Learn More at www.hypelab.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 270k weekly subscribers. Bitcoin set a new ATH of $73,780, FTX dropped its lawsuit against Bybit, Solana hit a new ATH for daily transaction fees and big new venture rounds came in for Gelato ($11M) and Skyfire ($9.5M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 270,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

💰Bitcoin trades above $70,000 for first time in over seven months: Bitcoin (BTC) +3.72% topped $70,100 at 22:10 UTC, the first time the largest cryptocurrency by market capitalization crossed the $70,000 level in more than seven months, according to The Block’s Bitcoin price page. It later reached a new all-time high of $73,780 on Tuesday.

⚖️ FTX agrees to drop lawsuit against Bybit in $228 million settlement:FTX has agreed to drop its lawsuit against Bybit, its executives and investment arm Mirana in a settlement that would allow the defunct cryptocurrency exchange to collect around $228 million. The amount is expected to help FTX repay its creditors in the coming months.

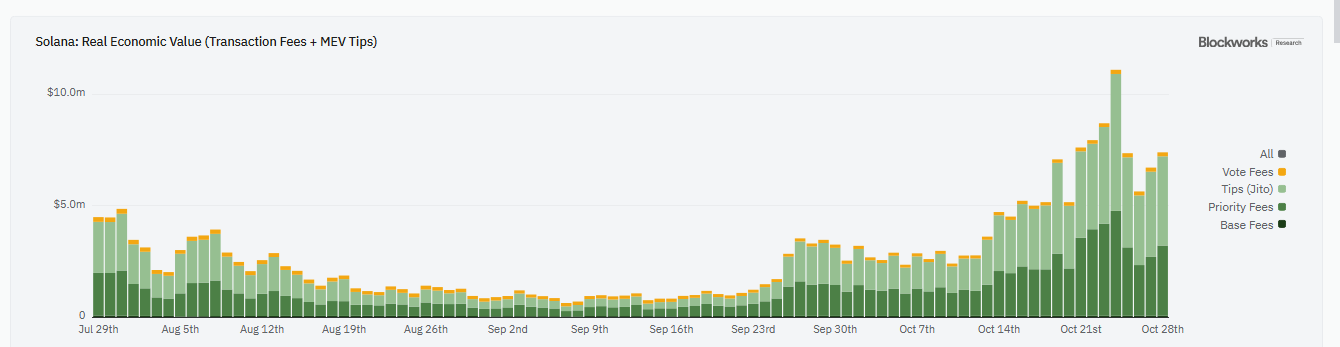

🚀 Solana registers new all-time high in daily transaction-related fees: Transaction-related fees on Solana (SOL) surpassed $11 million on Oct. 24, marking a new all-time high, according to Blockworks Research data.

🔥 Base plans to introduce fault proofs this month, aiming for decentralization:Base, an Ethereum Layer 2 platform incubated by Coinbase, will implement permissionless fault proofs on Oct. 30 — aiming to decentralize the network and eliminate single-entity control.

🚀 Cardano unlocks Bitcoin liquidity with BitcoinOS Grail Bridge integration:Cardano has integrated with the Bitcoin ecosystem through BitcoinOS’s Grail Bridge, unlocking the top digital asset’s substantial liquidity for its DeFi ecosystem.

💬 Tweet of the Week

Source: @EricBalchunas

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The march on institutional investments continues, as 5 of the last 6 weeks since the Fed cuts were announced have resulted in significant inflows. Last week we saw over $901M in digital asset investments, once again led by Bitcoin ($920M), while BlackRock added another $1.14B AUM to its BTC ETF holdings.

Source: @DavidShuttleworth

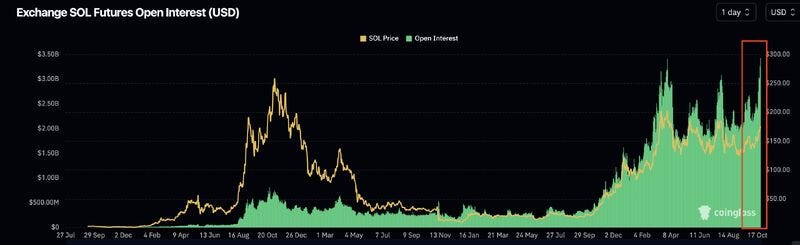

2. Open interest on Solana futures is now at record levels of $3.43B and has increased by 44% this month. Meanwhile daily network fees have reached $4.5M, their highest since March, and SOL : ETH is closing in on 0.70 (also a new record).

