Social Links: Twitter | Telegram | Podcast | Newsletter | NFTs

Learn more at www.connect.financial, www.revix.com, and www.momentofans.com

shared.image.missing_image

Thanks to Our Coinstack Sponsors…

Connect Financial empowers people and businesses to do more with their digital assets. Their flagship credit cards allow users to enjoy their crypto's spending power, without selling their digital assets and earn rewards on everyday purchases. Learn more at www.connect.financial.

Revix is a multi-asset WealthTech business targeting the African and Middle Eastern markets. It allows for effortless purchase of crypto, stocks, thematic ETFs, real estate, currencies, commodities, and more. With Revix, everyday people can easily grow and manage their own wealth, using a personal wealth management platform that is effortless, automated, and engaging. Learn more at www.revix.com.

Momento is the #1 social media platform in web3, where creators can connect with their fans to build deeper relationships, and mutually exchange value. Creators are empowered with a frictionless experience to mint short-form video content as digital collectibles which they can sell to their fans to give their fans access to unlockables like meet & greets, livestreams, tickets, memberships, and autographed merchandise. Learn more at www.momentofans.com

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top ten stories of the week…

Bitcoin Rallies 38% in Ten Days As Hedge Against Banking Failures - BTC has rallied from $20,187 to $28,200 since March 11 as it is seen as a hedge against banking sector volatility. Cathie Wood shared her thoughts on BTC’s recent price surge in a March 21 Bloomberg interview, stating its price behavior through the crisis “is going to attract more institutions.” “The fact that Bitcoin moved in a very different way from the equity markets, in particular, was quite instructive.” ARK has published a target price for BTC in 2030 at $682,000.

A New York Court Is About to Rule on the Future of Crypto - A ruling is expected in the next week or two in the SEC’s case against Ripple over the XRP token. Whichever way the verdict lands will establish a critical precedent in the fight over what constitutes a security versus a commodity for digital assets and whether the SEC or CFTC will have more bearing.

Celsius Holders Can Opt-In to Receiving 72.5% of their Crypto Back - A bankruptcy judge overseeing the bankruptcy case for crypto lending platform Celsius Network has approved a settlement plan allowing custody account holders to get back 72.5% of their crypto holdings. Should they opt in to the deal, Celsius customers cannot “pursue any litigation, including seeking relief from the automatic stay, turnover, or other claims or causes of action.”

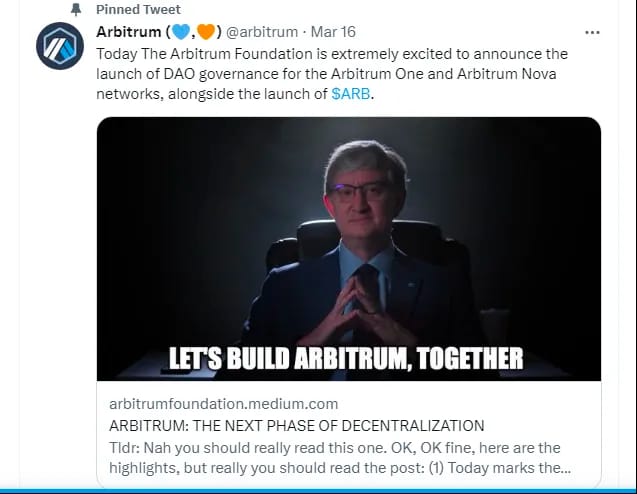

🚀 Arbitrum’s long-awaited airdrop to go live next week, with self-executing DAO - Layer 2 project Arbitrum will airdrop a governance token with the ticker ARB to its community members on March 23.

😒 Florida Governor Ron DeSantis Introduces State Legislation Banning CBDCs- Florida Governor Ron DeSantis proposed legislation on Monday that would ban central bank digital currencies (CBDCs) from the Sunshine State, portraying it as a measure to safeguard Floridians’ financial privacy.

✋ OKX to cease operations in Canada by June 22, 2023- On March 20, cryptocurrency exchange OKX informed Canadian users via email the firm “will no longer provide services or allow users to open new accounts in Canada starting on Mar. 24, 2023, 12:00 AM EST,” citing “new regulations.”

⚖️ FTX sues for control of Bahamas assets, calls FTX Digital Markets ‘a front’ to defraud customers- Bankrupt crypto exchange FTX is suing the liquidators of its Bahamas entity, saying FTX Digital Markets wrongly claims to own the exchange and was actually “a front to facilitate a conspiracy” to defraud customers.

