Learn More at www.hypelab.com and www.amphibiancapital.com

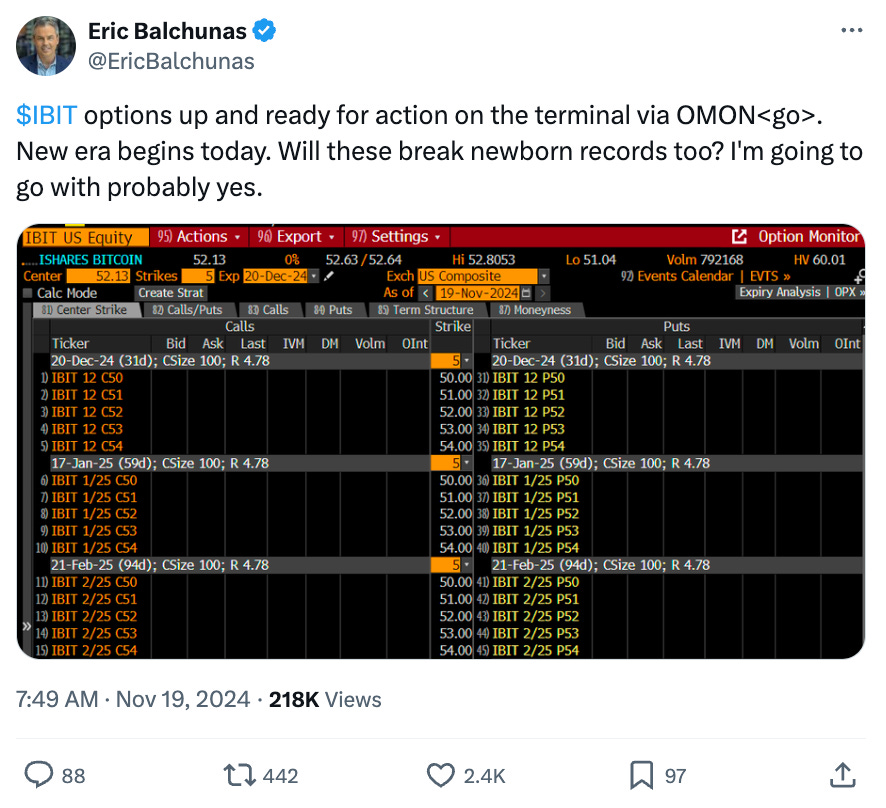

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 270k weekly subscribers. This week, spot Bitcoin ETF options went live, Gemini expanded into France, Ethereum ETFs recorded trading volume and big new venture rounds for Zero Gravity Labs ($40M) and Wyden ($16.9M).

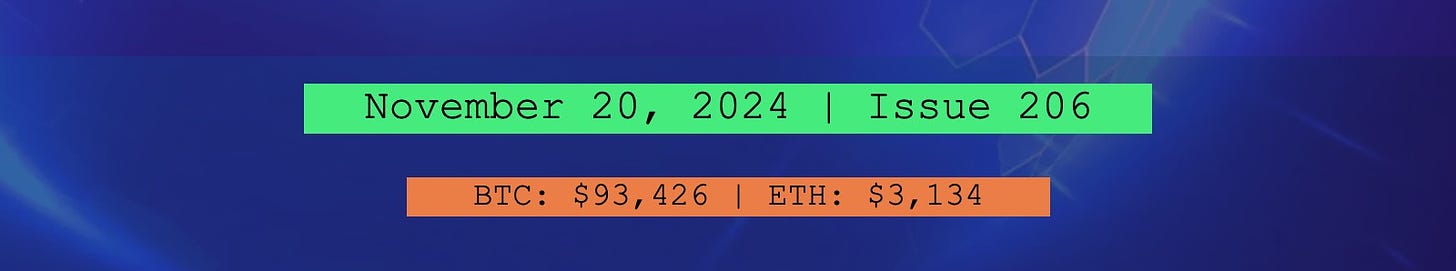

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. +14.92% net YTD approx with their USD fund, +11.00% net BTC on BTC YTD (90.93% in USD terms), and +14.39% net ETH on ETH YTD (33.01% in USD terms) through 10/31. They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. Approximate estimates through 10/31/24

