of Portfolio (The BEPKN Portfolio)

Bitcoin (BTC) 10% of portfolio

Ethereum (ETH) 20% of portfolio (extra weighting on this one)

Polkadot (DOT) 10% of portfolio

Kusama (KSM) 10% of portfolio

Nexo (NEXO) 10% of portfolio

40% of Portfolio - About 3% Each

Voyager (VGX)

Uniswap (UNI) Chainlink (LINK)

Terra (LUNA)

Cosmos (ATOM)

Sushi (SUSHI)

Polygon (MATIC)

Polystarter (POLS)

Decentraland (MANA)

Ocean Protocol (OCEAN)

Harmony (ONE)

RioDeFi (RFUEL)

PlasmaPay (PPAY)

Polymath (POLY)

Ren (REN)

PankcakeSwap (SWAP)

The People I’m Following Closely on Twitter

Begin Here If You’re Getting Started With Crypto

Michael Saylor - Bitcoin is Hope (Podcast)

Bankless - The DeFi community (Substack + Podcast + Discord)

The CoinStack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Just my opinions. Not intended as financial advice. At the time of publication, we are long on nearly everything we write about as we believe in it. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome:

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

Substack at CoinStack.substack.com

Please share with your friends and colleagues.