Telegram Users Can Now Transfer USDT Through Chats - USDT has been added to Telegram's @wallet bot, expanding the messaging app's facility for buying and selling crypto.

Unstoppable Domains to Roll Out Web3 Messaging Service on Polygon - The domain provider will allow users to send encrypted messages to one another, helping Web3 projects foster community.

⚖️ Federal Police Take Down 'Dark Web Cryptocurrency Laundromat', Seize $42M in Bitcoin - German and U.S. authorities today closed a crypto mixer called ChipMixer allegedly used by criminals on the dark web to launder funds—and seized a load of Bitcoin in the process.

💬 Tweet of the Week

The Crypto VC List 2023

By Ryan Allis, Managing Partner of Coinstack Partners

Following up on our popular 2022 Crypto VC List post, over the last week, we’ve created the below report to rank the Top 300 Global Crypto VC funds. Below is our list – shown in three formats:

Top Crypto VC Firms By Fund Size

Top Crypto VC Firms By All-Time Investment Count

Top Crypto VC Firms by Last 12-Month Investment Count

Let’s start with some summary data:

The total amount of capital under management by the top 300 global crypto VCs is $83.9 billion.

San Francisco is the #1 city in the world for crypto VC firm capital, representing 45.16% of the total capital among top 50 global crypto VC firms – followed by NYC, Hong Kong, Singapore, Austin, London, and Shanghai.

Even with a downturn in the 2nd half of the year, 2022 was the biggest year in history for crypto VC, with over $26.2 billion of new capital invested into companies compared to $25.1B in 2021.

New crypto VC investment in Q4 2022 ($2.5B) was 77% lower than Q1 2022 ($11.2B) – but we’ve turned the corner and we’re now heading back up.

In February 2023 there was $872 million in venture capital invested in crypto/blockchain firms, up 52% from $574 million in January 2023.

This means that even in our lowest bear market moments, we’re still seeing over $25M per weekday invested into crypto/blockchain company equity by venture capital firms (and around $45M per weekday currently). This doesn’t even count the amount being invested into tokens by venture firms.

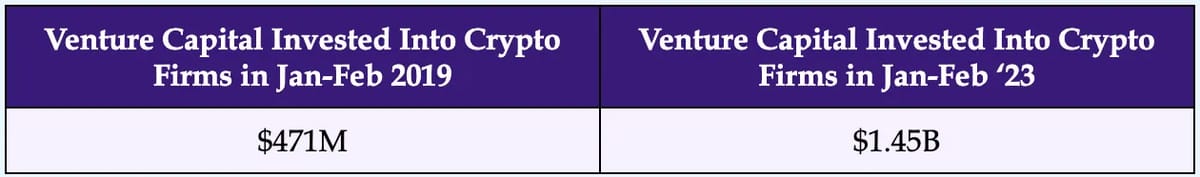

When you zoom out and look at the bigger picture, there is currently 3.1x more venture capital currently (Jan/Feb 2023) being invested into companies compared to this same time four years ago (Jan/Feb 2019) during the last bear market.

So even though the bear is here at the moment, there’s still 3x as much capital going around as last time. The digital assets industry is maturing – and we’re seeing much more institutional capital stick around this time. This is a big deal.

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. USDT Dominance is At 56% with USDC at 29% and BUSD at 6%