Become a Coinstack Sponsor

To reach our weekly audience of 280,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

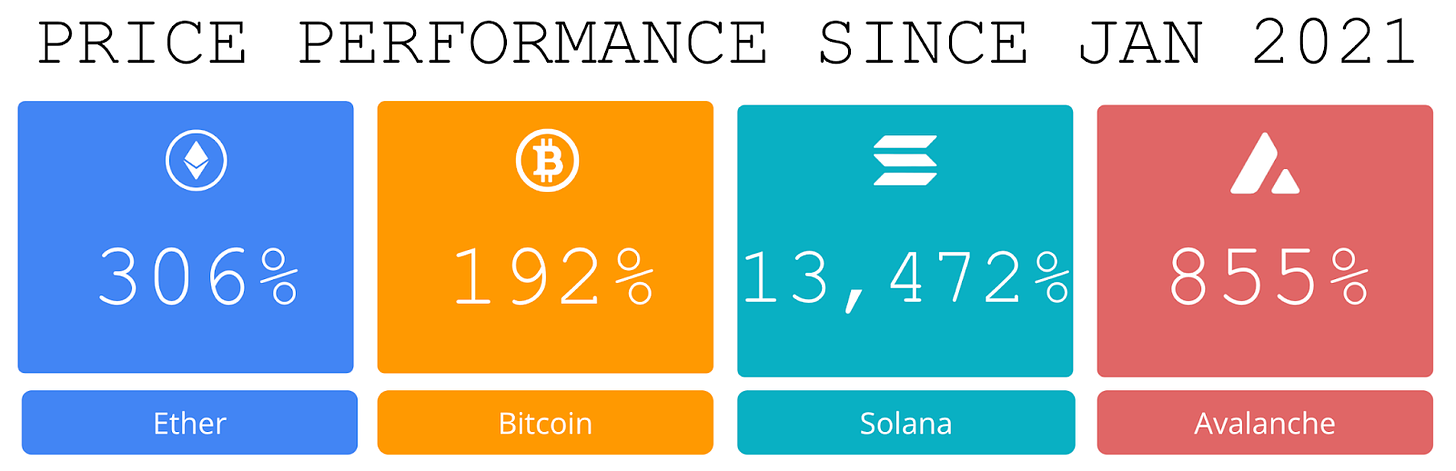

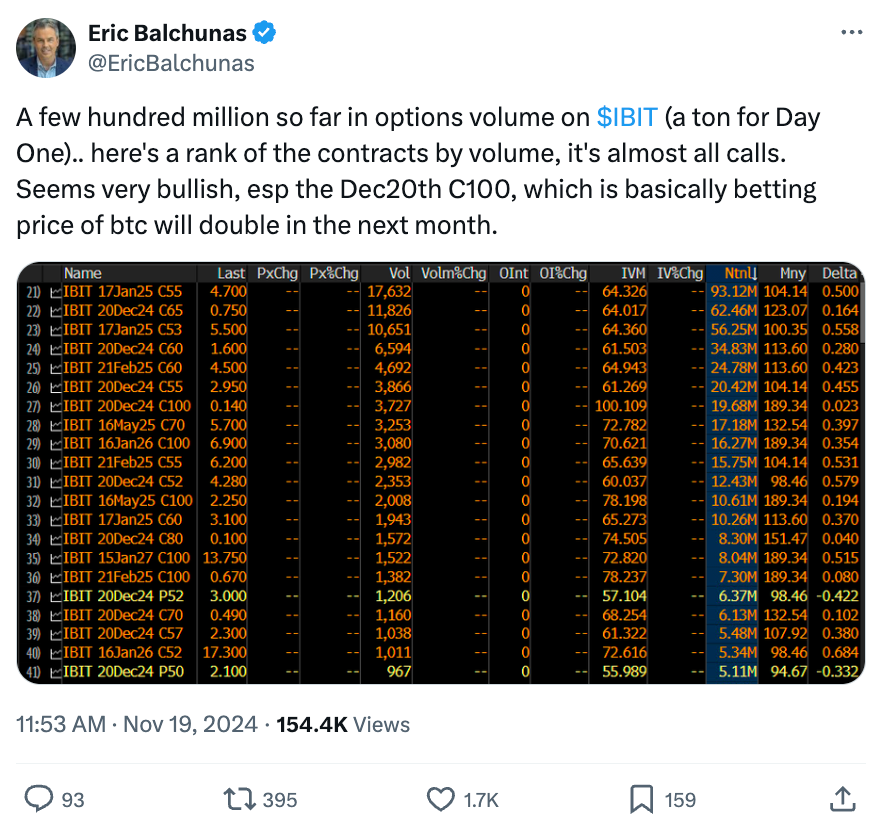

💰 BlackRock Spot Bitcoin ETF Options On Nasdaq Rack Up 9-Figure Trading Volume In First Few Hours: Analysts predict IBIT options will enhance liquidity, efficiency, and complexity in Bitcoin derivatives, attracting new institutional participants.

🏦 Gemini crypto exchange expands into France after being granted VASP license: Gemini, the U.S.-based cryptocurrency exchange founded by the Winklevoss twins, is launching operations in France, according to an announcement on Tuesday.

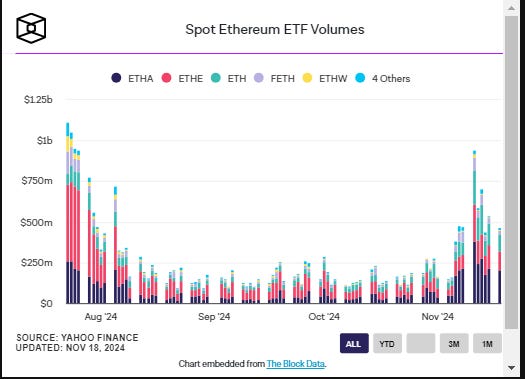

🚀 Ethereum ETFs record highest weekly trading volume since launch: Four months after going live, spot Ethereum ETFs have recorded their highest weekly volumes since the third week of their inception in August.