Source: @DavidShuttleworth

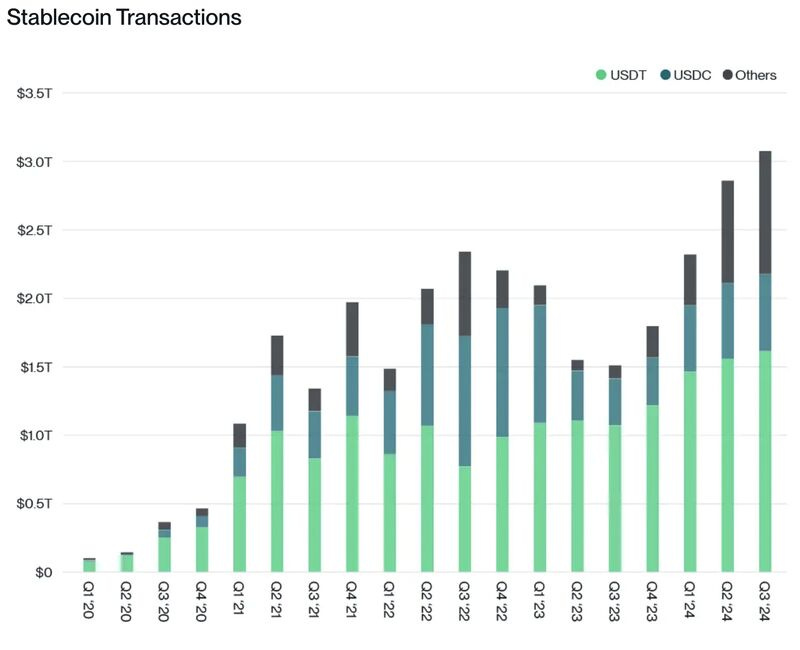

3. Stablecoins continue to operate as one of the the most powerful applications in the entire blockchain space. The current market cap for U.S. dollar-backed products has grown to $177B, but perhaps just as importantly, usage and adoption have grown with it. Tether.io's USDT, Circle's USDC, and others like DAI and FDUSD have now combined to settle more than $3.1 trillion of global transactions in Q3 alone. To put this into better perspective, Visa settled about $6.5T of transaction volume in the first half of 2024.