Source: @OurNetwork

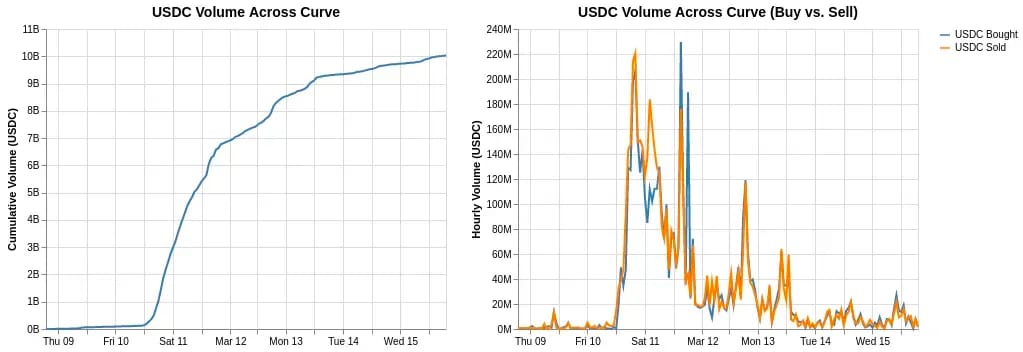

2. 10B+ Volume, $1M+ Fees Generated on Curve During USDC De-Peg

Source: @OurNetwork

3. Fraxswap's YTD Volume Exceeds 2022 Total

Source: @OurNetwork

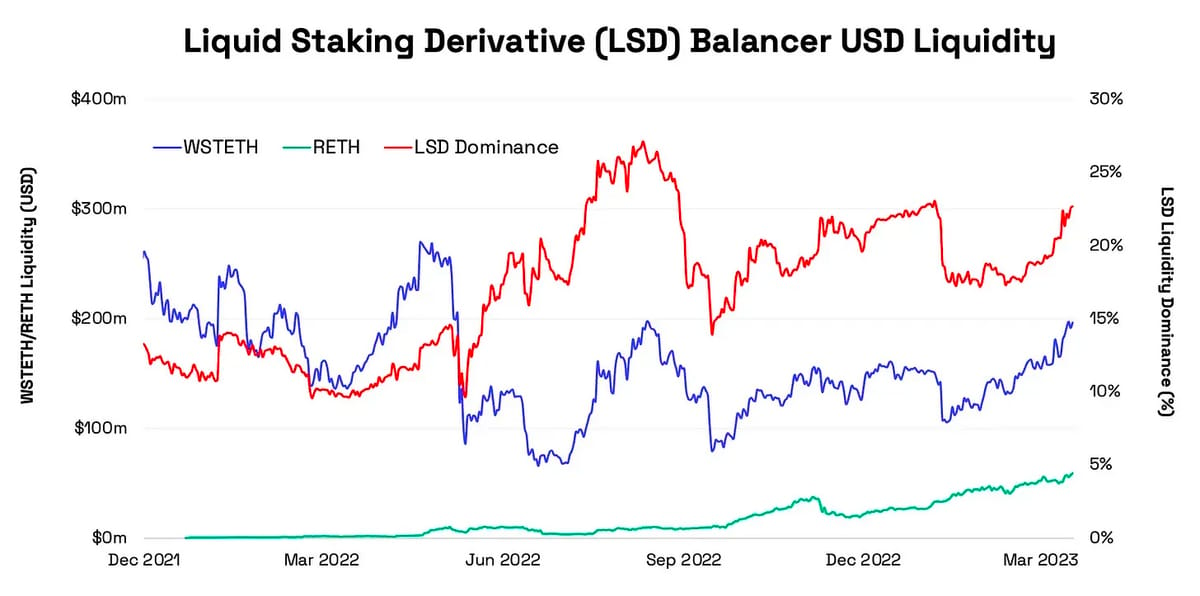

4. LSD Liquidity on Balancer Reaches $250M

5. Daily Volume on Uniswap Protocol Hits $11.84B

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Narratives and Trends

The predominant narratives and trends in DeFi are either related to established protocols expanding their footprints or new ecosystem-specific protocols introducing new mechanisms.

Verticalization

DeFi protocols are financial infrastructure at their core and not designed to be end-user products at the end of the day. To this effect, the front-ends or user experience layers that sit on top of the protocols are key determinants of adoption as they define both the consumer use case and their experience with crypto — both pivotal in the success of the underlying financial infrastructure (protocols).

Established protocols are realizing that in order to drive application usage and customer experiences, they must look to build vertically themselves. This is important for competitive reasons, as owning and defining the customer relationship provides pricing power, and for customer acquisition reasons, as the approachability and usability of cryptocurrency is perhaps a larger barrier to adoption than financial efficiency at this point.

Uniswap recently released an early version of its mobile wallet which is a vertical move to craft the end-user crypto experience in an approachable, friendly way that appeals to a wider set of users. Uniswap’s major barrier to growth, outside of US policy opacity, is getting more users comfortable with using on-chain protocols, not squeezing more efficiency out of its DEX. The mobile app is a step in that direction.

Synthetix is another example of recent vertical moves by established DeFi protocols. It has shepherded the build out of a number of protocols namely options protocols, Lyra, and perpetual exchange Kwenta which are both built on Ethereum Layer-2s (L2) and sit on top of Synthetix. . By taking it upon themselves to help nurture these protocols, Synthetix is able to drive the usage of its main underlying liquidity protocol.

As the major barrier for the adoption of mature DeFi protocols continues to be compelling applications and user experiences, continue to see protocols invest in vertical expansions to both accelerate adoption and to capture the value.

Native L2 App Protocols

As Ethereum’s L2s continue to gain momentum, there has been an accelerated adoption of native protocols of these ecosystems. For example, GMX and Radiant on Arbitrum are two of the fastest growing protocols in terms of both fundamentals and price appreciation this year. Looking at user retention metrics, it’s apparent these protocols have gained above-market traction compared to imported protocols like Uniswap or Aave.