🔭 Ethereum-compatible Layer 1 Monad begins rolling out testnet: The highly-anticipated Ethereum-compatible Layer 1 Monad has begun rolling out its testnet as part of a phased release.The news follows the launch of Monad’s devnet in March, having reached 10,000 transactions per second in internal testing.

🤝 Wintermute secures approval to overhaul Ethena’s revenue sharing model:The Ethena Foundation announced on Nov. 15 that the risk committee approved Wintermute’s proposal to overhaul revenue sharing for the Ethena protocol.The changes, aimed at benefiting staked ENA (sENA) holders, are expected to take effect by the end of November, pending the finalization of implementation details.

💬 Tweet of the Week

Source: @EricBalchunas

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

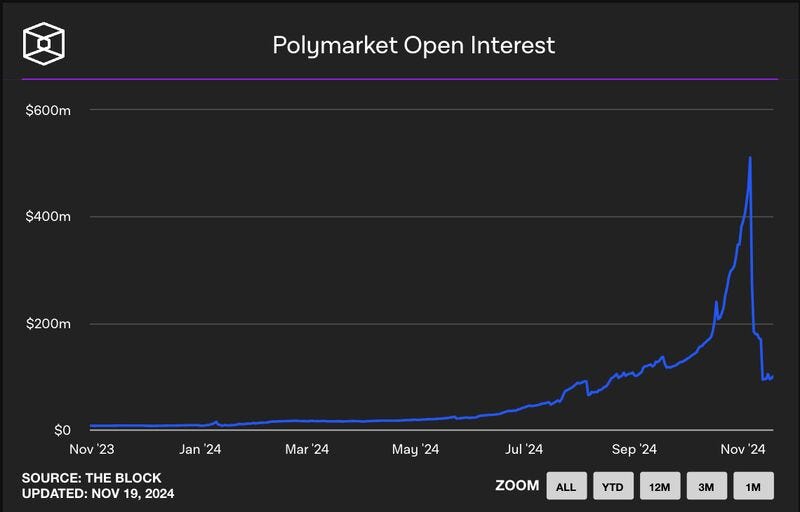

1. Since the Presidential election ended 2 weeks ago, open interest on Polymarket has declined by over 80%. Heading into the election, open interest surged to $511M, but now stands at just $100M.