Source: @DavidShuttleworth

4. Layer 2 Active Addresses Up Over 300% Year-over-year, Approaching 10M Weekly

Source: @OurNetwork

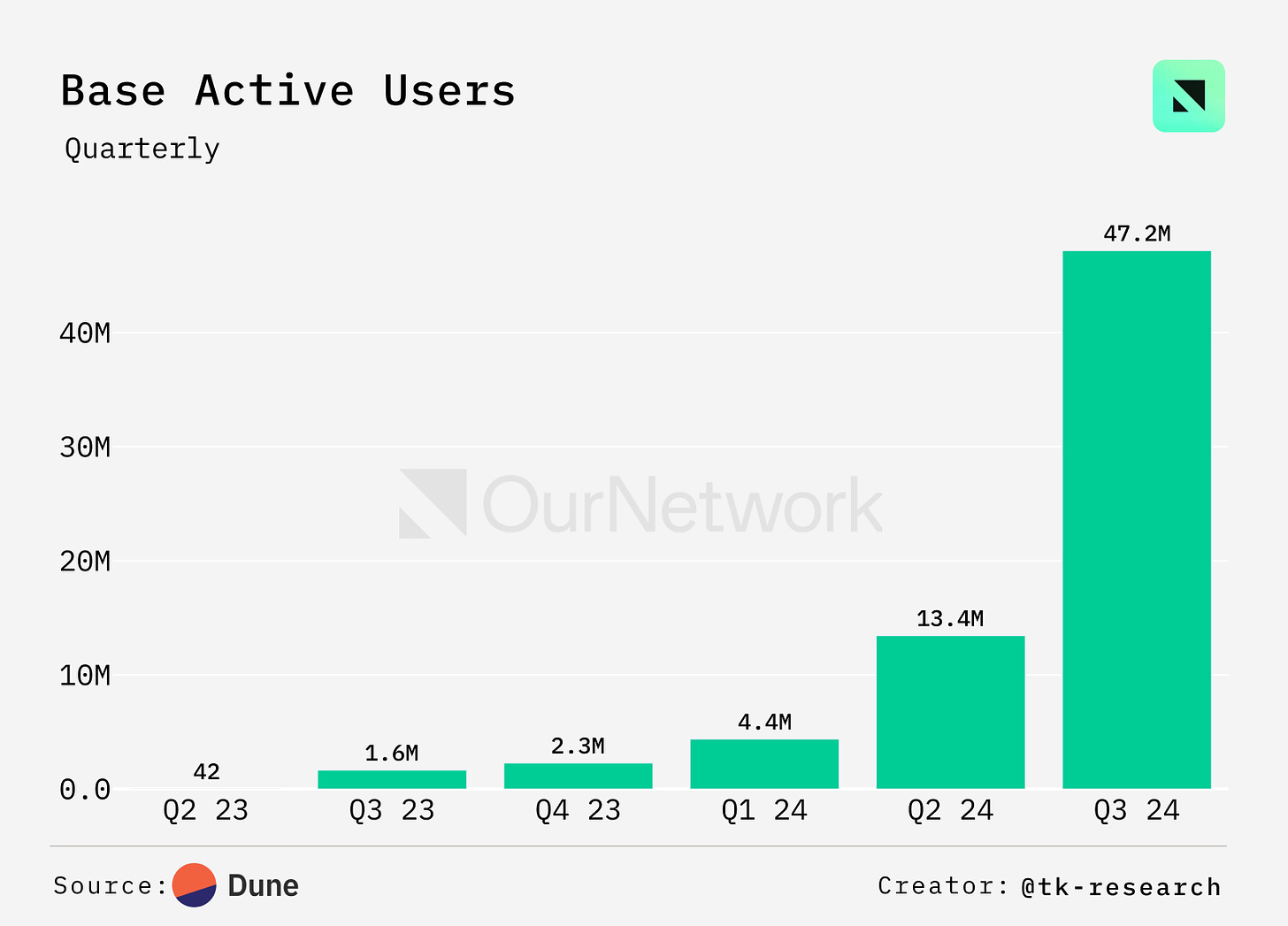

5. Number of Base Users Hits a Quarterly All-Time High of 47.2M in Q3 2024 while Network Revenue is Largely Unimpacted

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Intro

Cycles rhyme, but they never repeat exactly. If markets were to follow identical price action each time, trading would be simple, and everyone would be a top-tier trader. What’s key to understand is that for any market to precisely mirror a past move, the exact conditions and players would need to repeat their actions to a T—a statistical improbability and practical impossibility.

Over time, we've shown how the current range aligns closely with the 2023 range, highlighting that while we achieved a new all-time high early in the cycle, the timing has stayed remarkably consistent with prior cycles.

The major question now: are we still tracking the previous cycle’s path, or are we starting to deviate?

Given the regularity of Bitcoin’s 4-year cycle, many think “this time is different”—a famously dangerous notion in investing. Still, there’s a strong contingent expecting a top between $100k and $120k in Q1 next year. Personally, I don’t buy into that theory.

Recent market moves have been telling, especially over the past few weeks, about the nature of this cycle. Calling tops is notoriously challenging—indicators and technical signals can mislead even the best, remaining overheated far longer than anticipated. This current range, and the extended summer consolidation, suggests to me that this market is preparing for a longer, sustained climb. This setup, which I pointed out to premium subscribers months ago, will likely cause “max pain” for the majority of participants.

Here’s why: meme coin and speculative hype moves tend to be intense but short-lived. Many expect these runs to last longer, only to see Bitcoin hit a significant high—say, in Q1—followed by another six-month consolidation. When that pullback occurs, traders start calling for a market top, while early gamblers hold on for hope and give back gains.

Then, when BTC rallies again in the second half of 2025, the top-callers FOMO back in, and the gamblers, now with next to no capital, are forced to start fresh.

Now, imagine this scenario repeating until a blow-off top in 2028 or 2029. Gamblers cycle through boom and bust, traders get shaken out repeatedly, and only the true long-term holders of quality cryptos and elite traders endure.

So today, I want to explore why we’re seeing subtle deviations from prior cycles while still echoing familiar patterns.

Longtime readers know we’ve used last summer’s range to make calls on inflection points with exceptional accuracy. However, we’re now starting to diverge from that range in terms of timing. We anticipated a major breakout over the past two weeks, yet it hasn’t materialized. So what’s going on?

Relative Strength Vs Previous Cycles

First of all lets look at the relative strength of this cycle vs previous cycles. From a simple retracement perspective we can see that in no other cycle has BTC spent this long consolidating above the 75% level. In 2020 it consolidated below the 50% level. In 2017 there wasn’t as much of a consolidation at all. But generally, the stronger and longer the consolidation phase the bigger the expansion.

Also, notice where the RSI was at in the previous two cycles versus where we are currently. This is a great signal that the market has plenty of room to run before we can consider it getting overheated. RSI is still very low relative to 2020 and 2017. In fact, it looks much more like it did in 2017 which tells us calling a top using this indicator may be a very tricky task going forward.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com