One of the main drivers of this trend has been the wealth effect that new protocols can create. They can issue new tokens and distribute them to users, which can generate positive sentiment among users. However, while this strategy can be effective in the early stages of growth, its sustainability has proven questionable. Therefore, new native protocols must look to expand their moats through traditional competitive angles, rather than relying solely on positive sentiment created by wealth effects.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

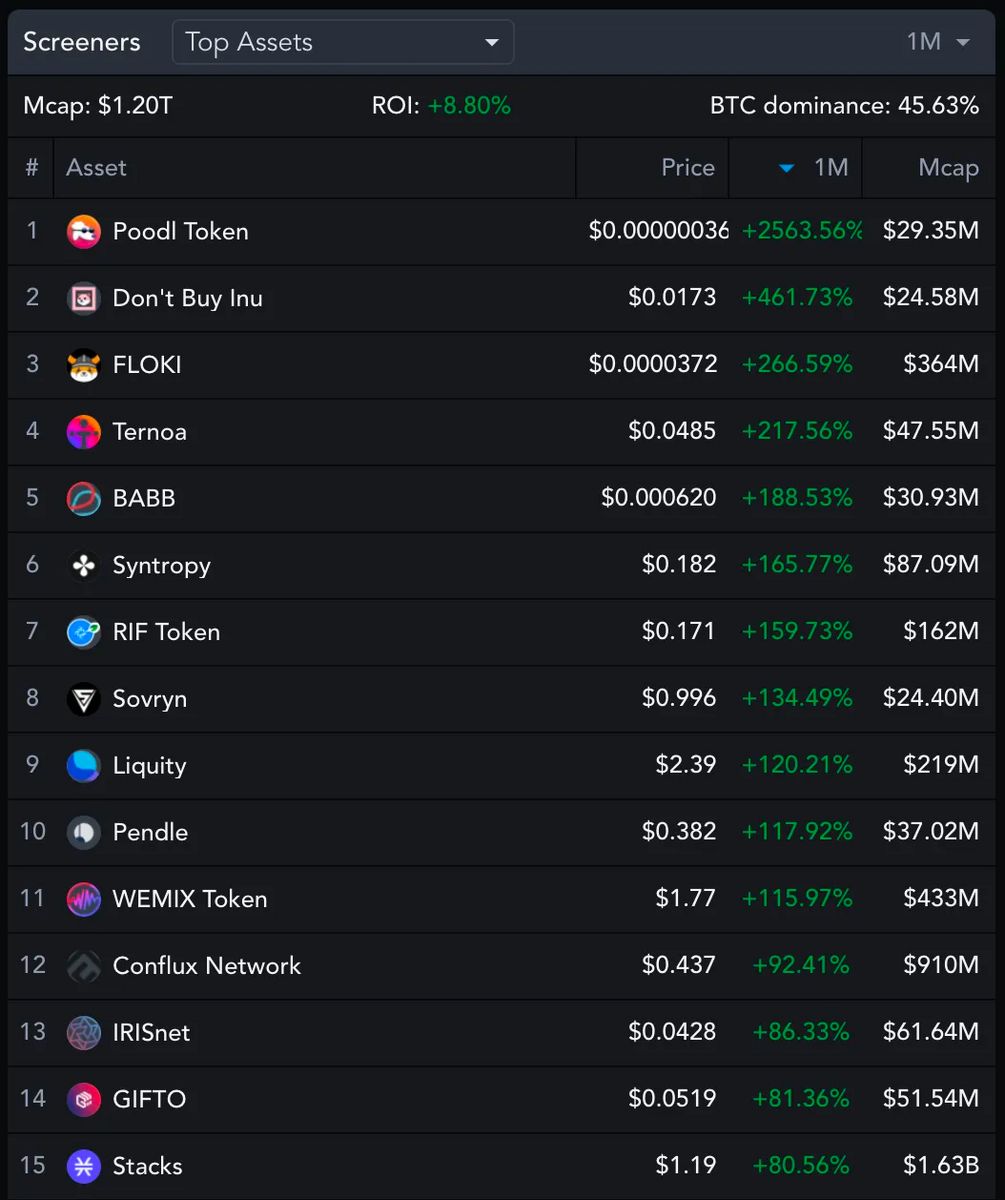

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for Web3 companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn more at www.connect.financial, www.revix.com, and www.momentofans.com