Source: @DavidShuttleworth

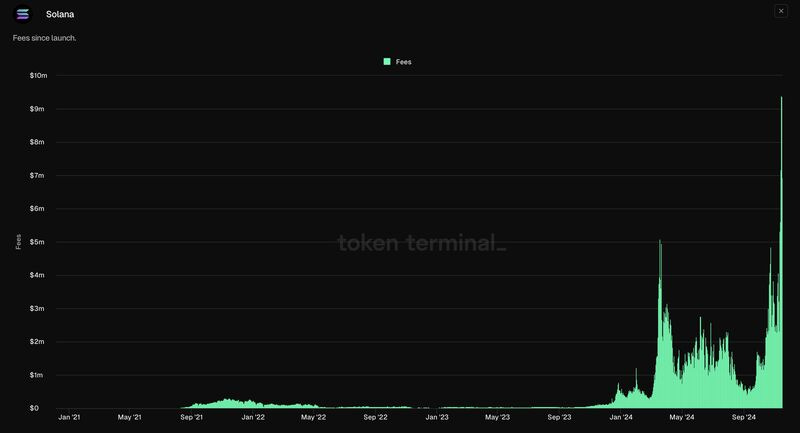

2. Daily fees on Solana recently reached an all-time high of $9.39M as activity across the network continues to surge. This pushes total weekly fees to $43.8M, also a new record.

When SOL was at its peak in November 2021, total weekly fees were just $1.98M. This time around, Solana now handles over 50M daily transactions along with nearly $7B in DEX volume per day. Buckle up.

Source: @DavidShuttleworth

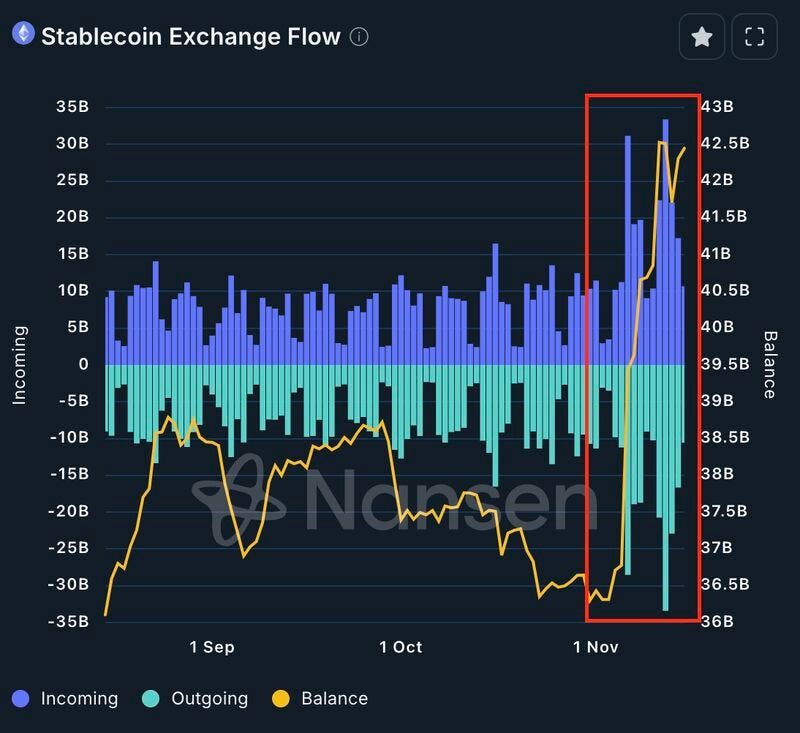

3. There are now over $42.5B total Ethereum-based stablecoins on exchanges as the march on issuance and liquidity continues, and buy-side sentiment remains strong. This is one of the highest levels of stablecoin liquidity on exchanges ever, and has grown by $5.8B (16%) in less than two weeks since the election. Interestingly, however, total BTC balances on exchanges during this same time have reached their lowest levels since 2018.

Source: @DavidShuttleworth

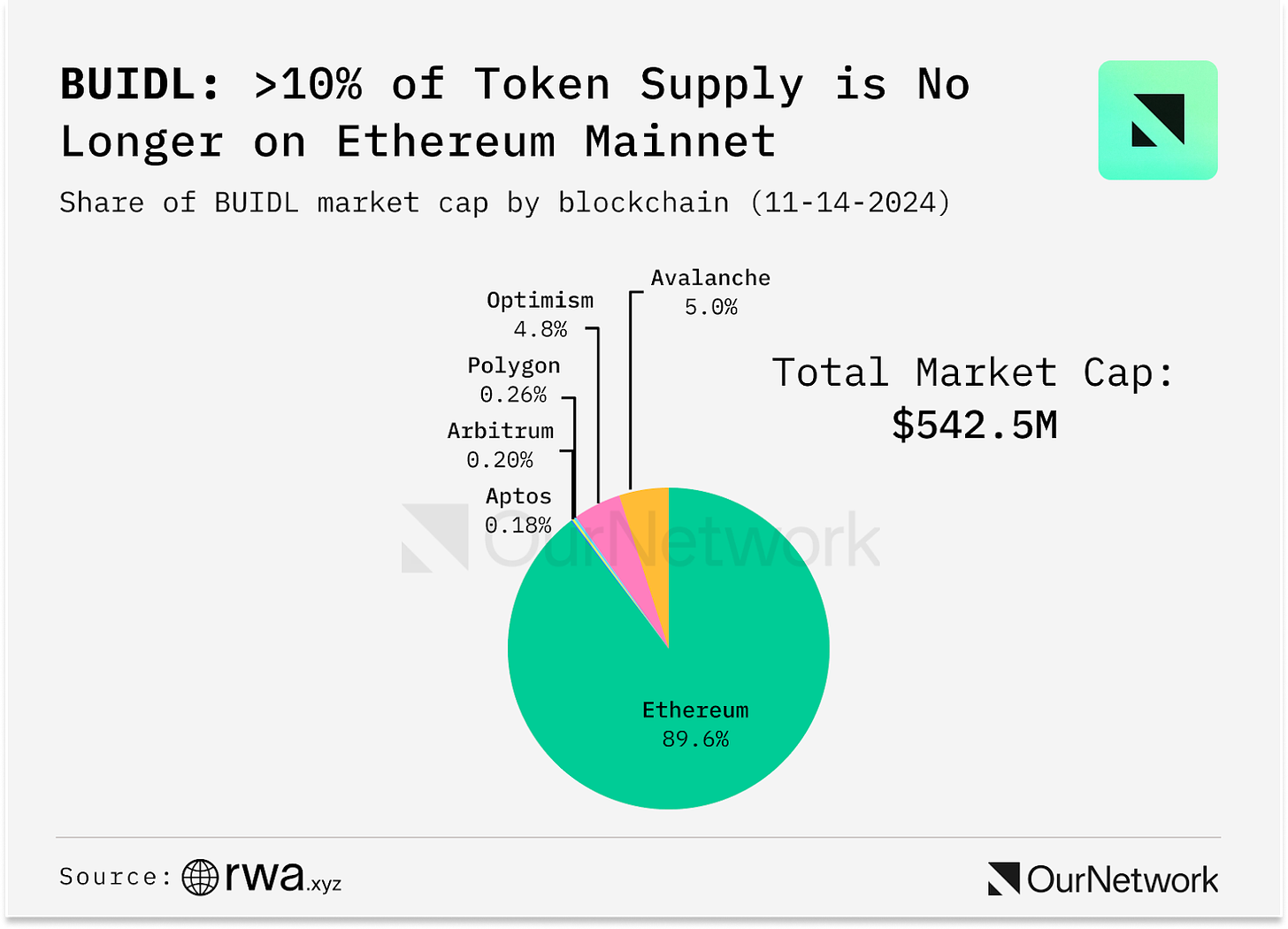

4. BUIDL’s launch onto Aptos, Polygon, Avalanche, Optimism, and Arbitrum brings these incentives to Treasuries for the first time: Aptos, Polygon, and Avalanche each agreed to pay BlackRock a quarterly fee based on the value of their network’s BUIDL shares. It’s too early to tell if it’ll be successful, but to date, $56.6M worth of mints have occurred across all five networks as of Nov. 14, comprising 10.4% of the fund.

Source: @OurNetwork

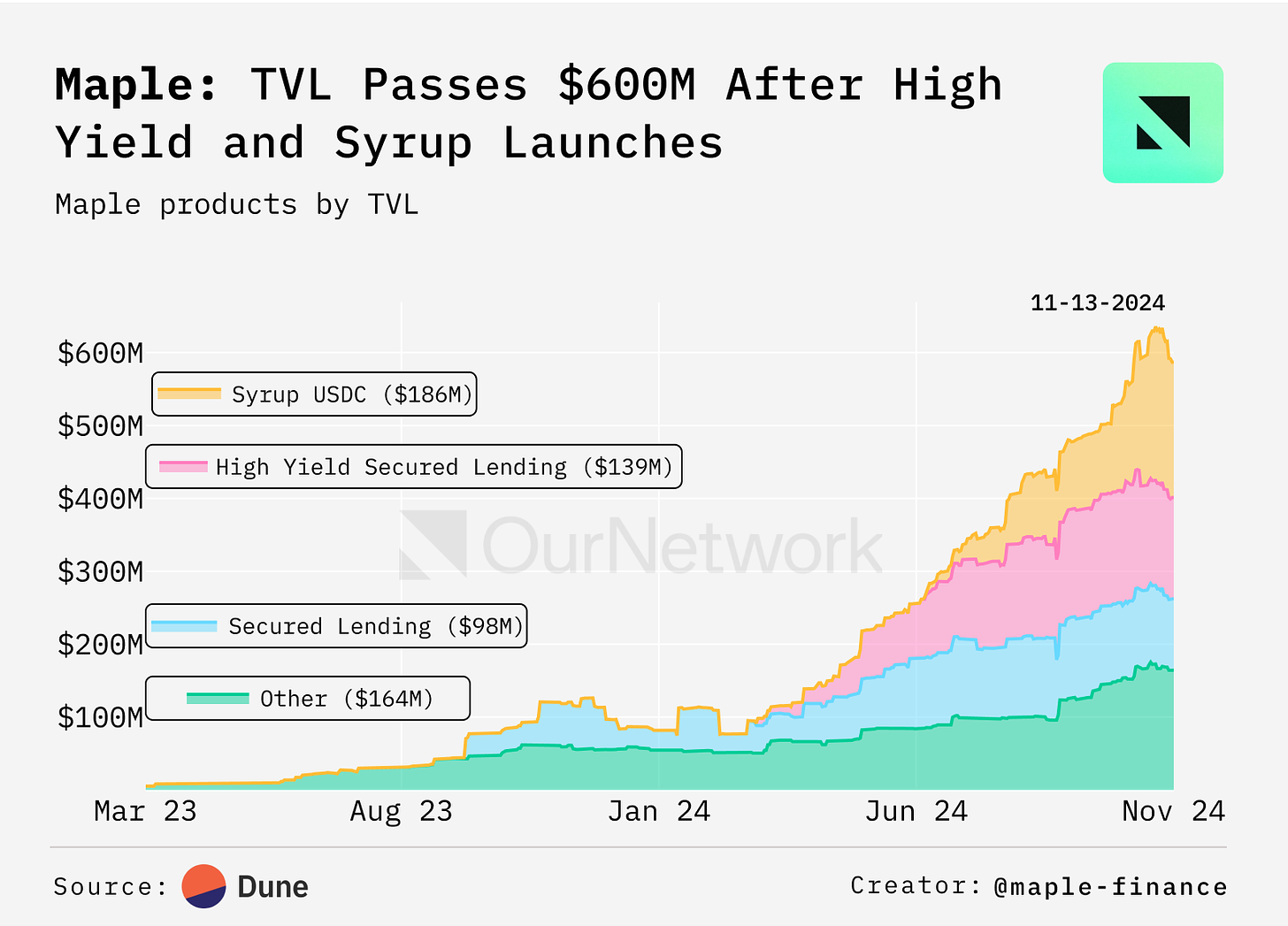

5. Maple Finance & Syrup offer corporate credit yield to lenders, through loans issued to institutional borrowers; these loans are always overcollateralized by liquid digital assets such as BTC, ETH and SOL. Since the launch of the High Yield Secured pool in March and Syrup in June, TVL on the platform has grown >700%, recently crossing the $600M threshold. Protocol revenue has followed a similar trajectory, with October revenue up >700% from the beginning of the year.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Nik Fahrer, CPA serves as a national tax director in Forvis Mazars National Office. In that capacity, he assists with the implementation and support of the firm's technology and growth initiatives. Nik is the leader of Forvis Mazars' Digital Asset practice and volunteers his time as a member of the AICPA Digital Asset Tax Task Force. This is an excerpt from the full article, which you can find here.

Introduction

The AICPA Digital Assets Tax Task Force (DAT TF) has been monitoring digital asset transaction reporting closely, and on the same day the final regulations on broker reporting (T.D. 10000) appeared, the IRS issued guidance that seems to have been overshadowed by the regulations, namely, Rev. Proc. 2024-28. Taxpayers, however, need to know about this critical safe-harbor guidance, as the Jan. 1, 2025, deadline to meet the safe harbor is fast approaching.

What is Rev. Proc. 2024-28?

Final regulations' effect on the universal method for digital assets: Prior to finalizing the regulations on broker reporting, Treasury and the IRS permitted taxpayers to use — or at least they were not prohibited from using — the universal method for tracking basis in digital assets. The universal method assumes all of a taxpayer's digital assets are held in one wallet or account, even if they are actually dispersed among multiple wallets or accounts. Upon sale of a digital asset, the account owner could specifically identify the basis for the digital asset sold from the pool of digital assets. This would result in a remaining digital asset with used basis and an "orphaned" basis with no digital asset (i.e., a unit of unused basis). Thus, taxpayers who have been using the universal method for years may have a significant number of digital assets with no basis attached.

Transition relief through the Rev. Proc. 2024-28 safe harbor: For taxpayers that used the universal method, Rev. Proc. 2024-28 allows for transition relief to the rules of Regs. Sec. 1.1012-1(j). The purported intention of the transition relief is to synchronize taxpayer records and broker records, so that brokers' Forms 1099-DA, Digital Asset Proceeds From Broker Transactions, and taxpayers' Forms 8949, Sales and Other Dispositions of Capital Assets, better align when brokers begin reporting basis on transactions occurring in 2026.

While some taxpayers purposefully used the universal method, other taxpayers may be using the method without knowing, as some crypto accounting software has defaulted to this method in the past. In either case, when determining a taxpayer's cost basis, the universal method can create a mismatch where, as an example, an asset is sold out of Account A, but the taxpayer's records for income tax reporting show basis was removed from Account B.

Taxpayers electing the safe harbor under Rev. Proc. 2024-28 may make a reasonable allocation of units of unused basis to a wallet, provided that the wallet holds the same number of remaining digital assets and the unused basis units are the same type of digital asset as the remaining digital assets. A reasonable allocation may be completed using either a specific unit allocation method or a global allocation method. A taxpayer uses (1) the specific unit allocation method by allocating units of unused basis to either a pool of remaining digital assets within a single account or specific units within a single account, or (2) the global allocation method by setting a rule for using the units of unused basis and allocating such units to a pool of remaining digital assets.

This one-time allocation is irrevocable, applies only to capital assets (i.e., both the unit of unused basis and the remaining unit must both be capital assets), and generally must be completed by Jan. 1, 2025. Furthermore, the taxpayer must maintain sufficient records identifying the total remaining digital assets in each account, the total units of unused basis, the original cost basis of each unit of unused basis, and the acquisition date of the digital asset to which the unused basis was originally attached.

Rev. Proc. 2024-28, however, leaves taxpayers and tax practitioners, or at least those taxpayers and tax practitioners who have even come across this little-known guidance, searching for additional clarity and guidance. Awareness, clarity, and guidance are the primary tenets of the comment letter regarding Rev. Proc. 2024-28 submitted by the AICPA's Tax Executive Committee.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com and www.amphibiancapital.com